Bitcoin

Peter Schiff Discloses Downside Target For Bitcoin, Downtrend Imminent?

Peter Schiff, a popular critic of Bitcoin and staunch advocate for Gold, has delved into the ongoing debate surrounding BTC’s valuation, predicting a potential downside pressure in the near future and setting his target at the $54,000 price level.

Bitcoin Continues To Face Downside Pressure

Earlier today, Schiff identified a negative pattern on the Bitcoin chart, indicating that the price of the cryptocurrency is likely to decline. He claims that the most recent examination of Bitcoin’s short-term chart demonstrates a shift in the attitudes of the market.

Schiff’s observation was made amid a background of elevated volatility and erratic sentiment, as Bitcoin has been moving in a downward direction over the last several days. The recent disclosure by the economist about the short-term downside objective of Bitcoin has garnered significant interest from the cryptocurrency community.

According to him, the pivotal $60,000, which was observed to be a support level on this shorter-term BTC chart, has turned into a resistance level. As a result, Schiff suggests a negative change in trend due to a short-term head-and-shoulders pattern appearing on the Bitcoin chart.

With the neckline just below $57,000, Schiff highlighted that the head lingers around $60,000, while the shoulder is situated around $58,500. Thus, he has placed his downside target for Bitcoin at the $54,000 level in the short term.

Schiff also voiced concerns about the lack of discussion about the largest cryptocurrency asset from the American business news channel CNBC, following a decrease in Bitcoin Spot Exchange-Traded Funds (ETFs) in the past few days.

Over the past two days, the BTC Spot ETFs have fallen by more than 10%, closing below their market high by about 23%, but yet neither the products nor BTC were talked about by the news channel in the timeframe. Meanwhile, should the Spot BTC ETFs have increased by 10%, the digital asset would have been covered all day.

Peter Schiff has consistently attacked BTC over time. Earlier this month, the economist declared that buyers of BTC Spot ETFs will soon begin to pull out as the market’s volatility overwhelms them.

Given that the coin’s long-term bear market is starting to gather up steam once more, Schiff claims all of the new investors in the funds will be riding along with the wave, prompting his confidence that these investors will bail out soon.

BTC In The Bear Market, Party Is Over

As the market continues to fluctuate, the gold advocate addressed the current state of BTC, noting that the digital asset is in a bear market, despite all the excitement surrounding the spot ETFs.

“Turn out the lights HODLers, the party is over,” he said, claiming that one BTC is currently worth less than 25 ounces, up by 33% in comparison to gold, and down by 23% in the US dollars.

Featured image from iStock, chart from Tradingview.com

Bitcoin

Strategic Bitcoin Reserve Proposed by Brazil’s VP Advisor

Brazil’s Vice President Geraldo Alckmin’s (PSB) chief of staff, Pedro Giocondo Guerra, underscored on Wednesday the importance of establishing a national strategic Bitcoin reserve. Guerra was speaking at the swearing-in ceremony of the new president of the FPBC (Parliamentary Front for Competitive Brazil), Deputy Júlio Lopes (PP-RJ), while representing the government of President Luiz Inácio Lula da Silva (PT).

“Rigorously debating the constitution of a sovereign reserve of bitcoin value is in the public interest and will be decisive for our prosperity. After all, Bitcoin is digital gold, the gold of the internet. It’s a technology that allows us to transmit wealth from one end of the planet to the other quickly and store the fruits of our labor efficiently and securely,” Guerra stated.

Will Brazil Get A Strategic Bitcoin Reserve?

His remarks highlighted Bitcoin’s intrinsic appeal—particularly its digital scarcity and deflationary design, in contrast to fiat currencies that can be printed at will. Guerra noted that an official BTC reserve might bolster the country’s resilience and adaptability, especially amid global economic and geopolitical fluctuations.

Notably, Congressman Eros Biondini (PL-MG) has introduced PL 4501/2024, which would permit the creation of a Sovereign Strategic Reserve of Bitcoins—referred to in the bill as RESBit. According to Biondini, the primary goal is to guard Brazil against currency fluctuations and geopolitical uncertainties by diversifying the government’s international reserves.

The text proposes a limit of 5% of the country’s international reserves—which totaled $366 billion in December—for Bitcoin acquisitions. Should it pass, Brazil would be authorized to invest as much as $18.3 billion in Bitcoin, based on the reserve’s valuation at the time the bill was drafted.

Currently under review by Rapporteur Luiz Gastão (PSD-CE) in the Lower House’s Economic Development Committee, the bill sets forth guidelines for gradual acquisition and emphasizes robust security measures, using cold wallets and advanced AI- and blockchain-based monitoring.

The legislation details how the Central Bank and the Ministry of Finance would jointly manage RESBit, ensuring transparency through regular biannual reports to both the public and Congress. In addition, the text addresses the need for educational and innovation programs, including specialized courses on blockchain, crypto-economics, and cybersecurity, as well as incentives like tax benefits for crypto-related startups.

Related Reading: Trump Endorses Pro-Bitcoin Senator Lummis: ‘Make US The Crypto Capital’

A technical advisory committee composed of experts in blockchain, digital economy, and cybersecurity would also be established to ensure rigorous oversight and to foster collaboration with international regulators and research institutions. The proposal cites global precedents, such as El Salvador’s adoption of Bitcoin as legal tender, the United States’ approval of BTC ETFs, China’s investment in blockchain and digital currency efforts, Dubai’s success in developing a blockchain-friendly business environment, and the EU’s regulatory framework for digital assets.

In its justification section, the bill argues that Brazil is already one of the countries with the highest rate of cryptocurrency adoption, yet government policy has not kept pace with the rapid evolution of this market.

According to the text, “The creation of RESBit will allow Brazil to diversify its international reserves, reducing exposure to foreign exchange fluctuations and geopolitical risks while increasing economic resilience. This measure will also position Brazil as a regional leader in financial and technological innovation, attracting external investment and strengthening our presence in the digital economy.”

At press time, BTC traded at $86,205.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin Bet Grows Bigger: The Blockchain Group Snaps Up 580 BTC

The Blockchain Group, a France-based blockchain solutions firm, recently announced its largest Bitcoin (BTC) purchase to date, acquiring 580 BTC. This marks the company’s third BTC acquisition since it began buying the digital asset in November 2024.

The Blockchain Group Buys 580 Bitcoin

In its most significant BTC acquisition so far, The Blockchain Group has purchased 580 BTC for approximately $50.64 million at an average price of $88,020 per coin. According to the announcement, the purchase was made through its Luxembourg-based subsidiary.

Notably, the acquisition was financed through proceeds raised from a convertible bond issuance announced on March 6. The move aligns with the firm’s Bitcoin Treasury strategy.

To recall, The Blockchain Group made its first BTC purchase in November 2024, acquiring 15 BTC at an average cost of $68,785 per coin. Its second purchase followed in December 2024, when it bought 25 BTC at an average price of roughly $97,692.

Following its latest acquisition, the company’s total BTC holdings now stand at 620 BTC, with a total net asset value of slightly over $54 million at current market prices.

According to data from Yahoo! Finance, The Blockchain Group’s stock (ALTBG.PA) closed today’s trading session at €0.4975 ($0.54), up 3.09% on the day. On a year-to-date basis, the company’s shares have surged by an impressive 65.78%, suggesting that its exposure to BTC has positively impacted its valuation.

The Blockchain Group’s official website states that its pivot to Bitcoin is part of a broader strategy to optimize the use of its excess cash and financial instruments. Since its first BTC acquisition, the company’s stock has risen by 225%.

Corporate BTC Adoption To Grow In 2025

Corporate adoption of Bitcoin is expected to pick up even further in 2025, driven not only by the digital asset’s intrinsic value but also by a favorable regulatory environment under pro-crypto US President Donald Trump’s administration.

Earlier this week, the largest corporate holder of Bitcoin, Strategy, acquired an additional 6,911 coins, pushing its total holdings beyond 500,000 BTC. In the same vein, US-based financial services firm Fold Holdings announced the addition of 475 BTC to its corporate treasury earlier this month.

As corporate adoption grows, several US states have also begun legislative processes to add BTC to their treasuries. For instance, Utah and Kentucky have recently made significant strides with their BTC reserve bills.

Additionally, Mexican billionaire Ricardo Salinas recently revealed that close to 70% of his investment portfolio is allocated to Bitcoin and related assets. At press time, BTC trades at $86,838, down 1.1% in the last 24 hours.

Featured Image from Unsplash.com, charts from Yahoo! Finance and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Will Bitcoin’s Rally Continue or Just Be a Temporary Surge?

Bitcoin (BTC) has shown signs of a relief rally this week, offering a glimmer of hope to investors after the recent market downturn.

Despite this brief uptick, analysts are warning that the upward momentum may not last long.

Will Bitcoin’s Rally Last?

According to data from BeInCrypto, Bitcoin’s price has recovered by 2.0% over the past week. The gains have more than doubled over the fortnight, with the coin appreciating by 5.0%. At the time of writing, the largest cryptocurrency traded at $87,381, representing a slight 0.1% dip over the past day.

Spot Bitcoin exchange-traded funds (ETFs) have also seen inflows for nine consecutive days, according to data from SoSo Value. Since last Friday, the ETFs have collectively attracted $944 million in inflows.

This sustained interest suggests growing confidence among institutional investors. Yet, analysts are unconvinced of the rally’s potential.

In its latest Cryptocurrency Compass newsletter, research firm Fairlead Strategies predicted that Bitcoin’s relief rally could persist for another one to two weeks. However, founder Katie Stockton warned that a price drop may follow.

“Intermediate-term momentum is to downside, and the weekly stochastics are not yet oversold, increasing risk that the rebound is fleeting. We expect the same for most risk assets,” she wrote.

Despite the bearish outlook, Stockton acknowledged short-term positives. Bitcoin’s near-term momentum has improved, and the price still has room to rise before hitting overbought territory. Nonetheless, she cautioned that this window may close by month’s end.

This could potentially trigger a phase of consolidation—or “digestion.” This means that Bitcoin’s upward momentum might slow down or pause for a longer period as the market adjusts and absorbs the recent gains.

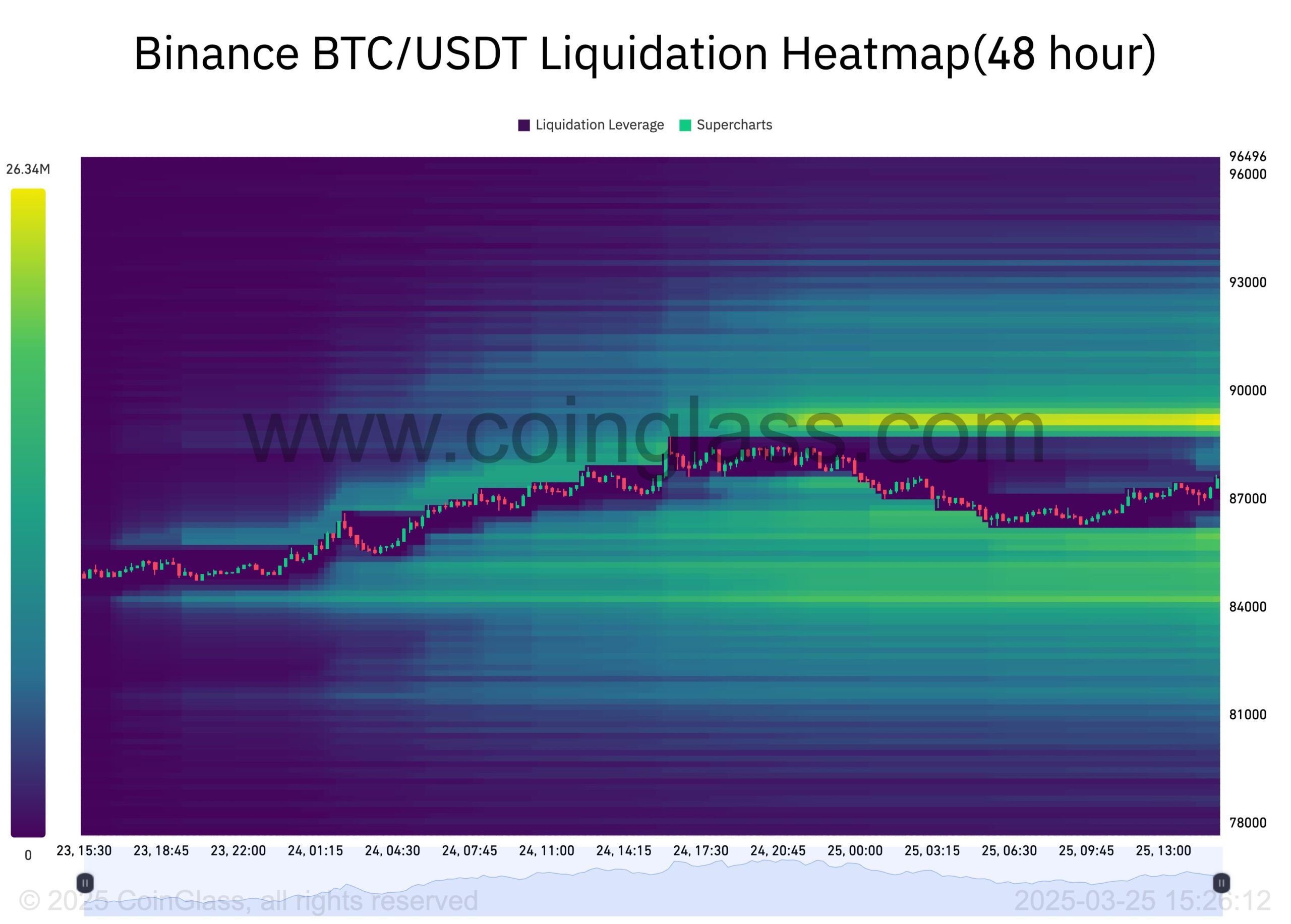

Another analyst also shared a cautious outlook. In a recent post on X (formerly Twitter), Koroush AK estimated Bitcoin’s potential price movements using a liquidation heatmap.

He noted that there’s significant selling pressure around $89,000 (major supply) and buying interest around $85,000 (demand).

“The idea of a HTF dead cat bounce is still valid if price reverts at the highs around the ≈$90K key zone,” he wrote.

For context, a “dead cat bounce” refers to a temporary recovery or brief upward movement in the price of an asset after a prolonged downtrend. This is followed by a continuation of the downtrend. However, he added that the bearish scenario would be nullified if Bitcoin manages to break past the resistance level.

Meanwhile, changing macroeconomic conditions are also a growing concern, particularly with US President Donald Trump’s tariff announcements scheduled for April 2. In their recent report, K33 Research stressed that although markets are currently stable, the upcoming tariff decisions could trigger considerable volatility in the market.

“Tariffs remain the primary producer of market-moving headlines, rendering most traders risk-averse as we approach a big day of tariff announcements on April 2,” the report read.

The report further advised caution and recommended avoiding leverage due to the anticipated tariff-induced volatility.

Recently, BeInCrypto also explored how Trump’s tariff plans might impact crypto markets. High tariffs could pressure risk assets like Bitcoin, potentially mirroring the market’s reaction in February. Conversely, if tariffs are delayed or applied selectively, investor fears may ease. This, in turn, could lead to a potential recovery in crypto prices.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoHow the LIBRA Scandal is Undermining Milei’s Trust in Argentina

-

Market22 hours ago

Market22 hours agoPaul Atkins Reveals $6 Million in Crypto Exposure

-

Market21 hours ago

Market21 hours agoWill Bitcoin Hit $90,000 in April? Analysts Weigh In

-

Market17 hours ago

Market17 hours agoShould You Buy Movement (MOVE) For April 2025?

-

Altcoin17 hours ago

Altcoin17 hours agoDogecoin Price Prediction: Here’s What Needs To Happen For DOGE To Recover Above $0.3

-

Altcoin23 hours ago

Altcoin23 hours agoBonk Inu Acquires Exchange Art Marketplace, BONK Price To Rally?

-

Regulation22 hours ago

Regulation22 hours agoUS SEC Chair Nominee Paul Atkins To Prioritize Regulatory Clarity For Crypto Industry

-

Market18 hours ago

Market18 hours agoCan Cardano (ADA) Reach Back to $1 in April?