Bitcoin

Why Are the Purchases Shrinking?

Michael Saylor’s Strategy (formerly MicroStrategy) added 130 Bitcoin (BTC) to its holdings between March 10 and March 16, spending approximately $10.7 million.

The average BTC price for this purchase was $82,981. This marks the company’s smallest Bitcoin purchase since August 2024.

Why are MicroStrategy’s Bitcoin Purchases Becoming Smaller?

As of March 16, MicroStrategy holds 499,226 BTC, worth around $33.1 billion. The company’s overall average cost per Bitcoin stands at approximately $66,000.

This latest acquisition comes just weeks after MicroStrategy made its largest Bitcoin purchase of 2025. In February, the company spent $2 billion on BTC at prices above $97,000.

Now, with Bitcoin trading lower, this smaller buy raises questions about the firm’s strategy.

“On-chain clues: Is Bitcoin gearing up for a major reversal? Active addresses peak, signaling potential bullish momentum ahead,” Saylor posted on X (formerly Twitter) today.

One possible reason for the limited purchase is that MicroStrategy may be waiting for more capital from its stock offerings.

Last month, the company raised $2 billion through a private offering of convertible senior notes. Most of those funds likely went toward its previous acquisition. If additional funding is needed, the company may be pacing its purchases.

MicroStrategy finances Bitcoin acquisitions through stock sales and zero-interest convertible notes without selling off other assets.

While this approach has worked so far, the firm’s ability to raise capital depends on maintaining strong financial stability. A sharp rise in liabilities relative to assets could make future financing more difficult.

However, there’s a more concerning reason why MicroStrategy could have made such a small Bitcoin purchase today.

Bitcoin is currently trading just below $83,000, and some analysts suggest the price has not yet bottomed. Arthur Hayes and other experts predict BTC could drop to around $70,000 before the next upward move.

BeinCrypto analysts believe the market is experiencing a temporary correction rather than the end of the bullish phase.

If MicroStrategy shares this view, it may be waiting for a further dip before making a larger investment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Is Bitcoin the Solution to Managing US Debt? VanEck Explains

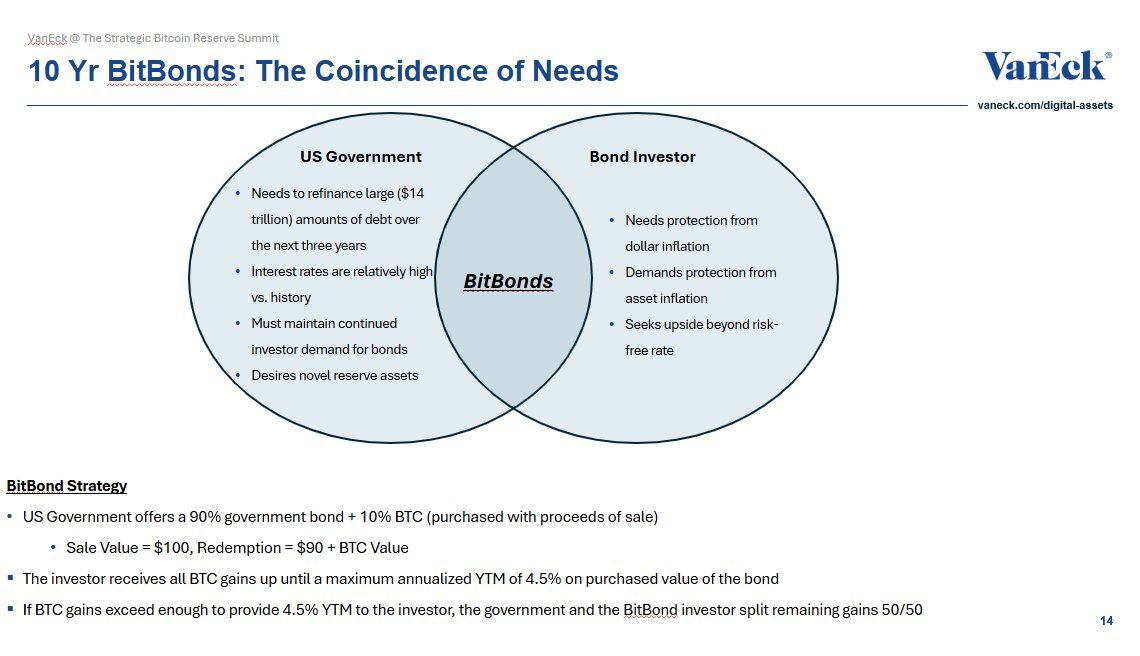

Matthew Sigel, Head of Digital Assets Research at VanEck, has proposed a new financial instrument, “BitBonds,” to help manage the US government’s looming $14 trillion refinancing debt requirement.

The 10-year financial instrument combines traditional US Treasury bonds with Bitcoin (BTC) exposure. This offers a potential solution to the nation’s fiscal concerns.

Can Bitcoin-Backed Bonds Help Solve the US Debt Crisis?

According to Sigel’s proposal, BitBonds’ investment structure allocates 90% of the funds to low-risk US Treasury securities and 10% to Bitcoin, combining stability with the potential for higher returns. Additionally, the government would purchase Bitcoin with proceeds from the bond sale.

Investors would receive all Bitcoin gains up to a maximum annualized yield-to-maturity of 4.5%. Furthermore, the investor and the government would split any additional gains equally.

“An aligned solution for mismatched incentives,” Sigel remarked.

From an investor perspective, Sigel highlighted that the bond offers a breakeven Bitcoin compound annual growth rate (CAGR) between 8% and 17%, depending on the coupon rate. Additionally, investors’ returns could skyrocket if Bitcoin grows at a 30%–50% CAGR.

“A convex bet—if you believe in Bitcoin,” he added.

However, the structure is not without risks: investors bear Bitcoin’s downside while only partially participating in its upside. Lower-coupon bonds may lose appeal if Bitcoin underperforms.

Meanwhile, the Treasury’s downside is limited. Even a complete collapse of Bitcoin’s value would still result in cost savings compared to traditional bond issuance. Yet, this is contingent on the coupon remaining below the breakeven threshold.

“BTC upside just sweetens the deal. Worst case: cheap funding. Best case: long-vol exposure to the hardest asset on Earth,” Sigel stated.

Sigel claimed that this hybrid approach aligns the interests of the government and investors over a 10-year period. The government faces high interest rates and significant debt refinancing needs. Meanwhile, investors seek protection from inflation and asset debasement.

The proposal comes amid growing concerns over the US debt crisis, exacerbated by the recent increase in the debt ceiling to $36.2 trillion, as reported by BeInCrypto. Notably, the Bitcoin Policy Institute (BPI) has also endorsed the concept.

“Building on President Donald J. Trump’s March 6, 2025, Executive Order establishing the Strategic Bitcoin Reserve, this white paper proposes that the United States adopt Bitcoin-Enhanced US Treasury Bonds (“₿ Bonds” or “BitBonds”) as an innovative fiscal tool to address multiple critical objectives,” the brief read.

In the paper, co-authors Andrew Hohns and Matthew Pines suggested that issuing $2 trillion in BitBonds at a 1% interest rate could cover 20% of the Treasury’s 2025 refinancing needs.

“Over a ten-year period, this represents nominal savings of $700 billion and a present value of $554.4 billion,” the authors wrote.

BPI estimates that if Bitcoin achieves a CAGR of 36.6%, the upside could potentially defease up to $50.8 trillion of federal debt by 2045.

These recommendations are part of broader conversations regarding Bitcoin’s potential impact on national finance. Previously, Senator Cynthia Lummis argued that a US Strategic Bitcoin Reserve could halve the national debt. In fact, VanEck’s analysis indicated that such a reserve could help reduce $21 trillion of debt by 2049.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

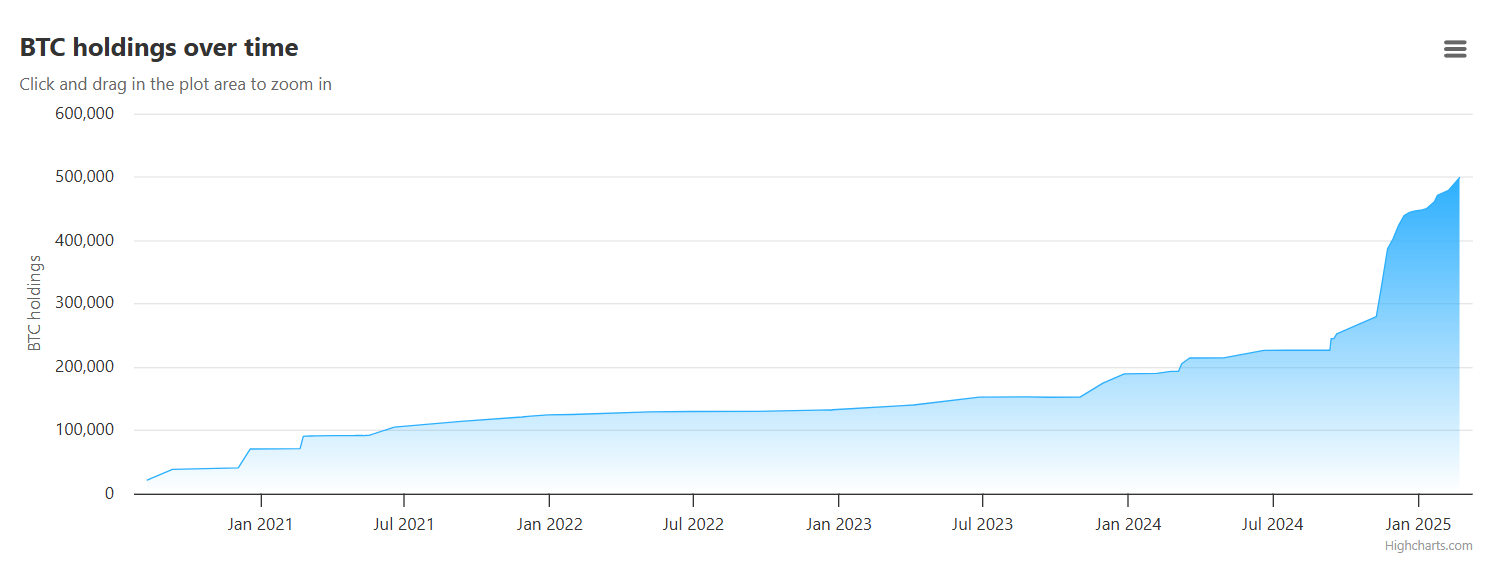

Bitcoin Adoption Grows As Public Firms Raise Holdings In Q1

Public companies have added nearly 100,000 Bitcoin to their balance sheets during the first quarter of 2025, pushing total corporate Bitcoin holdings to a staggering 688,000 BTC worth $56.7 billion. According to data from crypto fund issuer Bitwise, this represents a 16% increase in total crypto holdings by publicly traded companies.

12 New Corporate Buyers Enter The Market

The Bitcoin buying spree wasn’t limited to existing crypto investors. Twelve public companies purchased Bitcoin for the first time during Q1, bringing the total number of Bitcoin-holding public firms to 79.

Hong Kong construction firm Ming Shing led new buyers, with its subsidiary Lead Benefit acquiring 833 BTC through two separate purchases – an initial 500 BTC buy in January followed by 333 BTC in February.

Video platform Rumble ranked as the second-largest new buyer, adding 188 BTC to its treasury in mid-March. In a move that stunned market watchers, Hong Kong investment firm HK Asia Holdings Limited purchased just one Bitcoin in February – a modest investment that still caused its share price to almost double in a single day of trading.

Companies are buying bitcoin, Q1 2025 edition. pic.twitter.com/qZc62N8vu5

— Bitwise (@BitwiseInvest) April 14, 2025

Japanese Firm Acquires At A Discount

While new entrants made headlines, existing Bitcoin holders also strengthened their positions. Japanese investment firm Metaplanet announced on April 14 that it had purchased an additional 319 BTC at an average price of 11.8 million yen (about $82,770) per coin.

This latest purchase brings Metaplanet’s total Bitcoin holdings to 4,525 BTC, currently valued at approximately $383.2 million. The company has spent nearly $406 million (58.145 billion yen) building its crypto stack.

Based on current holdings, Metaplanet now ranks as the 10th largest public company crypto holder worldwide, sitting behind Jack Dorsey’s Block, Inc., which holds 8,480 BTC.

BTC reclaiming the green zone in the last week. Source: Coingecko

Bitcoin Price Recovers After Brief Slump

Bitcoin trades at around $85,787 as of April 15, showing a decent performance over the past 24 hours according to CoinGecko data. The cryptocurrency has gained roughly 2.5% since the end of Q1 on March 31.

The price has bounced back from a brief drop below $75,000 on April 7. That temporary decline came after a broader market selloff triggered by a new round of global tariffs announced by US President Donald Trump.

The growing corporate interest in the top crypto comes as more companies look to diversify their treasury holdings. The combined value of public companies’ Bitcoin rose about 2.3% during the first quarter, reaching nearly $57 billion with BTC priced at $82,400 by quarter’s end.

Featured image from Crews Bank, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bolivia Reverses Crypto-for-Fuel Plan Amid Energy Crisis

Bolivia’s Ministry of Trade and Imports has rejected a state-backed plan to use cryptocurrency for fuel imports.

This move, which marks a stunning policy reversal, signals a retreat from the government’s recent push to adopt digital assets as a workaround for dollar shortages.

Bolivia Rejects Crypto-for-Fuel Scheme Amid Energy Sector Turmoil

The initial plan, announced in March by Bolivia’s state-owned energy giant YPFB, aimed to use crypto to secure fuel imports. This was in response to acute shortages of both US dollars and refined fuel.

As reported by Reuters on March 13, the proposal had received government backing at the time.

But in a statement released Tuesday, Director of Trade and Imports Marcos Duran clarified that YPFB will not be permitted to use crypto for international transactions.

“YPFB must use Bolivia’s own resources and dollar-based financial transfers,” Duran said.

Head of digital assets at VanEck, Mathew Sigel, labels this a clear U-turn on crypto policy.

“U-Turn: Bolivia appears to back away from its crypto-for-fuel scheme,” Sigel quipped.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoCan Pi Network Avoid a Similar Fate?

-

Altcoin17 hours ago

Altcoin17 hours agoWhispers Of Insider Selling As Mantra DAO Relocates Nearly $27 Million In OM To Binance

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Poised for Summer Rally as Gold Leads and Liquidity Peaks

-

Market16 hours ago

Market16 hours agoTrump Family Plans Crypto Game Inspired by Monopoly

-

Altcoin22 hours ago

Altcoin22 hours agoBinance Delists This Crypto Causing 40% Price Crash, Here’s All

-

Market21 hours ago

Market21 hours agoEthereum Price Consolidation Hints at Strength—Is a Move Higher Coming?

-

Market18 hours ago

Market18 hours agoXRP Early Investors Continue To Sell As Price Holds Above $2

-

Market17 hours ago

Market17 hours agoForget XRP At $3, Analyst Reveals How High Price Will Be In A Few Months