Market

5 Meme Coins to Watch in April 2025

With the end of March, Q1 2025 is also coming to a conclusion. This quarter was not the best for the crypto market, with its excessive losses and extreme volatility, similar to how meme coins operate.

Discussing the bane of the meme coin market, Harrison Seletsky, the Director Of Business Development at Digital Identity Platform SPACE ID, talked about the role of a strong investor base.

“Hype can move the price of a memecoin up, but they also collapse just as fast if there is no interest to sustain them, which is usually the case. That’s why it’s so important to filter out the noise as much as possible,” Seletsky noted.

Thus, BeInCrypto has analyzed five meme coins that have stood the test of time and volatility and are preparing for further gains in April.

Fartcoin (FARTCOIN)

FARTCOIN has emerged as one of the top-performing meme coins this month, rising 107% to trade at $0.61. This impressive increase has allowed the meme coin to recover all the losses it faced in March and February.

To recover its January losses, FARTCOIN will need to continue its upward momentum. The key resistance level to watch is $0.69. A successful break above this level and a move toward $1.00 could signal the beginning of a sustained rally, potentially pushing the price higher in the coming days.

However, if FARTCOIN fails to hold $0.69 as support and misses the $1.00 target, it could face a sharp decline. A drop back to $0.37 would erase much of the recent gains, invalidating the bullish outlook. This pullback could shift investor sentiment towards caution, stalling further growth.

Cheems (CHEEMS)

CHEEMS has emerged as one of the top-performing meme coins this month, rising 130% since the beginning of March. Currently trading at $0.000001927, the altcoin has also posted a new all-time high (ATH) of $0.000002179.

The shift in broader market cues toward recovery has likely sparked newfound interest among CHEEMS investors. If the positive trend continues, the meme coin could push toward $0.000002500, further fueling its rally.

However, if the bullish signals begin to fade or if investors start selling their holdings, CHEEMS could face downward pressure. A fall toward the support level of $0.000001660 or lower would invalidate the bullish outlook. This potential decline could halt the altcoin’s growth and shift market sentiment.

Mubarak (MUBARAK)

MUBARAK launched this month and has already experienced notable volatility. The meme coin is up 95% since its launch, with the current all-time high (ATH) at $0.221. This strong early performance reflects investor optimism and a positive market reception for altcoin’s entry into the crypto space.

Currently trading at $0.145, MUBARAK is aiming to break through the resistance levels at $0.149 and $0.173. Successfully clearing these levels would likely lead to a new ATH beyond $0.221. Such a breakthrough would demonstrate continued bullish momentum and attract more investors to the altcoin.

However, if MUBARAK fails to capture sufficient investor attention, the price could dip to $0.130. A further decline could push the altcoin down to $0.118 or $0.105, invalidating the bullish outlook. Such a drop would signal weakening market sentiment and potential setbacks for MUBARAK’s growth.

Dogecoin (DOGE)

Dogecoin has not registered exceptional gains this month but managed to break out of a two-month downtrend. The altcoin rose 22% in a week, trading at $0.203. This recent upward movement signals a potential shift in market sentiment, suggesting that Dogecoin could see more positive momentum.

Given the current market conditions, Dogecoin is likely to continue its gradual uptrend. This momentum could help the altcoin breach the $0.220 resistance and move toward $0.267. If this upward trend continues, Dogecoin could see sustained growth and attract additional investor interest.

However, if Dogecoin fails to breach the $0.220 level, the price may struggle to maintain its upward movement. A failure to hold above this level could lead to a drop toward $0.176 or even $0.147, invalidating the bullish outlook and potentially extending the losses experienced by the altcoin.

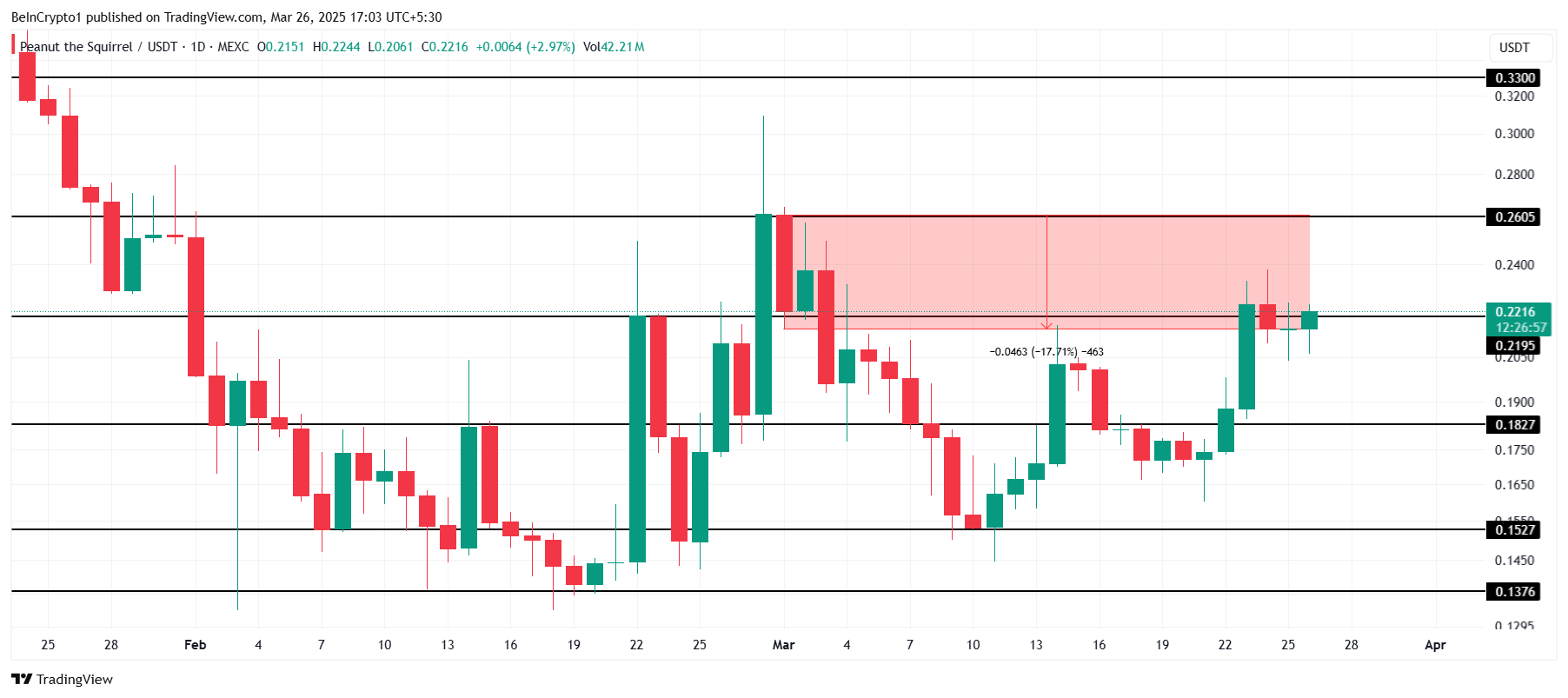

Peanut The Squirrel (PNUT)

PNUT has experienced a 17% loss this month but is closer to recovering its losses. Currently trading at $0.221, the meme coin is beginning to show signs of recovery. The altcoin’s recent price movement signals that it may be positioned for potential growth if market conditions improve.

The primary target for PNUT is to breach the $0.260 resistance and flip it into a support level. If successful, this would pave the way for the meme coin to reach the next key resistance at $0.330. A move above $0.260 would signal further bullish momentum for PNUT.

However, if PNUT fails to breach $0.260 and the price struggles to hold, it could fall back to $0.219. A further drop to $0.182 would invalidate the bullish outlook, erasing recent gains and potentially setting the stage for a prolonged downtrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ONDO Whales Retreat as Price Risks Dropping Below $0.70

ONDO is facing notable downside pressure. It has been down over 5% in the last 24 hours and corrected more than 19% over the past 30 days. With its market cap now sitting around $2.5 billion, the coin is way below competitors like Chainlink and Mantra in terms of market cap.

Recent technical indicators and whale behavior suggest that the current weakness may not be over, despite a slight recovery in momentum.

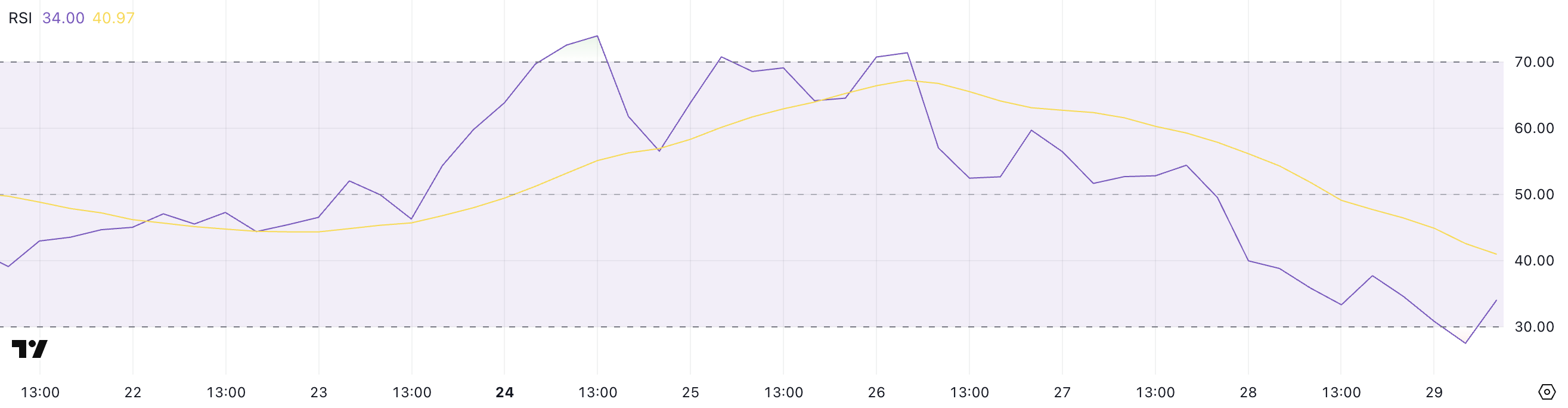

ONDO RSI Is Recovering From Oversold Levels

ONDO’s Relative Strength Index (RSI) is currently sitting at 34 after rebounding slightly from an earlier dip to 27.5. Just two days ago, the RSI was at 54.39, indicating how quickly momentum has shifted.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price changes. It ranges from 0 to 100.

Readings below 30 are typically considered oversold, suggesting the asset may be undervalued and due for a bounce, while readings above 70 are viewed as overbought, indicating potential for a pullback.

With ONDO’s RSI now at 34, it has technically exited oversold territory but remains near the lower end of the scale. This suggests that while the sharpest selling pressure may have eased, the market is still fragile ,and sentiment remains cautious.

If the RSI continues to recover and climbs above 40 or 50, it could signal a shift toward more bullish momentum.

However, if selling resumes and RSI falls back below 30, it would indicate renewed downside risk and potential for further price declines.

Whales Recently Stopped Their Accumulation

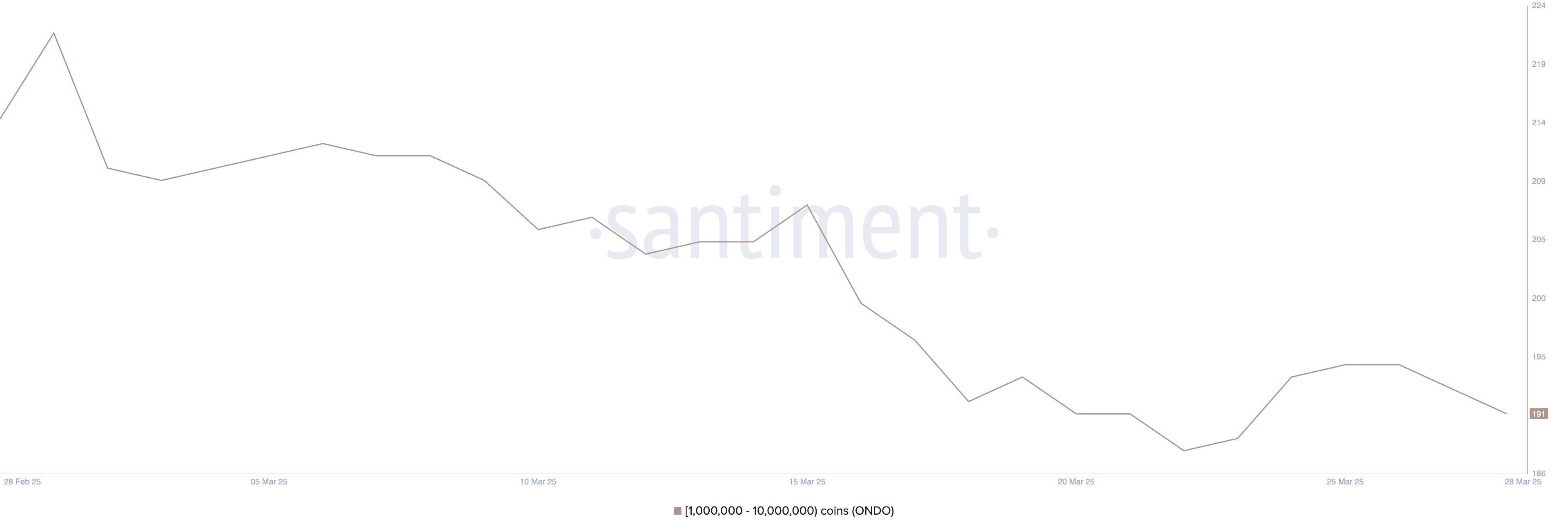

The number of ONDO whales—addresses holding between 1 million and 10 million ONDO—fluctuated in late March, initially increasing from 188 to 195 between March 22 and March 26 before declining to 191 in recent days.

This whale activity pattern is significant as these large holders often influence market sentiment and price movements, with their accumulation or distribution phases potentially foreshadowing broader market trends.

Tracking whale addresses provides valuable insights into how influential investors are positioning themselves, which can help predict potential price action.

The failure of Whale addresses to maintain the breakout above 195 and the subsequent return to 191 could signal bearish sentiment among larger investors.

This retreat might indicate that whales are taking profits or reducing exposure, which could create downward price pressure on ONDO in the short term.

When large holders begin to reduce their positions after a period of accumulation, it often precedes price corrections, suggesting that ONDO may experience resistance in maintaining upward momentum until whale confidence returns and accumulation resumes.

Will ONDO Fall Below $0.70 For The First Time Since November?

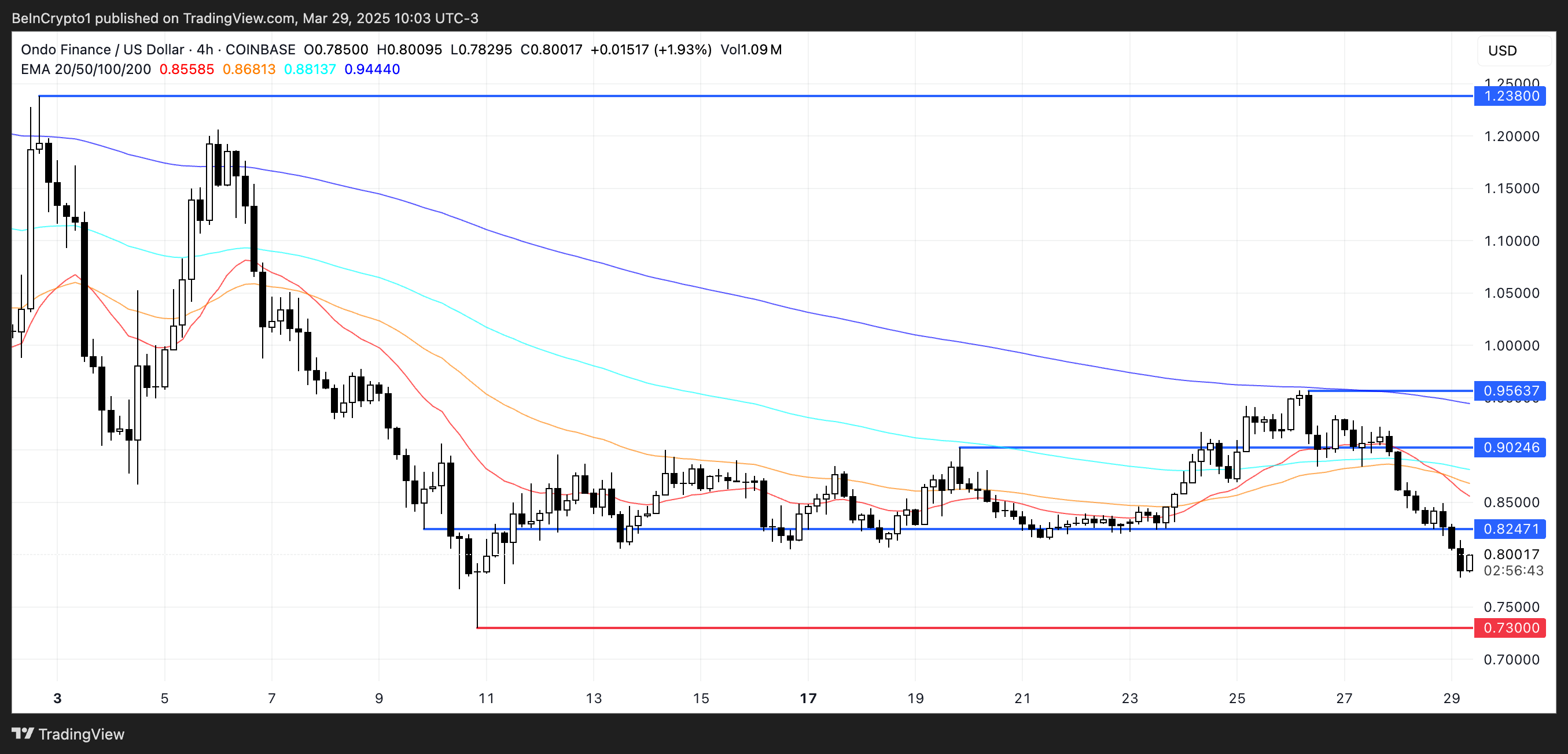

ONDO’s Exponential Moving Average (EMA) lines are currently aligned in a bearish formation, suggesting the ongoing downtrend may persist. If this weakness continues, ONDO could drop to test the key support level at $0.73.

A break below that would be significant, potentially sending the price under $0.70 for the first time since November 2024.

The token has been struggling to keep pace with other Real World Asset (RWA) coins like Mantra, and this underperformance adds further pressure to ONDO’s short-term outlook.

However, if sentiment shifts and ONDO manages to reverse its trend, the first key level to watch is the resistance at $0.82.

A breakout above this level could trigger a broader recovery, with price targets at $0.90 and $0.95.

If the RWA sector as a whole regains momentum, ONDO could even rise above the $1 mark and aim for the next major resistance at $1.23.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

GRASS Jumps 30% in a Week, More Gains Ahead?

GRASS has surged nearly 30% over the past week, with its market cap climbing back to $415 million and its price breaking above $1.70 for the first time since March 10.

This strong performance has been backed by bullish technical signals, including a consistently positive BBTrend and a rising ADX. However, with momentum indicators beginning to cool slightly, the next few days will be key in determining whether GRASS continues its rally or enters a period of consolidation.

GRASS BBTrend Remains Strong, But Is Slightly Declining

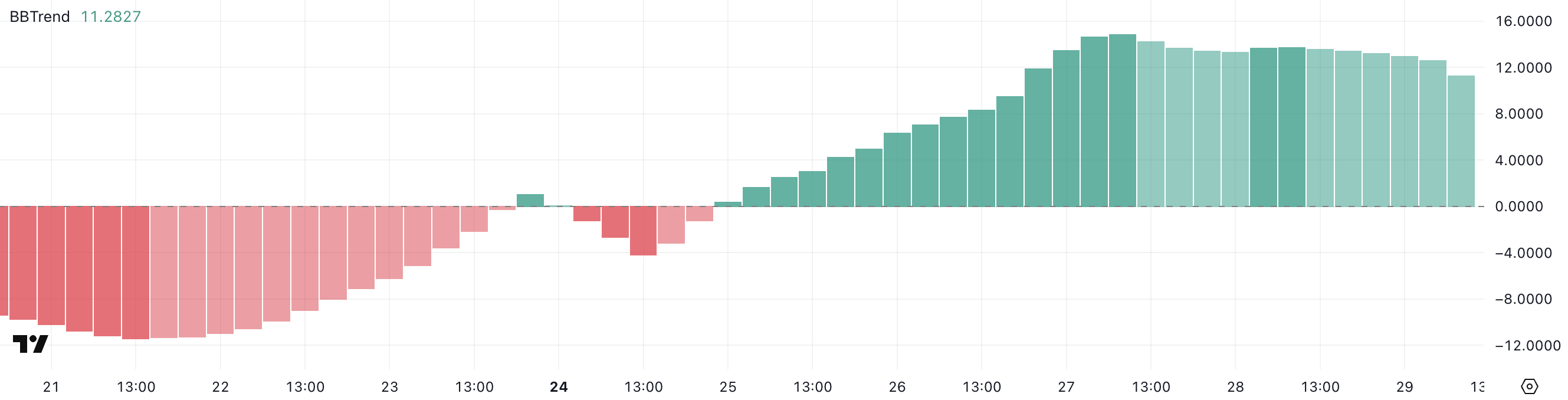

GRASS’s BBTrend is currently at 11.28, marking the fourth consecutive day in positive territory, after peaking at 14.85 two days ago.

The BBTrend (Bollinger Band Trend) indicator measures the strength of price trends by analyzing how far the price moves away from its moving average within Bollinger Bands.

Generally, values above zero indicate an uptrend, while values below zero suggest a downtrend. The higher the positive reading, the stronger the bullish momentum, whereas deep negative values reflect strong selling pressure.

With GRASS maintaining a BBTrend of 11.28, the token is still in an active uptrend, although slightly cooler than its recent peak.

Sustained positive BBTrend readings typically signal that buyers remain in control and that upward momentum could continue.

However, the slight pullback from 14.85 might suggest that momentum is starting to ease. If the BBTrend begins to decline further, it could be an early sign of consolidation or a possible reversal.

For now, GRASS appears to be holding onto bullish momentum, but traders should monitor any shifts in trend strength closely.

GRASS ADX Shows The Uptrend Is Getting Stronger

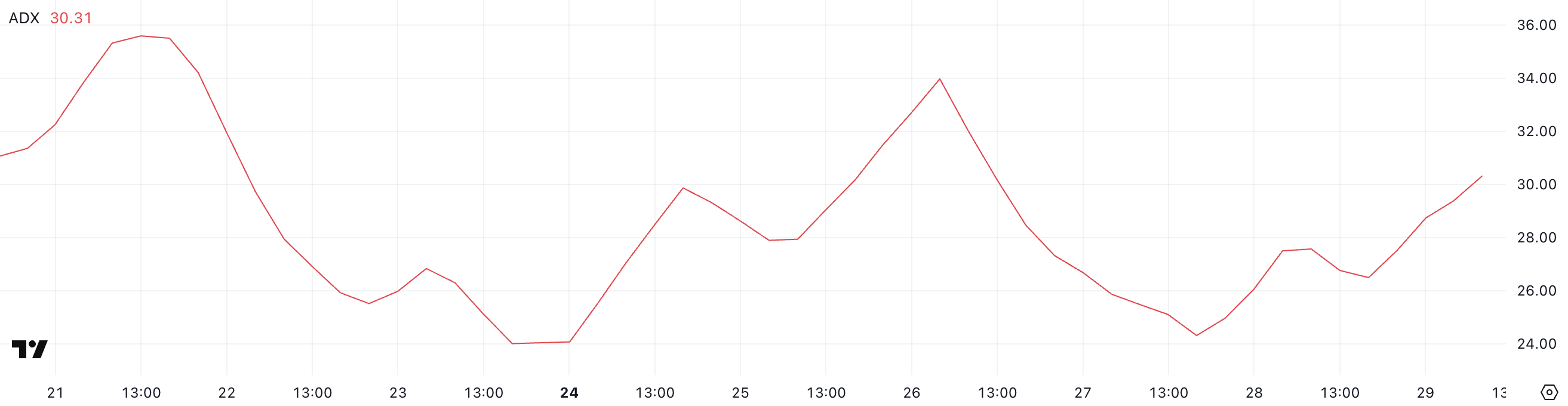

GRASS is currently in an uptrend, with its Average Directional Index (ADX) rising to 30.31 from 26.49 just a day ago, indicating a strengthening trend momentum.

The ADX is a widely used technical indicator that measures the strength of a trend, regardless of its direction, on a scale from 0 to 100.

Values below 20 suggest a weak or non-existent trend, while readings above 25 indicate that a trend is gaining traction.

When the ADX moves above 30, it typically signals that the trend is becoming well-established and may continue in the same direction.

With GRASS’s ADX now above the 30 threshold, the current uptrend appears to be gaining strength. This suggests that bullish momentum is firming up and that price action may continue favoring the upside in the near term.

As long as the ADX remains elevated or continues climbing, the trend is likely to sustain, attracting more interest from momentum traders.

However, if the ADX begins to plateau or reverse, it could signal a potential slowdown or consolidation phase ahead.

GRASS Could Form A New Golden Cross Soon

GRASS’s Exponential Moving Average (EMA) lines are showing signs of a potential golden cross, a bullish signal that occurs when a short-term EMA crosses above a long-term one.

If this crossover confirms, it could mark the beginning of a sustained uptrend. GRASS is likely to test the immediate resistance at $1.85 as some artificial intelligence coins start to recover good momentum.

Should bullish momentum from the past week persist, the token may push even higher toward $2.26 and eventually $2.56 or $2.79, possibly solidifying its position as one of the best-performing altcoins in the market.

However, if the trend fails to hold and sentiment shifts bearish, GRASS could pull back to retest the support at $1.63.

A break below this level might open the door to a deeper correction, potentially driving the price down to $1.22.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Vitalik Buterin Promotes Ethereum Layer 2 Roadmap

Ethereum co-founder Vitalik Buterin has introduced a new roadmap aimed at strengthening the security and finality of Layer 2 (L2) solutions.

His proposal introduces a flexible, multi-proof system designed to support Ethereum’s scalability while preserving its core principles of decentralization and trust minimization.

Ethereum’s New Layer 2 Roadmap

At the heart of Buterin’s technical framework is a “2-of-3” model. This system uses three different proof types—optimistic, zero-knowledge (ZK), and trusted execution environment (TEE) provers.

A transaction is finalized when any two of these agree, significantly reducing the risk tied to relying on a single-proof method. The model offers a pragmatic balance between speed, robustness, and decentralization.

Buterin emphasized the importance of diversification, especially as zero-knowledge systems mature. He warned that shared code among ZK rollups could cause bugs to propagate across implementations, raising systemic risk.

“This means that the finality of rollups can be as fast as zk proving (~<1hr for now) while protecting the system from soundness bugs in the zk system,” Wei Dai, a research partner at 1kxnetwork, explained.

Meanwhile, Buterin’s roadmap also lays out the requirements for what he calls “Stage 2 rollups.” These next-generation rollups would deliver near-instant confirmations, high finality, and strong resistance to failures—even in semi-trusted environments.

Importantly, they would still adhere to Ethereum’s 30-day upgrade delay, a rule that safeguards the network’s stability during transitions.

Buterin Makes Case for Open-Source Funding

Beyond scalability, Buterin is also advocating a cultural shift in how the crypto community approaches development funding.

In a separate blog post, he suggested shifting the focus from “public goods funding” to “open-source funding.”

His concern is that the phrase “public goods” has become politically and socially loaded, often used in ways that prioritize perception over impact.

“A big part of the reason why the term ‘public good’ is vulnerable to social gaming is precisely the fact that the definition of ‘public good’ is stretched so easily,” Buterin argued

He noted that public goods funding is vulnerable to social desirability bias. This often favors those who can navigate community politics over those who deliver meaningful value.

In contrast, open-source funding emphasizes transparency, collaboration, and the building of tools that genuinely benefit the broader ecosystem.

Buterin believes that the goal should not be to fund any open-source project indiscriminately but to support those that create maximum value for humanity.

This stance aligns with his broader vision of a sustainable, community-driven blockchain infrastructure.

Together, Buterin’s proposals could redefine both the technical direction of Ethereum’s scalability efforts and the philosophical foundations of its funding strategies—reinforcing the network’s long-term commitment to decentralization, security, and public benefit.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation23 hours ago

Regulation23 hours agoSonic Labs To Abandon Plans For Algorithmic USD Stablecoin, Here’s Why

-

Market22 hours ago

Market22 hours agoCoinbase Users Lost $46 Million to Crypto Scams in March

-

Altcoin22 hours ago

Altcoin22 hours agoPiDaoSwap, Trump Media, & Grayscale

-

Regulation22 hours ago

Regulation22 hours agoUS SEC Drops Charges Against Hawk Tuah Girl Hailey Welch

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Price Hits 300-Week MA For The Second Time Ever, Here’s What Happened In 2022

-

Market19 hours ago

Market19 hours agoWhy Did MUBARAK Drop 40% Despite Binance Listing?

-

Altcoin19 hours ago

Altcoin19 hours agoAnalyst Reveals Bullishness On Ethereum Price At This Point, Can It Hit $4,000 Again?

-

Market23 hours ago

Market23 hours agoHBAR Faces Volatility After Price Failed To Cross The $0.20 Mark