Bitcoin

Bitcoin To The Rescue? Saylor Says EU Will Need BTC Amid Euro Woes

Bitcoin proponent Michael Saylor has publicly stated that the European Union should consider buying Bitcoin, especially after the Euro experienced a recent drop in value. According to reports, the Euro (EUR) has weakened against the United States dollar (USD) since yesterday.

The decline followed a report from the Federal Reserve that many interpreted as leaning towards lower interest rates in the future. The Euro’s value fell from a high of 1.08 against the USD on Thursday to its current level of 1.07.

“Europe gonna need Bitcoin” – @saylor

With rising debt, inflation and financial centralization — a digital euro (CBDC) set for launch in 2025 — Bitcoin is not just an option, it’s the alternative… The question is not if but when Europe will realize it. https://t.co/3AkOUnbBwY pic.twitter.com/AG01HkR4ex

— BTC Prague (@BTCPrague) March 20, 2025

Euro Under Pressure Following Fed Signals

The recent weakening of the Euro occurred after the Fed decided to keep interest rates steady. These rates have remained between 4.25% and 4.50% since December. However, Federal Reserve Chair Jerome Powell reportedly suggested the possibility of a 50-basis-point rate cut before the end of 2025.

Furthermore, the Central Bank has been under pressure from US President Donald Trump to cut interest rates, claiming that this is the proper course of action.

The greenback has increased in relation to other currencies, particularly the Euro, as a result of the rally in US stocks and bonds brought on by these dovish US sentiment.

Saylor’s Bitcoin Pitch As A Potential Hedge

Saylor, executive chairman and co-founder of MicroStrategy (now Strategy), said on social media that Bitcoin might provide a remedy amid this currency movement. In a statement made public this week, Saylor appeared to urge the European Union to proceed swiftly with any intentions to purchase BTC.

EUR gonna need BTC

— Michael Saylor⚡️ (@saylor) March 20, 2025

He implied that if the EU had held Bitcoin, it could have acted as a protection against the recent decrease in the Euro’s value. For context, the price of Bitcoin has risen by 2.6% against the US dollar in the last 24 hours, trading at $85,400, at the time of writing.

Saylor also pointed out how the US dollar has far outperformed the Turkish Lira (TRY) since 2021, and how this has resulted in a significant devaluation of the Turkish currency. He observed that Bitcoin has been among the top-performing assets in the same timeframe.

EU’s Potential Crypto Venture Gains Traction

A member of the European Parliament, Sarah Knafo, has recently urged the EU to consider establishing a strategic reserve of Bitcoin.

She highlighted the apparent success of El Salvador, a country that has officially adopted Bitcoin. According to reports, El Salvador’s economy has been transformed through President Nayib Bukele’s adoption of Bitcoin and other forward-thinking initiatives.

Featured image from Gemini Imagen, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

China Liquidates Seized Crypto to Boost Struggling Treasury

Amid mounting economic challenges and a growing pile of confiscated cryptocurrencies, local governments in China are increasingly liquidating seized digital assets to bolster strained public finances.

The practice raises legal and regulatory questions, especially concerning China’s blanket ban on crypto trading.

China Selling Seized Crypto To Bolster Treasury

China reportedly held around 15,000 Bitcoin (BTC) worth $1.4 billion by the end of 2024. According to River, a Bitcoin investment firm, this places the country among the top 15 global holders of the asset.

However, reports suggest China’s local governments are offloading digital currencies through private firms despite the national crypto ban.

Cas Abbe, a Web3 growth manager, and Binance exchange affiliate, noted on X that the dump in crypto prices may partly stem from these offloading activities.

“Local governments in China are selling seized crypto to top up their treasury. Despite the crypto trading ban in China, local governments are using private companies to offload their holdings. This explains pretty much the dump even before tariff news hit the market,” Abbe noted.

The surge in liquidations comes as authorities grapple with inconsistent policies for handling crypto seized from criminal investigations, which spiked sharply in 2023.

Over $59 billion was tied to crypto-related crimes in China that year. Blockchain security firm SAFEIS reported that more than 3,000 people were prosecuted for offenses ranging from internet fraud to illegal gambling.

Despite Beijing’s ban, local governments have reportedly turned to private firms to offload confiscated tokens. Specifically, they are converting them into cash to fund their treasuries.

Jiafenxiang, a Shenzhen-based technology firm, has sold more than 3 billion yuan ($414 million) worth of digital assets in offshore markets since 2018. Documents reviewed by Reuters link the company to liquidation deals with local authorities in Xuzhou, Hua’an, and Taizhou.

Though practical for cash-strapped regions, the process is legal gray territory. Such practices risk undermining the country’s crypto enforcement regime without clear regulatory frameworks.

“This raises so many questions about transparency. How are they even doing this legally?” noted one analyst in a post.

Experts are now calling for urgent regulatory reforms. These include judicial recognition of crypto as assets and the creation of standardized disposal mechanisms.

Some are even floating the idea of building a centralized national crypto reserve. This mirrors Trump’s administration’s proposals to manage seized assets more strategically.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Is Bitcoin the Solution to Managing US Debt? VanEck Explains

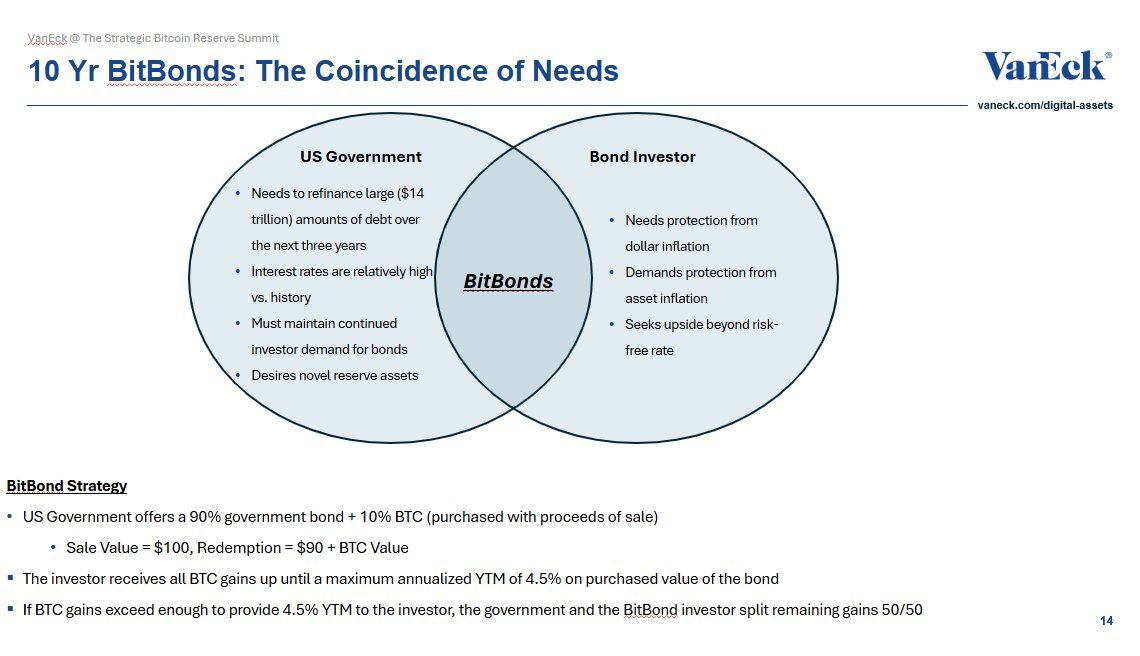

Matthew Sigel, Head of Digital Assets Research at VanEck, has proposed a new financial instrument, “BitBonds,” to help manage the US government’s looming $14 trillion refinancing debt requirement.

The 10-year financial instrument combines traditional US Treasury bonds with Bitcoin (BTC) exposure. This offers a potential solution to the nation’s fiscal concerns.

Can Bitcoin-Backed Bonds Help Solve the US Debt Crisis?

According to Sigel’s proposal, BitBonds’ investment structure allocates 90% of the funds to low-risk US Treasury securities and 10% to Bitcoin, combining stability with the potential for higher returns. Additionally, the government would purchase Bitcoin with proceeds from the bond sale.

Investors would receive all Bitcoin gains up to a maximum annualized yield-to-maturity of 4.5%. Furthermore, the investor and the government would split any additional gains equally.

“An aligned solution for mismatched incentives,” Sigel remarked.

From an investor perspective, Sigel highlighted that the bond offers a breakeven Bitcoin compound annual growth rate (CAGR) between 8% and 17%, depending on the coupon rate. Additionally, investors’ returns could skyrocket if Bitcoin grows at a 30%–50% CAGR.

“A convex bet—if you believe in Bitcoin,” he added.

However, the structure is not without risks: investors bear Bitcoin’s downside while only partially participating in its upside. Lower-coupon bonds may lose appeal if Bitcoin underperforms.

Meanwhile, the Treasury’s downside is limited. Even a complete collapse of Bitcoin’s value would still result in cost savings compared to traditional bond issuance. Yet, this is contingent on the coupon remaining below the breakeven threshold.

“BTC upside just sweetens the deal. Worst case: cheap funding. Best case: long-vol exposure to the hardest asset on Earth,” Sigel stated.

Sigel claimed that this hybrid approach aligns the interests of the government and investors over a 10-year period. The government faces high interest rates and significant debt refinancing needs. Meanwhile, investors seek protection from inflation and asset debasement.

The proposal comes amid growing concerns over the US debt crisis, exacerbated by the recent increase in the debt ceiling to $36.2 trillion, as reported by BeInCrypto. Notably, the Bitcoin Policy Institute (BPI) has also endorsed the concept.

“Building on President Donald J. Trump’s March 6, 2025, Executive Order establishing the Strategic Bitcoin Reserve, this white paper proposes that the United States adopt Bitcoin-Enhanced US Treasury Bonds (“₿ Bonds” or “BitBonds”) as an innovative fiscal tool to address multiple critical objectives,” the brief read.

In the paper, co-authors Andrew Hohns and Matthew Pines suggested that issuing $2 trillion in BitBonds at a 1% interest rate could cover 20% of the Treasury’s 2025 refinancing needs.

“Over a ten-year period, this represents nominal savings of $700 billion and a present value of $554.4 billion,” the authors wrote.

BPI estimates that if Bitcoin achieves a CAGR of 36.6%, the upside could potentially defease up to $50.8 trillion of federal debt by 2045.

These recommendations are part of broader conversations regarding Bitcoin’s potential impact on national finance. Previously, Senator Cynthia Lummis argued that a US Strategic Bitcoin Reserve could halve the national debt. In fact, VanEck’s analysis indicated that such a reserve could help reduce $21 trillion of debt by 2049.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Adoption Grows As Public Firms Raise Holdings In Q1

Public companies have added nearly 100,000 Bitcoin to their balance sheets during the first quarter of 2025, pushing total corporate Bitcoin holdings to a staggering 688,000 BTC worth $56.7 billion. According to data from crypto fund issuer Bitwise, this represents a 16% increase in total crypto holdings by publicly traded companies.

12 New Corporate Buyers Enter The Market

The Bitcoin buying spree wasn’t limited to existing crypto investors. Twelve public companies purchased Bitcoin for the first time during Q1, bringing the total number of Bitcoin-holding public firms to 79.

Hong Kong construction firm Ming Shing led new buyers, with its subsidiary Lead Benefit acquiring 833 BTC through two separate purchases – an initial 500 BTC buy in January followed by 333 BTC in February.

Video platform Rumble ranked as the second-largest new buyer, adding 188 BTC to its treasury in mid-March. In a move that stunned market watchers, Hong Kong investment firm HK Asia Holdings Limited purchased just one Bitcoin in February – a modest investment that still caused its share price to almost double in a single day of trading.

Companies are buying bitcoin, Q1 2025 edition. pic.twitter.com/qZc62N8vu5

— Bitwise (@BitwiseInvest) April 14, 2025

Japanese Firm Acquires At A Discount

While new entrants made headlines, existing Bitcoin holders also strengthened their positions. Japanese investment firm Metaplanet announced on April 14 that it had purchased an additional 319 BTC at an average price of 11.8 million yen (about $82,770) per coin.

This latest purchase brings Metaplanet’s total Bitcoin holdings to 4,525 BTC, currently valued at approximately $383.2 million. The company has spent nearly $406 million (58.145 billion yen) building its crypto stack.

Based on current holdings, Metaplanet now ranks as the 10th largest public company crypto holder worldwide, sitting behind Jack Dorsey’s Block, Inc., which holds 8,480 BTC.

BTC reclaiming the green zone in the last week. Source: Coingecko

Bitcoin Price Recovers After Brief Slump

Bitcoin trades at around $85,787 as of April 15, showing a decent performance over the past 24 hours according to CoinGecko data. The cryptocurrency has gained roughly 2.5% since the end of Q1 on March 31.

The price has bounced back from a brief drop below $75,000 on April 7. That temporary decline came after a broader market selloff triggered by a new round of global tariffs announced by US President Donald Trump.

The growing corporate interest in the top crypto comes as more companies look to diversify their treasury holdings. The combined value of public companies’ Bitcoin rose about 2.3% during the first quarter, reaching nearly $57 billion with BTC priced at $82,400 by quarter’s end.

Featured image from Crews Bank, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market22 hours ago

Market22 hours agoTrump Family Plans Crypto Game Inspired by Monopoly

-

Altcoin23 hours ago

Altcoin23 hours agoWhispers Of Insider Selling As Mantra DAO Relocates Nearly $27 Million In OM To Binance

-

Market19 hours ago

Market19 hours agoBitcoin Eyes $90,000, But Key Resistance Levels Loom

-

Market21 hours ago

Market21 hours agoETH Retail Traders Boost Demand Despite Institutional Outflows

-

Altcoin21 hours ago

Altcoin21 hours agoCould Tomorrow’s Canada Solana ETF Launch Push SOL Price to $200?

-

Market23 hours ago

Market23 hours agoForget XRP At $3, Analyst Reveals How High Price Will Be In A Few Months

-

Market15 hours ago

Market15 hours agoSolana (SOL) Jumps 20% as DEX Volume and Fees Soar

-

Market14 hours ago

Market14 hours agoHedera Under Pressure as Volume Drops, Death Cross Nears