Ethereum

Rebel Satoshi (RBLZ) hailed as an altcoin to watch amidst ETH and SHIB turbulent price action

- Rebel Satoshi ($RBLZ) has received endorsement from several market experts amid its ICOs.

- Some market experts are optimistic that Ethereum (ETH) will reach a price of $4,853 in 2024.

- A number of analysts believe Shiba Inu (SHIB) will experience a 59% price surge in 2024.

Rebel Satoshi (RBLZ) remains one of the altcoins to watch according to some experts, because of its potential to disrupt market dynamics. Meanwhile, Ethereum (ETH) and Shiba Inu (SHIB) trade in the red after months of continuous growth.

Read on as we delve deeper into the future prospects of $RBLZ, ETH, and SHIB to find the best crypto to invest in.

Experts show confidence in $RBLZ’s presale trajectory

Amidst the volatile price actions of Ethereum and SHIB, experts are focusing on Rebel Satoshi’s $RBLZ, with several endorsing its presale trajectory with a vote of confidence. Hailed by some as a top ICO, Rebel Satoshi is gaining traction as a symbol of a broader movement, catching the eye of market analysts and investors alike.

Rebel Satoshi aims to disrupt the crypto landscape by promoting decentralization and community empowerment. It represents a shift towards a more equitable and participatory digital economy, challenging the dominance of top crypto coins.

The presale of $RBLZ demonstrated a solid market performance, achieving a 150% price growth. This impressive rally from $0.010 in the Early Bird Round to $0.025 by the end of the presale hints at its massive potential in the coming months.

Following the presale, $RBLZ successfully launched on major platforms like Uniswap, CoinGecko, DEXTools, and Coinstore, maintaining its closing presale price.

Additionally, the announcement of a second token, $RECQ, has sparked further interest, with its presale performance anticipated to surpass that of $RBLZ. Currently, it is in Stage 1 of its presale at $0.0037, with the aim of reaching $0.0125 by the presale’s conclusion.

The upward trajectory of $RBLZ’s price post-presale indicates a promising future, supported by a vibrant community engaged in quests and earning rewards. The Rebel Satoshi ecosystem is set for expansion, with the launch of the Rebel Satoshi Arcade and exclusive merchandise on the horizon.

Ethereum tumbles: can ETH cross the $4,500 mark in 2024?

Ethereum kicked off 2024 strongly, with its native token trading at $2,282.87 and surging above $4,000 in March. However, the price has since experienced a downturn, slipping below the $3,300 mark by early April, reflecting a period of volatility and price correction.

In the second quarter, Ethereum faced challenges as it started in the red, raising concerns about its near-term performance. Additionally, uncertainties loom over ETH’s potential for a significant price boost, as the US SEC has yet to approve applications for a spot Ethereum ETF.

The absence of regulatory approval has impacted ETH’s price movements, with its correlation with Bitcoin playing a significant role in recent months. As Bitcoin faces volatility, Ethereum is following suit.

For those who wonder if ETH is the best crypto to buy now, experts weigh the potential impact of an approved Ethereum ETF on ETH’s price trajectory. If approved, analysts predict ETH could reach a price of $4,853 by the end of 2024 due to increased institutional interest and accessibility.

However, in a bearish scenario, where regulatory hurdles persist, or market sentiment turns negative, ETH is expected to struggle and maintain a price level below $4,055 in the coming months.

Market analysts foresee a 59% price growth for SHIB in 2024

Shiba Inu experienced a noteworthy rally in the first quarter of 2024, with its native token reaching highs of $0.00004534 by March. However, as the second quarter progresses, SHIB’s price has undergone a correction phase, dipping below the $0.00003 mark.

Despite the recent correction, experts remain optimistic about SHIB’s future growth prospects, citing its increasing popularity as a key driver. Recently, Shiba Inu achieved a significant milestone by becoming the most popular token on WazirX, a leading Indian cryptocurrency exchange.

Interestingly, Shiba Inu surpassed even Bitcoin as the top-traded crypto in March. This surge in popularity has highlighted Shiba Inu’s strong community support and its potential for further market expansion.

Analysts project further growth for Shiba Inu due to its widespread popularity and broader bullish market sentiments. With expectations of a 59% increase, experts predict SHIB could reach $0.000041 by the end of 2024.

However, in a shift towards bearish sentiments in the market, SHIB is anticipated to maintain a price level below $0.000034 for the rest of the year.

For the latest updates and more information, visit the official Rebel Satoshi Website or contact Rebel Red via Telegram.

Ethereum

Ethereum Price Eyes $2,700 As Wyckoff Accumulation Nears Completion

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst Incognito has predicted that the Ethereum price could soon rally to as high as $2,700. This bullish prediction comes despite ETH’s underperformance so far, with the altcoin’s market share already dropping to new lows.

Ethereum Price Could Rally To $2,700 As Wyckoff Accumulation Nears

In a TradingView post, Incognito predicted that the Ethereum price could witness a big move to $2,700 with the Wyckoff accumulation almost over. He remarked that if support holds, the ETH should see a breakout of the falling wedge. The analyst’s accompanying chart showed that $2,499 is the target for the falling wedge, while $2,700 is the second target that Ethereum could reach on this breakout.

Related Reading

However, Incognito warned that this could be a huge trap to shake out sellers, so he advised market participants to be looking to take profits. In the meantime, the Ethereum price could indeed break out to the upside, especially with the Bitcoin price attempting to reclaim the $90,000 level.

The Ethereum price is likely to reach new local highs if Bitcoin can sustain this bullish momentum, given their positive correlation. In an X post, crypto analyst Ali Martinez remarked that this week would be big for ETH as the TD Sequential just flashed a buy signal, hinting at a potential shift in momentum.

Martinez also raised the possibility of the Ethereum price recording a new bull rally. For that to happen, he mentioned that ETH needs to break the supply wall at $2,330. The leading altcoin could face significant selling pressure at that range, as 12.62 million addresses bought 68.63 million ETH around that range.

ETH May Have Already Bottomed

In an X post, crypto analyst Titan of Crypto suggested that the Ethereum price has already bottomed or may be bottoming out. He revealed that the leading altcoin is progressing within a giant ascending channel on the macro chart. His accompanying chart showed that ETH could rally to as high as $4,200 following this bullish reversal.

Related Reading

Crypto analyst Hardy also echoed a similar sentiment, suggesting that the Ethereum price has already reached its bottom. He noted that ETH’s weekly candle close was bullish and a good indicator of a potential reversal at the key support level around its current price. His accompanying chart showed that Ethereum could rally to as high as $4,300 on this bullish reversal.

Ethereum price reclaiming the $4,000 level could pave the way for a rally to a new all-time high (ATH). Crypto analyst Crypto Patel predicted that ETH could reach between $6,000 and $8,000 by the end of the year.

At the time of writing, the Ethereum price is trading at around $1,639, up almost 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Ethereum Analyst Sets $3,000 Target As Price Action Signals Momentum – Details

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum and the broader crypto market experienced a small but notable pump yesterday, reigniting hopes of a potential trend reversal after weeks of sustained selling pressure. As market uncertainty intensifies, driven largely by global economic tensions and geopolitical strain between the US and China, investors are closely watching for signs of a breakout.

Related Reading

Despite the headwinds, analysts are starting to shift their tone. Some believe that the worst may be behind for Ethereum and that a strong move to the upside could be brewing. One of the most vocal among them is top analyst Carl Runefelt, who shared a bold outlook, suggesting that Ethereum “might go absolutely parabolic starting from here.” His analysis suggests that ETH is poised to break out from a daily descending trendline, which could serve as a key technical signal indicating va shift in momentum in favor of the bulls.

As Ethereum holds above critical support levels and inches closer to a potential trend reversal, traders and investors are now watching closely for follow-through confirmation. If volume and sentiment continue to build, this could be the beginning of a significant rally — one that may reset expectations for the rest of the cycle.

Ethereum Eyes Recovery Amid Rising Global Tensions

Global tensions and macroeconomic uncertainty continue to weigh heavily on investor sentiment, with the ongoing trade war between the US and China sending shockwaves through equities and high-risk assets. In the midst of this fragile backdrop, Ethereum has managed to find a solid support level around $1,500 and is now attempting to reclaim higher ground. After weeks of selling pressure that erased bullish expectations for the year, ETH is showing early signs of recovery.

Ethereum’s current price structure has become a focal point for market participants. The recent bounce from $1,500 marks a potential higher low, a technical setup often associated with trend reversals. If ETH can successfully push above the $1,700 mark and break the descending trendline, it could spark renewed momentum for bulls.

Runefelt shared an optimistic view, stating that Ethereum could go up really fast from here. According to his analysis, the next key price target sits at $3,000, assuming a confirmed breakout above short-term resistance levels.

Despite continued global risks, the Ethereum network remains fundamentally strong, with growing adoption in DeFi and real-world assets. If the breakout materializes and broader market sentiment stabilizes, ETH could lead the next leg of the crypto recovery.

Related Reading

Price Faces Key Resistance As Bulls Struggle for Momentum

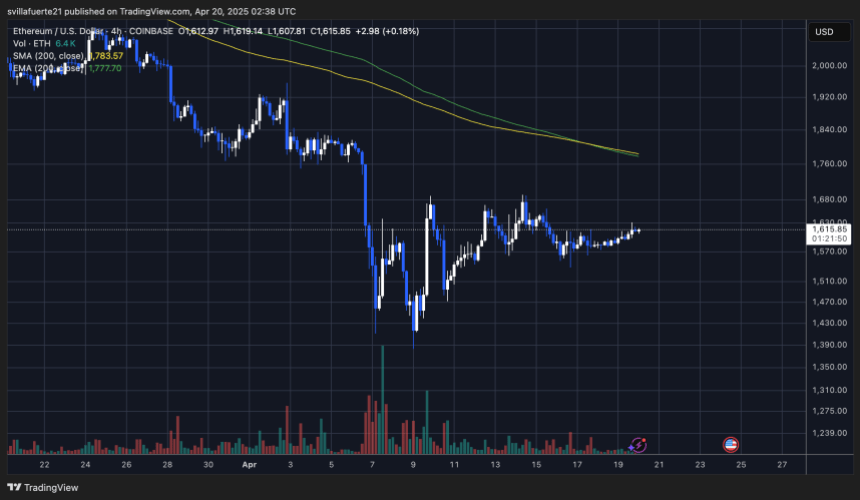

Ethereum is currently trading at $1,630 after another failed attempt to break above the $1,700–$1,800 resistance zone. This price range has acted as a major barrier over the past several weeks, limiting bullish momentum and keeping ETH locked in a broader downtrend. Bulls must reclaim the local high at $1,691, set last week, to signal a potential shift in structure and confirm the start of a recovery rally.

A decisive move above $1,700 could open the door to a test of the $2,000 level, which would mark a significant psychological and technical milestone. However, the lack of follow-through on recent upside attempts reflects ongoing uncertainty across crypto markets, largely driven by macroeconomic tensions and risk-off sentiment.

Related Reading

If Ethereum fails to gain strength above current levels, a retracement toward $1,500 is likely, with the possibility of further downside if selling pressure intensifies. This level has served as a critical support zone in recent weeks. Without a convincing breakout, ETH remains vulnerable to renewed weakness and deeper corrections. All eyes are now on whether bulls can build enough momentum to flip resistance into support and avoid another leg down.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum Enters Historic Buy Zone As Price Dips Below Key Level – Insights

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is currently trading at a critical resistance level as bulls attempt to regain momentum and push for a fresh high. The broader market remains under pressure as global uncertainty escalates, largely fueled by ongoing trade tensions between the United States and China. Last week, US President Donald Trump announced a 90-day tariff pause on all countries except China, intensifying concerns about an extended trade conflict that could destabilize global financial markets.

Related Reading

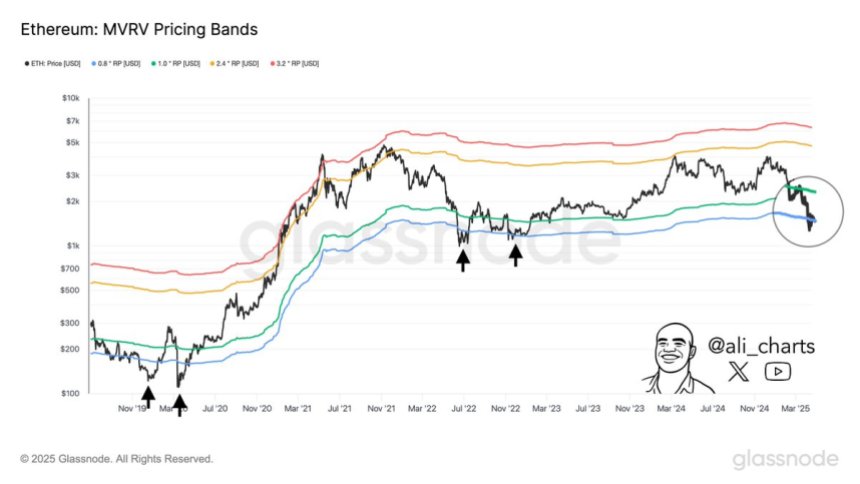

In this high-stakes environment, Ethereum’s price action is drawing close attention from investors and analysts. Top crypto analyst Ali Martinez shared that historically, the best Ethereum buying opportunities have emerged when the price drops below the lower MVRV (Market Value to Realized Value) Price Band—a level that signals potential undervaluation. Notably, ETH is now trading precisely in that zone.

This alignment between technical conditions and macroeconomic instability suggests that Ethereum could be entering a phase of accumulation, with long-term investors looking to capitalize on discounted prices. However, sustained upward momentum will depend on whether bulls can overcome immediate resistance and whether macro conditions improve. The coming days could prove pivotal for ETH as it tests both technical and psychological thresholds.

Ethereum Dips Into Historical Opportunity Zone

Ethereum is currently trading below key resistance levels after enduring several weeks of selling pressure and weak market performance. Since losing the crucial $2,000 support level, ETH has fallen roughly 21%, a clear indication that bulls have yet to regain control. Broader macroeconomic pressures, especially rising global tensions and uncertain trade conditions between the US and China, have further dampened market sentiment. These conditions have driven many investors to exit riskier assets like cryptocurrencies, leading to elevated volatility and reduced market participation.

Despite this downtrend, some analysts believe Ethereum could be nearing a pivotal turnaround zone. According to Martinez, one of the best historical signals for Ethereum accumulation has been price action dipping below the lower bound of the MVRV Price Band—a metric that compares market value to realized value to assess whether an asset is over- or undervalued. Currently, Ethereum is trading beneath that lower band.

Martinez emphasizes that this positioning has typically preceded strong upside reversals, especially during periods of extreme market pessimism. While short-term volatility may persist, ETH’s entry into this zone could present a rare opportunity for long-term investors to accumulate at historically discounted levels—if market conditions stabilize and sentiment shifts.

Related Reading

ETH Stalls In Tight Range

Ethereum is currently trading at $1,610 after nearly a week of low volatility and sideways action. Since last Tuesday, ETH has remained locked in a tight range between $1,550 and $1,630, reflecting the market’s uncertainty and hesitation to take a clear directional stance. This narrow trading zone highlights a period of price compression, often a precursor to a larger move in either direction.

For bulls to regain momentum and shift sentiment, Ethereum must reclaim the $1,700 level and push decisively above the $2,000 mark. These levels not only serve as key psychological barriers but also represent critical zones of previous support that have now turned into resistance. A breakout above $2,000 would likely trigger renewed buying interest and set the stage for a potential recovery rally.

Related Reading

However, if bearish pressure builds and the $1,550 floor is breached, Ethereum could quickly test the $1,500 support zone. A breakdown below that level would confirm further downside risk, potentially accelerating sell-offs and deepening the current correction. Until a breakout or breakdown occurs, traders should prepare for more consolidation and volatility as the market awaits a macro or technical catalyst.

Featured image from Dall-E, chart from TradingView

-

Bitcoin14 hours ago

Bitcoin14 hours agoUS Economic Indicators to Watch & Potential Impact on Bitcoin

-

Market24 hours ago

Market24 hours agoWill XRP Break Support and Drop Below $2?

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin LTH Selling Pressure Hits Yearly Low — Bull Market Ready For Take Off?

-

Bitcoin20 hours ago

Bitcoin20 hours agoHere Are The Bitcoin Levels To Watch For The Short Term

-

Market17 hours ago

Market17 hours agoBitcoin Price Breakout In Progress—Momentum Builds Above Resistance

-

Altcoin12 hours ago

Altcoin12 hours agoExpert Reveals Why BlackRock Hasn’t Pushed for an XRP ETF

-

Market15 hours ago

Market15 hours agoSolana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

-

Market14 hours ago

Market14 hours agoVitalik Buterin Proposes to Replace EVM with RISC-V