Bitcoin

What is Matt Hougan’s Bitcoin Price Prediction For 2025?

Matt Hougan, Bitwise’s Chief Investment Officer, has forecast a significant price surge for Bitcoin and Ethereum in 2025.

During a YouTube interview, he outlined the reasons behind this bold prediction.

3 Reasons Why Bitcoin Could Reach $200,000 by 2025

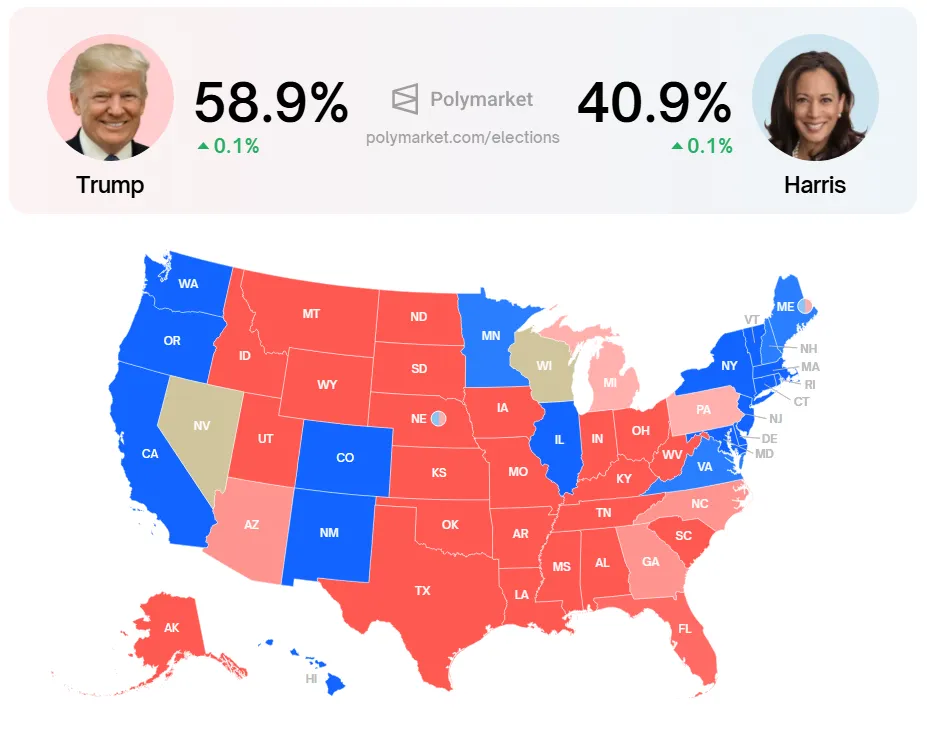

Hougan shared three key factors for his bullish outlook. These stem from the US elections, large amounts of sidelined capital, and the long-term impact of Bitcoin ETFs. On the political front, Hougan argued that either a pro-crypto President, Donald Trump, or a neutral President, Kamala Harris, could have a positive—or at least non-negative—impact on Bitcoin.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

At the time of writing, Trump’s chances of becoming president reached 58.9%. Bitcoin prices have also surpassed $67,000, as investors believe that Trump will introduce policies that could drive significant market growth.

Moreover, Hougan revealed that many major investors have yet to enter the market. They are waiting for more political and regulatory clarity. However, if Bitcoin continues its upward trajectory, these investors may feel compelled to jump in sooner rather than later.

“The election represent uncertainty, and so investors are sitting on the sidelines, waiting. They realized that crypto is not going away. They realized that it’s moving into the institutional sort of part of the world, but they thought they could wait and delay. I think if this rally continues, if [Bitcoin] trips up towards $70,000, then, it becomes a self-fulfilling prophecy. People would realize they have to get on the train.” Hougan said.

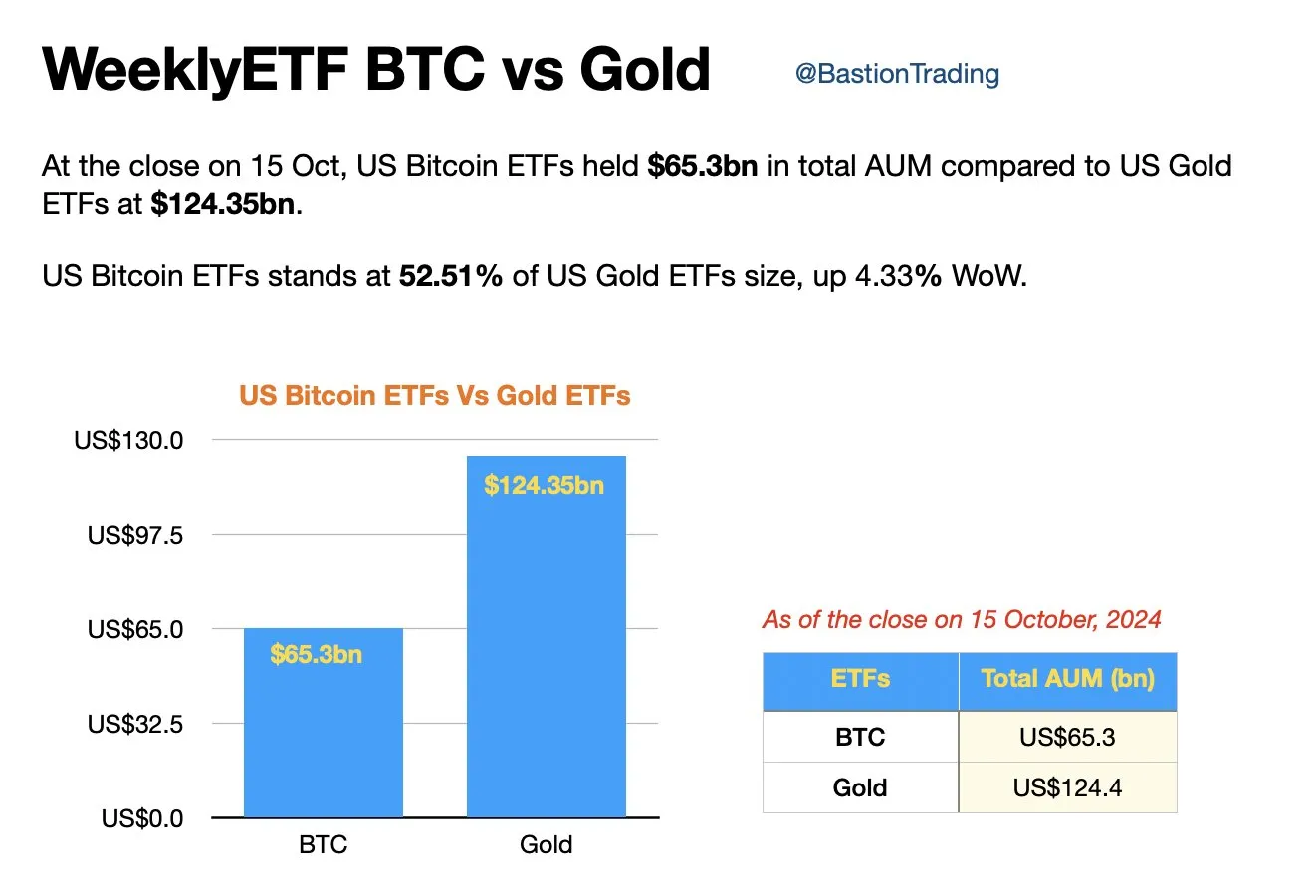

Additionally, Hougan also emphasized the long-term potential of Bitcoin ETFs. As a former CEO of ETF.com, he believes the $20 billion inflow in the first year of Bitcoin ETFs represents a major success. Similar to gold ETFs, Bitcoin ETFs are still in their early stages.

The latest data shows that, despite being in existence for less than a year, Bitcoin ETFs’ Assets Under Management (AUM) are already over 52% of that of Gold ETFs.

“Before I came to Bitwise six and a half years ago, I was the CEO of etf.com, so this is my neck of the woods. The thing that crypto should realize about ETFs is that they are multi-year stories. If you look back at the Gold ETF, which launched the most successful ETF launch of all time…I think the same thing is going to happen for Bitcoin ETFs. We’re still really at the earliest stage.” Hougan said.

When asked about his Bitcoin price forecast, Hougan predicted that BTC would reach a new all-time high by the end of the year. Moreover, he affirmed that Bitcoin could hit $200,000 in 2025.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Hougan is also optimistic about Ethereum. He says that while it is currently undervalued due to the rise of competing blockchains, it remains the top platform for DeFi applications, stablecoins, and tokenization. With regulatory and technological advancements, Ethereum could also set a new record high by 2025.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

5 Facts About Bitcoin’s Creator

April 5, 2025, marks what would be the 50th birthday of Satoshi Nakamoto—the pseudonymous creator of Bitcoin. This alleged birthday is based on the date listed in his P2P Foundation profile.

While Nakamoto’s true identity remains unconfirmed, his legacy continues to shape the digital financial landscape. Here are five facts about the elusive Bitcoin architect:

April 5 Wasn’t Random

Nakamoto listed April 5, 1975, as his birthday—exactly 42 years after the US government banned private gold ownership under Executive Order 6102 on April 5, 1933, to stabilize the dollar.

Bitcoin, by contrast, was designed to be a decentralized, deflationary alternative to fiat currency. Notably, BTC difficulty adjustment happens every 2016 block—2016 being 6102 in reverse.

Satoshi Nakamoto’s Bitcoin Fortune Remains Untouched

Satoshi’s wallet, believed to hold 1.096 million BTC, has remained untouched since early 2010. Over the past decade, its value has risen more than 333-fold, now exceeding $91 billion.

Despite the wallet’s inactivity, CoinJoin transactions are regularly sent to its address. Some view this as an act of homage or a method of obfuscation.

Still No Definitive Identity

In March 2024, a UK court ruled that Australian computer scientist Craig Wright is not Satoshi, calling his claims “deliberately false.”

An October 2024 HBO documentary controversially pointed to Canadian developer Peter Todd, who strongly denied any connection.

More recently, internet theories have speculated on Jack Dorsey’s possible ties, though no evidence supports the claim. Nakamoto’s identity remains the internet’s most persistent mystery.

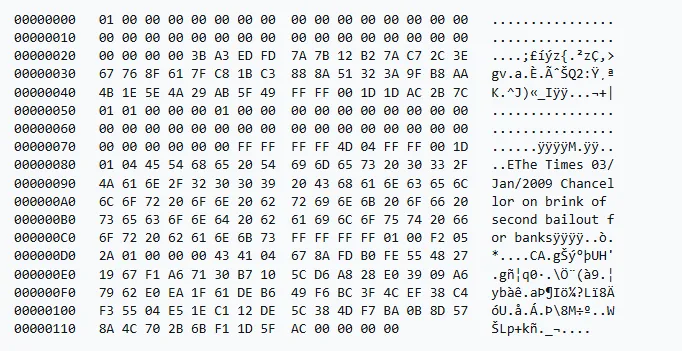

The Genesis Block’s Silent Message

Embedded in Bitcoin’s first block is the headline: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” The line is from a UK newspaper.

It is seen as a critique of centralized monetary policy and remains one of Nakamoto’s only public statements beyond technical documentation.

Bitcoin’s Design Still Holds

Fifteen years after its launch, Bitcoin remains secure and deflationary by design. Nakamoto’s codebase, while modified and improved by the open-source community, still forms the foundation of the network, securing over $1.6 trillion in value.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Eyes Breakout as Global M2 Hits Record $108 Trillion

The global M2 money supply has surged to an all-time high of $108.4 trillion, raising fresh questions about Bitcoin’s next move.

The milestone comes amid escalating economic uncertainty following former President Donald Trump’s new “Liberation Day” tariffs and China’s swift retaliatory measures, which together have roiled global markets.

What is M2 and Why Does It Matter for Bitcoin?

Despite the extreme volatility over the past two weeks, Bitcoin’s average value has remained almost unchanged.

Analysts claim that Bitcoin’s latest volatility reflects macroeconomic fears and fluctuating long/short ratios – but the largest cryptocurrency is nowhere near a bear market.

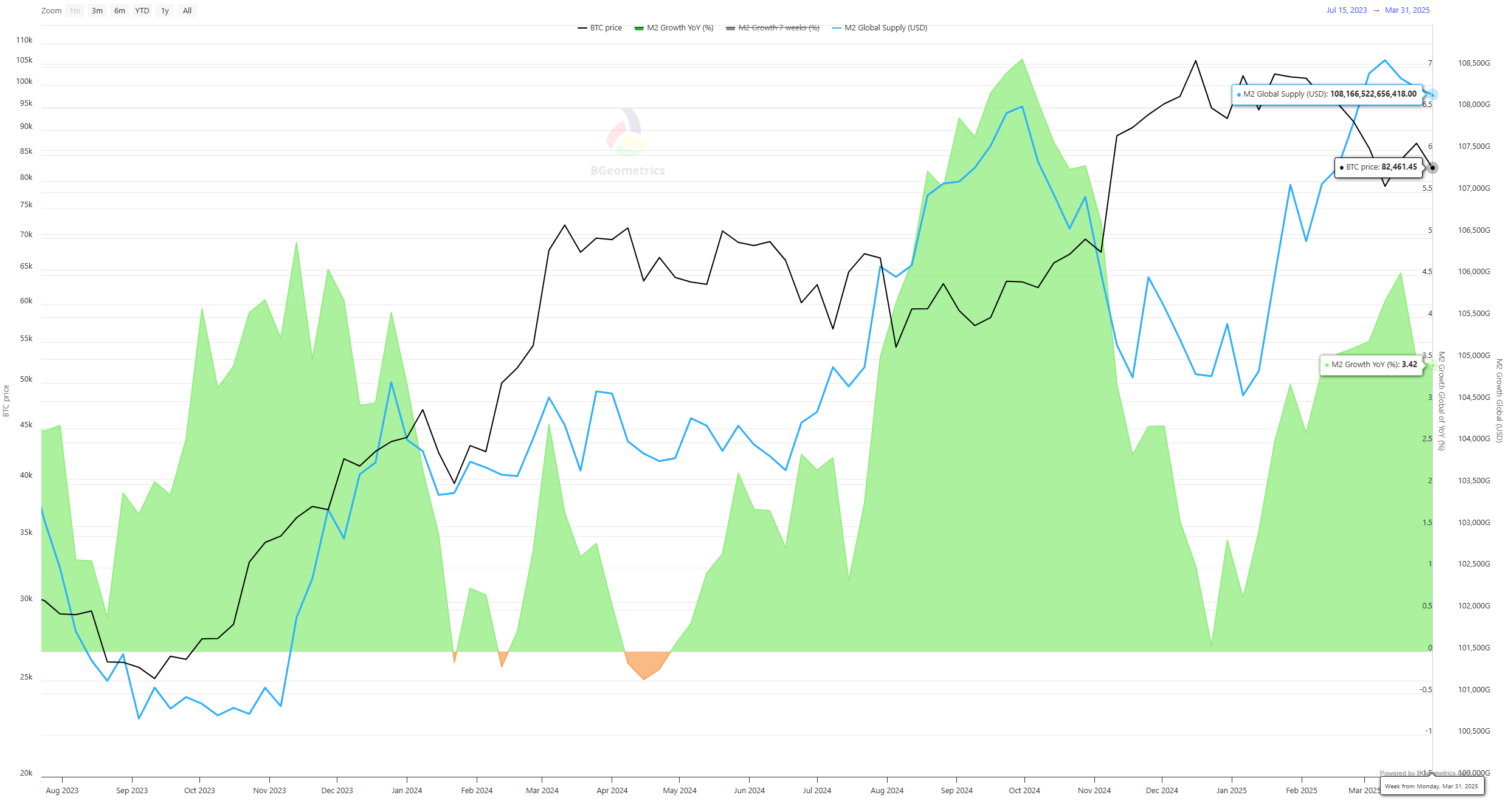

This is largely due to the historical correlation between rising M2 levels and significant Bitcoin rallies.

M2 is a broad measure of a country or region’s money supply. It includes physical cash, checking and savings deposits, and other liquid assets that can be quickly converted to cash.

When M2 increases, it typically signals greater liquidity in the financial system. It simply means more money that often seeks returns in riskier assets such as equities, real estate, or cryptocurrencies like Bitcoin.

Past surges in the M2 money supply have preceded major Bitcoin rallies. Following the COVID-era stimulus programs in 2020-2021, the US M2 supply jumped by over 25%.

This correlated with Bitcoin’s rise from under $10,000 in mid-2020 to an all-time high of over $69,000 by November 2021. Analysts point to a similar pattern today, albeit with a lag.

“Market proponents say that Trump’s tariffs are primarily a negotiation strategy, and their effect on businesses and consumers will remain manageable. Adding to the uncertainty are the inflationary pressures that could challenge the US Federal Reserve’s rate-cutting outlook. Also, resolving the debt ceiling remains a pressing issue, as the Treasury currently relies upon ‘extraordinary measures’ to meet US financial obligations. The exact timeline for when these measures will be exhausted is unclear, but analysts anticipate they may run out after the first quarter,” said Maksym Sakharov, Co-Founder of WeFi Deobank.

Also, Bitcoin’s price often trails global M2 growth by roughly two months.

With M2 accelerating since late February and the current spike taking it to its highest level ever, market watchers suggest that Bitcoin could see a delayed but strong upside if liquidity continues to expand.

However, macroeconomic headwinds could temper near-term gains. Trump’s tariff shock and China’s tit-for-tat response have already triggered the steepest Wall Street losses in five years.

Investors may delay allocating capital to high-volatility assets until trade tensions stabilize.

Still, with M2 surging and Bitcoin supply capped, the setup for a renewed bullish move remains in place. That is if historical patterns hold and markets regain confidence.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Bitcoin

Vitalik’s L2 Roadmap, XRP Unlock and More

This week in crypto, a lot happened across different ecosystems, despite the broader market’s prevailing bearish sentiment. Besides Bitcoin’s (BTC) drop to a 7-day low of $81,400, here are this week’s biggest updates.

For starters, crypto markets could have a new Ethereum Layer-2 roadmap. Meanwhile, Hyperliquid users could soon start enjoying better security.

Vitalik Buterin Pushes for Ethereum L2 Roadmap

Co-founder Vitalik Buterin outlined a roadmap for Ethereum’s Layer-2 (L2) ecosystem, emphasizing decentralization, security, and cost-efficiency.

He advocates for a model that reduces centralization risks while ensuring user-friendly experiences for developers and investors.

Buterin also reiterated his commitment to open-source funding within the Ethereum community. This stance comes as the phrase “public goods” has become politically and socially loaded. The phrase is often used in ways that prioritize perception over impact.

Against this backdrop, Buterin proposed shifting the focus from “public goods funding” to “open-source funding.” He said this would encourage greater financial support for projects that enhance network security and scalability.

“A big part of the reason why the term ‘public good’ is vulnerable to social gaming is precisely the fact that the definition of ‘public good’ is stretched so easily,” Buterin argued.

His vision aligns with ongoing efforts to strengthen Ethereum’s L2 playing field and make it more resistant to potential censorship or network failures.

Hyperliquid Tightens Security After JELLY Crisis

Decentralized trading platform Hyperliquid also features among the key headlines this week in crypto. The platform announced new security measures following the JELLY incident, which resulted in substantial losses for users.

To prevent future incidents, the platform has increased monitoring, enhanced smart contract audits, and introduced stricter withdrawal limits.

Hyperliquid’s response aims to restore confidence in decentralized finance (DeFi) platforms amid rising security concerns.

“Hyperliquid is not perfect, but it will continue to iterate and grow through the collective efforts of builders, traders, and supporters,” the network explained.

BeInCrypto data shows that Hyperliquid’s HYPE token price was $11.89 as of this writing, up by a modest 0.97% in the last 24 hours.

Crypto Markets, Equities Sync Amid Recession Fears

Another headline this week in crypto was how the digital assets industry continues to mirror traditional financial (TradFi). Specifically, more than ever, the crypto market appears synchronized with indices like the S&P 500 and Nasdaq.

The synchrony comes as investors react to growing recession concerns. Bitcoin and Ethereum have followed similar downturns seen in stock markets, reinforcing the argument that cryptocurrencies are increasingly correlated with broader economic conditions.

With macroeconomic uncertainty looming, analysts warn that crypto could further decline if economic conditions worsen. However, some argue long-term investors may find opportunities in current market lows.

According to former BitMEX CEO Arthur Hayes, Bitcoin could reach $250,000 by year-end. However, this forecast is contingent on the Federal Reserve (Fed) shifting to Quantitative Easing (QE) to support markets.

Meanwhile, former Goldman Sachs executive Raoul Pal pointed to macroeconomic indicators that suggest a Bitcoin rally is imminent. He shared a chart correlating the global M2 money supply and Bitcoin’s price.

Based on history, Bitcoin tends to rise around 10 weeks after M2 increases. Pal’s analysis suggests that Bitcoin may soon enter a bullish phase.

“The waiting game is almost over…the 10-week lead is my preferred… but,” Pal stated.

Ripple Unlocked $1 Billion in XRP

Also, this week in crypto, Ripple released another 1 billion XRP from its escrow, increasing selling pressure on the token.

Historically, such unlocks have been followed by price declines. This aligns with recent Keyrock research that showed that 90% of unlocks create negative price pressure.

The tokens were moved from the “Ripple (27)” escrow address to two operational wallets, “Ripple (12)” and “Ripple (13).” This suggested the intention to distribute or sell XRP.

Investors remain cautious, watching for signs of potential accumulation. Meanwhile, others anticipate further downside as XRP struggles to regain upward momentum amid broader market uncertainty.

Notwithstanding, there are other positive developments for the XRP market. According to Glassnode data, Retail investors are choosing XRP over Bitcoin, and nearly half of XRP’s realized cap is increasing.

Another bullish fundamental for XRP this week is Coinbase’s filing for a futures contract offering in the Ripple token. The move indicates shifting regulatory tides in the US and also bolsters XRP ETF (exchange-traded funds) approval odds.

Standard Chartered Predicts Crypto Winners

Standard Chartered also made it to the top headlines this week in crypto. The bank identified Bitcoin (BTC) and Avalanche (AVAX) as the primary beneficiaries of a potential post-Liberation Day crypto market surge.

The bank suggests that favorable macroeconomic conditions and increasing institutional adoption could propel these assets higher in the coming months.

“We expect volatility to edge gradually lower once the ETF market matures, increasing Bitcoin’s share of an optimal gold-BTC portfolio. Access plus lower volatility could see Bitcoin reach the $500,000 level before Trump leaves office,” wrote Geoff Kendrick, Head of Digital Asset Research at Standard Chartered, in an email to BeInCrypto.

This forecast aligns with the growing narrative that institutional interest will play a key role in shaping the next phase of the crypto market cycle. However, skeptics remain cautious, citing regulatory uncertainty and potential economic headwinds as factors that could delay or dampen such a rally.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoXRP Price Vulnerable To Falling Below $2 After 18% Decline

-

Market23 hours ago

Market23 hours agoWill the SEC Approve Grayscale’s Solana ETF?

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Whales Buy the Dip – Over 130K ETH Added In A Single Day

-

Bitcoin21 hours ago

Bitcoin21 hours agoVitalik’s L2 Roadmap, XRP Unlock and More

-

Altcoin17 hours ago

Altcoin17 hours agoAnalyst Predicts XRP Price To Reach Double Digits By July 21 Cycle Peak

-

Market22 hours ago

Market22 hours agoPENDLE Token Outperforms BTC and ETH with a 10% Rally

-

Market15 hours ago

Market15 hours agoNFT Market Falls 12% in March as Ethereum Sales Drop 59%

-

Market18 hours ago

Market18 hours agoPEPE Price Breaks Ascending Triangle To Target Another 20% Crash