Bitcoin

BlackRock Larry Fink Hails Bitcoin, Calls It a Global Asset Class

BlackRock CEO Larry Fink has labeled Bitcoin (BTC) as a distinct asset class. Backing this belief, the asset management giant has launched an international campaign aimed at institutional partners to drive mainstream adoption of the cryptocurrency.

Bitcoin’s price continues its upward trajectory, surpassing the $65,000 mark on Monday.

BlackRock CEO Champions Bitcoin Adoption Campaign

Larry Fink made the remarks during the firm’s third quarter earnings report, indicating that BlackRock is engaging institutions globally about digital assets. Specifically, the discussion centers on asset allocation for Bitcoin, looking at it as an alternative to commodities such as gold.

Further, in the earnings report, Larry Fink noted that Bitcoin’s expansion is not a function of regulation or who becomes the next president of the US. Rather, liquidity and transparency are the drivers, with the former Bitcoin skeptic calling for enhanced analytics and more investor acceptance.

With these, Fink implied that Bitcoin and crypto, in general, are similar to other new financial products, which, despite stalling, ultimately reach scale.

Read More: What Is a Bitcoin ETF?

Larry Fink’s perspective on Bitcoin marks a notable transformation, considering he was an outspoken Bitcoin skeptic. Like JPMorgan CEO Jamie Dimon, the BlackRock exec has a history of dismissing BTC as a speculative and potentially dangerous asset.

Nevertheless, Fink’s assertions may represent a general sentiment among BlackRock managers. The firm’s head of digital assets, Robbie Mitchnick, recently said that Bitcoin is a safe haven and fundamentally a risk-off asset.

Mitchnick expressed that Bitcoin is not tied to any single country’s economic health or policies, adding that its scarcity makes it immune to the usual risks of currency debasement and political turmoil.

Earlier this month, another BlackRock executive, Jay Jacobs, said there is plenty of room for Bitcoin adoption. The US Head of Thematic and Active ETFs (exchange-traded funds) estimated that Bitcoin will grow to a market of $30 trillion in the coming years.

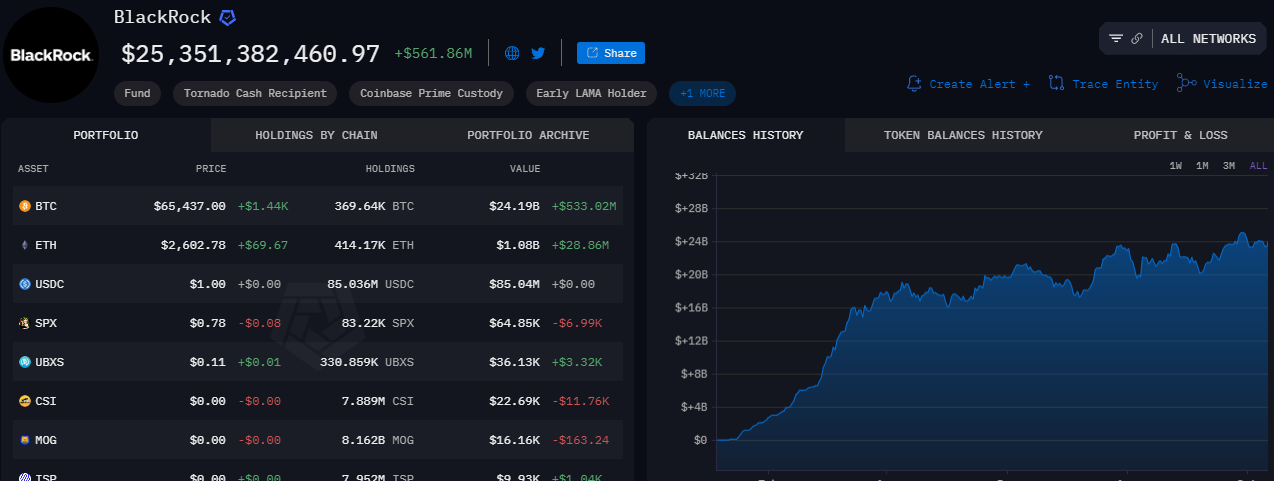

BlackRock’s Bitcoin ETF Soars to $23 Billion

During the earnings call, BlackRock CEO Larry Fink revealed that the firm’s IBIT ETF has surged to a $23 billion market in just nine months. Launched on January 11, the ETF provides institutional investors with indirect access to Bitcoin. This period has been marked by significant successes, with the fund attracting billions in investments and breaking trading volume records.

“…and we will continue to pioneer new products to make investing easier and more affordable,” Fink added.

BlackRock’s IBIT is a market leader in the Bitcoin ETF space in the US. It manages nearly 370,000 BTC, emerging as one of the largest Bitcoin holders. IBIT has already surpassed MicroStrategy’s Bitcoin holdings and now only lags behind Satoshi Nakamoto and Binance. Data on Arkham shows BlackRock’s Bitcoin stash is worth $25.35 billion.

Read more: Who Owns the Most Bitcoin in 2024?

As BlackRock and other crypto ETF issuers continue offering institutional access to Bitcoin, concerns about custodial risks have emerged. Critics also fear that increased institutional adoption could undermine the core principles of Bitcoin.

The cryptocurrency was designed to decentralize financial power, but with institutional control growing, some worry it could shift influence back to the very entities Bitcoin was intended to bypass.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

BTC Price Rebound Likely as Long-Term Holders Reenter Market

Bitcoin (BTC) is on track to end Q1 with its worst performance since 2019. Without an unexpected recovery, BTC could close the quarter with a 25% decline from its all-time high (ATH).

Some analysts have noted that experienced Bitcoin holders are shifting into an accumulation phase, signaling potential price growth in the medium term.

Signs That Veteran Investors Are Accumulating Again

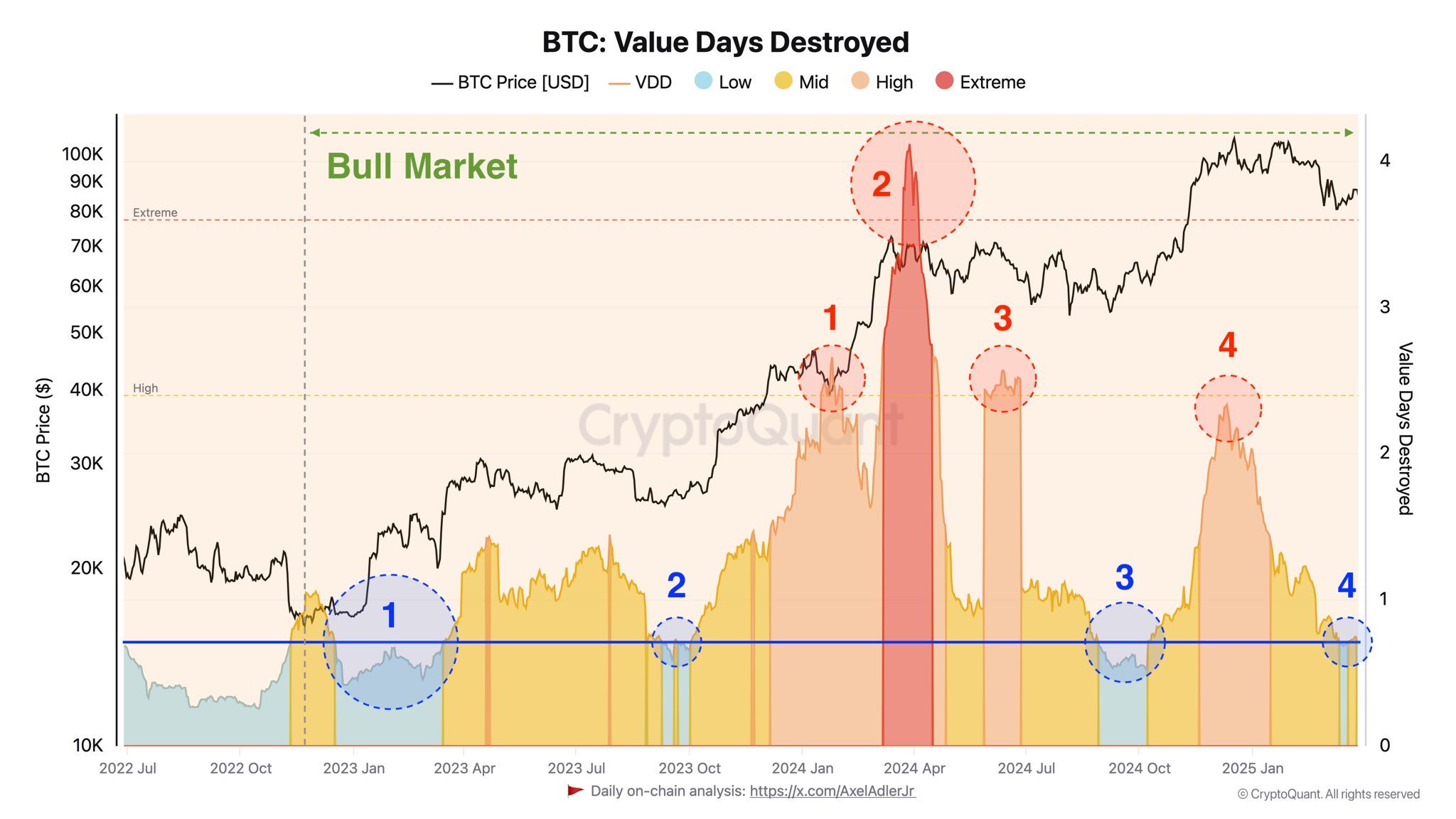

According to AxelAdlerJr, March 2025 marks a transition period where veteran investors move from selling to holding and accumulating. This shift is reflected in the Value Days Destroyed (VDD) metric, which remains low.

VDD is an on-chain indicator that tracks investor behavior by measuring the number of days Bitcoin remains unmoved before being transacted.

A high VDD suggests that older Bitcoin is being moved, which may indicate selling pressure from whales or long-term holders. A low VDD suggests that most transactions involve short-term holders, who have a smaller impact on the market.

Historically, low VDD periods often precede strong price rallies. These phases suggest that investors are accumulating Bitcoin with expectations of future price increases. AxelAdlerJr concludes that this shift signals Bitcoin’s potential for medium-term growth.

“The transition of experienced players into a holding (accumulation) phase signals the potential for further BTC growth in the medium term,” AxelAdlerJr predicted.

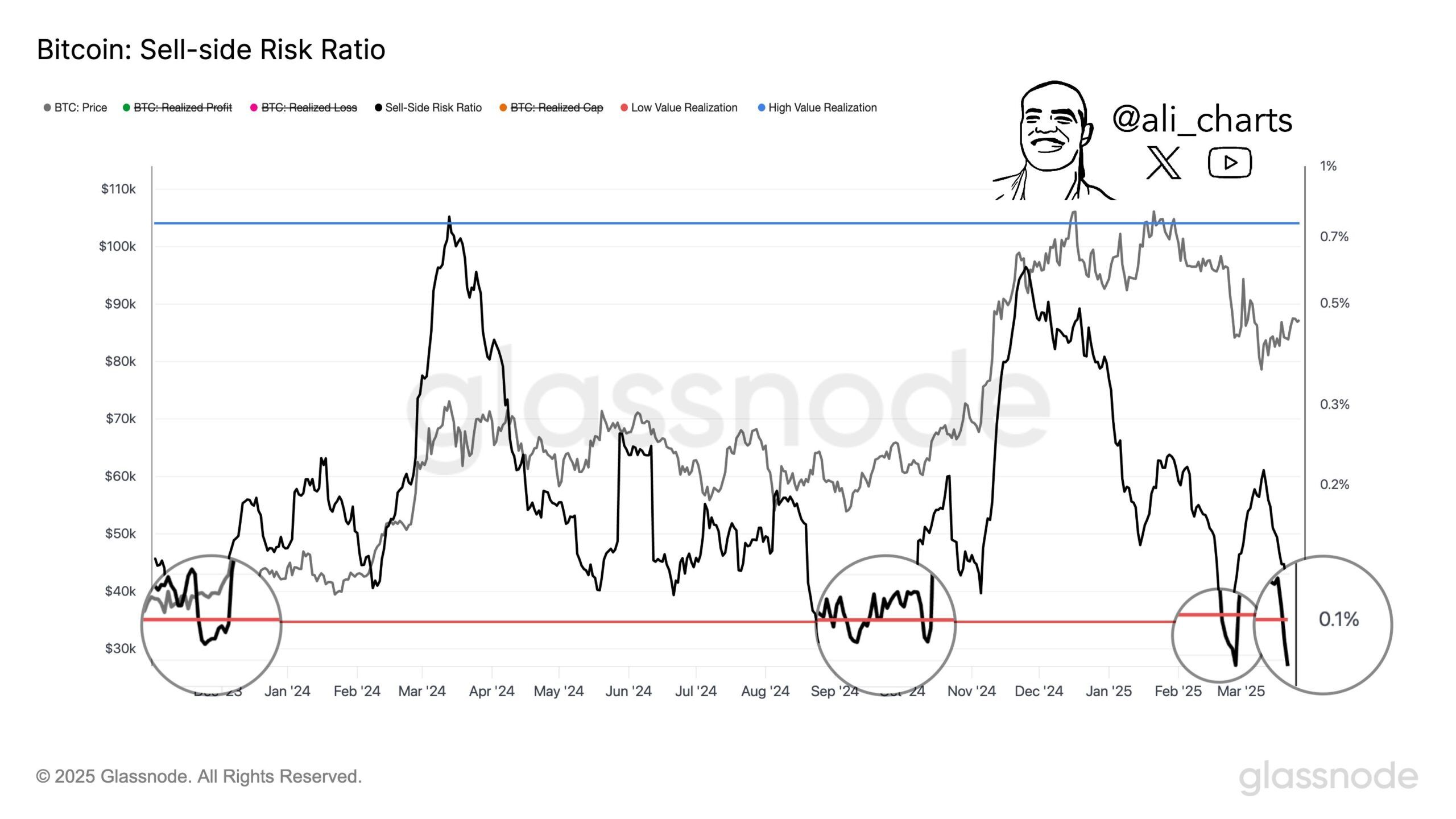

Bitcoin’s Sell-Side Risk Ratio Hits Low

At the same time, analyst Ali highlighted another bullish indicator: Bitcoin’s sell-side risk ratio had dropped to 0.086%.

According to Ali, over the past two years, every time this ratio fell below 0.1%, Bitcoin experienced a strong price rebound. For example, in January 2024, Bitcoin surged to a then-all-time high of $73,800 after the sell-side risk ratio dipped below 0.1%.

Similarly, in September 2024, Bitcoin hit a new peak after this metric reached a low level.

The combination of veteran investors accumulating Bitcoin and a sharp decline in the sell-side risk ratio are positive signals for the market. However, a recent analysis from BeInCrypto warns of concerning technical patterns, with a death cross beginning to form.

Additionally, investors remain cautious about potential market volatility in early April. The uncertainty stems from President Trump’s upcoming announcement regarding a major retaliatory tariff.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Marathon Digital to Sell $2 Billion in Stock to Buy Bitcoin

Marathon Digital Holdings, one of the largest Bitcoin mining companies in the US, made headlines with its announcement of a $2 billion stock offering to increase its Bitcoin holdings.

This strategic move, detailed in recent SEC filings, shows Marathon’s aggressive approach to capitalize on the growing crypto market.

Marathon’s $2 Billion Stock Offering: Key Details

On March 30, 2025, Marathon Digital Holdings announced a $2 billion at-the-market (ATM) stock offering to fund its strategy of acquiring more Bitcoin. The company filed a Form 8-K with the SEC, outlining its plan to raise capital through the sale of shares, with the proceeds primarily aimed at increasing its Bitcoin holdings.

According to the SEC filing (Form 424B5), Marathon intends to use the funds for “general corporate purposes,” which include purchasing additional Bitcoin and supporting operational needs.

Marathon holds 46,376 BTC, making it the second-largest publicly traded company in Bitcoin ownership, behind MicroStrategy. The company’s Bitcoin holdings have grown significantly in recent years, from 13,726 BTC in early 2024 to the current figure.

“We believe we are the second largest holder of bitcoin among publicly traded companies. From time to time, we enter into forward or option contracts and/or lend bitcoin to increase yield on our Bitcoin holdings.” Marathon confirmed

This $2 billion stock offering continues Marathon’s strategy to bolster its balance sheet with Bitcoin, a move that aligns with its long-term vision of leveraging cryptocurrency as a store of value.

Marathon’s strategy mirrors that of MicroStrategy. MicroStrategy’s stock price has soared with Bitcoin’s value, providing a blueprint for companies like Marathon to follow. By increasing its Bitcoin holdings, Marathon aims to position itself as a leader in the crypto mining sector while diversifying its revenue streams beyond traditional mining operations.

Marathon Digital CEO Fred Thiel advises investing small amounts in Bitcoin monthly, citing its consistent long-term growth potential.

The issuance of new shares to raise $2 billion could dilute the ownership of existing shareholders, potentially impacting the company’s stock price (MARA). As of March 31, 2025, MARA stock has experienced volatility, trading at around $12.47 per share, down from a 52-week high of $24, according to data from Yahoo Finance.

Moreover, Marathon’s heavy reliance on Bitcoin exposes it to the cryptocurrency’s price fluctuations. If Bitcoin’s price were to decline significantly, the value of Marathon’s holdings would decrease, potentially straining its financial position.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

US Macroeconomic Indicators This Week: NFP, JOLTS, & More

Crypto markets have much to look forward to this week, which marks the end of the first quarter (Q1). As Q2 commences on Tuesday, several US economic data will drive Bitcoin (BTC) and crypto sentiment this week.

Traders and investors will watch a slate of US economic data releases that could ripple through Bitcoin and altcoin prices.

5 US Economic Data To Watch This Week

These US macroeconomic indicators could drive volatility amid fresh insights into the health of the world’s largest economy.

“Buckle up—volatility’s knocking. Right on time for the monthly shake-up,” a user on X quipped.

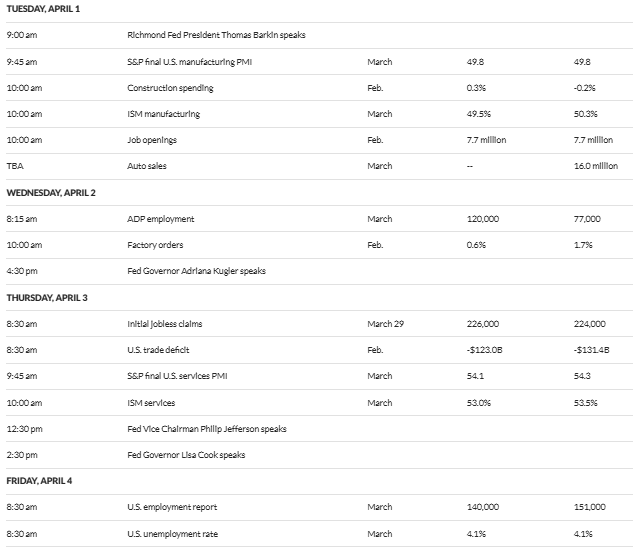

JOLTS

The first is the Job Openings and Labor Turnover Survey, or JOLTS, due for release on Tuesday, April 1. This report tracks available job vacancies in the US, effectively offering a window into employer confidence and labor market demand.

A strong showing, with openings exceeding recent trends of around 7.7 million, would suggest a strong economy. While this would strengthen the US dollar, it would dampen Bitcoin’s appeal as a hedge against weakness.

Conversely, a sharp drop in openings might stoke expectations of Federal Reserve rate cuts to bolster the economy. This outcome would lift risk assets like Bitcoin and crypto as investors seek alternatives to low-yield bonds.

ADP Employment

Adding to the list of US macroeconomic indicators this week is the ADP Employment report on Wednesday, April 2. This report will provide a private-sector payroll snapshot, serving as a preview of Friday’s main event.

There is a median forecast of 120,000 for March, following the previous month’s 77,000 reading. If job growth tops the consensus forecast, it could reinforce confidence in traditional markets, possibly pressuring crypto prices as the dollar gains ground.

On the other hand, a weaker-than-expected figure, say below 77,000, might hint at a slowdown. This would boost Bitcoin’s allure as a safe haven amid uncertainty. While not as authoritative as the official numbers, surprises here often set the tone for crypto traders adjusting their positions.

Liberation Day

Meanwhile, the stakes are high this week, with the US economy enduring uncertainties like Trump-era policies, including tariffs and government streamlining efforts. BeInCrypto reported on the upcoming Liberation Day, which is expected to bring new tariff announcements targeting nations imposing trade barriers.

“The last two months have already hurt American businesses and consumers, but the April 2 deadline seriously could make all of that look like a tempest in a teapot. We don’t know exactly what they’re going to do, but from what they’re saying, it sounds functionally like new tariffs on all US imports,” said Joseph Politano, economic policy analyst at Apricitas Economics.

Analysts predict extreme market volatility, with potential stock and crypto crashes reaching 10-15% if Trump enforces broad tariffs.

“April 2nd is similar to election night. It is the biggest event of the year by an order of magnitude. 10x more important than any FOMC, which is a lot. And anything can happen, “Alex Krüger predicted.

Initial Jobless Claims

On Thursday, April 3, crypto markets will watch the Initial Jobless Claims report, which shows the number of US citizens filing for unemployment insurance. Released weekly, this is a near-real-time pulse on layoffs and labor market stability.

Fewer claims, under the previous week’s 224,000 reading, could suggest resilience, supporting the dollar but tempering crypto enthusiasm. However, potentially exceeding the median forecast of 226,000 might raise red flags about economic health.

Such an outcome would drive demand for decentralized assets to hedge against potential turmoil. Given its weekly cadence, this report tends to spark quick reactions in the crypto market, especially when amplified by broader narratives like government efficiency cuts or tariff impacts in 2025.

US Employment Report

The week’s crescendo arrives Friday, April 4, with the US Employment Report, widely known as Non-Farm Payrolls. This comprehensive labor market update—including jobs added, the unemployment rate, and wage growth—is a linchpin for markets worldwide.

A strong report, higher than the previous reading of 151,000 jobs and a steady 4.1% unemployment rate, could bolster faith in the economy. This could curb crypto gains if the dollar rallies.

However, strong wage growth exceeding 0.3% month-over-month (MoM) might rekindle inflation fears, indirectly supporting Bitcoin as a store of value.

Conversely, a disappointing tally—under the median forecast of 140,000 jobs with unemployment ticking beyond 4.1%—could ignite recession worries. This would send investors flocking to Bitcoin and crypto.

Significant deviations from consensus forecasts, often by 50,000 jobs or more, have historically triggered sharp Bitcoin moves of 1-2% or greater.

“BofA [Bank of America] Securities expects a pickup in job growth for March. Keep an eye on those numbers,” crypto researcher Orlando noted.

For crypto market participants, the game plan is clear: track consensus estimates on economic calendars, watch real-time reactions, and brace for swings. Nevertheless, this week’s data could dictate Bitcoin’s next move in Q2 2025, particularly in April.

Fed Chair Jerome Powell will also address the economic outlook at the SABEW Annual Conference on Friday at 11:25 a.m. EST.

BeInCrypto data shows BTC was trading for $82,192 as of this writing, down by over 1% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoWhales Accumulate 470,000 Ethereum In One Week – Bullish Momentum Ahead?

-

Regulation21 hours ago

Regulation21 hours agoJapan Set To Classify Cryptocurrencies As Financial Products, Here’s All

-

Market23 hours ago

Market23 hours ago3 Token Unlocks for April: Parcl, deBridge, Scroll

-

Market20 hours ago

Market20 hours agoTop 3 Made in USA Coins to Watch This Week

-

Market19 hours ago

Market19 hours agoSolana (SOL) Price Risks Dip Below $110 as Bears Gain Control