Bitcoin

US Senate Panel Approves Crypto Advocate, Billionaire Howard Lutnick For Commerce Secretary

The Senate Commerce, Science, and Transportation Committee advanced the candidacy of Howard Lutnick, a crypto proponent and billionaire entrepreneur, to the position of Commerce secretary by a vote of 16–12.

America’s technological and financial scene undergoes a radical change and a wealthy man with strong ties to cryptocurrencies is leading important national initiatives valued in hundreds of billions of dollars.

Lutnick: Major Tech Programs Hang In The Balance

Lutnick’s appointment places him in charge of the $280 billion CHIPS and Science Act and the massive $42.5 billion BEAD program. These figures don’t only appear on paper; they reflect America’s determined efforts to transform its semiconductor sector and technical infrastructure. With global tech supremacy on the line, the stakes are higher than ever.

Warren’s Crypto Concerns Spark Fierce Debate

The confirmation hasn’t been without its share of fireworks. Senator Elizabeth Warren has thrown down the gauntlet, demanding answers about Lutnick’s ties to Tether, the controversial stablecoin issuer.

Her January 28 letter pulled no punches, questioning everything from Cantor Fitzgerald’s investment in Tether to potential compliance issues. The plot thickened when it emerged that Lutnick’s financial disclosure form detailed assets worth over $806 million and involvement in 800 entities.

Washington is split by the confirmation as Ranking Member Maria Cantwell voted against Lutnick, citing inadequate dedication to current program goals. One thing is evident as this billionaire entrepreneur takes on his new position: the tech and crypto scene of America is set to change and might even completely alter the digital future of the country.

Cruz Champions Tech Policy

While Warren raises red flags, fellow Senator Ted Cruz is upbeat about what he sees as a victory for tech innovation. His vision? A complete reimagining of the BEAD program, moving away from its fiber-optic focus to embrace alternatives like satellite internet and fixed wireless. It’s a stark departure from previous policies, with Cruz dismissing the former Biden administration’s approach as riddled with “lawless conditions.”

WATCH: The Senate Commerce Committee meets to advance Howard Lutnick as Secretary of Commerce and to move critical pieces of legislation, including the Kids Off Social Media Act, the AM Radio for Every Vehicle Act, the Fire Ready Nation Act, and the Illegal Red Snapper and Tuna… pic.twitter.com/FmVwLSkdk6

— Senator Ted Cruz (@SenTedCruz) February 5, 2025

Bitcoin Dreams And Stablecoin Schemes

Lutnick is open about his plans for cryptocurrency. At the 2024 Bitcoin Conference in Nashville, he confidently stated that cryptocurrency is “the future of financial independence.” He wants to require checks for stablecoins and might create a national Bitcoin reserve. This idea has made crypto fans excited but has worried traditional finance regulators.

The newly formed SEC Crypto Task Force, under Commissioner Hester Peirce, will work closely with Lutnick to navigate these uncharted waters.

Featured image from Pexels, chart from TradingView

Bitcoin

Public Companies are Buying Bitcoin Again After a Brief Pause

Bitcoin is rebounding after tariff chaos, and public companies like Metaplanet are conducting major acquisitions. The firm bought $28.2 million worth of the asset, nearly a $2 million increase from last week.

However, despite this new confidence, Metaplanet’s stock has continued to perform shakily. The crypto market is showing cautious optimism, but that won’t immediately translate into major gains.

Although a few corporate Bitcoin whales briefly paused their big purchases recently, the markets are heating back up again. Metaplanet began buying the dip last week, and Bitcoin has been making steady progress since then.

Today, its CEO, Simon Gerovich, announced a new purchase as BTC rebounds:

“Metaplanet has acquired 330 BTC for ~$28.2 million at ~$85,605 per bitcoin and has achieved BTC Yield of 119.3% YTD 2025. As of 4/21/2025, we hold 4855 $BTC acquired for ~$414.5 million at ~$85,386 per bitcoin,” he claimed.

Trump’s tariff threats caused massive uncertainty and crypto liquidations in the last few weeks. However, since he announced a pause, crypto and industry-related stocks have been rallying.

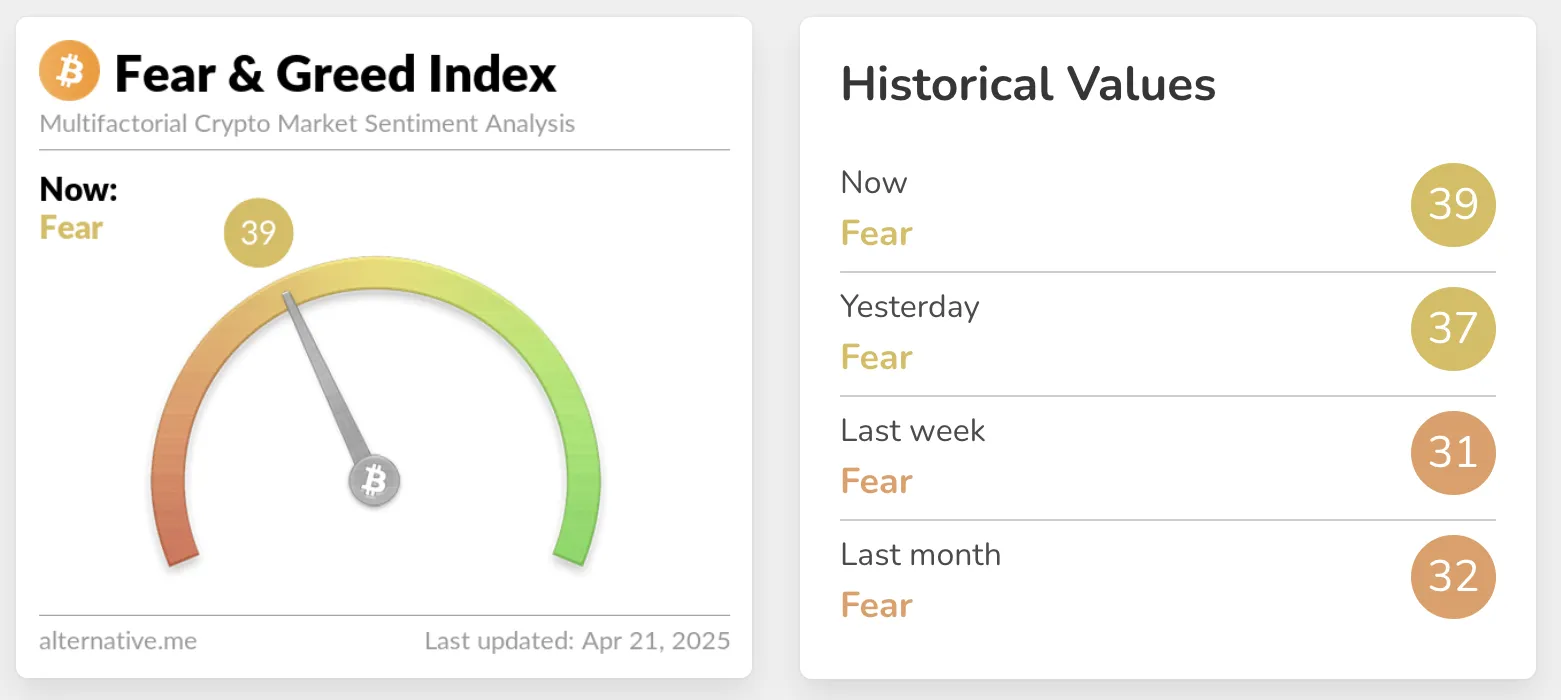

Whales like Metaplanet and MicroStrategy immediately began buying Bitcoin, and the whole market is rising. The Crypto Fear and Greed Index was recently in Extreme Fear but has since recovered greatly:

Still, markets are showing cautious optimism, not a full rally. A quick look at some major crypto-related stocks will paint a clearer picture.

MicroStrategy rose over 4% in the last five days and nearly 6% in the last month, but it’s a pillar of confidence in BTC. Metaplanet, a much smaller Bitcoin holder, only fell 1.89% in the last five days but over 20% in the last 30.

In other words, it can be difficult to cleanly connect Bitcoin’s recent successes with major holders like Metaplanet. Compare two prominent US-based crypto miners, Marathon and Riot.

The former recovered from its slump in early April, while the latter only continued to drop. Coinbase, too, has only made brief rallies on a trend of continual decline.

While Bitcoin’s adoption has surged dramatically over the past year, there’s still a lot of uncertainty about tariffs and recession. Metaplanet may be in shaky territory right now, but its confidence in Bitcoin can provide a long-term sense of stability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Dollar Dips While Bitcoin Hits New Heights

The US Dollar Index (DXY) has dropped to a three-year low amid reports that President Donald Trump is considering removing Federal Reserve Chairman Jerome Powell.

Meanwhile, the development positively affected Bitcoin’s (BTC) price, pushing it to its highest level since President Trump’s Liberation Day.

Trump’s Push Against Powell Adds Pressure on the Dollar

According to the latest data, DXY has plunged below 99. At press time, it stood at 98.2, representing the lowest value since March 2022.

Economist Peter Schiff highlighted the severity of the situation in the latest post on X (formerly Twitter).

“Gold is up over $50, hitting a record high of $3,380. The euro is above $1.15. The dollar has also fallen below 141 Japanese yen and .81 Swiss francs (a new 14-year low, just 3% above a record low). The dollar Index is below 98.5, a new three-year low. This is getting serious,” Schiff posted.

The dollar’s steep fall comes amid the latest comments made by National Economic Council Director Kevin Hassett on Friday, April 18. Hassett revealed that Trump and his team are actively exploring the possibility of ousting Powell.

His statement was in response to a reporter’s question about whether removing Powell was an option.

“The president and his team will continue to study that matter,” Hassett replied.

In addition, he called out the Federal Reserve for politically motivated actions under Powell’s leadership. Specifically, Hassett criticized the Fed for raising interest rates shortly after Trump’s election and cutting them ahead of the election, moves he claims favored the Democratic Party.

Notably, the growing contempt towards Powell is a response to the Fed’s stance on interest rates. BeInCrypto reported earlier that the Fed will likely not cut rates in May amid rising inflation and President Trump’s tariff pause.

Recently, Trump also blamed the Fed Chair for being slow to act on interest rate cuts. In a post on social media, Trump compared Powell’s actions unfavorably to the European Central Bank (ECB), which is set to implement its seventh interest rate cut.

Trump argued that Powell, whom he described as “always too late and wrong,” should have taken similar measures long ago to address economic conditions.

“Powell’s termination cannot come fast enough!” the President wrote.

The Fed Chair’s potential removal raises serious questions about the Federal Reserve’s independence and its implications for global markets. Powell, whose term as chair extends to May 2026, has previously stated that legal protections prevent his removal and that he intends to serve out his term.

Will Dollar Weakness Drive Bitcoin to New Heights?

Nonetheless, it’s worth noting that if Powell is removed and President Trump successfully persuades the Federal Reserve to cut interest rates, it could likely lead to a crypto market rally. Generally, when the Fed lowers interest rates, the US dollar tends to weaken.

Therefore, investors prefer cryptocurrencies, especially Bitcoin, which is often seen as a hedge against inflation and the weakening of fiat currencies. The inverse relation between the DXY and BTC further solidifies the case for a rally if the dollar depreciates.

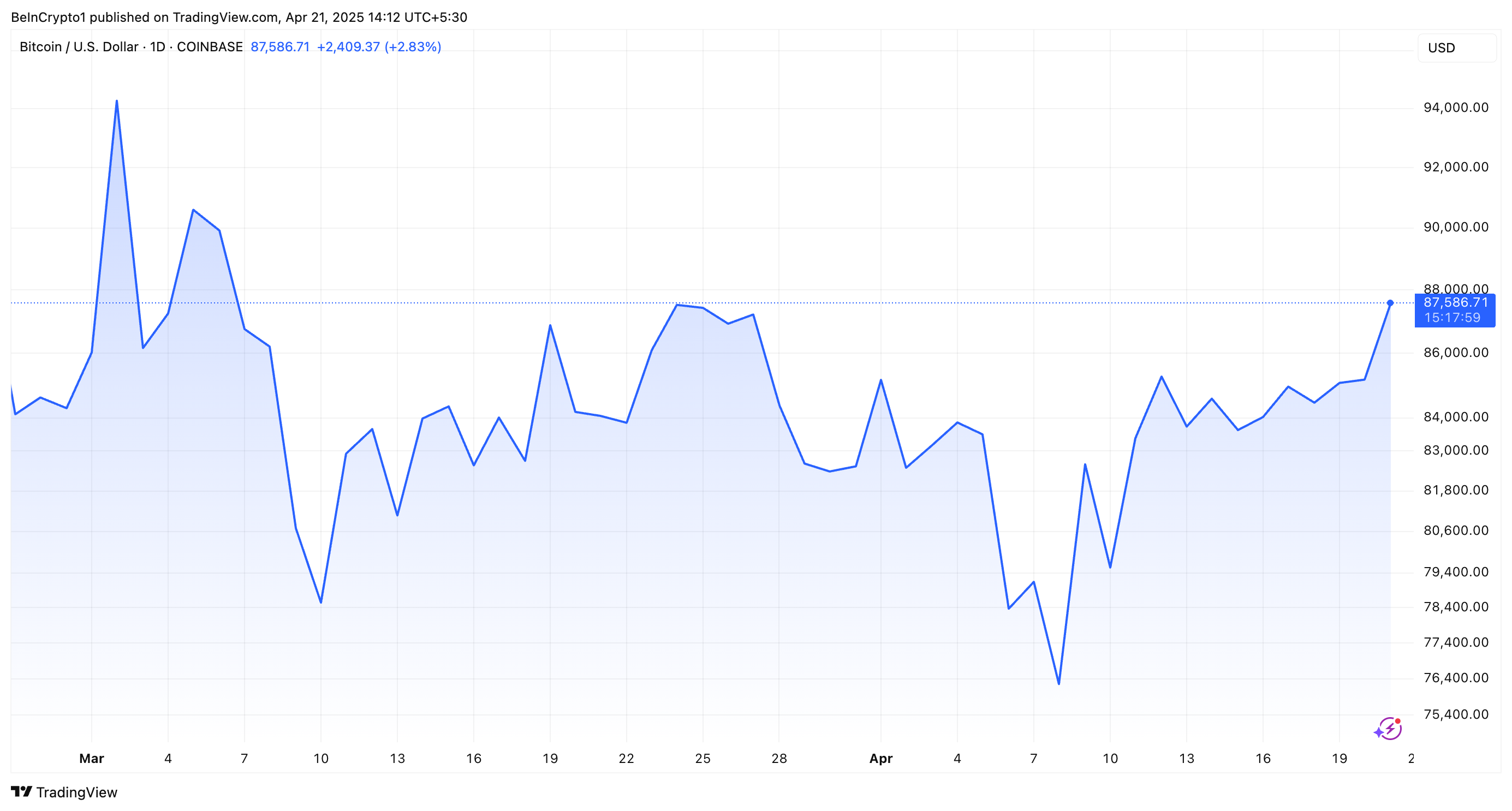

In fact, the latest decline in the dollar index has coincided with a notable increase in Bitcoin’s price. The largest cryptocurrency surged to over $87,000 for the first time since April 2.

“USD weakness is driving the rally in crypto,” Sean McNulty, Derivatives Trading Lead at FalconX, told Bloomberg.

At the time of writing, BTC was trading at $87,586. BeInCrypto data showed that this represented an appreciation of 3.5% over the past day. As markets celebrate these gains, the focus remains on Trump’s next moves and their broader economic consequences.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Solana, Bitcoin in Texas, and Initia

Several top crypto news stories are in the lineup this week in crypto, spanning various ecosystems with the potential to drive volatility.

This week, traders looking to capitalize on event-specific volatility should monitor the following developments.

This week, the Solana Community Conference, or Breakpoint, is among the top crypto news stories. It kicks off on April 25 and is Solana’s flagship gathering of developers, investors, and innovators.

Historically, Solana Breakpoint is a stage for major announcements, such as new project launches, partnerships, or technological advancements. In recent years, key announcements in similar gatherings have included the Solana Seeker phone or the Firedancer validator client.

According to Solscan data, Solana’s ecosystem boasts nearly 4 million active wallets. Meanwhile, DefiLlama data shows up to $7.37 billion in total value locked (TVL). With these numbers, the Solana community conference could drive positive sentiment for SOL, which was trading at $141.05 at press time.

Traders should brace for potential price volatility, as positive news could spark short-term spikes. In the same way, any underwhelming news or network concerns, like past outages, might temper enthusiasm.

Texas Bitcoin Reserve Hearing

Another top crypto news story this week concerns a strategic crypto reserve. On April 23, Texas will hold a strategic Bitcoin reserve hearing, marking a significant event given the state’s pro-crypto stance.

The bill, introduced four months ago, passed the committee with a 9-0 vote and received senate approval with 80% support. Similarly, Dan Patrick, Lieutenant Governor for the State of Texas, listed Bitcoin Reserve as a top priority for 2025.

“My statement announcing the first round of top 40 priority Bills for the 2025 legislative session,” he shared on X (Twitter) in January.

Against these backdrops, the Wednesday hearing could clarify Texas’s approach to institutional Bitcoin adoption. This could set a precedent for other states or federal policy.

A favorable outcome might bolster Bitcoin’s legitimacy, driving demand from institutional investors and positively influencing the BTC price.

Initia’s Mainnet and INIT Token Launch

Also in the headlines, this week in crypto, Initia’s mainnet launch and its token, INIT, debut on Thursday, April 24. This comes after the network revealed a 50 million token airdrop three weeks ago.

The Thursday event will mark a key milestone for the layer-1 blockchain, which is focused on interoperability and user experience. The launch could attract attention from decentralized finance (DeFi) and cross-chain enthusiasts, as Initia aims to simplify dApp interactions.

For traders, INIT’s initial price action will be critical, as new token launches often experience high volatility due to speculative trading.

“Initia INIT Binance Spot Listing Date Announced! Listing on: 24th April 2025. Mainnet will also officially launch on the same day. Airdrop claim date and exact time are yet to be announced,” the network stated recently.

Investors should evaluate Initia’s partnerships and developer adoption, as its success hinges on ecosystem growth.

Injective’s Lyora Mainnet Upgrade

Injective’s Lyora mainnet upgrade, scheduled for Tuesday, April 22, aims to enhance network performance and transaction speed. It would strengthen its position as a DeFi-focused layer-1 chain.

“The Injective Lyora Mainnet is nearly here! Vote today to dramatically enhance Injective infrastructure, performance, and transaction speeds. The official launch is on April 22,” Injective said.

This upgrade could improve user experience and attract developers to Injective’s ecosystem, particularly for derivatives and trading platforms.

Traders should watch INJ’s price for short-term momentum, as successful upgrades often drive positive sentiment.

At the same time, investors should consider Injective’s growing TVL (total value locked) and partnerships, like its collaboration with Sonic for AI agent platforms, as indicators of long-term potential.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.