Bitcoin

Jack Dorsey’s Block Will DCA Into Bitcoin Every Month

In the early morning of today’s Asia time, Jack Dorsey, CEO of Block Inc., revealed the company’s latest plan. Dorsey stated that it intends to purchase Bitcoin (BTC) monthly, utilizing the dollar-cost averaging (DCA) method.

This move highlights Block’s commitment to integrating Bitcoin into its financial strategy. Moreover, it also emphasizes Dorsey’s position as a prominent “Bitcoin maximalist.”

Details of Block’s Bitcoin DCA Strategy Unveiled

Dollar-cost averaging is an investment approach where the same dollar amount is invested in a particular asset at regular intervals regardless of the asset’s price fluctuations. This method helps reduce the impact of volatility on the overall purchase.

Hence, companies with Bitcoin holdings, like Block, can strategically navigate Bitcoin’s volatile nature using DCA. Furthermore, this approach offers the potential to achieve a lower average cost per share over time.

Read more: What Is Dollar-Cost Averaging (DCA)?

Block provided further details on how they will implement the DCA strategy in its official statement. The company announced it will allocate 10% of its gross profits from Bitcoin-related products towards monthly purchases of Bitcoin.

“Under the DCA program, we plan to purchase Bitcoin on a monthly cadence, starting April 2024. We will execute these over a shorter time window due to lower notional trade values and improved Bitcoin liquidity compared to 2020 and 2021. To reduce slippage, we have chosen to purchase Bitcoin over a two-hour window that has historically had the greatest amount of liquidity,” the company explained.

The shift to a Bitcoin-centric portfolio isn’t new for Block. The company made headlines in October 2020 when it purchased 4,709 BTC at an average price of $10,618 per Bitcoin.

Subsequent investments in February 2021 saw the addition of 3,318 BTC at a much higher price point of $51,236 each. As of March 31, 2024, Block acknowledged owning 8,038 BTC on the company’s balance sheet.

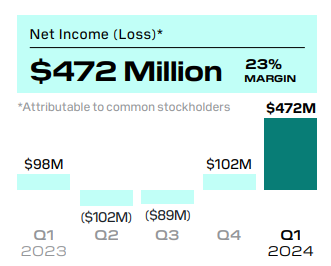

These early investments have proven lucrative. At the same reporting period, Block claimed its initial $233 million investment in Bitcoin had ballooned to approximately $573 million, marking a 146% increase. The remeasurement gain from its $233 million Bitcoin investment contributed to its net income in the first quarter of 2024.

Read more: Who Owns the Most Bitcoin in 2024?

Block’s involvement in the Bitcoin ecosystem has significantly evolved beyond acquisitions. It recently launched a “Bitcoin Conversions” feature for Square users.

This feature allows merchants to convert a portion of their sales directly into Bitcoin, enhancing the utility of Block’s services in the crypto sector. Jack Dorsey explained the rationale behind this strategic direction in a recent letter to investors.

“We believe the world needs an open protocol for money, one that is not owned or controlled by any entity … An open protocol for money helps us serve more people around the world faster,” Dorsey stated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Adoption Grows As Public Firms Raise Holdings In Q1

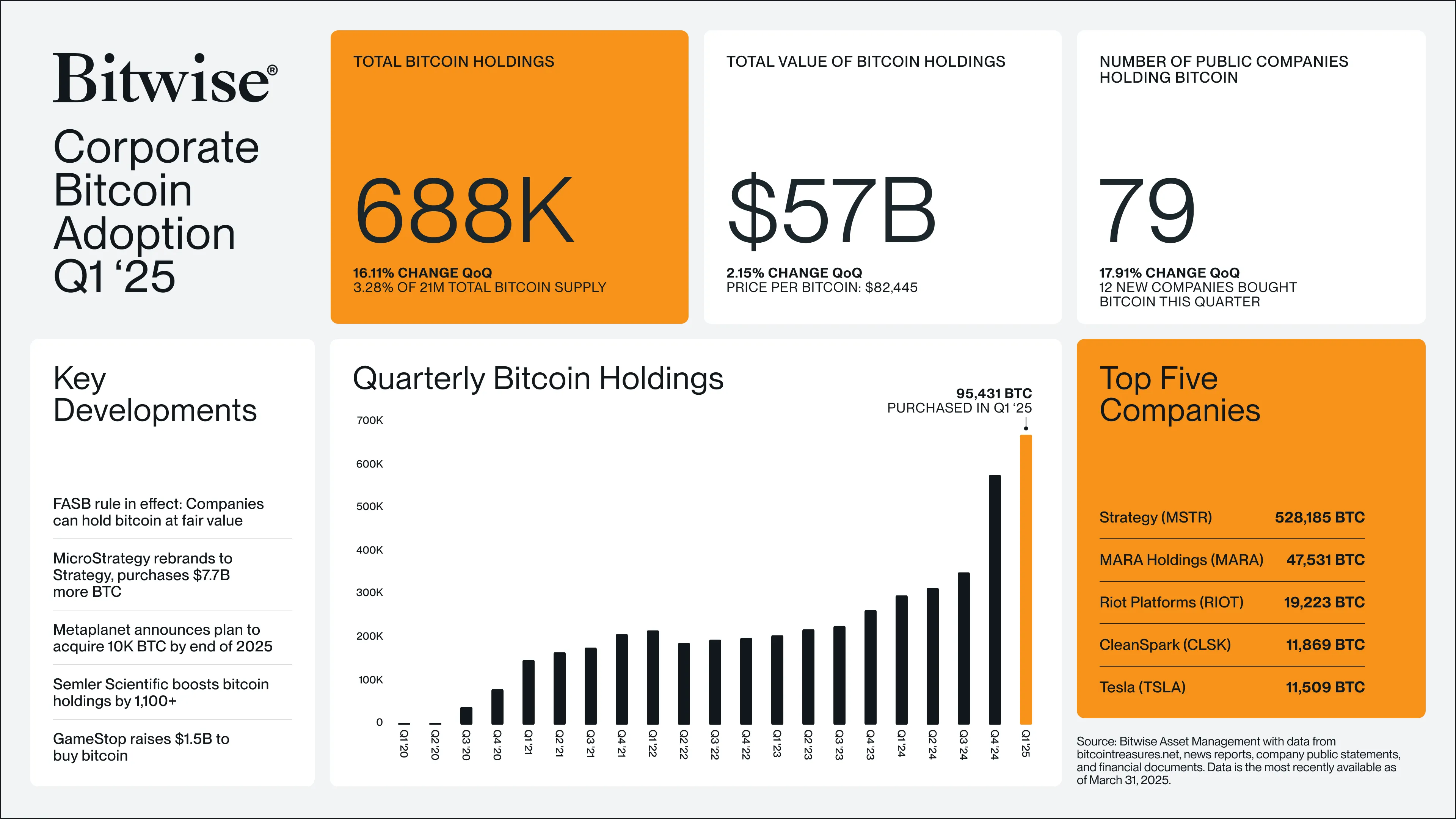

Public companies have added nearly 100,000 Bitcoin to their balance sheets during the first quarter of 2025, pushing total corporate Bitcoin holdings to a staggering 688,000 BTC worth $56.7 billion. According to data from crypto fund issuer Bitwise, this represents a 16% increase in total crypto holdings by publicly traded companies.

12 New Corporate Buyers Enter The Market

The Bitcoin buying spree wasn’t limited to existing crypto investors. Twelve public companies purchased Bitcoin for the first time during Q1, bringing the total number of Bitcoin-holding public firms to 79.

Hong Kong construction firm Ming Shing led new buyers, with its subsidiary Lead Benefit acquiring 833 BTC through two separate purchases – an initial 500 BTC buy in January followed by 333 BTC in February.

Video platform Rumble ranked as the second-largest new buyer, adding 188 BTC to its treasury in mid-March. In a move that stunned market watchers, Hong Kong investment firm HK Asia Holdings Limited purchased just one Bitcoin in February – a modest investment that still caused its share price to almost double in a single day of trading.

Companies are buying bitcoin, Q1 2025 edition. pic.twitter.com/qZc62N8vu5

— Bitwise (@BitwiseInvest) April 14, 2025

Japanese Firm Acquires At A Discount

While new entrants made headlines, existing Bitcoin holders also strengthened their positions. Japanese investment firm Metaplanet announced on April 14 that it had purchased an additional 319 BTC at an average price of 11.8 million yen (about $82,770) per coin.

This latest purchase brings Metaplanet’s total Bitcoin holdings to 4,525 BTC, currently valued at approximately $383.2 million. The company has spent nearly $406 million (58.145 billion yen) building its crypto stack.

Based on current holdings, Metaplanet now ranks as the 10th largest public company crypto holder worldwide, sitting behind Jack Dorsey’s Block, Inc., which holds 8,480 BTC.

BTC reclaiming the green zone in the last week. Source: Coingecko

Bitcoin Price Recovers After Brief Slump

Bitcoin trades at around $85,787 as of April 15, showing a decent performance over the past 24 hours according to CoinGecko data. The cryptocurrency has gained roughly 2.5% since the end of Q1 on March 31.

The price has bounced back from a brief drop below $75,000 on April 7. That temporary decline came after a broader market selloff triggered by a new round of global tariffs announced by US President Donald Trump.

The growing corporate interest in the top crypto comes as more companies look to diversify their treasury holdings. The combined value of public companies’ Bitcoin rose about 2.3% during the first quarter, reaching nearly $57 billion with BTC priced at $82,400 by quarter’s end.

Featured image from Crews Bank, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bolivia Reverses Crypto-for-Fuel Plan Amid Energy Crisis

Bolivia’s Ministry of Trade and Imports has rejected a state-backed plan to use cryptocurrency for fuel imports.

This move, which marks a stunning policy reversal, signals a retreat from the government’s recent push to adopt digital assets as a workaround for dollar shortages.

Bolivia Rejects Crypto-for-Fuel Scheme Amid Energy Sector Turmoil

The initial plan, announced in March by Bolivia’s state-owned energy giant YPFB, aimed to use crypto to secure fuel imports. This was in response to acute shortages of both US dollars and refined fuel.

As reported by Reuters on March 13, the proposal had received government backing at the time.

But in a statement released Tuesday, Director of Trade and Imports Marcos Duran clarified that YPFB will not be permitted to use crypto for international transactions.

“YPFB must use Bolivia’s own resources and dollar-based financial transfers,” Duran said.

Head of digital assets at VanEck, Mathew Sigel, labels this a clear U-turn on crypto policy.

“U-Turn: Bolivia appears to back away from its crypto-for-fuel scheme,” Sigel quipped.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Poised for Summer Rally as Gold Leads and Liquidity Peaks

The crypto market and broader economy are moving fast as global liquidity reached an all-time high in April 2025. Gold has already broken past $3,200, setting a new record. Meanwhile, Bitcoin is still 30% below its previous peak.

Amid this backdrop, analysts are taking a closer look at the link between Bitcoin and gold. Fresh data also shows strong corporate demand for Bitcoin, with record levels of buying in Q1 2025.

What Bitcoin’s Ties to Gold and Liquidity Signal for Its Price

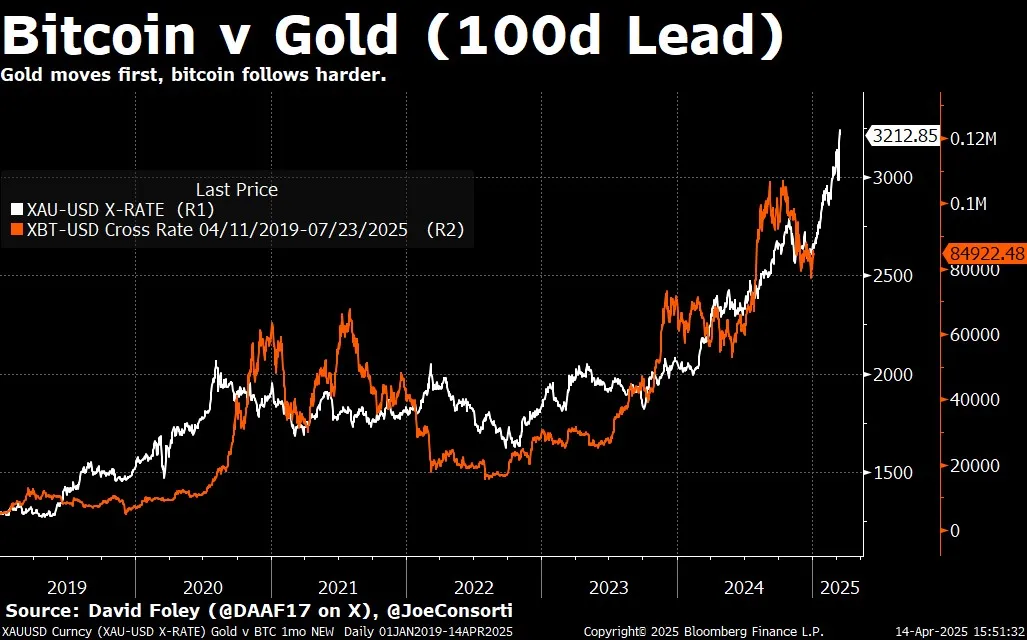

According to Joe Consorti, Head of Growth at Theya, Bitcoin tends to follow gold’s lead with a lag of about 100 to 150 days. A chart shared by Consorti on X, based on Bloomberg data, illustrates this trend from 2019 to April 14, 2025.

The chart shows gold (XAU/USD) in white and Bitcoin (XBT/USD) in orange. The data reveals that gold usually moves first during upswings, but Bitcoin often rallies harder afterward—especially when global liquidity is rising.

“When the printer roars to life, gold sniffs it out first, then Bitcoin follows harder,” Consorti said.

That 100-to-150-day lag is notable. It suggests Bitcoin could be set for a sharp move higher within the next 3 to 4 months. The recent surge in global liquidity also supports this view.

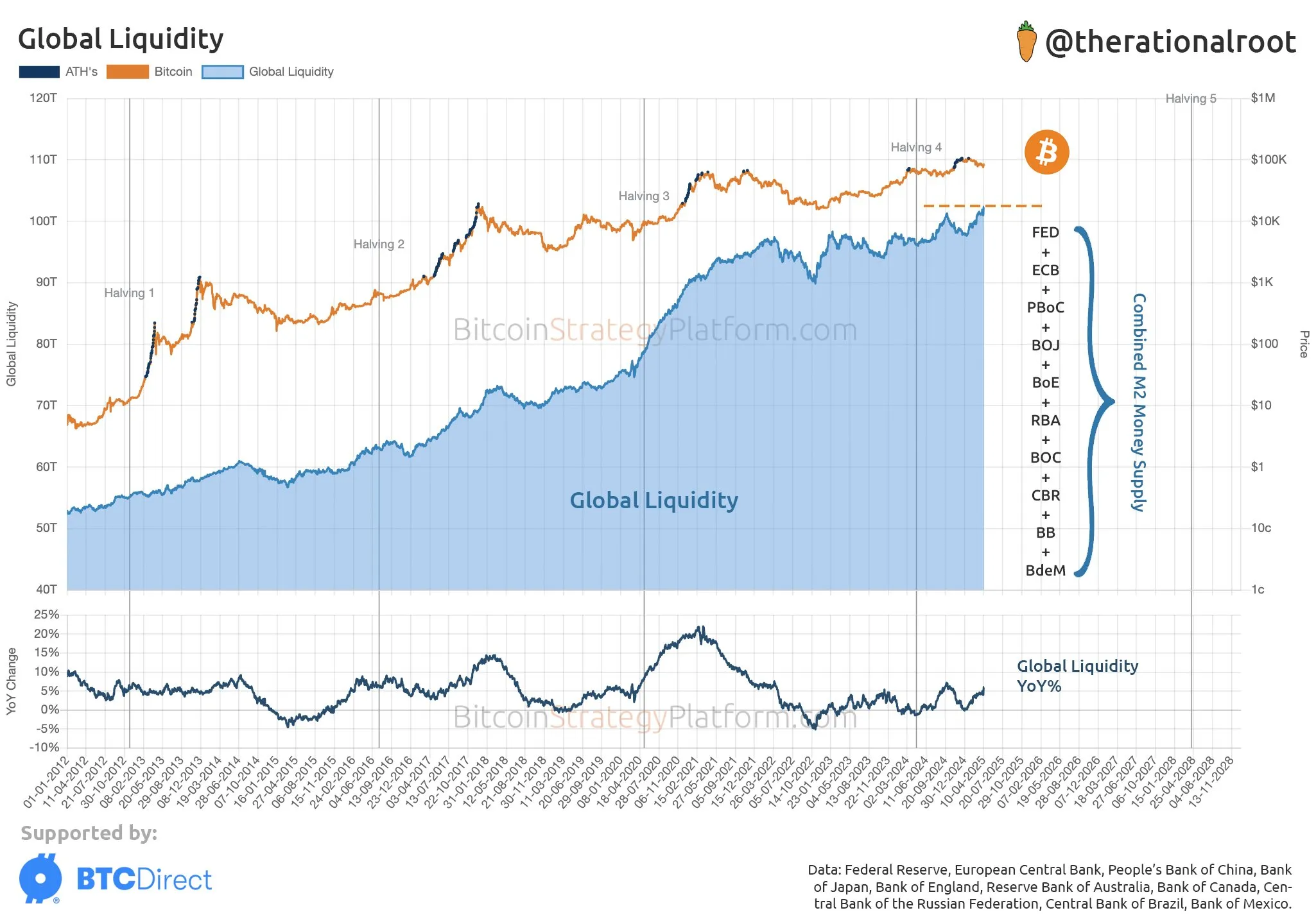

According to analyst Root, M2 money supply from major central banks—including the US Federal Reserve, European Central Bank (ECB), People’s Bank of China (PBoC), Bank of Japan (BoJ), Bank of England (BoE), Reserve Bank of Australia (RBA), Bank of Canada (BoC), and others—has hit a record high as of April 2025.

The sharp rise points to more cash flowing through the global economy.

Historically, Bitcoin bull markets have often lined up with major increases in global liquidity, as more money in the system tends to push investors toward riskier assets like Bitcoin.

Why Bitcoin Might Outperform Gold and Stocks

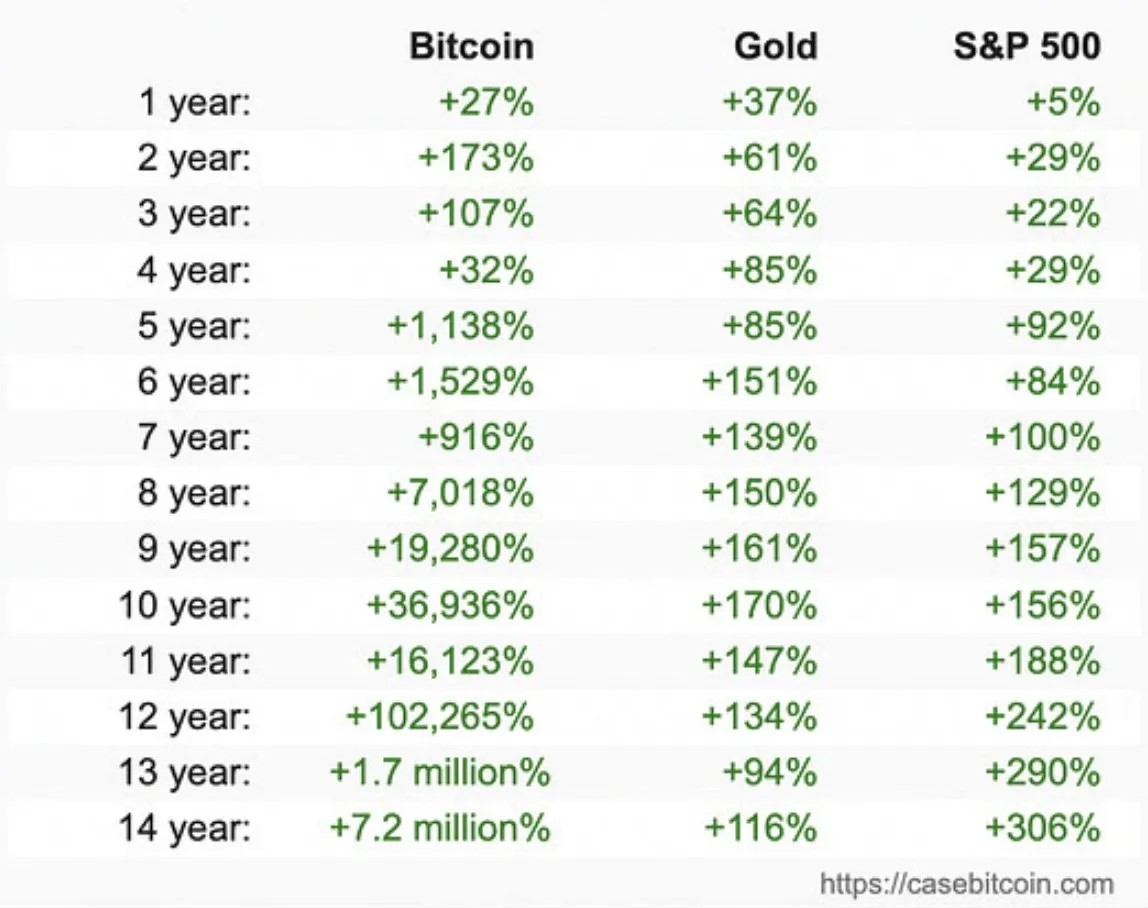

Matt Hougan, Chief Investment Officer at Bitwise Invest, states that Bitcoin is not just outperforming gold but is also surpassing the S&P 500 in the long run. This indicates that Bitcoin is becoming a stronger investment option despite its price volatility.

Data also supports this. A recent Bitwise report shows corporations bought over 95,400 BTC in Q1—about 0.5% of all Bitcoin in circulation. That makes it the largest quarter for corporate accumulation on record.

“People want to own Bitcoin. Corporations do too. 95,000 BTC purchased in Q1,” Bitwise CEO Hunter Horsley said.

With rising corporate demand and Bitcoin’s strong performance against traditional assets, the stage may be set for a major rally in summer 2025—driven by peak global liquidity and Bitcoin’s historic tendency to follow gold’s lead.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoIs The XRP Price Mirroring Bitcoin’s Macro Action? Analyst Maps Out How It Could Get To $71

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Urges Pi Network To Learn From The OM Crash Ahead Of Open Mainnet Transition

-

Market24 hours ago

Market24 hours agoOndo Finance (ONDO) Rises 3.5% Following MANTRA Crash

-

Market20 hours ago

Market20 hours agoBitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

-

Market13 hours ago

Market13 hours agoCan Pi Network Avoid a Similar Fate?

-

Market19 hours ago

Market19 hours agoCoinGecko Conduct Survey on AI and Proof of Personhood

-

Market18 hours ago

Market18 hours agoTrump’s Tariffs Spark Search for Jerome Powell’s Successor

-

Market16 hours ago

Market16 hours agoXRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?