Bitcoin

Trump Signs Executive Order for US Bitcoin Reserve

Donald Trump has followed through on his promises and signed an executive order to establish a Strategic Bitcoin Reserve and a separate US Digital Asset Stockpile.

While some industry figures have lauded the order, others remain skeptical. They argue that the initiative is little more than a rebranding of existing government holdings with no substantive new strategy.

Donald Trump Signs Order for Strategic Bitcoin Reserve

The order directs the US Department of Treasury to initially fund the Strategic Bitcoin Reserve with BTC seized through criminal and civil asset forfeiture. The administration has vowed not to sell these assets.

“Bitcoin, the original cryptocurrency, is referred to as “digital gold” because of its scarcity and security, having never been hacked. With a fixed supply of 21 million coins, there is a strategic advantage to being among the first nations to create a Strategic Bitcoin Reserve,” the order read.

Arkham Intelligence data shows that the US government holds 198,109 BTC in its public wallets, valued at $17.5 billion at current market prices.

Despite this substantial holding, David Sacks, the White House’s AI and Crypto Czar, noted that a comprehensive audit of the government’s digital assets has never been conducted. The new executive order mandates this accounting.

“Premature sales of Bitcoin have already cost US taxpayers over $17 billion in lost value. Now the federal government will have a strategy to maximize the value of its holdings,” he wrote.

It also authorizes budget-neutral strategies for potentially acquiring more Bitcoin. Yet, critics argue that the reserve lacks substantive impact.

Industry Experts Divided on Strategic Bitcoin Reserve

Jacob King, founder of WhaleWire, dismissed the recent attention around the reserve.

“In reality, this has existed for over a decade—they’re just slapping a fancy title on it to appease Bitcoiners,” he remarked.

King also pointed out that the reserve would not involve any new Bitcoin purchases. Therefore, he believes, this makes the move largely insignificant in the grand scheme of the market.

Peter Schiff, an outspoken critic of Bitcoin, also weighed in on the order. According to Schiff, the move was made under pressure from donors and conflicted cabinet members.

He described the order as a “bogus” attempt to capitalize on the Bitcoin the government already holds.

“If they seize any more Bitcoin they can keep that too. But they can’t buy any more, as buying by definition requires a payment,” Schiff posted.

Despite the criticisms, some industry leaders see the order as a significant step toward legitimizing Bitcoin on the world stage.

“The end game was never the US government buys all of the world’s Bitcoin,” Ryan Rasmussen, Head of Research at Bitwise, said.

Rasmussen explained that the move will likely prompt other countries to buy Bitcoin. He also expects it to pressure wealth managers, financial institutions, pensions, and endowments to adopt the cryptocurrency.

The reserve, Rasmussen said, will alleviate concerns about the US selling its holdings and may pave the way for future acquisitions. He added that the move increases the likelihood of US states adopting Bitcoin.

Matt Hougan, CIO at Bitwise, also concurred. He pointed out that the order could significantly reduce the likelihood of future Bitcoin bans. Hougan added that the reserve,

“Accelerates the speed at which other nations will consider establishing strategic bitcoin reserves, because it creates a short-term window for nations to front-run potential additional buying by the US.”

Analyst Nic Carter also praised the decision, calling it a successful fulfillment of a key campaign promise. He highlighted that Bitcoin had received official US government approval, a distinction not granted to other cryptocurrencies. Carter emphasized that using no taxpayer funds helped shield the initiative from backlash.

“Announcement couldn’t have gone better,” he claimed.

The signing of the executive order took place just one day before the White House Crypto Summit. Initially, it was anticipated that Trump would sign the Bitcoin reserve order at the summit, which had driven Bitcoin prices up. Nonetheless, the actual signing led to a dip in the cryptocurrency’s value.

After briefly regaining that level on March 5, Bitcoin dropped below $90,000 again. At press time, Bitcoin was trading at $87,469, marking a 4.5% decrease over the past 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Is Bitcoin Ready for Another Surge?

The US Dollar Index (DXY), which measures the dollar’s value against a basket of foreign currencies, has dropped to a three-year low. The decline contrasts with gold’s performance, which hit an all-time high of $3,220 amid rising trade war tensions.

Yet, DXY’s dip has sparked optimism among cryptocurrency investors. Many see the weakening dollar as a bullish signal for Bitcoin (BTC), which has recently shown signs of modest recovery.

Will Bitcoin Rally Following the DXY Index’s Fall?

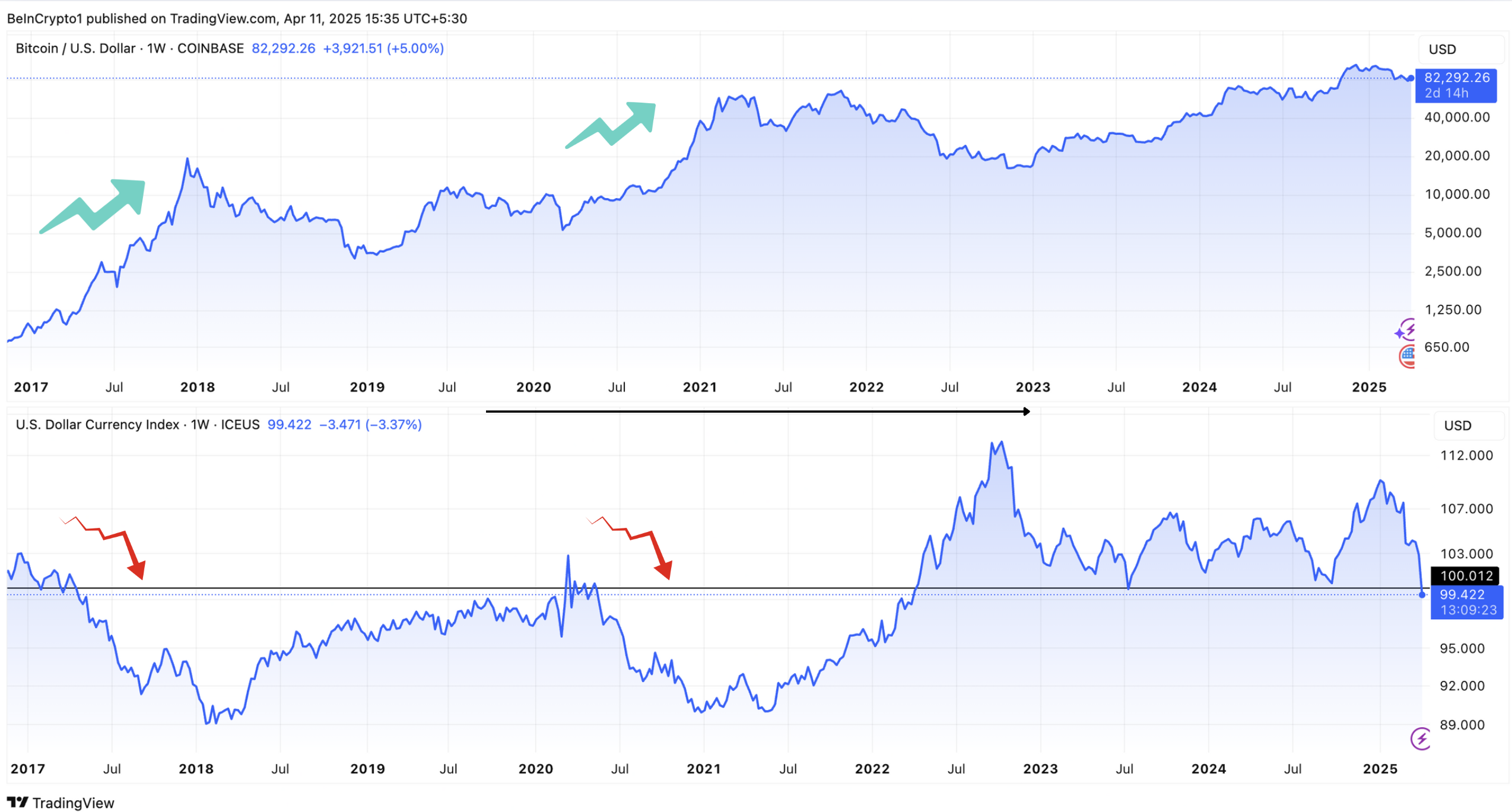

Data shows that the DXY index dropped by 1.5% in the last 24 hours. As of press time, it stood at 99.4, marking its lowest level since April 2022. The decline is part of a broader trend in 2025, with the DXY down 8.3% since January.

“The US dollar index dropped to its lowest level in nearly three years amid capital outflows from American assets. Escalating trade tensions and growing concerns over broader economic fallout, particularly for the US, have weighed heavily on market sentiment,” CryptoQuant’s Alex Adler told BeInCrypto.

Notably, the index’s fall below 100 marks a critical threshold. Historical data highlights a strong correlation between a declining DXY and substantial Bitcoin price surges.

The last two times the DXY fell below the 100 mark—in April 2017 and May 2020—Bitcoin experienced significant, months-long rallies. These substantial increases have led to speculation that history could repeat itself. If it does, Bitcoin could potentially be poised for another major surge.

Interestingly, Bitcoin has already shown signs of recovery after the 90-day tariff pause. The largest cryptocurrency reclaimed the $80,000 level, signaling renewed investor confidence. According to BeInCrypto data, Bitcoin appreciated by 0.8% over the past 24 hours. This reflected minor but positive gains that suggest momentum could be building.

In fact, the market watchers on X (formerly Twitter) share a similar outlook.

“Weak dollar is going to be a surprising tailwind for emerging markets this year that wasn’t on anyone’s bingo card,” a user wrote.

Meanwhile, an analyst observed that the US dollar’s decline has occurred despite the Federal Reserve’s failure to reduce interest rates or implement quantitative easing (QE).

“Traditionally, DXY going down is very bullish for BTC,” he said.

The analyst also highlighted a notable bearish divergence on the charts. Thus, he predicted that the dollar could potentially drop to 90, signaling a further decline in its value.

Similarly, another analyst described DXY’s decline as “one of the best anticipated macro moves ahead.”

“Each time this has happened in the past, it resulted in a massive bull market for Bitcoin, Crypto, and stocks,” Jackis remarked.

He also acknowledged that the markets have been slow to react, attributing this delay to a lag of more than three months. Additionally, he noted that the ongoing bond situation between China and the US, driven by escalating trade tensions, is contributing to this slow reaction.

Yet, he believes this situation will either be resolved through a deal between the two countries or the Federal Reserve will intervene by buying long-term bonds to stabilize the market. Now, the coming weeks will be crucial to determine whether Bitcoin will actually enter another bull run or falter under geopolitical tensions and broader market shifts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Over $2.5 Billion in Bitcoin and Ethereum Options Expire Today

Crypto markets will witness over $2.5 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire today.

Traders are particularly attentive to this event because it has the potential to influence short-term trends through the volume of contracts due for expiry and their notional value. Examining the put-to-call ratios and maximum pain points can provide insights into traders’ expectations and possible market directions.

Bitcoin and Ethereum Options Expiring Today

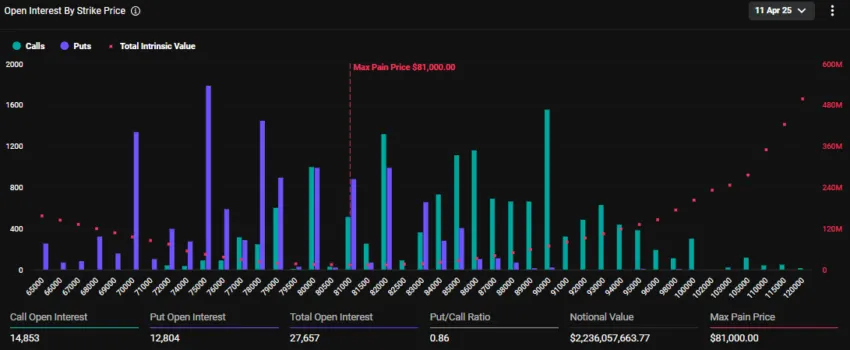

The notional value of today’s expiring BTC options is $2.23 billion. According to Deribit’s data, these 27,657 expiring Bitcoin options have a put-to-call ratio of 0.86. This ratio suggests a prevalence of purchase options (calls) over sales options (puts).

The data also reveals that the maximum pain point for these expiring options is $81,000. In crypto options trading, the maximum pain point is the price at which most contracts expire worthless. Here, the asset will cause the greatest number of holders’ financial losses.

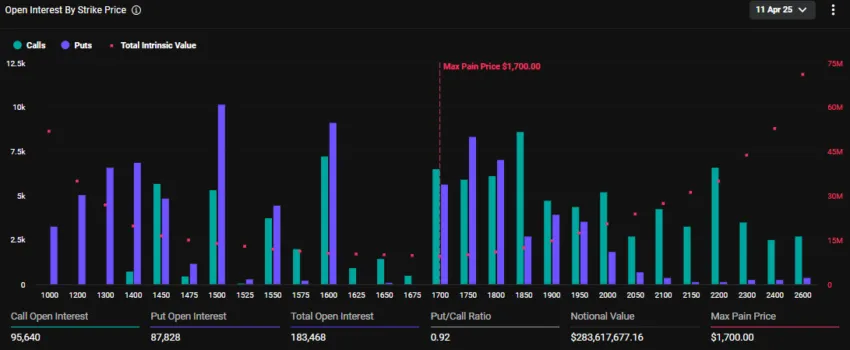

In addition to Bitcoin options, 183,468 Ethereum contracts are set to expire today. These expiring options have a notional value of $283.6 million and a put-to-call ratio of 0.92. The maximum pain point is $1,700.

The current market prices for Bitcoin and Ethereum are below their respective maximum pain points. BTC is trading at $80,622, while ETH sits at $1,543.

“With recent market volatility and ongoing tariff developments, how do you think these expiries will impact price action?” Deribit posed.

Deribit is a crypto options and futures exchange. Indeed, crypto markets are reeling from massive volatility induced by the trade war chaos following President Trump’s tariffs. Meanwhile, Cardano founder Charles Hoskinson says future tariffs will be ineffective on crypto.

He thinks that tariffs are already priced and that future announcements will be a ‘dud’ for the crypto market.

Traders Brace for Extended Weakness as Call Premium Fades Until September

Elsewhere, analysts at Deribit note a shift in crypto options, with short-term dips still bringing put demand. Meanwhile, the call premium is further out of the curve and fades.

“You now have to look all the way to September before calls retake the skew. Traders might be bracing for extended weakness,” Deribit noted.

This suggests traders might be bracing for extended weakness in the crypto market. A fading call premium, where the implied volatility (IV) of calls drops relative to puts, suggests that traders are less optimistic about price increases in the near to medium term.

A negative or reverse volatility skew, where OTM puts ((out-of-the-money puts) have higher IV than OTM calls ((out-of-the-money calls), is common in equity markets when investors fear price drops.

This pattern appears to play out in the crypto options market, reflecting heightened concerns about downside risks. Analysts at Greeks.live note that BTC’s IV has declined significantly and is now largely holding nearly 50% across all maturities.

On the other hand, ETH’s IV has maintained a higher level, with short to medium-term volatility holding near 80%. Selling ETH options in the short term would be a good trade for traders.

Global economic uncertainty, including the US-China tariff war, has dampened risk appetite. Crypto’s inherent volatility could also be fueling this cautious outlook.

“Sentiment was more panicky this week, with Trump’s frequent switching of tariff policies making the market extremely risk averse,” analysts at Greeks.live wrote.

The Greeks.live analysts agree with Deribit’s expectations of extended weakness. However, unlike Hoskinson, they expect continued uncertainty and volatility in the market for a long time.

For traders, this suggests a need for hedging strategies, like buying puts or diversifying into stablecoins.

“Cryptocurrencies are currently suffering from a lack of new incoming money, a lack of new narratives, and a more subdued investor sentiment. In this worse market of bulls to bears, the probability of a black swan will be significantly higher, and buying some deep vanilla puts would be a good choice,” Greeks.live analysts concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Holders are More Profitable Than Ethereum Since 2023

New data from Glassnode suggests that Bitcoin’s MVRV (Market Value to Realized Value) has been higher than Ethereum’s for 812 consecutive days. This means that the average BTC investor has accumulated much larger profits than their ETH counterpart since 2023.

Due to recent losses, Ethereum’s MVRV actually fell below 1.0, suggesting that the average investor has lost money. It may be undervalued and well-posed for a resurgence, but this will take time.

Bitcoin vs Ethereum: Which is More Profitable?

Despite a few recent market turmoils, the price of Bitcoin is doing reasonably well right now. Although much of its gains since Trump’s election have been wiped out, its pre-election value spent most of 2024 at a shelf near its previous all-time high.

According to new data from Glassnode, Bitcoin’s investor profitability is far above Ethereum’s.

“Since November 2022 (FTX collapse), Bitcoin’s realized cap has grown by $468 billion (+117%), while Ethereum’s increased by just $61 billion (+32%). Bitcoin investors have held consistently larger unrealized profits than #Ethereum holders since January 2023. BTC investor profitability has exceeded ETH for 812 consecutive days – an all-time record,” Glassnode said.

Glassnode came to these conclusions by analyzing both tokens’ MVRV and their ratio of market value to realized value. This metric compares the listed price of Bitcoin and Ethereum to the actual price at which these tokens were most recently traded.

Despite maintaining similar MVRVs for a prolonged period, Bitcoin is plowing well ahead today:

While Bitcoin has been more volatile than Ethereum, the altcoin has seen a much smaller uptick during bullish cycles. For instance, in the latest bull run between October and December 2024, Bitcoin surged by nearly 70%.

In the same period, Ethereum’s price increase was less than 50%. Yet, if we look at the drop during the current market downturn, BTC lost 3% in the first week of April, while ETH lost over 15%.

Meanwhile, the altcoin’s investor sentiment is also dropping. Major whales who HODL’ed the token for many years are now selling their ETH holdings.

Also, the average Bitcoin holder enjoys an MVRV of around 2.0, meaning that they have huge unrealized gains. Most of their counterparts have an MVRV below 1.0, signifying that they have lost money. These data points are concerning, especially for the median ETH holder.

However, there’s a silver lining. Ethereum recently fell to a yearly low, but there’s also a strong uptick of new investors. New developments, like the SEC approving ETH ETF options trading, could spur a recovery.

In other words, Ethereum may be highly undervalued and, therefore, an attractive investment.

Still, for the time being, Bitcoin holders are in a much better position than ETH holders. Ethereum is still the second-largest cryptoasset by market cap, and it can always make a comeback. This will almost certainly pose a significant challenge.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoADA Price Surge Signals a Potential Breakout

-

Market23 hours ago

Market23 hours ago3 Bullish Altcoins Surging After Trump’s Tariff Pause

-

Bitcoin21 hours ago

Bitcoin21 hours agoBitcoin Holders are More Profitable Than Ethereum Since 2023

-

Market11 hours ago

Market11 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

-

Market20 hours ago

Market20 hours agoEthereum Price Climbs, But Key Indicators Still Flash Bearish

-

Bitcoin23 hours ago

Bitcoin23 hours agoThis is Why Hoskinson Thinks Bitcoin Will Hit $250,000 in 2025

-

Altcoin13 hours ago

Altcoin13 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Market13 hours ago

Market13 hours agoEthereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?