Market

4 Reasons Why HashKey Capital is Bullish on Altcoins

HashKey Capital remains optimistic about altcoins, taking cues from the ongoing Bitcoin boom. Their bullish stance is based on a mix of market analysis, strategic investments, and economic factors that suggest strong potential for low-cap tokens.

At the same time, Bitcoin (BTC) continues to perform well, with the $70,000 milestone within reach. Should positive sentiment lead to capital flowing into altcoins, Ethereum and Solana are expected to be the primary beneficiaries.

HashKey Capital Eyes Market Potential for Altcoins

The investment firm has articulated its bullish outlook in a recent Medium post. It outlined the strategic rationale behind its focus on altcoins amid changing market outlook and investor sentiments. Specifically, HashKey Capital has identified a critical shift in investor behavior, citing an increasing demand for diversified portfolios that extend beyond Bitcoin and Ethereum.

Growing Institutional Interest

The post emphasizes that the increasing institutional interest in cryptocurrencies serves as a strong catalyst for the growth of altcoins. It highlights the growing narrative around cryptocurrencies as major financial players and asset managers become more involved in the digital asset space.

Further, institutions are looking beyond Bitcoin and Ethereum, considering altcoins as viable investment vehicles. Among them is Bitwise, which recently revised its XRP ETF (exchange-traded fund) filing. Others, like Grayscale, are pivoting their trust funds to altcoins such as Aave, Sui, and XRP.

Read more: 10 Best Altcoin Exchanges In 2024

According to Jupiter Zheng, HashKey Capital’s partner of liquids funds and research, professional investors are eager to explore altcoin opportunities. Due to their lower market capitalization and growth potential, these tokens have historically provided substantial returns.

Changing Market Conditions

HashKey Capital’s optimism is also grounded in favorable market conditions. Recent trends indicate that cryptocurrency markets are stabilizing, aided by improved liquidity and shifting macroeconomic conditions. The firm points to signs of a market bottoming out, which, coupled with the potential easing of US interest rates, is seen as a favorable environment for altcoin investments.

“The peaking of US interest rates combined with improved liquidity in the crypto market creates an ideal environment for investors to explore altcoins,” Zheng noted

The increase in applications for spot crypto ETFs (exchange-traded funds) also reflects a growing acceptance and normalization of digital assets. For instance, Nashville-based investment firm Canary Capital filed for a Litecoin ETF, which further enhances the investment avenue for altcoins.

Regional Regulatory Boost

Another key component of HashKey Capital’s bullish outlook on altcoins is the supportive regulatory environment. Hong Kong is a key focus for the asset manager, given that it is based there. The region has made significant strides in establishing a strong framework for digital assets.

This has attracted institutional interest and provided a favorable atmosphere for crypto investments, with the likes of Animoca Brands exploring a possible IPO (initial public offering) in Hong Kong or the Middle East. The regulatory clarity is expected to facilitate greater adoption of altcoins and pave the way for new projects to emerge.

As HashKey navigates this regulatory playing field, its focus on altcoins aligns with the broader trend of institutional players entering the market. This influx of capital and expertise is anticipated to drive innovation and create new investment opportunities within the altcoin space.

Diversification Strategy

Nevertheless, HashKey Capital’s strategy goes beyond capitalizing on market trends. It is also about prudent risk management through diversification. The firm plans to allocate less than 50% of its funds to Bitcoin and Ethereum, allowing for greater exposure to smaller-cap cryptocurrencies. This strategic allocation aims to optimize risk-return profiles by tapping into the potential of various altcoin projects.

The selection criteria prioritize projects that exhibit strong fundamentals and novel approaches. Taken together, the asset manager’s altcoin pivot highlights an understanding of market inefficiencies. Smaller market cap-sized cryptocurrencies often experience higher volatility, but they also provide opportunities for outsized returns. By strategically investing in a range of altcoins, the crypto investment firm seeks to balance risk while pursuing substantial upside potential.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season.

HashKey Capital’s expression of bullishness on altcoins is timely, coming along with analysts’ expectation that the colloquial “alt season” is near sight. As BeInCrypto reported, the Altcoin Season Index has dropped to its lowest level since early September, signaling a potential shift. Nevertheless, some are also skeptical about an altcoin season happening, given Bitcoin’s prevailing dominance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Struggles as Whale Selling Rises To $2.3 Billion

XRP has been on a consistent downtrend in recent days, with its price falling sharply and approaching the $2 mark. This has resulted in extended losses for the cryptocurrency, with a notable rise in selling pressure.

Despite the bearish momentum, key investors are trying to offset the negative impact.

XRP Whales Are Uncertain

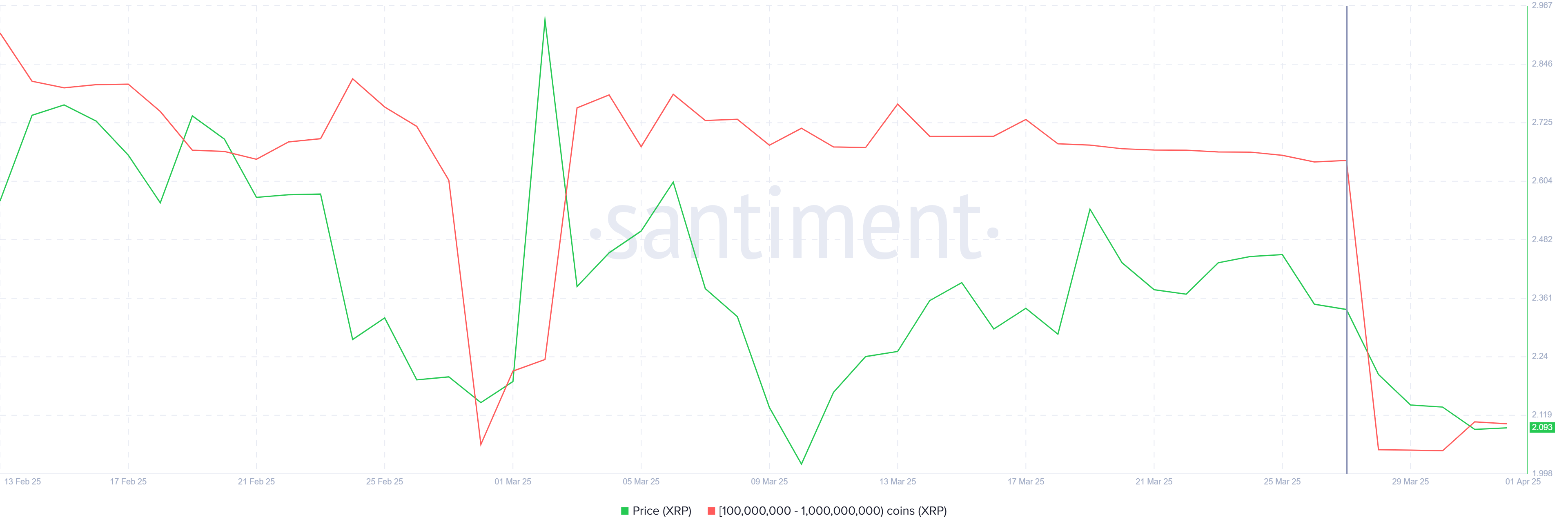

Whale activity has been a major factor contributing to the recent decline in XRP’s price. Addresses holding between 100 million and 1 billion XRP have sold over 1.12 billion XRP, worth $2.34 billion, in the past seven days. This has brought their total holdings down to 8.98 billion XRP.

The selling activity from these whale addresses reflects a cautious outlook for XRP. While whale selling often indicates uncertainty in the market, it’s important to note that their behavior can also have significant short-term price movements. The recent heavy selling could signal that market participants are unsure about the short-term price action, and further bearish trends could follow if this continues.

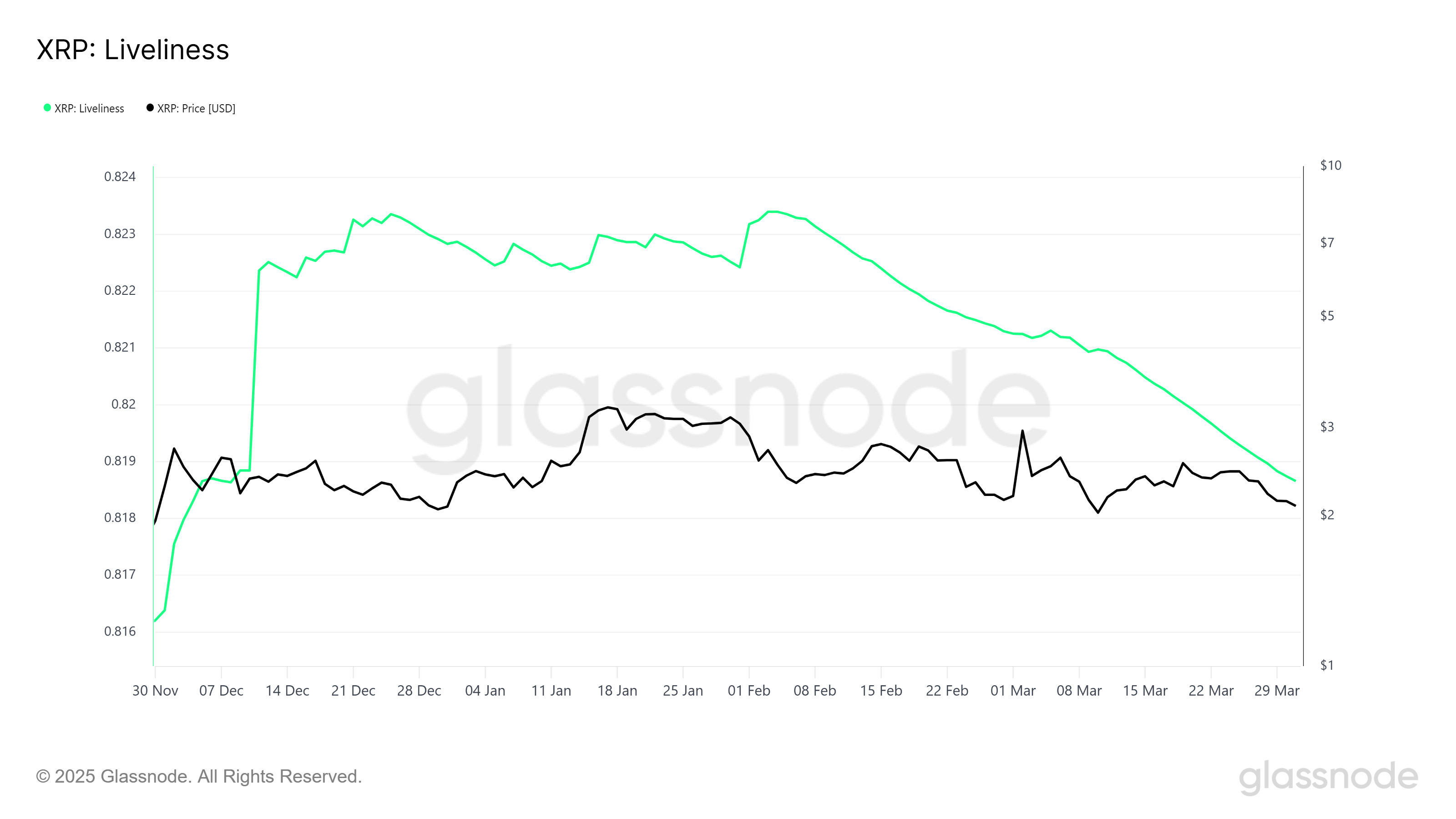

On the broader market level, XRP’s macro momentum shows signs of divergence from the whale selling. The Liveliness metric, which tracks the behavior of long-term holders (LTHs), is currently declining.

A falling Liveliness typically signals that LTHs are accumulating more of the asset at lower prices rather than selling. This drop to a three-month low suggests that long-term holders are sticking to their conviction and accumulating XRP, even as whale selling intensifies.

The steady accumulation of LTHs might help cushion the bearish effects created by the whales. This behavior can counteract the selling pressure, potentially offering stability to XRP’s price and supporting a recovery if market conditions improve.

XRP Price Needs To Find Direction

XRP’s price has fallen by 14.5% this week, bringing it to $2.09, which is dangerously close to losing the critical $2.02 support level. The ongoing bearish momentum has created mixed signals in the market, which are likely to keep the price stuck in a narrow range for the time being.

If XRP can bounce back from the $2.02 support, it could recover some of the recent losses. However, the altcoin may remain consolidated below the $2.27 resistance level unless more positive news or market conditions arise to push it higher.

If XRP breaks through the $2.27 barrier or falls below $2.02, it could invalidate the current consolidation outlook. A successful breach of $2.27 could pave the way for a price recovery, with $2.56 being the next significant target.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started another decline below the $83,500 zone. BTC is now consolidating and might struggle to recover above the $83,850 zone.

- Bitcoin started a fresh decline below the $83,200 support zone.

- The price is trading below $83,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $82,550 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another decline if it stays below the $83,850 resistance zone.

Bitcoin Price Faces Resistance

Bitcoin price failed to start a recovery wave and remained below the $85,500 level. BTC started another decline and traded below the support area at $83,500. The bears gained strength for a move below the $82,500 support zone.

The price even declined below the $82,000 level. A low was formed at $81,320 before there was a recovery wave. There was a move above the $82,500 level, but the bears were active near $83,850. The price is now consolidating and there was a drop below the 50% Fib retracement level of the upward move from the $81,320 swing low to the $83,870 high.

Bitcoin price is now trading below $83,250 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $82,550 on the hourly chart of the BTC/USD pair. On the upside, immediate resistance is near the $83,250 level. The first key resistance is near the $83,850 level.

The next key resistance could be $84,200. A close above the $84,200 resistance might send the price further higher. In the stated case, the price could rise and test the $84,800 resistance level. Any more gains might send the price toward the $85,000 level or even $85,500.

Another Decline In BTC?

If Bitcoin fails to rise above the $83,850 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $82,550 level. The first major support is near the $82,250 level and the 61.8% Fib retracement level of the upward move from the $81,320 swing low to the $83,870 high.

The next support is now near the $81,250 zone. Any more losses might send the price toward the $80,000 support in the near term. The main support sits at $78,500.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $82,250, followed by $81,250.

Major Resistance Levels – $83,250 and $83,850.

Market

Is CZ’s April Fool’s Joke a Crypto Reality or Just Fun?

On April 1, Binance co-founder Changpeng Zhao (CZ) shared an amusing hypothetical on social media platform X (Twitter).

He posed the hypothetical scenario of a user generating a cryptocurrency wallet address commonly used for token burns, which permanently remove tokens from circulation.

Binance’s CZ Shares Cryptic Hypothetical on April Fools Day

Changpeng Zhao’s April Fools’ joke about generating a token burn address sparked discussions. However, the chances of it happening are astronomically low. CZ shared the post during the early hours of the Asian session, kickstarting an interesting discourse.

“Imagine downloading Trust Wallet and finding your newly generated address is: 0x000000000000000000000000000000000000dead. Theoretically speaking, it has the same chance as any other address. Alright, enough imagining. Not gonna happen. Get back to building. Happy Apr 1!” Changpeng Zhao wrote.

It comes in time for April Fools’ Day, celebrated annually on April 1, dedicated to practical jokes, hoaxes, and playful deception. Trust Wallet, integrated as Binance’s non-custodial wallet provider, played along with the joke.

“Happy April Fool’s Day,” wrote Trust Wallet.

While the idea seems far-fetched, CZ was not technically wrong. Theoretically, there is an infinitesimally small probability that someone could randomly generate a wallet address matching “0x000…dead” using software like Trust Wallet.

However, the chances are comparable to winning the lottery multiple times. To put things into perspective, one can generate blockchain addresses using cryptographic hashing functions that produce 160-bit outputs.

This means there are 2¹⁶⁰ possible Ethereum addresses—a number so vast that generating any specific address, such as “0x000…dead,” is practically impossible.

“Haha, imagine the odds! That is a 1 in 2^160 type of vibe. Good one, CZ—back to work now, no distractions from the code,” Synergy Media wrote, putting the rarity into context.

While CZ’s April Fool’s joke entertained the crypto community, the reality remains unchanged. The likelihood of generating a wallet address identical to “0x000…dead” is close to zero. This means the post was a fun thought experiment but nothing more.

“Imagine that you can randomly generate a Bitcoin private key every second, and suddenly one day the private key you generated happens to correspond to Satoshi Nakamoto’s wallet or Binance’s wallet. That’s terrifying,” another user quipped.

However, the joke does highlight the fascinating cryptographic underpinnings of blockchain technology. While every address is technically possible, some are rare and might as well be myths. Crypto users will have to keep burning their tokens the old-fashioned way.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum’s Price Dips, But Investors Seize The Opportunity To Stack Up More ETH

-

Bitcoin18 hours ago

Bitcoin18 hours agoStrategy Adds 22,048 BTC for Nearly $2 Billion

-

Market23 hours ago

Market23 hours agoStrategic Move for Trump Family in Crypto

-

Market18 hours ago

Market18 hours agoBNB Breaks Below $605 As Bullish Momentum Fades – What’s Next?

-

Market22 hours ago

Market22 hours agoTop Crypto Airdrops to Watch in the First Week of April

-

Market17 hours ago

Market17 hours agoTrump Family Gets Most WLFI Revenue, Causing Corruption Fears

-

Altcoin22 hours ago

Altcoin22 hours ago$33 Million Inflows Signal Market Bounce

-

Market20 hours ago

Market20 hours agoBitcoin Mining Faces Tariff Challenges as Hashrate Hits New ATH