Ethereum

New Users See Largest Spike In 27 Months

On-chain data shows a large amount of new addresses have popped up on the Ethereum network recently, a sign that ETH adoption is occurring.

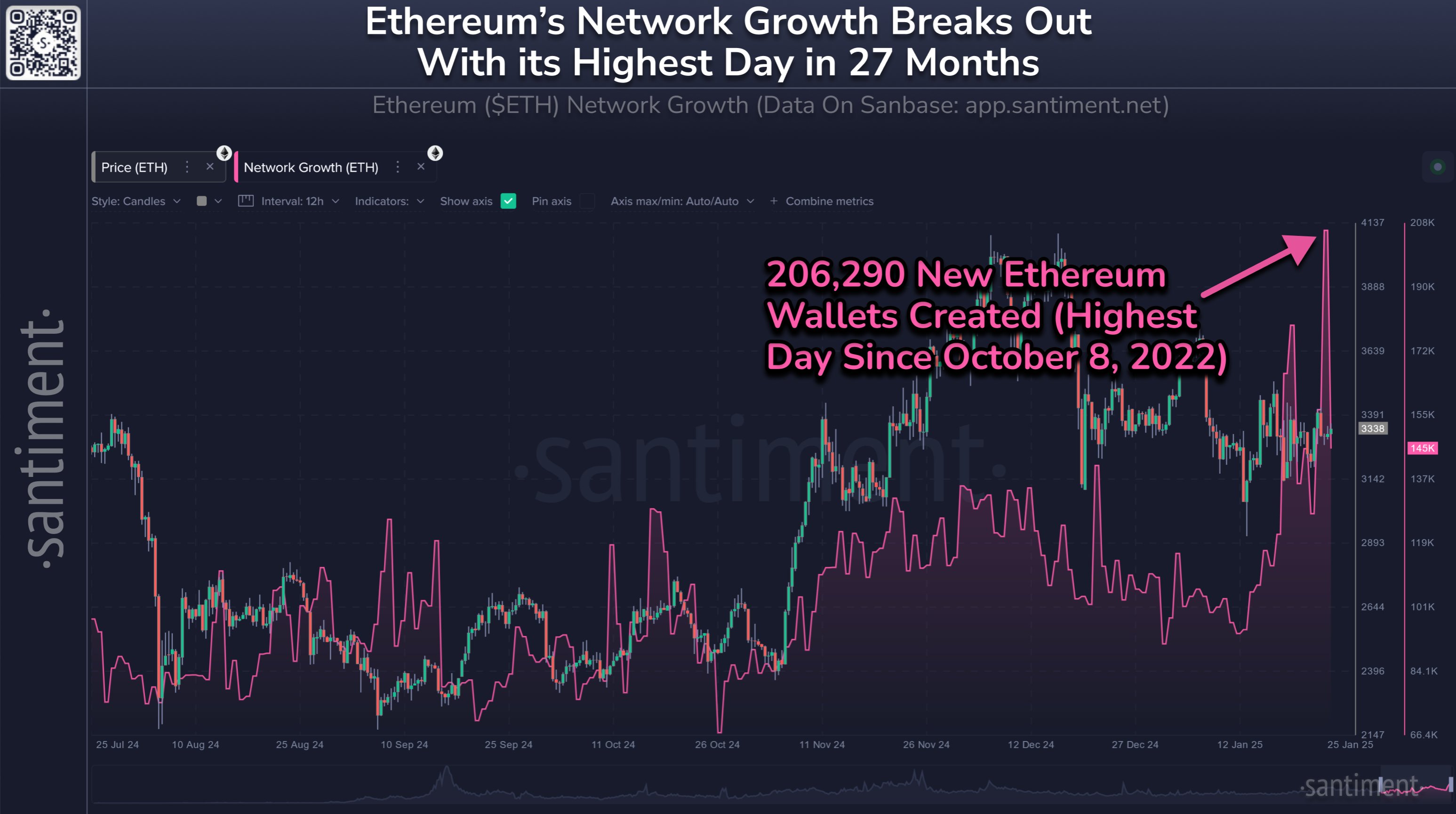

Ethereum Network Growth Registered A Sharp Spike Recently

In a new post on X, the on-chain analytics firm Santiment has discussed about the latest trend in the Network Growth for Ethereum. The “Network Growth” here refers to an indicator that keeps track of the total number of addresses that are coming online on the ETH blockchain for the first time.

An address is said to be ‘online’ or active when it participates in some kind of transaction activity on the network, whether as a sender or receiver. Thus, the Network Growth measures the number of addresses making their very first transfer.

When the value of this indicator is high, it means the network is witnessing the creation of a large number of addresses. This kind of trend can arise when new users join the chain or old ones who had sold earlier return.

A spike in the Network Growth can also naturally occur when existing users create multiple wallets for a purpose like privacy. In general, all of these factors are at play to some degree whenever the indicator observes an increase, so some adoption of the cryptocurrency could be assumed to be taking place.

Now, here is the chart shared by the analytics firm that shows the trend in the Ethereum Network Growth over the past six months:

The value of the metric seems to have been quite high in recent days | Source: Santiment on X

As displayed in the above graph, the Ethereum Network Growth saw a huge spike during the weekend, implying a large number of new addresses were generated on the ETH blockchain.

In total, the users created 206,290 addresses during this spike, which is the largest value for the indicator since October 2022, more than two years ago.

As the analytics firm notes,

The 27-month high in daily wallet creation comes during a time when ETH crowd sentiment has veered particularly negative as other altcoins have outperformed it. Regardless, due to DeFi and staking options for crypto’s #2 market cap asset, Ethereum is still the entire sector’s leader in total non-empty addresses.

Historically, adoption is something that has been constructive for cryptocurrencies, as a wider userbase can provide for a stronger foundation on which future price moves can thrive.

The potential bullish effects of adoption, however, usually only become apparent in the long term. Thus, these new addresses are unlikely to have any noticeable influence on the price of Ethereum in the near future.

ETH Price

Ethereum, like the rest of the cryptocurrency sector, has crashed during the past day. After a drawdown of around 7%, ETH’s price is now trading under $3,100.

Looks like the price of the coin has plummeted over the past day | Source: ETHUSDT on TradingView

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Ethereum

Ethereum Consolidates Since ‘The Big Dump’ – Local Trend Reversal Or Continuation?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) has been stuck in a tight range, trading below $1,900 and above $1,750 after days of heavy selling pressure. The broader crypto market remains under stress, with fear dominating sentiment and keeping ETH from regaining momentum.

Related Reading

The downturn is largely driven by macroeconomic uncertainty and escalating trade war fears, which have shaken both crypto and the U.S. stock markets. As investors brace for further volatility, some fear that the market is setting up for a deeper correction.

However, not all analysts are bearish. Some believe that a recovery could be on the horizon in the coming months, especially if technical indicators begin to show strength. Top analyst Daan shared insights on X, revealing that Ethereum has been consolidating since the major sell-off and has formed a falling wedge pattern—a bullish formation that could indicate a local trend reversal.

For now, ETH remains at risk of further declines, but if this pattern plays out, Ethereum could soon break out of its consolidation range and start building momentum for a recovery. The next few weeks will be crucial in determining whether ETH can stabilize or if more downside is ahead.

Ethereum Falling Wedge Could Signal a Reversal

Ethereum has lost over 57% of its value, creating a challenging environment for bulls as selling pressure continues. ETH is now trading below a multi-year support level, which has flipped into strong resistance. As long as Ethereum remains below the $1,900–$2,000 range, bulls will struggle to regain momentum, keeping bearish sentiment intact.

The entire crypto market has mirrored this weakness, experiencing a significant breakdown alongside the U.S. stock market. Global trade war fears and uncertainty surrounding U.S. President Trump’s policies have further fueled the sell-off in risk assets. Since the U.S. elections in November 2024, macroeconomic volatility and rising uncertainty have driven markets lower. With the U.S. stock market hitting its lowest levels since September 2024, investors remain on edge, questioning if Ethereum has further downside ahead.

Despite this bleak outlook, there is some optimism. Daan’s insights suggest that Ethereum has been consolidating since the major drop and has formed a falling wedge pattern. This bullish formation could lead to a local trend reversal if ETH breaks out and holds above resistance.

For this potential recovery to materialize, ETH must break above the white zone and reclaim $2,000. If this happens, bulls could start testing higher levels and build momentum for a broader market recovery. However, the ETH/BTC ratio remains near multi-year lows, showing only minor resilience in recent days. Sustained strength is needed before a real reversal can take place.

Related Reading

With Ethereum still struggling, the next few weeks will be crucial in determining whether this falling wedge breakout can lead to a meaningful rally or if the downtrend will continue.

Ethereum

Ethereum Could Be Mirroring Bitcoin’s 2018-2021 Cycle Amid Record Selling

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst The Cryptagon has raised the possibility of the Ethereum price mirroring Bitcoin’s 2018 to 2021 cycle, which he indicated was bullish ETH. This development comes amid record selling among ETH investors, which continues to exert downward pressure on the crypto.

Ethereum Could Be Mirroring Bitcoin’s 2018-2021 Cycle

In a TradingView post, the Cryptagon stated that Ethereum has been repeating Bitcoin’s 2018 to 2021 cycle very closely. He remarked that ETH’s long-term holders may remain bullish just by looking at this BTC cycle, seeing as ETH could achieve a similar end result like the flagship witnessed in that cycle.

Related Reading

The analyst admitted that Ethereum has been under heavy pressure since early December last year and almost touched the 12-month falling support this week. However, despite this development, the Cryptagon suggested that this is not the time to be bearish on ETH, as it could still reach new highs as it mirrors Bitcoin’s 2021 cycle.

He noted that in the 2021 cycle, a rebound on the falling support caused a massive breakout above the falling resistance and the Bitcoin price rallied to the 1.618 Fibonacci extension. In line with this, the Cryptagon predicted that Ethereum could at least reach $8,000 in this market cycle as it repeats a similar price action.

This bullish outlook for Ethereum comes amid record selling, which threatens any bullish reversal for ETH. In an X post, Cryptoquant founder Ki Young Ju revealed that Ethereum has faced record active selling over the past three months.

This has contributed to ETH’s underperformance, with the altcoin being outperformed by other major altcoins like XRP and Solana over this period. While XRP touched its current all-time high (ATH) and SOL hit a new ATH, ETH has yet to come anywhere close to its current ATH.

The Most Important Price Level For ETH At The Moment

In an X post, crypto analyst Ali Martinez, revealed that $1,887 is the most important support level for Ethereum at the moment. At this level, investors bought 1.63 million ETH. A drop below this level could lead to another massive crash for the second-largest crypto by market cap, with many of these investors possibly selling off their coins in order to cut their losses.

Related Reading

Martinez has already raised the possibility of Ethereum crashing to as low as $800. He noted that the $4,000 price level had been holding a strong horizontal resistance trendline. However, ETH recently broke out of this trendline, which has significantly increased the probability of a 70% price drop to this $800 target.

At the time of writing, the Ethereum price is trading at around $1,893, up over 1% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Ethereum Net Taker Volume Signals Huge Selling Pressure – Can Bulls Hold Key Levels?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) is facing significant selling pressure, trading below the $1,900 mark as market uncertainty continues to weigh on price action. After losing the critical $2,000 level, ETH plunged as low as $1,750, marking its lowest point since October 2023. Bulls are now under pressure, as they must defend the current demand zone to prevent further downside and restore investor confidence.

Related Reading

Market conditions remain fragile, with Ethereum struggling to find strong buying interest. If bulls fail to hold current support levels, ETH could see further declines, adding to the bearish sentiment that has dominated the market in recent weeks.

On-chain data from CryptoQuant reveals that Ethereum’s Net Taker Volume remains at a low level, indicating that selling pressure is still strong. This suggests that market participants are leaning bearish, with more sell orders than buy orders dominating Ethereum’s price action.

With ETH trading in a vulnerable position, the next few days will be crucial. If bulls can stabilize the price and push ETH back above $1,900, a potential recovery could begin. However, if selling pressure persists, Ethereum may continue its downward trend, testing lower support levels in the coming weeks.

Ethereum Faces Heavy Selling Pressure

Ethereum has lost over 57% of its value, creating an extremely difficult environment for bulls as the market remains in a deep downtrend. Currently, ETH is trading below a multi-year support level, which has now turned into a strong resistance zone. As ETH struggles to break back above the $1,900–$2,000 range, the bearish trend continues, with bulls failing to regain momentum.

Related Reading

The entire crypto market has suffered a breakdown, mirroring weakness in the U.S. stock market, as global trade war fears and growing uncertainty surrounding U.S. President Trump’s policies shake investor confidence. Since the U.S. elections in November 2024, macroeconomic volatility and uncertainty have been the dominant forces in driving markets lower. With no clear resolution in sight, investors remain cautious, as the U.S. stock market has now reached its lowest levels since September 2024.

Top analyst Quinten Francois shared data on X, revealing that Ethereum’s Net Taker Volume is at historic lows, signaling intense selling pressure. This indicates that sellers continue to dominate the market, preventing ETH from staging any meaningful recovery. Until buyers step in with strong demand, ETH may remain stuck in a bearish phase, with further downside risk if key support levels fail.

With Ethereum struggling below critical resistance and selling pressure increasing, the next few weeks will be pivotal in determining whether ETH can stabilize or if the market will see further losses. If bulls cannot reclaim lost ground, Ethereum could face even deeper corrections in the near term.

ETH Stuck In Range As Bulls Fight to Reclaim $2,000

Ethereum is currently trading at $1,880, remaining range-bound between $1,750 and $1,950 since last Monday. This tight trading range has kept ETH in a consolidation phase, with neither bulls nor bears gaining full control over price action.

For Ethereum to start a recovery rally, bulls must push the price back above $2,000 as soon as possible. A break and close above this psychological level would indicate renewed buying momentum, allowing ETH to potentially test higher resistance levels. However, Ethereum remains in a fragile position, as selling pressure continues to weigh on the market.

If ETH fails to hold its current levels and breaks below $1,750, it could result in a steady continuation of the downtrend, with further downside risks emerging. Bears would likely target lower support zones, extending the bearish phase and delaying any chance of a sustained recovery.

Related Reading

With uncertainty still dominating the market, traders are closely watching whether Ethereum can break out of this range or if it will extend its decline, following the broader market’s risk-off sentiment. The next few trading sessions will be critical for ETH’s short-term direction.

Featured image from Dall-E, chart from TradingView

-

Market20 hours ago

Market20 hours agoXRP Likely To Be Classified as a Non-Security Like Ethereum

-

Market19 hours ago

Market19 hours agoBTC could surge to $85k as Bitcoin Pepe’s presale eyes $5M

-

Altcoin19 hours ago

Altcoin19 hours agoSEI Price Jumps 7.3% As World Liberty Financial Loads Up 541,242 Coins

-

Bitcoin17 hours ago

Bitcoin17 hours ago$3.29 Billion Bitcoin & Ethereum Options Expiry

-

Market17 hours ago

Market17 hours agoCourt Ruling Raises 3AC’s FTX Claim to $1.53 Billion

-

Market16 hours ago

Market16 hours agoCardano (ADA) Struggle Persists—Is a Rebound Still Possible?

-

Market14 hours ago

Market14 hours agoXRP Price Hints At Symmetrical Triangle, But A Crash Could Come Before The Surge

-

Altcoin21 hours ago

Altcoin21 hours agoBTC Slips Below $82K; Altcoins Flux; TRUMP Soars 10%