Market

3 Bullish Signs Say XRP Will Breakout to $0.58

Ripple (XRP) price could revisit $0.58 after dropping below that region three days ago. This prediction is backed by several indicators that have historically proven to be key to the token’s price movement.

Currently, XRP changes hands at $0.53, representing a 4.81% decrease within the past week. However, it could be set to erase these losses and climb higher.

High Liquidity, Higher Ripple Price

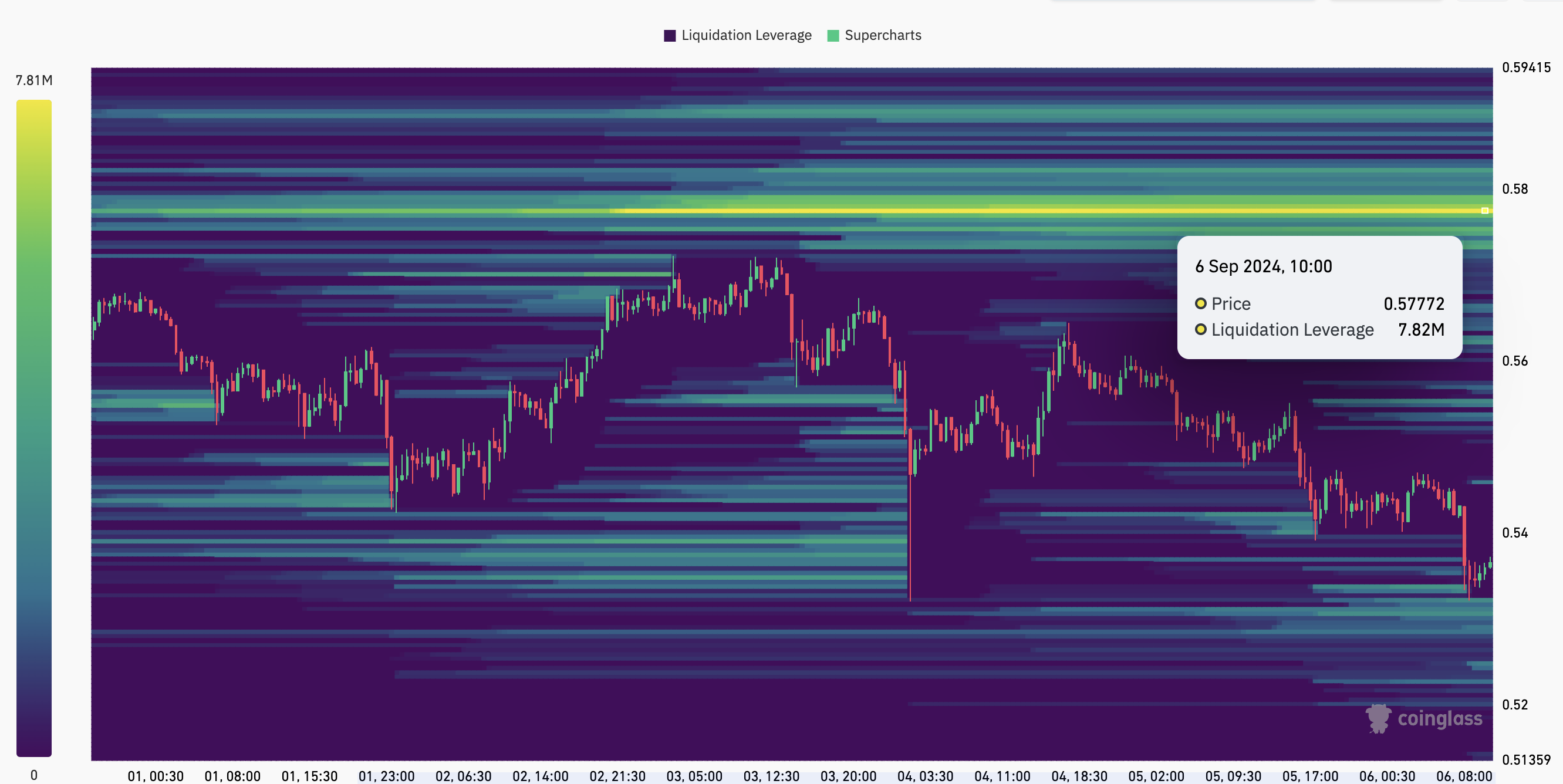

One of the indicators backing XRP’s price increase is the liquidation heatmap, which predicts price levels where large-scale liquidations are likely to occur. Beyond that, the heatmap can give traders an edge as it also helps them understand price points where there is a large pool of liquidity.

In most cases, if there is high liquidity concentration at a point, the cryptocurrency’s price might move toward the zone. According to Coinglass, the one-week heatmap shows a high concentration of liquidity, around $0.58.

This level, which changes color from purple to yellow, indicates that traders perceive it as a range to make favorable trades. Therefore, with significant buy pressure, XRP’s price might inch closer to the territory.

Read more: 10 Best Altcoin Exchanges In 2024

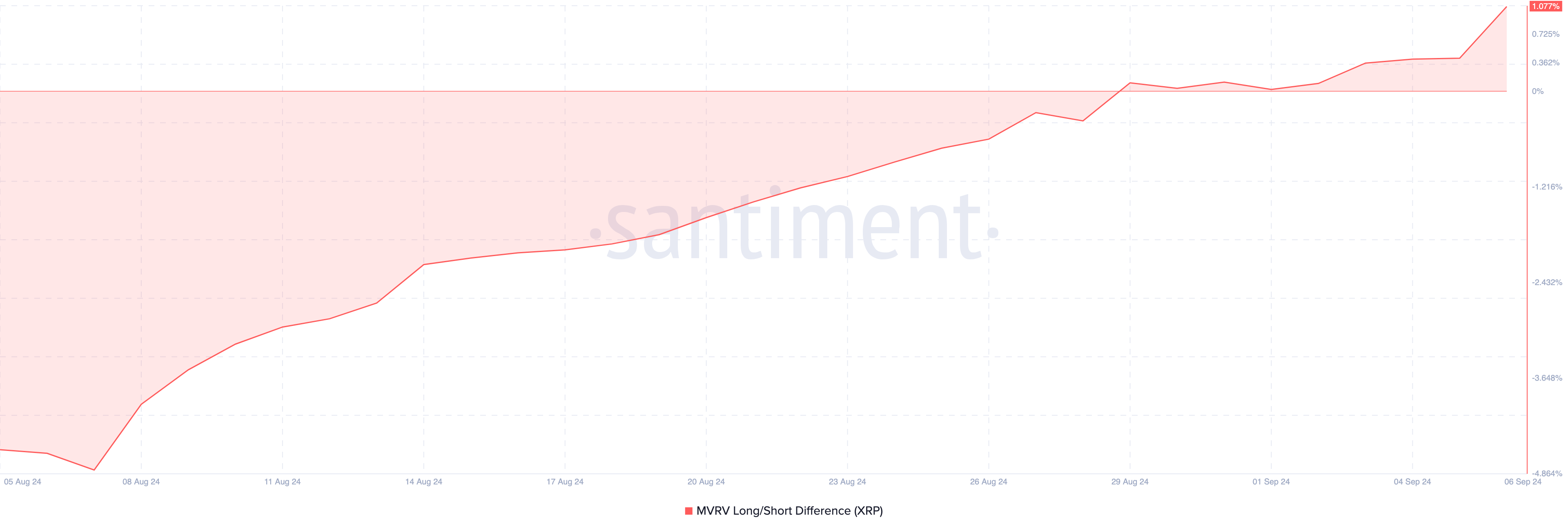

Another indicator supporting this bias is the XRP’s Market Value to Realized Value (MVRV) Long/Short Difference. This metric shows whether short-term holders are making more profits than long-term holders.

Negative readings of the MVRV Long/Short Difference indicate that short-term holders have more unrealized gains. Conversely, a positive reading suggests that long-term holders have the upper hand.

The metric was in negative territory toward the end of last month, suggesting that XRP’s price might become weaker due to short-term selling pressure. However, as of this writing, the reading is back in the positive range, indicating that more holders might be willing to hold instead of selling. As long as this trend continues, the token might resist a notable downturn.

XRP Price Prediction: Bullish Pattern

On the 4-hour chart, BeInCrypto observed that XRP’s price had formed a falling wedge. This technical pattern appears when two descending trendlines are drawn on the chart. In this instance, the upper trendline represents the highs, while the lower one spots the lows.

Technically, the falling wedge pattern is a bullish signal overall. Thus, the downtrend and XRP’s recent consolidation could come to an end. However, to validate this thesis, the token has to rise above the strong resistance at $0.55.

Once this happens, the token could get a clear path that leads it to $0.58 at the 50% Fibonacci level.

Read more: 7 Best Crypto Contract Trading Platforms in 2024

However, this forecast might not come true if XRP whales, who bought over 50 million tokens a few days ago, start selling. If this happens, then XRP’s price might remain stagnant at $0.53. In a worst-case scenario, the cryptocurrency’s value could drop toward $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple Buys Hidden Road for $1.25 Billion to Boost XRP Ledger

Ripple has signed a $1.25 billion agreement to acquire Hidden Road, a global prime brokerage platform. The deal marks one of the largest mergers in the crypto space and signals Ripple’s expansion into institutional finance infrastructure.

With this move, Ripple becomes the first cryptocurrency company to own a multi-asset prime broker operating at a global scale.

Understanding Ripple’s $1.25 Billion Acquisitions

Hidden Road serves over 300 institutional clients and clears around $3 trillion in trades each year across markets, including foreign exchange, digital assets, derivatives, and fixed income.

The acquisition aims to address a key gap in the crypto sector: reliable infrastructure for institutional investors.

By integrating Hidden Road’s services, Ripple plans to offer financial institutions a complete suite of trading and clearing tools that meet traditional finance standards.

Ripple’s large balance sheet will give Hidden Road the capital to grow its services and scale operations globally. The company is expected to become one of the largest non-bank prime brokers as it expands access to both digital and traditional markets.

The deal also strengthens Ripple’s RLUSD stablecoin. Hidden Road will adopt RLUSD as collateral across its brokerage products. This will make RLUSD the first stablecoin to support cross-margining between crypto and traditional asset classes.

As part of the integration, Hidden Road will shift its post-trade processes to the XRP Ledger. This move will cut operating costs and highlight the blockchain’s ability to support institutional-grade decentralized finance.

Ripple also plans to extend digital asset custody services to Hidden Road clients, reinforcing its push into enterprise payments and asset management.

What Does It Mean for XRP Ledger?

In recent months, the XRP community has raised concerns about the network’s underutilization despite its high market capitalization.

As of March, XRP Ledger recorded just $44,000 in daily decentralized exchange (DEX) trading volume—an extremely low figure compared to other major blockchains. The network also lags behind in node distribution, validator count, and smart contract engagement.

So, Ripple’s acquisition of Hidden Road directly addresses the XRP Ledger’s ongoing utility concerns.

As Hidden Road shifts post-trade operations to XRPL and uses Ripple USD (RLUSD) as collateral, this will increase on-chain activity, boost DEX trading volume, and improve total value locked (TVL).

The migration also encourages institutional participants to interact with the ledger, potentially driving up validator participation and smart contract usage.

This real-world integration might strengthen XRPL’s practical utility and drive more engagement on the network.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump-Backed WLFI Proposes Airdrop Test for USD1 Stablecoin

World Liberty Financial (WLFI), backed by the Trump family, announced a new governance proposal to test its airdrop system by distributing its USD1 stablecoin to WLFI token holders.

The move comes shortly after the decentralized finance (DeFi) project launched the stablecoin in late March.

World Liberty Financial Eyes USD1 Stablecoin Airdrop

WLFI’s initiative serves three primary goals. First, it seeks to validate the project’s technical infrastructure. Secondly, it serves as a reward mechanism for early supporters, and lastly, it aims to increase USD1’s visibility ahead of a broader rollout.

“Testing the airdrop mechanism in a live setting is a necessary step to ensure smart contract functionality and readiness. This distribution also serves as a meaningful way to thank our earliest supporters and introduce them to USD1,” the proposal read.

The airdrop will distribute a fixed amount of USD1—a stablecoin pegged to the US dollar and backed by assets like US Treasuries—to all eligible WLFI holders on the Ethereum (ETH) mainnet.

The exact amount per wallet will be determined based on the total number of eligible wallets and WLFI’s budget. In addition, the company reserves the right to modify or terminate the test at its discretion.

Interestingly, comments in the proposal reflect strong community support. The general consensus is likely in favor of a USD1 stablecoin airdrop.

“I believe it is a very valid proposal, which serves both to keep the community engaged and to test the network for implementation. Therefore, I believe it is a positive measure for both holders and the institution. Let’s go ahead, let’s design in order to build,” a user wrote.

The next step would include finalizing the details of the airdrop. Afterward, the proposal will proceed to a governance vote. The voting options will include “Yes” to approve the airdrop, “No” to reject it, and “Abstain” for those who wish not to vote. This process ensures transparency and community involvement in the decision-making process.

Meanwhile, the proposal emerges amid intensified scrutiny of the Trump family’s role in the cryptocurrency venture.

On April 2, Senator Elizabeth Warren and Representative Maxine Waters sent a letter to SEC acting chair Mark Uyeda. The lawmakers requested that the SEC preserve all records and communications related to World Liberty Financial.

They also requested access to information to clarify how the Trump family’s financial stake in WLFI might be influencing SEC operations. Additionally, they expressed concerns that this potential conflict of interest could undermine the SEC’s mission to protect investors and ensure fair, orderly markets.

“The Trump family’s financial stake in World Liberty Financial represents an unprecedented conflict of interest with the potential to influence the Trump Administration’s oversight—or lack thereof—of the cryptocurrency industry, creating an obvious incentive for the Trump Administration to direct federal agencies, including the SEC, to take positions favorable to cryptocurrency interests that directly benefit the President’s family,” the letter read.

Earlier, Senator Warren and five other democrats had sent a letter to the Federal Reserve and the OCC, raising similar concerns.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FARTCOIN Rally Pushes Price to New Heights as Market Struggles

Solana-based meme coin FARTCOIN is today’s talk of the town. The altcoin has outperformed broader market trends, recording a 28% gain over the past day.

While many assets struggle with declining prices and trading volumes amid recent market troubles, FARTCOIN has seen a surge in both, attracting significant buy orders.

FARTCOIN Defies Market Meltdown

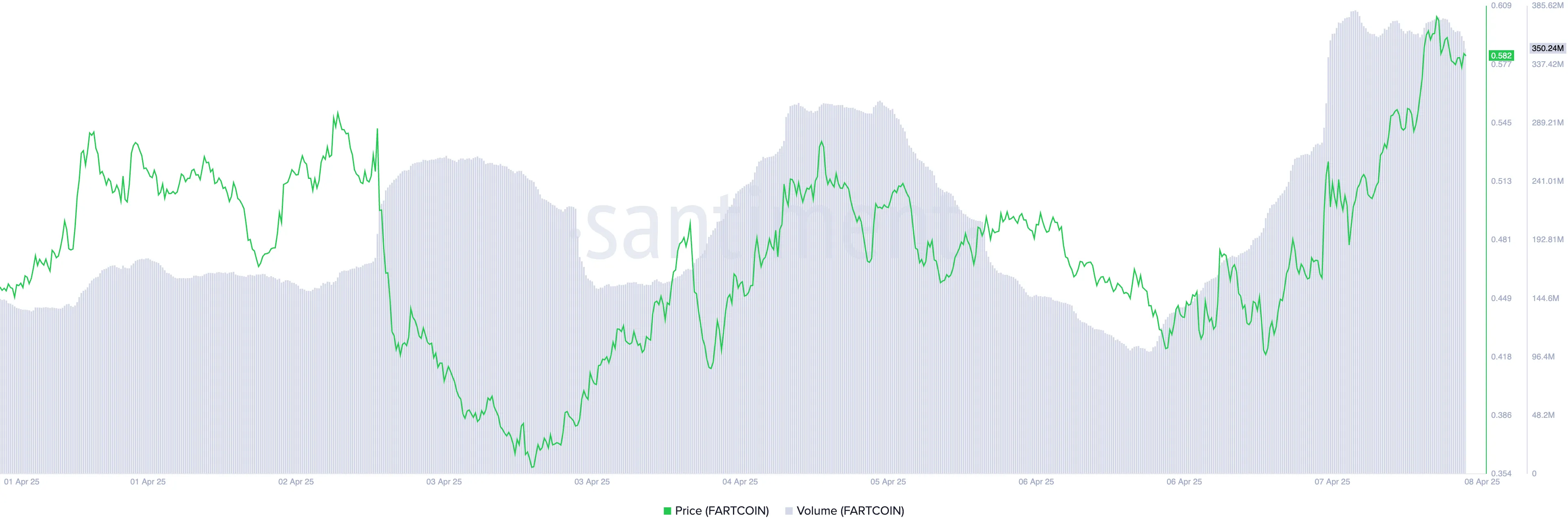

FARTCOIN’s upward momentum is evident, driven by a sharp rise in trading volume. Reflecting on the meme coin’s recent trend, crypto trader “RookieXBT” noted in a March 7 post on X that FARTCOIN is seeing “increasing volume while the world falls apart,” adding that “no other coin is doing this.”

FARTCOIN’s trading volume totals $363 million as of this writing, rocketing over 80% in the past 24 hours.

When an asset’s price rises alongside its trading volume, it signals strong market interest and conviction behind the price move.

FARTCOIN’s high trading volume confirms that widespread participation rather than isolated trades support its rally. This combination is a bullish signal, suggesting the uptrend may have the momentum to continue.

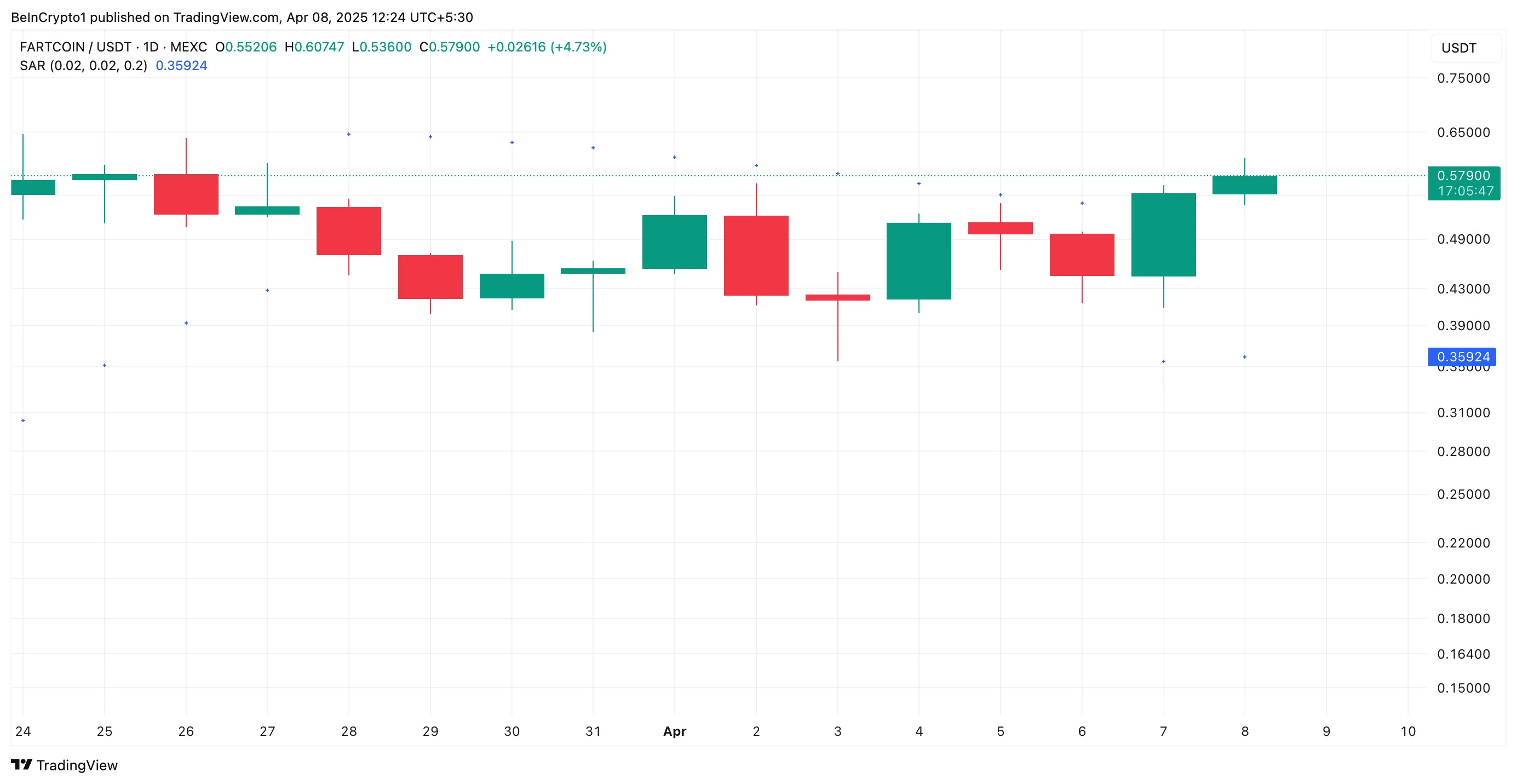

Further, the setup of the token’s Parabolic Stop and Reverse (SAR) indicator supports this bullish outlook. At press time, the dots of the momentum indicator rest below FARTCOIN’s price on the daily chart.

An asset’s Parabolic SAR indicator identifies potential trend direction and reversals. When its dots are placed under an asset’s price, the market is in an uptrend. It indicates an asset’s price is rising, and the rally may continue.

FARTCOIN Breakout Sets Stage for Bullish Continuation or Sharp Reversal

FARTCOIN’s double-digit rally has pushed its price past the key resistance of $0.54, which it had struggled to break above in the past two weeks. If demand strengthens, that price level will solidify into a support floor, and the token’s rally could continue.

In that scenario, FARTCOIN’s price could climb to $0.73.

On the other hand, a failed retest of the $0.54 support floor could trigger FARTCOIN’s price to fall to $0.34.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBinance Founder CZ Joins Pakistan Crypto Council as Advisor

-

Regulation23 hours ago

Regulation23 hours agoPakistan’s Crypto Council Appoints Binance Founder Changpeng Zhao As Strategic Advisor

-

Market22 hours ago

Market22 hours agoXRP and Bitcoin Briefly Rallies After Rumors of 90-Day Tariff Pause

-

Market21 hours ago

Market21 hours agoIs $0.415 the Key to Further Gains?

-

Market19 hours ago

Market19 hours agoMANTRA Launches $108 Million RWA Fund As OM Price Surges

-

Altcoin23 hours ago

Altcoin23 hours agoDogecoin Whale Dumps 300M Coins Amid Market Crash, Can DOGE Price Dip Below $0.1?

-

Market18 hours ago

Market18 hours agoCrypto Whales Are Buying These Altcoins Post Market Crash

-

Altcoin21 hours ago

Altcoin21 hours agoPeter Schiff Predicts Ethereum Price To Drop Below $1,000, Compares It To Bitcoin And Gold