Bitcoin

Will the Corporate Bitcoin Accumulation Trend Continue in 2025?

Bitcoin additions to corporate treasuries have risen during the first quarter of 2025, with industry giants like Tether and Metaplanet reaching record allocations compared to the previous quarter.

However, recent trade policy announcements in the US have cast a shadow over further Bitcoin accumulation. BeInCrypto interviewed Max Shannon, an analyst at CoinShares, to explore the sustainability of this trend throughout the year and the likelihood of further corporate adoption.

Which Companies Are Leading the Bitcoin Treasury Charge?

As Bitcoin’s path to mainstream adoption gains momentum, more companies are either expanding their BTC holdings or allocating the asset to their corporate treasuries for the first time in 2025.

The first quarter of 2025 stood out, with several major industry players making their largest Bitcoin allocations. Tether, the world’s largest stablecoin issuer, gradually acquired 8,888 BTC since January, bringing its total BTC balance to over 100,000. In the previous quarter, the issuer had only added 1,035 to its reserve.

Metaplanet also increased its allocation efforts. The Japanese publicly traded company first started purchasing Bitcoin in May 2024. By December, Metaplanet had accumulated 1,762 BTC, which grew to 4,046 by March 2025.

While other high-profile companies did not break their previous allocation records, they significantly expanded their Bitcoin supply.

Expanding the Ranks: From MicroStrategy to GameStop

Strategy, formerly known as MicroStrategy, has maintained its consistency with its aggressive accumulation style. So far this year, the company has bought a whopping 53,396 BTC.

Meanwhile, Fold Holdings, a financial services company, publicly announced that it had bought 475 BTC in early March, bringing its total accumulation to 1,485.

Corporations outside Web3 are also now joining the trend of acquiring Bitcoin.

Two weeks ago, video game and electronics retailer GameStop announced an update to its investment policy, revealing the addition of Bitcoin as a treasury reserve asset. Although the company made no immediate commitment to purchase BTC, speculation is high that it will allocate a portion of its $4.8 billion cash balance to the cryptocurrency.

Factors Driving Corporate Bitcoin Adoption

Bitcoin has become increasingly appealing to investors looking for an asset to hedge against inflation. Given BTC’s self-limiting supply, it is not subject to the type of depreciation that can impact fiat currencies.

“Companies understand that monetary inflation is the core reason behind the decline of their balance sheet’s purchasing power parity,” Shannon told BeInCrypto.

According to him, this may have led Metaplanet to accumulate record amounts of Bitcoin during the first three months of 2025. Metaplanet has already announced plans to amass 10,000 BTC by the end of the year.

“For Japanese firms facing persistent yen depreciation, Bitcoin serves as a hard-asset hedge. Moreover, in markets with negative real yields, BTC offers superior long-term risk-adjusted returns. Although It has no yield it offers long-term upside and inflation resistance when the inflation rates (either prices paid or monetary inflation) are higher than the nominal interest rate,” he said.

Given heightened concerns over spikes in inflation in the United States, Bitcoin has also become more appealing among American investors. Changes in accounting for digital currencies have also made them a more attractive addition to investment portfolios.

The Appeal of New Accounting Standards

In addition to its perceived value as an inflation hedge, Bitcoin’s attractiveness as a corporate investment has been further amplified by recent modifications to accounting standards in the United States.

In January, the Financial Accounting Standards Board (FASB) issued a new rule that enabled companies with BTC in their treasuries to report the profits on unrealized gains from their digital assets. Instead of waiting until they have sold their assets, companies can now report that increase in value as income in their financial statements.

“Selling a depreciating fiat currency in return for a digital hard asset such as Bitcoin that is also liquid and a ‘cash equivalent’ that can benefit from the new FASB accounting treatment (which can also improve the income statement) makes Bitcoin an attractive treasury asset,” Shannon added.

Despite its potential for inflation stability, Bitcoin’s inherent volatility can also attract investors with a greater risk appetite and companies aiming to diversify their holdings.

Can Bitcoin’s Volatility Be a Strategic Advantage?

Beta measures a stock’s volatility relative to the overall market. The higher the beta, the more volatile the stock is.

According to Shannon, adding a volatile asset like Bitcoin to the balance sheet increases the beta of the equity. If the price of Bitcoin goes up, the overall investor portfolio can score big.

“This can enhance returns for investors and has proven to do so. The volatility of the equity also tends to increase which improves the interest rate on convertible debt, therefore, impacting the capital structure and cost of capital for the company. The volatility also gives way for option and derivative traders which can increase the volumes of the stock and make it a more liquid asset,” Shannon told BeInCrypto.

However, investors can face higher potential losses during a Bitcoin bear market. Because of this, BTC as a treasury asset may be more appealing to companies looking to diversify or firms large enough to weather the storm.

Bitcoin for Specific Business Cases

The volatility and heightened trading activity accompanying Bitcoin adoption might offer a strategic advantage to particular companies, notably those with performance issues or in highly competitive sectors.

“Underperforming or mature businesses in competitive markets would benefit from an asset that increases the volatilty and volumes, as well as the beta of the equity,” Shannon told BeInCrypto.

GameStop is a good example of the former. The retailer’s Q4 2024 earnings report showed a significant decline in its sales volume.

Despite the worrying financial report, GameStop’s stock value rose by 12% after signaling that it would add BTC as a treasury reserve asset. Limited crypto exposure is expected to strengthen the company’s financial position in 2025.

In turn, Tether’s perceived robustness could make it more capable of withstanding Bitcoin’s significant price volatility.

Leveraging Profits for Bitcoin: Tether’s Financial Strategy

As the issuer of the largest stablecoin, Tether generates substantial revenue from transaction fees and managing its vast reserves. This financial strength could provide a buffer to absorb potential losses from Bitcoin price drops.

Demonstrating this financial capacity, Tether allocates 15% of its quarterly net profits to Bitcoin.

“This is similar to Dollar Cost Averaging by allocating 15% of its net realized operating profits for Bitcoin. This is a relatively conservative approach because it is post-tax so the excess cash (retained earnings) that accrues to equity can be used for a higher growth asset. In this instance, there are not huge drawbacks because the company is well capitalised with $7 billion in net equity, so its prudent risk management. However, there are still black swans where cash would be better needed than Bitcoin,” Shannon explained.

Despite its inherent unpredictability, Bitcoin’s observed long-term decline in volatility over recent years has supported the rationale for including it –even in small amounts– within a well-diversified portfolio.

“Bitcoin has improved the risk-adjusted returns of the 60/40 portfolio since 2017. [It] still has volatility risk which companies may not be willing to absorb, however, the volatility has historically trended down and could continue this into the future,” Shannon added.

While acknowledging Bitcoin’s advantages, Shannon finds it increasingly challenging to foresee if corporate asset accumulation will maintain the same rapid pace in Q2 as it did at the beginning of the year.

Market Disruptions: Will Corporate Appetite Wane?

Though only in its second week, April has proven to be a hard month for financial markets. The cryptocurrency sector experienced the most pronounced impact.

Trump’s recent Liberation Day celebration sent stocks on a downward spiral as investors braced themselves for incoming uncertainty. During the two days that followed Trump’s tariff announcements, over $1 billion in long and short positions were wiped out by the weekend volatility.

Amid this new wave of anxiety, Shannon anticipates that companies will prioritize more pressing concerns over further Bitcoin accumulation.

“The longer-term trend points to further balance sheet accumulation, however, its hard to call quarter over quarter. Based on the current volality of the markets, and tariff implications on margins, I suspect operational issues will be front of mind rather than Bitcoin accumulation,” he said.

Even after this initial wave of uncertainty subsides, macroeconomic conditions will significantly determine future corporate Bitcoin acquisitions. Bitcoin will also need to remain competitive to incentivize these purchases.

“A higher Bitcoin price should lead to FOMO and outperformance of Bitcoin-backed companies. For this to occur, trade policy certainty is needed (or in fact a reversal via deals with trading partners) as well as a lower 10 year yield and either a consolidation or recovery of the equity markets,” Shannon added.

For now, external headwinds may outweigh Bitcoin accumulation strategies.

An Uncertain Future

Corporate Bitcoin accumulation has reached new heights during the first quarter of 2025, but recent political and economic developments may stump future advancements.

Until the future of US trade policy and international reactions becomes more certain, the cryptocurrency market will likely experience heightened volatility. These circumstances might lead traditional investors and companies to favor a conservative strategy, directing their resources toward other priorities.

Only the passage of time will determine the outcome.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Adoption Grows As Public Firms Raise Holdings In Q1

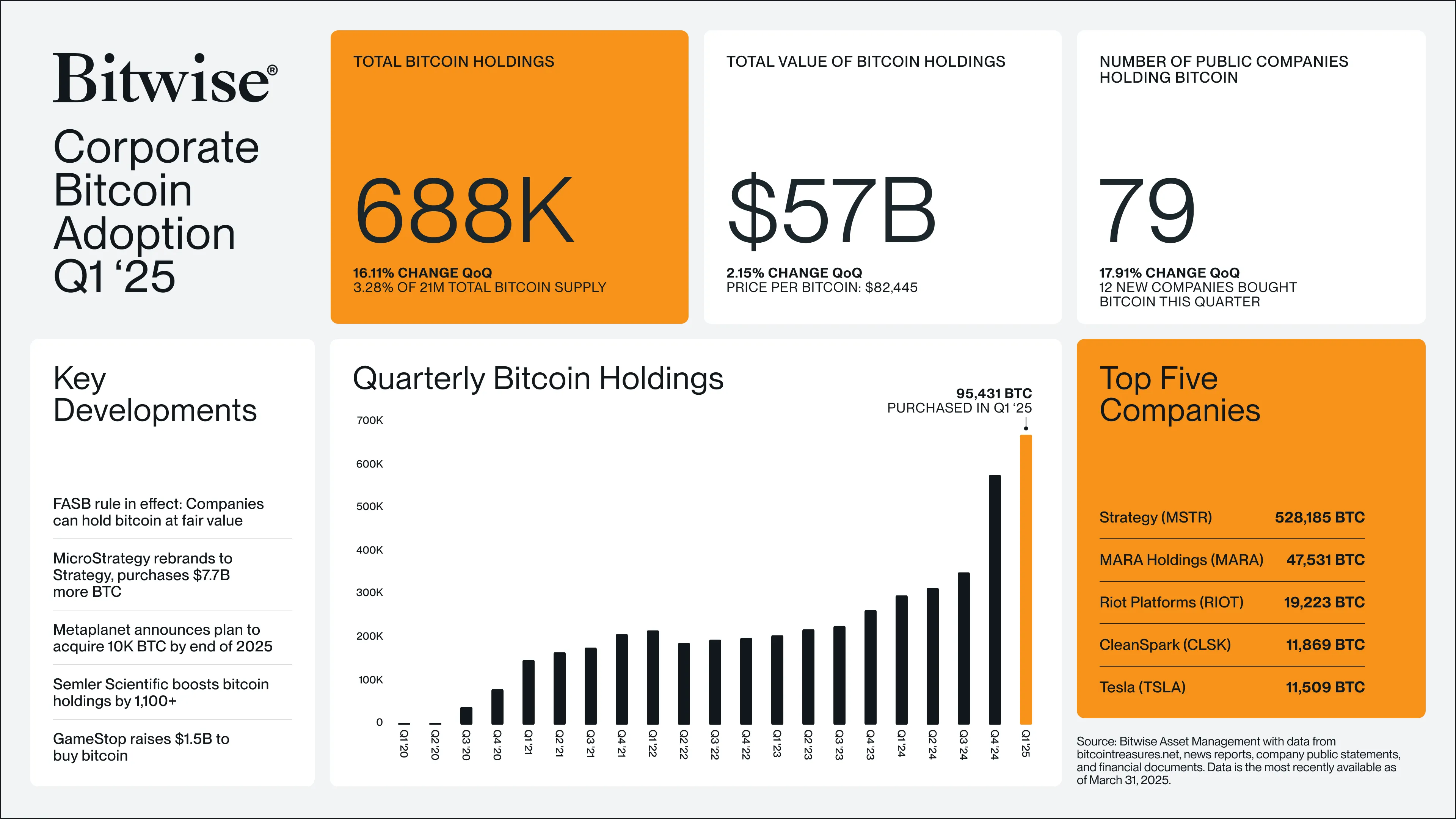

Public companies have added nearly 100,000 Bitcoin to their balance sheets during the first quarter of 2025, pushing total corporate Bitcoin holdings to a staggering 688,000 BTC worth $56.7 billion. According to data from crypto fund issuer Bitwise, this represents a 16% increase in total crypto holdings by publicly traded companies.

12 New Corporate Buyers Enter The Market

The Bitcoin buying spree wasn’t limited to existing crypto investors. Twelve public companies purchased Bitcoin for the first time during Q1, bringing the total number of Bitcoin-holding public firms to 79.

Hong Kong construction firm Ming Shing led new buyers, with its subsidiary Lead Benefit acquiring 833 BTC through two separate purchases – an initial 500 BTC buy in January followed by 333 BTC in February.

Video platform Rumble ranked as the second-largest new buyer, adding 188 BTC to its treasury in mid-March. In a move that stunned market watchers, Hong Kong investment firm HK Asia Holdings Limited purchased just one Bitcoin in February – a modest investment that still caused its share price to almost double in a single day of trading.

Companies are buying bitcoin, Q1 2025 edition. pic.twitter.com/qZc62N8vu5

— Bitwise (@BitwiseInvest) April 14, 2025

Japanese Firm Acquires At A Discount

While new entrants made headlines, existing Bitcoin holders also strengthened their positions. Japanese investment firm Metaplanet announced on April 14 that it had purchased an additional 319 BTC at an average price of 11.8 million yen (about $82,770) per coin.

This latest purchase brings Metaplanet’s total Bitcoin holdings to 4,525 BTC, currently valued at approximately $383.2 million. The company has spent nearly $406 million (58.145 billion yen) building its crypto stack.

Based on current holdings, Metaplanet now ranks as the 10th largest public company crypto holder worldwide, sitting behind Jack Dorsey’s Block, Inc., which holds 8,480 BTC.

BTC reclaiming the green zone in the last week. Source: Coingecko

Bitcoin Price Recovers After Brief Slump

Bitcoin trades at around $85,787 as of April 15, showing a decent performance over the past 24 hours according to CoinGecko data. The cryptocurrency has gained roughly 2.5% since the end of Q1 on March 31.

The price has bounced back from a brief drop below $75,000 on April 7. That temporary decline came after a broader market selloff triggered by a new round of global tariffs announced by US President Donald Trump.

The growing corporate interest in the top crypto comes as more companies look to diversify their treasury holdings. The combined value of public companies’ Bitcoin rose about 2.3% during the first quarter, reaching nearly $57 billion with BTC priced at $82,400 by quarter’s end.

Featured image from Crews Bank, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bolivia Reverses Crypto-for-Fuel Plan Amid Energy Crisis

Bolivia’s Ministry of Trade and Imports has rejected a state-backed plan to use cryptocurrency for fuel imports.

This move, which marks a stunning policy reversal, signals a retreat from the government’s recent push to adopt digital assets as a workaround for dollar shortages.

Bolivia Rejects Crypto-for-Fuel Scheme Amid Energy Sector Turmoil

The initial plan, announced in March by Bolivia’s state-owned energy giant YPFB, aimed to use crypto to secure fuel imports. This was in response to acute shortages of both US dollars and refined fuel.

As reported by Reuters on March 13, the proposal had received government backing at the time.

But in a statement released Tuesday, Director of Trade and Imports Marcos Duran clarified that YPFB will not be permitted to use crypto for international transactions.

“YPFB must use Bolivia’s own resources and dollar-based financial transfers,” Duran said.

Head of digital assets at VanEck, Mathew Sigel, labels this a clear U-turn on crypto policy.

“U-Turn: Bolivia appears to back away from its crypto-for-fuel scheme,” Sigel quipped.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Poised for Summer Rally as Gold Leads and Liquidity Peaks

The crypto market and broader economy are moving fast as global liquidity reached an all-time high in April 2025. Gold has already broken past $3,200, setting a new record. Meanwhile, Bitcoin is still 30% below its previous peak.

Amid this backdrop, analysts are taking a closer look at the link between Bitcoin and gold. Fresh data also shows strong corporate demand for Bitcoin, with record levels of buying in Q1 2025.

What Bitcoin’s Ties to Gold and Liquidity Signal for Its Price

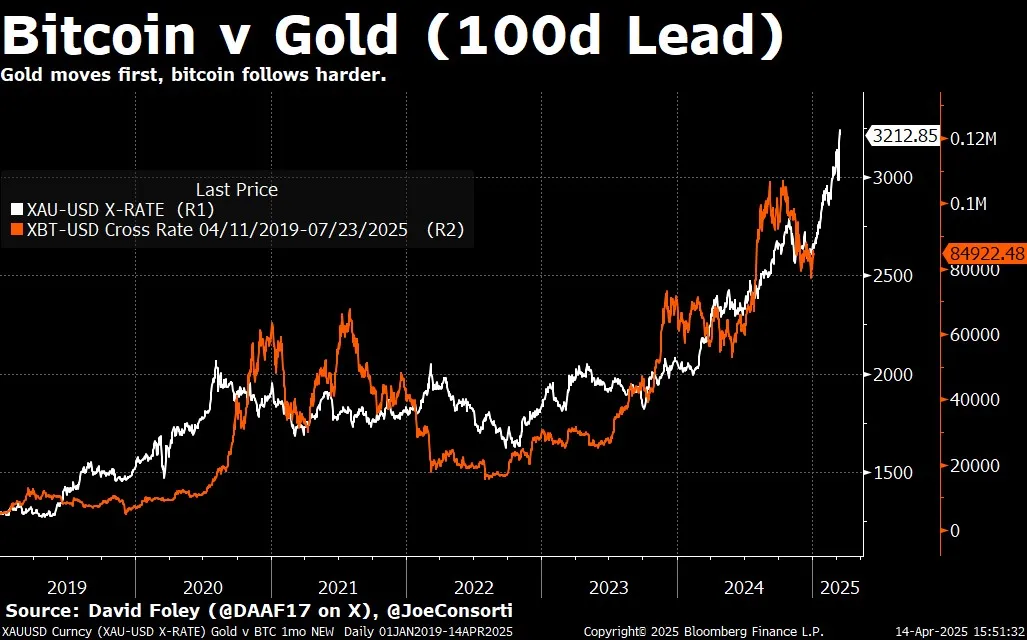

According to Joe Consorti, Head of Growth at Theya, Bitcoin tends to follow gold’s lead with a lag of about 100 to 150 days. A chart shared by Consorti on X, based on Bloomberg data, illustrates this trend from 2019 to April 14, 2025.

The chart shows gold (XAU/USD) in white and Bitcoin (XBT/USD) in orange. The data reveals that gold usually moves first during upswings, but Bitcoin often rallies harder afterward—especially when global liquidity is rising.

“When the printer roars to life, gold sniffs it out first, then Bitcoin follows harder,” Consorti said.

That 100-to-150-day lag is notable. It suggests Bitcoin could be set for a sharp move higher within the next 3 to 4 months. The recent surge in global liquidity also supports this view.

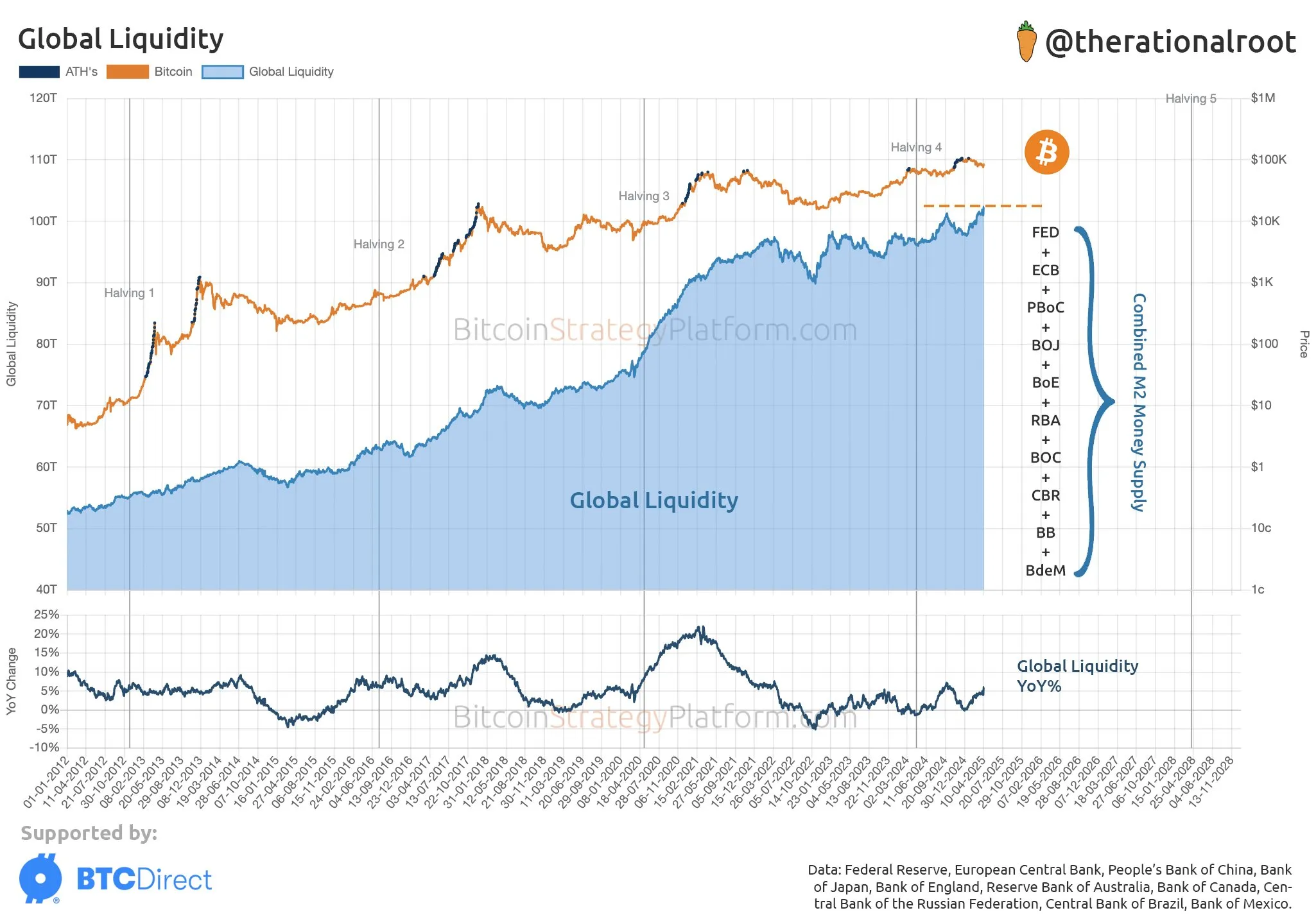

According to analyst Root, M2 money supply from major central banks—including the US Federal Reserve, European Central Bank (ECB), People’s Bank of China (PBoC), Bank of Japan (BoJ), Bank of England (BoE), Reserve Bank of Australia (RBA), Bank of Canada (BoC), and others—has hit a record high as of April 2025.

The sharp rise points to more cash flowing through the global economy.

Historically, Bitcoin bull markets have often lined up with major increases in global liquidity, as more money in the system tends to push investors toward riskier assets like Bitcoin.

Why Bitcoin Might Outperform Gold and Stocks

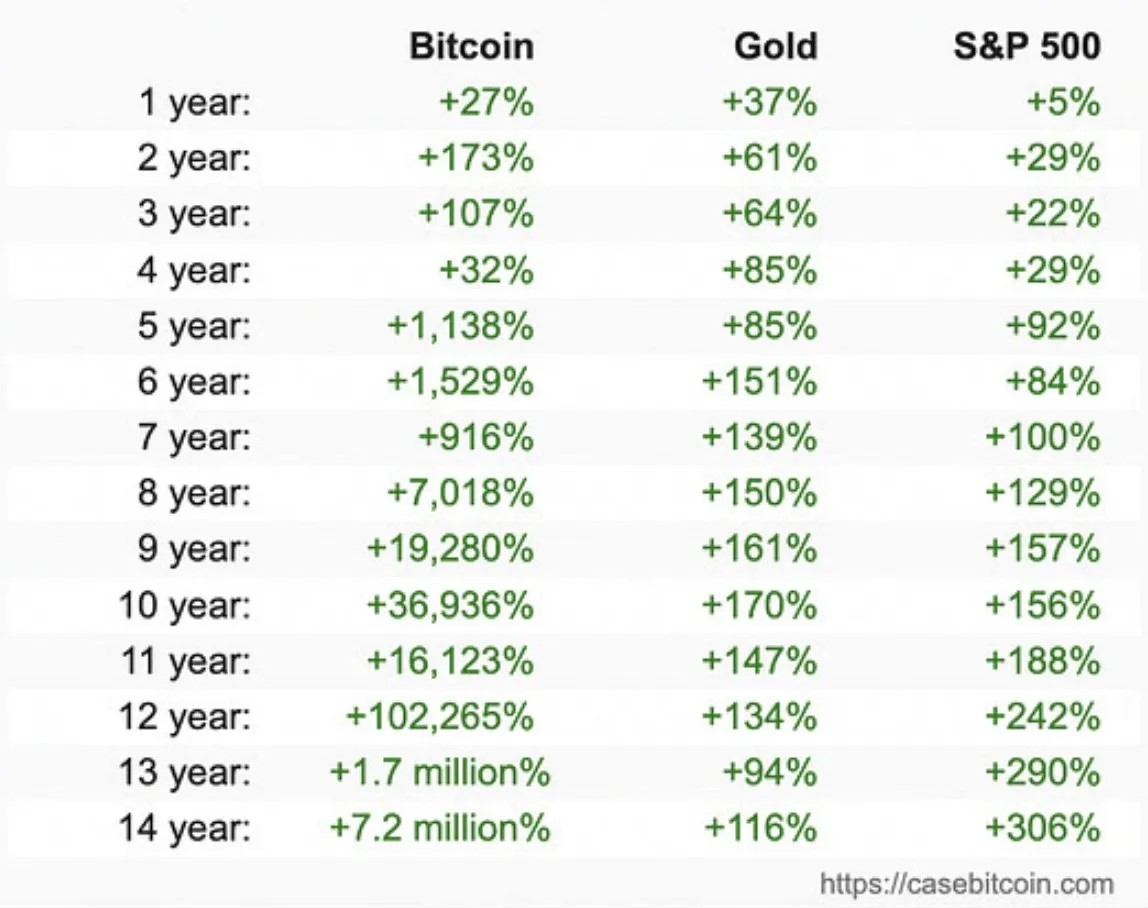

Matt Hougan, Chief Investment Officer at Bitwise Invest, states that Bitcoin is not just outperforming gold but is also surpassing the S&P 500 in the long run. This indicates that Bitcoin is becoming a stronger investment option despite its price volatility.

Data also supports this. A recent Bitwise report shows corporations bought over 95,400 BTC in Q1—about 0.5% of all Bitcoin in circulation. That makes it the largest quarter for corporate accumulation on record.

“People want to own Bitcoin. Corporations do too. 95,000 BTC purchased in Q1,” Bitwise CEO Hunter Horsley said.

With rising corporate demand and Bitcoin’s strong performance against traditional assets, the stage may be set for a major rally in summer 2025—driven by peak global liquidity and Bitcoin’s historic tendency to follow gold’s lead.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoIs The XRP Price Mirroring Bitcoin’s Macro Action? Analyst Maps Out How It Could Get To $71

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Urges Pi Network To Learn From The OM Crash Ahead Of Open Mainnet Transition

-

Market24 hours ago

Market24 hours agoOndo Finance (ONDO) Rises 3.5% Following MANTRA Crash

-

Market20 hours ago

Market20 hours agoBitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

-

Market13 hours ago

Market13 hours agoCan Pi Network Avoid a Similar Fate?

-

Market16 hours ago

Market16 hours agoXRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

-

Market15 hours ago

Market15 hours agoCardano Buyers Eye $0.70 as ADA Rallies 10%

-

Market22 hours ago

Market22 hours agoMANTRA (OM) Charts Look Worse than LUNA – No Buying Activity