Bitcoin

MicroStrategy Makes Another Bitcoin Purchase at $1.1 Billion

Michael Saylor announced today that MicroStrategy paid $1.1 billion to acquire 10,107 Bitcoin, only six days after making a similar purchase. This move reflects a broader trend in the firm’s purchasing strategy.

The firm used the proceeds from a recent sales agreement to fund its purchase. This latest acquisition drove MicroStrategy’s total Bitcoin holdings to 471,107.

Saylor Moves Forward With Bitcoin Purchase Trend

MicroStrategy founder Michael Saylor continues to make major Bitcoin purchases, which extends the firm’s lead as one of the world’s largest BTC holders. Today, he announced a new acquisition on social media, making it the firm’s fourth BTC purchase of January 2025.

“MicroStrategy has acquired 10,107 BTC for ~$1.1 billion at ~$105,596 per bitcoin and has achieved BTC Yield of 2.90% YTD 2025. As of 1/26/2025, we hold 471,107 $BTC acquired for ~$30.4 billion at ~$64,511 per bitcoin,” Saylor said.

According to the Form 8-K filed with the SEC, the Bitcoin purchases were made between January 21 and January 26. During that period, MicroStrategy also sold 2,765,157 shares, raising $1.1 billion.

Saylor made steady Bitcoin purchases throughout December 2024. During the first half of the month, Microstrategy made a $2.1 billion purchase. A week later, it carried out another $1.5 billion purchase.

On January 6, Microstrategy bought $101 million in Bitcoin. The purchase reflected a sharp decline from previous multi-billion-dollar acquisitions, raising speculation that Microstrategy would institute a pause in its streak.

However, when Bitcoin hit a new all-time high above $108,000 on January 20, Saylor continued to increase the size of Microstrategy’s acquisitions. As Bitcoin continues to perform well, the company seems set on capitalizing on it.

MicroStrategy Remains Firm on its BTC-First Strategy

At the beginning of the month, MicroStrategy publicly explored the possibility of a major stock offering to raise capital for further Bitcoin acquisitions. The firm unveiled plans to raise $2 billion through a perpetual preferred stock offering to strengthen its balance sheet.

Funding options for perpetual preferred stock include converting class A common stock, issuing cash dividends, or redeeming shares. This structure offers investors the potential for regular dividend payments without a defined maturity date, presenting a unique approach to capital raising.

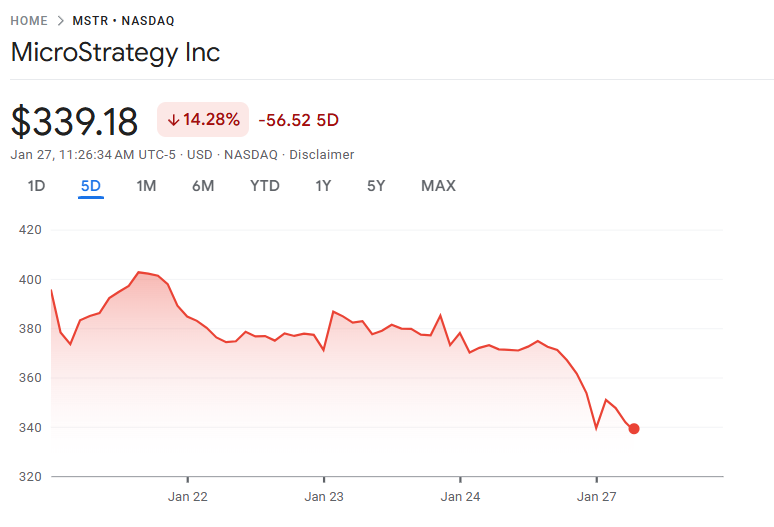

Despite today’s acquisition, the company’s stock was also affected by the wider sell-off today, driven by the DeepSeek AI concerns. MSTR is down by nearly 5% today but remains 14% up this month.

Regardless, MicroStrategy is likely to continue expanding its Bitcoin acquisitions throughout the upcoming market cycles. The success of the firm’s stock offerings will also significantly determine the extent of future Bitcoin purchases.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

What Good Friday Options Expiry Means for Bitcoin & Ethereum

On Good Friday, over $2.2 billion worth of Bitcoin and Ethereum options contracts expire today.

It comes as crypto markets continue to reel from macroeconomic uncertainty. President Donald Trump is pressuring the Federal Reserve (Fed) to cut interest rates, but the chair, Jerome Powell, will not budge.

Over $2.2 Billion Options Expire Today

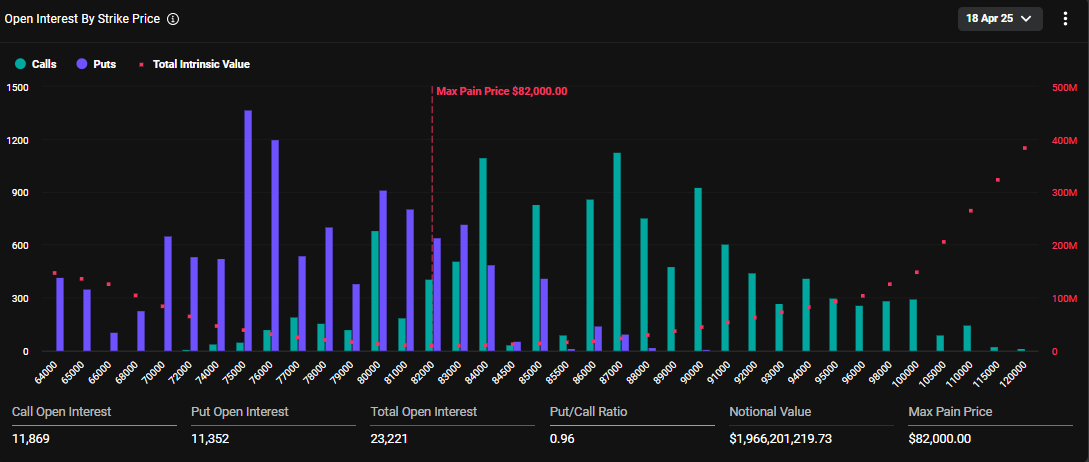

Today, April 18, amid Good Friday celebrations, 23,221 Bitcoin (BTC) options contracts will expire. The notional value for this Friday’s tranche of expiring Bitcoin options contracts is $1.966 billion, according to data on Deribit.

The put/call ratio is 0.96, suggesting a prevalence of purchase options (calls) over sales options (puts).

As the Bitcoin options expire, they have a maximum pain or strike price of $82,000; at this point, the asset will cause the greatest number of holders’ financial losses.

Similarly, crypto markets will witness the expiry of 177,130 Ethereum contracts, with a notional value of $279.789 million. The put-to-call ratio for these expiring Ethereum options is 0.84, with a maximum pain of $1,600.

This week’s options expiry event is slightly smaller than what crypto markets witnessed last week on Friday. As BeInCrypto reported, approximately $2.5 billion worth of BTC and ETH options expired then, with short-term dips bringing put demand.

Traders and investors must closely monitor today’s developments as options expiry could lead to price volatility. Nevertheless, put-to-call ratios below 1 for Bitcoin and Ethereum in options trading indicate optimism in the market. It suggests that more traders are betting on price increases.

Meanwhile, analysts at Deribit highlight low volatility and flat skew. While this suggests a calm market, historical data from CoinGlass suggests post-expiry price swings are common, potentially signaling an upcoming move.

“With volatility crushed and skew flat, is the market setting up for a post-expiry move?” they posed.

Blackswan Event Likely, Greeks.live Analysts Say

Analysts at Greeks.live shed light on current market sentiment, echoing the calm outlook. However, they note that the market is predominantly bearish to neutral. Traders expect continued choppy action before potentially revisiting $80,000 to $82,000.

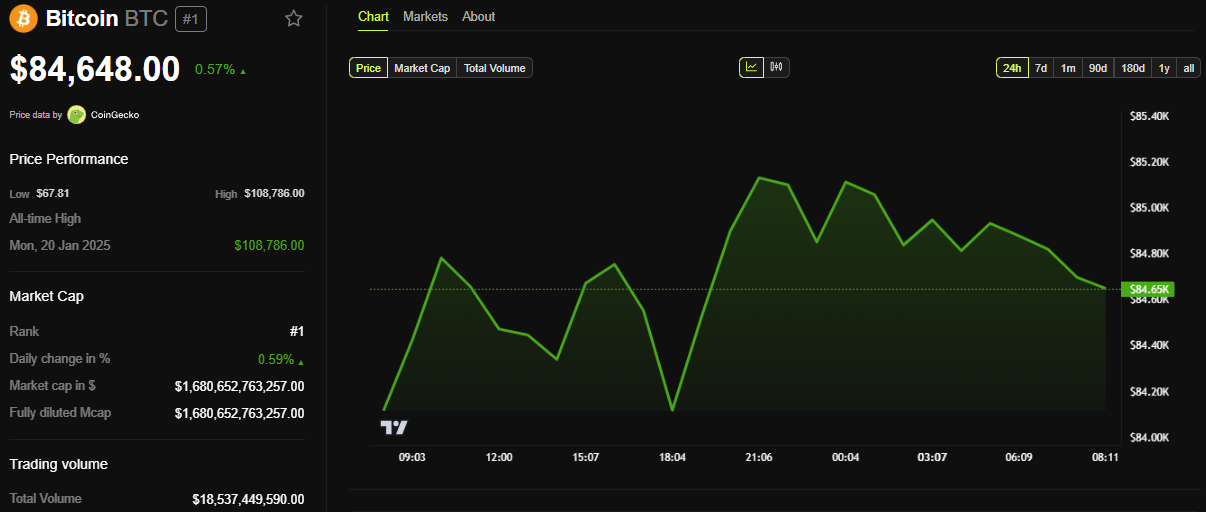

As of this writing, Bitcoin was trading for $84,648, slightly above its strike price of $82,000. Based on the Max Pain theory, prices will likely move toward this strike price as options near expiry.

Citing a mild sentiment, Greek.live analysts ascribe the calm to Trump not putting out a lot of news this week. Nevertheless, they anticipate more trade wars, heightened uncertainty, and volatility.

“We expect the trade and tariff wars to be far from over, and the uncertainty in the market will continue for a long time, as will the volatility in the market,” Greeks.live wrote.

They also ascribe the outlook to Powell’s comments, which created downward pressure as 100 bps rate cut expectations for the year were reduced. This led to crypto correlation with traditional markets.

Against this backdrop, Greeks.live says the probability of a black swan event is higher, where a rare, unexpected event that has a significant and often disruptive impact on the market occurs.

“…it is now a period of pain when the bulls have completely turned to bears, and investor sentiment is relatively low. In this worse market of bulls turning to bears, the probability of a black swan will be significantly higher,” they explained.

They urge traders to buy out-of-the-money (OTM) put options. An option is classified as out-of-the-money when its strike price is less favorable than the current market price of the underlying asset. This means it has no intrinsic value, only time value (the potential for it to become valuable before expiration).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Quantum Researchers Offer 1 Bitcoin To Break ‘Toy Version’

A quantum‑computing collective known as Project Eleven has thrown down a public gauntlet to the global cryptography community, offering a reward of one Bitcoin to the first team that can break a deliberately down‑scaled version of Bitcoin’s elliptic‑curve cryptography using a genuine quantum computer before 5 April 2026.

Announcing what it calls the “Q‑Day Prize” on X, the group wrote: “We just launched the Q‑Day Prize. 1 BTC to the first team to break a toy version of Bitcoin’s cryptography using a quantum computer. Deadline: April 5, 2026. Mission: Protect 6 M BTC (over $500 B).” The post crystallises a concern that has hovered over the Bitcoin ecosystem for more than a decade: the eventual arrival of large‑scale, error‑corrected quantum hardware capable of running Shor’s algorithm against real‑world keys.

Project Eleven is not asking contestants to shatter Bitcoin’s 256‑bit curve directly. Instead, teams must demonstrate Shor’s algorithm against elliptic‑curve keys ranging from one to twenty‑five bits—sizes derisively called “toy” by professional cryptographers but still orders of magnitude beyond what has been publicly achieved on physical quantum processors. The organisers argue that even a three‑bit break would be “big news,” because it would provide the first quantitatively verifiable benchmark of quantum progress on the elliptic‑curve discrete‑log problem (ECDLP). In their words, “Nobody has rigorously benchmarked this threat yet.”

To qualify, a submission must include gate‑level code or explicit instructions runnable on actual quantum hardware, along with a narrative of methods employed, error‑rates managed and the classical post‑processing required. Hybrid attacks that lean on classical shortcuts are disallowed. All entries will be published, a decision the group frames as an exercise in radical transparency: “Instead of waiting for breakthroughs to happen behind closed doors, we believe in facing this challenge head‑on, in a transparent and rigorous manner.”

Why 1 Bitcoin—And Why Now?

Bitcoin’s security ultimately rests on the hardness of the discrete‑logarithm problem over the secp256k1 curve. While classical attacks scale exponentially, Peter Shor’s 1994 quantum algorithm could in principle solve the problem in polynomial time, collapsing the cost from cosmic to merely gargantuan. Current research estimates that on the order of two thousand fully error‑corrected logical qubits—perhaps backed by millions of physical qubits—would be sufficient to threaten a 256‑bit key. Firms such as Google, IBM, IonQ and newcomer QuEra are racing to cross the four‑digit logical‑qubit threshold, though none has publicly demonstrated anything close to that capability today.

Project Eleven says its prize is intended less as a bounty and more as a diagnostic. More than ten million Bitcoin addresses, holding over six million coins, have already exposed their public keys through prior spending activity. If quantum technology crosses the critical threshold before those coins are migrated to post‑quantum addresses, the funds would be vulnerable to immediate theft. “Quantum computing is steadily progressing,” the group warns. “When that happens, we need to know.”

The initiative lands amid a flurry of quantum‑resilience proposals within the wider Bitcoin ecosystem. Earlier this month, a group of developers submitted the Quantum‑Resistant Address Migration Protocol (QRAMP), a Bitcoin Improvement Proposal that would orchestrate a network‑wide move to post‑quantum key formats. Because QRAMP would require a consensus‑breaking hard fork, its political prospects remain uncertain.

Separately, Canadian startup BTQ has pitched an exotic proof‑of‑work alternative called Coarse‑Grained Boson Sampling, which would substitute today’s hash‑based mining puzzles with photonic sampling tasks executed on quantum hardware. Like QRAMP, BTQ’s concept demands a hard fork and has yet to garner broad support.

From a technical standpoint, running even a five‑bit elliptic‑curve version of Shor’s algorithm is brutally unforgiving: qubits with fidelities above 99.9 %, coherent for hundreds of microseconds, and orchestrated through deep circuits numbering in the thousands of two‑qubit gates would be required. Error‑correction overhead further compounds the engineering burden, meaning that contenders will likely have to employ small‑code logical qubits and impressive compilation techniques merely to keep noise under control.

Yet the prize may prove irresistible for university labs and corporate R&D teams eager to demonstrate practical quantum advantage. Cloud‑accessible devices from IBM’s Quantum System Two, Quantinuum’s H‑series and OQC’s superconducting platforms already allow limited, pay‑per‑shot access to dozens—or in IBM’s case, hundreds—of physical qubits. Whether any of those machines can sustain the circuit depth necessary remains to be seen.

Either outcome supplies invaluable data. In the words of Project Eleven’s launch tweet, the objective is stark: “Break the biggest ECC key with Shor’s algorithm. The reward: 1 BTC + go down in cryptography history.”

At press time, BTC traded at $84,771.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Gary Gensler Explains Why Bitcoin Will Outlast Altcoins

Former US Securities and Exchange Commission (SEC) Chair Gary Gensler has stated that Bitcoin (BTC) could continue to exist and thrive for a long time.

However, Gensler emphasized that this may not be the case for most altcoins, as they lack solid fundamentals.

Why Gary Gensler Believes in Bitcoin

In a recent interview with CNBC, Gensler mentioned that Bitcoin’s enduring presence could be attributed to its strong global interest.

“Something like Bitcoin may persist for a long time because there’s 7 billion people around the globe, a real keen interest in it,” he stated.

Gensler, who served as SEC Chair from 2021 to 2025, made these remarks in response to questions about the crypto industry’s reaction to the dismissal of lawsuits and investigations initiated during his tenure.

While at the SEC, Gensler took a hard stance on cryptocurrency regulation. He launched multiple enforcement actions targeting several exchanges, token issuers, and other crypto entities.

While he refrained from commenting directly on the dismissal of these cases, he shifted focus to broader trends within the cryptocurrency market.

“I’m going to step back a little bit from any individual cases and just say this again to your viewing public. This is a very small part of the financial markets, but if you were interested in this, think about every financial asset sort of trades on a bit of fundamentals and sentiment. But this field is almost 99, or maybe one might say 100% sentiment and very little on fundamentals,” said Gensler.

The former SEC chair advocated for careful asset risk assessment. He noted that the primary focus should be the project’s fundamentals. Moreover, he warned that many assets are driven predominantly by sentiment. As a result, he suggested that such tokens are generally unsustainable and likely to lose value over time.

When pressed on whether Bitcoin should be grouped with other cryptocurrencies, Gensler drew an analogy to precious metals. He implied that Bitcoin holds a unique position in the cryptocurrency world.

“There’s only two or three precious metals. We humans have a certain fascination with two or three precious metals like gold,” he remarked.

Gensler believes that the vast majority of cryptocurrencies, especially those driven by trends, memes, or social sentiment, will not attract lasting interest. He stressed that only a few, like Bitcoin, will stand the test of time.

These comments align with Gensler’s previous statements on the crypto market. In a January 2025 interview with CNBC, he acknowledged BTC’s volatility yet showed faith in its long-term prospects.

“With 7 billion people around the globe, 7 billion people want to trade it just like we do have gold for 10,000 years. We have Bitcoin. It might be something else in the future as well,” Gensler noted.

Despite the optimistic outlook, Gensler disclosed that he did not own any Bitcoin or other crypto assets.

Gensler’s remarks reflect ongoing debates about the legitimacy and sustainability of cryptocurrencies. While Bitcoin has gained traction as a store of value, many altcoins struggle to demonstrate the same level of acceptance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin22 hours ago

Altcoin22 hours agoHow Rising Solana Network Inflows Could Drive SOL Price to $150?

-

Bitcoin22 hours ago

Bitcoin22 hours agoGary Gensler Explains Why Bitcoin Will Outlast Altcoins

-

Market21 hours ago

Market21 hours agoBitcoin Whales Withdraw $280 Million: Bullish Signal?

-

Altcoin14 hours ago

Altcoin14 hours agoCZ Honors Nearly $1 Billion Token Burn Promise

-

Market22 hours ago

Market22 hours agoXRP’s $2.00 Pivot Point—A Launchpad or Breakdown Zone?

-

Market14 hours ago

Market14 hours agoOver $700 Million In XRP Moved In April, What Are Crypto Whales Up To?

-

Altcoin21 hours ago

Altcoin21 hours agoHow Crypto Traders Made $666K from $4.5K in One Trade?

-

Market19 hours ago

Market19 hours agoExpanding Blockspace and Enhancing Privacy