Bitcoin

Bitcoin Risk at All-Time Low: Here’s the Explanation

Once viewed as a speculative experiment, Bitcoin has matured into a secure and trusted digital asset.

Here’s a closer look at why the risk associated with BTC has reached an all-time low.

Why Bitcoin Risk Has Never Been Lower

Proven Technical Robustness

Early doubts about Bitcoin’s technical foundations have been dispelled. Satoshi Nakamoto’s engineering decisions have proven effective, including the one-megabyte block size and ten-minute block frequency. The network has mined over 846,448 blocks without a critical hack, showcasing its resilience and security.

Moreover, many protocols are exploring ways to leverage Bitcoin’s security to enable staking across different blockchain platforms. Implementing BTC, a Proof of Work (PoW) asset, in a Proof of Stake system, will help strengthen other networks’ safety.

“Questions early on persisted around Satoshi’s engineering prowess. Was one megabyte block size a good idea? How about the 10 minute block frequency? Will the cryptography suffice? Is it hackable? But with time, Satoshi’s programming competence had been vetted” Komodo Chief Technology Officer Kadan Stadelmann told BeInCrypto.

Read more: How To Buy BTC and Everything You Need To Know

Bitcoin’s hash rate, a measure of its computational security, continues to reach new highs. This increase in mining power reinforces the network’s security, making it more stable against potential attacks.

Regulatory Acceptance

The initial uncertainty surrounding Bitcoin’s regulatory status has been addressed. In 2014, the IRS designated it as property, removing fears of taxes on unrealized gains. The US Commodity Futures Trading Commission followed suit in 2015, declaring BTC a commodity. This regulatory clarity has provided a stable environment for the OG cryptocurrency to thrive.

Once BTC’s regulatory status was clarified, attention shifted to the potential threat from copycat digital assets. This led to the emergence of numerous altcoins. However, the presence of altcoins has only strengthened Bitcoin’s position. Today, BTC and the broader cryptocurrency market are viewed as distinct industries, with Bitcoin standing out on its own.

Institutional Endorsements

The perception of Bitcoin shifted dramatically when institutions began investing. In August 2020, MicroStrategy purchased $250 million worth of BTC, signaling confidence in its stability.

“Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy,” MicroStrategy’s CEO Michael Saylor states.

Saylor’s endorsement of Bitcoin as a powerful, decentralized asset has further bolstered its reputation. Following MicroStrategy, Tesla and Square invested significantly in BTC, increasing its credibility.

Read more: Top 11 Public Companies Investing in Cryptocurrency

Adoption by Nation-States

Three years ago, President Nayib Bukele’s decision to make BTC legal tender in El Salvador garnered global attention. On September 7, 2021, the “Bitcoin Law” took effect, making El Salvador the first country to adopt it as an official currency.

President Nayib Bukele was recently sworn in for a second term, reaffirming his pro-Bitcoin stance. The country has continued to purchase Bitcoin, acquiring up to 30 BTC per month. As of May, El Salvador had over $70 million in unrealized profits from its crypto investments.

Despite some criticism, surveys show significant awareness and usage of BTC wallets, indicating successful integration. Kadan Stadelmann notes an in-person survey of 1,800 representative households, the findings of which were validated by a blockchain analytics firm, researchers found nearly 68 percent of potential users knew about Chivo Wallet and 78 percent of that particular group at least attempted to download the app.

In 2022, Central African Republic (CAR) echoed El Salvador’s move. A mineral-rich nation, one of the poorest in the world and mired in an ongoing Civil War, also adopted Bitcoin as a legal tender, arguing that it will secure an independent financial future for the country.

Growing Investment Potential

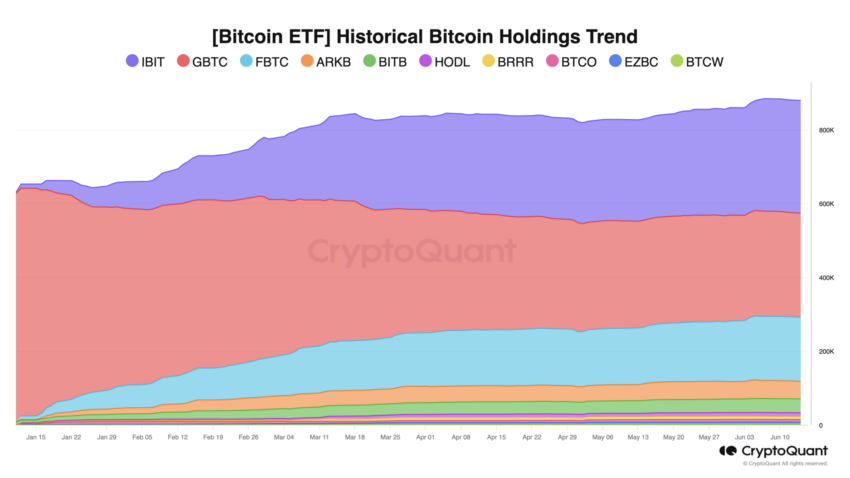

The US Securities and Exchange Commission’s (SEC) approval of the spot Bitcoin ETF marked a massive shift in the regulatory field, indicating a growing acceptance of digital currencies within traditional financial systems. No wonder sovereign wealth funds and other major financial entities are beginning to view Bitcoin as digital gold.

Wall Street mogul BlackRock has been educating these institutions about Bitcoin, anticipating their entry into the market. The ongoing interest from large-scale investors suggests a stable future for Bitcoin.

“Many of these interested firms — whether we’re talking about pensions, endowments, sovereign wealth funds, insurers, other asset managers, family offices — are having ongoing diligence and research conversations, and we’re playing a role from an education perspective,” said Robert Mitchnick, BlackRock’s head of Bitcoin and crypto.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

While government and corporate adoption are not essential for BTC’s success, they contribute significantly to its legitimacy. With inflation concerns and the search for secure alternatives, Bitcoin’s appeal as a hedge grows. Its established security and increasing mainstream acceptance suggest that Bitcoin’s experimental phase is well behind it.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Is Bitcoin About To Skyrocket Or Crash? What Truflation Says

In the March 27, 2025 analysis, titled “Where is Bitcoin headed next? A Signal hidden in Real-Time Data,” Truflation highlights a recurring phenomenon: each time its inflation index experiences a pronounced downtrend that later pauses or reverses, Bitcoin has tended to surge soon afterward.

Where Is Bitcoin Headed Next?

Truflation’s research points to a backdrop shaped by the aftermath of COVID-19, when central banks worldwide slashed interest rates to almost zero and funneled liquidity into the economy. That period of easy money overlapped with Bitcoin’s run to all-time highs in 2021. By 2022 and 2023, however, persistent inflation took hold, prompting the US Federal Reserve to reverse course. Interest rate hikes and quantitative tightening became the primary tools for fighting price pressures, with the Federal Reserve explicitly aiming to bring consumer price inflation down to 2%.

According to the Truflation report, real-time inflation readings reached as low as 2% in June 2023. The official Consumer Price Index (CPI), published by the Bureau of Labor Statistics, mirrored that pattern about a month and a half later, bottoming out at 3% in July 2023. Yet from mid-2023 onward, Truflation’s index did not simply keep dropping in a straight line. Instead, it oscillated between higher and lower bounds, demonstrating a cyclical pattern of disinflation that would then stabilize or reverse course. Truflation now believes that each of these cyclical “inflection points” closely correlates with subsequent upswings in Bitcoin’s price.

The report references four distinct periods from September 2023 to September 2024 when Truflation’s index trended downward and then either flattened or rebounded. In each of those cases, Bitcoin’s price rose soon after. Truflation suggests that a fifth such event may now be unfolding: the inflation index dropped steeply in early 2025, hitting around 1.30%—a level not seen in several months—before rebounding to 1.80%. This situation is reminiscent of previous disinflation troughs that, based on Truflation’s data, presaged a new wave of Bitcoin buying.

“When Truflation’s disinflation trend pauses or reverses, Bitcoin tends to rally shortly after. This pattern has repeated a few times already — and if history rhymes, it may be unfolding once again soon,’” the analysis states.

The underlying reason, Truflation explains, revolves around Bitcoin’s forward-looking nature and its sensitivity to changes in liquidity conditions. Strong disinflation usually prompts speculation that the Federal Reserve may be done raising rates and could soon turn dovish. While steep and unrelenting disinflation can trigger fears of recession, a slowdown or pause in that disinflation trend often reassures markets that the economy is not sliding into an economic downturn.

This “soft landing” scenario emboldens risk-on sentiment. Traders and investors who believe that inflation has been subdued enough to delay additional tightening—or to accelerate rate cuts—frequently channel their optimism into assets like Bitcoin.

The report acknowledges that no single piece of data, including Truflation’s own, holds absolute sway over an asset as complex and widely traded as Bitcoin. However, it emphasizes that real-time inflation expectations reverberate throughout global markets, influencing equities, commodities, and foreign exchange trading, in addition to crypto. By anticipating shifts in those expectations, some investors may find themselves ahead of the curve when official CPI reports and central bank pronouncements finally confirm or contradict the evolving trend.

“Truflation doesn’t influence Bitcoin in a vacuum. No single data source ever does. But inflation expectations ripple across a wide range of markets — from equities to commodities — and especially into bond yields and forex markets,” the analysis concludes.

At press time, BTC traded at $84,461.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Strategic Bitcoin Reserve Proposed by Brazil’s VP Advisor

Brazil’s Vice President Geraldo Alckmin’s (PSB) chief of staff, Pedro Giocondo Guerra, underscored on Wednesday the importance of establishing a national strategic Bitcoin reserve. Guerra was speaking at the swearing-in ceremony of the new president of the FPBC (Parliamentary Front for Competitive Brazil), Deputy Júlio Lopes (PP-RJ), while representing the government of President Luiz Inácio Lula da Silva (PT).

“Rigorously debating the constitution of a sovereign reserve of bitcoin value is in the public interest and will be decisive for our prosperity. After all, Bitcoin is digital gold, the gold of the internet. It’s a technology that allows us to transmit wealth from one end of the planet to the other quickly and store the fruits of our labor efficiently and securely,” Guerra stated.

Will Brazil Get A Strategic Bitcoin Reserve?

His remarks highlighted Bitcoin’s intrinsic appeal—particularly its digital scarcity and deflationary design, in contrast to fiat currencies that can be printed at will. Guerra noted that an official BTC reserve might bolster the country’s resilience and adaptability, especially amid global economic and geopolitical fluctuations.

Notably, Congressman Eros Biondini (PL-MG) has introduced PL 4501/2024, which would permit the creation of a Sovereign Strategic Reserve of Bitcoins—referred to in the bill as RESBit. According to Biondini, the primary goal is to guard Brazil against currency fluctuations and geopolitical uncertainties by diversifying the government’s international reserves.

The text proposes a limit of 5% of the country’s international reserves—which totaled $366 billion in December—for Bitcoin acquisitions. Should it pass, Brazil would be authorized to invest as much as $18.3 billion in Bitcoin, based on the reserve’s valuation at the time the bill was drafted.

Currently under review by Rapporteur Luiz Gastão (PSD-CE) in the Lower House’s Economic Development Committee, the bill sets forth guidelines for gradual acquisition and emphasizes robust security measures, using cold wallets and advanced AI- and blockchain-based monitoring.

The legislation details how the Central Bank and the Ministry of Finance would jointly manage RESBit, ensuring transparency through regular biannual reports to both the public and Congress. In addition, the text addresses the need for educational and innovation programs, including specialized courses on blockchain, crypto-economics, and cybersecurity, as well as incentives like tax benefits for crypto-related startups.

Related Reading: Trump Endorses Pro-Bitcoin Senator Lummis: ‘Make US The Crypto Capital’

A technical advisory committee composed of experts in blockchain, digital economy, and cybersecurity would also be established to ensure rigorous oversight and to foster collaboration with international regulators and research institutions. The proposal cites global precedents, such as El Salvador’s adoption of Bitcoin as legal tender, the United States’ approval of BTC ETFs, China’s investment in blockchain and digital currency efforts, Dubai’s success in developing a blockchain-friendly business environment, and the EU’s regulatory framework for digital assets.

In its justification section, the bill argues that Brazil is already one of the countries with the highest rate of cryptocurrency adoption, yet government policy has not kept pace with the rapid evolution of this market.

According to the text, “The creation of RESBit will allow Brazil to diversify its international reserves, reducing exposure to foreign exchange fluctuations and geopolitical risks while increasing economic resilience. This measure will also position Brazil as a regional leader in financial and technological innovation, attracting external investment and strengthening our presence in the digital economy.”

At press time, BTC traded at $86,205.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin Bet Grows Bigger: The Blockchain Group Snaps Up 580 BTC

The Blockchain Group, a France-based blockchain solutions firm, recently announced its largest Bitcoin (BTC) purchase to date, acquiring 580 BTC. This marks the company’s third BTC acquisition since it began buying the digital asset in November 2024.

The Blockchain Group Buys 580 Bitcoin

In its most significant BTC acquisition so far, The Blockchain Group has purchased 580 BTC for approximately $50.64 million at an average price of $88,020 per coin. According to the announcement, the purchase was made through its Luxembourg-based subsidiary.

Notably, the acquisition was financed through proceeds raised from a convertible bond issuance announced on March 6. The move aligns with the firm’s Bitcoin Treasury strategy.

To recall, The Blockchain Group made its first BTC purchase in November 2024, acquiring 15 BTC at an average cost of $68,785 per coin. Its second purchase followed in December 2024, when it bought 25 BTC at an average price of roughly $97,692.

Following its latest acquisition, the company’s total BTC holdings now stand at 620 BTC, with a total net asset value of slightly over $54 million at current market prices.

According to data from Yahoo! Finance, The Blockchain Group’s stock (ALTBG.PA) closed today’s trading session at €0.4975 ($0.54), up 3.09% on the day. On a year-to-date basis, the company’s shares have surged by an impressive 65.78%, suggesting that its exposure to BTC has positively impacted its valuation.

The Blockchain Group’s official website states that its pivot to Bitcoin is part of a broader strategy to optimize the use of its excess cash and financial instruments. Since its first BTC acquisition, the company’s stock has risen by 225%.

Corporate BTC Adoption To Grow In 2025

Corporate adoption of Bitcoin is expected to pick up even further in 2025, driven not only by the digital asset’s intrinsic value but also by a favorable regulatory environment under pro-crypto US President Donald Trump’s administration.

Earlier this week, the largest corporate holder of Bitcoin, Strategy, acquired an additional 6,911 coins, pushing its total holdings beyond 500,000 BTC. In the same vein, US-based financial services firm Fold Holdings announced the addition of 475 BTC to its corporate treasury earlier this month.

As corporate adoption grows, several US states have also begun legislative processes to add BTC to their treasuries. For instance, Utah and Kentucky have recently made significant strides with their BTC reserve bills.

Additionally, Mexican billionaire Ricardo Salinas recently revealed that close to 70% of his investment portfolio is allocated to Bitcoin and related assets. At press time, BTC trades at $86,838, down 1.1% in the last 24 hours.

Featured Image from Unsplash.com, charts from Yahoo! Finance and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin20 hours ago

Altcoin20 hours agoDogecoin Price Set To Reach $1 As Once In A Year Buy Opportunity Returns

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Fails To Break $2,100 Resistance – Growing Downside Risk?

-

Regulation16 hours ago

Regulation16 hours agoSonic Labs To Abandon Plans For Algorithmic USD Stablecoin, Here’s Why

-

Market20 hours ago

Market20 hours agoAnalysts Reveal Q2 Crypto Market Outlook: BTC at $200,000?

-

Market15 hours ago

Market15 hours agoCoinbase Users Lost $46 Million to Crypto Scams in March

-

Altcoin15 hours ago

Altcoin15 hours agoPiDaoSwap, Trump Media, & Grayscale

-

Regulation15 hours ago

Regulation15 hours agoUS SEC Drops Charges Against Hawk Tuah Girl Hailey Welch

-

Market23 hours ago

Market23 hours agoCoinbase to Rival Binance With BNB Perpetual Futures