Ethereum

Ethereum Staking For Spot ETFs Nears Approval In Hong Kong: Expert Hints

Hong Kong regulators are reportedly close to approving staking features for spot Ethereum exchange-traded funds (ETFs). This development comes as the region continues its efforts to establish itself as a crypto hub.

Andrew Vranjes, Blockdaemon’s Head of International and Vice President, recently spoke on this potential approval during an interview at Token2049 in Singapore.

Vranjes revealed that Blockdaemon has been actively working with spot crypto ETF issuers in Hong Kong to devise staking solutions that align with regulatory requirements.

Progress In Ethereum Spot ETFs In Hong Kong

Vranjes expressed optimism about the progress, indicating that regulators might allow staking within specific guidelines. He hinted that the initial approval might be limited to certain investor categories, such as accredited investors, before potentially expanding to a broader market.

“We’re positive because of the level of conversation,” Vranjes stated, pointing out that the discussions between Blockdaemon, ETF issuers, and regulators are ongoing, involving detailed documentation and regulatory scrutiny.

Vranjes particularly revealed that Blockdaemon is deeply engaged in discussions with clients and regulators, exchanging comprehensive documents to ensure that the proposed staking solutions meet regulatory standards.

He suggested that an official announcement regarding Ethereum staking for spot ETFs in Hong Kong could be imminent, emphasizing that the current phase involves meticulous planning and compliance checks.

“We’re in that sort of fine-grained kind of motion. I think we’re closer to the announcement than further away at this stage,” Vranjes noted.

ETH Spot ETF Performance So Far

Hong Kong’s spot crypto ETF flows lag significantly behind those in the US. For instance, the combined trading volume of the three spot Ethereum ETFs in Hong Kong stood at $30,740 as of Tuesday (September 17), with no daily flows recorded.

In contrast, nine ETH ETFs in the US saw a combined trading volume of $176.26 million and net daily outflows of $15.11 million on the same day, according to SosoValue data.

📊 Ethereum ETF Tracker | 2024-09-17

🟥 Daily Total Net Inflow -$15.11M

💰 Total Value Traded $176.26M

🏦 Total Net Assets $6.41B

📊 ETF Market Value Ratio 2.27%🥇 Net Inflows/Outflows for Each ETF

🟩 ETH +$2.77M

⬜️ ETHW $0

⬜️ ETHA $0

⬜️ ETHV $0

⬜️ CETH $0

⬜️ QETH… pic.twitter.com/IXlCkAr2HI— SoSoValue Research (@SoSoValue) September 18, 2024

Vranjes suggested that Hong Kong could potentially approve Ethereum staking for ETFs before the US, noting that would not surprise him.

If Hong Kong successfully rolls out Ethereum staking for spot ETFs, it could set a precedent, potentially influencing other markets.

The US, which currently has higher trading volumes in crypto ETFs, could face pressure to adopt similar measures. The move could also boost Ethereum’s position in the global market, offering investors additional ways to generate returns.

Featured image created with DALL-E, Chart from TradingView

Ethereum

Ethereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

Given the continued volatility in the general crypto market, several major digital assets such as Ethereum and Bitcoin experienced a decrease in investor participation. As a result, the two crypto giants were faced with significant selling pressure, with ETH recording more losses than Bitcoin.

Ethereum Outpaces Bitcoin In Recent Losses

Over the last few days, Ethereum and Bitcoin have struggled with notable bearish pressure that has hampered their upward movements. During this volatile period, seasoned market expert and host of the Crypto Banter show, Kyle Doops, has outlined substantial losses in both assets as observed in the 6-Hour Rolling Losses metric.

Ethereum’s value has declined more precipitously than that of several of its competitors, triggering selling pressure among investors. During the recent sell-off, Ethereum holders have locked in $564 million in losses, highlighting growing investor caution and a shift in market sentiment.

According to the expert, this is one of the worst losses ETH investors have experienced since the 2023 bull began. The notable losses raise concerns about ETH’s short-term resilience and future performance as volatile market conditions constantly affect investors’ confidence in the altcoin.

Kyle Doops highlighted that while losses are decreasing, this could imply that the market is adjusting to lower pricing. With the market adapting to lower price conditions, the market expert is confident that capitulation is still present.

In another X post, Kyle Doops reported that Bitcoin is navigating rough waters as it suffers significant losses amid persistent market turbulence. This huge loss has also triggered speculations about the sustainability of BTC’s renewed upward trend to key levels like $85,000.

Data from the expert reveals that investors of the largest cryptocurrency asset experienced about $250 million in realized losses in just 6 hours after last week’s sharp drop. In the current market cycle, this loss is one of the biggest so far.

However, looking at the chart, each leg down is exhibiting less pain, which suggests that sellers might be running out of ammo. As key technical resistance levels continue to hinder BTC’s uptrend, the future of the flagship asset is becoming increasingly uncertain.

Where One Of ETH’s Strongest Support Lies

ETH has made a brief rebound to the $1,600 mark after a sudden drop on Wednesday. Delving into the price action, Ali Martinez, a crypto analyst, has underlined a crucial support zone for Ethereum, where significant investor interest was seen in spite of continued price fluctuation.

While the altcoin slowly rebounds, Ali Martinez highlighted that the $1,528.50 is a key support level in its price dynamics. This is due to the notable accumulation around this level. On-chain data shows that about 2.61 million wallet addresses purchased more than 4.82 million ETH in this zone, making it a robust area of support against downside pressure.

Featured image from Unsplash, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is trading around the $1,600 level after several days of failed attempts to reclaim higher prices. Bulls are showing signs of life, but their momentum remains weak as bearish pressure continues to dominate the market. Despite a brief recovery bounce last week, Ethereum’s broader structure still reflects a clear downtrend.

Related Reading

The crypto market remains under the shadow of macroeconomic uncertainty, as ongoing tensions between the United States and China weigh heavily on global financial sentiment. No resolution or agreement between the two economic giants has been announced, leaving investors cautious and risk-averse.

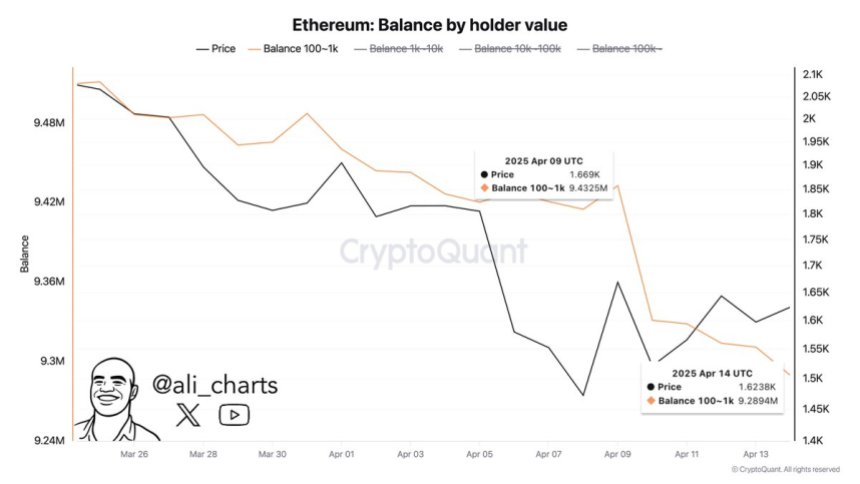

Adding to the negative sentiment, CryptoQuant data shows that Ethereum whales have offloaded approximately 143,000 ETH over the past week. This large-scale distribution reinforces fears of further downside, with long-term holders and large wallets choosing to reduce exposure rather than accumulate.

While some analysts still see potential for a turnaround if key levels are reclaimed, the current market environment remains fragile. Unless Ethereum can regain and hold above short-term resistance levels, the threat of another leg down remains very real. Traders are now closely watching price action for signs of a shift — but for now, caution continues to lead the way.

Ethereum Faces Selling Pressure As Whales Exit

Ethereum is facing a critical test as price action continues to lack clarity, and support levels remain fragile. Despite brief attempts to rebound, ETH has failed to establish a clear bottom, and the downtrend structure remains intact. The market is struggling to define a strong demand zone, making it difficult for bulls to sustain upward momentum. As selling pressure mounts, analysts are warning that Ethereum may continue to slide toward lower demand levels in the absence of strong buying interest.

Broader macroeconomic conditions continue to weigh heavily on risk assets like Ethereum. Global trade tensions, particularly the unresolved tariff standoff between the United States and China, have created uncertainty across financial markets. Combined with fears of a slowing global economy and lack of coordinated fiscal support, crypto markets remain under pressure.

Adding to the bearish sentiment, top analyst Ali Martinez shared on-chain data revealing that whales have offloaded approximately 143,000 ETH over the past week. This large-scale distribution by influential holders has significantly weakened Ethereum’s outlook, reinforcing concerns that smart money is preparing for deeper downside.

Since late December, ETH has remained in a prolonged bearish trend, with every attempt at recovery being met by renewed selling. Unless bulls reclaim key technical levels and shift market sentiment, Ethereum may continue to slide further.

Related Reading

ETH Price Stuck In Volatile Range

Ethereum is currently trading at $1,600 after enduring days of massive volatility and macroeconomic-driven uncertainty. Despite brief relief bounces, ETH remains locked in a bearish structure, unable to generate sustained momentum. For bulls to regain control, reclaiming the $1,850 resistance level is critical. This level aligns with the 4-hour 200 MA and EMA around $1,800, making it a key zone to watch for confirmation of a short-term trend reversal.

Holding above these moving averages would signal renewed strength and possibly mark the beginning of a recovery rally. However, price action continues to struggle beneath them, and failure to push above these indicators would confirm persistent weakness. In that case, Ethereum may retest the $1,500 level or even dip below it if selling pressure intensifies.

Related Reading

The current environment is shaped by global tensions and macro uncertainty, with no clear catalysts to drive a breakout in either direction. As long as ETH remains below its key moving averages, the risk of another leg down remains elevated. Bulls must act swiftly to flip sentiment and avoid a deeper correction toward long-term demand levels.

Featured image from Dall-E, chart from TradingView

Ethereum

77K Ethereum Moved to Derivatives—Is Another Price Crash Looming?

Meet Samuel Edyme, Nickname – HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others.

Edyme’s foray into the crypto universe is nothing short of cinematic. His journey began not with a triumphant investment, but with a scam. Yes, a Ponzi scheme that used crypto as payment roped him in. Rather than retreating, he emerged wiser and more determined, channeling his experience into over three years of insightful market analysis.

Before becoming the voice of reason in the crypto space, Edyme was the quintessential crypto degen. He aped into anything that promised a quick buck, anything ape-able, learning the ropes the hard way. These hands-on experience through major market events—like the Terra Luna crash, the wave of bankruptcies in crypto firms, the notorious FTX collapse, and even CZ’s arrest—has honed his keen sense of market dynamics.

When he isn’t crafting engaging crypto content, you’ll find Edyme backtesting charts, studying both forex and synthetic indices. His dedication to mastering the art of trading is as relentless as his pursuit of the next big story. Away from his screens, he can be found in the gym, airpods in, working out and listening to his favorite artist, NF. Or maybe he’s catching some Z’s or scrolling through Elon Musk’s very own X platform—(oops, another screen activity, my bad…)

Well, being an introvert, Edyme thrives in the digital realm, preferring online interaction over offline encounters—(don’t judge, that’s just how he is built). His determination is quite unwavering to be honest, and he embodies the philosophy of continuous improvement, or “kaizen,” striving to be 1% better every day. His mantras, “God knows best” and “Everything is still on track,” reflect his resilient outlook and how he lives his life.

In a nutshell, Samuel Edyme was born efficient, driven by ambition, and perhaps a touch fierce. He’s neither artistic nor unrealistic, and certainly not chauvinistic. Think of him as Bruce Willis in a train wreck—unflappable. Edyme is like trading in your car for a jet—bold. He’s the guy who’d ask his boss for a pay cut just to prove a point—(uhhh…). He is like watching your kid take his first steps. Imagine Bill Gates struggling with rent—okay, maybe that’s a stretch, but you get the idea, yeah. Unbelievable? Yes. Inconceivable? Perhaps.

Edyme sees himself as a fairly reasonable guy, albeit a bit stubborn. Normal to you is not to him. He is not the one to take the easy road, and why would he? That’s just not the way he roll. He has these favorite lyrics from NF’s “Clouds” that resonate deeply with him: “What you think’s probably unfeasible, I’ve done already a hundredfold.”

PS—Edyme is HIM. HIM-buktu. Him-mulation. Him-Kardashian. Himon and Pumba. He even had his DNA tested, and guess what? He’s 100% Him-alayan. Screw it, he ate the opp.

-

Market21 hours ago

Market21 hours agoBitcoin Whales Withdraw $280 Million: Bullish Signal?

-

Altcoin14 hours ago

Altcoin14 hours agoCZ Honors Nearly $1 Billion Token Burn Promise

-

Altcoin22 hours ago

Altcoin22 hours agoHow Rising Solana Network Inflows Could Drive SOL Price to $150?

-

Bitcoin21 hours ago

Bitcoin21 hours agoGary Gensler Explains Why Bitcoin Will Outlast Altcoins

-

Market14 hours ago

Market14 hours agoOver $700 Million In XRP Moved In April, What Are Crypto Whales Up To?

-

Altcoin21 hours ago

Altcoin21 hours agoHow Crypto Traders Made $666K from $4.5K in One Trade?

-

Market19 hours ago

Market19 hours agoExpanding Blockspace and Enhancing Privacy

-

Market17 hours ago

Market17 hours agoBitcoin Price Poised for $90,000 Surge