Bitcoin

El Salvador Ignores IMF, Bolsters Crypto Holdings

In a dramatic gesture that reinforces its stance on Bitcoin, El Salvador has bought 11 BTC for its national reserves, which now amount to 6,044 units.

The move follows an agreement with the International Monetary Fund (IMF) for $1.4 billion, whose conditions include a reduction in some of the policies concerning Bitcoin. Still, the Central American country has not relented on the cryptocurrency.

IMF Deal Brings New Challenges

The IMF loan deal comes with some strings. El Salvador agreed to make acceptance of Bitcoin voluntary on the part of the private sector–a step back from an earlier directive compelling businesses to accept the cryptocurrency.

The state also intends to dial back its presence in the Chivo wallet, a government-owned wallet designed for Bitcoin use. These concessions appear to satisfy the concerns expressed by the IMF but haven’t made the country desist from buying more Bitcoin.

Source: El Salvador National Bitcoin Office

This fine balance between fulfilling the requirements of the IMF and following a Bitcoin-driven finance plan indicates how serious the government is when it comes to being unique in global adoption of cryptocurrencies. It’s a balancing act El Salvador seems ready to ace.

A Devoted Vision For Bitcoin

In the face of these warnings, however, the El Salvador National Bitcoin Office restated its interest in Bitcoin. It even went on to mention the possibility of acquiring more, which would be faster than before. The unflinching vision reveals that the government believes Bitcoin has a future. It’s something that forms an integral part of its financial vision.

BTCUSD trading at $104,319 on the 24-hour chart: TradingView.com

El Salvador’s assets total 6,044 BTC, or around $610 million, according to the National Bitcoin Office’s portfolio tracker. CoinGecko reports that the cryptocurrency is currently trading at about $101,350.

The National Bitcoin Office of the nation said in a Jan. 19 X post that it acquired additional 11 Bitcoins for its strategic bitcoin hoard valued more over $1 million. On January 20 it bought one Bitcoin for $106,000 as well.

El Salvador adds another 11 BTC to our Strategic Bitcoin Reserve!

— The Bitcoin Office (@bitcoinofficesv) January 20, 2025

President Nayib Bukele’s administration has been very vocal about their ambitions regarding Bitcoin’s integration into everyday financial activities. Critics argue that it is not long-term sustainable, whereas supporters believe that this is a revolutionary step toward economic innovation.

Image: La Prensa Gráfica

Bitcoin In El Salvador’s Financial Identity

Bitcoin is becoming more than just a basic investment for El Salvador; it represents financial autonomy. This country’s latest acquisition places the nation in a unique position on the international scene and demonstrates that traditional banking systems and digital assets can coexist.

Breaking its previous all-time high of $108,000, which it reached on December 17, Bitcoin momentarily climbed past $109,000 on January 20.

The new high for Bitcoin arrived just before Donal Trump took office as the 47th US president, Monday.

Featured image from DALL-E, chart from TradingView

Bitcoin

Here Are The Bitcoin Levels To Watch For The Short Term

Bitcoin has produced a range-bound movement recently, with prices oscillating between $83,000 and 86,000. Interestingly, popular crypto analyst Burak Kesmeci has identified the important price levels for any short-term action.

Support At 82,800, Resistance At 92,000 – But Where Is Bitcoin Headed?

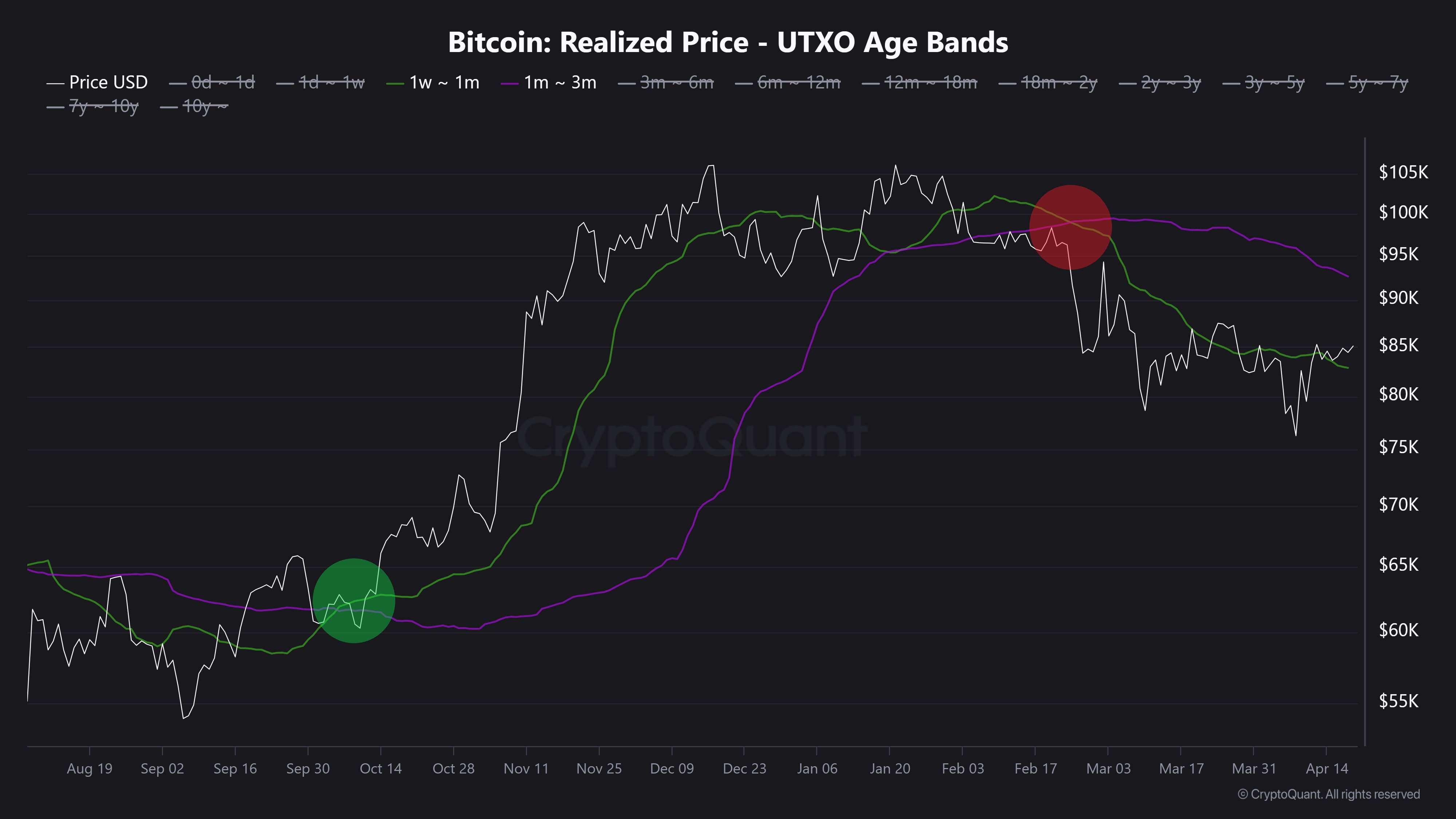

In a new post on X, Kesmeci shared an interesting on-chain analysis of the Bitcoin market. Using the short-term investor cost basis, the analyst identified two key price levels that could prove critical to Bitcoin’s next major move.

Firstly, Burak Kesmeci focuses on the average cost prices of new traders over the past 1-4 weeks, which are likely the most reactive to price changes. The realized price for these traders currently stands at $82,800, forming a near-term support that indicates many recent buyers are still in profit and may defend this level as a psychological floor.

Meanwhile, Kesmeci also highlights the $92,000 price level, which marks the average cost basis for BTC holders for 1-3 months. This price point has emerged as an important resistance zone, as investors are likely to exit the market once they break even. Furthermore, the $92,000 price level is also marked by a confluence with various technical indicators.

The interplay between these two levels is significant. Historically, short-term bullish trends in BTC tend to begin when the cost basis of more recent investors, 1–4 weeks, crosses above that of the 1–3 BTC holders. This shift signals increased confidence and willingness to buy at higher levels, which often fuels broader rallies.

However, that dynamic remains to play out in the current market. As of now, Bitcoin is trading around 85,000, positioning it above its support at the 1–4 week average of $82,800 but still below the 1–3 month resistance of $92,000. Furthermore, both cost basis levels have been declining over the past two months, reflecting hesitation or a lack of aggressive buying from new entrants.

Notably, Kesmeci states that BTC must surge above $92,000 to confirm a strong bullish momentum for a price reversal.

Bitcoin ETFs Offload 1,725 BTC

In other news, Ali Martinez reports that the Bitcoin ETFs have suffered withdrawals of 1,725 Bitcoin, valued at $146.92 million, over the past week. This development illustrates a high level of negative sentiment among institutional investors, adding to market uncertainty around the BTC market.

Meanwhile, Bitcoin trades at $85,249 following a price change of 0.89% in the past day. The premier cryptocurrency also reflects a 0.58% loss on the weekly chart and a 1.06% gain on a monthly chart.

Feature image from Adobe Stock, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin LTH Selling Pressure Hits Yearly Low — Bull Market Ready For Take Off?

Following an extensive price correction in the past three months, the Bitcoin bull market continues to hang in the balance. Despite a modest price rebound in April, the premier cryptocurrency is yet to display a strong intent to resume its bull rally amidst a lack of positive market factors. However, crypto analyst Axel Adler Jr. has highlighted a promising development that could signal major upside potential for Bitcoin.

Bitcoin Long-Term Holders Looking To Halt Selling Pressure

In a recent post on X, Adler Jr. shared an important update in Bitcoin long-term holders (LTH) activity, which could prove significantly positive for the broader BTC market.

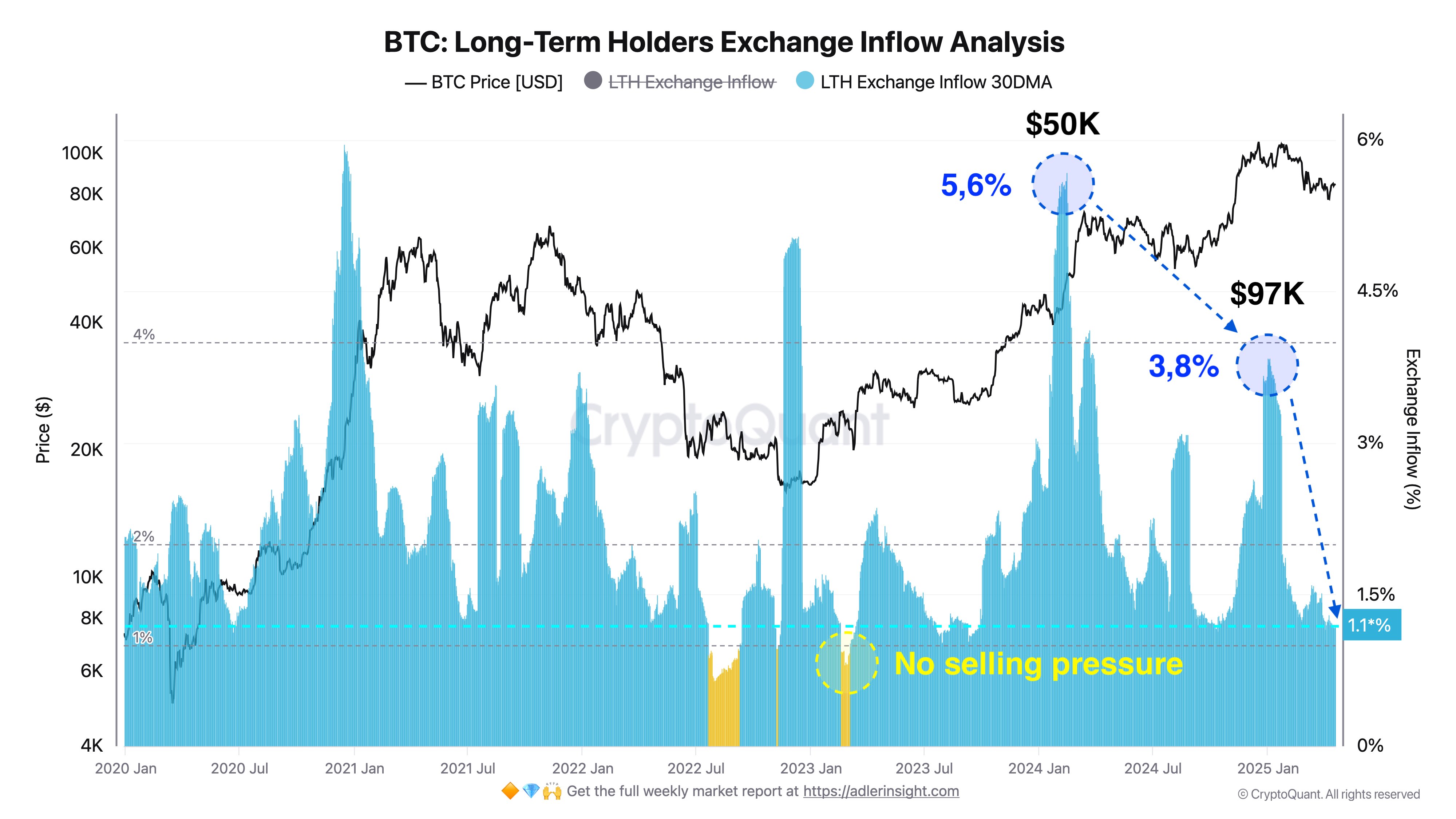

Using on-chain data from CryptoQuant, the renowned analyst reports that selling pressure by long-term holders, i.e. amount of LTH holdings on exchanges, has now hit its lowest point at 1.1% over the past year. This development indicates that Bitcoin LTH are now opting to hold on to their assets rather than take profits.

Adler explains that a further decline in these LTH exchange holdings to 1.0% would signal the total absence of selling pressure. Notably, this development could encourage new market entry and sustained accumulation, creating a strong bullish momentum in the BTC market.

Importantly, Alder highlights that the majority of the Bitcoin LTH entered the market at an average price of $25,000, Since then, CryptoQuant has recorded the highest LTH selling pressure of 5.6% at $50,000 in early 2024 and 3.8% at $97,000 in early 2025.

According to Adler, these two instances likely represent the primary profit-taking phases for long-term holders who intended to exit the market. Therefore, a resurgence in selling pressure from this cohort of BTC investors is unlikely in the short-term, which supports a building bullish case as long-term holders currently control 77.5% of Bitcoin in circulation.

BTC Price Overview

At the time of writing, Bitcoin was trading at $85,226 following a 0.36% gain in the past day and a 0.02% loss in the past week. Both metrics only reflect the ongoing market consolidation as BTC continues to struggle to achieve a convincing price breakout beyond $86,000.

Meanwhile, the asset’s performance on the monthly chat now reflects a 1.97% gain, indicating a potential trend reversal as the market correction ceases. Nevertheless, BTC remains in need of a strong market catalyst to ignite any sustainable price rally. With a market cap of $1.67 trillion, Bitcoin is ranked as the largest digital asset, controlling 62.9% of the crypto market.

Featured image from Adobe Stock, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Analyst Says Bitcoin Price Might Be Gearing Up For Next Big Move — What To Know

The Bitcoin price seems stuck in a consolidation range, ricocheting off the $83,000 and $86,000 levels over the past week. With no clear direction for the premier cryptocurrency, investors are left wondering what phase the market cycle is in—bullish or bearish.

According to a popular crypto analyst on the social media platform X, the Bitcoin price could be preparing for its next big move in either direction over the next few weeks. In any case, here are the important levels to watch out for in the next few days.

Crucial Levels To Watch For BTC’s Next Move

In an April 19 post on the X platform, crypto analyst Ali Martinez shared an interesting analysis of the Bitcoin price while highlighting the current layout of the world’s largest cryptocurrency by market cap. The online pundit noted that BTC bears and bulls are locked in a battle, leading to a choppy market condition.

Notably, the premier cryptocurrency appears to have entered the $83,000 – $86,000 range on Saturday, April 12. Hence, Martinez’s analysis basically revolves around the price of BTC bouncing off the support and resistance levels on its one-hour timeframe.

Source: @ali_charts on X

As shown in the chart above, the Bitcoin price attempted multiple times to breach the resistance zone around the $86,000 region over the past week. However, the bulls’ optimism was met with the staunch resilience of the Bitcoin bears, as the price of BTC almost always found its way back toward the $83,000 mark.

Most recently, the flagship cryptocurrency made its way toward the $86,000 level on Wednesday, April 16, but failed to break the significant resistance zone after the US Federal Reserve (Fed) chair Jerome Powell suggested that interest rate cuts might not be coming as early as anticipated by crypto traders.

Martinez noted in his post that the next significant move for the Bitcoin price depends primarily on the $83,000 and $86,000 levels. According to the crypto pundit, a breakout above the $86,000 mark could spell the start of a bullish run for Bitcoin, while a break below $83,000 could mean further correction for the market leader.

Bitcoin Price Overview

After reaching its all-time high of $108,786 in January 2025, the price of BTC has been on a steady decline in the past few months. According to data from CoinGecko, the flagship cryptocurrency has losst more than 22% of its value since hitting its record-high price.

As of this writing, the price of Bitcoin stands at around $84,530, reflecting a 0.3% decline in the past 24 hours. Meanwhile, the Bitcoin price is up by more than 1% on the weekly timeframe.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin22 hours ago

Altcoin22 hours agoUniswap Founder Urges Ethereum To Pursue Layer 2 Scaling To Compete With Solana

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Market18 hours ago

Market18 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Altcoin21 hours ago

Altcoin21 hours agoWhat’s Up With BTC, XRP, ETH?

-

Market12 hours ago

Market12 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Market16 hours ago

Market16 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Market13 hours ago

Market13 hours agoVOXEL Climbs 200% After Suspected Bitget Bot Glitch

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Accumulators At A Crucial Moment: ETH Realized Price Tests Make-Or-Break Point