Ethereum

Ethereum Exchange Reserve Stays At 2016 Lows: Bullish Sign?

On-chain data shows the Ethereum Exchange Reserve has remained at low levels recently. Here’s what it could mean for the ETH price.

Ethereum Exchange Reserve Has Been Moving Flat Recently

As explained by an analyst in a CryptoQuant Quicktake post, the Ethereum Exchange Reserve has recently been at its lowest level since 2016. The “Exchange Reserve” here refers to an on-chain indicator that keeps track of the total amount of ETH that’s sitting in the wallets affiliated with all centralized exchanges.

When the value of this metric goes up, it means the investors are depositing a net number of tokens to these platforms. As one of the main reasons why holders transfer to exchanges is for selling-related purposes, this kind of trend can have a bearish impact on the ETH price.

On the other hand, the indicator witnessing a decline suggests the exchange outflows are overwhelming the exchange inflows. Such a trend can be a sign that the investors are accumulating, which can naturally be bullish for the asset.

Now, here is a chart that shows the trend in the Ethereum Exchange Reserve over the past decade:

The value of the metric seems to have been following a downward trajectory in recent years | Source: CryptoQuant

As is visible in the above graph, the Ethereum Exchange Reserve started riding a downtrend back in 2021, which accelerated during the 2022 bear market. In this new cycle, the decline in the metric has continued, although it’s notably slower than back then.

Nonetheless, the fact that coins have continued to leave exchanges could be a positive sign, as it means the investors are preferring to hold in their self-custodial wallets. Holders tend to move to self-custody when they plan to hold into the long term, as it’s the safer method of doing so.

More recently, the decline has completely crawled to a stop after the indicator hit the lowest levels since 2016, which implies the sector may have reached a state of equilibrium. ETH has been showing bearish price action lately, but the flat trajectory means the holders haven’t yet panicked into net selling.

It’s possible that the pause in the downtrend is only a temporary deviation for the Exchange Reserve, but for now, it seems inflows and outflows are balancing each other out.

While the Ethereum Exchange Reserve has been in this state recently, the same hasn’t been true for Bitcoin, as another analyst has pointed out in a Quicktake post.

The trend in the BTC Exchange Inflow/Outflow Ratio over the last ten years | Source: CryptoQuant

From the chart, it’s visible that the ratio between the Bitcoin exchange inflows and outflows has been under the 1 mark, which means these platforms have been witnessing the exodus of a net amount of BTC recently.

ETH Price

At the time of writing, Ethereum is floating around $2,700, up 1.5% over the last seven days.

Looks like the price of the coin has been moving sideways over the last few days | Source: ETHUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

Ethereum

Ethereum Metrics Reveal Critical Support Level – Can Buyers Step In?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is trading above the $1,600 mark after a turbulent period marked by heightened volatility and growing uncertainty surrounding global trade policies. As US President Donald Trump’s tariff measures continue to shake investor sentiment, crypto markets have struggled to find direction. Ethereum, like the broader market, is attempting to stabilize after weeks of aggressive selling pressure and macroeconomic headwinds.

Related Reading

Despite signs of weakness, bulls are now trying to regain control. However, price action still suggests the downtrend may not be over yet. ETH must reclaim key levels to confirm short-term momentum for any meaningful recovery to unfold. Until then, caution dominates the market outlook.

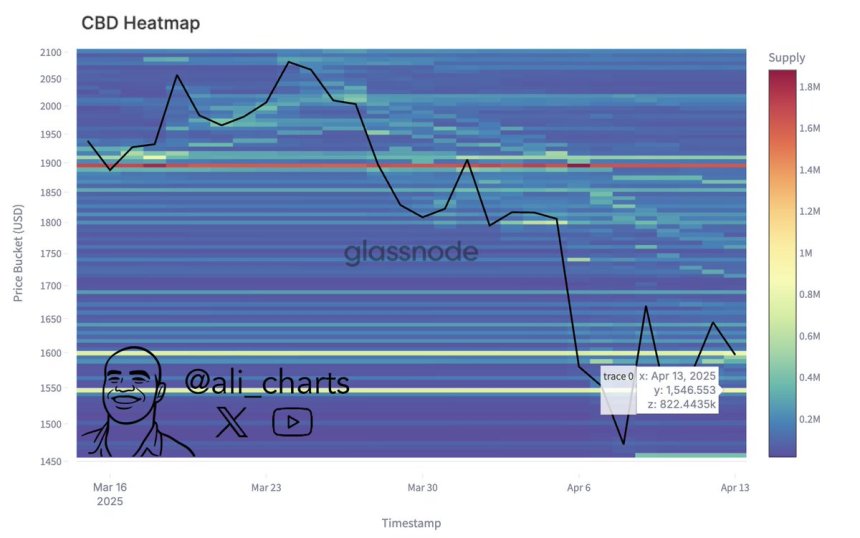

Glassnode data provides a hopeful perspective for Ethereum bulls. According to on-chain metrics, the most critical support level currently sits at $1,546.55—where whales accumulated over 822,440 ETH. This level could serve as a strong foundation for a bounce if tested again, as historically, zones with heavy accumulation tend to attract renewed buying interest.

The coming days will be crucial for Ethereum’s trajectory. Holding above this support while pushing into higher resistance could be the catalyst needed to reignite bullish sentiment and reverse recent losses.

Ethereum Tests Key Resistance As Bulls Eye Recovery

Ethereum has surged more than 20% since last Wednesday’s low near $1,380, generating renewed optimism among investors hoping for a broader market recovery. Currently trading around key resistance levels, ETH appears to be forming a base for a potential breakout that could mark the beginning of a new upward phase. However, the path forward remains uncertain as global macroeconomic conditions continue to weigh heavily on market sentiment.

Growing speculation of a policy shift following US President Donald Trump’s announcement of a 90-day tariff pause for all countries except China sparked the recent surge. This decision triggered a temporary risk-on sentiment across global markets, with cryptocurrencies benefiting from the momentum. Still, concerns about long-term US foreign policy and lingering trade tensions have left many investors cautious.

While some analysts believe that Ethereum has already priced in the worst of the selloff, others warn that we may only be in the early stages of a broader bear cycle. Despite the divergence in outlooks, on-chain data suggests that a major support level has formed.

According to analyst Ali Martinez, the most critical support for Ethereum sits at $1,546.55—an area where more than 822,440 ETH were previously accumulated. This level is being closely monitored as a potential pivot zone. If bulls can maintain price action above this threshold and successfully push through current resistance, it could trigger a strong continuation rally and restore confidence in the altcoin market.

Until then, Ethereum remains at a crossroads, with the next move likely to be shaped by a combination of market momentum, geopolitical developments, and investor conviction.

Related Reading

ETH Price Struggles at Resistance: Bulls Must Reclaim $1,875

Ethereum is trading at $1,630 after setting a fresh 4-hour high around $1,691, slightly above the previous local peak. The short-term price structure suggests that bulls are trying to regain momentum, but the recovery remains uncertain without a clear breakout above key resistance levels. For Ethereum to confirm a true reversal and enter a bullish recovery phase, it must reclaim the $1,875 level — a zone that aligns with both the 4-hour 200-day moving average (MA) and exponential moving average (EMA).

This critical level has acted as a major barrier since the downtrend began, and breaking above it would signal a shift in trend and market sentiment. However, failing to push beyond this range could send ETH back to retest the $1,500 support zone or even lower.

Related Reading

The $1,600 level now acts as a key psychological and technical threshold. Holding above it is essential for bulls to keep short-term momentum alive and prevent another sharp selloff. As macroeconomic uncertainty and market volatility continue, Ethereum’s next move depends heavily on whether bulls can defend current support and build enough strength to break above the $1,875 resistance zone.

Featured image from Dall-E, chart from TradingView

Ethereum

SEC Delays Decision On Staking For Grayscale’s Ethereum ETFs

The US Securities and Exchange Commission (SEC) has announced a delay in its decision regarding the approval of staking for Ethereum ETFs from asset manager Grayscale. This setback comes as the SEC awaits the confirmation of pro-crypto commissioner Paul Atkins, whose appointment has yet to be finalized.

SEC Postpones Staking Approval On Ethereum ETFs

On February 14, 2025, NYSE Arca, Inc. submitted a proposed rule change to the SEC, seeking to amend the listing and trading rules for Grayscale’s Ethereum Trust ETF and Grayscale Ethereum Mini Trust ETF to allow staking.

The proposal was published for public comment on March 3, 2025. Under the Securities Exchange Act of 1934, the SEC is required to act on such proposals within 45 days, although it can extend this period for good cause.

The original deadline for the SEC’s decision was April 17, 2025, but the Commission has now extended this timeframe to June 1, 2025, to allow for a thorough evaluation of the proposal.

In a parallel move, Fox journalist Eleanor Terret reported that the SEC is also delaying its decision on whether to permit WisdomTree and VanEck to conduct in-kind creations and redemptions for their Bitcoin and Ethereum spot ETFs until June 3, 2025.

As reported by Terret, the in-kind process allows for direct exchanges of the underlying assets—Bitcoin and Ethereum—rather than converting them into cash, which was previously mandated by the SEC under Gary Gensler’s leadership.

New Era For Crypto?

Atkins’ delayed arrival at the SEC is partly due to procedural steps that require President Trump’s approval and a formal swearing-in. While this sign-off is expected to occur soon, it has left the agency in a state of transition, with implications for the future of crypto regulation.

However, this shift in regulatory approach signals a potential turning point for the cryptocurrency industry. Under Gensler’s tenure, the SEC was criticized for its stringent, enforcement-heavy stance towards cryptocurrency, which stifled innovation and created uncertainty for many market participants.

Conversely, the anticipated arrival of Atkins, known for his pro-crypto perspective, may herald a new era of more favorable regulatory conditions.

Atkins’ position could pave the way for the approval of numerous altcoin ETFs filed by various asset managers, aimed at providing broader exposure to cryptocurrencies like XRP, Cardano, and Solana.

ETH, the second largest cryptocurrency on the market, is trading at $1,630 on Monday, up 6% on a weekly basis. On longer time frames, the token is still down 15% after the sell-off in February and March that saw the price of ETH drop towards $1,380.

Featured image from DALL-E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Ethereum Price Threatened With Sharp Drop To $1,400, Here’s Why

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum might be on track to facing renewed pressure, according to an interesting technical outlook. Despite short bursts of recovery attempts, the broader market structure is still trying to flip in favor of bulls, but price movement shows that the bears are still in control. Notably, a recent technical analysis posted by crypto analyst Youriverse on the TradingView platform highlights a potential sharp drop in the price of Ethereum towards $1,400 if the current downward trend continues.

Strong Rejection From Key Fibonacci Zone Hints At Persistent Resistance

Technical analysis shows that the Ethereum price chart is currently characterized by a noticeable Fair Value Gap (FVG) on the 4-hour timeframe. This interesting gap was left behind after a steep 10% drop last Sunday, marking a strong area of seller dominance.

Related Reading

This gap represents a zone of clear imbalance where selling activity outweighs buying pressure and has influenced Ethereum’s price action throughout the past seven days. Earlier last week, Ethereum retraced into this gap, reaching the midpoint, but was met with swift rejection. This swift rejection showed the intense selling pressure present within this Fair Value Gap.

Interestingly, the Ethereum price has returned to this Fair Value Gap again, and another rejection here could send it back to a bottom below $1,400. Furthermore, Ethereum is trading within an area identified as the “golden pocket” of the Fibonacci extension indicator, which is drawn from the $1,383 bottom on April 9. Unless price action breaks decisively above this level and heads toward the next Fib level of 0.786 at $1,724, there is still a risk of a significant rejection that could lead to further downside below $1,400.

Stochastic RSI Weakness Suggests Possible Downturn Ahead For Ethereum

In addition to the Fair Value Gap and Ethereum’s struggle within the golden pocket of the Fibonacci retracement zone, the Stochastic RSI is now introducing another layer of bearish pressure to the current outlook. This momentum oscillator, which measures the relative strength of recent price movements, is approaching the overbought region on the daily timeframe.

Related Reading

Ethereum’s approach of overbought zone with the Stochastic RSI is due to inflows that have pushed the crypto’s price from the $1,383 bottom on April 9. Now that the Stochastic RSI is moving into the overbought zone, it adds to the bearish outlook that it could reject at the Fair Value Gap and start a new downside correction very soon.

So far, the Ethereum price was rejected at $1,650 in the past 24 hours, which further supports the bearish continuation thesis. If the selling pressure builds again, as suggested by both the weakening RSI and persistent resistance at the Fair Value Gap, the analyst warns of a breakdown that could drag the price to as low as $1,400, or even lower.

At the time of writing, Ethereum is trading at $1,627.

Featured image from Unsplash, chart from Tradingview.com

-

Market18 hours ago

Market18 hours agoCan Pi Network Avoid a Similar Fate?

-

Ethereum22 hours ago

Ethereum22 hours agoSEC Delays Decision On Staking For Grayscale’s Ethereum ETFs

-

Market21 hours ago

Market21 hours agoXRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

-

Market23 hours ago

Market23 hours agoTrump’s Tariffs Spark Search for Jerome Powell’s Successor

-

Market20 hours ago

Market20 hours agoCardano Buyers Eye $0.70 as ADA Rallies 10%

-

Altcoin13 hours ago

Altcoin13 hours agoWhispers Of Insider Selling As Mantra DAO Relocates Nearly $27 Million In OM To Binance

-

Altcoin18 hours ago

Altcoin18 hours agoBinance Delists This Crypto Causing 40% Price Crash, Here’s All

-

Market16 hours ago

Market16 hours agoPi Network Price Rise To $1 is Now In The Hands Of Bitcoin