Market

a16z Pledges $23 Million for 2026 Pro-Crypto Election Effort

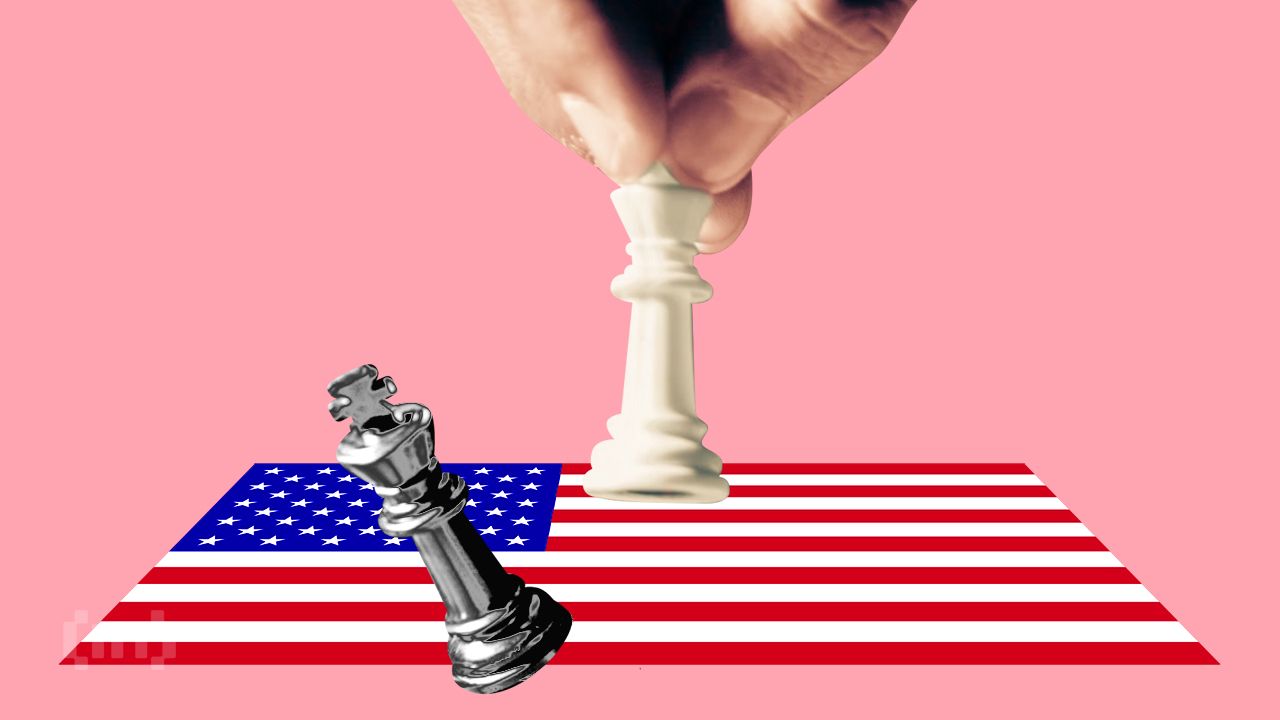

Andreessen Horowitz (a16z) pledged over $23 million to Fairshake and its affiliated political action committees (PACs) for the 2026 midterm elections.

This commitment reinforces its dedication to promoting bipartisan support for comprehensive cryptocurrency regulation.

a16z Advocates Practical Regulatory Framework

The investment, announced in a Monday press release, aims to foster a “practical regulatory framework” for the crypto industry. With growing public interest in digital assets, a16z urges policymakers to develop guidelines that protect consumers while fostering innovation. The firm views Fairshake as a platform to elevate crypto issues to the national stage, aiming to build bipartisan support for balanced regulation.

“Crypto isn’t red or blue but is critical in ensuring America remains the leader in technology for decades to come,” the release read.

a16z’s approach involves direct engagement with lawmakers to build a supportive regulatory framework. The firm plans to introduce key policymakers from both parties to entrepreneurs and developers within the blockchain ecosystem. According to a16z, this would demonstrate the industry’s challenges and its potential under clear, supportive regulation.

Read more: How To Donate Crypto Using The Giving Block.

This ongoing educational initiative also reflects a16z’s view that regulatory enforcement should not precede legislation. Citing the risks of “arbitrary enforcement actions” that could exclude Congress from the regulatory process, a16z argues that consistent guidelines are essential for a thriving and compliant crypto sector.

a16z noted that this regulatory push aligns with rising crypto adoption, with over 40 million Americans now owning digital assets. Bitcoin and Ethereum exchange-traded products (ETFs) have also gained traction, accounting for $65 billion in on-chain holdings.

Stablecoins, a key part of the ecosystem, have seen similar growth and now rank among the largest holders of US treasuries globally. In response, a16z is calling for stablecoin regulations that foster competition and support economic stability. Additionally, the firm advocates for a compliance framework that supports legitimate decentralized networks and businesses.

Broader Industry Push For Crypto-Friendly Candidates

Amid ongoing US election euphoria, a16z’s donation comes amid a broader industry push to support crypto-friendly candidates and lawmakers. The move echoes recent actions by Coinbase, another major crypto player. Coinbase CEO Brian Armstrong recently stated that his company has been making significant donations to back pro-crypto lawmakers in the upcoming elections.

Similar to a16z, Armstrong stressed the need for a regulatory framework that keeps pace with industry growth and technological advancements. He described the 2026 midterms as a chance to elect a “crypto-friendly Congress” that could protect U.S. innovation and global competitiveness.

“We’re not slowing down post-election. Today I am announcing that Coinbase has committed another $25 million to support Fairshake PAC, which they will use leading up to the 2026 midterms to elect pro-crypto candidates,” Armstrong said.

In addition to its financial support for Fairshake, a16z has invested substantial time and resources in meeting with lawmakers. It has also published over a hundred articles and policy briefs to guide informed decision-making in Washington.

According to a16z, these steps are necessary given the industry’s high stakes. Decisions made now potentially shape the trajectory of US crypto innovation for years to come.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

By combining direct contributions to Fairshake, educating policymakers, and advocating for legislation that supports growth while protecting consumers, a16z’s $23 million donation to Fairshake aims to help shape a stable future for crypto in the US.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Eyes $2.0 Breakout—Can It Hold and Ignite a Bullish Surge?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Onyxcoin Buyers Drive Strong Demand as XCN Surges Past $0.01

Onyxcoin has surged by nearly 30% in the past 24 hours, riding the wave of a broader crypto market rally.

But beyond the market-wide momentum, on-chain data suggests that XCN’s spike, its strongest in over a month, is driven by genuine demand for the altcoin.

Onyxcoin Rallies, But There Is a Catch

XCN’s double-digit rally has been accompanied by a surge in its daily trading volume. This totals $128 million at press time, rocketing 480% over the past day.

When an asset’s price and trading volume spike simultaneously, it signals strong market interest and momentum. This means more participants are actively trading XCN and validating its price movement.

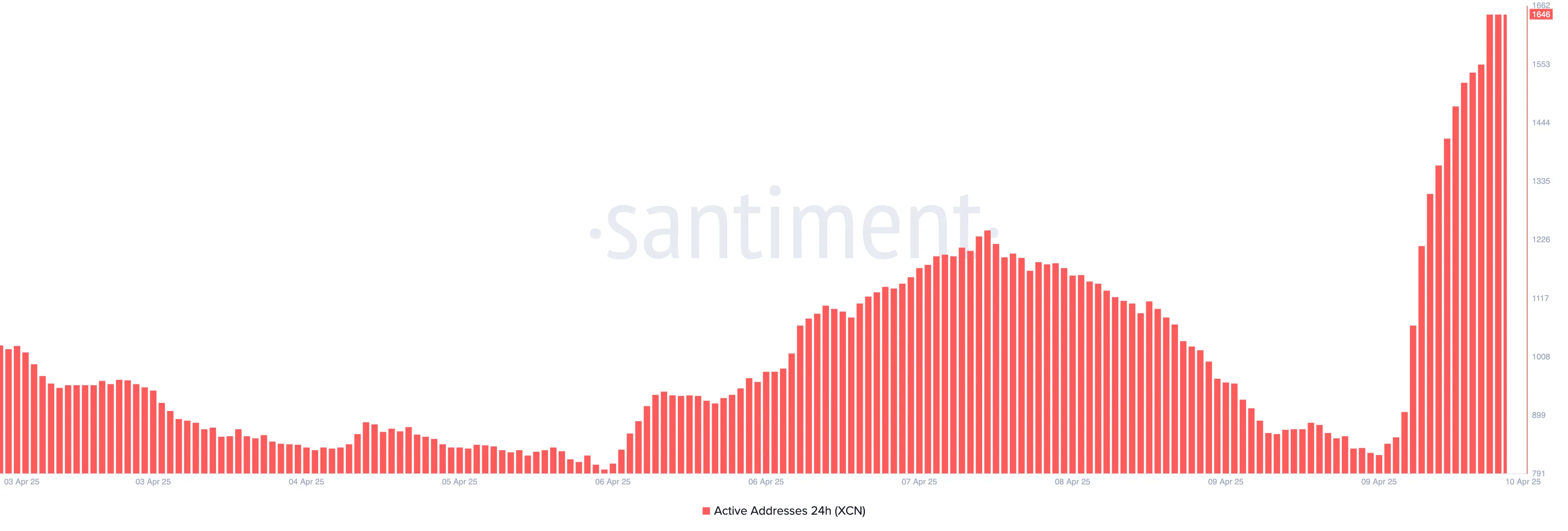

Moreover, the daily count of active addresses that have traded XCN today has climbed to a 60-day high of 1,646.

This spike in active addresses reflects growing retail and possibly institutional interest in XCN. More wallets transacting the token typically suggests broader network participation and confidence, which can serve as a strong bullish signal for the asset.

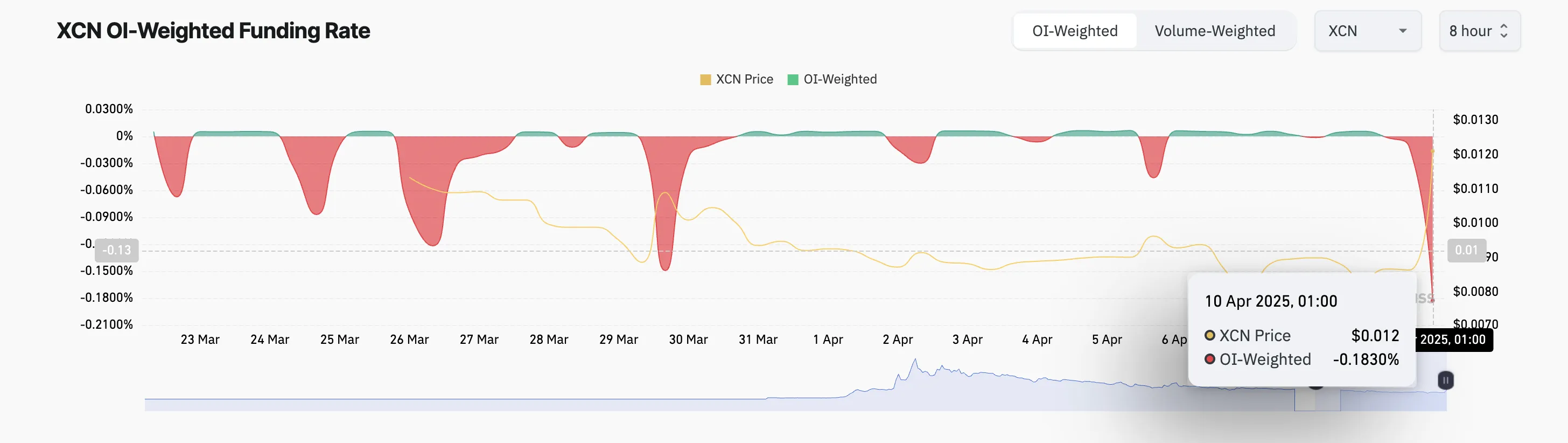

However, not all traders share this bullish sentiment. In the XCN futures market, the outlook is persistently bearish, as reflected by the token’s negative funding rate. This is at a two-month low of -0.18% at press time.

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures to keep the contract price in line with the spot price.

When an asset’s funding rate is negative like this, short traders pay long traders. This indicates bearish sentiment and that more XCN traders are betting on the price to fall.

XCN Clears Key Barrier as Accumulation Grows — Is $0.015 Next?

Apart from the broader market recovery, the price rally is also supported by a visible uptick in on-chain user engagement, signaling that XCN traders are not just following hype but are actively accumulating.

On the daily chart, XCN has broken above the crucial $0.01 resistance level—a price point it struggled to break for two weeks. If the rally persists, XCN’s price could climb to $0.015, a high it last reached on March 5.

However, if market participants begin profit-taking, XCN could shed its recent gains and fall below the $0.011 support toward $0.0075.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Jumps But Smacks Into $120 Resistance Wall—Can It Break Through?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Altcoin17 hours ago

Altcoin17 hours agoIs Dogecoin Price Levels About To Bounce Back?

-

Bitcoin15 hours ago

Bitcoin15 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Altcoin18 hours ago

Altcoin18 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Market15 hours ago

Market15 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Market24 hours ago

Market24 hours agoPaul Atkins SEC Confirmation Vote

-

Market17 hours ago

Market17 hours agoFBI Ran Dark Web Money Laundering to Track Crypto Criminals

-

Market11 hours ago

Market11 hours agoBitcoin Rallies After Trump Pauses Tariff—Crypto Markets Cheer the Move

-

Altcoin16 hours ago

Altcoin16 hours ago21Shares Files For Spot Dogecoin ETF With US SEC