Blockchain

Aptos Flips Solana in Daily Transactions, Here’s Why

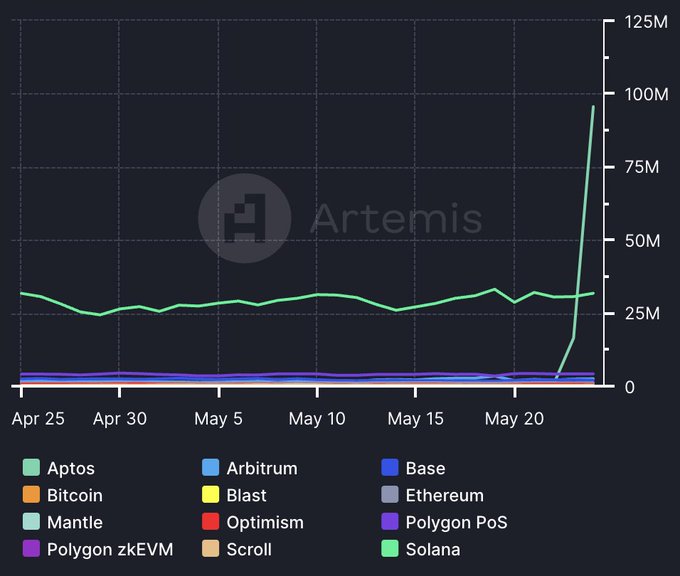

Aptos has achieved a new milestone in blockchain transactions, surpassing Solana by recording 96.6 million transactions in a single day, compared to Solana’s 31.7 million.

This surge in transaction volume is a record high in the Layer 1 blockchain industry, surpassing the record set by Sui Network by more than 50%.

Factors Behind Aptos’ Surge in Transactions

Increased transactional activity on Aptos can be linked to the release of a new tap-to-earn game called Tapos Cat. This game has been quickly adopted, and within the first day on the mainnet, it processed 10 million transactions.

Tapos Cat is a game that enables users to accumulate $HEART tokens as a reward for engaging in the game, which entails ‘tickling’ a virtual cat. The structure of the game provides for multiple transactions, and no gas fees are taken for the first 72 hours of the game’s operation.

Source: Artemis

Moreover, Aptos has kept the gas fees and the success rates relatively constant even though the transactions are quite frequent. Such stability is achieved due to the Aggregator functionality provided on the Aptos platform, which allows for multiple transactions to be performed simultaneously.

This technical capability has evidently been instrumental in addressing the issue of increased load on the network without negatively impacting the performance.

Criticism and Defense of New Transaction Models

Despite the entry of Tapos Cat, not everybody raised the baton to celebrate its arrival on the scene. The CEO of the Helius Labs has recently shared his doubts about the game’s longevity and practical application. He notes that the game mainly encourages users to click and buy, which he believes is done to manipulate numbers rather than serve users’ needs.

Hatred should not be our anthem

We are in a time in crypto where hatred is prominent.

As a collective, we forget that we are a small community trying to change the global order by building trustless systems that can operate at scale.

But what do we do instead?

We shill our… https://t.co/aWdW2NOXWl

— Naresh | Aptos (@NareshKx) May 25, 2024

In defense of the Aptos approach, its supporters have pointed out that innovation is the key to success and that the company is staffed with the best professionals. They state that although Tapos Cat might seem to lack an intrinsic use case at first, it is a crucial engineering endeavor that establishes the viability and durability of the Aptos network.

Thus, reaching high transaction volumes without increasing gas fees or having failed transactions, the game proves the network can operate large-scale operations.

Meanwhile, amid this development, Aptos (APT) price has been bullish in the last 24 hours. At press time, APT was exchanging hands at $9.05, a 1.46% surge from the day’s support. Solana (SOL) price, however, has had a tough time in the last 24 hours, failing to breach the $170 resistance. Trading at $167 at press time, SOL was down 0.96% from the intra-day high.

Read Also: Elon Musk’s xAI Teams Up with Oracle for AI Supercomputer

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Blockchain

Blockchain in the Ballot Box? NY Assembly Considers Tech to Fight Election Fraud

New York State may soon explore the application of blockchain technology in its electoral processes. Assemblyman Clyde Vanel has introduced a bill aimed at assessing how blockchain can support election transparency and reduce voter fraud.

The initiative comes at a time when blockchain adoption is gaining traction across the US under the new presidential administration.

Blockchain For Delivering ‘Uncensored Truth’

Vanel’s bill, submitted to the Assembly Election Law Committee, tasks the New York State Board of Elections with evaluating on-chain systems as tools for delivering what he terms “uncensored truth” in democratic processes. If approved, the Board will examine similar initiatives in other states and produce a comprehensive report within 12 months.

While the proposal is currently under committee review, it must pass through several legislative stages—including Assembly and Senate votes—before reaching the Governor’s desk for final approval. This marks the fifth version of Vanel’s election-focused blockchain legislation since 2017, none of which have yet become law.

Meanwhile, New York State has increasingly engaged with blockchain and cryptocurrency policy. In 2023, the New York State Cryptocurrency and Blockchain Study Task Force was launched to investigate the environmental and economic impacts of digital assets.

New York also pioneered regulatory frameworks for crypto companies with the introduction of the BitLicense in 2015 by former Department of Financial Services Superintendent Benjamin Lawsky.

Growing US Involvement With Crypto Amid Administration Shift

Interest in digital assets has grown since President Trump’s re-election, which included a March executive order advocating for the development of a Strategic Bitcoin Reserve.

In response, over 15 US states have moved to draft legislation supporting public investment in Bitcoin, with Arizona and Utah initially leading the effort. However, Utah later removed the Bitcoin provision from its proposed bill.

Additionally, lawmakers across state lines are examining various ways blockchain can support public infrastructure and government transparency. From digital identity verification to immutable public records, blockchain’s potential applications continue to be tested in pilot programs nationwide.

In the electoral space, blockchain’s decentralized structure could offer an added layer of protection against tampering and misinformation, particularly in contentious or high-turnout elections.

Should New York proceed with this evaluation, the outcome could influence broader efforts to digitize and secure voting systems. While critics may question blockchain’s scalability or voter accessibility, supporters argue it offers a tamper-resistant, auditable solution well-suited for modern governance.

Vanel’s legislation could lay the groundwork for a more technologically integrated electoral process that balances innovation with security.

If passed and successfully implemented, New York’s blockchain election report could serve as a reference point for other states considering similar measures, potentially setting the stage for a nationwide shift in how democratic systems utilize emerging technologies.

Featured image created with DALL-E, Chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Blockchain

Trump Administration Push for Blockchain-Powered USAID Overhaul—Here’s What Could Change

A newly surfaced proposal concerning blockchain is now circulating within the US State Department hinting at a potential shift in how the United States Agency for International Development (USAID) operates.

Under a set of recommendations backed by Trump administration officials and linked to the Elon Musk-led DOGE government efficiency unit, the agency may begin utilizing blockchain technology to enhance transparency and security in foreign aid disbursement.

Adopting Blockchain in Foreign Aid Reform

According to a draft document obtained by Politico, blockchain integration is being considered as part of a broader effort to modernize and restructure USAID’s procurement processes.

The proposal outlines that all aid distributions could be tracked using blockchain to “ensure accountability,” “reduce inefficiencies,” and allow implementing partners “greater flexibility.”

Although the proposal doesn’t clarify whether a public, private, or hybrid blockchain system would be used, it emphasizes the benefits of “secure and traceable” fund flows for international aid programs.

Meanwhile, USAID, the US agency responsible for administering foreign development assistance, has faced criticism in recent years over perceived inefficiencies and spending priorities.

The proposal aligns with ongoing efforts from the Trump camp to realign foreign aid programs with national strategic interests. It describes current aid structures as too “expansive and disorganized,” urging a shift toward focused initiatives tied to measurable outcomes in regions critical to US interests. The document wrote:

A better approach would be to foster peace and stability in regions critical to U.S. interests, catalyze economic opportunities that support American businesses and consumers, and mitigate global threats such as pandemic diseases.

Potential Restructuring and Strategic Realignment

Alongside blockchain adoption, the document proposes renaming USAID to the “U.S. Agency for International Humanitarian Assistance (IHA)” and moving the agency under the direct control of the State Department.

Areas of focus would include global health, food security, and disaster response, with an emphasis on reducing politically oriented programs and streamlining operations.

The recommendations follow past efforts by the Trump administration to limit USAID funding and staff, moves that were met with legal pushback and public criticism.

While the document reflects a serious policy proposal, it does not yet represent formal government action. The proposal acknowledges that some aspects would require congressional approval and legislative changes.

It is also unclear whether Secretary of State Marco Rubio or other senior officials within the current administration have reviewed or approved the recommendations.

Still, the introduction of blockchain as a transparency mechanism signals a growing interest in applying emerging technologies to government operations—an area of focus that may continue regardless of future political leadership.

Featured image created with DALL-E, Chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Blockchain

Ethena Labs and Securitize to launch Converge, a new blockchain for DeFi

- Ethena Labs and Securitize are joining forces to launch Converge, a new blockchain for decentralized finance and tokenized assets.

- Converge will be Ethereum Virtual Machine-compatible and serve both retail and institutional DeFi.

- ENA price rose 5% to change hands above $0.38 following the announcement

Ethena Labs and Securitize are teaming up on a venture that will see the crypto projects unveil Converge, a new blockchain built for tokenized assets and decentralized finance.

Announced on Mar. 17, Converge will be a custom-built, Ethereum-compatible blockchain. The developers envision a platform that will cater to both everyday investors and deep-pocketed institutional players.

Per a blog post introducing the new blockchain, the anticipated launch date is Q2 2025.

Ethena, Securitize unveil Converge

According to Ethena Labs, Converge is a blockchain platform designed to bridge the gap between traditional finance and DeFi.

The technology behind the EVM-compatible chain will allow users to leverage user-friendly decentralized applications for retail investors. Converge will also offer a suite of top tools aimed at institutional investors.

Both Ethena Labs and Securitize plan to tap into the new blockchain to advance the DeFi and asset tokenization ecosystem. In this case, the partnership will see Ethena bring its burgeoning DeFi to Converge.

Securitize will also revamp its traction in the real-world asset (RWA) tokenization space. With nearly $2 billion minted, Securitize stands out as one of the top platforms championing the growth of tokenized assets.

Converge’s unveiling will bring an EVM-compatible settlement layer, driving new adoption for stablecoins and tokenized assets.

“We’re developing Converge to fill a clear gap in the market as the go-to settlement layer for institutional-grade DeFi and tokenized assets,” Guy Young, founder of Ethena Labs, said in a statement.

According to Young, “storage and settlement of stablecoins and tokenized assets” is set to be a massive opportunity in the coming years.

Stablecoins, blockchains and exchanges are a “holy trinity of crypto protocols” the Ethena Labs founder posted on X.

Further comments came from Carlos Domingo, the co-founder and CEO of Securitize. He noted:

“By combining Ethena’s innovation in DeFi with Securitize’s leadership in tokenizing real-world assets, Converge sets a new standard for how institutions can confidently engage with on-chain financial markets.”

Converge’s initial launch partners

The two firms will look to advance Converge via key industry collaborations. Helping the cause are initial launch partners, including Pendle, Aave Labs (via its Horizon project), Morpho, Ethereal and Maple Finance.

Converge’s RWA traction will also benefit from custodial support from Anchorage, Copper, Fireblocks and Zodia among other institutional-grade custody providers.

Also key will be interoperability partners LayerZero and Wormhole. Meanwhile, Converge will tap into oracle support from Pyth Network and RedStone.

Furthermore, Converge will use Ethena’s native governance token ENA for staking and security. The latter will tap into a permissioned validator set. The USDe and USTb stablecoins will power network transactions as gas tokens.

The news saw the ENA token jump more than 5% to trade above $0.38.

-

Market15 hours ago

Market15 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Market21 hours ago

Market21 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Market19 hours ago

Market19 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Market20 hours ago

Market20 hours agoCharles Schwab Plans Spot Crypto Trading Rollout in 2026

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Enters Historic Buy Zone As Price Dips Below Key Level – Insights

-

Market16 hours ago

Market16 hours agoVOXEL Climbs 200% After Suspected Bitget Bot Glitch

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Accumulators At A Crucial Moment: ETH Realized Price Tests Make-Or-Break Point

✓ Share: