Bitcoin

Will the Fed Return to Quantitative Easing?

Crypto and financial markets, in general, are reeling from renewed volatility and mounting geopolitical pressure. As a result, speculation is intensifying around whether the Federal Reserve (Fed) will pivot back toward Quantitative Easing (QE).

A potential QE would be reminiscent of the aggressive monetary interventions of 2008 and 2020. For crypto, the implications could be enormous, with many traders bracing for a potential V-shaped recovery and a historic rally if QE is revived.

Analysts Share Signals Why the FED Could Act

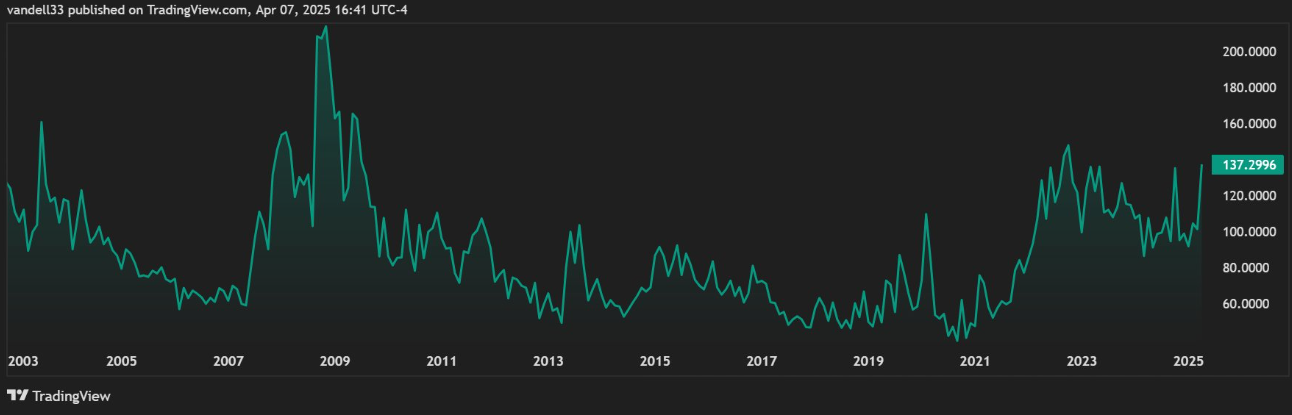

Analysts have shared reasons that could prompt the Fed to intervene, with one citing the MOVE Index. This is Wall Street’s “fear gauge” for the bond market. At 137.30, the index is currently within the 130–160 range where the Fed has historically acted during crises.

“Now it’s at 137.30, in the 130–160 range where the Fed might step in, depending on the economy. If they don’t, they’ll still cut rates soon because they have to refinance the debt to keep the Ponzi going,” wrote Vandell, co-founder of Black Swan Capitalist.

This signal aligns with other warning signs of financial instability, including global market sell-offs that set the tone for the crypto black Monday narrative. This prompted the Fed to schedule a closed-door board meeting on April 3.

According to analysts, this timing was not random, with mounting pressure likely to see the Fed cave and President Trump having his way.

“With the Fed hinting at QE, everything changes Risk: Reward is now in favor of the bulls. Watch for choppy price action, but do not miss the recovery rally. And remember… it’s easier to trade this market than to hold through it,” said Aaron Dishner, a crypto trader and analyst.

This suggests that investors are reading between the lines, particularly with the Fed’s next scheduled policy decision not until May 6–7. JPMorgan recently became the first Wall Street bank to forecast a US recession amid Donald Trump’s proposed tariffs, adding urgency to the conversation.

The bank suggests the Fed may be forced to act sooner, possibly with rate cuts or even QE, before the scheduled FOMC meeting. Against this backdrop, crypto investor Eliz shared a provocative take.

“I honestly think Trump is doing all this to speed up the Fed’s process to lower rates and QE,” they noted.

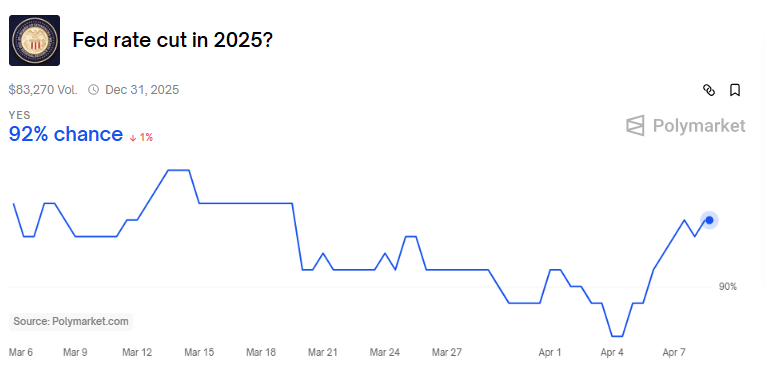

That may not be far-fetched given that the Fed must also manage over $34 trillion in federal debt. Noteworthy, this becomes harder to service at higher interest rates. According to Polymarket, there is now a 92% chance the Fed will cut rates at some point in 2025.

Why Crypto Could Benefit From QE

Should QE materialize, history suggests crypto could be one of the biggest beneficiaries. BitMEX founder and former CEO Arthur Hayes predicted that QE could inject up to $3.24 trillion into the system, nearly 80% of the amount added during the pandemic.

“Bitcoin rose 24x from its COVID-19 low thanks to $4 trillion in stimulus. If we see $3.24 trillion now, BTC could hit $1 million,” he said.

This aligns with his recent prediction that Bitcoin could reach $250,000 by year-end if the Fed shifts to QE to support markets.

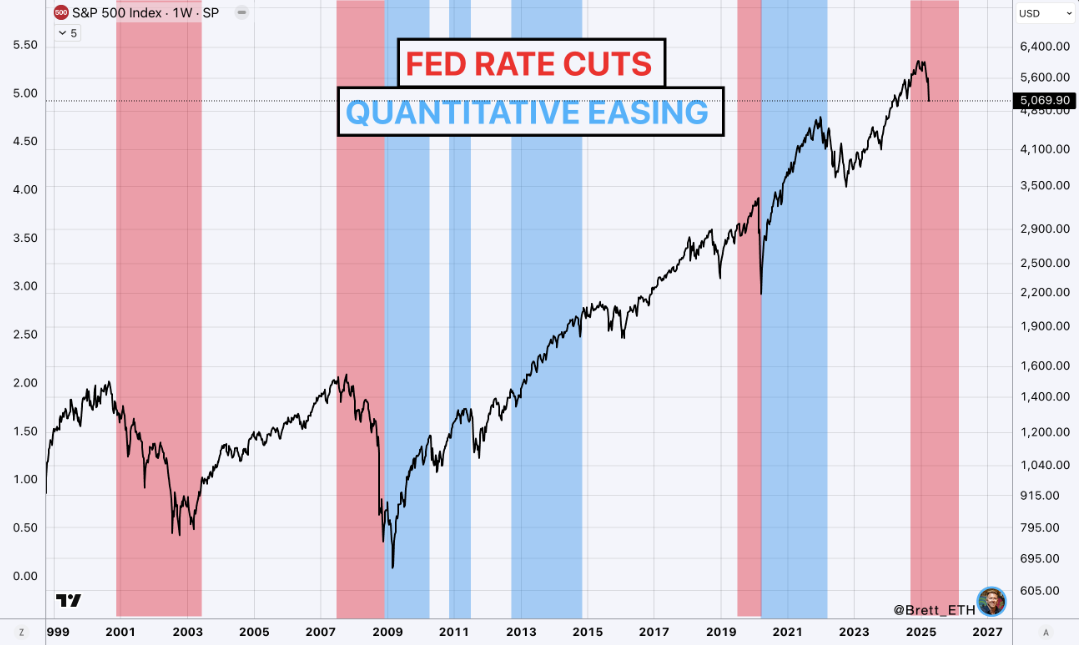

Analyst Brett offered a more measured view, noting that QE typically follows rate cuts rather than precedes them.

“We’re likely going to see rate cuts through mid-2026…like in 2008 and 2020, Powell has said QE doesn’t come until rate cuts are complete,” Brett explained.

Based on this, the analyst committed to buying selectively but did not expect a V-shaped bounce unless something drastic changed.

That “something” could be Trump reversing his tariffs or the Fed front running a recession with emergency easing measures. If either happens, the crypto market could rally hard and fast.

Altseason on the Horizon?

Meanwhile, Our Crypto Talk says a Quantitative Easing in May could lay the groundwork for a possible altcoin season.

Their forecast echoes previous cycles where QE triggered explosive moves in risk assets. When QE kicked off in March 2020, altcoins surged over 100X by the time it ended in 2022.

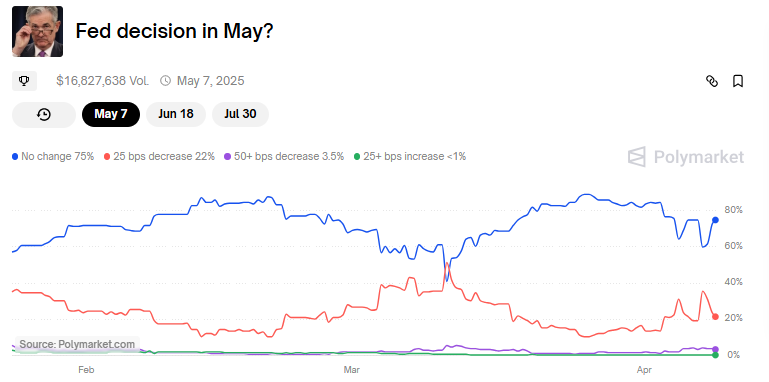

Traders are now eyeing May as a potential kickoff for the next liquidity wave, with bettors wagering a 75% chance the Fed will hold rates steady. If those odds shift, traders expect the money printer to follow.

While some anticipate more price “chop” in the short term, most agree that the long-term setup is increasingly favorable.

“If QE really kicks off in May, this chop is just the calm before the giga pump,” wrote MrBrondorDeFi on X.

Even if quantitative easing does not occur immediately, confidence remains strong that it will happen this year.

“Maybe not May, then later. It will happen this year, which is good for another rally and new highs,” Our Crypto Talk added.

Therefore, the buck stops with the Fed. Whether it is rate cuts, QE, or both, the implications for crypto are enormous.

If history repeats and the Fed opens the liquidity floodgates again, Bitcoin and altcoins could be poised for a historic breakout. This could eclipse the gains seen during the 2020-2021 bull run.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin STH MVRV Climbs To 0.90, Is A Price Rebound On?

Bitcoin (BTC) has moved to reclaim the $86,000 price level following a 2.65% gain in the last 24 hours. Notably, the premier cryptocurrency has maintained a bullish form over the past few rising by over 15% since retesting the $74,000 rice zone. Amid a potential resumption of the broader bull rally, prominent crypto analyst Burak Kesmeci has highlighted notable developments in Bitcoin short-term holders MVRV (Market Value to Realized Value) ratio.

Bitcoin Market Recovery Awaits Final Signal: Analyst

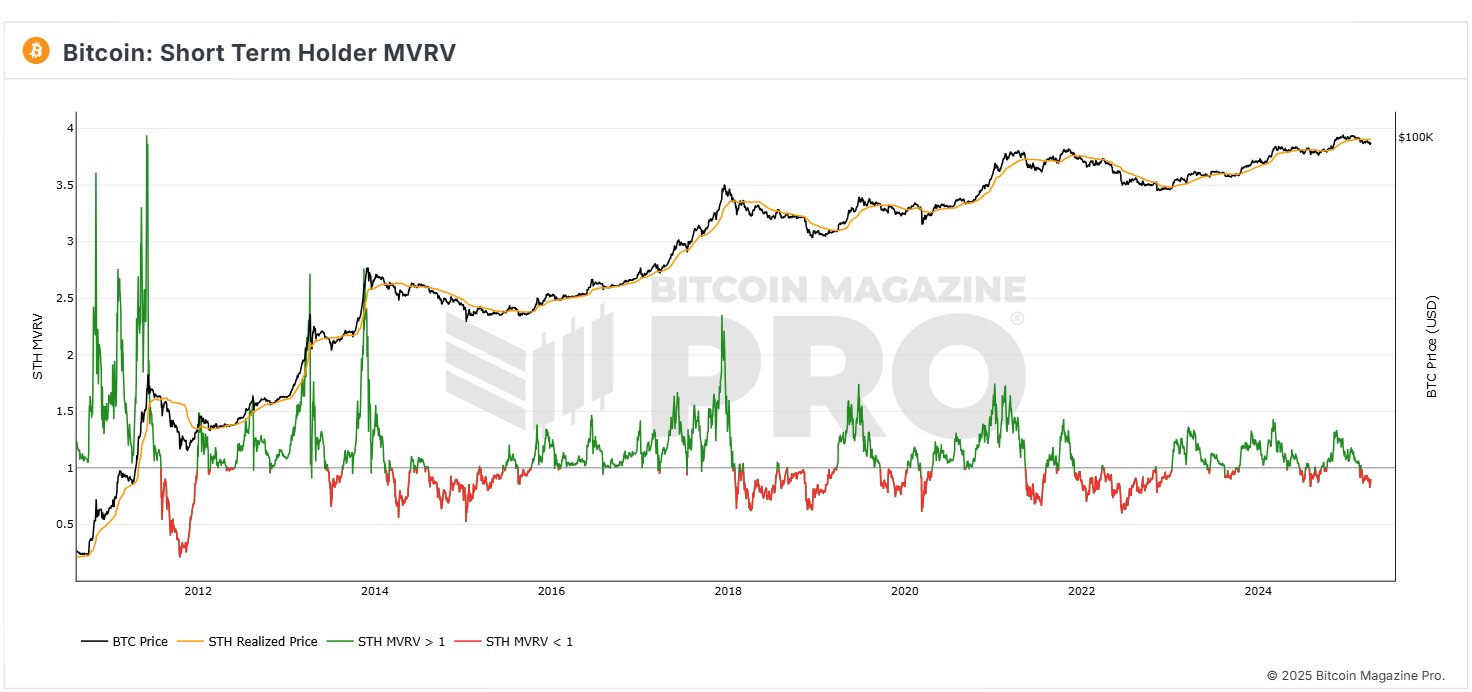

In a new post on X, Kesmeci explains that Bitcoin is showing early signs of a market recovery following recent developments in the Bitcoin MVRV for short-term investors. For context, the MVRV measures investors’ profitability by comparing the market value of an asset to the price at which it was acquired. An MVRV score below 1.00 indicates that the average holder is at a loss, while a score above 1.00 suggests profit.

The MVRV for Bitcoin short-term holders i.e. addresses that have held Bitcoin for less than 155 days, is particularly important as this cohort of investors is usually the most reactive to price changes. Notably, the STH MVRV provides insight into market sentiment and potential price direction.

According to Kesmeci, the Bitcoin STH MVRV is now at 0.90, close to a profit level above 1.00. The STH MVRV had hit 0.82 amidst the recent “tax tariff poker” crisis, ignited by international tariff changes by the US government. Notably, this decline falls lower than levels seen during the Japan-based carry trade crisis on August 5, 2024, when STH MVRV dipped to 0.83.

Over the last few days, the STH MVRV has climbed to 0.90 in line with the resurgence of BTC prices However, Kesmeci warns that Bitcoin must still cross 1.00 to confirm the potential for any significant price gains for short-term investors. Albeit, the rise from 0.82 to 0.90 remains a positive development that indicates an ongoing shift in market sentiment.

BTC Price Outlook

At press time, Bitcoin is trading at $85,390 following a slight price retracement in the past few hours. Amidst recent daily gains, the premier cryptocurrency is up by 2.11% on its weekly chart and 4.33% on the monthly chart as bullish momentum continues to build among investors. However, market bulls must offset the 38.98% decline in daily trading volume if the present uptrend must persist.

Notably, BTC investors should expect to face ample resistance at the $88,000 price zone which has acted as a strong price barrier in previous times. Meanwhile, in the advent of any price fall, the immediate price support lies around $79,000.

Featured image from iStock, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

New Bill Pushes Bitcoin Miners to Invest in Clean Energy

US Senators Sheldon Whitehouse and John Fetterman have introduced the Clean Cloud Act of 2025. The bill aims to reduce carbon emissions from energy-intensive crypto-mining operations and artificial intelligence data centers.

This comes at a time when Bitcoin miners are increasingly moving towards renewable energy sources to power their operations.

Clean Cloud Act Links Rising Energy Demand to Bitcoin Mining

According to the bill, the Environmental Protection Agency (EPA) would have the authority to set annual carbon performance standards for facilities with over 100 kilowatts of installed IT power.

These standards would tighten each year, with emissions limits declining by 11% annually.

Companies that exceed the cap will pay a starting fee of $20 per ton of carbon dioxide equivalent. This fee will rise yearly, adjusting for inflation and an additional $10 per ton. The bill also enforces strict accounting methods to include indirect emissions from the grid.

The lawmakers argue that crypto miners and AI centers are driving up power demand at an unsustainable pace. According to them, the current clean energy sources cannot keep up with the rapid growth of the demand for Bitcoin mining.

They noted that data centers alone use 4% of all electricity in the US and could hit 12% by 2028. They also pointed out that utilities have even restarted old coal plants to meet rising demand, worsening the country’s carbon footprint.

Considering this, Senator Whitehouse noted that this pressure is driving up electricity costs for consumers. He said the bill would push tech firms toward clean energy investments and help ensure the US power grid can reach net-zero emissions within the next decade.

“The good news is that we don’t have to choose between leading the world on AI and leading the world on climate safety: big technology and AI companies have all the money in the world to pay for developing new sources of clean energy, rather than overloading local grids and firing up fossil fuel pollution. The Clean Cloud Act will drive utilities and the burgeoning crypto and AI industries to invest in new sources of clean energy,” the lawmaker stated.

To protect low-income households, 25% of the revenue generated from emissions penalties will offset energy costs. The rest will fund grants supporting long-duration storage and clean power generation projects.

Meanwhile, this move is coming as the crypto industry steadily transitions to greener energy.

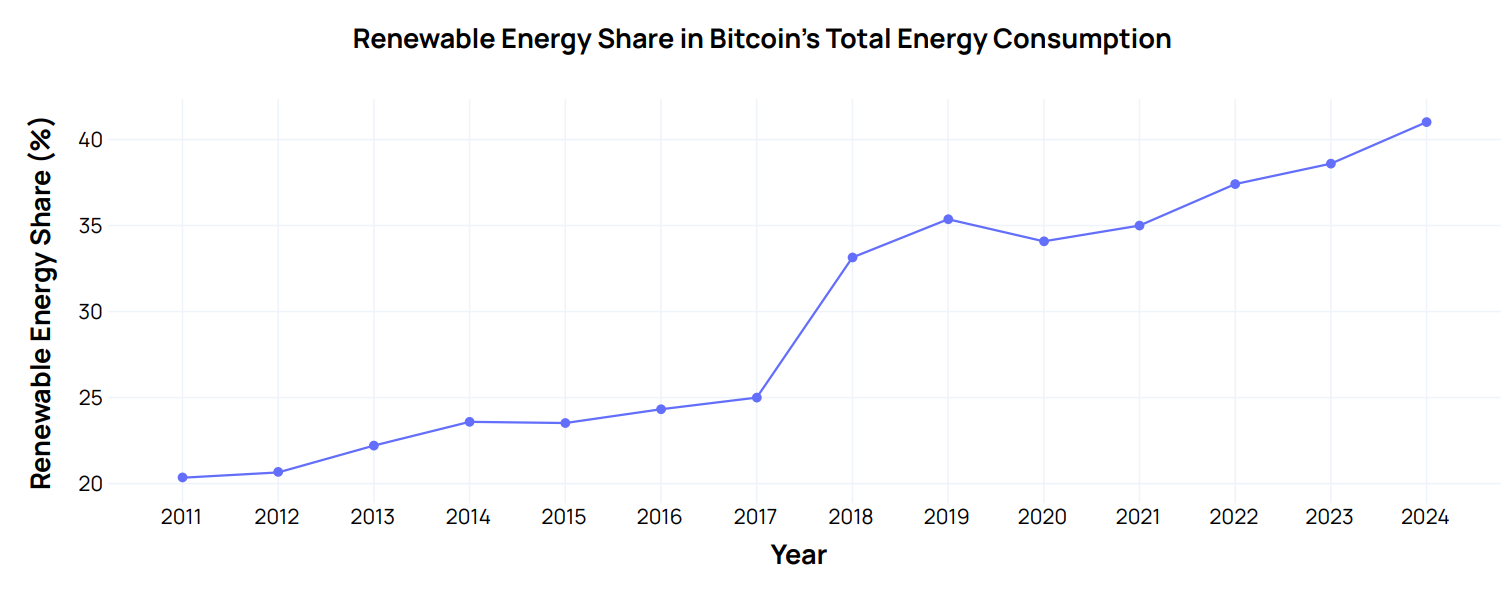

A recent MiCA Crypto Alliance report shows that renewable energy powered 41% of Bitcoin mining by the end of 2024, up from 20% in 2011.

Following this rapid adoption rate, the report forecast that renewables could support over 70% of mining activities by 2030, driven by cost efficiency, evolving policies, and a broader shift toward sustainable practices

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

CryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why

Ki Young Ju, the CEO of blockchain analytics platform CryptoQuant, has declared that the Bitcoin bull cycle is over. Notably, the premier cryptocurrency has struggled to establish a sustained uptrend since hitting a new all-time high of around $109,000 in January, causing doubts about the viability of the current bull run.

Bitcoin’s Unresponsive Price Points To Bear Market Onset

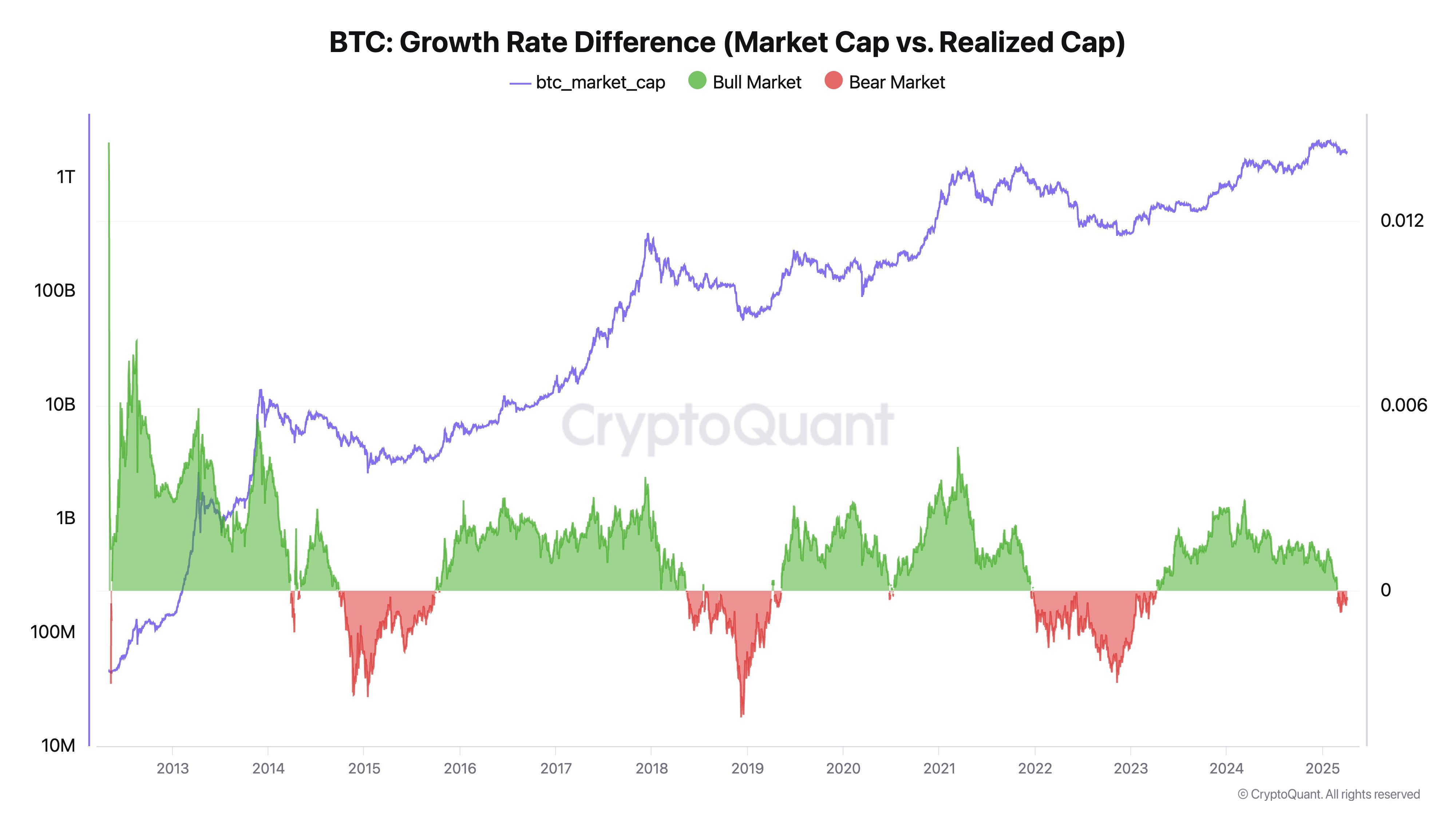

In an X post on April 5, Ki Young Ju shared an interesting theory on why Bitcoin may have concluded its current bull run. The prominent crypto figure has based this postulation on on-chain data concepts around the Realized Cap and the Market Cap.

Young Ju describes the Realized Cap as the total capital that flows into the BTC market as revealed by actual on-chain activity. The Realized cap reveals a more accurate measurement of the BTC network by summing the price at which each coin last moved.

On the other hand, the Market Cap provides a BTC network valuation based on the latest exchange trading prices. The CryptoQuant CEO explains that market cap/prices do not increase or decrease in proportion to transaction sizes based on common misconceptions but in response to the balance between buying and selling pressure.

Young Ju states that amidst low sell pressure, a small buy can cause a rise in price and market cap. On the other hand, large Bitcoin purchases during high sell pressure can fail to effect a positive price reaction as the market consists of a high number of sellers.

Looking at both concepts, it is understood that Realized Cap measures the capital inflows into the BTC market while Market Cap indicates price reaction to these inflows. Therefore, the CryptoQuant boss explains that a rise in Realized Cap, while Market Cap declines or remains unchanged, presents a classic bearish signal as prices are failing to respond positively despite new investments.

Alternatively, a stagnant Realized Cap accompanied by an increased Market Cap is a bullish signal that reflects the low level of sellers; thus any small amount of new capital can induce substantial price gains.

Ki Young Ju states the former situation is currently playing out in the Bitcoin market with prices failing to rise inflow as indicated by on-chain data in exchange transactions, ETF markets, and custodial wallets activity. This development suggests the presence of a bear market. While Young Ju states that the current sell pressure could wane at any time, historical data supports a reversal period of at least six months.

Bitcoin Price Overview

At press time, Bitcoin was trading at $83,700 reflecting a decline of 0.94% in the past day.

Featured image from TheStreet, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin9 hours ago

Altcoin9 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Reclaims Key Support At $1,574, Here’s The Next Price Target

-

Market19 hours ago

Market19 hours agoDOGE Spot Outflows Exceed $120 Million in April

-

Market17 hours ago

Market17 hours agoFARTCOIN Is Overbought After 250% Rally – Is the Bull Run Over?

-

Bitcoin22 hours ago

Bitcoin22 hours agoScottish School Lomond Pioneers Bitcoin Tuition Payment In The UK

-

Market14 hours ago

Market14 hours agoHackers are Targeting Atomic and Exodus Wallets

-

Market13 hours ago

Market13 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Bitcoin20 hours ago

Bitcoin20 hours agoCryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why