Bitcoin

OKX Chief Marketing Officer Highlights Economic Dangers of a US Strategic Bitcoin Reserve

Bitcoin enthusiasts have long touted the creation of a strategic Bitcoin reserve as a hedge against inflation that can reduce the national debt and reinforce the United States’ position as a global financial leader.

Its implementation could also unleash several damaging effects on the US economy, with consequences rippling across the globe. BeInCrypto spoke with Haider Radique, the Chief Marketing Officer at OKX Exchange, to break down the risks of creating a strategic Bitcoin reserve.

Strategic Bitcoin Reserves Grow in Popularity

The concept of a strategic Bitcoin reserve has gained notable popularity over the years, both in the United States and worldwide.

A strategic reserve is a stock of crucial resources acquired by the federal government that can be used to address significant supply disruptions. Many crypto enthusiasts have been campaigning for governments to adopt Bitcoin as a strategic reserve.

In the United States, 15 states have already introduced or passed bills to do just this. Republican Wyoming Senator Cynthia Lummis was one of the first politicians to introduce this type of legislation at a federal level.

Lummis calls for the US Treasury to acquire one million Bitcoin over five years in her proposed BITCOIN Act. The Bitcoin reserve would be kept intact for at least 20 years.

Countries like Germany, Switzerland, Russia, Brazil, and Poland have also taken steps in the same direction. However, several major players in the finance industry fear intense economic instability and pervasive market volatility if a strategic Bitcoin reserve is created.

This fear is particularly relevant if the United States were to establish such a reserve, given its role as the custodian of global trade and issuer of the world’s reserve currency.

“On its face, the idea of a Bitcoin National Reserve seems like a good one – it would serve as an endorsement of Bitcoin by the United States, and it would certainly have the potential to ignite markets in the short term. But if you look under the hood, there may be a number of downsides that should cause the industry to pause and reflect on potential negative long-term consequences,” Radique told BeInCrypto.

Understanding how a reserve works is vital to comprehend the associated risks.

Bitcoin Stockpiles vs. Strategic Bitcoin Reserve

With Donald Trump as the new US president, Bitcoin enthusiasts are bracing themselves for a real shot at creating the long-awaited reserve.

Two weeks ago, Trump signed an executive order to establish a national digital stockpile. The order called for the creation of a working group to explore this possibility. The group has until July to submit a report on the criteria for such a stockpile.

Some participants in the crypto community were disheartened by this move, given that the nature of the order was particularly distinct from a Bitcoin reserve. While the concept of a stockpile derives from seized assets mainly produced from illicit activity, a reserve implies purchasing additional Bitcoin.

The United States already has the biggest Bitcoin stockpile in the world. The federal government holds at least 198,800 BTC acquired through government seizures, currently valued at approximately $19 billion. Countries that trail behind it are China, the United Kingdom, El Salvador, and Ukraine.

A Bitcoin reserve, by contrast, would require the purchase of more Bitcoin. Lummis proposes this approach in her BITCOIN Act. According to her plan, Bitcoin would be directly linked to the US dollar in order to bolster the currency. Essentially, this vision entails a monetary system where Bitcoin takes on an active role.

The pressing need to introduce such a drastic change to the United States’ current monetary system remains unclear.

Debate Over Bitcoin’s Role as a Reserve Asset

Returning to the definition of a strategic reserve, the federal government purchases these commodities in times of economic need. Most economists refer to the Strategic Petroleum Reserve as a key example of the concept.

In 1975, President Gerald Ford created the reserve when Arab members of the Organization of Petroleum Exporting Countries (OPEC) imposed an oil embargo against the United States that sent shockwaves throughout the American economy.

The legislation mandated the storage of up to one billion barrels of petroleum, recognizing its critical role in the economy. Without petroleum, economic activity would cease.

These reserves continue to serve a critical purpose. In response to the Russian invasion of Ukraine, President Biden recently tapped into these reserves to ease the strain on energy prices.

On the other hand, Bitcoin does not serve a critical purpose that warrants this sort of urgent stashing, nor is its use crucial to the functioning of the US economy. Its role as a strategic asset remains largely unclear.

Furthermore, acquiring large amounts of Bitcoin would likely lead to significant market volatility rather than economic stability. If the United States were to purchase large quantities, it would quickly reduce the supply available on the market.

“If the US government decided to acquire large swathes of Bitcoin, the short term liquidity in markets would be constrained, which could entail massive volatility in both directions. We should remember that the vast majority of Bitcoin addresses –nearly 72% according to CoinMarketCap– are long-term holders of more than one year. A mass acquisition of Bitcoin could therefore constrain liquidity further in the short term,” Radique explained.

These sharp movements in Bitcoin supply would also worry investors.

Impact on Dollar Confidence

If the United States were to create a strategic Bitcoin reserve, investors could interpret this as the federal government deciding to back the US dollar with the digital asset rather than gold. In other words, the US would send signals of a loss of confidence in the current dollar-based system.

In a recent opinion article, Nic Carter used this argument to advocate against creating a Bitcoin reserve.

“The US considering a near term abandonment of the current, relatively stable monetary system and replacing it with a monetary standard not based on gold, but a highly volatile, emerging asset, would cause utter panic among its creditors. In my view, if we even got close to a Lummis-style reserve, markets would anticipatorily start to go berserk, and Trump would be forced to withdraw the policy,” he stated.

The same effect would occur if the United States chose to sell part of its Bitcoin reserves.

Liquidation Risks

If the United States were to purchase additional Bitcoin, it would also choose when to sell it.

“Despite the emergence of bipartisan support for crypto in the US political system recently, government policy can change quickly. Therefore, as circumstances change over time, the concentration of large amounts of Bitcoin on a country’s balance sheet could represent a liquidation risk,” Radique told BeInCrypto.

Previous instances where governments sold portions of their Bitcoin stockpile holdings have shown how such actions can significantly impact the market.

“We only need to look to last year, when the German government sold around 50,000 BTC, to see what such a move could do to markets. This is often cited as a key downside of a strategic Bitcoin reserve by critics,” Radique added.

Germany sold all of its Bitcoin holdings last July to comply with a federal law that mandates the liquidation of seized digital assets. The large Bitcoin sell-off in a short period caused the price of Bitcoin to drop.

In November, a similar situation occurred in the United States when the government transferred over $2 billion in Bitcoin to third-party wallets. This move sparked price drops and raised concerns among investors about potential future auctions.

Questions would also arise over the implications of the federal government’s ownership over such large amounts of Bitcoin.

Concerns Over Centralization

For many, the idea of a strategic Bitcoin reserve could appear to conflict with one of Bitcoin’s core principles: decentralization.

This philosophy, which lies at the heart of Bitcoin, ensures that no single entity can control the entire network. However, if the US government were to start acquiring Bitcoin in large volumes, it could spark concerns about centralization.

If the US Treasury were to control a significant portion of the Bitcoin supply, it could influence the market. Such control might allow the government to impact Bitcoin prices, which goes against its decentralized nature.

Overregulation risks also arise as institutional adoption of digital assets expands across public and private sectors.

“It is our collective responsibility as Bitcoiners to advocate for this technology to be as accessible as possible while preserving its original philosophy and peer-to-peer utility,” said Radique.

As the debate over the adoption of a strategic Bitcoin reserve continues, a measured approach will benefit its implementation.

The Case for Patience

One reassuring aspect of this ongoing debate is the understanding that expediting the process might be unnecessary. Since Bitcoin is not an essential commodity for the proper functioning of the US economy, establishing a strategic reserve is not an immediate priority.

Bitcoin has existed for less than two decades. Allowing the market more time to mature also reduces the asset’s volatility in the long run.

“Bitcoin has gone from a little-known cypherpunk invention to a global cultural phenomenon and accessible, institutionalized asset in a remarkably short time,” Radique explained.

By taking a wait-and-see approach, Bitcoin could evolve into a more reliable and liquid asset, making it a viable option for the US government to include in its portfolios in the future.

The post OKX Chief Marketing Officer Highlights Economic Dangers of a US Strategic Bitcoin Reserve appeared first on BeInCrypto.

Bitcoin

Is Bitcoin Ready for Another Surge?

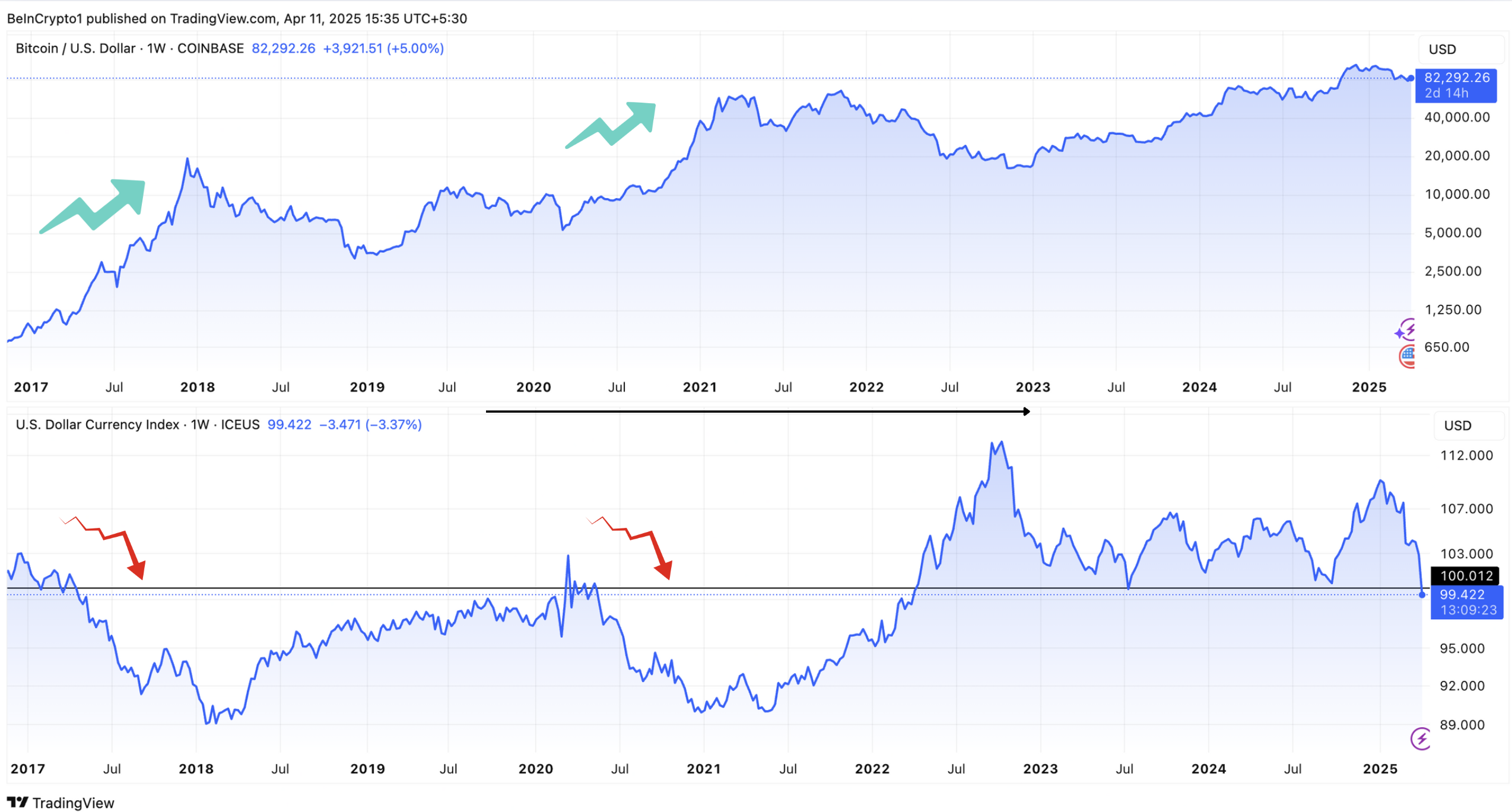

The US Dollar Index (DXY), which measures the dollar’s value against a basket of foreign currencies, has dropped to a three-year low. The decline contrasts with gold’s performance, which hit an all-time high of $3,220 amid rising trade war tensions.

Yet, DXY’s dip has sparked optimism among cryptocurrency investors. Many see the weakening dollar as a bullish signal for Bitcoin (BTC), which has recently shown signs of modest recovery.

Will Bitcoin Rally Following the DXY Index’s Fall?

Data shows that the DXY index dropped by 1.5% in the last 24 hours. As of press time, it stood at 99.4, marking its lowest level since April 2022. The decline is part of a broader trend in 2025, with the DXY down 8.3% since January.

“The US dollar index dropped to its lowest level in nearly three years amid capital outflows from American assets. Escalating trade tensions and growing concerns over broader economic fallout, particularly for the US, have weighed heavily on market sentiment,” CryptoQuant’s Alex Adler told BeInCrypto.

Notably, the index’s fall below 100 marks a critical threshold. Historical data highlights a strong correlation between a declining DXY and substantial Bitcoin price surges.

The last two times the DXY fell below the 100 mark—in April 2017 and May 2020—Bitcoin experienced significant, months-long rallies. These substantial increases have led to speculation that history could repeat itself. If it does, Bitcoin could potentially be poised for another major surge.

Interestingly, Bitcoin has already shown signs of recovery after the 90-day tariff pause. The largest cryptocurrency reclaimed the $80,000 level, signaling renewed investor confidence. According to BeInCrypto data, Bitcoin appreciated by 0.8% over the past 24 hours. This reflected minor but positive gains that suggest momentum could be building.

In fact, the market watchers on X (formerly Twitter) share a similar outlook.

“Weak dollar is going to be a surprising tailwind for emerging markets this year that wasn’t on anyone’s bingo card,” a user wrote.

Meanwhile, an analyst observed that the US dollar’s decline has occurred despite the Federal Reserve’s failure to reduce interest rates or implement quantitative easing (QE).

“Traditionally, DXY going down is very bullish for BTC,” he said.

The analyst also highlighted a notable bearish divergence on the charts. Thus, he predicted that the dollar could potentially drop to 90, signaling a further decline in its value.

Similarly, another analyst described DXY’s decline as “one of the best anticipated macro moves ahead.”

“Each time this has happened in the past, it resulted in a massive bull market for Bitcoin, Crypto, and stocks,” Jackis remarked.

He also acknowledged that the markets have been slow to react, attributing this delay to a lag of more than three months. Additionally, he noted that the ongoing bond situation between China and the US, driven by escalating trade tensions, is contributing to this slow reaction.

Yet, he believes this situation will either be resolved through a deal between the two countries or the Federal Reserve will intervene by buying long-term bonds to stabilize the market. Now, the coming weeks will be crucial to determine whether Bitcoin will actually enter another bull run or falter under geopolitical tensions and broader market shifts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Over $2.5 Billion in Bitcoin and Ethereum Options Expire Today

Crypto markets will witness over $2.5 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire today.

Traders are particularly attentive to this event because it has the potential to influence short-term trends through the volume of contracts due for expiry and their notional value. Examining the put-to-call ratios and maximum pain points can provide insights into traders’ expectations and possible market directions.

Bitcoin and Ethereum Options Expiring Today

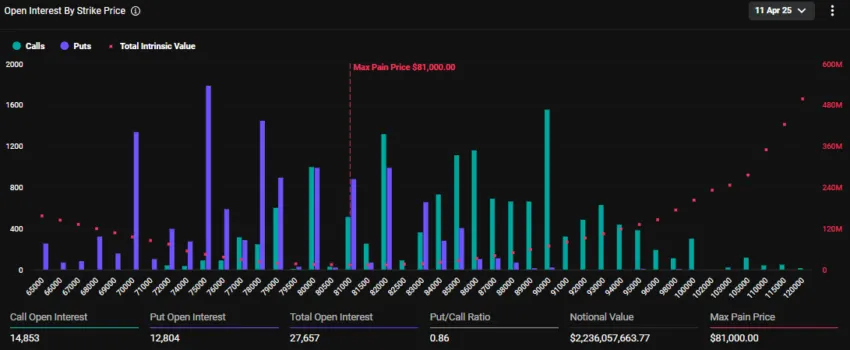

The notional value of today’s expiring BTC options is $2.23 billion. According to Deribit’s data, these 27,657 expiring Bitcoin options have a put-to-call ratio of 0.86. This ratio suggests a prevalence of purchase options (calls) over sales options (puts).

The data also reveals that the maximum pain point for these expiring options is $81,000. In crypto options trading, the maximum pain point is the price at which most contracts expire worthless. Here, the asset will cause the greatest number of holders’ financial losses.

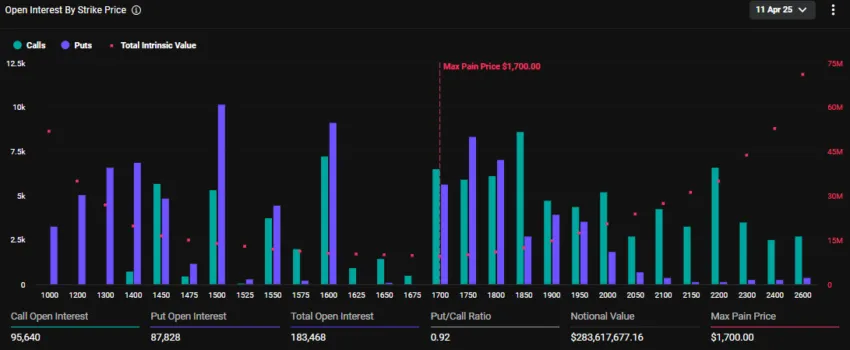

In addition to Bitcoin options, 183,468 Ethereum contracts are set to expire today. These expiring options have a notional value of $283.6 million and a put-to-call ratio of 0.92. The maximum pain point is $1,700.

The current market prices for Bitcoin and Ethereum are below their respective maximum pain points. BTC is trading at $80,622, while ETH sits at $1,543.

“With recent market volatility and ongoing tariff developments, how do you think these expiries will impact price action?” Deribit posed.

Deribit is a crypto options and futures exchange. Indeed, crypto markets are reeling from massive volatility induced by the trade war chaos following President Trump’s tariffs. Meanwhile, Cardano founder Charles Hoskinson says future tariffs will be ineffective on crypto.

He thinks that tariffs are already priced and that future announcements will be a ‘dud’ for the crypto market.

Traders Brace for Extended Weakness as Call Premium Fades Until September

Elsewhere, analysts at Deribit note a shift in crypto options, with short-term dips still bringing put demand. Meanwhile, the call premium is further out of the curve and fades.

“You now have to look all the way to September before calls retake the skew. Traders might be bracing for extended weakness,” Deribit noted.

This suggests traders might be bracing for extended weakness in the crypto market. A fading call premium, where the implied volatility (IV) of calls drops relative to puts, suggests that traders are less optimistic about price increases in the near to medium term.

A negative or reverse volatility skew, where OTM puts ((out-of-the-money puts) have higher IV than OTM calls ((out-of-the-money calls), is common in equity markets when investors fear price drops.

This pattern appears to play out in the crypto options market, reflecting heightened concerns about downside risks. Analysts at Greeks.live note that BTC’s IV has declined significantly and is now largely holding nearly 50% across all maturities.

On the other hand, ETH’s IV has maintained a higher level, with short to medium-term volatility holding near 80%. Selling ETH options in the short term would be a good trade for traders.

Global economic uncertainty, including the US-China tariff war, has dampened risk appetite. Crypto’s inherent volatility could also be fueling this cautious outlook.

“Sentiment was more panicky this week, with Trump’s frequent switching of tariff policies making the market extremely risk averse,” analysts at Greeks.live wrote.

The Greeks.live analysts agree with Deribit’s expectations of extended weakness. However, unlike Hoskinson, they expect continued uncertainty and volatility in the market for a long time.

For traders, this suggests a need for hedging strategies, like buying puts or diversifying into stablecoins.

“Cryptocurrencies are currently suffering from a lack of new incoming money, a lack of new narratives, and a more subdued investor sentiment. In this worse market of bulls to bears, the probability of a black swan will be significantly higher, and buying some deep vanilla puts would be a good choice,” Greeks.live analysts concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Holders are More Profitable Than Ethereum Since 2023

New data from Glassnode suggests that Bitcoin’s MVRV (Market Value to Realized Value) has been higher than Ethereum’s for 812 consecutive days. This means that the average BTC investor has accumulated much larger profits than their ETH counterpart since 2023.

Due to recent losses, Ethereum’s MVRV actually fell below 1.0, suggesting that the average investor has lost money. It may be undervalued and well-posed for a resurgence, but this will take time.

Bitcoin vs Ethereum: Which is More Profitable?

Despite a few recent market turmoils, the price of Bitcoin is doing reasonably well right now. Although much of its gains since Trump’s election have been wiped out, its pre-election value spent most of 2024 at a shelf near its previous all-time high.

According to new data from Glassnode, Bitcoin’s investor profitability is far above Ethereum’s.

“Since November 2022 (FTX collapse), Bitcoin’s realized cap has grown by $468 billion (+117%), while Ethereum’s increased by just $61 billion (+32%). Bitcoin investors have held consistently larger unrealized profits than #Ethereum holders since January 2023. BTC investor profitability has exceeded ETH for 812 consecutive days – an all-time record,” Glassnode said.

Glassnode came to these conclusions by analyzing both tokens’ MVRV and their ratio of market value to realized value. This metric compares the listed price of Bitcoin and Ethereum to the actual price at which these tokens were most recently traded.

Despite maintaining similar MVRVs for a prolonged period, Bitcoin is plowing well ahead today:

While Bitcoin has been more volatile than Ethereum, the altcoin has seen a much smaller uptick during bullish cycles. For instance, in the latest bull run between October and December 2024, Bitcoin surged by nearly 70%.

In the same period, Ethereum’s price increase was less than 50%. Yet, if we look at the drop during the current market downturn, BTC lost 3% in the first week of April, while ETH lost over 15%.

Meanwhile, the altcoin’s investor sentiment is also dropping. Major whales who HODL’ed the token for many years are now selling their ETH holdings.

Also, the average Bitcoin holder enjoys an MVRV of around 2.0, meaning that they have huge unrealized gains. Most of their counterparts have an MVRV below 1.0, signifying that they have lost money. These data points are concerning, especially for the median ETH holder.

However, there’s a silver lining. Ethereum recently fell to a yearly low, but there’s also a strong uptick of new investors. New developments, like the SEC approving ETH ETF options trading, could spur a recovery.

In other words, Ethereum may be highly undervalued and, therefore, an attractive investment.

Still, for the time being, Bitcoin holders are in a much better position than ETH holders. Ethereum is still the second-largest cryptoasset by market cap, and it can always make a comeback. This will almost certainly pose a significant challenge.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoBinance, Trade Wars, Ripple and SEC

-

Regulation20 hours ago

Regulation20 hours agoUS Senators Reintroduce PROOF Act To Set Reserve Standards for Crypto Firms

-

Market20 hours ago

Market20 hours ago3 Altcoins to Watch for Binance Listing This April

-

Market16 hours ago

Market16 hours agoThis is Why The Federal Reserve Might Not Cutting Interest Rates

-

Market23 hours ago

Market23 hours agoHow You Can Find Altcoin Winners Early

-

Market22 hours ago

Market22 hours agoInvestors Shift to Crypto, Gold, and Equities Amid Tariff Volatility

-

Market14 hours ago

Market14 hours agoCrypto Whales Are Buying These Altcoins Post Tariffs Pause

-

Market13 hours ago

Market13 hours agoBinance and the SEC File for Pause in Lawsuit