Bitcoin

Florida Moves Toward State Crypto Investment

The American state of Florida could be one of the pioneering local governments that allows a percentage of its state funds for cryptocurrency investments, particularly Bitcoin.

Florida Senator Joe Gruters has filed a bill that would permit the US state to use 10% of its funds to buy Bitcoin. This political backing could entice other American states to build their own cryptocurrency investments.

My state of Florida introduces a Bitcoin investment bill! 💪

If passed Florida’s CFO may allocate up to 10% of public funds to invest in $BTC or other digital assets.Thank you Senator Joe Gruters 🫡 pic.twitter.com/nF0SoTbT96

— Lucidvein (@Lucidvein) February 8, 2025

Florida To Invest In Bitcoin

Gruters introduced a legislative measure that would allow Florida to invest in Bitcoin using state funds to combat inflation.

The senator said that Senate Bill 550 proposed to permit Florida’s chief financial officer to use up to 10% of its funds to buy Bitcoin and other cryptocurrencies.

“The state should have access to tools such as BTC to protect against inflation,” Gruters said.

The bill aims to incorporate Bitcoin into state financial planning in the US, a legislative action that could reshape state authorities’ investment funds strategy and lead to other states adopting crypto.

Fighting Inflation With BTC

Gruters eyes that the proposed bill would help financial planners of Florida to hedge against inflation.

“Inflation has eroded the purchasing power of assets held in state funds managed by the Chief Financial Officer, and this erosion diminishes the value of the state’s reserves, affecting the financial stability and economic security of this state, its taxpayers, and its residents,” Gruters said.

The senator explained in the bill that inflation has “eroded the purchasing power of assets” managed by the state’s chief financial officer, adding that the state is responsible for safeguarding “Florida’s financial resources” against inflation and economic uncertainties.

“Bitcoin is viewed as a hedge against inflation by sovereign nations and prominent investment advisors, including BlackRock, Fidelity, and Franklin Templeton,” he said.

Hence, the American senator explained that Florida should have access to tools like Bitcoin to protect state funds from inflation.

Impact On The State Economy

Once Gruter’s proposed legislation was enacted, it would be beneficial to the state in several ways.

Analysts said that investing in Bitcoin would diversify Florida’s state assets, adding that the state would incorporate in its portfolio an asset that historically provides high returns but with significant volatility.

Market observers added that this crypto legislation would help turn Florida into a blockchain hub that promotes cryptocurrency innovation, further establishing Florida as a crypto-friendly state.

Florida might become the model state for adopting Bitcoin in state financial planning, making BTC adoption in government finance a reality.

Crypto analysts also see that Florida’s success could encourage other states to follow its lead and start incorporating digital assets into their financial systems.

Featured image from Shutterstock, chart from TradingView

Bitcoin

Crypto Outflows Hit $795 Million On Trump’s Tariffs & Market Fear

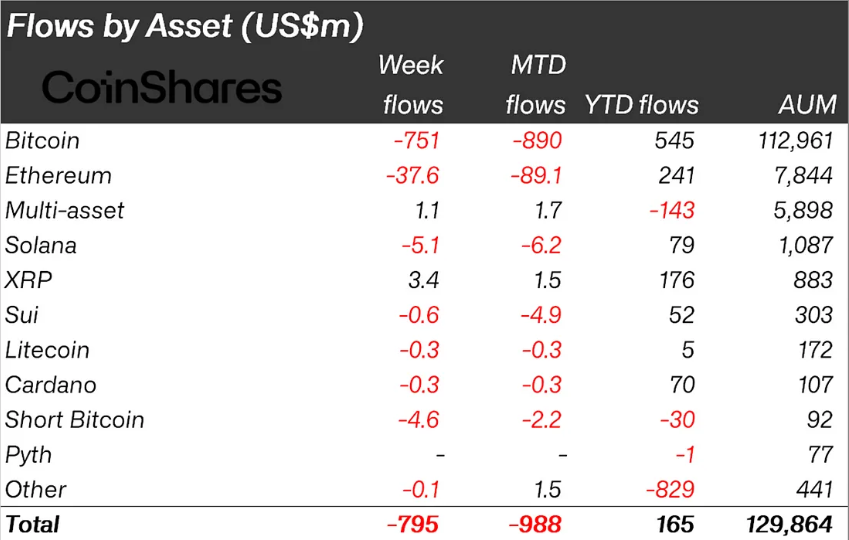

According to the latest CoinShares research, crypto outflows hit $795 million last week. This marks the third consecutive week of negative flows, as financial uncertainty continues to weigh heavy on investor sentiment.

This report aligns with the outlook for Bitcoin spot ETFs (exchange-traded funds), which saw $713 million in outflows last week, a 314% surge from the prior week’s $172.69 million.

Crypto Outflows Reached $795 Million Last Week

CoinShares’ researcher James Butterfill reveals that while Bitcoin led the outflows at $751 million, some altcoins, including XRP, Ondo Finance (ONDO), Algorand (ALGO, and Avalanche (AVAX), managed positive flows.

It suggests investors adjust their investment strategies, pivoting to altcoins as broader economic chaos bombards the Bitcoin (BTC) market.

“…recent tariff activity continues to weigh on sentiment towards the asset class,” wrote Butterfill.

This trend is not new, as altcoins have outperformed Bitcoin on flow metrics in the past. Two weeks ago, altcoins broke a five-week streak of negative flows, catapulting crypto inflows to $226 million.

Meanwhile, the influence of Trump’s tariffs on digital asset investment products has been consistent. In the week ending April 7, crypto outflows hit $240 million in the backdrop of Trump’s trade chaos.

Investor sentiment took a particularly sharp turn after President Donald Trump’s tariff pause announcement sidelined China, reigniting fears of a US-China trade war. This spooked markets across traditional and digital assets, along with China’s retaliatory move, exacerbates the sentiment.

Nevertheless, despite sidelining China, Trump’s temporary rollback of tariffs helped lift assets under management (AuM) by 8% to $130 billion, up from the lowest point seen since November 2024.

“… a late-week price rebound helped lift total AuM from their lowest point on April 8 (the lowest since early November 2024) to $130 billion, marking an 8% increase following President Trump’s temporary reversal of the economic calamitous tariffs,” Butterfill added.

Bitcoin Bleeds, ETF Flows Confirm Sentiment

As indicated, Bitcoin bore the brunt of last week’s bearish turn. Outflows surged in line with a 314% week-over-week increase in Bitcoin ETF outflows. The consistent bleed highlights that institutional interest is cooling, particularly among US-based ETF providers.

Short-Bitcoin products also suffered, with $4.6 million in outflows. This suggests traders may retreat to the sidelines entirely rather than taking leveraged bets on downside movement.

CoinShares emphasized that last week’s outflows spanned multiple regions and product providers. This signals that the bearish tone is not isolated to any one market. It aligns with broader risk-off behavior across equities and commodities in response to the volatile US trade stance.

Trump’s unpredictable tariff moves have reintroduced uncertainty into a fragile macro environment. Crypto markets, particularly institutional products, are responding with a broad withdrawal of capital.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin All-Time High in 2025? Expert Sees 77% Chance

According to a mathematical analysis by financial expert Fred Krueger, Bitcoin (BTC) has a 77% chance of reclaiming its all-time high (ATH) this year.

His outlook adds to other experts’ predictions, who see a declining US Dollar Index (DXY) and rising M2 global liquidity as key catalysts for Bitcoin’s next bull run.

Will Bitcoin Hit an All-Time High in 2025?

In a detailed post on X, Krueger applied the Geometric Brownian Motion (GBM) model to estimate the probability of Bitcoin rising from its current price of around $85,000 to $108,000 by 2025.

For context, GBM is a mathematical model commonly used to represent the behavior of asset prices in finance. The model assumes that the logarithm of the asset price follows a Brownian motion with drift. In simpler terms, this means that the asset price has two components:

- A deterministic trend (drift) represents the asset’s expected return over time. It is often expressed as a constant percentage rate.

- A random component (stochastic part) accounts for the volatility or unpredictability of asset price. It is modeled as a Wiener process (i.e., random fluctuations).

GBM serves in various financial applications, including pricing options, forecasting future asset prices, and assessing portfolio risks.

For his analysis, Krueger initially assumed BTC follows a GBM with zero drift and 80% volatility. This yielded a 65% chance of Bitcoin reaching its all-time high of $108,000. However, he then adjusted the model to incorporate the coin’s historical growth trend, applying a 40% power law drift.

“This increases the mathematical odds to 77%. ChatGPT ran a simulation which confirms this result,” Krueger stated.

The analyst’s revised forecast challenges figures on prediction markets. On Polymarket, the odds of BTC hitting an ATH before 2026 are much lower at just 52%.

“This is wrong and can be arbitraged by dynamic hedging,” Krueger claimed.

Notably, the odds are even lower on Kalshi. It estimates a 23% chance of Bitcoin reaching a new high of $150,000 in the same timeframe.

Meanwhile, sharing Krueger’s positive outlook, another analyst foresees an upcoming bull run, citing a strong correlation with M2 Global Liquidity and a weakening US dollar.

“April would be the month where Bitcoin marks the full bottom and starts the leg up and this has already begun this week!” he wrote on X.

He emphasized that M2 Global Liquidity reaching a new ATH is a bullish indicator for Bitcoin, which typically follows with a 75 to 105-day lag. Additionally, the DXY’s drop to a 3-year low, coupled with the inverse correlation between DXY and BTC, further fuels optimism for Bitcoin’s potential growth.

“Now that M2 is rising strongly, the next step is the rotation of profits from gold into Bitcoin. This is already happening and explains why Bitcoin jumped from the super cycle entry zone at 74,000-76,000 to 86,000. It’s all playing out as expected,” he noted.

The analyst expects a short-term pullback to $80,000. However, he remains bullish long-term. According to him, BTC could reach $550,000 to $650,000 by 2030, driven by currency debasement and Bitcoin’s fixed supply.

Currently, Bitcoin trades around 22.1% below its all-time high. BeInCrypto data showed that it declined 0.6% over the past day. At press time, BTC’s trading price stood at $84,338.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin STH MVRV Climbs To 0.90, Is A Price Rebound On?

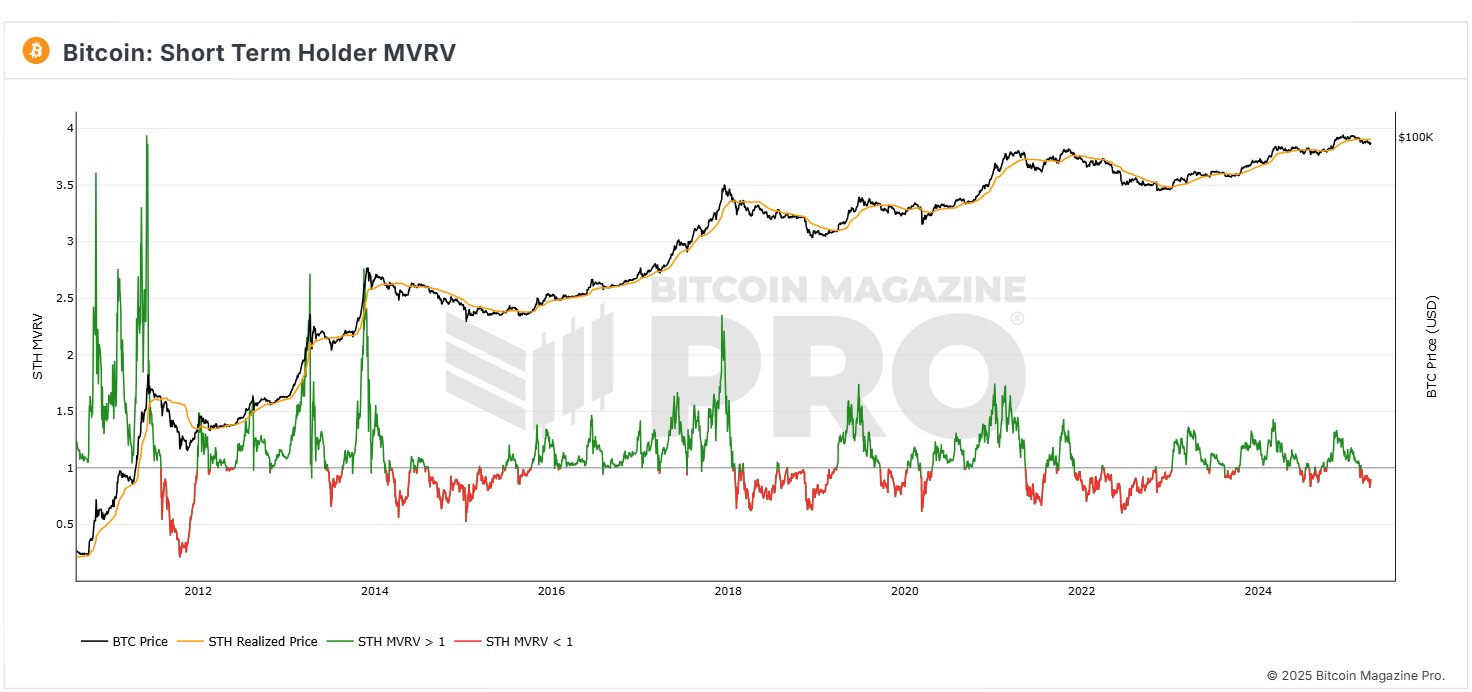

Bitcoin (BTC) has moved to reclaim the $86,000 price level following a 2.65% gain in the last 24 hours. Notably, the premier cryptocurrency has maintained a bullish form over the past few rising by over 15% since retesting the $74,000 rice zone. Amid a potential resumption of the broader bull rally, prominent crypto analyst Burak Kesmeci has highlighted notable developments in Bitcoin short-term holders MVRV (Market Value to Realized Value) ratio.

Bitcoin Market Recovery Awaits Final Signal: Analyst

In a new post on X, Kesmeci explains that Bitcoin is showing early signs of a market recovery following recent developments in the Bitcoin MVRV for short-term investors. For context, the MVRV measures investors’ profitability by comparing the market value of an asset to the price at which it was acquired. An MVRV score below 1.00 indicates that the average holder is at a loss, while a score above 1.00 suggests profit.

The MVRV for Bitcoin short-term holders i.e. addresses that have held Bitcoin for less than 155 days, is particularly important as this cohort of investors is usually the most reactive to price changes. Notably, the STH MVRV provides insight into market sentiment and potential price direction.

According to Kesmeci, the Bitcoin STH MVRV is now at 0.90, close to a profit level above 1.00. The STH MVRV had hit 0.82 amidst the recent “tax tariff poker” crisis, ignited by international tariff changes by the US government. Notably, this decline falls lower than levels seen during the Japan-based carry trade crisis on August 5, 2024, when STH MVRV dipped to 0.83.

Over the last few days, the STH MVRV has climbed to 0.90 in line with the resurgence of BTC prices However, Kesmeci warns that Bitcoin must still cross 1.00 to confirm the potential for any significant price gains for short-term investors. Albeit, the rise from 0.82 to 0.90 remains a positive development that indicates an ongoing shift in market sentiment.

BTC Price Outlook

At press time, Bitcoin is trading at $85,390 following a slight price retracement in the past few hours. Amidst recent daily gains, the premier cryptocurrency is up by 2.11% on its weekly chart and 4.33% on the monthly chart as bullish momentum continues to build among investors. However, market bulls must offset the 38.98% decline in daily trading volume if the present uptrend must persist.

Notably, BTC investors should expect to face ample resistance at the $88,000 price zone which has acted as a strong price barrier in previous times. Meanwhile, in the advent of any price fall, the immediate price support lies around $79,000.

Featured image from iStock, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market21 hours ago

Market21 hours agoXRP Outflows Cross $300 Million In April, Why The Price Could Crash Further

-

Altcoin19 hours ago

Altcoin19 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?

-

Market24 hours ago

Market24 hours agoBitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

-

Altcoin22 hours ago

Altcoin22 hours agoBinance Breaks Silence Amid Mantra (OM) 90% Price Crash

-

Market20 hours ago

Market20 hours agoFLR Token Hits Weekly High, Outperforms Major Coins

-

Bitcoin19 hours ago

Bitcoin19 hours agoCrypto Outflows Hit $795 Million On Trump’s Tariffs & Market Fear

-

Market19 hours ago

Market19 hours agoAuto.fun Launchpad Set to Debut Amid Fierce Market Rivalry

-

Altcoin18 hours ago

Altcoin18 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds