Ethereum

Ethereum Analyst Predicts $3,700 Once ETH Breaks Through Resistance

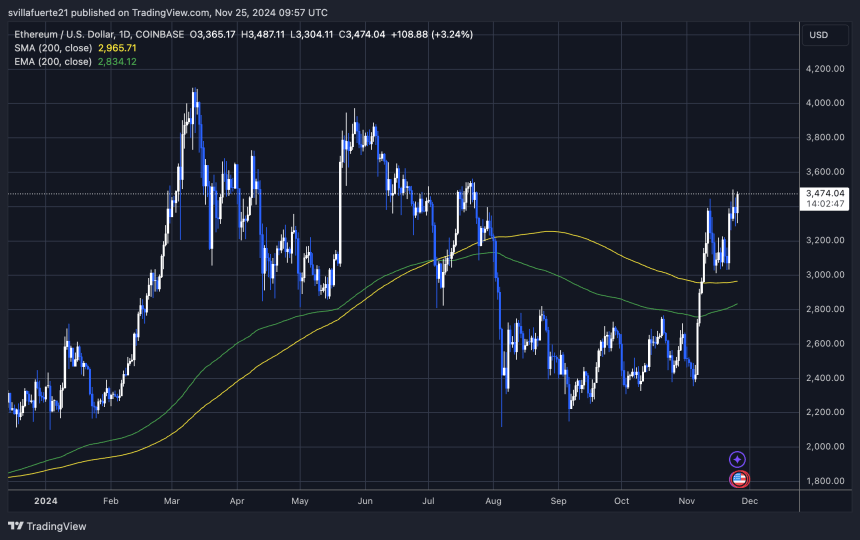

Ethereum has been trading at its highest levels since late July, hovering around $3,470. This marks a significant rebound for the second-largest cryptocurrency, which has managed to hold above the crucial 200-day moving average (MA) at $2,965. By maintaining this level, Ethereum confirmed a bullish price structure, paving the way for continued momentum as it approaches its next milestone—yearly highs near $4,000.

Top analyst and investor Carl Runefelt recently shared his technical analysis on X, pointing out that Ethereum’s price action has built a solid foundation for further growth. According to Runefelt, Ethereum is poised for a substantial rally once it breaks above key resistance levels, signaling increased confidence among traders and investors.

Related Reading

This bullish sentiment is further fueled by Ethereum’s consistent on-chain activity and growing institutional interest, which continue to support its upward trajectory. However, breaking past $4,000 will require Ethereum to overcome resistance zones that have historically triggered pullbacks.

As ETH consolidates gains, market participants are watching closely for signs of the next breakout, which could set the tone for the remainder of the year. Ethereum’s recent strength underscores its role as a market leader and a bellwether for broader cryptocurrency trends.

Ethereum Testing Crucial Supply

Ethereum is testing a crucial supply zone just below the $3,500 level, a key resistance that could propel the cryptocurrency to yearly highs in the coming days. This level has become a focal point for traders and investors, as breaking it would likely signal a bullish continuation of Ethereum’s recent momentum.

Top analyst Carl Runefelt recently shared his insights on X, emphasizing the significance of this resistance. According to his technical analysis, once Ethereum breaks through the $3,500 barrier, it could rapidly climb to $3,700, potentially within hours. The market sentiment surrounding Ethereum remains optimistic, with surging demand as a catalyst for further price gains.

Ethereum’s strength at this critical level is also reigniting speculation about a possible Altseason. If ETH continues its upward trajectory and attracts more capital, it could pave the way for other altcoins to follow suit. Historically, Ethereum’s price action has been a leading indicator for broader market movements, and this time appears no different.

Related Reading

As ETH approaches this pivotal moment, all eyes are on its ability to maintain upward momentum. A strong push past $3,500 would confirm the bullish structure and set the stage for Ethereum to dominate market narratives in the weeks ahead.

Key Levels To Watch

Ethereum is trading at $3,470, hovering below the crucial $3,500 resistance level. This local high has become a key area of focus for traders and analysts, as breaking above it could set the stage for a significant rally. If Ethereum manages to push through this resistance with strength, it could trigger a breakout that propels the price toward $3,900 within days.

However, the market remains cautious about the potential risks associated with this pivotal moment. A failed breakout at the $3,500 mark could lead to sideways consolidation as Ethereum seeks stronger buying pressure to resume its upward momentum. In a more bearish scenario, a substantial correction could occur, driving ETH back to lower levels to establish a more solid base of support.

Related Reading

The current price action highlights the importance of this resistance zone. A clean break above $3,500 would likely confirm Ethereum’s bullish structure and reinforce confidence in a continued uptrend.

On the other hand, any hesitation or rejection at this level could signal the need for further consolidation before the next major move. As ETH approaches this critical juncture, the market is closely watching to determine its next direction and the potential implications for the broader crypto landscape.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum Fails To Break $2,100 Resistance – Growing Downside Risk?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has lost its grip on the key $2,000 level, reigniting fears of a deeper correction as selling pressure returns to the market. Since March 19, ETH has managed to hold above $1,930, but recent weakness has pushed the price dangerously close to breaking below the $1,900 mark. The drop has added fuel to bearish speculation, with traders and analysts now questioning whether a larger pullback is underway.

Related Reading

The inability to hold above psychological support levels has weighed heavily on sentiment, especially as broader market volatility continues to grow. Top analyst Carl Runefelt shared his outlook on Ethereum’s current structure, noting that the asset has repeatedly failed to overcome resistance at $2,100 — a level that now acts as a firm ceiling for bullish momentum. According to Runefelt, this repeated rejection suggests Ethereum could be in serious trouble if buyers don’t step in soon.

With momentum fading and no clear catalyst in sight, Ethereum risks slipping further if $1,900 fails to hold. Traders are watching closely for signs of a reversal, but for now, the path of least resistance appears to be downward. ETH must regain lost levels quickly to avoid confirming a broader bearish trend.

Bulls Face Key Test As Resistance Weighs on Price Action

Ethereum is under pressure as the broader crypto market faces one of its most crucial tests in months. With macroeconomic uncertainty mounting and fears of a potential recession in the United States, risk assets across the board are struggling to gain traction — and Ethereum is no exception. The current market environment remains hostile, with inflation concerns, unstable monetary policy, and global trade tensions shaking investor confidence.

ETH’s price action has been particularly underwhelming. Despite widespread expectations that Ethereum would lead a strong rally in early 2025, the asset has failed to meet bullish projections. Instead of gaining ground, ETH has stalled and is now struggling to hold support levels amid growing selling pressure.

Runefelt’s bearish outlook suggests that Ethereum has repeatedly failed to break through the $2,100 resistance level. According to Runefelt, this resistance zone is critical — and Ethereum’s inability to overcome it could be a sign of deeper weakness ahead. He warns that if Bitcoin experiences a breakdown, Ethereum could follow and potentially retest the wick near $1,750, which marked a local low during a previous correction.

With momentum fading and no clear bullish catalyst in sight, Ethereum’s price structure remains fragile. Unless bulls reclaim key levels soon, ETH could face a deeper retrace, especially if broader market sentiment continues to deteriorate.

Traders are closely watching Bitcoin and macroeconomic developments for cues, knowing that a decisive move in either direction could shape Ethereum’s next major trend. For now, the pressure is on — and Ethereum’s resilience is about to be tested.

Related Reading

ETH Bulls Struggle to Hold Key Support

Ethereum (ETH) is currently trading at $1,910 after failing to hold above the critical $2,000 level, a psychological and technical barrier that has now flipped into resistance. The breakdown has weakened short-term momentum and left bulls in a defensive position as selling pressure continues to mount.

At this stage, the $1,880 level has emerged as a key support zone that bulls must defend to avoid a deeper correction. Holding this level could allow for a consolidation phase and give Ethereum a chance to stabilize before attempting another push higher. However, if ETH loses $1,880, it could spark a wave of aggressive selling, triggering a continuation of the current downtrend and potentially pushing the price toward the $1,750 range.

Related Reading

To regain control of the trend, bulls must reclaim the $2,000 mark as soon as possible. A decisive move back above this level would signal renewed strength and could open the door for a rebound toward higher resistance zones. Until then, Ethereum remains in a fragile position, with the risk of further downside growing as macroeconomic pressure and technical weakness continue to weigh on price action.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum Price Eyes Major Resistance At $2,100 As Analyst Reveals Bullish Price Range

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst Ben Gray has asserted that the Ethereum price is bullish and revealed the price range that the leading altcoin is targeting. However, ETH is set to face major resistance at $2,100, a level which it needs to break out from as it targets new highs.

Ethereum Price Faces Major Resistance At $2,100

In a TradingView post, Ben Gray revealed that the Ethereum price is facing a key resistance level at $2,160 even as it eyes a rally to new highs. Despite this development, the analyst asserted that ETH’s market is bullish. While noting that the leading altcoin is fluctuating between $2,044 and $2,080, he remarked that there are signs that Ethereum initially formed a bottom.

Related Reading

Based on his analysis of the 4-hour candlestick chart, Gray stated that the Ethereum price is attempting to break through upwards, with the key resistance level at $2,160. He further showed his optimism for ETH in 2025 by stating that the expected range is between $2,904 and $4,887, although that puts the altcoin below its current all-time high (ATH).

Meanwhile, the crypto analyst mentioned that the Ethereum price has shown a strong and positive performance this week. Going forward, he stated that the key focus should be on whether ETH can break through the resistance level of $2,160, which would play a key role in determining the altcoin’s trajectory in the short and mid-term.

Crypto analyst Ali Martinez also recently highlighted the $2,300 level as another resistance level to watch out for the Ethereum price. He noted that with ETH reclaiming $2,040, the next key hurdle is this $2,300 level, where the pricing bands suggest strong resistance.

Why ETH Has Bottomed

In an X post, crypto analyst Titan of Crypto stated that the Ethereum price is showing signs of bottoming. He revealed that the weekly Stochastic RSI bullish crossover is in oversold territory, a development that has often signaled market bottoms for ETH. His accompanying chart showed that the leading altcoin could rally to as high as $6,000 as it records a bullish reversal.

Related Reading

Crypto analyst Crypto Caesar also stated that the Ethereum price is currently bottoming out and that ETH is “heavily undervalued.” He added that in every bull cycle, there is always a moment when most market participants think that the altcoin will never recover after a big bearish event. However, Ethereum always recovers and ends up making new highs. As such, the analyst believes this time won’t be different, and ETH is ready to stage a bullish reversal.

At the time of writing, the Ethereum price is trading at around $2,022, down almost 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Ethereum Reclaims Realized Price – Bulls Face Strong Resistance At $2,300

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) is once again trading above the $2,000 mark after several days of struggle, offering a glimmer of hope for investors looking for a recovery. The second-largest cryptocurrency has faced intense selling pressure in recent weeks, losing over 38% of its value since late February. Panic spread through the market when ETH broke below the key $2,000 level and later plunged under $1,800 — a move that signaled weakness and raised fears of a deeper correction.

Related Reading

Despite the volatility, market sentiment is beginning to shift. Some investors now believe that the worst may be behind Ethereum, and a slow but steady recovery could be on the horizon. Supporting this narrative, on-chain data from Glassnode reveals that Ethereum has reclaimed its realized price at $2,040 — a level that reflects the average price at which all ETH in circulation last moved.

This recovery of the realized price is often seen as a subtle but important bullish signal. It suggests that, on average, holders are back in profit, which may help reduce selling pressure and rebuild confidence in the market. For now, Ethereum’s ability to stay above $2,000 will be key to confirming a broader trend reversal.

Ethereum Faces Pivotal Moment As Bulls Aim To Confirm Recovery

Ethereum is beginning to show signs of life after weeks of uncertainty, but a decisive move is still needed to shift market sentiment. The $2,000 level, recently reclaimed, now acts as the key battleground for bulls attempting to ignite a meaningful recovery. As speculation builds around whether Ethereum will continue to trend higher or fall back into a broader correction, price action remains indecisive. Without strong conviction from buyers, the current bounce may fade quickly.

To sustain any upward momentum, bulls must defend the $2,000 level with strength and consistency. A failure to hold this support could invite renewed selling pressure and invalidate early signs of recovery. For now, the price hovers in a critical range with no confirmed trend in either direction.

Top analyst Ali Martinez shared an important on-chain signal on X, noting that Ethereum has successfully reclaimed its realized price at $2,040. This level reflects the average price at which ETH last moved on-chain and often serves as a pivot point for market sentiment. Martinez also pointed to $2,300 as the next significant resistance, with pricing bands suggesting heavy selling pressure at that level.

Reclaiming $2,300 would mark a major technical breakthrough and potentially confirm a shift in trend. Until then, Ethereum remains in a fragile position, caught between renewed optimism and lingering caution. Bulls must step in with volume and follow-through to turn this early bounce into a full-fledged recovery rally.

Related Reading

Technical Details: Price Struggles Below Key Averages

Ethereum (ETH) is currently trading at $2,070, hovering just above the crucial $2,000 support level. Despite recent attempts to regain strength, ETH remains 5% below the 4-hour 200 moving average (MA) and 200 exponential moving average (EMA) — a sign that momentum is still tilted in favor of the bears. These technical indicators often act as dynamic resistance, and until bulls reclaim them, the path to recovery remains uncertain.

For Ethereum to initiate a meaningful uptrend, reclaiming the $2,200 level is essential. A breakout above this zone would not only restore short-term bullish sentiment but also confirm a potential reversal from the recent downtrend. However, if ETH continues to struggle below the moving averages and fails to gain traction above $2,000, the risk of further downside increases significantly.

Related Reading

A breakdown below $2,000 could trigger a sharper correction, with the next major support sitting around the $1,800 level — a zone that previously acted as a pivot during the February selloff. As market sentiment hangs in the balance, bulls must act quickly to defend key support and regain control of price action. Otherwise, Ethereum could face another leg down in the coming sessions.

Featured image from Dall-E, chart from TradingView

-

Market23 hours ago

Market23 hours agoCan Cardano (ADA) Reach Back to $1 in April?

-

Market22 hours ago

Market22 hours agoShould You Buy Movement (MOVE) For April 2025?

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Price Prediction: Here’s What Needs To Happen For DOGE To Recover Above $0.3

-

Market20 hours ago

Market20 hours agoBinance To List MUBARAK, BROCCOLI, BANANAS31, and Tutorial

-

Market16 hours ago

Market16 hours agoWhy BTC Price Stayed Unchanged

-

Market15 hours ago

Market15 hours agoBitcoin Price Stalls at $88K—Can Bulls Overcome Key Resistance?

-

Altcoin20 hours ago

Altcoin20 hours agoBinance Announces Vote To List Results, Set To List MUBARAK, BROCCOLI, TUT, BANANA

-

Market19 hours ago

Market19 hours agoOnyxcoin (XCN) Nears Oversold After a 30% Monthly Drop