Bitcoin

Bitcoin Realized Volatility Near Historic Lows — What This Means For Price

The price of Bitcoin looked set to reclaim $100,000 on Friday, rallying on the back of the United States Securities and Exchange Commission’s (SEC) decision to drop the lawsuit against crypto exchange Coinbase. However, the premier cryptocurrency failed to capitalize on this momentum shift following the $1.4 billion exploit of the ByBit exchange.

With the Bitcoin price now hovering above $96,000, recent on-chain data suggests that certain volatility metrics are nearing historically low levels. Here’s how the latest volatility trend could impact the BTC price performance over the coming weeks.

Is A BTC Price Rally On The Horizon?

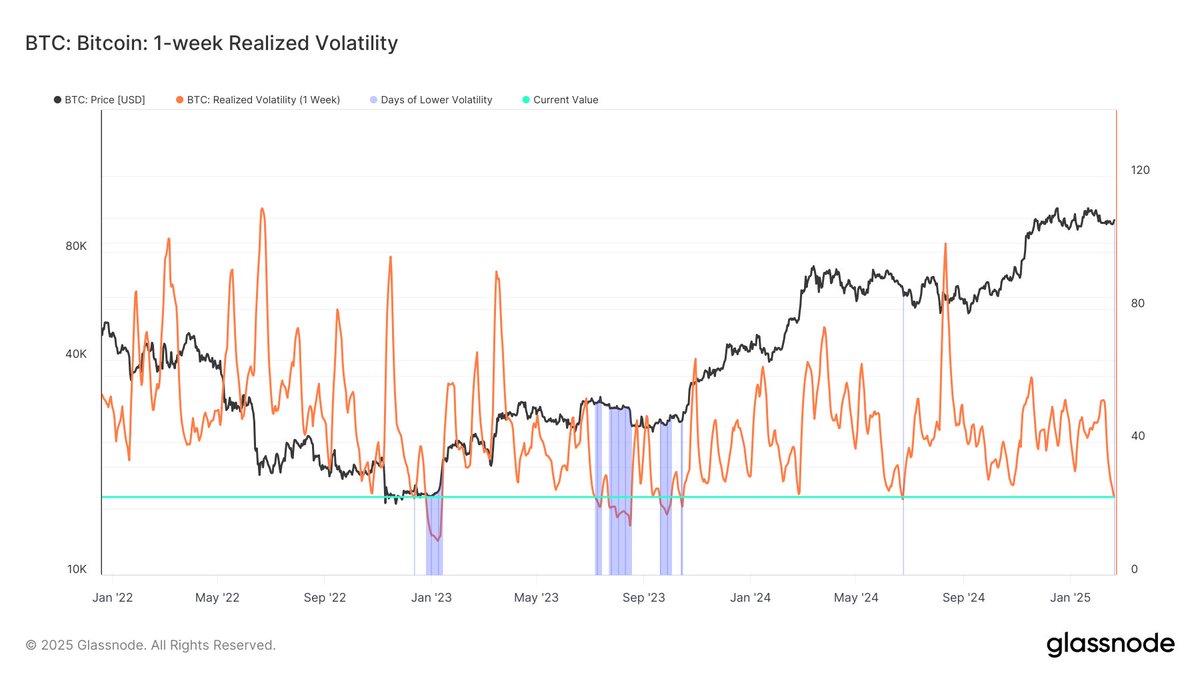

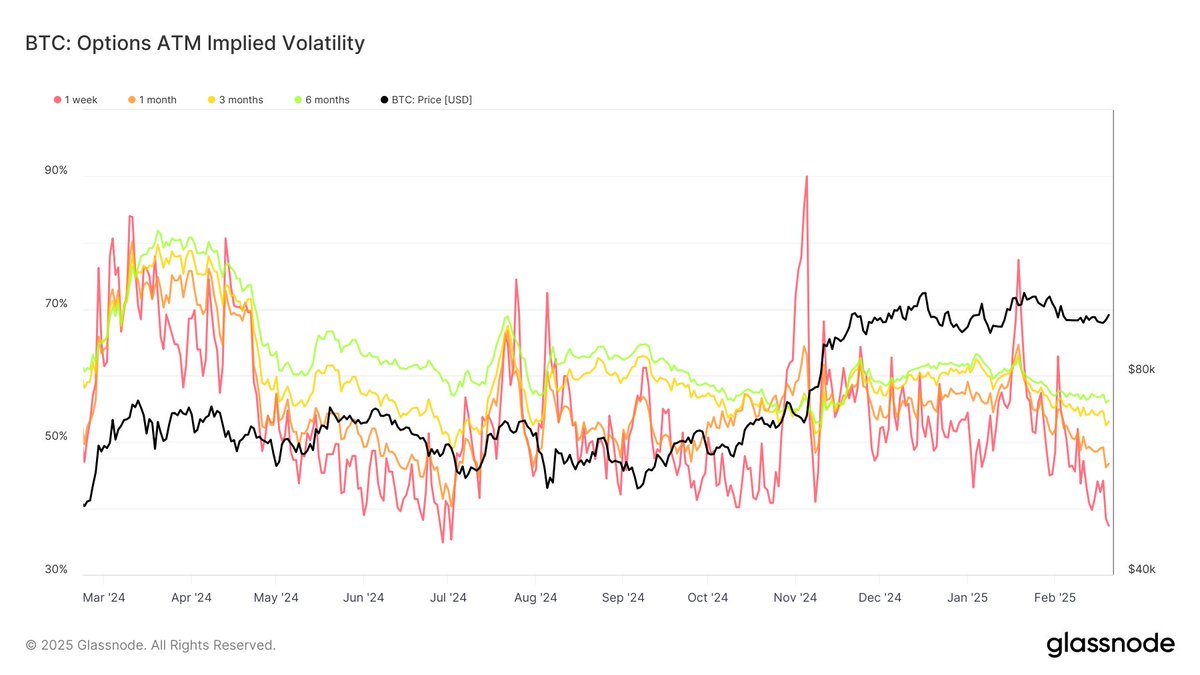

In a recent post on the X platform, crypto analytics firm Glassnode explained how two key volatility indicators nearing historically low levels could impact the Bitcoin price and its future trajectory. The two relevant metrics here are the 1-week “realized volatility” and “options implied volatility.”

For context, realized volatility (also referred to as historical volatility) measures how much the price of an asset (BTC, in this case) has changed over a specific period. Implied volatility, on the other hand, is a metric that assesses the likelihood of future changes in an asset’s price.

According to Glassnode data, Bitcoin’s 1-week realized volatility recently dropped to 23.42%. The on-chain intelligence firm noted that the metric’s current value is close to historical lows, as BTC’s realized volatility has only fallen beneath this level a few times in the past four years.

Source: Glassnode/X

Notably, the 1-week realized volatility metric dropped to 22.88% and 21.35% in October 2024 and November 2024, respectively. These points have acted as bottoms, with the metric rebounding from this level in the past. From a historical perspective, such declines in realized volatility have preceded significant price movements, increasing the odds of a potential breakout – or even a correction.

Source: Glassnode/X

At the same time, Bitcoin’s 1-week options implied volatility has also experienced a significant decline to 37.39%. The indicator’s current level is close to multi-year lows — last seen in 2023 and early 2024. Similarly, the Bitcoin price witnessed substantial market moves the last time the implied volatility was around this level.

Moreover, it is worth noting that the longer-term options implied volatility is currently exhibiting a different trend. The 3-month implied volatility stands at around 53.1%, while the 6-month indicator is hovering at 56.25%. This suggests that market participants expect increased volatility over the coming months.

Bitcoin Price At A Glance

As of this writing, Bitcoin is valued at roughly $95,340, reflecting an over 3% decline in the past 24 hours.

The price of Bitcoin on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Bitcoin

ETF Issuers Bring Stability to Bitcoin Despite Tariff Chaos

BlackRock’s Bitcoin ETF is in the top 1% of performers in this category despite tariff chaos. Analysts theorize that the issuers are stabilizing Bitcoin’s volatility, and the ETF market will make BTC more secure in the future.

The issuers act as major whales, buying up any token dumps from retail investors. However, this new stability is entirely contingent on these powerful firms, which are exposed to broader macroeconomic concerns.

Are the ETFs Stabilizing Bitcoin?

The threat of Trump’s tariffs has brought chaos and uncertainty into global markets, but the price of Bitcoin has been relatively fine. Although it has fallen from its all-time high in January, its price shelf is still well above its performance before the November election.

According to one analyst, the ETFs may be providing Bitcoin with this extra stability:

“Bitcoin ETFs have eked out positive inflows past month and YTD and IBIT is +2.4 billion YTD (Top 1%). Impressivem and in my opinion, helps explain why BTC’s price has been relatively stable: its owners are more stable. ETF investors are much stronger hands than most think. This should increase stability and lower volatility and correlation long term,” claimed Eric Balchunas.

Since the Bitcoin ETFs first hit the market, they’ve totally transformed the crypto industry, but it’s been difficult to quantify that transformation.

However, this impending economic crisis has given analysts a useful chance to collect hard data from a stress test. Balchunas emphasized that ETF issuers had a powerful demand for BTC, which has powered some changes.

Over the last few months, US ETF issuers have been buying tremendous amounts of Bitcoin. Collectively, they surpassed Satoshi’s holdings in December and bought 20x as much BTC as the global mining output in January. Who met this apparent crisis in supply? Retail investors.

Bitcoin is more integrated than ever into traditional finance, and that presents a few opportunities. For any number of reasons, retailers have been compelled to dump their tokens.

Normally, these actions could spook the markets, but ETF issuers (and Michael Saylor’s Strategy) have been willing to buy as much Bitcoin as possible.

In other words, these whales have done a lot to hold up confidence in the entire market. Ideally, ETF issuers will have a mostly positive impact on the sector, potentially curing Bitcoin’s infamous chronic volatility.

Unfortunately, this substantial change comes with serious practical drawbacks, even discounting fears of de-decentralization. Since the ETFs transformed the market like this, Bitcoin has been more entangled than ever with broader macroeconomic trends.

These trends, however, could force these big whales to sell. Can we afford to tie Bitcoin’s fate to these actors?

The ETF issuers have a high confidence in Bitcoin, which has kept its price steady throughout the tariff chaos. If they lose that confidence for any reason, it could cause a powerful demand crisis.

This investment trend has been a tremendous benefit to the crypto industry, but it’s important to keep an eye on the potential risks involved.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

China Liquidates Seized Crypto to Boost Struggling Treasury

Amid mounting economic challenges and a growing pile of confiscated cryptocurrencies, local governments in China are increasingly liquidating seized digital assets to bolster strained public finances.

The practice raises legal and regulatory questions, especially concerning China’s blanket ban on crypto trading.

China Selling Seized Crypto To Bolster Treasury

China reportedly held around 15,000 Bitcoin (BTC) worth $1.4 billion by the end of 2024. According to River, a Bitcoin investment firm, this places the country among the top 15 global holders of the asset.

However, reports suggest China’s local governments are offloading digital currencies through private firms despite the national crypto ban.

Cas Abbe, a Web3 growth manager, and Binance exchange affiliate, noted on X that the dump in crypto prices may partly stem from these offloading activities.

“Local governments in China are selling seized crypto to top up their treasury. Despite the crypto trading ban in China, local governments are using private companies to offload their holdings. This explains pretty much the dump even before tariff news hit the market,” Abbe noted.

The surge in liquidations comes as authorities grapple with inconsistent policies for handling crypto seized from criminal investigations, which spiked sharply in 2023.

Over $59 billion was tied to crypto-related crimes in China that year. Blockchain security firm SAFEIS reported that more than 3,000 people were prosecuted for offenses ranging from internet fraud to illegal gambling.

Despite Beijing’s ban, local governments have reportedly turned to private firms to offload confiscated tokens. Specifically, they are converting them into cash to fund their treasuries.

Jiafenxiang, a Shenzhen-based technology firm, has sold more than 3 billion yuan ($414 million) worth of digital assets in offshore markets since 2018. Documents reviewed by Reuters link the company to liquidation deals with local authorities in Xuzhou, Hua’an, and Taizhou.

Though practical for cash-strapped regions, the process is legal gray territory. Such practices risk undermining the country’s crypto enforcement regime without clear regulatory frameworks.

“This raises so many questions about transparency. How are they even doing this legally?” noted one analyst in a post.

Experts are now calling for urgent regulatory reforms. These include judicial recognition of crypto as assets and the creation of standardized disposal mechanisms.

Some are even floating the idea of building a centralized national crypto reserve. This mirrors Trump’s administration’s proposals to manage seized assets more strategically.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

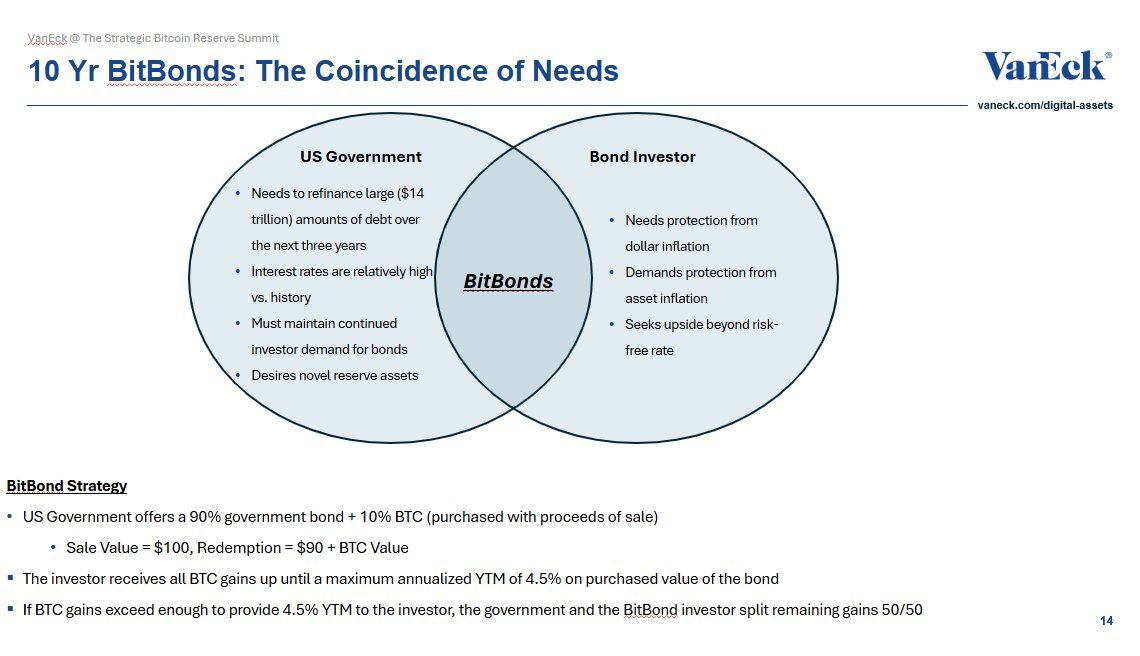

Is Bitcoin the Solution to Managing US Debt? VanEck Explains

Matthew Sigel, Head of Digital Assets Research at VanEck, has proposed a new financial instrument, “BitBonds,” to help manage the US government’s looming $14 trillion refinancing debt requirement.

The 10-year financial instrument combines traditional US Treasury bonds with Bitcoin (BTC) exposure. This offers a potential solution to the nation’s fiscal concerns.

Can Bitcoin-Backed Bonds Help Solve the US Debt Crisis?

According to Sigel’s proposal, BitBonds’ investment structure allocates 90% of the funds to low-risk US Treasury securities and 10% to Bitcoin, combining stability with the potential for higher returns. Additionally, the government would purchase Bitcoin with proceeds from the bond sale.

Investors would receive all Bitcoin gains up to a maximum annualized yield-to-maturity of 4.5%. Furthermore, the investor and the government would split any additional gains equally.

“An aligned solution for mismatched incentives,” Sigel remarked.

From an investor perspective, Sigel highlighted that the bond offers a breakeven Bitcoin compound annual growth rate (CAGR) between 8% and 17%, depending on the coupon rate. Additionally, investors’ returns could skyrocket if Bitcoin grows at a 30%–50% CAGR.

“A convex bet—if you believe in Bitcoin,” he added.

However, the structure is not without risks: investors bear Bitcoin’s downside while only partially participating in its upside. Lower-coupon bonds may lose appeal if Bitcoin underperforms.

Meanwhile, the Treasury’s downside is limited. Even a complete collapse of Bitcoin’s value would still result in cost savings compared to traditional bond issuance. Yet, this is contingent on the coupon remaining below the breakeven threshold.

“BTC upside just sweetens the deal. Worst case: cheap funding. Best case: long-vol exposure to the hardest asset on Earth,” Sigel stated.

Sigel claimed that this hybrid approach aligns the interests of the government and investors over a 10-year period. The government faces high interest rates and significant debt refinancing needs. Meanwhile, investors seek protection from inflation and asset debasement.

The proposal comes amid growing concerns over the US debt crisis, exacerbated by the recent increase in the debt ceiling to $36.2 trillion, as reported by BeInCrypto. Notably, the Bitcoin Policy Institute (BPI) has also endorsed the concept.

“Building on President Donald J. Trump’s March 6, 2025, Executive Order establishing the Strategic Bitcoin Reserve, this white paper proposes that the United States adopt Bitcoin-Enhanced US Treasury Bonds (“₿ Bonds” or “BitBonds”) as an innovative fiscal tool to address multiple critical objectives,” the brief read.

In the paper, co-authors Andrew Hohns and Matthew Pines suggested that issuing $2 trillion in BitBonds at a 1% interest rate could cover 20% of the Treasury’s 2025 refinancing needs.

“Over a ten-year period, this represents nominal savings of $700 billion and a present value of $554.4 billion,” the authors wrote.

BPI estimates that if Bitcoin achieves a CAGR of 36.6%, the upside could potentially defease up to $50.8 trillion of federal debt by 2045.

These recommendations are part of broader conversations regarding Bitcoin’s potential impact on national finance. Previously, Senator Cynthia Lummis argued that a US Strategic Bitcoin Reserve could halve the national debt. In fact, VanEck’s analysis indicated that such a reserve could help reduce $21 trillion of debt by 2049.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoHedera Under Pressure as Volume Drops, Death Cross Nears

-

Market21 hours ago

Market21 hours ago3 US Crypto Stocks to Watch Today: CORZ, MSTR, and COIN

-

Market20 hours ago

Market20 hours agoBitcoin Price on The Brink? Signs Point to Renewed Decline

-

Market22 hours ago

Market22 hours agoEthena Labs Leaves EU Market Over MiCA Compliance

-

Market18 hours ago

Market18 hours agoXRP Price Pulls Back: Healthy Correction or Start of a Fresh Downtrend?

-

Altcoin18 hours ago

Altcoin18 hours agoRipple Whale Moves $273M As Analyst Predicts XRP Price Crash To $1.90

-

Market17 hours ago

Market17 hours agoArbitrum RWA Market Soars – But ARB Still Struggles

-

Bitcoin17 hours ago

Bitcoin17 hours agoIs Bitcoin the Solution to Managing US Debt? VanEck Explains