Bitcoin

Metaplanet Issues $6.2 Million Bond to Boost Bitcoin Holdings

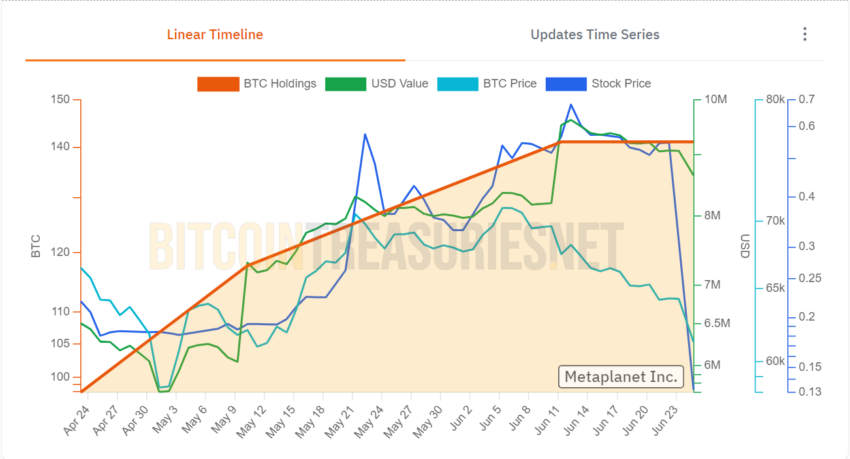

Japanese investment firm Metaplanet has announced the issuance of a $6.2 million bond to bolster its Bitcoin (BTC) holdings.

The issuance of bonds is a key step in improving Metaplanet’s financial situation and offering its customers new investment opportunities. As Metaplanet continues to expand its Bitcoin holdings, the firm is positioning itself as a key player in Japan’s crypto market.

Metaplanet revealed its bond issuance plan on June 24, and the Board of Directors approved it. The company intends to use the funds to buy Bitcoin, which aligns with its strategy to hold the cryptocurrency as a reserve asset. The bond issuance offers an annual interest rate of 0.5% and will mature on June 25, 2025.

This move follows a recent acquisition of Bitcoin worth $1.6 million. Currently, Metaplanet’s total Bitcoin holdings are 141 BTC, valued at around $9.4 million.

Read more: Who Owns the Most Bitcoin in 2024?

Metaplanet initiated its Bitcoin purchases in April, influenced by the desire to reduce risks tied to Japan’s economic environment. By adopting Bitcoin as a reserve asset, Metaplanet aims to reduce its exposure to the yen. This strategy comes as the yen has been affected by high government debt levels and prolonged negative real interest rates.

The firm’s strategy echoes that of MicroStrategy, a US-based software company that has become the largest corporate holder of Bitcoin since 2020. Markus Thielen, founder of crypto research firm 10x Research, commented on Metaplanet’s alignment with MicroStrategy’s model.

“We like their approach as they are copying MicroStrategy to some extent, but their BTC purchases are minor. A few million will not move the needle. They need to go all in,” he noted.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Metaplanet’s move signals a growing trend among corporations seeking to leverage Bitcoin’s potential as a hedge against traditional economic vulnerabilities. BeInCrypto reported that Canadian fintech DeFi Technologies started to adopt Bitcoin as its primary treasury reserve asset earlier this month.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Mt. Gox’s $1 Billion Bitcoin Transfer: Is Liquidation Coming?

The defunct cryptocurrency exchange Mt. Gox has executed another massive Bitcoin (BTC) transfer, moving $1 billion in BTC.

The transfer comes as the exchange’s creditor payouts approach, with the deadline set for October 2025.

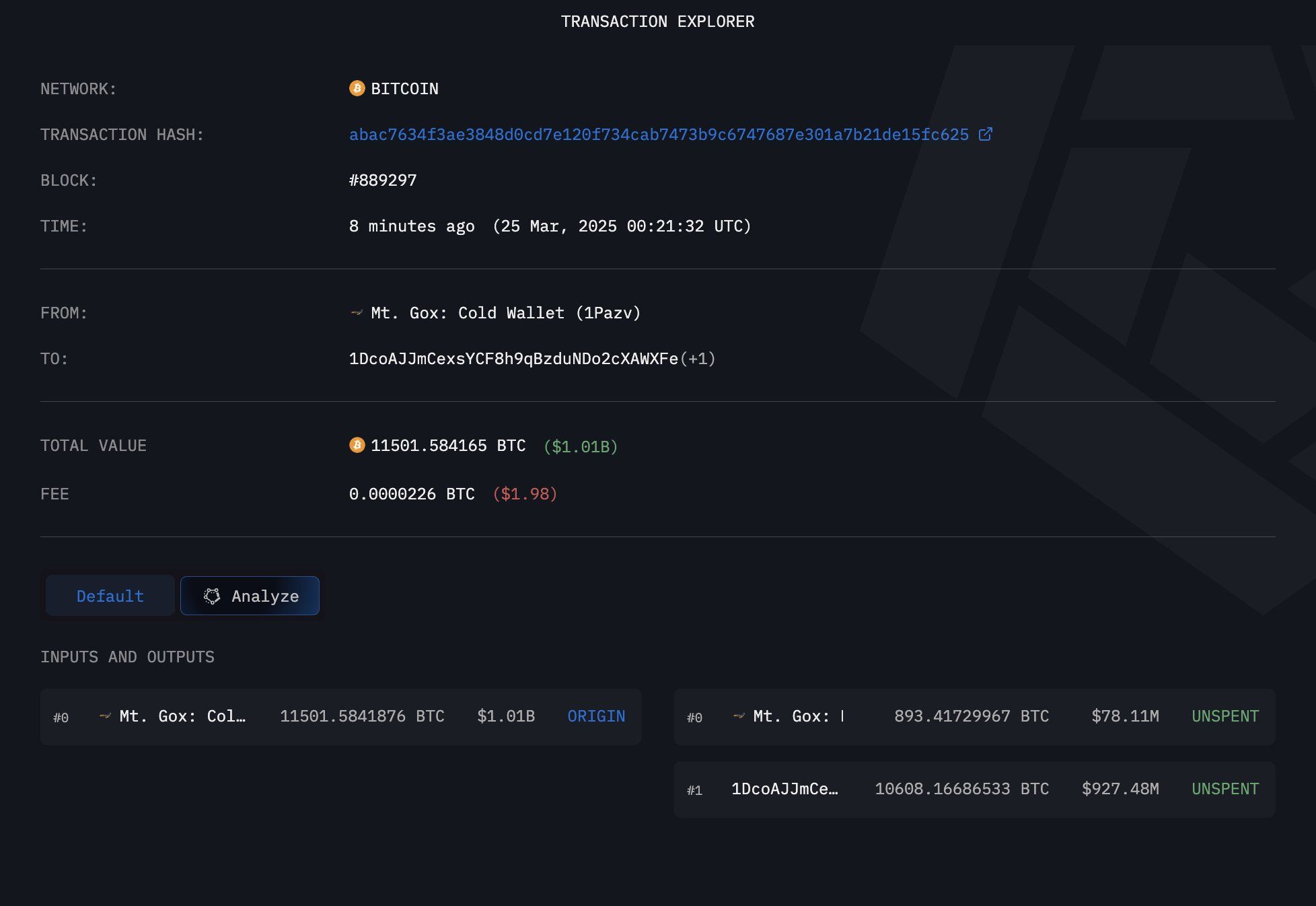

Mt. Gox Shifts 11,501 BTC in Massive Transfer

According to blockchain analytics firm Arkham Intelligence, Mt. Gox transferred a total of 11,501 Bitcoins to two wallets. A change wallet (address: 1DcoA) received 10,608 BTC worth $929 million. In addition, Mt. Gox’s hot wallet (address: 1Jbez) received 893 BTC worth $78 million.

This move follows two significant transactions earlier this month. On March 6, the exchange transferred 12,000 BTC worth $1 billion at the time. Less than a week later, it made another 11,834 BTC transfer valued at $910 million.

In the latter instance, 332 BTC worth over $25 million was deposited into the Bitstamp exchange, hinting at potential liquidation activity. Thus, SpotOnChain suggested that the 893 BTC sent to the hot wallet could soon be on the move again, too.

After the latest transfer, Mt. Gox still holds 35,583 BTC worth over $3 billion. The latest actions may signal preparations as the exchange moves to repay creditors who lost funds in its infamous hack over a decade ago.

An approaching repayment deadline adds urgency to the situation. Last October, the trustee overseeing Mt. Gox’s assets extended the cutoff for creditor repayments by a year, setting a new date of October 31, 2025.

“Many rehabilitation creditors still have not received their Repayments because they have not completed the necessary procedures for receiving Repayments. Additionally, a considerable number of rehabilitation creditors have not received their Repayments due to various reasons, such as issues arising during the Repayments process,” the notice read.

Meanwhile, the transfer had minimal impact on Bitcoin’s price. According to BeInCrypto data, BTC was only down 0.19% over the past day. At the time of writing, it traded at 86,756.

Notably, the coin has been gradually recovering from recent losses. BeInCrypto’s analysis indicates Bitcoin is approaching a breakout from a descending wedge pattern. If confirmed, this could set the stage for further gains, potentially reaching up to $95,000.

Arthur Hayes, former CEO of BitMEX, has also shared a bullish outlook for Bitcoin.

“The price is more likely to hi $110k than $76.5k next. If we hit $110k, then it’s yachtzee time and we ain’t looking back until $250k,” he wrote on X.

His reasoning is based on the expectation that the US Federal Reserve will shift from quantitative tightening (QT) to quantitative easing (QE), which would increase liquidity. Hayes also suggested that tariffs and their inflationary effect won’t have a lasting impact on the economy. Therefore, this would not hinder Bitcoin’s potential rise.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

What Does Trump’s Liberation Day Tariff Mean for Crypto Prices?

President Trump plans to announce a new round of reciprocal tariffs on April 2. This will be aimed at reducing the $1.2 trillion trade deficit for the US. He calls it “Liberation Day” for the US economy.

As Trump’s earlier tariffs significantly impacted the crypto market and triggered liquidations, his April 2 decision might also have notable implications for the market.

What’s New with Trump’s Liberation Day Tariff Plans?

Trump may delay some of the most aggressive sector-specific tariffs. This might include industries like those in autos, semiconductors, and pharmaceuticals.

Instead of blanket sector tariffs, the US might focus only on countries with the largest trade surpluses and the highest barriers to US goods. These are informally referred to as the “Dirty 15”—a group of 10 to 15 countries.

However, the decision is still not final. Trump could still change course, as he’s done in past announcements.

“I may give a lot of countries breaks, but it’s reciprocal, but we might be even nicer than that. You know we’ve been very nice to a lot of countries for a long time. But I call it liberation day. April 2nd is liberation day,” the US president announced.

Delaying or narrowing the scope of tariffs could ease some pressure on both the stock and crypto markets.

As we’ve seen recently, when tariffs seem aggressive, markets often dip. When they seem more measured or delayed, prices often stabilize or rebound.

Possible Scenarios for the Crypto Market Under Trump’s Tariff Plans

The April 2 tariff announcement could impact the crypto market in a few key ways, depending on how aggressive or targeted the final policy is. Here’s a breakdown of how and why it might move crypto prices.

If Tariffs Are Aggressive (Broad, High Duties)

- Risk sentiment drops: Equity and bond markets would likely react negatively to aggressive tariffs, especially on autos, chips, or pharma. That tends to spill over into crypto, which investors still treat as a risk-on asset class.

- Bitcoin and Ethereum could dip, as traders hedge against slower global growth and increased inflation risk.

- Capital flight into USD or cash could trigger short-term outflows from speculative assets like altcoins.

For instance, when Trump reaffirmed steep tariffs in February, Bitcoin dropped below $90,000 amid broader market jitters. The same pattern could repeat.

If Tariffs Are Narrowed (Delays or Selective Targeting)

- Market relief rally: If Trump’s administration confirms they’ll delay auto/chip/pharma tariffs and only target a few countries with high trade barriers, investor anxiety may ease.

- That could fuel a short-term recovery in crypto prices, particularly if equity markets also rebound.

- Increased clarity reduces volatility, which markets—including crypto—tend to reward.

For instance, when Trump hinted at flexibility earlier this month, Bitcoin rebounded to around $88,000. Narrower tariffs could spark a similar uptick.

Overall, the crypto market has been highly sensitive to macroeconomic signals lately. Tariffs drive fears of slower global trade and higher inflation.

All of these affect investor risk appetite. Even though crypto isn’t directly tied to trade flows, it’s deeply entwined with broader liquidity conditions and investor sentiment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

MicroStrategy’s Bitcoin Holdings Exceed 500,000 BTC

Michael Saylor announced that Strategy (formerly MicroStrategy) just purchased $584 million worth of Bitcoin, bringing its total holdings to over 500,000 BTC. Bitcoin is up this morning, and MicroStrategy’s purchase helps build market confidence.

However, the firm can only continue these acquisitions through sizable debt obligations. It seems unlikely that Strategy could ever sell off these assets without risking market confidence.

Strategy’s Bitcoin Buys Grow Again

Strategy (formerly Microstrategy) has been on a wild trajectory in the last few weeks. It has been one of the world’s largest Bitcoin holders for months, but the company’s purchase sizes have fluctuated wildly in the last few weeks.

Today, however, Michael Saylor announced that Strategy purchased a huge amount of Bitcoin:

“Strategy has acquired 6,911 BTC for ~$584.1 million at ~$84,529 per bitcoin and has achieved BTC Yield of 7.7% YTD 2025. As of 3/23/2025, Strategy holds 506,137 BTC acquired for ~$33.7 billion at ~$66,608 per bitcoin,” Saylor claimed via social media.

The price of Bitcoin is very uncertain right now, and this has left an outsized impact on Strategy. Last month, the firm began offering STRK, a new perpetual security, to fund massive BTC acquisitions.

Shortly before today’s purchase, he upsized his latest stock offering by over $200 million.

This has reinvigorated the firm’s purchasing strategy but also left it with other serious problems. In essence, Strategy will never be able to sell its Bitcoin without seriously damaging the market.

The company has funded these purchases with massive debt obligations, but it has negative cash inflows. Saylor’s routine acquisitions keep market confidence high, but the community watches carefully for any signs of diminished activity.

Enthusiasts carefully watch for smaller purchases, and they would certainly notice a sale of any size.

That is to say, what happens if Strategy’s unsecured debt goes down if the price of Bitcoin goes down? The community would take a forced liquidation as a very bearish sign.

The company’s tax obligations are another possible source of trouble. For now, at least, the price of Bitcoin is on the mend.

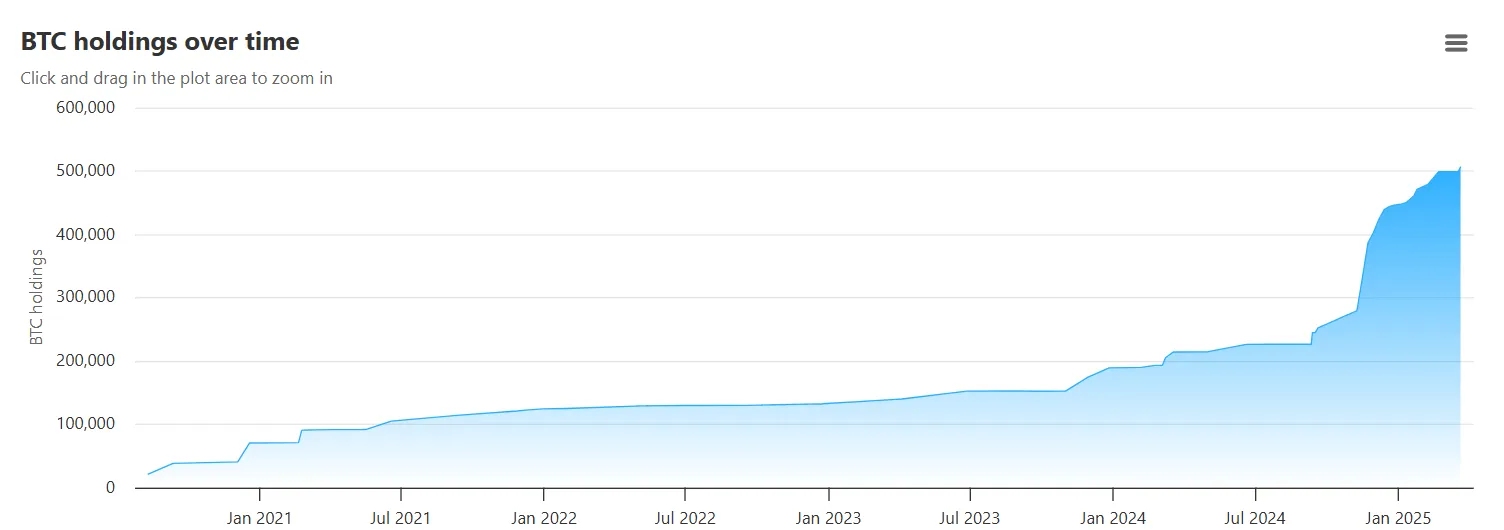

After this acquisition, MicroStrategy holds more than 500,000 Bitcoins. As the following chart shows, the company’s BTC purchase activity significantly intensified since late 2024, even though the asset’s price reached an all-time high during that period.

It’s evident that Saylor will serve as an important guarantor of Bitcoin’s confidence. However, if market conditions spin out of control, Strategy’s massive debt could cause some serious trouble.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoAnalyst Predicts XRP Price Could Surge Above $1400 as Bull Flag Breaks

-

Market21 hours ago

Market21 hours agoEthereum Price Back Above $2,000—Breakout or Just a Temporary Bounce?

-

Market20 hours ago

Market20 hours agoBitcoin Price Breaks Out with First Spot ETF Inflows in A Month

-

Altcoin20 hours ago

Altcoin20 hours agoIs Ethena Price At Risk? Trump’s World Liberty Financial Sells 184K ENA Sparking Concerns

-

Market17 hours ago

Market17 hours agoXRP Price Consolidates—Breakout Incoming or More Choppy Moves?

-

Altcoin17 hours ago

Altcoin17 hours agoEthereum Price To Hit $5K Before SOL Rally To $300, Arthur Hayes Says

-

Market16 hours ago

Market16 hours agoBlackRock Expands Bitcoin ETPs to Europe After US ETF Success

-

Altcoin16 hours ago

Altcoin16 hours agoWhy Is Pi Coin Price Down 5% Today?