Ethereum

Ethereum Crosses $3,400 As Trump’s World Financial Liberty Buys More ETH

Ethereum (ETH) surged past $3,400 today, marking the second consecutive day that the digital asset has outperformed Bitcoin (BTC) in price action. Meanwhile, Donald Trump-linked decentralized finance (DeFi) project, World Financial Liberty (WFL), continues to accumulate more ETH.

Ethereum Crosses $3,400, ETH Holders Rejoice

Momentum appears to be shifting in favor of the second-largest cryptocurrency by market cap, as ETH soared past $3,400, registering a 4.4% gain in the past 24 hours. Analysts are now predicting strong price appreciation in the near future.

Crypto analyst Ted noted that ETH has entered its short-term expansion phase and could climb to $4,000 before experiencing any significant pullback. Furthermore, they projected that ETH could hit $4,500 in February, followed by a new all-time high (ATH) in March—especially if Trump’s WFL continues its aggressive ETH purchases.

Indeed, Trump’s WFL has been accumulating ETH at an impressive rate. Earlier today, Ted highlighted that the WFL wallet had purchased another $10 million worth of ETH. This follows an earlier acquisition of 6,041 ETH – worth $20 million at prevailing market prices – reported earlier this month.

Additionally, ConsenSys CEO Joseph Lubin recently hinted that the Trump family may leverage the Ethereum blockchain to launch new business ventures. However, details on the nature and timing of these ventures remain unknown.

Crypto trader Altcoin Scholar shared their insights on ETH’s bullish price momentum. The trader emphasized that ETH is currently trading within a large ascending triangle formation on the weekly chart, and a breakout above the $4,000 resistance level could skyrocket ETH to new ATHs.

How Are Ethereum Whales Reacting?

One of the best ways to gauge sentiment around a cryptocurrency is by tracking the trading activity of its largest holders. In this case, monitoring ETH ‘whales’ – investors with significant holdings – can provide insight into their confidence in the asset’s future price potential.

Recent on-chain data points toward huge accumulation by ETH whales. Between January 10 and January 17, large holders amassed more than $1 billion worth of ETH.

Most recently, 13 ‘mega whales’ – each holding more than 10,000 ETH – joined the network, further reinforcing the rising confidence among institutional and high-net-worth investors. At the same time, the Ethereum smart contract network continues to see an influx of new users.

However, not all ETH whales share the same bullish sentiment. Recently, one major holder sold more than 10,000 ETH at a loss exceeding $1 million. At press time, ETH trades at $3,422, up 4.4% in the past 24 hours.

Featured Image from Unsplash.com, charts from X and TradingView.com

Ethereum

Did Ethereum Survive The Storm? Analyst Eyes Breakout Next

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) continues to hold a crucial support level after recovering from last week’s correction. Its recent bounce from historical demand zones has led some analysts to suggest that the altcoin is gearing up for a breakout.

Related Reading

Ethereum Holds Key Support

Ethereum has reclaimed the key $1,600 level after dropping below the $1,400 support for the first time since 2023. The second-largest cryptocurrency by market capitalization recently fell to a two-year low during last week’s correction, fueled by US President Donald Trump’s trade tariff war.

ETH touched $1,385 last Wednesday, retesting the 2018 all-time high (ATH) levels before recovering. Amid Trump’s 90-day tariff pause announcement, Ethereum jumped over 10% from $1,480 to $1,600, briefly nearing the $1,700 resistance. However, its price retraced to the $1,400-$1,500 support zone on Thursday amid the market’s volatility.

Over the weekend, the King of Altcoins recovered, hovering between the $1,580-$1,680 price range for the past four days. Ethereum has reclaimed the $1,600 support in the past 24 hours, fueling a bullish sentiment among some market watchers.

Analyst Ted Pillows noted that ETH might be getting closer to a breakout from its short-term downtrend line. According to him, investors could expect the cryptocurrency to hold the $1,550-$1,600 level now that global markets are gaining some strength.

He considers holding this range could propel Ethereum’s price toward the one-month downtrend line. A breakout and confirmation of this resistance, at around $1,670, could set the base for a 20% jump toward the $2,000 resistance level.

Is ETH Out Of The Woods?

Merlijn The Trader suggested that ETH is gearing up for a breakout. The market watcher pointed out the cryptocurrency’s two-month descending channel, which could be “history” if volume surges.

The analyst considers that as Ethereum nears the channel’s upper boundary, “all we need now is volume” for a surge above the $1,690 mark, adding that a breakout from this level would target $2,700.

He also underscored that ETH’s double top formation was completed after “smashing” the $1,432 target, signaling that it “survived the storm.” Notably, the cryptocurrency confirmed this pattern, which developed within its $2,196-$3,904 Macro Range, following its March close below the $2,100 support.

After recovering from the recent lows, “Now comes the face-melting rally no one expects. $4,000 is only the beginning.”

Meanwhile, Rekt Capital highlighted that Ethereum’s Dominance has almost equaled old All-Time Lows. He explained that since June 2023, ETH’s Dominance has dropped from 20% to 8%, historically a reverse area for the cryptocurrency.

Related Reading

“Generally, Ethereum Dominance needs to hold this green area for a chance at reversal Increasing ETH Dominance would be highly beneficial for Altcoin valuations over time,” he noted Monday.

When the ETH Dominance hit the $7.5%-8.25% range, it reversed “to become more market-dominant,” which could signal a reversal for the King of Altcoins.

As of this writing, ETH trades at $1,609, a 1% decrease in the daily timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com

Ethereum

Ethereum Metrics Reveal Critical Support Level – Can Buyers Step In?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is trading above the $1,600 mark after a turbulent period marked by heightened volatility and growing uncertainty surrounding global trade policies. As US President Donald Trump’s tariff measures continue to shake investor sentiment, crypto markets have struggled to find direction. Ethereum, like the broader market, is attempting to stabilize after weeks of aggressive selling pressure and macroeconomic headwinds.

Related Reading

Despite signs of weakness, bulls are now trying to regain control. However, price action still suggests the downtrend may not be over yet. ETH must reclaim key levels to confirm short-term momentum for any meaningful recovery to unfold. Until then, caution dominates the market outlook.

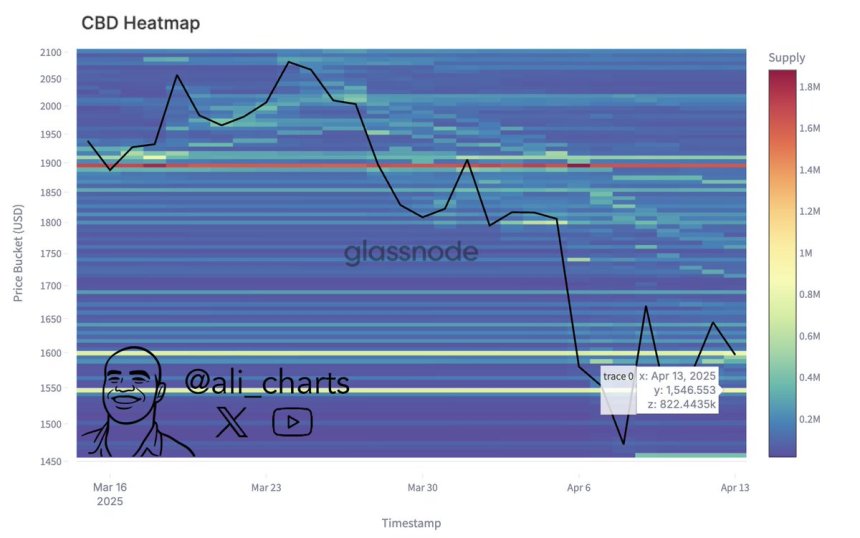

Glassnode data provides a hopeful perspective for Ethereum bulls. According to on-chain metrics, the most critical support level currently sits at $1,546.55—where whales accumulated over 822,440 ETH. This level could serve as a strong foundation for a bounce if tested again, as historically, zones with heavy accumulation tend to attract renewed buying interest.

The coming days will be crucial for Ethereum’s trajectory. Holding above this support while pushing into higher resistance could be the catalyst needed to reignite bullish sentiment and reverse recent losses.

Ethereum Tests Key Resistance As Bulls Eye Recovery

Ethereum has surged more than 20% since last Wednesday’s low near $1,380, generating renewed optimism among investors hoping for a broader market recovery. Currently trading around key resistance levels, ETH appears to be forming a base for a potential breakout that could mark the beginning of a new upward phase. However, the path forward remains uncertain as global macroeconomic conditions continue to weigh heavily on market sentiment.

Growing speculation of a policy shift following US President Donald Trump’s announcement of a 90-day tariff pause for all countries except China sparked the recent surge. This decision triggered a temporary risk-on sentiment across global markets, with cryptocurrencies benefiting from the momentum. Still, concerns about long-term US foreign policy and lingering trade tensions have left many investors cautious.

While some analysts believe that Ethereum has already priced in the worst of the selloff, others warn that we may only be in the early stages of a broader bear cycle. Despite the divergence in outlooks, on-chain data suggests that a major support level has formed.

According to analyst Ali Martinez, the most critical support for Ethereum sits at $1,546.55—an area where more than 822,440 ETH were previously accumulated. This level is being closely monitored as a potential pivot zone. If bulls can maintain price action above this threshold and successfully push through current resistance, it could trigger a strong continuation rally and restore confidence in the altcoin market.

Until then, Ethereum remains at a crossroads, with the next move likely to be shaped by a combination of market momentum, geopolitical developments, and investor conviction.

Related Reading

ETH Price Struggles at Resistance: Bulls Must Reclaim $1,875

Ethereum is trading at $1,630 after setting a fresh 4-hour high around $1,691, slightly above the previous local peak. The short-term price structure suggests that bulls are trying to regain momentum, but the recovery remains uncertain without a clear breakout above key resistance levels. For Ethereum to confirm a true reversal and enter a bullish recovery phase, it must reclaim the $1,875 level — a zone that aligns with both the 4-hour 200-day moving average (MA) and exponential moving average (EMA).

This critical level has acted as a major barrier since the downtrend began, and breaking above it would signal a shift in trend and market sentiment. However, failing to push beyond this range could send ETH back to retest the $1,500 support zone or even lower.

Related Reading

The $1,600 level now acts as a key psychological and technical threshold. Holding above it is essential for bulls to keep short-term momentum alive and prevent another sharp selloff. As macroeconomic uncertainty and market volatility continue, Ethereum’s next move depends heavily on whether bulls can defend current support and build enough strength to break above the $1,875 resistance zone.

Featured image from Dall-E, chart from TradingView

Ethereum

SEC Delays Decision On Staking For Grayscale’s Ethereum ETFs

The US Securities and Exchange Commission (SEC) has announced a delay in its decision regarding the approval of staking for Ethereum ETFs from asset manager Grayscale. This setback comes as the SEC awaits the confirmation of pro-crypto commissioner Paul Atkins, whose appointment has yet to be finalized.

SEC Postpones Staking Approval On Ethereum ETFs

On February 14, 2025, NYSE Arca, Inc. submitted a proposed rule change to the SEC, seeking to amend the listing and trading rules for Grayscale’s Ethereum Trust ETF and Grayscale Ethereum Mini Trust ETF to allow staking.

The proposal was published for public comment on March 3, 2025. Under the Securities Exchange Act of 1934, the SEC is required to act on such proposals within 45 days, although it can extend this period for good cause.

The original deadline for the SEC’s decision was April 17, 2025, but the Commission has now extended this timeframe to June 1, 2025, to allow for a thorough evaluation of the proposal.

In a parallel move, Fox journalist Eleanor Terret reported that the SEC is also delaying its decision on whether to permit WisdomTree and VanEck to conduct in-kind creations and redemptions for their Bitcoin and Ethereum spot ETFs until June 3, 2025.

As reported by Terret, the in-kind process allows for direct exchanges of the underlying assets—Bitcoin and Ethereum—rather than converting them into cash, which was previously mandated by the SEC under Gary Gensler’s leadership.

New Era For Crypto?

Atkins’ delayed arrival at the SEC is partly due to procedural steps that require President Trump’s approval and a formal swearing-in. While this sign-off is expected to occur soon, it has left the agency in a state of transition, with implications for the future of crypto regulation.

However, this shift in regulatory approach signals a potential turning point for the cryptocurrency industry. Under Gensler’s tenure, the SEC was criticized for its stringent, enforcement-heavy stance towards cryptocurrency, which stifled innovation and created uncertainty for many market participants.

Conversely, the anticipated arrival of Atkins, known for his pro-crypto perspective, may herald a new era of more favorable regulatory conditions.

Atkins’ position could pave the way for the approval of numerous altcoin ETFs filed by various asset managers, aimed at providing broader exposure to cryptocurrencies like XRP, Cardano, and Solana.

ETH, the second largest cryptocurrency on the market, is trading at $1,630 on Monday, up 6% on a weekly basis. On longer time frames, the token is still down 15% after the sell-off in February and March that saw the price of ETH drop towards $1,380.

Featured image from DALL-E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market24 hours ago

Market24 hours agoCan Pi Network Avoid a Similar Fate?

-

Altcoin19 hours ago

Altcoin19 hours agoWhispers Of Insider Selling As Mantra DAO Relocates Nearly $27 Million In OM To Binance

-

Market18 hours ago

Market18 hours agoTrump Family Plans Crypto Game Inspired by Monopoly

-

Altcoin24 hours ago

Altcoin24 hours agoBinance Delists This Crypto Causing 40% Price Crash, Here’s All

-

Market23 hours ago

Market23 hours agoEthereum Price Consolidation Hints at Strength—Is a Move Higher Coming?

-

Market19 hours ago

Market19 hours agoForget XRP At $3, Analyst Reveals How High Price Will Be In A Few Months

-

Bitcoin23 hours ago

Bitcoin23 hours agoBolivia Reverses Crypto-for-Fuel Plan Amid Energy Crisis

-

Market22 hours ago

Market22 hours agoPi Network Price Rise To $1 is Now In The Hands Of Bitcoin