Bitcoin

Move Over Bitcoin, Robert Kiyosaki Advocates For Ethereum Investment

In a recent episode on the popular podcast ‘The Rich Dad Channel,’ Robert Kiyosaki, the author of the renowned book “Rich Dad Poor Dad,” advocated for crypto investments, specifically Ethereum and Bitcoin. The financial expert has shed light on the diminishing value of the United States Dollar (USD), emphasizing the potential onset of a market crash.

Ethereum To Serve As Hedge Against Currency Depreciation

During the podcast, speaking with Andy Schectman, the President and owner of Miles Franklin, precious metals, Kiyosaki discussed the importance of investing and saving in digital currencies, suggesting that cryptocurrencies could be a possible hedge against risks associated with the fiat currencies, particularly the US dollar.

The financial expert, who has been a long-time advocate of digital currencies, has consistently encouraged investors to allocate funds to crypto assets in order to safeguard their wealth against inflation and other economic conditions.

While acknowledging his limited understanding of Bitcoin, the world’s largest cryptocurrency, Kiyosaki also expressed his support of Ethereum, as well as other precious metals like gold and silver during his podcast. He relayed his belief that the declining value of the US dollar will further deteriorate over time as the debt crisis worsens.

Furthermore, Kiyosaki disclosed that he avoids saving his funds in fiat currency, emphasizing that “savers were losers.” Additionally, he revealed that he started saving Bitcoin approximately 10 years ago and has more recently expanded into Ethereum.

The financial expert reiterated his skepticism regarding the credibility of the US dollar, branding it as “fake,” and advocated for the broader financial community to diversify assets into tangible resources such as gold and silver, as well as digital currencies like Ethereum and Bitcoin.

Moreover, Kiyosaki stressed that there was no need for the crypto community to debate the relative value of Bitcoin over gold or silver. He emphasized that the crucial point was diversifying into a valuable asset that would not depreciate like the US dollar.

“Don’t save money, fake money (US dollar, Euro, Yen, Peso) goes down in value. Save gold, silver, Bitcoin, real money that goes up in value, especially in a market crash,” Kiyosaki stated in an X (formerly Twitter) post.

Kiyosaki Loses Faith In The US Dollar

In the podcast, Kiyosaki declared that he had lost faith in the US dollar, citing market vulnerabilities and crippling debts totalling trillions of dollars. The financial author disclosed in an X post in late April that the American economy was currently experiencing a depression.

He revealed that the economy had witnessed subpar growth in recent years, with growth rates of only 3.4% and 1.6% in Q4 of 2023 and Q1 of 2024, respectively. Kiyosaki also cautioned that the broader market crash had commenced, emphasizing that “crashes were the best time to get rich,” and urging investors to capitalize on the opportunity by investing when prices have bottomed.

ETH price makes its way above $3,000 | Source: ETHUSD on Tradingview.com

Featured image from Inside Bitcoins, chart from Tradingview.com

Bitcoin

Solana, Bitcoin in Texas, and Initia

Several top crypto news stories are in the lineup this week in crypto, spanning various ecosystems with the potential to drive volatility.

This week, traders looking to capitalize on event-specific volatility should monitor the following developments.

This week, the Solana Community Conference, or Breakpoint, is among the top crypto news stories. It kicks off on April 25 and is Solana’s flagship gathering of developers, investors, and innovators.

Historically, Solana Breakpoint is a stage for major announcements, such as new project launches, partnerships, or technological advancements. In recent years, key announcements in similar gatherings have included the Solana Seeker phone or the Firedancer validator client.

According to Solscan data, Solana’s ecosystem boasts nearly 4 million active wallets. Meanwhile, DefiLlama data shows up to $7.37 billion in total value locked (TVL). With these numbers, the Solana community conference could drive positive sentiment for SOL, which was trading at $141.05 at press time.

Traders should brace for potential price volatility, as positive news could spark short-term spikes. In the same way, any underwhelming news or network concerns, like past outages, might temper enthusiasm.

Texas Bitcoin Reserve Hearing

Another top crypto news story this week concerns a strategic crypto reserve. On April 23, Texas will hold a strategic Bitcoin reserve hearing, marking a significant event given the state’s pro-crypto stance.

The bill, introduced four months ago, passed the committee with a 9-0 vote and received senate approval with 80% support. Similarly, Dan Patrick, Lieutenant Governor for the State of Texas, listed Bitcoin Reserve as a top priority for 2025.

“My statement announcing the first round of top 40 priority Bills for the 2025 legislative session,” he shared on X (Twitter) in January.

Against these backdrops, the Wednesday hearing could clarify Texas’s approach to institutional Bitcoin adoption. This could set a precedent for other states or federal policy.

A favorable outcome might bolster Bitcoin’s legitimacy, driving demand from institutional investors and positively influencing the BTC price.

Initia’s Mainnet and INIT Token Launch

Also in the headlines, this week in crypto, Initia’s mainnet launch and its token, INIT, debut on Thursday, April 24. This comes after the network revealed a 50 million token airdrop three weeks ago.

The Thursday event will mark a key milestone for the layer-1 blockchain, which is focused on interoperability and user experience. The launch could attract attention from decentralized finance (DeFi) and cross-chain enthusiasts, as Initia aims to simplify dApp interactions.

For traders, INIT’s initial price action will be critical, as new token launches often experience high volatility due to speculative trading.

“Initia INIT Binance Spot Listing Date Announced! Listing on: 24th April 2025. Mainnet will also officially launch on the same day. Airdrop claim date and exact time are yet to be announced,” the network stated recently.

Investors should evaluate Initia’s partnerships and developer adoption, as its success hinges on ecosystem growth.

Injective’s Lyora Mainnet Upgrade

Injective’s Lyora mainnet upgrade, scheduled for Tuesday, April 22, aims to enhance network performance and transaction speed. It would strengthen its position as a DeFi-focused layer-1 chain.

“The Injective Lyora Mainnet is nearly here! Vote today to dramatically enhance Injective infrastructure, performance, and transaction speeds. The official launch is on April 22,” Injective said.

This upgrade could improve user experience and attract developers to Injective’s ecosystem, particularly for derivatives and trading platforms.

Traders should watch INJ’s price for short-term momentum, as successful upgrades often drive positive sentiment.

At the same time, investors should consider Injective’s growing TVL (total value locked) and partnerships, like its collaboration with Sonic for AI agent platforms, as indicators of long-term potential.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

US Economic Indicators to Watch & Potential Impact on Bitcoin

Several US economic indicators are in the pipeline this week, with potential implications for Bitcoin and crypto.

US macroeconomic data have broadly influenced sentiment in the cryptocurrency market over the past several months. Therefore, it is imperative that traders and investors adjust their portfolios and align their trading strategies to capitalize on key economic events.

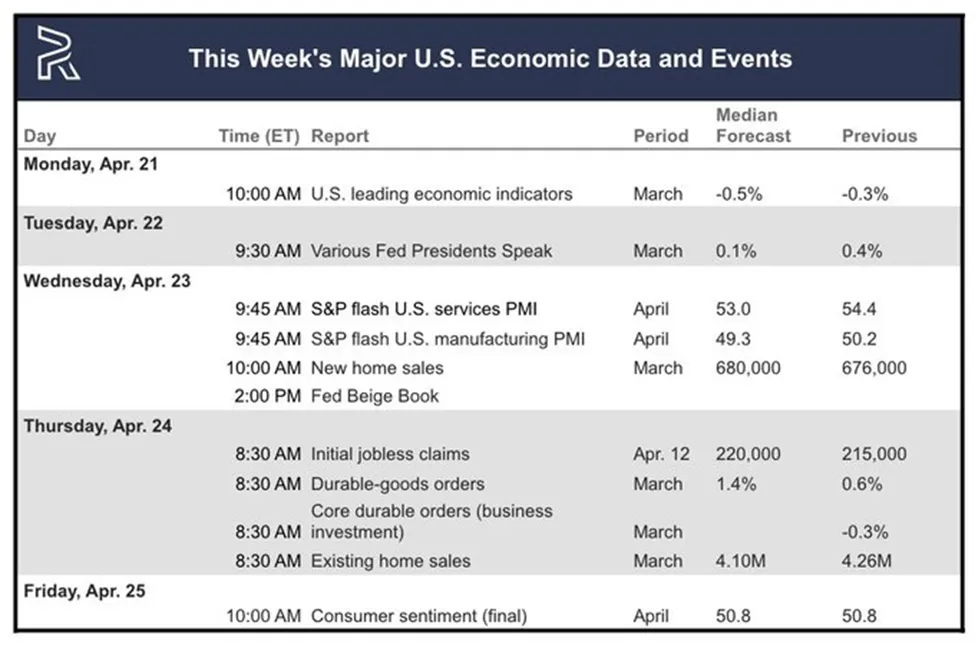

US Economic Events This Week

Several factors, including macroeconomic sentiment, monetary policy expectations, and Bitcoin’s growing narrative as a hedge or risk asset, influence Bitcoin’s price dynamics. These make the following indicators particularly relevant this week.

US Leading Economic Indicators

The first US economic indicator that could influence Bitcoin price is March’s leading economic indicator, due today, Monday, April 21.

The Conference Board Leading Economic Index (LEI), last reported for February 2025, declined by 0.3% month-over-month (MoM) after a revised 0.1% increase in December 2024.

This drop, driven by pessimistic consumer expectations and weaker manufacturing orders, continued a trend of negative signals. However, the six-month growth rate is improving, suggesting less severe headwinds than in 2024.

There is a median forecast of a 0.5% decline for the March report, versus a consensus of -0.6%. While these data points to economic slowdown, stabilizing trends and a projected 2.0% GDP growth for 2025 offer some optimism.

However, policy uncertainties, such as Trump’s tariffs, could exacerbate risks. For Bitcoin, declining LEI may dampen risk appetite, pushing investors toward safer assets like bonds and pressuring prices in the short term.

Conversely, Bitcoin’s “digital gold” narrative could gain traction if economic uncertainty fuels distrust in fiat systems. However, this is less likely unless broader trade tensions or policy shocks amplify the effect.

Services PMI

The S&P Global US Services PMI for March 2025 climbed to 54.4 from 51.0 in February, signaling strong expansion in the services sector. This rise, paired with a composite PMI 53.5, reflects resilient consumer demand.

This strength bolsters the US dollar, reducing expectations for Federal Reserve (Fed) rate cuts, which could challenge Bitcoin’s appeal. A stronger dollar and higher yields typically weigh on Bitcoin, as seen in past cycles when real yields rise.

However, rising input costs and tariff concerns temper business confidence. For the April Services PMI, the median forecast is 53.0.

Strong services activity may support broader risk-on sentiment, potentially lifting Bitcoin if equity markets rally, given its occasional correlation with indices like the Nasdaq.

Still, tariff uncertainties could cap any negative pressure, keeping the impact neutral to slightly bearish, as dollar strength overshadows marginal risk-on gains.

Manufacturing PMI

In contrast, the S&P Global US Manufacturing PMI for March 2025 fell to 50.2 from 52.7, hovering near stagnation. Meanwhile, the ISM Manufacturing PMI contracted to 49.0 from 50.3, with new orders, production, and employment declines.

This weakness, consistent with October 2024’s ISM reading 46.5, reflects high interest rates, weak global demand, and tariff-related uncertainty.

Moody’s Analytics and Statista highlight manufacturing’s struggles, warning of broader slowdown risks, especially with trade policy volatility under the Trump administration.

For Bitcoin, weak manufacturing data signals reduced risk appetite, likely exerting downward pressure, particularly given its equity market correlation.

While a sharp manufacturing decline could theoretically spur rate-cut expectations, persistent inflation and tariff-driven cost pressures make this unlikely. The outlook here is bearish, as fears of economic slowdown dominate.

“S&P Global Services/ManufacturingPMI (Wednesday): The pulse of the economy. Watch for a dip or rise in the numbers…it could hint at whether the recovery is running out of gas or shifting into overdrive,” one user remarked.

Initial Jobless Claims

Initial Jobless Claims for the week ending April 19 recorded 215,000, down from 223,000 the week before.

It indicates a slight improvement but still reflects a labor market under pressure, suggesting ongoing challenges. High interest rates, cautious business investment, and uncertainties surrounding tariff policies likely drive this sentiment by eroding employer confidence.

“…66% of Americans expect higher unemployment in the next 12 months, the highest share since the Great Financial Crisis. Such sharp spikes have never occurred outside of recessions. The job market is set to get worse pretty quickly,” one analyst noted recently.

Nevertheless, despite reduced hiring and economic pressures, the decline suggests some layoff stabilization.

Analysts note that lower claims could ease concerns about rapid deterioration, persistent inflation, and policy uncertainties, which limit expectations for Fed rate cuts.

Meanwhile, jobless claims are a critical driver of Bitcoin sentiment. The modest drop in claims may temper economic weakness signals. If claims continue to decline significantly, sparking hopes of monetary easing, Bitcoin could benefit from increased liquidity and lower yields.

Consumer Sentiment

Consumer Sentiment, as measured by the University of Michigan’s index, was 50.8 in March 2025. This was a modest drop from February’s reading, reflecting tariff-related pessimism and inflation fears despite solid economic conditions.

Preliminary March data suggests a reading of 50.8, with sentiment still sour, per TradingEconomics estimates.

“US consumer sentiment is lower than in the great financial crisis. Consumer sentiment fell to 50.8, the 2nd-lowest level in history. The sentiment is lower than during every US recession over the last 50 years…This is a crisis,” a global markets investor noted.

Consumer sentiment is a gauge of retail investor confidence, critical for Bitcoin’s retail-driven market. Lower sentiment could sap enthusiasm for speculative assets, pushing Bitcoin lower, especially if risk-off sentiment dominates.

Conversely, if sentiment stabilizes or tariff fears ease, Bitcoin could ride a risk-on wave, though this seems unlikely given current trends.

The probable effect is bearish, as declining confidence aligns with broader economic caution.

BeInCrypto data shows Bitcoin (BTC) was trading for $87,424 as of this writing. This represents a modest 2.66% gain in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Here Are The Bitcoin Levels To Watch For The Short Term

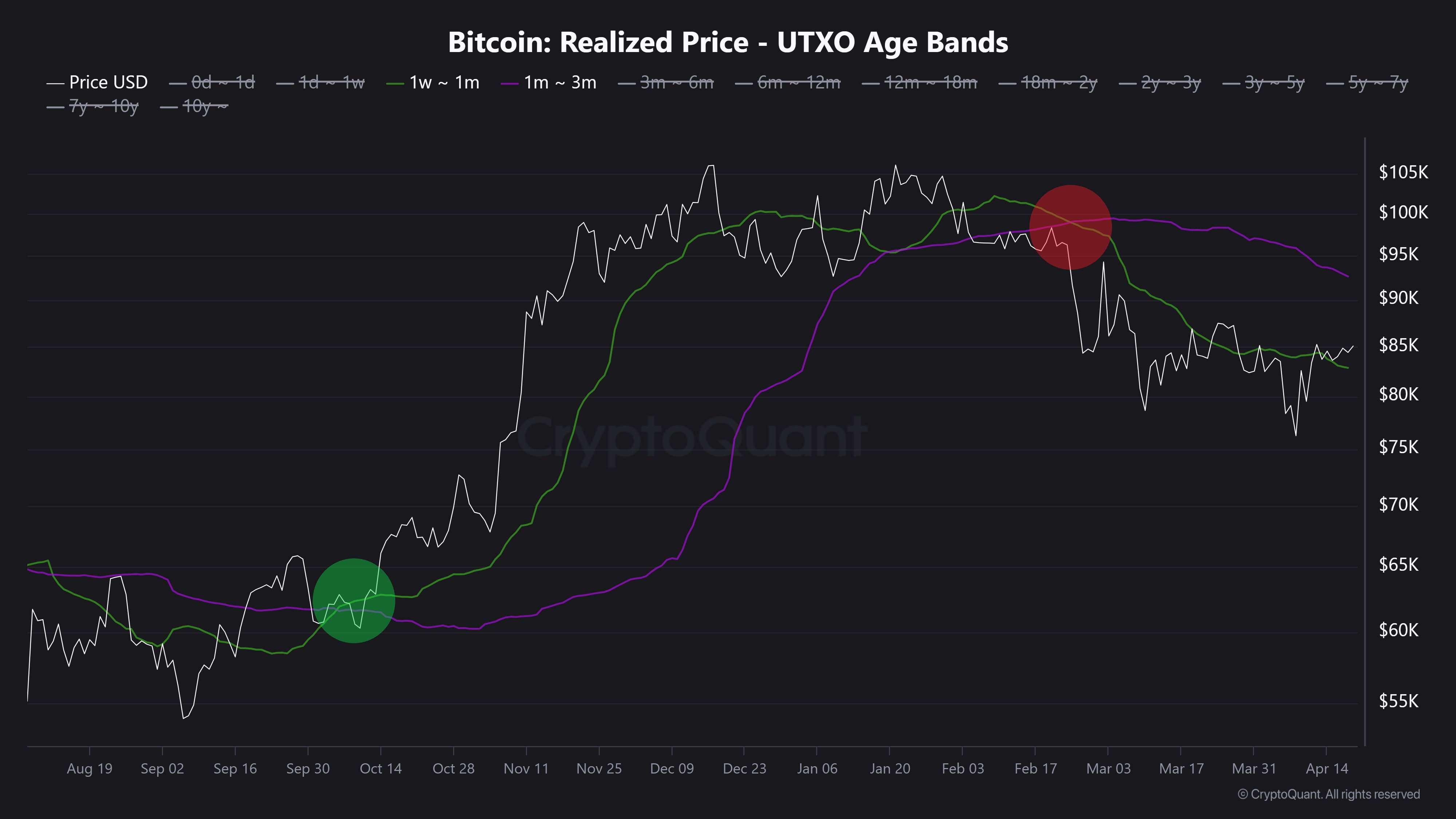

Bitcoin has produced a range-bound movement recently, with prices oscillating between $83,000 and 86,000. Interestingly, popular crypto analyst Burak Kesmeci has identified the important price levels for any short-term action.

Support At 82,800, Resistance At 92,000 – But Where Is Bitcoin Headed?

In a new post on X, Kesmeci shared an interesting on-chain analysis of the Bitcoin market. Using the short-term investor cost basis, the analyst identified two key price levels that could prove critical to Bitcoin’s next major move.

Firstly, Burak Kesmeci focuses on the average cost prices of new traders over the past 1-4 weeks, which are likely the most reactive to price changes. The realized price for these traders currently stands at $82,800, forming a near-term support that indicates many recent buyers are still in profit and may defend this level as a psychological floor.

Meanwhile, Kesmeci also highlights the $92,000 price level, which marks the average cost basis for BTC holders for 1-3 months. This price point has emerged as an important resistance zone, as investors are likely to exit the market once they break even. Furthermore, the $92,000 price level is also marked by a confluence with various technical indicators.

The interplay between these two levels is significant. Historically, short-term bullish trends in BTC tend to begin when the cost basis of more recent investors, 1–4 weeks, crosses above that of the 1–3 BTC holders. This shift signals increased confidence and willingness to buy at higher levels, which often fuels broader rallies.

However, that dynamic remains to play out in the current market. As of now, Bitcoin is trading around 85,000, positioning it above its support at the 1–4 week average of $82,800 but still below the 1–3 month resistance of $92,000. Furthermore, both cost basis levels have been declining over the past two months, reflecting hesitation or a lack of aggressive buying from new entrants.

Notably, Kesmeci states that BTC must surge above $92,000 to confirm a strong bullish momentum for a price reversal.

Bitcoin ETFs Offload 1,725 BTC

In other news, Ali Martinez reports that the Bitcoin ETFs have suffered withdrawals of 1,725 Bitcoin, valued at $146.92 million, over the past week. This development illustrates a high level of negative sentiment among institutional investors, adding to market uncertainty around the BTC market.

Meanwhile, Bitcoin trades at $85,249 following a price change of 0.89% in the past day. The premier cryptocurrency also reflects a 0.58% loss on the weekly chart and a 1.06% gain on a monthly chart.

Feature image from Adobe Stock, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Market17 hours ago

Market17 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Market23 hours ago

Market23 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Market21 hours ago

Market21 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Market18 hours ago

Market18 hours agoVOXEL Climbs 200% After Suspected Bitget Bot Glitch

-

Market22 hours ago

Market22 hours agoCharles Schwab Plans Spot Crypto Trading Rollout in 2026

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Enters Historic Buy Zone As Price Dips Below Key Level – Insights

-

Market16 hours ago

Market16 hours agoTokens Big Players Are Buying