Market

4 Upcoming Crypto Airdrops to Boost Your Portfolio

The crypto markets are entering what could be one of the most volatile weeks of 2024, with major US economic events on the horizon. As analysts brace for increased market swings, crypto airdrops might offer investors a way to benefit without upfront investments.

Airdrops distribute free tokens, often as a strategy to gain followers and expand a project’s user base. This week, five notable airdrops are worth keeping an eye on.

Confidential Layer

Confidential Layer advertises itself as the first decentralized protocol linking public and privacy blockchains. It operates as a non-custodial cross-chain protocol, offering a bridge between public and private blockchains.

The network launched its airdrop campaign on October 30, with a total airdrop pool of 35% of the total supply of CLONE tokens. Allocations are available for all eligible participants.

“Over 35% of the token supply is allocated for airdrops and incentives, built for the community and rewarding early adopters. We’re here to recognize and support those who join us early,” the project noted.

Read more: What are Crypto Airdrops?

To qualify for the airdrop, farmers must engage in specified tasks, including completing social assignments and referring friends. It delivers an exciting adventure to secure exclusive rewards, with airdrop distribution expected to take place in December 2024.

PAWS

Operating as a Telegram mini-app looking to reward users for their digital footprint within the TON ecosystem, PAWS airdrop stands confirmed. It features a reward system that recognizes and incentivizes user engagement on the platform.

The PAWS airdrop offers eligible users an opportunity to claim tokens based on their Telegram activity and previous participation in related airdrops.

“Users who received tokens from the DOGS, NOT, and HMSTR airdrops are eligible to participate in the PAWS token distribution,” a paragraph on the page read.

This strategic approach to eligibility comes as PAWS commits to rewarding long-term Telegram users and early adopters of similar projects. Additionally, the airdrop features a unique point-based system, allowing users to earn additional rewards through referrals and completing social tasks to earn PAW points.

BulbaSwap

BulbaSwap enables users to execute token swaps for AI and meme coins while offering opportunities for liquidity providers to earn rewards.

The project recently confirmed its upcoming airdrop through its project documentation. A credits-based system has already been implemented to reward early platform adopters. Focusing on active traders, liquidity providers, and referral partners, these three participation categories form the basis of the BulbaSwap airdrop program.

“This structured approach ensures that participants contributing to different aspects of the ecosystem can earn their share of the future token distribution,” BulbaSwap said.

With the credits program currently active, users can accumulate points based on their platform engagement. Bridging Ethereum (ETH) to Morph L2 is one of the participation criteria, with the “boost” page providing one avenue to maximize credits. Additional mechanisms include combining trading, liquidity provision, and referrals, participating in different trading pairs, and maintaining consistent platform activity.

Meanwhile, the BulbaSwap airdrop confirmation came after the project closed its $1.3 million seed round led by Foresight Ventures. Morph L2, MEXC Ventures Labs, and Kronos Research also participated in the fundraiser.

dGEN1

Combining the functionality of a traditional smartphone with native Web3 capabilities, Freedom Factory confirmed an airdrop program exclusive for dGEN1 device owners. It will reward the project’s early adopters and supporters with a share of a dedicated token pool. The distribution is set to commence in spring 2025 (March), coinciding with the delivery of the dGEN1 devices.

Read more: Best Upcoming Airdrops in 2024

The airdrop utilizes a unique NFT-based claim mechanism. Each dGEN1 device owner receives an NFT that represents their right to claim an equal share of the airdrop pool. The pool’s composition includes various tokens, with the exact value and distribution per holder transparently displayed on a dedicated website.

“Added 0.5% of our reflection token to the dGEN1 airdrop pool, so the buyers of EthereumPhone [ethOS] can claim both our token and the reflections that accrue while we wait for delivery,” OG Baby Miggles noted.

This suggests that dGEN1 buyers could also be potentially included in future airdrops for Ethereum-based projects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Experts Reveal What Could Drive Ethereum’s Price Recovery

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has faced significant price challenges this year, drawing sharp criticism from the community. It has been battered by escalating geopolitical tensions and broader market uncertainty.

Yet, market watchers believe that a recovery could be on the horizon. They point to several catalysts that may drive the price momentum starting now.

Will Ethereum’s Price Recover? Experts Weigh In

Analyst Ted Pillows recently highlighted a series of major events scheduled for May 2025 that could drive Ethereum’s price upward, including a surge in tokenization. In a post on X (formerly Twitter), Pillows drew attention to the Pectra upgrade, expected on May 7. This upgrade introduces several major enhancements to staking, deposit processing, blob capacity, account abstraction, and more.

Moreover, he pointed to the likely introduction of ETH-staking exchange-traded funds (ETFs). Since the introduction of spot ETH ETFs last year, their performance has been underwhelming compared to spot Bitcoin (BTC) ETFs.

In fact, many believe that the lack of staking yields in Ethereum ETFs is hindering their growth. Nonetheless, this may change soon. In February 2025, Cboe filed a request with the SEC to allow the 21Shares Core Ethereum ETF to stake ETH held by the Trust.

The next month, a similar request for the Fidelity Ethereum Fund followed. In addition, NYSE also filed on behalf of the Bitwise Ethereum ETF in late March.

“Each event could potentially push ETH up by $1,000,” Pillows wrote.

Pillows also noted that Ethereum is currently “the most hated token,” drawing parallels to Solana (SOL) after it crashed to $8. However, his observation isn’t without merit, as community sentiment does reflect substantial pessimism towards the altcoin.

“If you had invested $10,000 in Ethereum 7 years ago.You would still have $10,000 today. Trump you destroyed us man!” a user remarked.

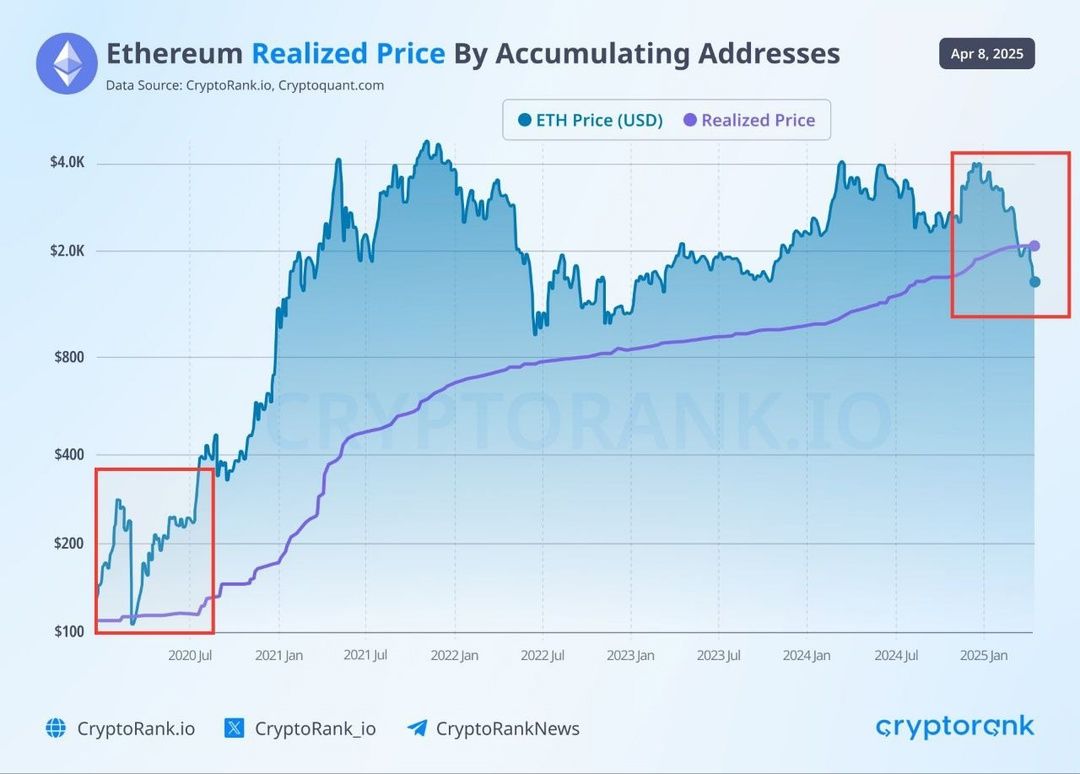

Despite this, many view ETH’s low price as a favorable time to buy in. According to an analyst, ETH is currently undervalued. He emphasized that its market price has dropped below the realized price for the first time since 2020.

“Generational ETH buy opportunity!” the analyst claimed.

BeInCrypto’s latest analysis corroborated ETH’s undervalued state, as evidenced by the MVRV Ratio’s position in the “opportunity zone.”

Notably, optimism has arisen amid ETH’s recent recovery. Following the SEC’s approval of options trading on BlackRock’s iShares Ethereum ETF (ETHA), the altcoin saw a positive price uptick.

Moreover, President Trump’s decision to pause nearly all tariffs for 90 days also led to a broader market recovery. That’s not all. Trump further boosted market sentiment by declaring,

“This is a great time to buy!”

As a result, ETH surged by double digits over the past day. At press time, it was trading at $1,613, reflecting a 13.7% rise.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

THORWallet CEO Explains Why DeFi is Here to Stay

In an interview with BeInCrypto, Marcel Robert Harmann, the Founder and CEO of THORWallet, shares his journey from the early days of crypto to building a successful wallet. Despite the noise created by trends like meme coins and NFTs, Harmann’s belief in the transformative potential of decentralized finance (DeFi) remains steadfast, even as the industry faces challenges with regulation and reputation.

Harmann also delves into the complex relationship between crypto and traditional finance, particularly when it comes to regulation, privacy, and the future of financial services. He discusses how THORWallet is bridging the gap between DeFi and CeFi, offering users a seamless experience while adhering to the core principles of decentralization and transparency.

Reflecting on Crypto Journey: How Marcel Harmann’s View of the Crypto Industry Has Evolved

Those early days were definitely tough in terms of the hours worked, but looking back, it was all worth it. It was hard work, but it didn’t feel like a burden—I was driven to achieve and to build.

Four years later, we’re still here, profitable and growing. The average lifespan of a crypto startup is usually less than 12 months, so we’ve managed to defy the odds.

My view on crypto has remained the same. The industry still excites me, but I think you really need to cut through the noise. There’s a lot of distraction, like the NFT hype, which has lost value over time except for a few select projects. Then, there are meme coins—just noise.

They’re mostly money grabs from people who don’t fully understand the mechanics behind them. With any fast-growing market, especially one involving large amounts of money, scams are inevitable. It’s just part of the industry.

The key is to stay focused, stick to your core principles, and not get distracted by the noise. Crypto, in my view, is still a paradigm shift, particularly for the financial industry, and my belief in its potential hasn’t changed.

Views on the Balance Between Regulation, Criminality, and Reputation in Crypto

I believe that proper regulation is essential, but it needs to be implemented in the right way and at the right time. For example, MiCA (the Markets in Crypto-Assets Regulation) isn’t inherently bad. However, recently, we’ve seen instances of over-regulation, even in Switzerland.

Switzerland is traditionally less regulated than the EU, but even here, we’ve seen regulatory overreach, particularly concerning stablecoins. This led to pushback from the industry, and after a lot of pressure and education towards regulators, the regulations were softened, which is a positive outcome.

In essence, good regulation is beneficial, but over-regulation can stifle innovation. Currently, the first part of crypto, like MiCA, is regulated, and DeFi (decentralized finance) is still in the process of being addressed. In my opinion, true DeFi protocols don’t necessarily need regulation.

However, regulators must verify if protocols are genuinely decentralized to protect users. They need to ensure that users are engaging with a non-custodial, decentralized technology and not a protocol with a centralized team behind the scenes that could tamper with the code—like in the case of a rug pull, where access to the admin key could allow manipulation.

Risks to Retail Investors

Some protocols claim to be decentralized but aren’t truly so, which poses a risk to retail investors. Regulators must assess whether DeFi protocols are genuinely decentralized. If they are and are built on a blockchain like Ethereum, they cannot shut down as long as the blockchain exists.

However, when users move assets from DeFi to traditional finance, regulators need to oversee the on- and off-ramp processes. The blockchain ensures full transparency, making it possible to trace the origin of funds and verify they are not involved in illicit activity.

So, I’m comfortable with where we’re heading in terms of regulation as long as it’s done the right way. But I do worry, particularly about the European Union, either not fully understanding the technology or, in some cases, deliberately trying to undermine DeFi altogether.

How Recent Crypto Trends, Like Bitcoin ETFs and Meme Coin Cycles, Have Shaped Blockchain Adoption

These cycles are overall more net positive. For example, Bitcoin ETFs bring institutional adoption, offering a stamp of approval from larger companies that say, “Yes, Bitcoin is here to stay” as an asset class.

This is a good thing overall. However, with meme coins and NFTs, it’s harder to say whether they’re net positive or not. While they attract a lot of new users, a lot of money is extracted from those who believe they can get rich quickly, but in the end, it’s just like a casino—where the house always wins.

Personally, I don’t focus on these trends. They will bring in more users, sure, but those who enter crypto and end up buying things like Trump coin, for example, often leave with a bad taste. They may not return for years.

It’s like when people first connected to the internet and got viruses from downloading an MP3. They were so burned by the experience that they didn’t touch the internet again for a while. Eventually, though, they came back once they understood it better.

The same will happen with crypto—people may be burned, but they will return when they understand the real value.

DeFi vs. CeFi

That being said, I believe there are genuine projects building a truly decentralized financial system that will exist alongside the traditional financial system. Projects like Compound and the first wave of DeFi protocols were the first iteration to showcase true financial innovation.

Then you have projects like ThorWallet, which is building a Web3 neo-bank. With ThorWallet, you can have your own bank in your pocket, and interact with DeFi protocols while also incorporating CeFi parts for convenience, like easy on- and off-ramping. This is the kind of true innovation that will drive the future of finance.

In the end, there are real builders who are focused on creating a better financial system, and this mission remains unchanged. The core of DeFi is freedom of finance, just like the internet’s core is freedom of information. Despite all the noise and distractions, the true innovators will just keep building.

How Broader Developments in Crypto Impacted ThorChain and ThorWallet

Overall, the vision for ThorWallet hasn’t changed; if anything, it’s been confirmed. The vision has always been clear, and it’s something I present whenever I pitch.

ThorWallet aims to provide all the financial services a person needs, but based on open, fair, and transparent DeFi technology, with decentralized services and products. We’re talking about holding, sending, and receiving assets, but also trading, savings accounts, lending, borrowing, and even perpetual contracts. While most people may not need the latter, it exists and could be beneficial if used properly.

When it comes to perpetual contracts, the reality is that most people use them for speculation. However, they can also be used for hedging and other strategies.

The point is that we now have many financial services that are fully transparent, immutable, and accessible by anyone with a mobile phone and an internet connection. You don’t need a passport, and no one can tell you that you’re not allowed to open a bank account. It’s full freedom of finance, and that vision remains unchanged—it’s only been reinforced over time.

Of course, we’ve adapted as we’ve gone along, particularly when it comes to our partnerships. We’ve become more discerning in choosing which decentralized protocols we work with, ensuring they’re truly decentralized and not prone to issues like rug pulls. It’s our duty to do the due diligence.

Since regulation in this area is still developing, we handle that responsibility ourselves. We want to ensure that any protocol we expose our users to is trustworthy. Over the years, this process has become more refined and sharper.

The Balance Between Privacy in Crypto and Transparency in TradFi: ThorWallet’s Approach

I think privacy is a fundamental right for everyone. But of course, in cases involving bad actors, there should be a system where, with proper legal procedures, privacy can be lifted to ensure justice is served.

For example, access to financial statements might be necessary in criminal cases, but this should be done through a clear judicial process, like a court order, to prevent unnecessary violations of privacy.

Currently, we’re seeing a global trend where governments treat everyone with suspicion, especially regarding tax fraud. This approach is wrong. Everyone shouldn’t be presumed guilty.

If a country has high tax evasion rates, the focus should be on improving governmental processes, not violating citizens’ privacy. For instance, in Switzerland, I’m more than happy to pay my taxes because I can see the value they bring—public infrastructure, clean lakes, and efficient services.

But in other countries, when taxes are high and public services are poor, it’s harder to accept the amount being taken. That’s why people sometimes try to evade taxes, and this leads to a distorted narrative.

When it comes to DeFi, it’s somewhat pseudo-anonymous. Transactions are transparent, but the addresses are not directly tied to specific individuals, which provides some level of anonymity. However, if you want to off-ramp, KYC and AML are required, which means that, in the end, there’s full visibility regarding who owns what address. So, it’s not entirely private, except in the case of privacy coins.

Using Privacy Protocols

That said, using privacy tools can be perfectly reasonable. For instance, you might want to keep certain transactions private, especially if large sums of money are involved. You might not want the public to know you’re worth millions when you deposit into a lending protocol, for example.

It’s important to approach this calmly and rationally, and there’s no problem as long as it’s explained well.

I’m committed to supporting any chain that I believe is sufficiently decentralized, whether it’s a privacy coin or not—ThorWallet remains fully tech-neutral. I do believe that, eventually, it will be possible to interact with privacy coins in a way that effectively hides your trace.

This is especially useful in cases where privacy is justified. However, the system is still designed to catch bad actors. For example, if someone is depositing $100 million but has reported an income of $100,000, it raises immediate questions.

If the transaction involves a privacy coin, regulators will inquire further. If there’s no solid explanation, the funds may be frozen until the source is clarified, and in some cases, this could lead to uncovering illicit activities like stolen funds.

So, there’s no issue with implementing privacy protocols as long as the system remains robust enough to prevent misuse.

Overcoming Challenges in Mass Adoption and Web3 Integration: THORWallet’s Next Big Steps

We’re very close to achieving our goal. For example, with ThorWallet, we aim to simplify complex DeFi technology so that users don’t need to be exposed to it. They should have experience similar to centralized finance (CeFi) apps like Revolut, but in the backend, it will run on a fully decentralized network.

Building a decentralized version of a Revolut app is much more complex, but this is what we’re working on with ThorWallet.

A key issue we’re addressing is the need for gas tokens. Currently, if you want to send USDC on Avalanche, for example, you need AVAX tokens to cover the transaction fees.

This makes it unattractive and difficult to onboard a large number of users. We’re working on abstracting this away so users won’t need to worry about specific gas assets. You could top up your MasterCard without worrying about the gas fees at all, for example. We have several technical solutions in place to achieve this, which will ultimately provide a gasless experience similar to CeFi platforms.

Addressing Latency Issues

Additionally, certain blockchains, like Bitcoin, have latency issues, which are slower than others. But we are finding ways to improve that as well, ensuring a smoother user experience. Once we’ve achieved this, we’ll be ready to onboard 100 million users. That’s why we’re raising growth funds now, as we’re 95% of the way there and ready for the next phase.

You’ll still need to pay transaction fees, but the way it works will be different. For instance, when you perform a swap, the gas fee will be included in the swap fee itself. If you top up your MasterCard, we might cover the gas fee for you since it’s usually very small, often just a few cents.

Another option is to implement a “gas tank” feature, where users can top it up with whatever they prefer—Fiat, USDC, or another asset. This gas tank would be used for any required gas fees on different blockchains, like Base or Avalanche, and users would see a message when their gas tank is running low, prompting them to top it up again.

This could even be a premium feature, where premium users get their gas fees covered by a subscription while other users manage their own gas tanks. Either way, our goal is to make the user experience as seamless as possible.

THORWallet and YouHodler: Competitors or Potential Partners in Bridging DeFi and Traditional Finance?

At this moment, we don’t view YouHodler as a direct competitor. They’re a centralized entity with a strong focus on perpetuals, which is not currently our focus. While they do service blockchain users, and you could argue they are competitors in that sense, they aren’t competing with us directly right now.

That said, I’m aware that they’re now making the transition from CeFi to DeFi, which is really exciting, and that could put them in the competitive space in the future. However, since we don’t yet offer perpetuals (perps) in ThorWallet, this could actually lead to a potential partnership instead.

What’s great about the Web3 space is that its dynamic is different from traditional finance. We’re more open to collaboration here. In fact, I had a discussion yesterday with Ilya, the CEO of YouHodler, about how their upcoming DeFi perpetual protocol could potentially integrate with ThorWallet.

The key in this space is to focus on expanding the overall market rather than competing for what’s already there.

Crypto vs. Traditional Finance: Which Will Have a Bigger Impact in the Long Run?

I believe crypto finance will eventually overtake traditional finance, at least from an IT infrastructure perspective. While the financial products themselves will remain similar, the technology behind them will shift to blockchain.

This switch from the outdated tech stack of traditional finance to the more modern blockchain infrastructure will enable the creation of new financial products that simply weren’t possible before, such as Flash loans. So, in short, I believe crypto finance will surpass traditional finance in the long run.

It reminds me of the managers at Daimler Benz and Audi, maybe about seven years ago. They had their best year yet while laughing at Tesla and electric cars. Fast forward a few years, and Tesla’s stock was worth more than all of Germany’s car producers combined.

Suddenly, every major car manufacturer in Germany was scrambling to make electric cars. They were stubborn at first, but eventually, they had to adopt the new paradigm. This shift in the auto industry is exactly what I see happening with traditional finance and crypto.

Final Thoughts

I had an interesting discussion yesterday regarding the European Union’s new stablecoin initiative, and I want to share my expertise and personal thoughts on it with your audience.

I’m really concerned about what’s happening. There are two types of Central Bank Digital Currencies (CBDCs): wholesale and retail.

Switzerland is focusing on wholesale CBDCs, where only national banks have stablecoins for transactions between banks. This gives them the advantage of immediate settlement, efficiency, and doesn’t disrupt the existing banking hierarchy. In this setup, banks still issue money to retail users, which I think is the correct approach.

Risks with CBDCs

However, the European Union, like China, is pushing forward with retail CBDCs, where they would issue digital currency directly to retail users, bypassing banks. This is troubling for two main reasons.

First, the European Union and national banks haven’t exactly excelled at managing their financial systems over the past 20 years, so I’m skeptical of their ability to handle such a monumental shift, especially without working through banks that already have the necessary infrastructure and experience.

Secondly, retail CBDCs mean that governments would have full visibility into every transaction users make. They could monitor your spending habits, and if they didn’t like something, they could block you from the financial system with just a few keystrokes.

This is an incredibly powerful tool, akin to having control over the army—just through financial means. The US Dollar has long been the strongest weapon because of its role in global finance, and we’ve already seen instances where countries like Russia have been cut off from the system. What’s even more concerning is the hypocrisy surrounding these actions, as Russian oligarchs may be blocked in Europe but can still open bank accounts in places like Wyoming. But that’s a different issue.

What worries me about CBDCs is that they would essentially lead us into an observation state, where everything we do financially is visible to the government. This is a dangerous path, especially when it comes to privacy and financial freedom.

It would be a major disruption to individual freedoms, and it should not be adopted. Anyone who’s interested in this topic should really look into it, and politicians need to wake up to the dangers they’re walking toward.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Rallies After Trump Pauses Tariff—Crypto Markets Cheer the Move

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $80,000 zone. BTC is now consolidating gains and might correct some to test the $80,500 zone.

- Bitcoin started a fresh increase above the $80,000 zone.

- The price is trading above $80,500 and the 100 hourly Simple moving average.

- There was a break above a key bearish trend line with resistance at $78,800 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $83,500 zone.

Bitcoin Price Jumps Over 5%

Bitcoin price started a fresh increase from the $74,500 zone. BTC formed a base and gained pace for a move above the $78,500 and $80,000 resistance levels.

The bulls pumped the price above the $80,500 resistance. There was a break above a key bearish trend line with resistance at $78,800 on the hourly chart of the BTC/USD pair. The pair even cleared the $82,500 resistance zone. A high was formed at $83,548 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $74,572 swing low to the $83,548 high.

Bitcoin price is now trading above $80,200 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $83,200 level. The first key resistance is near the $83,500 level.

The next key resistance could be $84,500. A close above the $84,500 resistance might send the price further higher. In the stated case, the price could rise and test the $85,800 resistance level. Any more gains might send the price toward the $88,000 level.

Are Dips Supported In BTC?

If Bitcoin fails to rise above the $83,500 resistance zone, it could start a downside correction. Immediate support on the downside is near the $81,400 level. The first major support is near the $80,500 level.

The next support is now near the $79,500 zone or the 50% Fib retracement level of the upward move from the $74,572 swing low to the $83,548 high. Any more losses might send the price toward the $78,000 support in the near term. The main support sits at $75,000.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $81,400, followed by $80,500.

Major Resistance Levels – $83,500 and $84,500.

-

Altcoin22 hours ago

Altcoin22 hours agoBinance To Delist These 7 Crypto Pairs Amid Market Turmoil, Are Prices At Risk?

-

Bitcoin20 hours ago

Bitcoin20 hours agoGoldman Sachs Raises US Recession Odds to 45%

-

Market20 hours ago

Market20 hours agoHow Ripple’s $1.25 Billion Deal Could Surge XRP Demand

-

Market8 hours ago

Market8 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Altcoin19 hours ago

Altcoin19 hours agoPepe Coin Whales Offload Over 1 Trillion PEPE

-

Market22 hours ago

Market22 hours agoXRP Price Warning Signs Flash—Fresh Selloff May Be Around the Corner

-

Bitcoin21 hours ago

Bitcoin21 hours agoWhy Bitcoin’s Value Could Benefit from Trade War, Analyst Explains

-

Ethereum9 hours ago

Ethereum9 hours agoEthereum Traders Pulling Back? ETH’s Open Interest On Binance Sees Continued Decline