Bitcoin

cbBTC Surges Past $1 Billion as Coinbase Ends WBTC Support

Coinbase, the largest US-based crypto exchange, has announced it will suspend trading for Wrapped Bitcoin (WBTC) on December 19, 2024, at approximately 12 p.m. ET.

The decision, revealed in a post on X (formerly Twitter), cites a routine review of its listed assets to ensure compliance with listing standards.

Coinbase Sidesteps WBTC Amid cbBTC Boom

The suspension will apply to both Coinbase Exchange and Coinbase Prime. Although trading will cease, WBTC holders will retain full access to their funds and the ability to withdraw them at any time. In preparation for the transition, Coinbase has moved WBTC trading to a limit-only mode, where users can place and cancel limit orders while matches may still occur.

“Coinbase will suspend trading for WBTC (WBTC) on December 19, 2024, at or around 12 pm ET. Your WBTC funds will remain accessible to you, and you will continue to have the ability to withdraw your funds at any time. We have moved our WBTC order books to limit-only mode. Limit orders can be placed and canceled, and matches may occur,” Coinbase detailed.

Coinbase’s move to suspend WBTC comes amid the rapid success of its wrapped Bitcoin token, cbBTC. Recently, cbBTC surpassed a $1 billion market capitalization, reflecting growing adoption and trust within the crypto community. This milestone has further cemented cbBTC’s position as a strong competitor to WBTC in the decentralized finance (DeFi) space.

As of this writing, data on Dune shows that cbBTC market capitalization has increased to $1.44 billion. CBTC’s native availability on networks like Solana, Ethereum, and Base has significantly expanded its accessibility, with Arbitrum being the latest addition.

“cbBTC is live on Arbitrum. cbBTC is an ERC-20 token that is backed 1:1 by Bitcoin (BTC) held by Coinbase. It is natively available on Arbitrum and securely accessible to more users across the Ethereum ecosystem,” Coinbase shared on Tuesday.

Additionally, prominent DeFi protocol Aave is targeting cbBTC for its Version 3 (V3) platform, enhancing its utility within the ecosystem. This growing momentum may have played a key role in Coinbase’s decision to phase out WBTC trading.

WBTC Core Team Urge Coinbase to Reconsider

The team behind Wrapped Bitcoin expressed regret and surprise at Coinbase’s decision. In a statement on X, WBTC’s core team emphasized its commitment to compliance, transparency, and decentralization.

“We regret and are surprised by Coinbase’s decision to delist WBTC…We urge Coinbase to reconsider this decision and continue supporting WBTC trading,” the team said.

The statement outlined WBTC’s longstanding reputation for novel mechanisms, regulatory compliance, and decentralized governance. Highlighting its seamless integration with DeFi protocols, WBTC described itself as an essential liquidity solution for Bitcoin users. Urging Coinbase to reconsider, WBTC reaffirmed its readiness to address any concerns or provide additional information to support its case.

Meanwhile, Coinbase’s announcement has sparked mixed reactions across the crypto community. Some users criticized the exchange, suggesting the decision reflects an inability to handle competition.

“Coinbase can’t handle fair competition?? WBTC superior to cbBTC” said Gally Sama in a post.

Nevertheless, others support the move, citing concerns over WBTC’s custody model, with one user referencing BitGo’s recent adoption of a multi-jurisdictional custody system.

“You put custody in the hands of a fraud. What did you think was gonna happen?” the user expressed.

This critique aligns with growing fears about Justin Sun’s involvement in WBTC’s custody processes, as BeInCrypto reported recently. Some users have acted preemptively to avoid potential risks, with one commenter sharing their reservations.

“When Sun got on the multisig for WBTC, I sent all my WBTC on OP to Coinbase and exchanged for true BTC that I withdrew to my hardware wallet… You gave me confirmation just now that I made the right move,” they wrote.

The decision to suspend WBTC trading could mark a pivotal moment in the competition between wrapped Bitcoin solutions. While cbBTC’s integration across multiple blockchain networks has gained momentum, skepticism surrounding WBTC’s custody model and leadership has intensified.

Justin Sun has voiced criticism of Coinbase’s cbBTC strategy, labeling it a setback for Bitcoin’s broader adoption. As the debate continues, the industry watches closely to see whether Coinbase’s cbBTC will solidify its dominance or if WBTC can regain its position as a leading wrapped Bitcoin solution. Regardless, the shifting dynamics reflect the importance of transparency, governance, and community trust in shaping the future of DeFi.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

ETF Issuers Bring Stability to Bitcoin Despite Tariff Chaos

BlackRock’s Bitcoin ETF is in the top 1% of performers in this category despite tariff chaos. Analysts theorize that the issuers are stabilizing Bitcoin’s volatility, and the ETF market will make BTC more secure in the future.

The issuers act as major whales, buying up any token dumps from retail investors. However, this new stability is entirely contingent on these powerful firms, which are exposed to broader macroeconomic concerns.

Are the ETFs Stabilizing Bitcoin?

The threat of Trump’s tariffs has brought chaos and uncertainty into global markets, but the price of Bitcoin has been relatively fine. Although it has fallen from its all-time high in January, its price shelf is still well above its performance before the November election.

According to one analyst, the ETFs may be providing Bitcoin with this extra stability:

“Bitcoin ETFs have eked out positive inflows past month and YTD and IBIT is +2.4 billion YTD (Top 1%). Impressivem and in my opinion, helps explain why BTC’s price has been relatively stable: its owners are more stable. ETF investors are much stronger hands than most think. This should increase stability and lower volatility and correlation long term,” claimed Eric Balchunas.

Since the Bitcoin ETFs first hit the market, they’ve totally transformed the crypto industry, but it’s been difficult to quantify that transformation.

However, this impending economic crisis has given analysts a useful chance to collect hard data from a stress test. Balchunas emphasized that ETF issuers had a powerful demand for BTC, which has powered some changes.

Over the last few months, US ETF issuers have been buying tremendous amounts of Bitcoin. Collectively, they surpassed Satoshi’s holdings in December and bought 20x as much BTC as the global mining output in January. Who met this apparent crisis in supply? Retail investors.

Bitcoin is more integrated than ever into traditional finance, and that presents a few opportunities. For any number of reasons, retailers have been compelled to dump their tokens.

Normally, these actions could spook the markets, but ETF issuers (and Michael Saylor’s Strategy) have been willing to buy as much Bitcoin as possible.

In other words, these whales have done a lot to hold up confidence in the entire market. Ideally, ETF issuers will have a mostly positive impact on the sector, potentially curing Bitcoin’s infamous chronic volatility.

Unfortunately, this substantial change comes with serious practical drawbacks, even discounting fears of de-decentralization. Since the ETFs transformed the market like this, Bitcoin has been more entangled than ever with broader macroeconomic trends.

These trends, however, could force these big whales to sell. Can we afford to tie Bitcoin’s fate to these actors?

The ETF issuers have a high confidence in Bitcoin, which has kept its price steady throughout the tariff chaos. If they lose that confidence for any reason, it could cause a powerful demand crisis.

This investment trend has been a tremendous benefit to the crypto industry, but it’s important to keep an eye on the potential risks involved.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

China Liquidates Seized Crypto to Boost Struggling Treasury

Amid mounting economic challenges and a growing pile of confiscated cryptocurrencies, local governments in China are increasingly liquidating seized digital assets to bolster strained public finances.

The practice raises legal and regulatory questions, especially concerning China’s blanket ban on crypto trading.

China Selling Seized Crypto To Bolster Treasury

China reportedly held around 15,000 Bitcoin (BTC) worth $1.4 billion by the end of 2024. According to River, a Bitcoin investment firm, this places the country among the top 15 global holders of the asset.

However, reports suggest China’s local governments are offloading digital currencies through private firms despite the national crypto ban.

Cas Abbe, a Web3 growth manager, and Binance exchange affiliate, noted on X that the dump in crypto prices may partly stem from these offloading activities.

“Local governments in China are selling seized crypto to top up their treasury. Despite the crypto trading ban in China, local governments are using private companies to offload their holdings. This explains pretty much the dump even before tariff news hit the market,” Abbe noted.

The surge in liquidations comes as authorities grapple with inconsistent policies for handling crypto seized from criminal investigations, which spiked sharply in 2023.

Over $59 billion was tied to crypto-related crimes in China that year. Blockchain security firm SAFEIS reported that more than 3,000 people were prosecuted for offenses ranging from internet fraud to illegal gambling.

Despite Beijing’s ban, local governments have reportedly turned to private firms to offload confiscated tokens. Specifically, they are converting them into cash to fund their treasuries.

Jiafenxiang, a Shenzhen-based technology firm, has sold more than 3 billion yuan ($414 million) worth of digital assets in offshore markets since 2018. Documents reviewed by Reuters link the company to liquidation deals with local authorities in Xuzhou, Hua’an, and Taizhou.

Though practical for cash-strapped regions, the process is legal gray territory. Such practices risk undermining the country’s crypto enforcement regime without clear regulatory frameworks.

“This raises so many questions about transparency. How are they even doing this legally?” noted one analyst in a post.

Experts are now calling for urgent regulatory reforms. These include judicial recognition of crypto as assets and the creation of standardized disposal mechanisms.

Some are even floating the idea of building a centralized national crypto reserve. This mirrors Trump’s administration’s proposals to manage seized assets more strategically.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Is Bitcoin the Solution to Managing US Debt? VanEck Explains

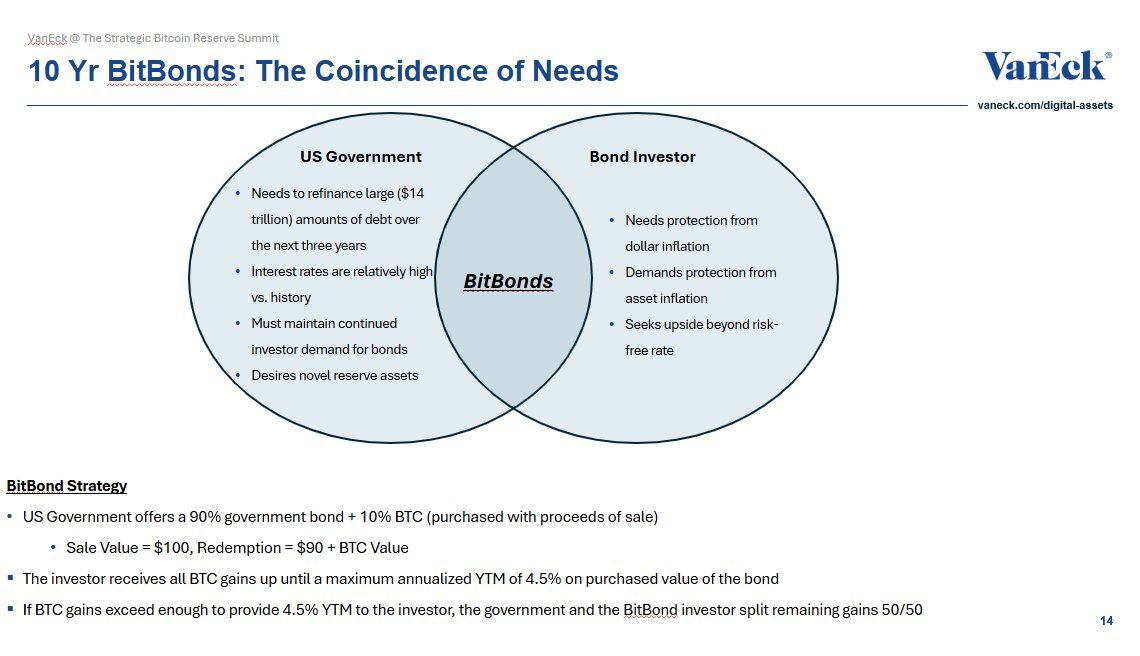

Matthew Sigel, Head of Digital Assets Research at VanEck, has proposed a new financial instrument, “BitBonds,” to help manage the US government’s looming $14 trillion refinancing debt requirement.

The 10-year financial instrument combines traditional US Treasury bonds with Bitcoin (BTC) exposure. This offers a potential solution to the nation’s fiscal concerns.

Can Bitcoin-Backed Bonds Help Solve the US Debt Crisis?

According to Sigel’s proposal, BitBonds’ investment structure allocates 90% of the funds to low-risk US Treasury securities and 10% to Bitcoin, combining stability with the potential for higher returns. Additionally, the government would purchase Bitcoin with proceeds from the bond sale.

Investors would receive all Bitcoin gains up to a maximum annualized yield-to-maturity of 4.5%. Furthermore, the investor and the government would split any additional gains equally.

“An aligned solution for mismatched incentives,” Sigel remarked.

From an investor perspective, Sigel highlighted that the bond offers a breakeven Bitcoin compound annual growth rate (CAGR) between 8% and 17%, depending on the coupon rate. Additionally, investors’ returns could skyrocket if Bitcoin grows at a 30%–50% CAGR.

“A convex bet—if you believe in Bitcoin,” he added.

However, the structure is not without risks: investors bear Bitcoin’s downside while only partially participating in its upside. Lower-coupon bonds may lose appeal if Bitcoin underperforms.

Meanwhile, the Treasury’s downside is limited. Even a complete collapse of Bitcoin’s value would still result in cost savings compared to traditional bond issuance. Yet, this is contingent on the coupon remaining below the breakeven threshold.

“BTC upside just sweetens the deal. Worst case: cheap funding. Best case: long-vol exposure to the hardest asset on Earth,” Sigel stated.

Sigel claimed that this hybrid approach aligns the interests of the government and investors over a 10-year period. The government faces high interest rates and significant debt refinancing needs. Meanwhile, investors seek protection from inflation and asset debasement.

The proposal comes amid growing concerns over the US debt crisis, exacerbated by the recent increase in the debt ceiling to $36.2 trillion, as reported by BeInCrypto. Notably, the Bitcoin Policy Institute (BPI) has also endorsed the concept.

“Building on President Donald J. Trump’s March 6, 2025, Executive Order establishing the Strategic Bitcoin Reserve, this white paper proposes that the United States adopt Bitcoin-Enhanced US Treasury Bonds (“₿ Bonds” or “BitBonds”) as an innovative fiscal tool to address multiple critical objectives,” the brief read.

In the paper, co-authors Andrew Hohns and Matthew Pines suggested that issuing $2 trillion in BitBonds at a 1% interest rate could cover 20% of the Treasury’s 2025 refinancing needs.

“Over a ten-year period, this represents nominal savings of $700 billion and a present value of $554.4 billion,” the authors wrote.

BPI estimates that if Bitcoin achieves a CAGR of 36.6%, the upside could potentially defease up to $50.8 trillion of federal debt by 2045.

These recommendations are part of broader conversations regarding Bitcoin’s potential impact on national finance. Previously, Senator Cynthia Lummis argued that a US Strategic Bitcoin Reserve could halve the national debt. In fact, VanEck’s analysis indicated that such a reserve could help reduce $21 trillion of debt by 2049.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Metrics Reveal Critical Support Level – Can Buyers Step In?

-

Market23 hours ago

Market23 hours agoSolana (SOL) Jumps 20% as DEX Volume and Fees Soar

-

Market22 hours ago

Market22 hours agoHedera Under Pressure as Volume Drops, Death Cross Nears

-

Market21 hours ago

Market21 hours agoEthena Labs Leaves EU Market Over MiCA Compliance

-

Market20 hours ago

Market20 hours ago3 US Crypto Stocks to Watch Today: CORZ, MSTR, and COIN

-

Market19 hours ago

Market19 hours agoBitcoin Price on The Brink? Signs Point to Renewed Decline

-

Market17 hours ago

Market17 hours agoXRP Price Pulls Back: Healthy Correction or Start of a Fresh Downtrend?

-

Altcoin17 hours ago

Altcoin17 hours agoRipple Whale Moves $273M As Analyst Predicts XRP Price Crash To $1.90