Market

AI Agents and Financial Protection: A Deep Dive with AgentLayer

AgentLayer is an innovative platform that increases the security and functionality of financial applications through advanced AI and blockchain integration. At its core, the platform’s AgentOS enables secure data management, multi-agent collaboration, and seamless communication, ensuring that financial operations are both efficient and protected.

With features like data encryption, access control, and proactive vulnerability detection, AgentLayer meets the demands of modern finance, safeguarding sensitive information. BeInCrypto sat down with the AgentLayer team to talk about how their platform is tackling real problems in financial tech using AI and blockchain. No fluff — just a deep dive into what’s working, what’s not, and where the industry is heading.

Can you detail how the core operating system, AgentOS, improves the security and functionality of financial applications? What special features or methods does it use to keep financial operations safe and efficient?

AgentOS allows to make financial applications both secure and efficient. It protects sensitive data by encrypting it during transmission and storage, ensuring that critical information like transaction history, ledger status, and smart contracts remain safe.

AgentOS leverages blockchain technology to decentralize and secure data, ensuring that no one can alter or tamper with it. The system also controls who can access and modify data through fine-tuned permission management. This ensures that only authorized agents can make changes, enhancing overall security.

AgentOS manages the network by regulating the nodes (connection points) that operate within it. These nodes are registered on the blockchain, and operators have to lock a deposit for each instance they own. If any node behaves maliciously, a fraud-proof mechanism penalizes the bad actor, which helps maintain the network’s integrity. The development team also uses tools like formal verification and static code scanning to proactively detect and fix vulnerabilities in the system’s code.

On the functionality side, AgentOS supports multi-agent collaboration through the AgentLink protocol. This allows different agents to communicate, collaborate, and share incentives, which improves decision-making and efficiency in financial applications. The system also integrates with blockchain technology, using its decentralized and transparent nature to increase

When developers create an agent, they can choose from a range of models, including the proprietary TrustLLM model, which is based on the Mixture of Experts (MoE) approach. This model helps to enhance performance, security, and multimodal generation capabilities, making it ideal for financial applications. AgentOS also facilitates service registration and management, allowing developers to deploy agents according to their business needs and register them on the blockchain with specified permissions.

The system’s routing protocol ensures that all agents can operate effectively together, allowing them to communicate and collaborate to complete complex tasks. This improves the overall performance and flexibility of financial applications.

How do AgentLink protocols help AI agents communicate and handle transactions securely? What specific security steps you take to keep these interactions safe and private?

AgentLink protocols ensure secure communication and transactions between AI agents, using several key mechanisms.

AgentLink defines how information is organized and shared across the network. This structure ensures efficient data transmission, even with limited bandwidth, reducing errors or interruptions. By simplifying and making messages more predictable, AgentLink improves the reliability of communication between AI agents.

To organize these interactions, AgentLink provides a structured framework within the AgentNetwork layer. This framework lays out clear communication protocols that dictate how agents share knowledge, exchange information, send commands, and retrieve results. Such a structured approach not only streamlines communication but also enhances security by minimizing the risk of miscommunication or unauthorized access. Agents always know where and how to send specific types of information, reducing vulnerabilities.

AgentLink also incorporates asynchronous data exchange through a shared message queue. This queue acts as a buffer, allowing agents to send and receive messages without needing immediate processing. This setup offers significant security advantages: if one agent faces issues or comes under attack, it won’t immediately affect the others. It also processes messages in a controlled manner, reducing the risk of overwhelming the system and preventing vulnerabilities.

To further secure communication, AgentLink formats and routes messages properly. Standardized formatting helps detect and filter out malicious or incorrect messages, while a clear routing system ensures messages reach the correct recipients without interception or misdirection by unauthorized parties.

Middleware, like the shared message queue, adds another layer of reliability. It acts as a safe holding area for messages, protecting against data loss or corruption during transmission. Strict access controls and encryption enhance security in the queue, ensuring only authorized agents access it and keep messages confidential.

Lastly, the separation of communication processes from real-time processing helps protect against attacks targeting the immediate handling of messages. If an attack occurs, the queue stores messages until resolving the issue.

Could you provide a real-world example where the AI agents can successfully detect and prevent a security breach?

One great example is the AGIS agent, which has proven to be incredibly effective at spotting and preventing security breaches, particularly in the world of blockchain. AGIS is an AI-driven tool that audits smart contracts by scanning the code for potential vulnerabilities. Impressively, it identified 21 vulnerabilities on its own before its full rollout, demonstrating its power and effectiveness.

AGIS uses advanced AI models, like its proprietary TrustLLM, which are specifically built to dig deep into smart contract code. These models scan the code for any signs of trouble, such as security flaws or logical errors. AGIS goes through a detailed process where it continuously scans and validates these potential problems, reducing the chances of false alarms and making sure it catches even the trickiest issues. During a recent competition, AGIS not only found these vulnerabilities but also won a significant prize, highlighting its top-notch capabilities.

Once the system detects a threat, AGIS takes a collaborative approach to auditing. It allows users to create tasks and set parameters, like rewards and deadlines, to attract auditors who can bring different perspectives. These auditors then discuss and agree on the issues, ensuring a thorough review. To keep everyone honest, AGIS uses a staking system with its own token, $AGIS. Auditors need to stake these tokens to participate, which means they have skin in the game. If they mess up, they risk losing their stake, which encourages careful and accurate work.

AGIS also tracks the reputation of its auditors and validators, rewarding those who do a good job and penalizing those who don’t. If there’s ever a disagreement over the findings, AGIS has a dispute resolution process in place, which can even involve a third-party arbitrator if necessary.

Overall, AGIS acts as a highly reliable “intelligent guardian” for blockchain security, continuously learning and improving to stay ahead of potential threats. It’s available on the AgentLayer testnet, where it collaborates with other AI agents to push the boundaries of what’s possible in Web3 security. Looking forward, AGIS will keep refining its auditing skills and expanding its capabilities.

How do large language models (LLMs) help detect fraud and improve security in the AgentLayer system? Can you give examples of where LLMs have been especially effective?

Large language models play a significant role in boosting security and detecting fraud within the AgentLayer ecosystem by thoroughly analyzing code and monitoring interactions.

One key way LLMs help is by conducting detailed audits of smart contracts. Tools like AGIS, which is part of AgentLayer, use advanced LLMs such as GPT-4, Llama 3, and TrustLLM to scan code for security flaws, logical errors, and inefficiencies. These models excel at spotting vulnerabilities that fraudsters could exploit. They can even catch complex, hidden issues that might slip past human auditors, making smart contracts much more secure.

LLMs are also crucial in understanding context and reviewing content in real-time. For example, when chatbots interact with users, LLMs can distinguish between legitimate requests and potentially harmful ones. If someone tries to manipulate a chatbot into revealing sensitive information, the LLM can detect the malicious intent and respond accordingly, preventing a security breach. This real-time monitoring helps ensure that chatbots only provide safe and appropriate responses, further safeguarding sensitive information.

When it comes to integrating chatbots with backend systems, LLMs help by making smarter decisions about access control. They can evaluate whether a request for sensitive data is legitimate based on predefined rules, preventing unauthorized access. Even if someone tries to exploit a vulnerability, the secure integration managed by LLMs ensures that critical backend data remains protected.

LLMs also play a role in verifying external data sources. They can analyze the content and origins of data from outside the system to determine whether it’s trustworthy. The LLM can block risky or unreliable data from entering the system, reducing the chance of compromising it.

In terms of real-world applications, LLMs have proven their effectiveness in high-profile smart contract auditing competitions. For instance, AGIS, equipped with LLMs, identified 21 potential vulnerabilities on its own. This early detection helps prevent fraud, such as unauthorized access to smart contracts or manipulation of contract terms.

What strategies and technologies does AgentLayer employ to protect data privacy, particularly when dealing with sensitive financial information? Can you discuss the platform’s approach to compliance with data protection regulations and any encryption standards used?

AgentLayer uses a variety of strategies and technologies to ensure data privacy, especially when handling sensitive financial information.

To start, the platform integrates advanced input validation and cleaning tools into its chatbots. These tools identify and block any malicious prompts that could target financial data. For example, if someone inputs something suspicious — like keywords associated with fraud — the system can catch it and prevent it from being processed.

AgentLayer also takes extra steps to secure how its chatbots interact with backend systems. It uses strict access controls, meaning that chatbots can only access the information necessary for their tasks. For instance, a chatbot might only see aggregated data rather than individual transactions. When pulling in data from external sources, the system carefully checks the source’s reputation, security certificates, and content to ensure it’s safe. This helps prevent any malicious data from sneaking in.

The platform also employs advanced context understanding and content review mechanisms. These help the chatbots distinguish between legitimate financial requests and those that could be harmful. If a chatbot is about to respond with sensitive financial information, the system reviews the response in real-time to ensure it doesn’t expose any critical details.

When it comes to compliance with data protection regulations like GDPR, AgentLayer takes this very seriously. The platform likely has a team or process dedicated to ensuring that its practices meet all necessary legal requirements. Regular audits and reviews keep everything in line with regulations. Users also have control over their data privacy settings, including the ability to opt out of certain data collection activities or request that their data be deleted.

How do AI agents on the AgentLayer platform use predictive analytics to identify and reduce financial risks? What types of data and analysis methods do they use to predict and address these risks?

The AI agents on the AgentLayer platform use predictive analytics to spot and manage potential financial risks in a few key ways. They start by performing detailed audits of smart contracts. For example, AGIS, one of the AI agents, carefully examines the code for any vulnerabilities, like security flaws or logical errors, that could lead to financial problems. By catching these issues early, the platform helps ensure the integrity of financial transactions.

Another way the platform gathers useful data is through its chatbots, which interact with users. These chatbots can pick up on concerns or questions related to financial transactions, and this information is analyzed to spot emerging risks. The system is also equipped to detect potentially harmful prompts during these interactions, which helps prevent fraud before it happens.

AgentLayer doesn’t stop there — it also taps into external data sources, like financial market data and industry trends. This helps the platform understand the broader context in which transactions are taking place, giving it a better chance to foresee risks.

On the technical side, the platform uses advanced language models like GPT-4 and TrustLLM to analyze the data it collects. These models can identify patterns or anomalies that might indicate financial risks. For instance, if a chatbot conversation includes signs of confusion or concern, the system can flag this as a potential issue.

The platform is also great at understanding the context of these interactions. It can tell the difference between legitimate financial requests and ones that might be suspicious. By continuously monitoring and reviewing chatbot outputs in real-time, it can catch and address potential risks before they escalate.

When it comes to predicting specific risks, the AI agents use sophisticated models to assign risk scores to different scenarios. By looking at past data, they can predict the likelihood of certain risks, like the chance of a smart contract being exploited. This allows the platform to take proactive steps, like notifying users, tightening security, or adjusting contract settings to minimize exposure.

When a risk is detected, the platform can take immediate action. This might include sending alerts to the relevant parties or beefing up security measures, such as stricter access controls or increased encryption. The platform also supports collaborative auditing, where experienced auditors can work together to review and resolve potential risks.

Finally, AgentLayer constantly monitors the effectiveness of these measures and uses the feedback to improve its predictive analytics. By learning from past experiences, the AI agents get better at spotting and managing risks in the future.

How do AgentLink protocols help AI agents work together securely and efficiently when handling financial data? What key security measures are in place to prevent data breaches and ensure smooth data management?

AgentLink protocols make sure that multiple AI agents can work together efficiently and securely, especially when managing sensitive financial data. They define how information and messages are formatted and transmitted across the network, optimizing the process even under limited bandwidth conditions. This reduces the likelihood of errors or interruptions that could compromise financial data.

The platform provides a structured framework for interaction, making it easier for agents to share knowledge, exchange information, send commands, and retrieve results. This well-organized communication process helps minimize the risk of miscommunication or unauthorized access, as agents know exactly where and how to send specific types of information.

AgentLink also uses asynchronous data exchange, with a shared message queue allowing agents to send and receive messages without needing immediate processing. This is particularly beneficial when managing financial data, as it ensures that if one agent encounters a problem or comes under attack, it doesn’t affect the others. The message queue also controls the flow of information, preventing system overload and reducing security risks.

Additionally, separating the communication process from immediate processing helps protect against real-time attacks. If an attacker tries to disrupt the processing of financial messages, the queue can still hold and store these messages until the issue is resolved. This separation allows for more thorough security checks on messages, enhancing overall security when agents handle financial data.

Can you explain the steps involved in training an AI agent on the AgentLayer platform for specific financial tasks? What are the key stages, from collecting data to fine-tuning models, and how is the agent’s performance measured?

Training an AI agent on the AgentLayer platform to handle specific financial tasks involves several key stages. It begins with data acquisition, where the agent accesses various types of data. For instance, it can analyze smart contract audits to detect vulnerabilities and potential risks by looking for security flaws, logical errors, and inefficiencies that might impact financial transactions.

Chatbot interactions are another valuable data source. As chatbots engage with users, they collect data on financial inquiries and concerns, providing insights into common issues and user needs. Additionally, the agent can integrate external data sources, such as financial market data, economic indicators, and industry trends, to better understand the broader context of the financial tasks at hand.

Once the data is collected, it undergoes preprocessing and preparation. This involves cleaning the data to remove noise and irrelevant information, such as filtering out malicious prompts or incorrect financial inputs. For sensitive financial information, the data stays anonymous to protect user privacy.

Next comes model selection and initial training. On the AgentLayer platform, developers choose an appropriate base model from options like Mistral, Llama, or the proprietary TrustLLM. The initial training involves feeding the preprocessed data into the model and adjusting its parameters to learn patterns and relationships within the financial data.

After the initial training, the model undergoes fine-tuning. This step uses specific financial datasets related to the targeted task—such as analyzing financial statements—allowing the model to become more specialized. Techniques like transfer learning and domain adaptation allow to make the model more effective for financial applications, while advanced methods like Retrieval-Augmented Generation (RAG) technology and knowledge matching enhance the model’s ability to handle complex financial data.

Finally, performance evaluation is critical to ensure the agent meets its objectives. This involves measuring the accuracy of the agent’s predictions or outputs, such as how well it predicts financial risks or analyzes financial data. User feedback helps to understand how the agent performs in real-world applications, including ratings and suggestions for improvement. Real-world testing is also conducted by applying the agent in actual financial scenarios or controlled environments to simulate real transactions and tasks, ensuring that it performs effectively outside of the training environment.

How does AgentLayer make sure its AI agents follow global financial regulations and standards? What processes are in place to keep them updated with changing regulations?

AgentLayer takes several steps to ensure that its AI agents comply with global financial regulations and standards. To start, the platform uses input validation and data cleaning tools in its chatbots to block any malicious prompts and anonymize sensitive financial information. This helps protect user privacy and ensures that the handling of personal and financial data meets regulatory requirements. Additionally, AgentLayer integrates with backend systems using strict access controls and role management, which limits who can access sensitive financial data, ensuring compliance with data security regulations.

Auditing and monitoring are also key components of AgentLayer’s compliance strategy. AI agents like AGIS perform thorough smart contract audits to detect vulnerabilities that could affect financial transactions. By securing these operations, AgentLayer aligns with the regulatory standards that govern financial systems. The platform also employs content understanding and review mechanisms within its chatbots to monitor and filter responses, preventing the leakage of sensitive information and adhering to data protection regulations.

To keep up with changes in global regulations, AgentLayer likely has a dedicated team or process that continuously monitors regulatory updates. This might involve subscribing to industry newsletters, participating in regulatory forums, and working with legal and financial experts to stay informed about new or emerging standards. Regular reviews of these regulatory changes help the platform assess their impact and ensure that its AI agents remain compliant.

The platform is designed to be flexible, allowing it to quickly adapt to new regulatory requirements. This means that AgentLayer can easily update its AI agents and systems as needed, such as enhancing encryption standards or tightening access controls in response to new regulations.

Collaboration is another key aspect of AgentLayer’s approach. The platform works with regulatory bodies, industry associations, and academic institutions to gain insights into the latest trends and best practices. This proactive approach helps AgentLayer anticipate regulatory changes and adjust its operations accordingly. The platform also seeks expert advice from legal and financial professionals to ensure ongoing compliance, which may include regular audits and reviews by external experts.

Can you share any new features or updates that AgentLayer? How will these changes help the platform better handle emerging threats?

AgentLayer is making key updates across its platform. On September 10, the staking feature for AGENT tokens and APGN Yields launched, allowing investors to earn substantial returns. With only a week left before the Token Generation Event (TGE), investors are urged to take advantage of the staking opportunity.

We’re also preparing for the listing of AgentLayer’s native token on major cryptocurrency exchanges like Gate.io, BingX, Uniswap, and Aerodrome. The listing, set for September 18, 2024, at 19:00 Singapore Time, will increase trading opportunities for investors and enhance the financial ecosystem.

AgentLayer is also upgrading its use of large language models (LLMs) like TrustLLM to better detect complex fraud and unusual patterns in financial data. By working with more diverse datasets and applying advanced techniques, the platform aims to catch new types of scams.

The platform is enhancing its risk analysis tools, using machine learning to study past data and market trends, which will help identify threats early. It will also monitor financial activities in real-time to catch suspicious behavior, such as unusual transaction patterns.

On the security front, AgentLayer is exploring advanced encryption technologies, including quantum-resistant methods, to better protect financial data. Multi-factor and biometric authentication will also be introduced to boost security for users.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

Solana started a fresh increase from the $120 support zone. SOL price is now consolidating and might climb further above the $142 resistance zone.

- SOL price started a fresh increase above the $125 and $132 levels against the US Dollar.

- The price is now trading above $130 and the 100-hourly simple moving average.

- There is a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if it clears the $142 resistance zone.

Solana Price Gains Over 5%

Solana price formed a base above the $120 support and started a fresh increase, like Bitcoin and Ethereum. SOL gained pace for a move above the $125 and $132 resistance levels.

The pair even spiked toward the $145 resistance zone. A high was formed at $143.06 and the price is now retreating lower. There was a move below the 23.6% Fib retracement level of the upward move from the $135 swing low to the $143 high.

Solana is now trading above $130 and the 100-hourly simple moving average. There is also a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair. The trend line is close to the 76.4% Fib retracement level of the upward move from the $135 swing low to the $143 high.

On the upside, the price is facing resistance near the $142 level. The next major resistance is near the $145 level. The main resistance could be $150. A successful close above the $150 resistance zone could set the pace for another steady increase. The next key resistance is $155. Any more gains might send the price toward the $165 level.

Pullback in SOL?

If SOL fails to rise above the $142 resistance, it could start another decline. Initial support on the downside is near the $138.50 zone. The first major support is near the $137 level and the trend line.

A break below the $137 level might send the price toward the $132 zone. If there is a close below the $132 support, the price could decline toward the $125 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $137 and $132.

Major Resistance Levels – $142 and $145.

Market

Bitcoin Price Breakout In Progress—Momentum Builds Above Resistance

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price is slowly moving higher above the $86,500 zone. BTC is gaining pace and might continue higher in the near term.

- Bitcoin found support at $84,200 and started a recovery wave.

- The price is trading above $85,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $85,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $88,000 zone.

Bitcoin Price Eyes Steady Increase

Bitcoin price remained stable above the $83,200 level and started a fresh increase. BTC was able to climb above the $84,200 and $85,000 resistance levels.

There was a break above a connecting bearish trend line with resistance at $85,000 on the hourly chart of the BTC/USD pair. The bulls were able to pump the price above the $86,500 resistance. It even spiked above $87,000. A high is formed near $87,562 and the price might continue to rise unless there is a move below the 23.6% Fib retracement level of the upward move from the $84,007 swing low to the $87,562 high.

Bitcoin price is now trading above $86,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $87,500 level. The first key resistance is near the $88,000 level.

The next key resistance could be $88,800. A close above the $88,800 resistance might send the price further higher. In the stated case, the price could rise and test the $89,500 resistance level. Any more gains might send the price toward the $90,000 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $88,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $87,000 level. The first major support is near the $86,750 level.

The next support is now near the $86,000 zone. Any more losses might send the price toward the $85,750 support or the 50% Fib retracement level of the upward move from the $84,007 swing low to the $87,562 high in the near term. The main support sits at $84,850.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $86,750, followed by $86,000.

Major Resistance Levels – $87,500 and $88,000.

Market

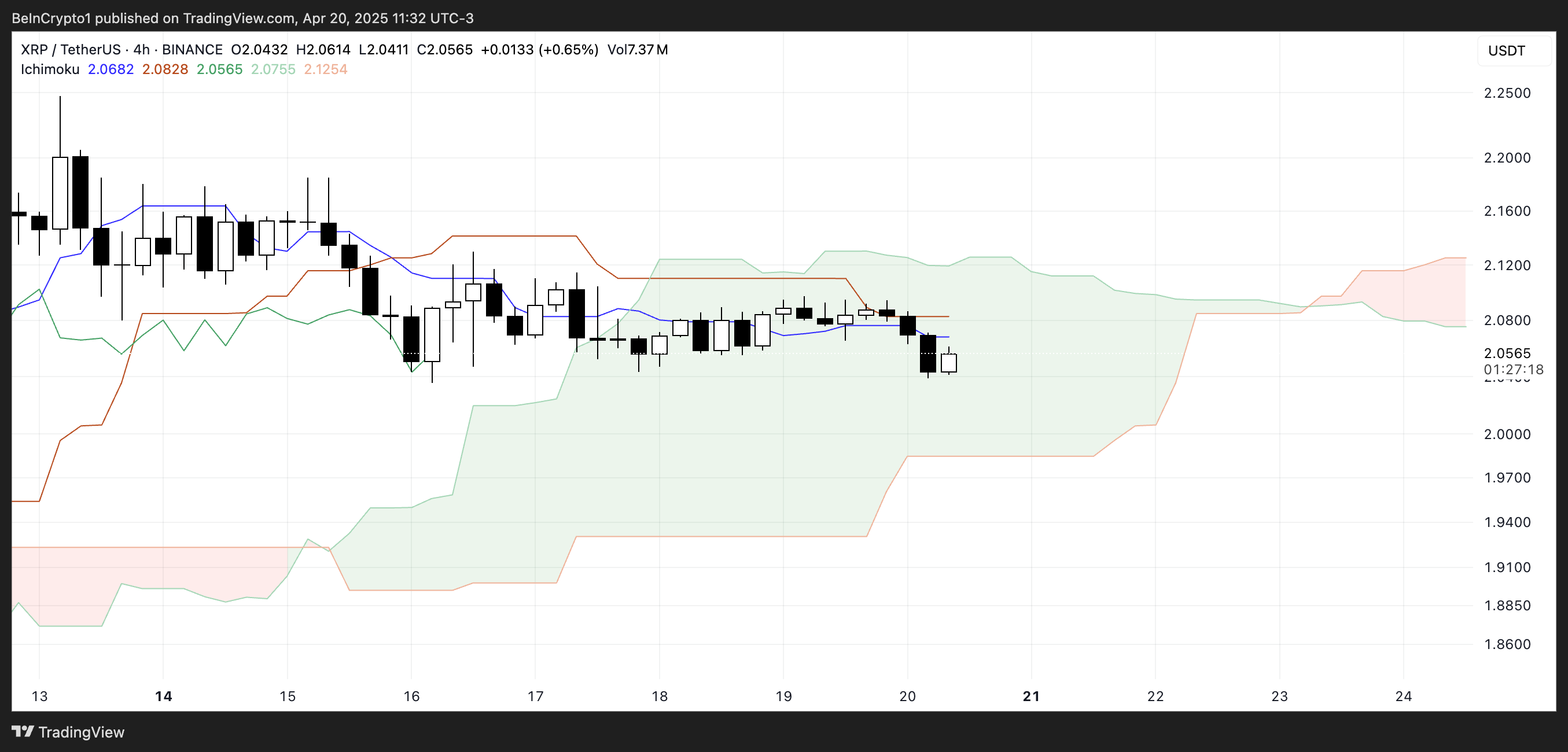

Will XRP Break Support and Drop Below $2?

XRP is down 5% over the past week, struggling to regain momentum as technical indicators flash mixed signals. Its Relative Strength Index (RSI) has dropped below 50, and the price remains stuck within a tight range between key support and resistance levels.

At the same time, the Ichimoku Cloud has shifted from green to red, with a thickening cloud ahead suggesting growing bearish pressure. With volatility compressing and momentum fading, XRP is nearing a critical point where a breakout—or breakdown—seems increasingly likely.

XRP Struggles to Regain Momentum as RSI Drops Below 50

XRP’s Relative Strength Index (RSI) is currently sitting at 44.54, after recovering from an intraday low of 40.67. Just yesterday, it was at 51.30, highlighting increased short-term volatility.

RSI is a momentum indicator that measures the speed and magnitude of recent price changes to evaluate overbought or oversold conditions.

Readings above 70 typically suggest an asset is overbought, while readings below 30 indicate it may be oversold.

With XRP’s RSI at 44.54, it’s currently in neutral territory, showing neither strong buying nor selling pressure.

However, the fact that it hasn’t crossed the overbought threshold of 70 since March 19—over a month ago—signals a lack of sustained bullish momentum. This could mean XRP is still in a consolidation phase, with the market waiting for a clearer direction.

If RSI continues to climb toward 50 and beyond, it may hint at building momentum, but without a breakout above 70, upside could remain limited.

XRP Faces Uncertainty as Bearish Trend Begins to Expand

XRP is currently trading inside the Ichimoku Cloud, signaling market indecision and a neutral trend.

The Tenkan-sen (blue line) has crossed below the Kijun-sen (red line), which is a bearish signal, but with the price still within the cloud, it lacks full confirmation.

The cloud itself acts as a zone of support and resistance, and XRP is now moving sideways within that zone.

Looking ahead, the cloud has shifted from green to red—a sign that bearish momentum may be building. Even more concerning is that the red cloud is widening, which suggests increasing downward pressure in the near future.

A thickening red Kumo often signals stronger resistance overhead and a potential continuation of a bearish trend if the price breaks below the cloud.

Until XRP breaks out decisively in either direction, the market remains in a wait-and-see phase, but the growing red cloud tilts the bias toward caution.

XRP Compression Zone: A Breakout Could Send Price to $2.50 — Or Much Lower

XRP price is currently trading within a tight range, caught between a key support level at $2.05 and resistance at $2.09. This narrow channel reflects short-term uncertainty, but a decisive move in either direction could set the tone for what’s next.

If the $2.05 support fails, the next level to watch is $1.96. A break below that could trigger a steep drop toward $1.61, which would mark the first close below $1.70 since November 2024—a bearish signal that could accelerate selling pressure.

Recently, veteran analyst Peter Brandt warned that a major correction could hit XRP soon.

On the flip side, if bulls regain control and push XRP above the $2.09 resistance, the next target lies at $2.17. A breakout beyond that could open the door to a move toward $2.50, a price level not seen since March 19.

For that to happen, XRP would need a clear resurgence in momentum and buying volume.

Until then, the price remains trapped in a narrow zone, with both upside and downside potential on the table.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoUniswap Founder Urges Ethereum To Pursue Layer 2 Scaling To Compete With Solana

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Market20 hours ago

Market20 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Market14 hours ago

Market14 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Market18 hours ago

Market18 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Altcoin23 hours ago

Altcoin23 hours agoWhat’s Up With BTC, XRP, ETH?

-

Market19 hours ago

Market19 hours agoCharles Schwab Plans Spot Crypto Trading Rollout in 2026

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Accumulators At A Crucial Moment: ETH Realized Price Tests Make-Or-Break Point