Ethereum

Ethereum Fundamentals Hint At Upside Potential As Staking Hits 29% High

Ethereum is at a critical juncture after failing to break above the $2,500 mark yesterday, leaving investors uncertain about its next move. As the broader crypto market anticipates a rally, Ethereum traders closely monitor signs of strength within the network. Despite recent price struggles, there are promising signals from the blockchain.

Key data from IntoTheBlock suggests a growing demand for ETH staking, reflecting long-term confidence in the network’s future. This surge in staking activity indicates that investors are still optimistic about Ethereum’s potential, particularly with upcoming developments like staking rewards and network upgrades.

However, the recent price action has raised concerns, as many had expected ETH to climb higher by now, especially following a period of positive sentiment across the market.

With the crypto market poised for a possible rally, Ethereum’s next moves could set the tone for broader market performance. Investors are now watching closely to see if ETH can regain momentum or if it will continue to struggle at current resistance levels. The coming days will be pivotal in determining whether ETH can break through and initiate a sustained upward trend.

Ethereum Staking Signals Long-Term Confidence

Ethereum is trading below a key resistance level as the broader crypto market prepares for a potential rally in the coming weeks. The market sentiment has been increasingly bullish, with investors expecting Ethereum to play a crucial role in the next upward move.

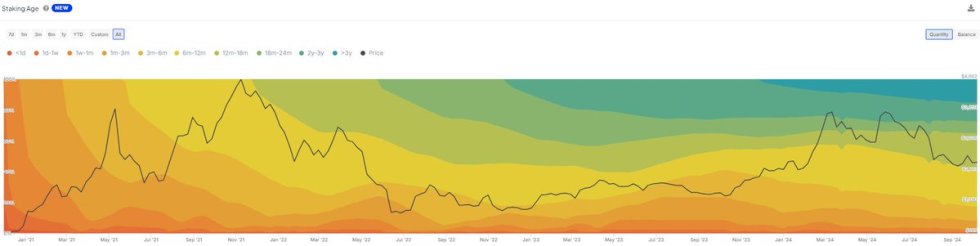

According to key data from IntoTheBlock, 28.9% of all ETH is now staked, a significant increase from the 23.8% recorded in January. This surge in staking activity is a clear indicator of growing long-term confidence in the Ethereum network.

Interestingly, over 15.3% of Ethereum has been staked for over three years, showing that many investors are committed to holding their ETH for the long haul. This strong staking activity reinforces the narrative that ETH is viewed as a valuable asset in the evolving crypto landscape and that many investors are betting on its long-term success.

The recent increase in staking and Ethereum’s upcoming network upgrades suggest that ETH is well-positioned for a potential surge. As market fundamentals continue to improve, the entire crypto market seems poised for a rally, and ETH could lead the charge. If ETH breaks past its resistance levels, the momentum could trigger a significant upward movement in the weeks ahead.

ETH Testing Supply Levels

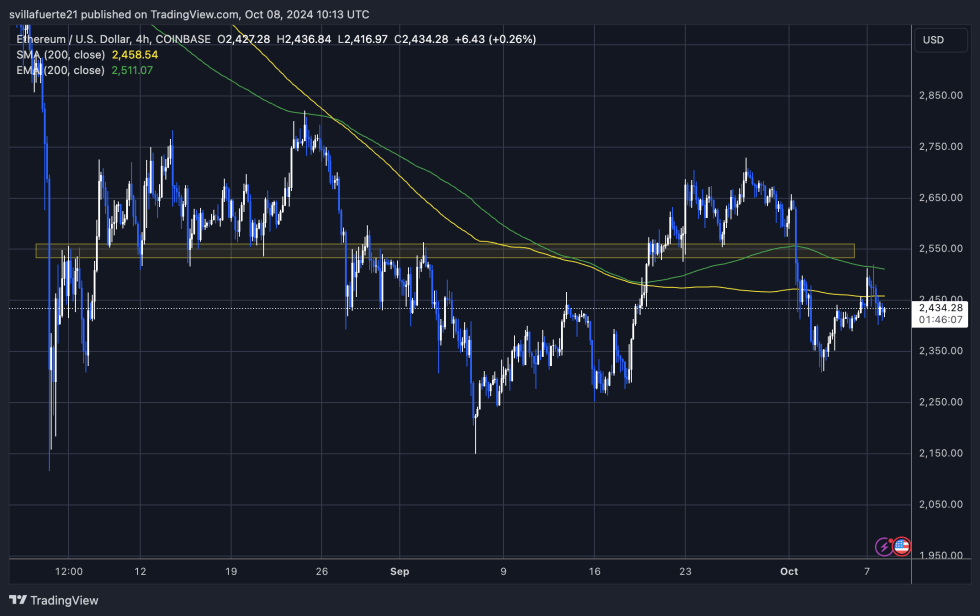

Ethereum is trading at $2,434 after failing to break above the 4-hour 200 moving average (MA) at $2,458. This technical level has acted as a significant resistance point, and bulls need to reclaim it to maintain upward momentum.

A key target for Ethereum’s price action is surpassing the 4-hour 200 MA and breaking above the 200 exponential moving average (EMA) at $2,511. Doing so would strengthen the bullish case and open the door for a potential rally.

However, if ETH continues to struggle and fails to break past these critical resistance levels, a deeper retracement could be on the horizon. In such a scenario, the next significant demand zone lies around $2,150, which could provide a solid foundation for a potential rebound.

With Ethereum investors closely watching these levels, the price action in the coming days will be crucial in determining whether ETH can regain its bullish momentum or face further downside risks. Bulls must reclaim key technical indicators or risk losing control of the trend, leading to a retest of lower support zones.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum Accumulators At A Crucial Moment: ETH Realized Price Tests Make-Or-Break Point

Compared to other major crypto assets in the market, Ethereum’s price performance is still lagging, and it has been unable to make any significant upward move in months. Given the prolonged waning price performance, on-chain data shows that a substantial portion of ETH investors are currently in the red.

ETH Realized Price Nears Breaking Point

FundingVest, an on-chain data analyst and verified author, revealed that Ethereum’s market dynamics have reached a decisive moment. In the post on the X (formerly Twitter) platform, FundingVest highlighted that ETH’s accumulation addresses are now at a pivotal juncture as the altcoin’s realized price teeters on a critical make-or-break level.

After navigating the ETH Realized Price For Accumulation Addresses metric, it appears that the asset has broken below the cost basis of accumulation wallet addresses. This make-or-break moment is likely to determine whether Ethereum experiences more selling pressure that would shake the network’s faith or regain its upward momentum.

Presently, ETH is trending under the realized price of long-term holders, a crucial level that usually serves as solid support for the altcoin in bullish cycles. One thing is certain: When the price falls below the long-term holders’ realized price, caution is advised, as this development might lead to significant losses in the future. Meanwhile, a quick reclaim above this level hints at a potential bullish reversal in price.

According to the expert, this indicates mounting strain on wallets that amassed significant wealth between the 2020 and 2021 market cycles. Dips below the long-term holders’ realized price are uncommon and frequently brief in the past.

However, persistent weakness in the zone can point to a more significant change in the market. With ETH’s current market price dropping below the average cost basis of these accumulators, this raises questions about its sustainability and prospects.

ETH Supply In Profit Drops Below Levels Of Past Bear Market

ETH continues to face bearish pressure, limiting its potential for a major price rally. This persistent downward movement led to a historic low in the percentage of Ethereum supply in profit, indicating a weak market sentiment.

Crypto analyst and trader Venturefounder reported that the ETH percentage supply in profit has fallen to 40%. According to the expert, this level is lower than the last bear market cycle bottom, around 42% when the altcoin was trading at the $800 mark.

Considering the sharp drop, Venturefounder claims it is already a clear signal to deploy. Although the drop in supply profit calls for alarm, there is still a positive side to the development, especially if it falls to about 30%. Should it ever reach 30%, which is the green zone on the chart, the expert noted that it will create generational buy opportunities for investors.

Venturefounder also revealed in another post that the ETH Realized Price Multiple has declined to its last cycle bottom level. The expert considers this drop another on-chain buy signal for the altcoin.

Featured image from Pixabay, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Ethereum Trades At Bear Market Lows: Fundamentals Signal Major Undervaluation

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is trading below critical resistance levels after enduring weeks of heavy selling pressure and lackluster performance. Since breaking below the psychological $2,000 mark, the price has dropped more than 21%, signaling growing uncertainty among short-term investors. This decline has raised questions among market participants, especially as Ethereum’s on-chain fundamentals remain robust.

Related Reading

Top analyst Ted Pillows shared insights suggesting that ETH is now trading near bear market lows—yet the network has never looked stronger. Over 95% of all stablecoin transactions are processed on Ethereum, and it still leads in Total Value Locked (TVL) across DeFi and Real World Asset (RWA) protocols. It is also the only altcoin with an approved spot ETF in the US, and numerous upgrades are lined up to improve its speed and reduce transaction costs.

Despite these strengths, Ethereum’s price remains suppressed, leading to growing speculation: is this just market sentiment at play, or could it reflect coordinated manipulation to shake out weak hands before a reversal? As Ethereum continues to dominate the utility narrative in crypto, many long-term holders see this downturn as a strategic accumulation zone, while others brace for more downside.

Ethereum Fundamentals Shine Despite Bearish Market Conditions

Ethereum is facing a critical test as it trades near major demand levels while macroeconomic uncertainty deepens. Global tensions persist as US President Donald Trump escalates his trade war with China. The recent 90-day tariff pause for all countries except China has done little to ease market fears. As economic pressure builds between the world’s two largest economies, investors are increasingly turning away from high-risk assets like crypto, driving volatility across digital markets.

Ethereum, like the broader crypto market, has suffered under this weight. The asset is now hovering just above bear market lows after a prolonged decline, prompting concerns over its short-term price action. Yet, despite the technical weakness, Pillows points to Ethereum’s strong fundamentals as a reason to remain optimistic.

According to Pillows, Ethereum remains the backbone of the decentralized finance (DeFi) ecosystem. It processes over 95% of all stablecoin transactions, commands the highest Total Value Locked (TVL), and leads the charge in Real World Asset (RWA) tokenization. It’s also the only altcoin the US has approved for a spot ETF, adding institutional legitimacy.

With several protocol upgrades ahead aimed at improving scalability and reducing costs, Pillows believes Ethereum’s current valuation could represent a long-term buying opportunity. As he puts it: if you believe in fundamentals, ETH remains the top bet among altcoins.

Related Reading

ETH Price Stuck In Range: Bulls Eye $1,800 Breakout

Ethereum is trading at $1,590 after several days of choppy price action between $1,500 and $1,700. The market remains stuck in this narrow range as bulls struggle to regain momentum amid broader macroeconomic uncertainty. The inability to reclaim key resistance zones has kept ETH under pressure, and a decisive breakout is needed to shift sentiment.

Bulls are currently eyeing the 4-hour 200-day Moving Average (MA) and Exponential Moving Average (EMA), both sitting near the $1,800 level. Reclaiming this zone would mark a major short-term victory for buyers and could signal the beginning of a recovery phase. A clean break above $1,800 would also invalidate the current lower-high structure and potentially drive ETH toward higher supply areas near $2,000.

Related Reading

However, the downside risks remain. If Ethereum fails to hold above current support levels and dips below $1,550, the next leg could send the asset beneath the $1,500 mark. For now, the $1,500–$1,800 corridor defines Ethereum’s battleground, and traders are closely watching for a breakout that sets the next major direction.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum Price Stalls In Tight Range – Big Price Move Incoming?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is trading at critical levels after enduring weeks of aggressive selling pressure. Since retracing below the key $2,000 mark, the second-largest cryptocurrency has struggled to regain bullish momentum. Currently down 21% from that level, ETH continues to hover near $1,580, reflecting a clear lack of conviction from both buyers and sellers.

Related Reading

The market has entered a period of extreme indecision. According to top analyst Daan, Ethereum’s price has remained notably compressed, barely moving over the past two days. This type of consolidation often precedes sharp price action in either direction, and traders are watching closely for signs of a breakout or breakdown.

Macroeconomic uncertainty continues to influence investor sentiment, with global trade tensions and monetary policy concerns keeping pressure on risk assets like Ethereum. For now, bulls must reclaim the $1,850 resistance zone to confirm a trend reversal, while a drop below $1,500 could open the door to deeper losses.

As volatility builds in the background, the current compression could be the calm before a storm—setting the stage for Ethereum’s next decisive move. Will it break out to the upside, or is more downside in store?

Ethereum Compression Signals Breakout As Macro Pressure Builds

Ethereum is facing a critical test as it trades at compressed levels following weeks of sustained selling pressure. The broader crypto market remains under pressure as global tensions escalate. US President Donald Trump’s trade war with China continues to shape macroeconomic sentiment, leaving investors cautious across all high-risk asset classes.

Despite last week’s announcement of a 90-day tariff pause for all countries except China, uncertainty remains. The unresolved status of US-China trade relations continues to weigh on markets and is one of the primary factors driving hesitation in price movement. For Ethereum, this has translated into extremely low volatility and a stalled price structure.

Daan shared insights suggesting that Ethereum’s price has been “extremely compressed” and has not shown meaningful movement for the better part of two days. According to Daan, this type of compression usually precedes a significant breakout—though the direction of that move remains unknown.

Investors and traders alike are closely monitoring this setup, as compressed price action typically leads to large, momentum-driven shifts. With broader macro risks still in play, Ethereum’s next move could define the short-term trend and set the tone for the market in the weeks ahead.

Related Reading

ETH Bulls Aim To Regain Control

Ethereum is trading at $1,590 after several days of sideways price action, hovering between support at $1,550 and resistance near $1,700. Despite holding above the lower end of this range, ETH has struggled to generate the momentum needed to break out and confirm a short-term recovery.

For bulls to establish a stronger position, ETH must push above the 4-hour 200-day moving average (MA) and exponential moving average (EMA), both of which continue to act as dynamic resistance. A breakout above these indicators could trigger renewed interest from traders and signal the beginning of a recovery phase.

However, the true test lies at the $2,000 level—a major psychological and technical resistance zone. Reclaiming this level would mark a shift in market sentiment and open the door to higher targets.

Related Reading

On the downside, failure to gain ground above the current range and a drop below $1,550 could quickly drag ETH below $1,500, increasing the risk of a deeper correction. For now, Ethereum remains in a consolidation phase, and the next decisive move will likely dictate whether bulls regain control or if sellers push prices into lower demand zones.

Featured image from Dall-E, chart from TradingView

-

Market19 hours ago

Market19 hours agoCardano (ADA) Moves Sideways, But Bullish Shift May Be Brewing

-

Altcoin15 hours ago

Altcoin15 hours agoAnalyst Reveals Dogecoin Price Can Reach New ATH In 55 Days If This Happens

-

Market22 hours ago

Market22 hours agoXRP Consolidation About To Reach A Bottom, Wave 5 Says $5.85 Is Coming

-

Market21 hours ago

Market21 hours agoCanary Capital Aims to Launch TRON-Focused ETF

-

Altcoin18 hours ago

Altcoin18 hours agoPi Coin Price Soars As Pi Network Reveals Massive Community Reward Plans.

-

Market17 hours ago

Market17 hours agoSCR, PLUME, ALT Tokens Unlocking This Week

-

Altcoin10 hours ago

Altcoin10 hours agoCardano Bulls Secure Most Important Signal To Drive Price Rally

-

Market15 hours ago

Market15 hours agoBinance Mandates KYC Re-Verification For India Users