Bitcoin

Why Bitcoin’s Value Could Benefit from Trade War, Analyst Explains

Escalating trade war tensions have triggered widespread market volatility, prompting growing concerns among investors. Yet, one analyst suggests that these very uncertainties could act as a catalyst for Bitcoin’s (BTC) value growth.

The outlook emerges as Bitcoin struggles to gain momentum, with both traditional and cryptocurrency markets showing signs of widespread losses.

Could a Trade War Be Bitcoin’s Big Break? Five Key Factors Driving Value Growth

In a detailed analysis posted on the social media platform X (formerly Twitter), Ben Sigman, analyst, and CEO of Bitcoin Libre, outlined five distinct factors through which a tariff-driven conflict could trigger a rise in Bitcoin’s value.

His first point revolved around the US dollar’s potential trajectory. According to him, a trade war would strengthen the dollar. Yet, a subsequent collapse would reverse this.

“Tariffs spike the dollar. EMs crack under $12 Trillion in USD debt. Trust in fiat slips. Capital scrambles for fixed-supply safety,” he said.

Sigman suggested that in this case, capital may seek refuge in assets with a fixed supply, such as Bitcoin, positioning it as a safeguard against financial instability.

Next, he pointed to Bitcoin’s potential as a hedge against inflation. Tariffs often disrupt global supply chains, increasing the cost of goods and stifling economic growth. In response, central banks, including the Federal Reserve, may reduce interest rates, thereby devaluing national currencies.

Sigman argued that Bitcoin’s inherent scarcity and global accessibility render it a compelling hedge in such a scenario.

Third, Sigman highlighted the accelerating trend of de-dollarization. He explained that nations such as China, which now conducts 56% of its trade invoicing in yuan, are increasingly seeking alternatives to the US dollar.

According to him, the BRICS (Brazil, Russia, India, China, and South Africa) coalition will also develop alternative financial systems. However, this shift is not without risks, as it could lead to capital flight.

“Bitcoin thrives in a fragmented world as the neutral, global option,” he claimed.

Fourth, Sigman predicted market panic. He estimates that a single tariff cycle could erase $5 trillion in market value, flatten bond yields, and render traditional safe-haven assets, such as gold, less attractive.

In such an environment, Bitcoin’s volatility may attract investors seeking high-risk, high-reward opportunities, potentially driving substantial capital inflows.

Finally, Sigman contended that a trade war could expose systemic vulnerabilities in global institutions. Tariffs may precipitate debt defaults and erode trust in fiat-based systems, prompting investors to turn to Bitcoin.

“Bitcoin was built for this – permissionless, borderless, bankless,” he concluded.

Nevertheless, not all analysts share Sigman’s optimism. Another prominent commentator, Fred Krueger, recently outlined nine predictions regarding the potential imposition of tariffs exceeding 100% on China within the next year. He forecasted that this measure could lead to significant declines in Bitcoin and other cryptocurrencies like Solana (SOL).

“All goes down together. at some point this ends. When? Trump is unfortunately insane and badly advised,” Krueger wrote.

When asked whether Bitcoin will go to zero, he quipped, stating,

“I will take it all at $1.”

As trade tensions between the US and China intensify—driven by further tariffs on Chinese goods and broader geopolitical frictions—the role of Bitcoin in the global financial sector remains intensely scrutinized. How the largest cryptocurrency performs in the long term remains to be seen.

For now, the market appears quite bearish. BeInCrypto data showed that over the past day, BTC dipped 3.1%. At the time of writing, it was trading at $76,914.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Set For Challenge With Two Major Resistance Zones

The Bitcoin (BTC) market proved rather turbulent in the past week after a price decline below $75,000 was followed by a rebound to above $83,000. With the premier cryptocurrency showing indications of a sustained uptrend, blockchain analytics firm CryptoQuant has identified two potential key resistance zones lying in wait.

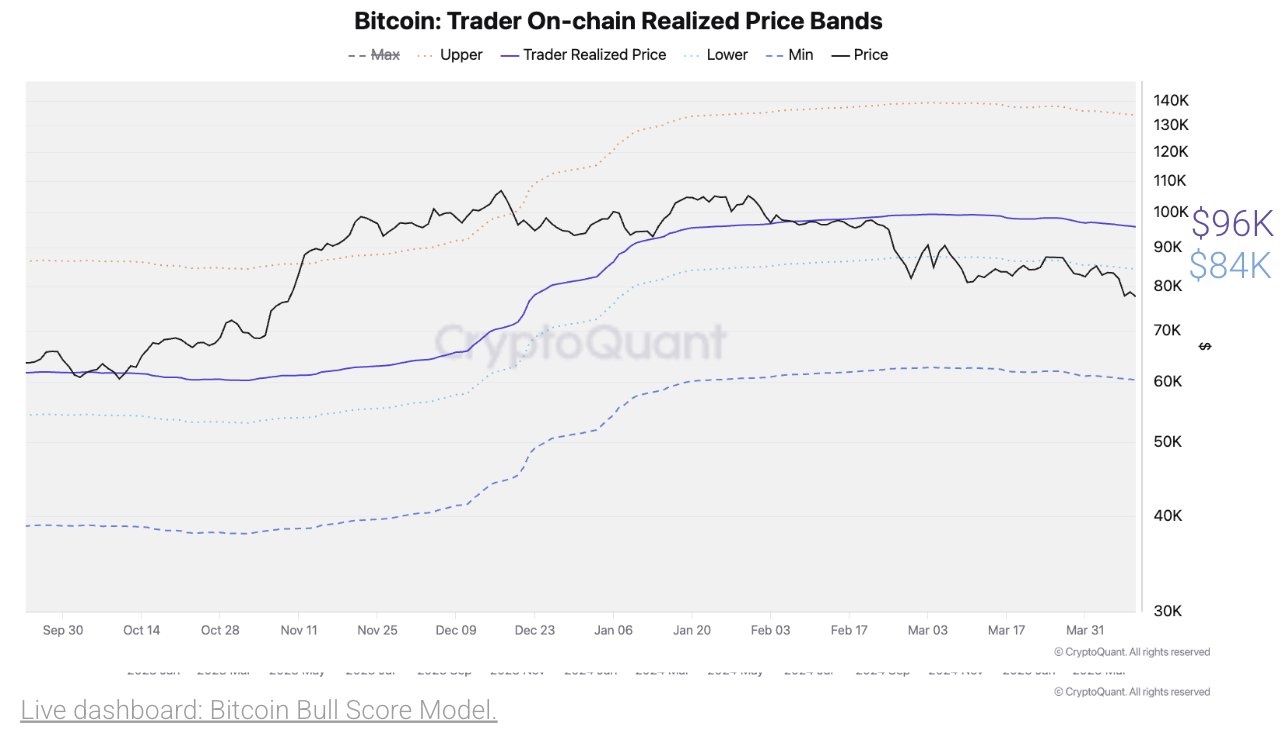

Bitcoin Realized Price Reveals Potential Strong Barriers At $84,000 And $96,000

In an X post on April 11, CryptoQuant shared an on-chain report on the BTC market indicating a potential encounter with two major resistances at $84,000 and $96,000 if Bitcoin maintains its current upward trajectory. These price barriers are revealed by the Realized Price metric which reflects the average price at which the current supply of BTC last moved on-chain thereby determining the market-wide cost basis.

When Bitcoin trades above this level, it indicates a healthy bullish momentum with the majority of holders in profit. Conversely, when BTC is below the threshold, it suggests underwater sentiment as most investors are holding a loss. Therefore, the Realized price often functions as a crucial market pivot acting as strong support during bull markets and stiff resistance in bear phases. According to Julio Moreno, Head of Research at CryptoQuant, BTC’s current on-chain realized price is $96,000 with an immediate lower price band of $84,000.

Interestingly, these two price levels have served as key support zones in the earlier bullish phase of the current market cycle. However, there is potential for both zones to act as resistance amidst the ongoing market correction. However, if Bitcoin is able to move past $84,000 and $96,000, it could signify the resumption of the bull market with the potential for the premier cryptocurrency to trade as high as $130,000. This projected gain would represent a 55% increase in current market prices.

BTC Price Overview

At press time, Bitcoin continues to trade at $83,180 reflecting a 3.65% gain in the past day. Meanwhile, daily trading volume is down by 11.99% and valued at $39.19 billion.

Amidst continuous macroeconomic developments driven by the US Government tariff changes, the crypto market continues to exhibit a strong level of uncertainty and assets fail to establish a clear momentum. However, blockchain analytics Glassnode reports that Bitcoin investors have formed a strong support zone at $79,000 and $82,080 at which over 40,000 BTC and 51,000 BTC have been accumulated respectively.

In the advent of any downtrend, both price levels are to offer short-term support and prevent a further price fall. With a market cap of $1.66 trillion, Bitcoin remains the largest digital asset accounting for over 60% of the crypto market cap.

Featured image from CNN, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin Price Volatility Far Lower Than During COVID-19 Crash — What This Means

Over the past few weeks, the cryptocurrency market has been overwhelmed by a high degree of uncertainty and volatility triggered by the constantly shifting global macroeconomics. This unsettled market condition saw the Bitcoin price dance between $74,000 and $83,000 in the space of a few days.

The price of BTC sank toward $74,000 at the start of the past week as crypto investors panicked after United States President Donald Trump announced new trade tariffs. On Thursday, April 10, the premier cryptocurrency reclaimed the $83,000 level after President Trump paused trade tariffs on all countries except China.

Is Bitcoin Now A ‘Mature Asset’?

The Bitcoin price has been quite reactive to virtually every piece of news in the global trade, demonstrating the highly volatile state of the cryptocurrency market. However, an on-chain analytics expert has explained that the volatility of the current Bitcoin market pales in comparison to past episodes.

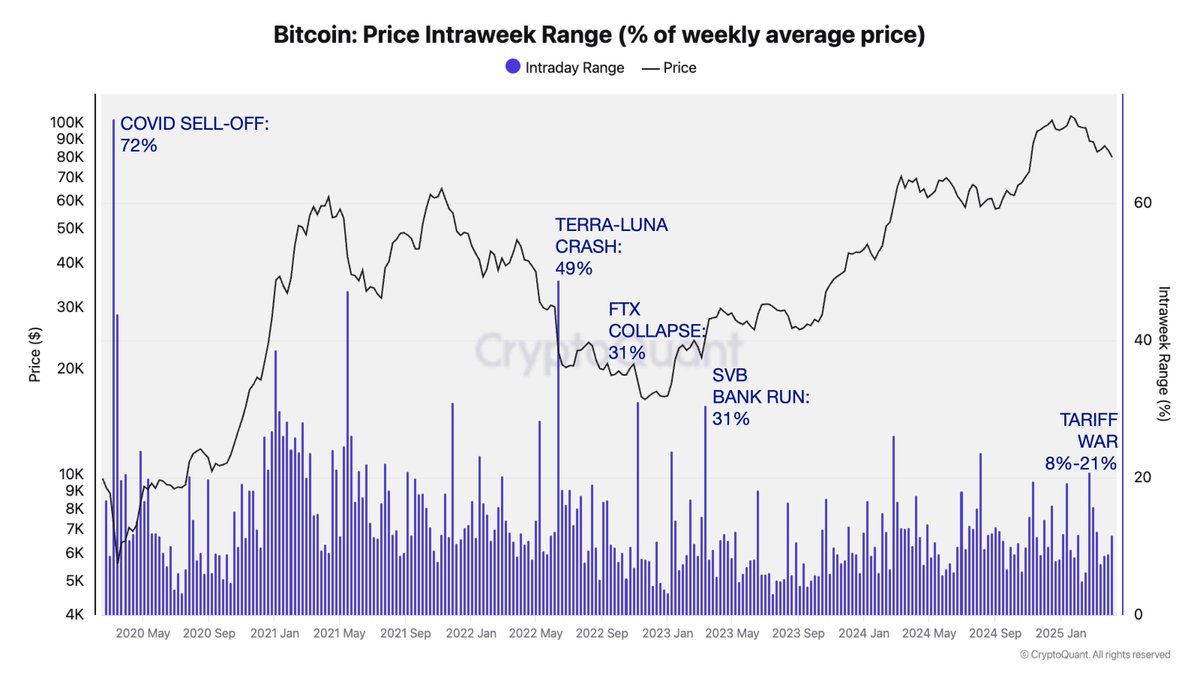

In a new post on the social media platform X, CryptoQuant’s head of research, Julio Moreno, revealed that the Bitcoin price volatility in the ongoing global trade drama has been “so far lower” than that from other past events, such as the COVID-19 crash, Terra-Luna collapse, FTX downfall, and the Silicon Valley Bank (SVB) bank run.

The relevant indicator here is the Price Intraweek Range metric, which estimates the percentage change in the average weekly price of Bitcoin. According to data from CryptoQuant, the Bitcoin Price Intraweek Range climbed to an all-time high of 72% during the COVID-19 market downturn in April 2020.

Source: @jjcmoreno on X

The chart above shows that the BTC Intraweek Range metric surged to 49% after the crash of the Terra Luna ecosystem in May 2022. Meanwhile, the indicator reached 31% following the collapse of the Sam-Bankman-Fried-led FTX exchange in late 2022 and the SVB bank run in early 2023.

With the escalating trade tensions between the United States and China, the Bitcoin Price Intraweek Range metric stands between 8% – 21%. This reduced volatility suggests that the premier cryptocurrency has matured as an asset, with deeper liquidity and a better market structure.

The relatively stable price action can be connected to the growing base of long-term holders and steady corporate adoption, as institutional players are beginning to view the world’s largest cryptocurrency less as a high-risk asset and more as a hedge against macroeconomic uncertainties.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $83,700, reflecting a 5% increase in the past 24 hours.

The price of BTC returns to above $83,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin’s Impact Alarming, Says NY Atty. General—Congress Needs To Act

New York Attorney General Letitia James issued a warning to US congressional leaders regarding regulation of cryptocurrency, particularly how Bitcoin and other virtual currencies could erode the US dollar’s position around the world. She urged stronger federal regulations to protect investors from fraud and criminal use in the cryptocurrency market.

NY’s Top Lawyer Demands Stricter Crypto Restrictions

James emphasized the importance of a federal regulatory system for digital currencies in her Congressional letter. She identified that lacking regulation, these type of currencies expose users to fraud and monetary volatility.

Bitcoin currently presents an actual threat to the dominance of the dollar, particularly since more businesses and individuals opt for digital currencies when sending money overseas, James indicated.

Her concerns echo those of BlackRock CEO Larry Fink, who suggested that Bitcoin could serve as a hedge against the dollar amid US fiscal challenges and rising inflation.

“Millions of New Yorkers actively buy, sell or hold cryptocurrency and other digital assets, and they deserve further protection,” James wrote in her message.

NEW: This morning @NewYorkStateAG Letitia James sent a letter to congressional leaders @LeaderJohnThune, @SenSchumer, @SpeakerJohnson and @RepJeffries urging them to pass a federal regulatory framework for digital assets to mitigate fraud, criminal activity, and financial… pic.twitter.com/yJjDgBqdBt

— Eleanor Terrett (@EleanorTerrett) April 10, 2025

Stablecoin Safeguards And Investor Protection Measures

The Attorney General placed particular emphasis on stablecoins, which are cryptocurrencies pegged to stable assets such as the US dollar. She called on lawmakers to establish regulations mandating that stablecoin issuers have a US presence and support their tokens with US dollars or treasuries.

James described how stablecoins facilitate the exchange of value among various cryptocurrencies but, in the absence of regulation, can be manipulated and create fraud.

She also demanded greater protections from crypto scams that have resulted in tremendous financial losses. “Thousands of New Yorkers and investors nationwide have lost millions of dollars to cryptocurrency scams and fraud that can be avoided with more robust federal regulations,” James said.

Keep Crypto Out Of Retirement Funds

James actually cautioned against having digital assets in retirement accounts like IRAs. She contended that cryptocurrencies are too volatile and risky for retirement savings plans, citing the extreme price fluctuations of Bitcoin as proof of instability capable of injuring the financial well-being of individuals, especially retirees relying on savings. This is because financial institutions like Fidelity began offering crypto IRA options to clients.

In addition to investor protection, James also contended that thorough crypto regulations would enhance national security. She explained that cryptocurrency purchases are usually anonymous and used for criminal activities, thus necessitating the government to implement stringent rules mandating crypto firms to register with regulators and adhere to anti-money laundering protocols.

Featured image from Dado Ruvic/REUTERS, chart from TradingView

-

Altcoin21 hours ago

Altcoin21 hours agoSolana Meme Coin Fartcoin Price Could Hit $1.29 If It Holds This Key Level

-

Market23 hours ago

Market23 hours agoArthur Hayes Expects Bitcoin Surge if Fed Injects Liquidity

-

Altcoin22 hours ago

Altcoin22 hours agoBinance Issues Important Update On 10 Crypto, Here’s All

-

Market20 hours ago

Market20 hours agoCrypto Whales Position for Gains with DOGE, WLD and ONDO

-

Market19 hours ago

Market19 hours agoSEC Signals Readiness to Rethink Crypto Trading Oversight

-

Market18 hours ago

Market18 hours agoEthereum ETFs See Seventh Consecutive Week of Net Outflows

-

Market22 hours ago

Market22 hours agoDogecoin and D.O.G.E – Elon Musk’s Billionaire Crypto Experiment

-

Market21 hours ago

Market21 hours agoBinance Reportedly Seeks Reentry Into American Market