Bitcoin

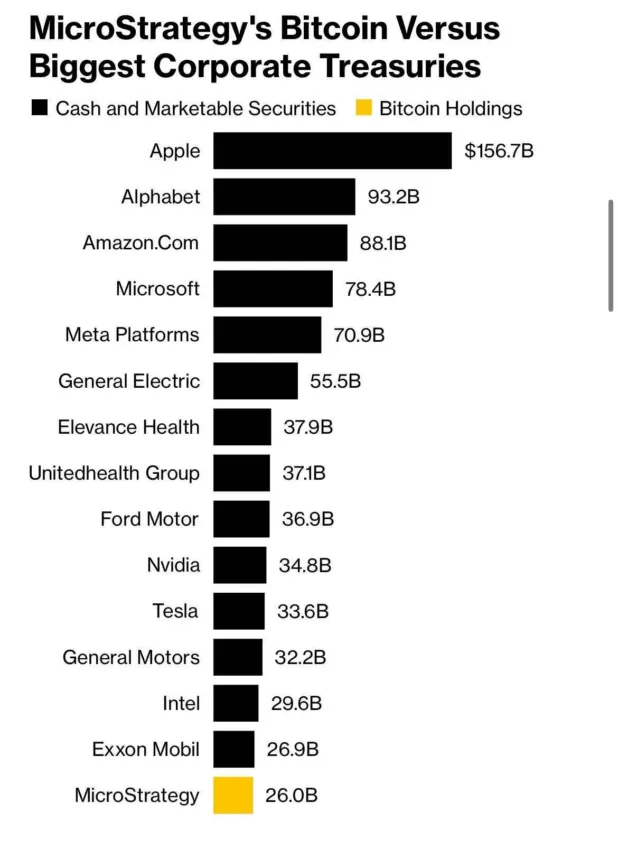

MicroStrategy Rises in Financial Rankings With $26B Bitcoin Stash

MicroStrategy’s decision to shift from traditional cash reserves to Bitcoin has reshaped its financial profile, catapulting the company into the spotlight as a leader in digital asset adoption.

This transformation coincides with Bitcoin’s recent surge to unprecedented price levels, significantly boosting MicroStrategy’s standing in corporate financial rankings.

Bitcoin-Focused MicroStrategy Outshines IBM and Nike in Asset Reserves

The company’s Bitcoin stash, now valued at approximately $26 billion, reportedly surpasses the cash and liquid assets held by giants like IBM, Nike, and Johnson & Johnson. For comparison, CompaniesMarketCap data shows that Nike’s reported cash and securities totaled $10.9 billion as of August, while IBM held $13.7 billion. Johnson & Johnson’s latest quarterly figures listed $20.29 billion.

This financial position shows that the niche software provider has redefined its identity by embracing Bitcoin as a core financial asset. However, despite this impressive position, MicroStrategy still trails around 14 companies, including Apple and Alphabet, in terms of corporate treasury assets.

The company began acquiring Bitcoin in 2020 as a countermeasure against inflation and declining revenue growth. Initially funded through operational cash flow, these purchases expanded to include capital raised via stock sales and convertible debt issuance.

To date, MicroStrategy has amassed 279,240 BTC at an average acquisition cost of $42,888, with a total investment of roughly $11.9 billion. This positions the firm as the largest publicly traded Bitcoin holder, controlling around 1.3% of the cryptocurrency’s total supply.

What initially faced skepticism has now become a major draw for investors seeking indirect exposure to Bitcoin. The shift in sentiment has propelled MicroStrategy’s stock by over 2,500% since 2020. This aligns with Bitcoin’s remarkable 700% price growth during the same timeframe.

Currently, the unrealized profit of MicroStrategy’s Bitcoin holdings stands at $13.4 billion, representing a 112% increase. The firm’s Bitcoin yield — measuring the relationship between its Bitcoin holdings and outstanding shares — has risen 26.4% year-to-date.

However, MicroStrategy’s executive chairman, Michael Saylor, remains steadfast in the company’s Bitcoin-centric vision. The firm plans to raise $42 billion over the coming years to expand its Bitcoin holdings further. Meanwhile, MicroStrategy aims to transform into a trillion-dollar Bitcoin bank, solidifying its role as a pioneer in corporate Bitcoin adoption.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Here Are The Bitcoin Levels To Watch For The Short Term

Bitcoin has produced a range-bound movement recently, with prices oscillating between $83,000 and 86,000. Interestingly, popular crypto analyst Burak Kesmeci has identified the important price levels for any short-term action.

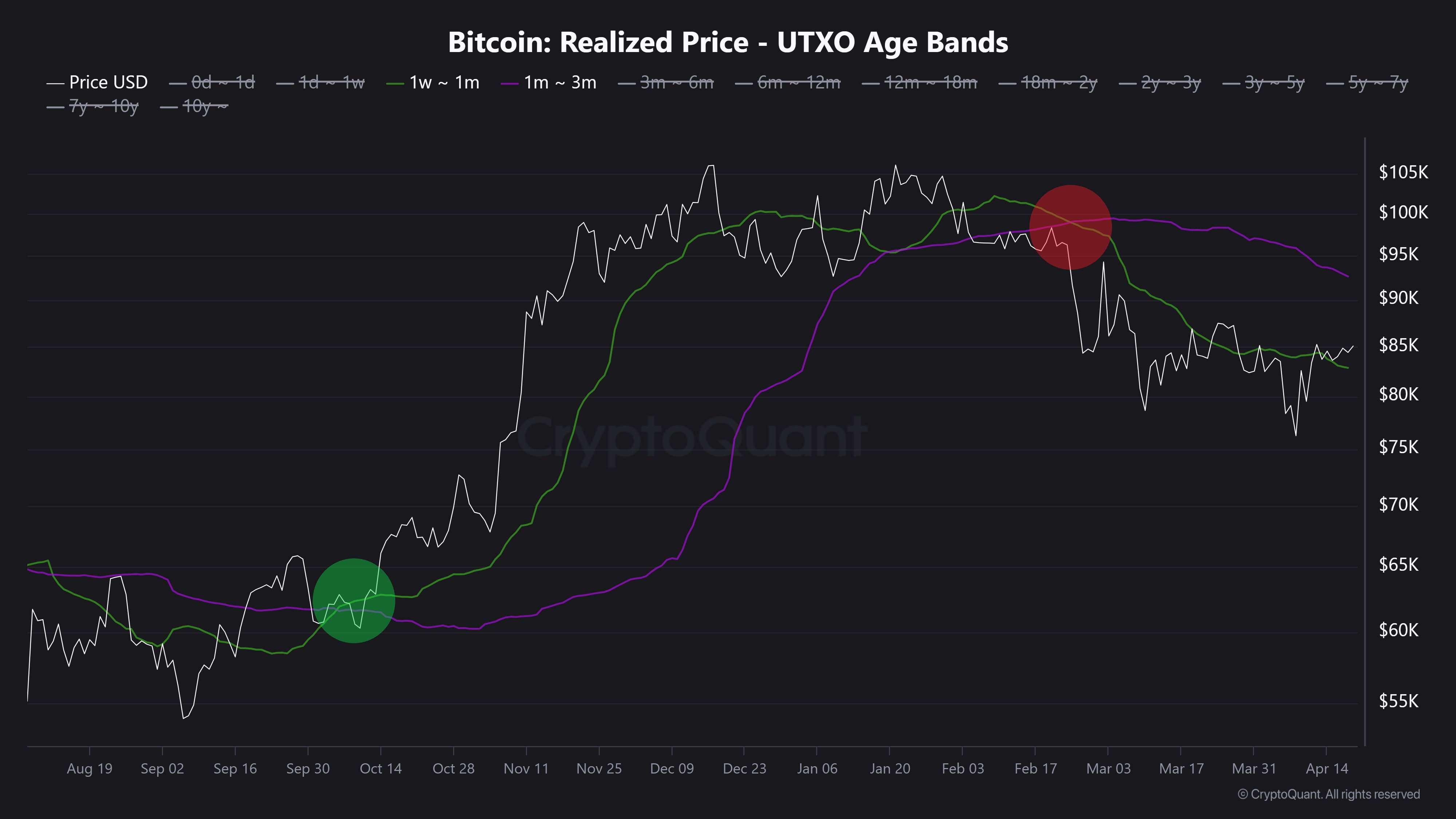

Support At 82,800, Resistance At 92,000 – But Where Is Bitcoin Headed?

In a new post on X, Kesmeci shared an interesting on-chain analysis of the Bitcoin market. Using the short-term investor cost basis, the analyst identified two key price levels that could prove critical to Bitcoin’s next major move.

Firstly, Burak Kesmeci focuses on the average cost prices of new traders over the past 1-4 weeks, which are likely the most reactive to price changes. The realized price for these traders currently stands at $82,800, forming a near-term support that indicates many recent buyers are still in profit and may defend this level as a psychological floor.

Meanwhile, Kesmeci also highlights the $92,000 price level, which marks the average cost basis for BTC holders for 1-3 months. This price point has emerged as an important resistance zone, as investors are likely to exit the market once they break even. Furthermore, the $92,000 price level is also marked by a confluence with various technical indicators.

The interplay between these two levels is significant. Historically, short-term bullish trends in BTC tend to begin when the cost basis of more recent investors, 1–4 weeks, crosses above that of the 1–3 BTC holders. This shift signals increased confidence and willingness to buy at higher levels, which often fuels broader rallies.

However, that dynamic remains to play out in the current market. As of now, Bitcoin is trading around 85,000, positioning it above its support at the 1–4 week average of $82,800 but still below the 1–3 month resistance of $92,000. Furthermore, both cost basis levels have been declining over the past two months, reflecting hesitation or a lack of aggressive buying from new entrants.

Notably, Kesmeci states that BTC must surge above $92,000 to confirm a strong bullish momentum for a price reversal.

Bitcoin ETFs Offload 1,725 BTC

In other news, Ali Martinez reports that the Bitcoin ETFs have suffered withdrawals of 1,725 Bitcoin, valued at $146.92 million, over the past week. This development illustrates a high level of negative sentiment among institutional investors, adding to market uncertainty around the BTC market.

Meanwhile, Bitcoin trades at $85,249 following a price change of 0.89% in the past day. The premier cryptocurrency also reflects a 0.58% loss on the weekly chart and a 1.06% gain on a monthly chart.

Feature image from Adobe Stock, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin LTH Selling Pressure Hits Yearly Low — Bull Market Ready For Take Off?

Following an extensive price correction in the past three months, the Bitcoin bull market continues to hang in the balance. Despite a modest price rebound in April, the premier cryptocurrency is yet to display a strong intent to resume its bull rally amidst a lack of positive market factors. However, crypto analyst Axel Adler Jr. has highlighted a promising development that could signal major upside potential for Bitcoin.

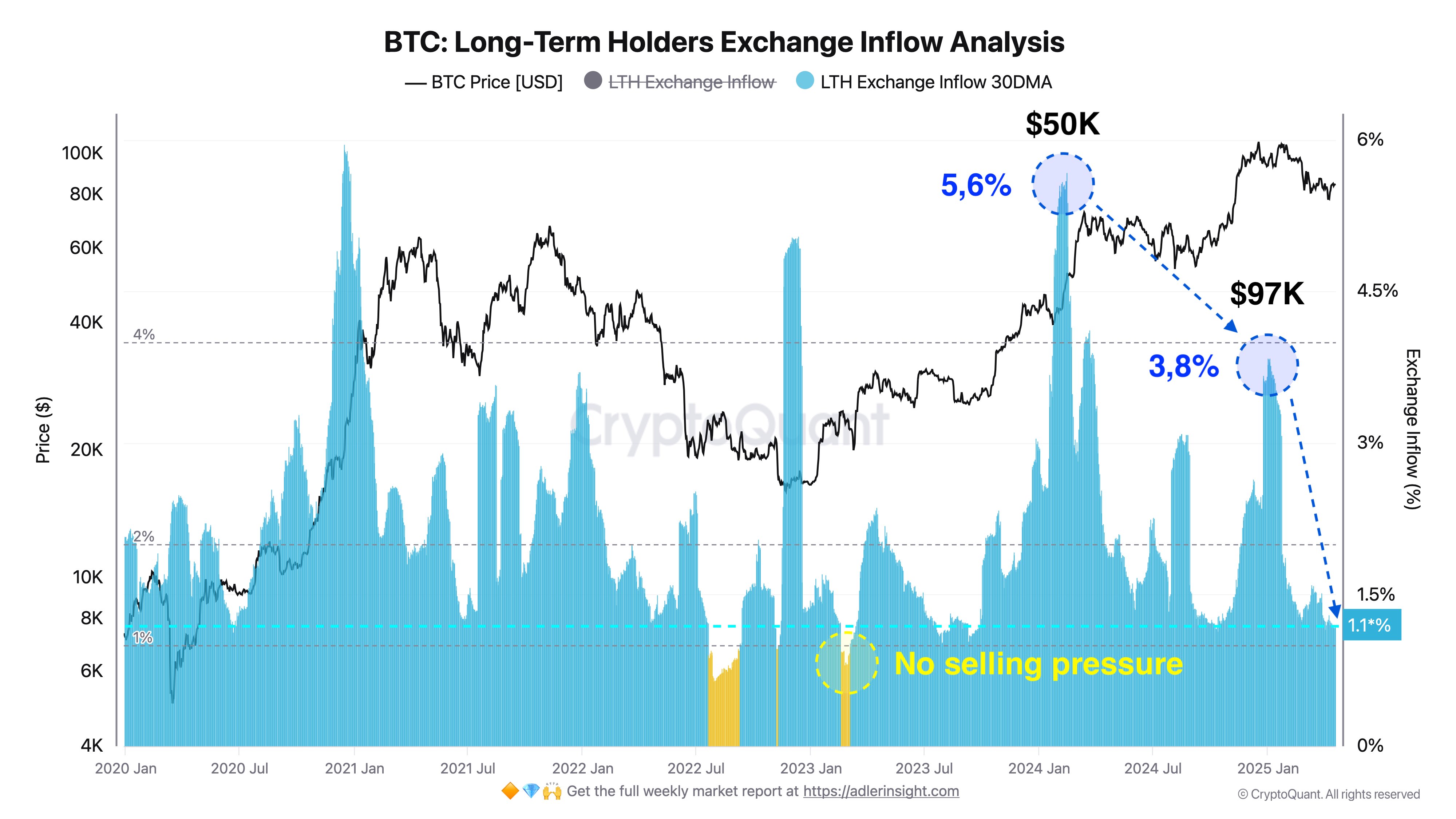

Bitcoin Long-Term Holders Looking To Halt Selling Pressure

In a recent post on X, Adler Jr. shared an important update in Bitcoin long-term holders (LTH) activity, which could prove significantly positive for the broader BTC market.

Using on-chain data from CryptoQuant, the renowned analyst reports that selling pressure by long-term holders, i.e. amount of LTH holdings on exchanges, has now hit its lowest point at 1.1% over the past year. This development indicates that Bitcoin LTH are now opting to hold on to their assets rather than take profits.

Adler explains that a further decline in these LTH exchange holdings to 1.0% would signal the total absence of selling pressure. Notably, this development could encourage new market entry and sustained accumulation, creating a strong bullish momentum in the BTC market.

Importantly, Alder highlights that the majority of the Bitcoin LTH entered the market at an average price of $25,000, Since then, CryptoQuant has recorded the highest LTH selling pressure of 5.6% at $50,000 in early 2024 and 3.8% at $97,000 in early 2025.

According to Adler, these two instances likely represent the primary profit-taking phases for long-term holders who intended to exit the market. Therefore, a resurgence in selling pressure from this cohort of BTC investors is unlikely in the short-term, which supports a building bullish case as long-term holders currently control 77.5% of Bitcoin in circulation.

BTC Price Overview

At the time of writing, Bitcoin was trading at $85,226 following a 0.36% gain in the past day and a 0.02% loss in the past week. Both metrics only reflect the ongoing market consolidation as BTC continues to struggle to achieve a convincing price breakout beyond $86,000.

Meanwhile, the asset’s performance on the monthly chat now reflects a 1.97% gain, indicating a potential trend reversal as the market correction ceases. Nevertheless, BTC remains in need of a strong market catalyst to ignite any sustainable price rally. With a market cap of $1.67 trillion, Bitcoin is ranked as the largest digital asset, controlling 62.9% of the crypto market.

Featured image from Adobe Stock, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Analyst Says Bitcoin Price Might Be Gearing Up For Next Big Move — What To Know

The Bitcoin price seems stuck in a consolidation range, ricocheting off the $83,000 and $86,000 levels over the past week. With no clear direction for the premier cryptocurrency, investors are left wondering what phase the market cycle is in—bullish or bearish.

According to a popular crypto analyst on the social media platform X, the Bitcoin price could be preparing for its next big move in either direction over the next few weeks. In any case, here are the important levels to watch out for in the next few days.

Crucial Levels To Watch For BTC’s Next Move

In an April 19 post on the X platform, crypto analyst Ali Martinez shared an interesting analysis of the Bitcoin price while highlighting the current layout of the world’s largest cryptocurrency by market cap. The online pundit noted that BTC bears and bulls are locked in a battle, leading to a choppy market condition.

Notably, the premier cryptocurrency appears to have entered the $83,000 – $86,000 range on Saturday, April 12. Hence, Martinez’s analysis basically revolves around the price of BTC bouncing off the support and resistance levels on its one-hour timeframe.

Source: @ali_charts on X

As shown in the chart above, the Bitcoin price attempted multiple times to breach the resistance zone around the $86,000 region over the past week. However, the bulls’ optimism was met with the staunch resilience of the Bitcoin bears, as the price of BTC almost always found its way back toward the $83,000 mark.

Most recently, the flagship cryptocurrency made its way toward the $86,000 level on Wednesday, April 16, but failed to break the significant resistance zone after the US Federal Reserve (Fed) chair Jerome Powell suggested that interest rate cuts might not be coming as early as anticipated by crypto traders.

Martinez noted in his post that the next significant move for the Bitcoin price depends primarily on the $83,000 and $86,000 levels. According to the crypto pundit, a breakout above the $86,000 mark could spell the start of a bullish run for Bitcoin, while a break below $83,000 could mean further correction for the market leader.

Bitcoin Price Overview

After reaching its all-time high of $108,786 in January 2025, the price of BTC has been on a steady decline in the past few months. According to data from CoinGecko, the flagship cryptocurrency has losst more than 22% of its value since hitting its record-high price.

As of this writing, the price of Bitcoin stands at around $84,530, reflecting a 0.3% decline in the past 24 hours. Meanwhile, the Bitcoin price is up by more than 1% on the weekly timeframe.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin24 hours ago

Altcoin24 hours agoUniswap Founder Urges Ethereum To Pursue Layer 2 Scaling To Compete With Solana

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Market20 hours ago

Market20 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Market14 hours ago

Market14 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Altcoin23 hours ago

Altcoin23 hours agoWhat’s Up With BTC, XRP, ETH?

-

Market18 hours ago

Market18 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Accumulators At A Crucial Moment: ETH Realized Price Tests Make-Or-Break Point

-

Market19 hours ago

Market19 hours agoCharles Schwab Plans Spot Crypto Trading Rollout in 2026