Bitcoin

Privacy and Staking in Bitcoin’s Growth 2025

Core DAO and Element Wallet are collaborating to expand Bitcoin’s utility for holders, offering new avenues for interaction beyond simple storage. This partnership emphasizes user privacy while aiming to maximize the security of decentralized finance (DeFi) mechanisms like Bitcoin staking.

BeInCrypto discussed with representatives from both platforms to explore how user privacy and enhanced functionality in staking can create new opportunities for Bitcoin-oriented DeFi participation.

Expanding Bitcoin Use Cases

For 2025, the CORE team aims to develop new use cases for Bitcoin holders who wish to use their BTC rather than keep it perpetually stored. Core achieves this by enabling Bitcoin users to interact easily with DeFi.

“A lot of people have been holding Bitcoin over the years and are totally happy with that. I get it, myself included, but there are also a lot of people who want to actually do something with their BTC and not just hold it. They want to actually put it to work, bring it into DeFi, take out a loan on it, or lend it out and earn some yield. Core basically allows for whatever you want to do with your Bitcoin,” explained Dylan Dennis, Contributor at Core DAO.

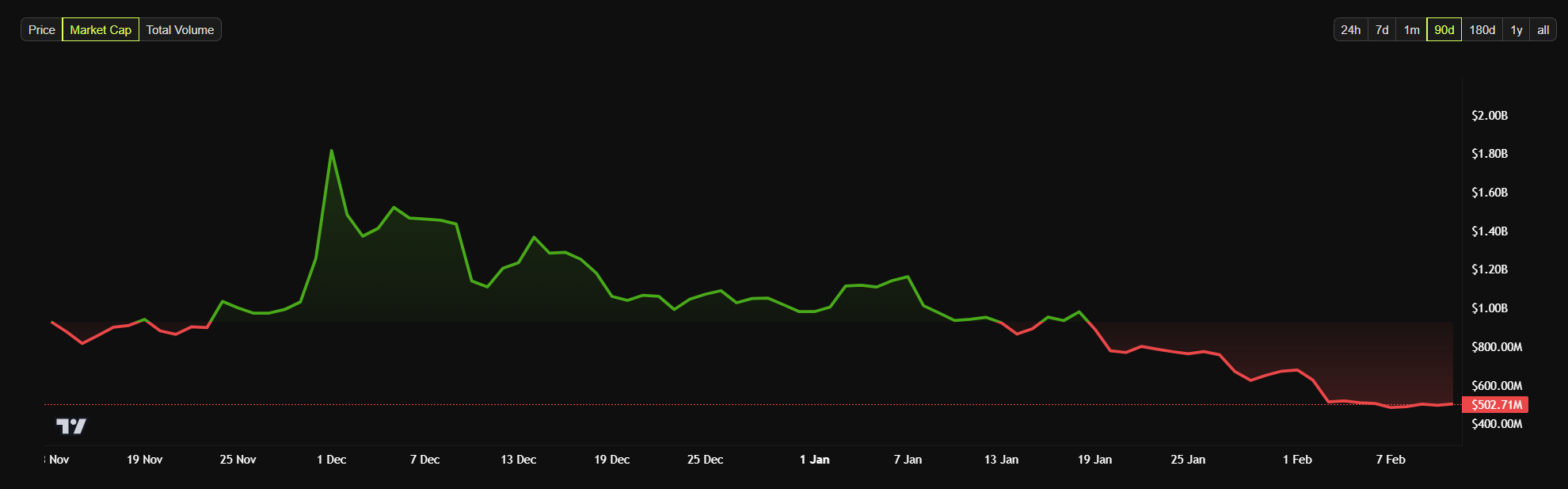

Designed to enhance Bitcoin’s utility while preserving its decentralization and security, Core is a layer-1 blockchain that integrates with Bitcoin and offers EVM compatibility. Launched in January 2023, it has achieved a market capitalization of over $497 million.

The Core DAO, a decentralized autonomous organization, supports and develops the Core blockchain, pursuing security, scalability, and decentralization through community-driven collaboration.

Members of the Core DAO used the term BTCfi to describe decentralized financial services and applications built on a Bitcoin-based blockchain. This initiative combines Bitcoin’s security and reliability with innovative financial services found in DeFi platforms.

BTCfi enhances Bitcoin’s value by expanding protection and increasing utility via on-chain yield and a comprehensive dApp ecosystem.

Meanwhile, Core’s EVM compatibility enables developers to use familiar Ethereum tools for interoperable dApps. These dApps increase Bitcoin’s versatility and cater to diverse user needs, from simple BTC staking to complex DeFi activities.

“Basically, Core was created by Bitcoiners. The whole point of Core is to scale Bitcoin and unlock new use cases for every kind of Bitcoiner, whether you’re someone who wants to take no new risk, and just keep your BTC in your wallet. Then on the other side, there’s this whole Bitcoin DeFi ecosystem, with 100+ Dapps, all BTC-based. Whatever you want to do with your BTC you could do it with Core,” Dennis said.

While exposing Core users to DeFi, Core also uses a three-in-one strategy to secure its high-throughput blockchain.

The Satoshi Plus Consensus for Ensured Decentralization

To stay true to Bitcoin’s core principles of decentralization and security, Core employs a mechanism defined as the Satoshi Plus Consensus. This method involves active collaboration from Bitcoin miners, CORE stakers, and Bitcoin Stakers.

Bitcoin miners contribute to the security of the blockchain by delegating their Proof-of-Work (PoW) mechanisms to a Core validator. This non-destructive delegation of PoW allows miners to leverage their existing work without choosing between securing Bitcoin and Core.

Core’s security is also enhanced through a delegated Proof-of-Stake (dPoS) mechanism, which allows holders of Core’s native CORE tokens to participate in network security by delegating their tokens to validators.

Finally, Core’s Satoshi Plus consensus mechanism incorporates non-custodial Bitcoin staking.

“With the non custodial staking, you can stake Bitcoin in your own wallet by putting a time lock on it. It’s called a time lock contract and it’s a Bitcoin native feature. You lock it in that transaction, you include the validator you want to delegate to, and for helping to decentralize and secure the core network, you get paid out in Core tokens for doing so without any new trust assumptions. So, something that helps to secure Core also helps with the whole mission, which is to unlock new use cases,” Dennis added.

Though Core emphasizes Bitcoin functionality for its holders, the Element Wallet is in charge of user privacy and the secure management of digital assets.

Addressing User Privacy and Asset Security

While the nature of the Core blockchain remains decentralized and transparent, the same does not apply to user details.

Privacy is a crucial aspect for Bitcoin users and the crypto ecosystem in general, explained Bruna Brambatti, Marketing Manager at Element Wallet.

“You’re going to see a lot of people that have random handles. They’re not using their profile picture. They are using an NFT. People like to be private and want to keep their money private. Even though we have this open space with the blockchain, we’re never going to know who the owner of that money in that wallet is,” she said.

Element Wallet is a multi-chain crypto wallet for seamless asset management and DeFi access. Though it’s compatible with different crypto assets like Bitcoin and TRON, it was initially built for Core participants and acts as the first and primary interface for the Core blockchain.

To address user privacy concerns, Element Wallet uses various mechanisms to protect identity and financial information. Element’s messaging uses end-to-end encryption for user privacy. Only the recipient can decrypt messages, protecting content from third parties.

While Element does not store these messages’ content, it maintains a record of communication between users, excluding the actual message content. The messages themselves are stored locally on the users’ devices.

Element also integrates in-chat peer-to-peer (P2P) transfers. Users can send payments or payment requests within these chats, enhancing security and clarity by communicating directly with the recipient. This functionality provides added security and convenience, enabling direct trading within the application.

“We never, ever have access to anyone’s funds or to their seed phrases. We do believe that the owners should have the power in their hands, so they can do what they think is best with their assets and trust that they are theirs,” Brambatti added.

To ensure that users can easily navigate the Core blockchain, Element Wallet incorporates user-friendly design strategies to simplify interaction.

Breaking Down Web3 Complexities

Core and Element representatives emphasized that community was at the heart of the blockchain’s success. To further cultivate user engagements, Core DAO focuses on breaking down onboarding barriers and facilitating user experience.

“We’re really focused on simplifying the kind of Web3 complexities that are often found in the space today. As we work closely with the Core DAO and the core team, and as the space evolves, we just find more opportunities to really simplify it and make UX be at the forefront of this,” explained Sean Schireson, Head of Product at Element Wallet.

Element Wallet simplifies Core chain-related activities by providing a unique and comprehensive wallet that meets all user needs.

“The Element Wallet really enhances the user experience on Core chain, since it was built for the Core ecosystem. If you want to buy crypto, swap, non custodially stake your Bitcoin, you could do it all. If you want to chat with people, you could do it on there. So just trying to get the whole community onboarded, so that we could all be on this one Element Wallet and all transact together and just make the experience better for everybody,” explained Dennis.

The Core team created Sparks, a dynamic system for measuring contributions to the Core community’s growth to encourage user participation. Sparks track user activity and engagement within the Core Chain ecosystem. Based on their interactions and involvement, they are awarded to users and their teams.

Daily Spark allocations are distributed based on activity level, with more active users receiving larger amounts. Users can also receive sparks by engaging with the Element Wallet.

“What we want to do is make that entry point feel like a consumer app that you’ve used and loved before. And that’s really our gold element. We’re not trying to necessarily reinvent the wheel, but we’re definitely trying to have a new spin on an otherwise kind of saturated UX market. And so that’s where we’re really focused on there,” concluded Schireson.

This focus on user experience and community engagement aims to facilitate broader adoption and participation in the developing BTCfi sector.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

China Liquidates Seized Crypto to Boost Struggling Treasury

Amid mounting economic challenges and a growing pile of confiscated cryptocurrencies, local governments in China are increasingly liquidating seized digital assets to bolster strained public finances.

The practice raises legal and regulatory questions, especially concerning China’s blanket ban on crypto trading.

China Selling Seized Crypto To Bolster Treasury

China reportedly held around 15,000 Bitcoin (BTC) worth $1.4 billion by the end of 2024. According to River, a Bitcoin investment firm, this places the country among the top 15 global holders of the asset.

However, reports suggest China’s local governments are offloading digital currencies through private firms despite the national crypto ban.

Cas Abbe, a Web3 growth manager, and Binance exchange affiliate, noted on X that the dump in crypto prices may partly stem from these offloading activities.

“Local governments in China are selling seized crypto to top up their treasury. Despite the crypto trading ban in China, local governments are using private companies to offload their holdings. This explains pretty much the dump even before tariff news hit the market,” Abbe noted.

The surge in liquidations comes as authorities grapple with inconsistent policies for handling crypto seized from criminal investigations, which spiked sharply in 2023.

Over $59 billion was tied to crypto-related crimes in China that year. Blockchain security firm SAFEIS reported that more than 3,000 people were prosecuted for offenses ranging from internet fraud to illegal gambling.

Despite Beijing’s ban, local governments have reportedly turned to private firms to offload confiscated tokens. Specifically, they are converting them into cash to fund their treasuries.

Jiafenxiang, a Shenzhen-based technology firm, has sold more than 3 billion yuan ($414 million) worth of digital assets in offshore markets since 2018. Documents reviewed by Reuters link the company to liquidation deals with local authorities in Xuzhou, Hua’an, and Taizhou.

Though practical for cash-strapped regions, the process is legal gray territory. Such practices risk undermining the country’s crypto enforcement regime without clear regulatory frameworks.

“This raises so many questions about transparency. How are they even doing this legally?” noted one analyst in a post.

Experts are now calling for urgent regulatory reforms. These include judicial recognition of crypto as assets and the creation of standardized disposal mechanisms.

Some are even floating the idea of building a centralized national crypto reserve. This mirrors Trump’s administration’s proposals to manage seized assets more strategically.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Is Bitcoin the Solution to Managing US Debt? VanEck Explains

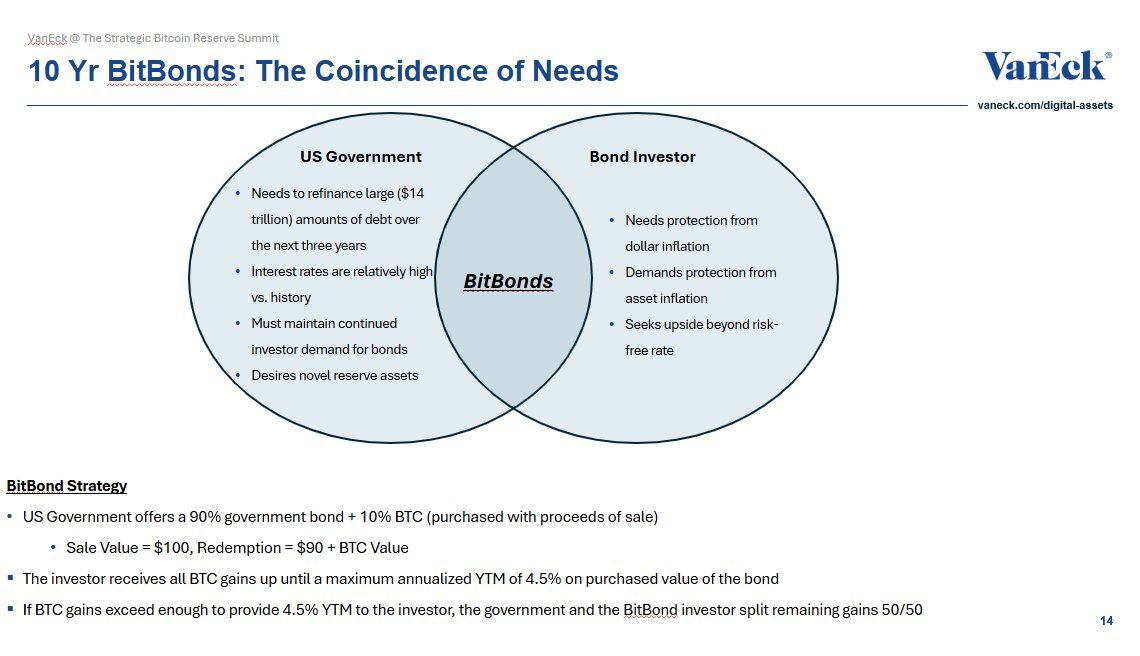

Matthew Sigel, Head of Digital Assets Research at VanEck, has proposed a new financial instrument, “BitBonds,” to help manage the US government’s looming $14 trillion refinancing debt requirement.

The 10-year financial instrument combines traditional US Treasury bonds with Bitcoin (BTC) exposure. This offers a potential solution to the nation’s fiscal concerns.

Can Bitcoin-Backed Bonds Help Solve the US Debt Crisis?

According to Sigel’s proposal, BitBonds’ investment structure allocates 90% of the funds to low-risk US Treasury securities and 10% to Bitcoin, combining stability with the potential for higher returns. Additionally, the government would purchase Bitcoin with proceeds from the bond sale.

Investors would receive all Bitcoin gains up to a maximum annualized yield-to-maturity of 4.5%. Furthermore, the investor and the government would split any additional gains equally.

“An aligned solution for mismatched incentives,” Sigel remarked.

From an investor perspective, Sigel highlighted that the bond offers a breakeven Bitcoin compound annual growth rate (CAGR) between 8% and 17%, depending on the coupon rate. Additionally, investors’ returns could skyrocket if Bitcoin grows at a 30%–50% CAGR.

“A convex bet—if you believe in Bitcoin,” he added.

However, the structure is not without risks: investors bear Bitcoin’s downside while only partially participating in its upside. Lower-coupon bonds may lose appeal if Bitcoin underperforms.

Meanwhile, the Treasury’s downside is limited. Even a complete collapse of Bitcoin’s value would still result in cost savings compared to traditional bond issuance. Yet, this is contingent on the coupon remaining below the breakeven threshold.

“BTC upside just sweetens the deal. Worst case: cheap funding. Best case: long-vol exposure to the hardest asset on Earth,” Sigel stated.

Sigel claimed that this hybrid approach aligns the interests of the government and investors over a 10-year period. The government faces high interest rates and significant debt refinancing needs. Meanwhile, investors seek protection from inflation and asset debasement.

The proposal comes amid growing concerns over the US debt crisis, exacerbated by the recent increase in the debt ceiling to $36.2 trillion, as reported by BeInCrypto. Notably, the Bitcoin Policy Institute (BPI) has also endorsed the concept.

“Building on President Donald J. Trump’s March 6, 2025, Executive Order establishing the Strategic Bitcoin Reserve, this white paper proposes that the United States adopt Bitcoin-Enhanced US Treasury Bonds (“₿ Bonds” or “BitBonds”) as an innovative fiscal tool to address multiple critical objectives,” the brief read.

In the paper, co-authors Andrew Hohns and Matthew Pines suggested that issuing $2 trillion in BitBonds at a 1% interest rate could cover 20% of the Treasury’s 2025 refinancing needs.

“Over a ten-year period, this represents nominal savings of $700 billion and a present value of $554.4 billion,” the authors wrote.

BPI estimates that if Bitcoin achieves a CAGR of 36.6%, the upside could potentially defease up to $50.8 trillion of federal debt by 2045.

These recommendations are part of broader conversations regarding Bitcoin’s potential impact on national finance. Previously, Senator Cynthia Lummis argued that a US Strategic Bitcoin Reserve could halve the national debt. In fact, VanEck’s analysis indicated that such a reserve could help reduce $21 trillion of debt by 2049.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Adoption Grows As Public Firms Raise Holdings In Q1

Public companies have added nearly 100,000 Bitcoin to their balance sheets during the first quarter of 2025, pushing total corporate Bitcoin holdings to a staggering 688,000 BTC worth $56.7 billion. According to data from crypto fund issuer Bitwise, this represents a 16% increase in total crypto holdings by publicly traded companies.

12 New Corporate Buyers Enter The Market

The Bitcoin buying spree wasn’t limited to existing crypto investors. Twelve public companies purchased Bitcoin for the first time during Q1, bringing the total number of Bitcoin-holding public firms to 79.

Hong Kong construction firm Ming Shing led new buyers, with its subsidiary Lead Benefit acquiring 833 BTC through two separate purchases – an initial 500 BTC buy in January followed by 333 BTC in February.

Video platform Rumble ranked as the second-largest new buyer, adding 188 BTC to its treasury in mid-March. In a move that stunned market watchers, Hong Kong investment firm HK Asia Holdings Limited purchased just one Bitcoin in February – a modest investment that still caused its share price to almost double in a single day of trading.

Companies are buying bitcoin, Q1 2025 edition. pic.twitter.com/qZc62N8vu5

— Bitwise (@BitwiseInvest) April 14, 2025

Japanese Firm Acquires At A Discount

While new entrants made headlines, existing Bitcoin holders also strengthened their positions. Japanese investment firm Metaplanet announced on April 14 that it had purchased an additional 319 BTC at an average price of 11.8 million yen (about $82,770) per coin.

This latest purchase brings Metaplanet’s total Bitcoin holdings to 4,525 BTC, currently valued at approximately $383.2 million. The company has spent nearly $406 million (58.145 billion yen) building its crypto stack.

Based on current holdings, Metaplanet now ranks as the 10th largest public company crypto holder worldwide, sitting behind Jack Dorsey’s Block, Inc., which holds 8,480 BTC.

BTC reclaiming the green zone in the last week. Source: Coingecko

Bitcoin Price Recovers After Brief Slump

Bitcoin trades at around $85,787 as of April 15, showing a decent performance over the past 24 hours according to CoinGecko data. The cryptocurrency has gained roughly 2.5% since the end of Q1 on March 31.

The price has bounced back from a brief drop below $75,000 on April 7. That temporary decline came after a broader market selloff triggered by a new round of global tariffs announced by US President Donald Trump.

The growing corporate interest in the top crypto comes as more companies look to diversify their treasury holdings. The combined value of public companies’ Bitcoin rose about 2.3% during the first quarter, reaching nearly $57 billion with BTC priced at $82,400 by quarter’s end.

Featured image from Crews Bank, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market23 hours ago

Market23 hours agoBitcoin Eyes $90,000, But Key Resistance Levels Loom

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Metrics Reveal Critical Support Level – Can Buyers Step In?

-

Market19 hours ago

Market19 hours agoSolana (SOL) Jumps 20% as DEX Volume and Fees Soar

-

Market18 hours ago

Market18 hours agoHedera Under Pressure as Volume Drops, Death Cross Nears

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Adoption Grows As Public Firms Raise Holdings In Q1

-

Market15 hours ago

Market15 hours agoBitcoin Price on The Brink? Signs Point to Renewed Decline

-

Market17 hours ago

Market17 hours agoEthena Labs Leaves EU Market Over MiCA Compliance

-

Market16 hours ago

Market16 hours ago3 US Crypto Stocks to Watch Today: CORZ, MSTR, and COIN