Ethereum

Bitcoin drops to $76k after Trump fails to rule out a recession

- Ether dropped 9%, XRP fell 2%, and Dogecoin lost over 8% in 24 hours

- Investors react to Trump’s comments about a possible recession

- The US stock market lost more than $1.7 trillion in value

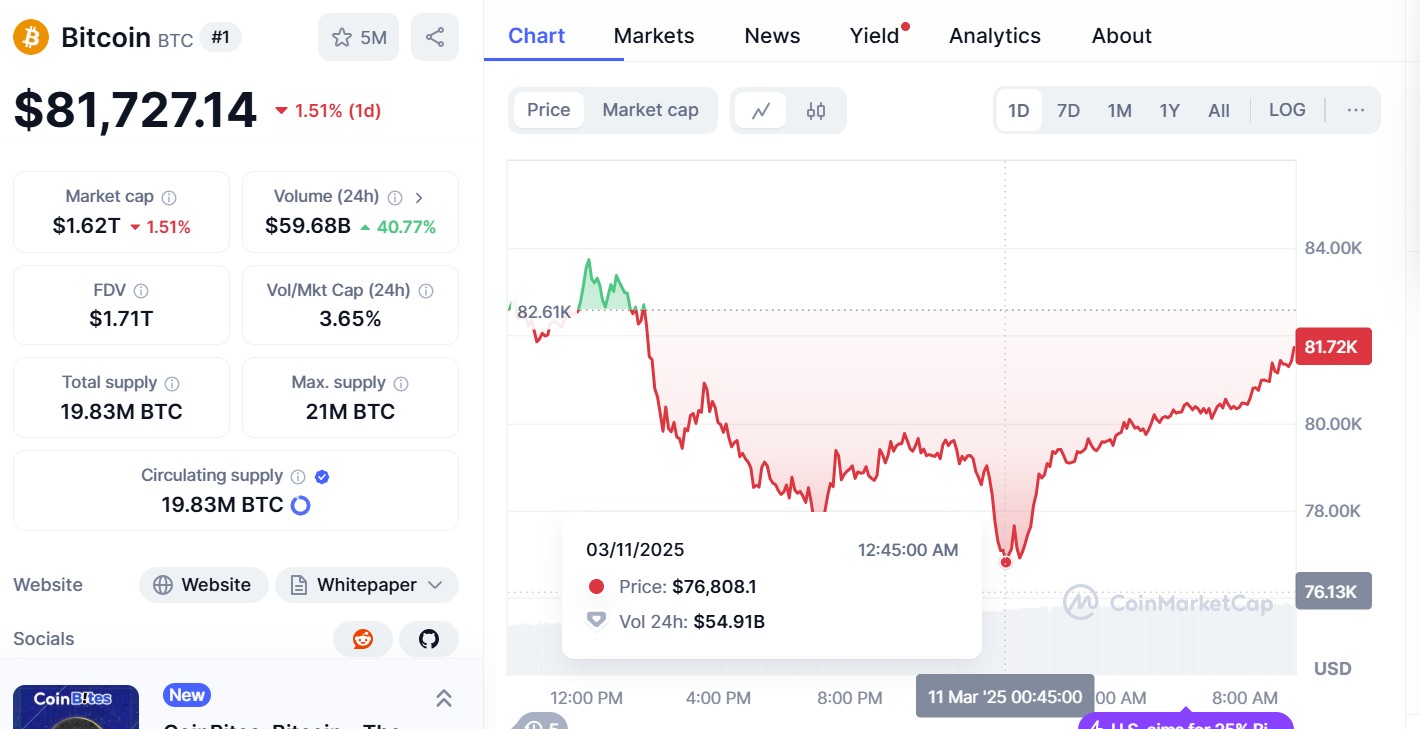

Crypto prices have fallen across the board, with Bitcoin dropping below $77,000 as investors continued to react to US President Donald Trump’s tariff policies and the Bitcoin reserve plan.

In the early hours of Tuesday, March 11, Bitcoin fell to $76,000, a figure not seen since last September. In a post on X, crypto trader Ali said:

“If #Bitcoin $BTC holds $80,000, the bull case remains strong. Losing this level, however, could put $69,000 in play as the next key support!”

If #Bitcoin $BTC holds $80,000, the bull case remains strong. Losing this level, however, could put $69,000 in play as the next key support! pic.twitter.com/PuqTrgKF0j

— Ali (@ali_charts) March 11, 2025

Bitcoin has risen slightly and is back up around $81,600 at the time of publishing, according to CoinMarketCap. Ether, on the other hand, was down over 9% in 24 hours to $1,920, XRP had fallen more than 2%, at $2.13, and Dogecoin was down over 8.81% to $0.1607.

The market reacts

News of the continued market sell-off comes as investors react to Trump’s trade tariffs, the announcement of the US Strategic Bitcoin Reserve, and the possibility of a recession.

Following Trump’s remarks, the US stock market lost more than $1.7 trillion in value yesterday. Elon Musk’s Tesla saw its shares drop by at least 15% to $222, losing over half its value from its December peak at $479.86. In a post on X, Musk said: “it will be fine long-term.”

Market conditions haven’t been helped by Trump’s trade tariffs on Canada, China, and Mexico. Last month, it was confirmed that Trump was imposing a 25% trade tariff on Canada and Mexico; however, this has been delayed until April 2. China had a 20% tariff levied against it.

BitMEX co-founder Arthur Hayes took to X to ask people to be “patient.”

“$BTC likely bottoms around $70k. 36% correction from $110k ATH, v normal for a bull market,” adding:

“Traders will try to buy the dip, if you are more risk averse wait for the central banks to ease then deploy more capital. You might not catch the bottom but you also won’t have to mentally suffer through a long period of sideways and potential unrealised losses.”

Ethereum

Ethereum’s True Value? Lower Than You Think

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin maximalist Samson Mow has doubled up on his value criticism of Ethereum’s price, asserting ETH is still overvalued despite Bitcoin’s price almost quadrupling since 2022. The JAN3 CEO referred to the glaring disparity in performance between the two top cryptocurrencies over a near three-year span.

Related Reading

Price Gap Grows As Bitcoin Rises

According to data, Ethereum now sits at $1,558, essentially the same as its August 2022 price of $1,600. Meanwhile, Bitcoin has climbed from $21,500 to $82,302 – an eye-popping 270% rise. The widening gap has only served to bolster Mow’s contention that Ethereum’s price does not correlate with its fundamentals.

Mow re-tweeted his August 23, 2022 post this week to emphasize his steadfast stance. His criticism focuses on supply variations between the cryptocurrencies. Bitcoin has less than 21 million overall coins, while Ethereum boasts 122 million circulating tokens.

#Ethereum is overvalued.

1 BTC = $21.5k

1 ETH = $1.6k21M BTC supply (actually less)

122M ETH supply (72M premined)Adjusted for unit bias (ETH price at 21M units) one ETH would be $9.3k.

So some people are paying $9.3k per unit of something that’s 60% printed from thin air.

— Samson Mow (@Excellion) August 23, 2022

‘60% Minted Out Of Thin Air’ Claim Targets Ethereum’s Origins

Based on Mow’s quotations, about 72 million ETH tokens (approximately 60% of the supply) were premined at the time of Ethereum’s launch. Token creation before the start of public mining has been quite an issue for purists in cryptocurrency for some time.

Possibly, the Bitcoin maximalist suggested that if 21 million coins were all there would be in supply for Ethereum like in Bitcoin, then each ETH would be valued today at around $9,300. Mow is again targeting investors in Ethereum, saying they are paying too much for an asset whose supply is exaggerated.

Sensitive To Macroeconomic Forces

Ethereum recently fell to a multi-year low of $1,380 on the back of global tariff trade war tensions. The cryptocurrency bounced back immediately to $1,680 on April 9 after US President Donald Trump declared a three-month tariff tariff hike pause on various countries, with China being the exception.

These movements illustrate how both cryptocurrencies are still sensitive to macroeconomic forces even as they have different value propositions and market performances.

Ether down in the last week. Source: Coingecko

Related Reading

Long-Standing Campaign Against Ethereum Continues

This is not Mow’s first time criticizing Ethereum. He has been vocal against ETH for years. In November 2024, he cautioned investors that the fate of Ethereum could be the same as their favorite tokens.

Mow, who forecasts Bitcoin to hit $1 million this year, has told investors to sell everything, including Ethereum, and invest in Bitcoin instead.

The debate underscores deep-seated differences in cryptocurrency investment philosophies. While Bitcoin maximalists such as Mow focus on scarcity and Bitcoin’s “digital gold” status, Ethereum supporters highlight the platform’s smart contract abilities and wider applications ecosystem.

As the price differential between the two leading cryptocurrencies continues to expand, these debates regarding relative value and suitable pricing models draw greater interest from investors and market analysts in common.

Featured image from Reuters, chart from TradingView

Ethereum

Ethereum Leads Market-Wide Drawdown As Altcoin Correlation Spikes – Details

Ethereum saw a powerful recovery this week, rebounding sharply from a $1,380 low and surging over 21% within hours. The rally was fueled by a temporary shift in macro sentiment following US President Donald Trump’s announcement of a 90-day pause on reciprocal tariffs for all countries except China, which remains under a 125% tariff. The news sparked a relief rally across financial markets, with Ethereum leading the bounce in the crypto sector.

Despite the strong move, ETH remains below key technical levels, and price action is showing signs of consolidation as bulls attempt to build momentum. The broader altcoin market continues to struggle, with sector-wide weakness weighing on investor confidence.

According to data from Glassnode, all major altcoin sectors have experienced sharp declines in recent months. The correction has been broad-based and highly correlated, offering little in terms of idiosyncratic performance. Even Bitcoin and Ethereum—typically seen as the most resilient assets in crypto—have posted negative returns over the same period.

As Ethereum enters a consolidation phase, traders are watching closely to see whether this bounce marks the beginning of a sustained recovery or just another short-lived reaction in a broader downtrend.

Ethereum Faces a Crucial Test Amid Macroeconomic Headwinds

Ethereum is once again at a pivotal point in the market, following weeks of intense selling pressure and uncertainty. After plunging to fresh lows, ETH bulls are finally stepping in, attempting to reclaim key levels after a strong bounce from the $1,380 mark. The move comes amid heightened volatility across global markets—not just in crypto, but in equities as well—as fears of a global recession and extended trade disputes between the U.S. and China continue to rattle investor sentiment.

Despite the bounce, Ethereum remains in fragile territory. The market is clearly divided: some investors see this rebound as the beginning of a recovery, while others caution it could be just a temporary pause in a deeper correction. The macroeconomic environment remains hostile, with U.S. tariffs still posing a major risk to both traditional and digital assets.

Glassnode data adds context to Ethereum’s struggle, showing that all altcoin sectors have moved sharply lower in recent months. There has been little differentiation between projects, with the drawdown being broad-based and highly correlated. Even Bitcoin and Ethereum—typically viewed as the strongest assets in crypto—have posted negative returns.

Ethereum has led this decline, losing over 60% of its value since late December. The sharp drop has triggered growing speculation about a potential bear market forming across the broader altcoin space. Whether this recent bounce will evolve into a sustainable rally or falter under macroeconomic pressure remains to be seen. For now, Ethereum faces a defining moment in its current cycle.

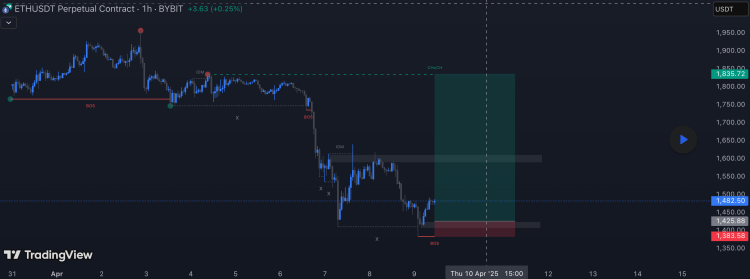

Bulls Struggles to Reclaim Key Levels But Defend $1,500

Ethereum is trading at $1,560 after failing to hold above the $1,600 mark and reclaim the critical $1,800 level. Despite the recent bounce from lower lows, ETH remains in a fragile position as market volatility rises and macroeconomic uncertainty continues to pressure risk assets.

Bulls are starting to build momentum, but the recovery is far from confirmed. Holding above $1,500 is now essential to prevent a continuation of the downtrend. This level has acted as a psychological support zone in previous market cycles, and losing it could trigger another wave of panic selling—especially as sentiment in the broader altcoin market remains subdued.

If bulls can defend the $1,500 level and consolidate above it, there’s a chance to reclaim higher levels in the short term, potentially challenging $1,600 again. However, a decisive break below $1,500 would likely lead to further downside, with price targets potentially extending into the $1,300–$1,200 range.

As volatility continues to drive erratic price action, ETH holders remain cautious. A confirmed push above $1,600 would help restore some confidence, but for now, Ethereum remains in a critical battle to hold its ground.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Breakout To $1,800 With These Two Supply Zones

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Even with the Ethereum price struggling amid the market downturn, there are still some who remain bullish on the second-largest cryptocurrency by market cap. One of those is pseudonymous crypto analyst NotWojak, who took to the TradingView website to share a rather bullish prediction for the Ethereum price that goes contrary to the current market sentiment.

Bearish Ethereum Price Downtrend Coming To An End

The Ethereum price is still stuck in an apparent downtrend. However, according to the crypto analyst, this could be ending anytime soon with two supply zones coming up. So far, there have been multiple liquidity sweeps across major levels, sending the Ethereum price towards lower lows. Nevertheless, this could turn bullish soon as they could suggest a reversal is coming for the cryptocurrency.

Related Reading

Currently, the two supply zones called out by the analyst are the $1,425 and $1,600 level. As they explain, the $1,425 level has already been mitigated during the latest retracement. So, this leaves only the $1,600 level unmitigated. As such, this could easily turn this level into resistance in the event of an uptrend.

Despite sellers still dominating currently with high volumes pouring into the market, the crypto analyst puts the bottom before $1,350. In this case, this level could be potential support and the breakout could begin from here.

The target for this major breakout has been placed 20% above the current level, with the analyst setting a high $1,835 target. This could lead to further upside, especially if resistances are easily cleared from here.

ETH On-Chain

Ethereum’s profitability has plummeted with the price decline as only 32% of all investors are seeing any profit on their positions. On the other side, 65% of all holders are in losses and only 2% are sitting at breakeven price, according to data from the on-chain data aggregation website, IntoTheBlock.

Related Reading

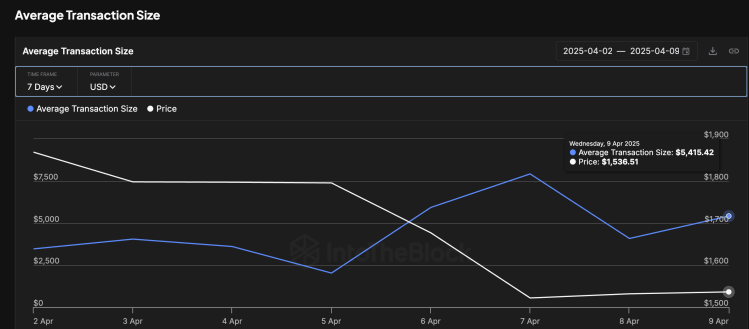

Ethereum whales have also been very active during this time and this could mean that large investors have been behind the selling that has crashed the ETH price. Large transactions rose from $4.8 billion to $6.48 billion by April 9 as the Ethernet price dropped back below $1,500.

Average transaction size also grew during the this time from $4,048 to $5,415. This suggests that investors are moving more coins at the time, which could explain the increased selling that has plagued the cryptocurrency. If this continues, then the ETH price could see further crashes from here.

At the time of writing, the Ethereum price was trending at $1,544, down 4.56% in the last day.

Featured image from Dall.E, chart from TradingView.com

-

Market23 hours ago

Market23 hours agoChina Raises Tariffs on US to 125%, Crypto Markets Steady

-

Bitcoin23 hours ago

Bitcoin23 hours agoIs Bitcoin Ready for Another Surge?

-

Market15 hours ago

Market15 hours agoThis is Why The Federal Reserve Might Not Cutting Interest Rates

-

Market22 hours ago

Market22 hours agoBinance, Trade Wars, Ripple and SEC

-

Regulation19 hours ago

Regulation19 hours agoUS Senators Reintroduce PROOF Act To Set Reserve Standards for Crypto Firms

-

Market18 hours ago

Market18 hours ago3 Altcoins to Watch for Binance Listing This April

-

Market21 hours ago

Market21 hours agoHow You Can Find Altcoin Winners Early

-

Market20 hours ago

Market20 hours agoInvestors Shift to Crypto, Gold, and Equities Amid Tariff Volatility