Bitcoin

Goldman Sachs Raises US Recession Odds to 45%

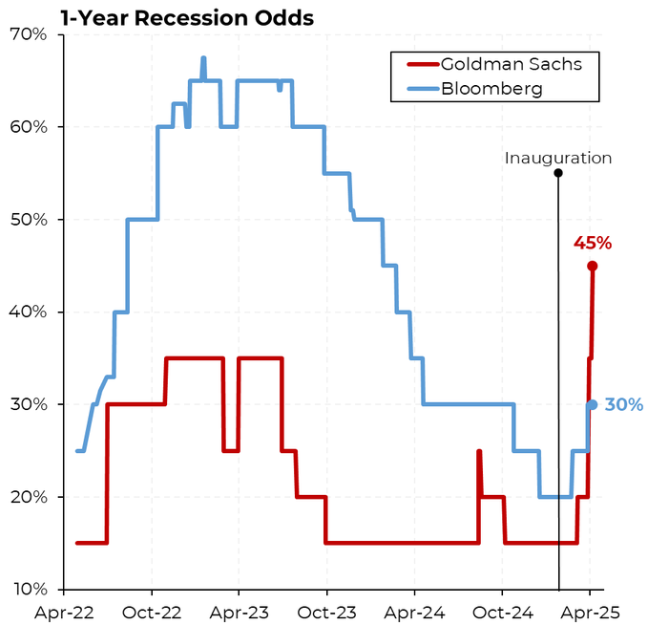

Goldman Sachs has raised its probability of a US recession within the next year to 45%. The prediction signals increased economic uncertainty amid escalating global tensions, tightening financial conditions, and looming tariff impacts.

This marks the highest probability of recession predicted by the investment bank since the post-pandemic inflation and interest rate hikes began.

Goldman Sachs Sees 45% Chances of US Recession

Goldman Sachs’ latest note, “Countdown to Recession,” outlines a sharp deterioration in economic conditions. These include the implications of tariffs expected to take effect on April 9.

Steven Rattner, former head of the Obama Auto Task Force and current Wall Street financier, shared the news on social media, emphasizing the gravity of Goldman’s new outlook.

“Goldman Sachs now predicts a 45% chance of a recession in the next year,” Rattner wrote.

According to Rattner, the recent surge in policy uncertainty and capital spending concerns compound financial market instability.

Meanwhile, Nick Timiraos, the chief economics correspondent for The Wall Street Journal, echoed the news, indicating the bank has adjusted its 2025 Q4 GDP growth forecast to a mere 0.5%.

“We are lowering our 2025 Q4/Q4 GDP growth forecast to 0.5% and raising our 12-month recession probability from 35% to 45% following a sharp tightening in financial conditions, foreign consumer boycotts, and a continued spike in policy uncertainty that is likely to depress capital spending by more than we had previously assumed,” Timiraos reported, citing Goldman Sachs.

While this reflects the anticipated fallout, the bank’s current forecast assumes that many new tariffs scheduled for April 9 will not materialize.

However, Goldman Sachs articulated that if Trump enacted these tariffs, the bank would adjust its prediction and formally forecast a recession. This could fuel already simmering inflation and drive further downward pressure on US economic growth.

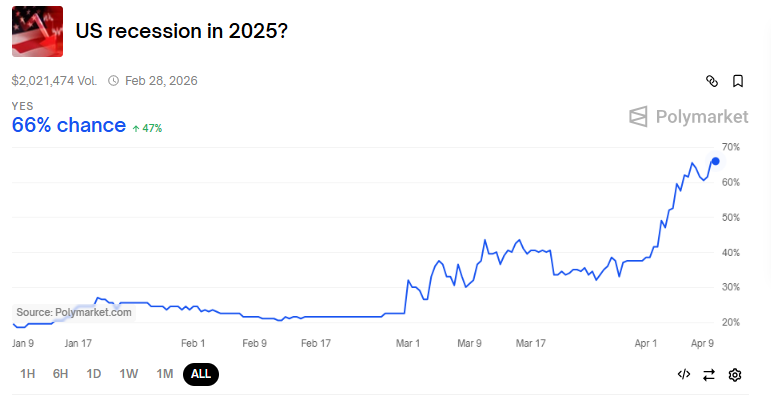

Amid escalating trade tensions, Polymarket bettors see almost 70% odds of US recession after Liberation Day tariffs.

Goldman Sachs Ups Bitcoin ETF Holdings

Despite the grim outlook for the economy, Goldman Sachs remains heavily invested in the crypto space, particularly Bitcoin (BTC). As of February 12, the bank held a substantial $1.5 billion in Bitcoin. This exposure comes through exposure to BlackRock and Fidelity’s Bitcoin ETFs (exchange-traded funds).

Moreover, recent filings reveal that Goldman Sachs has significantly increased its Bitcoin ETF holdings. Compared to previous filings, it boosted its position in the iShares Bitcoin Trust (IBIT) by 88% and the Franklin Bitcoin Trust (FBTC) by 105%.

This position reflects Goldman Sachs’ growing interest in digital assets as an alternative store of value amid traditional market instability.

This increase comes as Bitcoin has shown resilience in recent months, outpacing many other asset classes in performance. Recently, the bank’s CEO, David Solomon, highlighted the potential of blockchain technology to streamline traditional finance (TradFi). BeInCrypto reported Solomon saying Bitcoin was not a threat to the US dollar.

Besides Goldman Sachs, JPMorgan also predicted a recession in the US. BeInCrypto reported that it was the first major Wall Street bank to predict a US recession following former President Trump’s tariffs.

Their forecast warned of the broader economic consequences of trade wars, predicting that the Federal Reserve (Fed) might need to cut rates sooner than expected.

The possibility of a rate cut, which many see as a response to a weakening economy, adds to concerns about stagflation—a simultaneous rise in inflation and stagnation in economic growth.

This economic uncertainty also raises the odds of quantitative easing (QE) in the US financial system. Such an outcome could have far-reaching implications for the crypto market.

If the Fed opts for stealth QE, it could inject liquidity into the market and provide a short-term lifeline for risk assets like Bitcoin.

However, such actions could also intensify inflationary pressures, prompting a difficult balancing act for policymakers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Crypto Outflows Hit $795 Million On Trump’s Tariffs & Market Fear

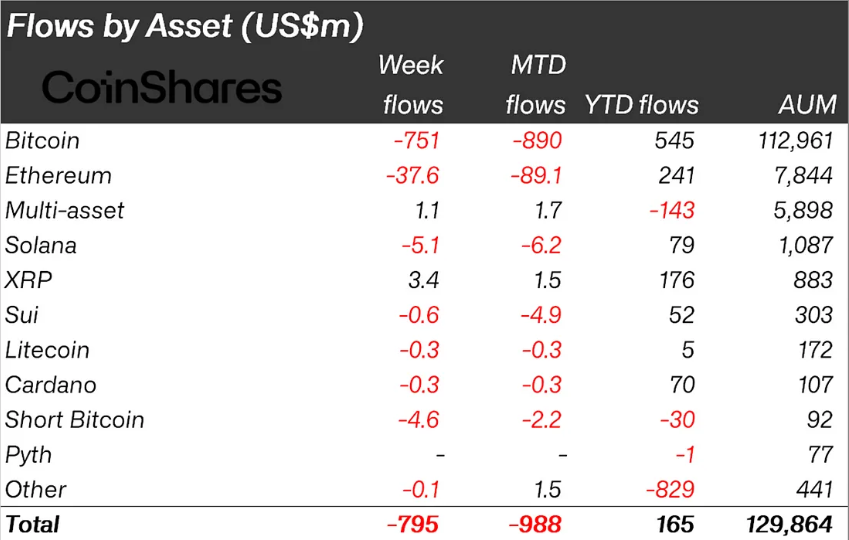

According to the latest CoinShares research, crypto outflows hit $795 million last week. This marks the third consecutive week of negative flows, as financial uncertainty continues to weigh heavy on investor sentiment.

This report aligns with the outlook for Bitcoin spot ETFs (exchange-traded funds), which saw $713 million in outflows last week, a 314% surge from the prior week’s $172.69 million.

Crypto Outflows Reached $795 Million Last Week

CoinShares’ researcher James Butterfill reveals that while Bitcoin led the outflows at $751 million, some altcoins, including XRP, Ondo Finance (ONDO), Algorand (ALGO, and Avalanche (AVAX), managed positive flows.

It suggests investors adjust their investment strategies, pivoting to altcoins as broader economic chaos bombards the Bitcoin (BTC) market.

“…recent tariff activity continues to weigh on sentiment towards the asset class,” wrote Butterfill.

This trend is not new, as altcoins have outperformed Bitcoin on flow metrics in the past. Two weeks ago, altcoins broke a five-week streak of negative flows, catapulting crypto inflows to $226 million.

Meanwhile, the influence of Trump’s tariffs on digital asset investment products has been consistent. In the week ending April 7, crypto outflows hit $240 million in the backdrop of Trump’s trade chaos.

Investor sentiment took a particularly sharp turn after President Donald Trump’s tariff pause announcement sidelined China, reigniting fears of a US-China trade war. This spooked markets across traditional and digital assets, along with China’s retaliatory move, exacerbates the sentiment.

Nevertheless, despite sidelining China, Trump’s temporary rollback of tariffs helped lift assets under management (AuM) by 8% to $130 billion, up from the lowest point seen since November 2024.

“… a late-week price rebound helped lift total AuM from their lowest point on April 8 (the lowest since early November 2024) to $130 billion, marking an 8% increase following President Trump’s temporary reversal of the economic calamitous tariffs,” Butterfill added.

Bitcoin Bleeds, ETF Flows Confirm Sentiment

As indicated, Bitcoin bore the brunt of last week’s bearish turn. Outflows surged in line with a 314% week-over-week increase in Bitcoin ETF outflows. The consistent bleed highlights that institutional interest is cooling, particularly among US-based ETF providers.

Short-Bitcoin products also suffered, with $4.6 million in outflows. This suggests traders may retreat to the sidelines entirely rather than taking leveraged bets on downside movement.

CoinShares emphasized that last week’s outflows spanned multiple regions and product providers. This signals that the bearish tone is not isolated to any one market. It aligns with broader risk-off behavior across equities and commodities in response to the volatile US trade stance.

Trump’s unpredictable tariff moves have reintroduced uncertainty into a fragile macro environment. Crypto markets, particularly institutional products, are responding with a broad withdrawal of capital.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin All-Time High in 2025? Expert Sees 77% Chance

According to a mathematical analysis by financial expert Fred Krueger, Bitcoin (BTC) has a 77% chance of reclaiming its all-time high (ATH) this year.

His outlook adds to other experts’ predictions, who see a declining US Dollar Index (DXY) and rising M2 global liquidity as key catalysts for Bitcoin’s next bull run.

Will Bitcoin Hit an All-Time High in 2025?

In a detailed post on X, Krueger applied the Geometric Brownian Motion (GBM) model to estimate the probability of Bitcoin rising from its current price of around $85,000 to $108,000 by 2025.

For context, GBM is a mathematical model commonly used to represent the behavior of asset prices in finance. The model assumes that the logarithm of the asset price follows a Brownian motion with drift. In simpler terms, this means that the asset price has two components:

- A deterministic trend (drift) represents the asset’s expected return over time. It is often expressed as a constant percentage rate.

- A random component (stochastic part) accounts for the volatility or unpredictability of asset price. It is modeled as a Wiener process (i.e., random fluctuations).

GBM serves in various financial applications, including pricing options, forecasting future asset prices, and assessing portfolio risks.

For his analysis, Krueger initially assumed BTC follows a GBM with zero drift and 80% volatility. This yielded a 65% chance of Bitcoin reaching its all-time high of $108,000. However, he then adjusted the model to incorporate the coin’s historical growth trend, applying a 40% power law drift.

“This increases the mathematical odds to 77%. ChatGPT ran a simulation which confirms this result,” Krueger stated.

The analyst’s revised forecast challenges figures on prediction markets. On Polymarket, the odds of BTC hitting an ATH before 2026 are much lower at just 52%.

“This is wrong and can be arbitraged by dynamic hedging,” Krueger claimed.

Notably, the odds are even lower on Kalshi. It estimates a 23% chance of Bitcoin reaching a new high of $150,000 in the same timeframe.

Meanwhile, sharing Krueger’s positive outlook, another analyst foresees an upcoming bull run, citing a strong correlation with M2 Global Liquidity and a weakening US dollar.

“April would be the month where Bitcoin marks the full bottom and starts the leg up and this has already begun this week!” he wrote on X.

He emphasized that M2 Global Liquidity reaching a new ATH is a bullish indicator for Bitcoin, which typically follows with a 75 to 105-day lag. Additionally, the DXY’s drop to a 3-year low, coupled with the inverse correlation between DXY and BTC, further fuels optimism for Bitcoin’s potential growth.

“Now that M2 is rising strongly, the next step is the rotation of profits from gold into Bitcoin. This is already happening and explains why Bitcoin jumped from the super cycle entry zone at 74,000-76,000 to 86,000. It’s all playing out as expected,” he noted.

The analyst expects a short-term pullback to $80,000. However, he remains bullish long-term. According to him, BTC could reach $550,000 to $650,000 by 2030, driven by currency debasement and Bitcoin’s fixed supply.

Currently, Bitcoin trades around 22.1% below its all-time high. BeInCrypto data showed that it declined 0.6% over the past day. At press time, BTC’s trading price stood at $84,338.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

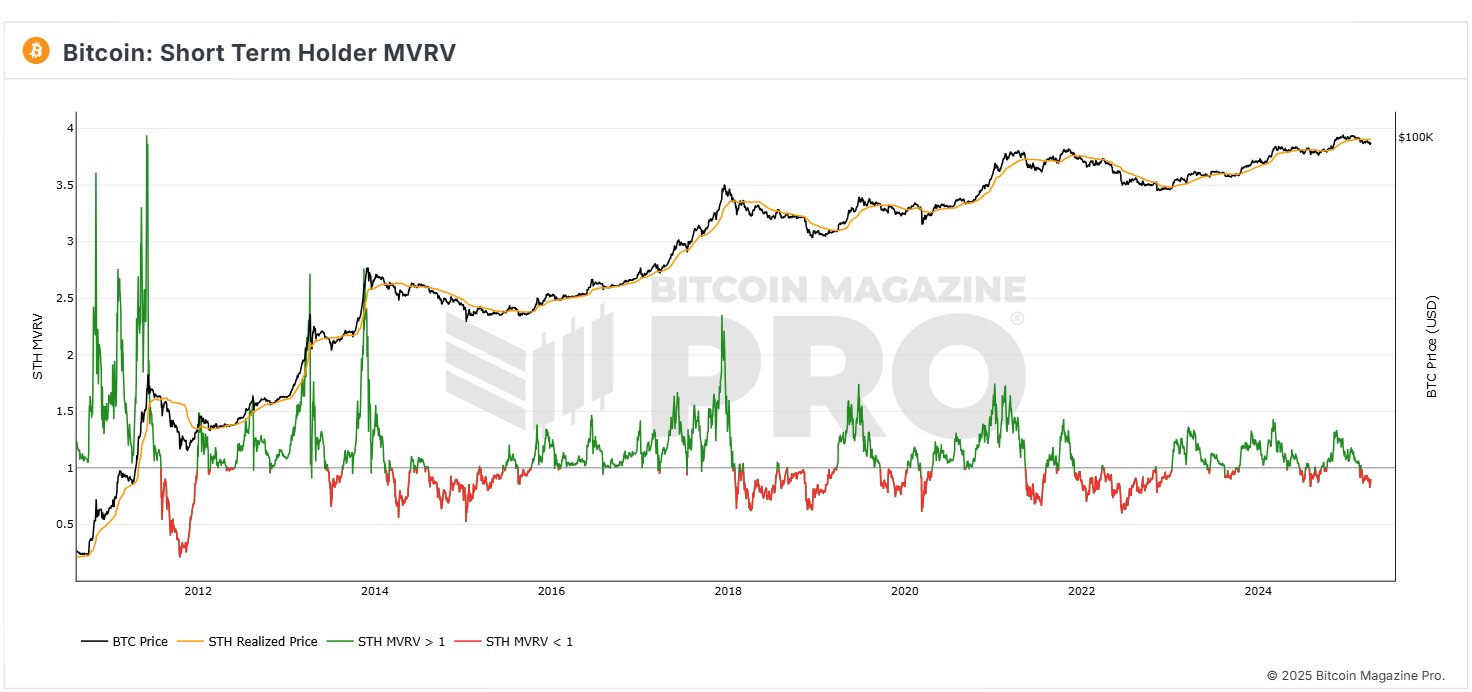

Bitcoin STH MVRV Climbs To 0.90, Is A Price Rebound On?

Bitcoin (BTC) has moved to reclaim the $86,000 price level following a 2.65% gain in the last 24 hours. Notably, the premier cryptocurrency has maintained a bullish form over the past few rising by over 15% since retesting the $74,000 rice zone. Amid a potential resumption of the broader bull rally, prominent crypto analyst Burak Kesmeci has highlighted notable developments in Bitcoin short-term holders MVRV (Market Value to Realized Value) ratio.

Bitcoin Market Recovery Awaits Final Signal: Analyst

In a new post on X, Kesmeci explains that Bitcoin is showing early signs of a market recovery following recent developments in the Bitcoin MVRV for short-term investors. For context, the MVRV measures investors’ profitability by comparing the market value of an asset to the price at which it was acquired. An MVRV score below 1.00 indicates that the average holder is at a loss, while a score above 1.00 suggests profit.

The MVRV for Bitcoin short-term holders i.e. addresses that have held Bitcoin for less than 155 days, is particularly important as this cohort of investors is usually the most reactive to price changes. Notably, the STH MVRV provides insight into market sentiment and potential price direction.

According to Kesmeci, the Bitcoin STH MVRV is now at 0.90, close to a profit level above 1.00. The STH MVRV had hit 0.82 amidst the recent “tax tariff poker” crisis, ignited by international tariff changes by the US government. Notably, this decline falls lower than levels seen during the Japan-based carry trade crisis on August 5, 2024, when STH MVRV dipped to 0.83.

Over the last few days, the STH MVRV has climbed to 0.90 in line with the resurgence of BTC prices However, Kesmeci warns that Bitcoin must still cross 1.00 to confirm the potential for any significant price gains for short-term investors. Albeit, the rise from 0.82 to 0.90 remains a positive development that indicates an ongoing shift in market sentiment.

BTC Price Outlook

At press time, Bitcoin is trading at $85,390 following a slight price retracement in the past few hours. Amidst recent daily gains, the premier cryptocurrency is up by 2.11% on its weekly chart and 4.33% on the monthly chart as bullish momentum continues to build among investors. However, market bulls must offset the 38.98% decline in daily trading volume if the present uptrend must persist.

Notably, BTC investors should expect to face ample resistance at the $88,000 price zone which has acted as a strong price barrier in previous times. Meanwhile, in the advent of any price fall, the immediate price support lies around $79,000.

Featured image from iStock, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin19 hours ago

Altcoin19 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Market23 hours ago

Market23 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Altcoin22 hours ago

Altcoin22 hours agoEthereum Price Eyes Rally To $4,800 After Breaking Key Resistance

-

Market17 hours ago

Market17 hours agoMANTRA’s OM Token Crashes 90% Amid Insider Dump Allegations

-

Market11 hours ago

Market11 hours agoBitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

-

Altcoin6 hours ago

Altcoin6 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?

-

Altcoin5 hours ago

Altcoin5 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds

-

Market10 hours ago

Market10 hours agoBitcoin Price Rises Steadily—But Can the Rally Hold This Time??