Market

3 Winners as US Elections Approach

The US presidential election is scheduled for November 5. With October already here, meme coins tied to the top 3 presidential candidates, dubbed “PolitiFi meme coins,” have seen explosive growth amid the heightened political climate.

Among them is MAGA (TRUMP), which the meme coin community built in favor of former President Donald Trump. The other two include Kamala Horris (KAMA), which supports current Vice President Kamala Harris, and lately, Jeo Boden (BODEN), a token initially deployed when current President Joe Biden was still in the race.

MAGA (TRUMP)

Two weeks ago, PolitiFi meme coins plummeted to their lowest points in seven months. MAGA (TRUMP), which is reflective of Donald Trump’s Make America Great Again campaign, also felt the heat during that period.

But in the last seven days, TRUMP’s price has increased by 75.60% and currently changes hands at $3.19. This renewed rally is linked to the speculation that the US presidential candidate may start mentioning crypto in their campaign even though they’ve avoided it in past debates.

According to the 4-hour chart, the recent resurgence was also validated by the golden cross on September 26. For context, a golden cross occurs when the shorter Exponential Moving Average (EMA) crosses above the longer one.

As seen below, the 20 EMA (blue) had crossed over the 50 EMA (yellow). Apart from that, the Relative Strength Index (RSI), which measures momentum, is now above the signal line and reinforces the bullish thesis.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

Should this remain the same, TRUMP’s price could breach the overhead resistance at $3.40. If that happens, the meme coin’s value might climb to $4.11 before the US elections come in full force.

However, if Trump’s chances of winning the election drop significantly in the coming weeks, this forecast might not happen. Instead, the token might decline to $2.35 if it fails to hold the support line at $2.82.

Kamala Horris (KAMA)

KAMA’s price is currently $0.0087, representing a 68.50% increase within the past week. The meme coin initially plunged to $0.0053 on Thursday, September 26. But since Kamala Harris reportedly displayed commitment toward crypto expansion, the token has been rising.

Despite significant gains, the 4-hour chart suggests KAMA’s price may face challenges in maintaining its upward trend. This is primarily due to the Awesome Oscillator (AO) and Moving Average Convergence Divergence (MACD), both momentum indicators, turning downward.

As such, KAMA might experience a pullback as it attempts to hit $0.0090. If the meme coin does not break above this point, a decline could be next.

In that scenario, KAMA’s price could decrease to $0.0075. Increased buying pressure and rising support for Kamala Harris on the outside could change things for the better. Should that happen, KAMA could erase one zero and climb to $0.011.

Jeo Boden (BODEN)

Jeo Boden was a trending PolitiFi meme coin and registered notable upswings earlier in the year. However, after President Joe Biden dropped out of the race, BODEN’s price crashed.

Things are starting to change again, especially as the token increased by 62% in the last seven days. This uptrend suggests that, even though Biden is no longer a candidate, BODEN could remain a notable force among PolitiFi meme coins.

As of this writing, BODEN’s price is $0.0092. Based on the 4-hour chart, the Bull Bear Power (BBP) had hit higher green histogram bars. The BBP measures the strength of buyers to sellers. When it increases, buyers (bulls) are in control, and the price might increase.

Read more: Best Crypto To Buy Now: Top Coins To Keep an Eye on in October 2024

Conversely, a negative reading of the BB suggests that bears (sellers) are dominant. Considering the current condition, BODEN’s price could be set to climb to $0.011. Retracement to $0.083 might, however, happen if buying pressure decreases.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Circle, BitGo, and Others Eye Bank Charters in US

With support from Trump’s White House and easing regulations, firms like Circle and BitGo are pursuing becoming full-fledged financial institutions.

Reports indicate a new wave of crypto companies knocking on the once-closed doors of the American banking system. This time, someone is listening.

Crypto Firms Seek Bank Charters as Wall Street’s Doors Reopen

After years of being sidelined, crypto companies are coming back, this time through the front door of the US banking system.

Citing sources familiar with the matter, the Wall Street Journal revealed that several major players, including Circle and BitGo, are preparing to apply for bank charters or financial licenses.

Traditional banks are also responding to the shift. US Bancorp is re-launching its crypto custody program via NYDIG, while Bank of America (BofA) said it would issue its stablecoin once the legal framework is in place.

Even global giants are watching closely. A consortium including Deutsche Bank and Standard Chartered is evaluating how to expand crypto operations into the US.

While details remain scarce, the interest signals that crypto is no longer just a niche but a competitive frontier.

These firms reportedly aim to operate with the same legitimacy and access as traditional lenders. This includes holding deposits, issuing loans, and launching stablecoins under regulatory supervision.

The timing is not random. A sharp pivot in federal policy, driven by President Trump’s pledge to make the US a Bitcoin superpower, has reopened regulatory pathways once shut after the FTX collapse.

In parallel, Congress is advancing stablecoin legislation requiring issuers to secure federal or state licenses.

The push for bank status comes amid a broader effort to legitimize crypto within US finance. Earlier this year, regulators rolled back key restrictions. Among them, the SEC’s controversial SAB 121, which had blocked banks from holding crypto on behalf of clients.

Meanwhile, Federal Reserve (Fed) Chair Jerome Powell affirmed that banks could serve crypto customers provided proper risk management strategies exist.

In another regulatory green light, the Office of the Comptroller of the Currency (OCC) clarified that banks can offer stablecoin and custody services. However, this is provided they comply with established banking rules.

These signals have emboldened crypto firms previously kept at arm’s length. Anchorage Digital, the only US crypto-native firm with a federal bank charter, says the regulatory lift is massive but worth it.

“It hasn’t been easy… the whole gamut of regulatory and compliance obligations that banks have can be intertwined with the crypto industry,” Anchorage CEO Nathan McCauley reportedly admitted.

McCauley cited tens of millions in compliance costs. Nevertheless, Anchorage has since collaborated with BlackRock, Cantor Fitzgerald, and Copper for high-profile custody and lending programs.

BitGo, which will reportedly custody reserves for Trump-linked stablecoin USD1, is nearing a bank charter application.

Circle, the issuer of USDC, is also pursuing licenses while fending off competition, just like Tether. This is a traditional finance (TradFi) venture into stablecoins.

The firm delayed its IPO this month, citing market turmoil and financial uncertainty. However, insiders say regulatory clarity remains a top priority.

Firms like Coinbase and Paxos are exploring similar routes, considering industrial banks or trust charters to expand their financial offerings legally.

At the policy level, venture firm a16z has called on the SEC to modernize crypto custody rules for investment firms, reflecting the industry’s hunger for clarity and parity.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Springs Back From $531 With Unshaken Bullish Conviction

My name is Godspower Owie, and I was born and brought up in Edo State, Nigeria. I grew up with my three siblings who have always been my idols and mentors, helping me to grow and understand the way of life.

My parents are literally the backbone of my story. They’ve always supported me in good and bad times and never for once left my side whenever I feel lost in this world. Honestly, having such amazing parents makes you feel safe and secure, and I won’t trade them for anything else in this world.

I was exposed to the cryptocurrency world 3 years ago and got so interested in knowing so much about it. It all started when a friend of mine invested in a crypto asset, which he yielded massive gains from his investments.

When I confronted him about cryptocurrency he explained his journey so far in the field. It was impressive getting to know about his consistency and dedication in the space despite the risks involved, and these are the major reasons why I got so interested in cryptocurrency.

Trust me, I’ve had my share of experience with the ups and downs in the market but I never for once lost the passion to grow in the field. This is because I believe growth leads to excellence and that’s my goal in the field. And today, I am an employee of Bitcoinnist and NewsBTC news outlets.

My Bosses and co-workers are the best kinds of people I have ever worked with, in and outside the crypto landscape. I intend to give my all working alongside my amazing colleagues for the growth of these companies.

Sometimes I like to picture myself as an explorer, this is because I like visiting new places, I like learning new things (useful things to be precise), I like meeting new people – people who make an impact in my life no matter how little it is.

One of the things I love and enjoy doing the most is football. It will remain my favorite outdoor activity, probably because I’m so good at it. I am also very good at singing, dancing, acting, fashion and others.

I cherish my time, work, family, and loved ones. I mean, those are probably the most important things in anyone’s life. I don’t chase illusions, I chase dreams.

I know there is still a lot about myself that I need to figure out as I strive to become successful in life. I’m certain I will get there because I know I am not a quitter, and I will give my all till the very end to see myself at the top.

I aspire to be a boss someday, having people work under me just as I’ve worked under great people. This is one of my biggest dreams professionally, and one I do not take lightly. Everyone knows the road ahead is not as easy as it looks, but with God Almighty, my family, and shared passion friends, there is no stopping me.

Market

XRP Futures Traders Increase Bets on Upside

Over the past week, XRP’s price has remained range-bound amid the broader market’s recovery attempt.

However, with a growing bullish bias toward the altcoin, XRP may be on the brink of breaking free from this range and trending upward. This analysis explains why.

XRP Futures Traders Bet on Upside as Long Positions

The momentum shift towards the bulls has become evident, particularly within the futures market, where long bets on XRP are now surpassing short positions. This is reflected by the token’s XRP’s long/short ratio, which is currently at 1.07.

The long/short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price declines) in the market.

When its value is below one, it indicates that the number of short positions outweighs long positions in the market, suggesting bearish sentiment or a lack of confidence in the token’s future price performance.

As with XRP, when an asset’s long/short ratio is above one, it means there are more long positions than short ones. It indicates that traders are predominantly bullish on XRP and hints at a higher likelihood of an upward breach of its narrow range.

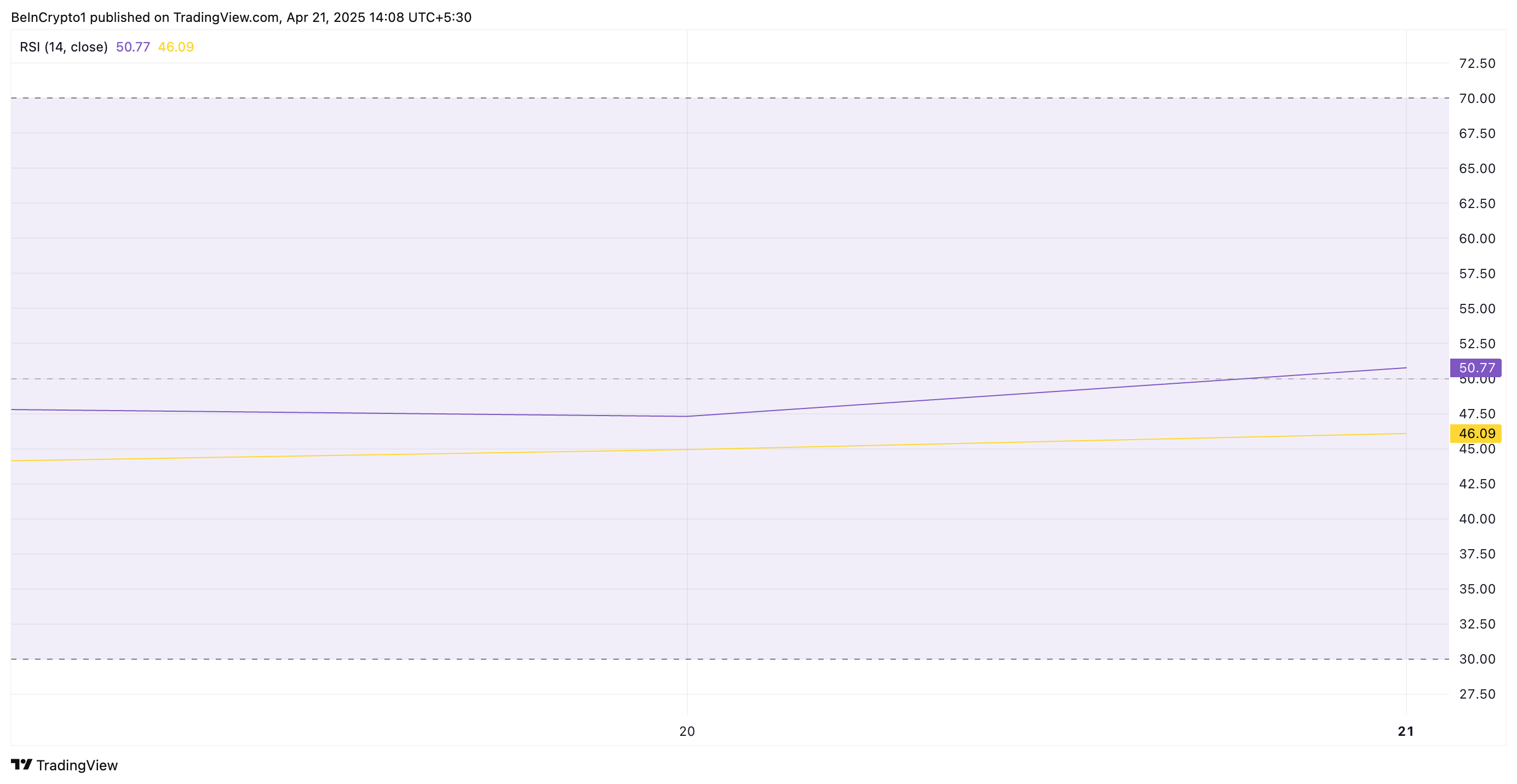

In addition, XRP’s relative strength index (RSI) has climbed steadily, indicating a gradual rise in demand for the token. The key momentum indicator, at 50.77, currently rests above the neutral line and is in an uptrend.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 50.77, XRP’s RSI signals a shift toward bullish momentum. It indicates that buying pressure is starting to outweigh selling pressure, and the asset may be poised for further price increases.

XRP Eyes $2.18 Resistance as Bulls Look to Push for $2.29

XRP currently trades at $2.13, just 3% away from its next significant resistance level, $2.18. If buying pressure intensifies and the altcoin successfully flips this price point into a support floor, it could trigger further price growth. In this scenario, XRP could potentially climb to $2.29.

However, if demand weakens and the bears regain control, XRP may remain range-bound. It could even break below the $2.03 support and fall to $1.99.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Market21 hours ago

Market21 hours agoTokens Big Players Are Buying

-

Market23 hours ago

Market23 hours agoVOXEL Climbs 200% After Suspected Bitget Bot Glitch

-

Market20 hours ago

Market20 hours agoDogecoin Defies Bullish Bets During Dogeday Celebration

-

Market18 hours ago

Market18 hours agoWill XRP Break Support and Drop Below $2?

-

Market11 hours ago

Market11 hours agoBitcoin Price Breakout In Progress—Momentum Builds Above Resistance

-

Bitcoin9 hours ago

Bitcoin9 hours agoUS Economic Indicators to Watch & Potential Impact on Bitcoin

-

Market8 hours ago

Market8 hours agoVitalik Buterin Proposes to Replace EVM with RISC-V