Bitcoin

Bitcoin Price Can Still Reach $100,000 Despite Sell-Off

Bitcoin’s potential to hit $100,000 remains a topic of keen interest among investors. Various market dynamics and economic indicators suggest that this ambitious target is still within reach.

Experts share insights on what it will take for Bitcoin to achieve this milestone.

The Path to a $100,0000 Bitcoin

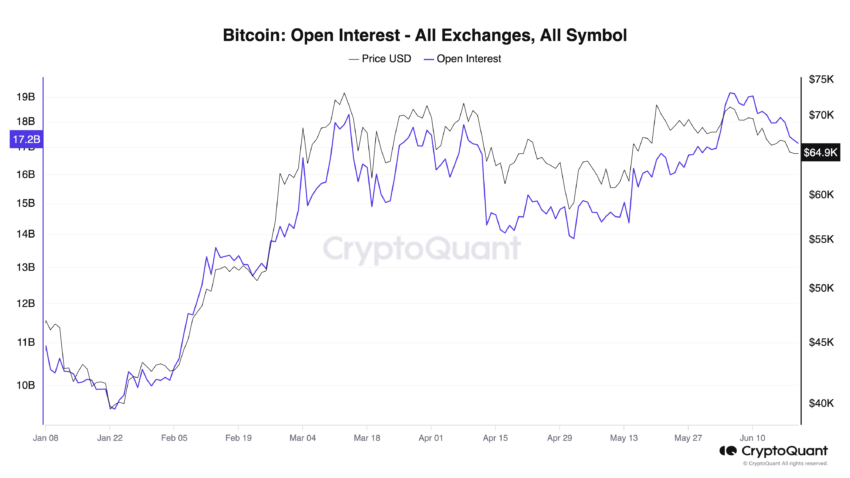

Felix Mohr, co-founder of MohrWolfe, told BeInCrypto about Bitcoin’s potential, emphasizing the growing demand and increasing Open Interest (OI). Recently, Bitcoin futures OI surged by $2.02 billion in just three days.

“This increased buying interest in Bitcoin is no coincidence. Investors have made it clear they anticipate two US Federal Reserve rate cuts by the end of the year,” Mohr explained.

Indeed, investor sentiment is significantly influenced by speculations surrounding the Federal Reserve’s monetary policy. A Reuters poll indicates a potential rate cut in September, although there is a risk of fewer cuts or none at all.

“Nearly two-thirds of economists, 74 of 116, in the May 31-June 5 Reuters poll predicted the first cut in the Fed funds rate to a 5.00%-5.25% range would come in September. That was the same conclusion as last month’s poll, with a similar majority,” reads the Reuters report.

Historically, Bitcoin benefits from a bullish stock market, which could be invigorated by Fed rate cuts. However, Federal Reserve Chair Jerome Powell remains cautious and economic indicators further complicate the picture.

The Consumer Price Index (CPI) increased by 3.4% over the past year, while Core CPI rose by 3.9%. The Producer Price Index (PPI) also exceeded expectations, climbing 2.2% annually. These figures suggest persistent inflation, which may deter the Fed from aggressive rate cuts.

“Amid the flurry of subpar economic data, the SP500 is at a record high, indicating a potential for reversal. Bitcoin and traditional markets have historically moved in tandem. A correction in traditional markets could collapse the Bitcoin price,” Mohr told BeInCrypto.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

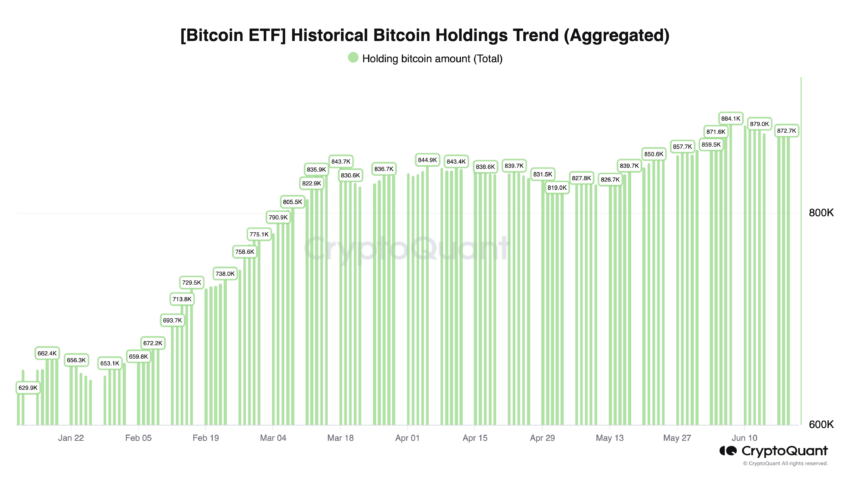

Nonetheless, Bitcoin’s trajectory is also influenced by institutional interest. The approval of Bitcoin exchange-traded funds (ETFs) by the SEC has been a significant catalyst.

The anticipation of Ethereum ETF approvals by major financial institutions later this year could also drive substantial price increases.

“Bitcoin has surpassed that all-time high to establish a new high of nearly $74,000 set in mid-March. The march towards $100,000 by year’s end begins again if indeed, the Fed cuts rates twice,” Mohr concluded.

Such an optimistic scenario is supported by Bernstein Research. The firm projects Bitcoin to reach $200,000 by 2025, $500,000 by 2029, and $1 million by 2033.

Bernstein’s analysts argue that Bitcoin ETFs, which have seen initial retail-driven allocations, are poised for broader adoption as major wirehouses and private banks prepare to offer these investment products.

Read more: Bitcoin (BTC) Price Prediction 2024 / 2025 / 2030

This institutional basis trade, they contend, acts as a “trojan horse” for wider adoption, potentially transforming Bitcoin into a mainstream asset class. Therefore, Bitcoin’s path to $100,000 and beyond remains achievable, contingent on favorable economic policies and continued institutional interest.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

What Does This Mean for Altcoins?

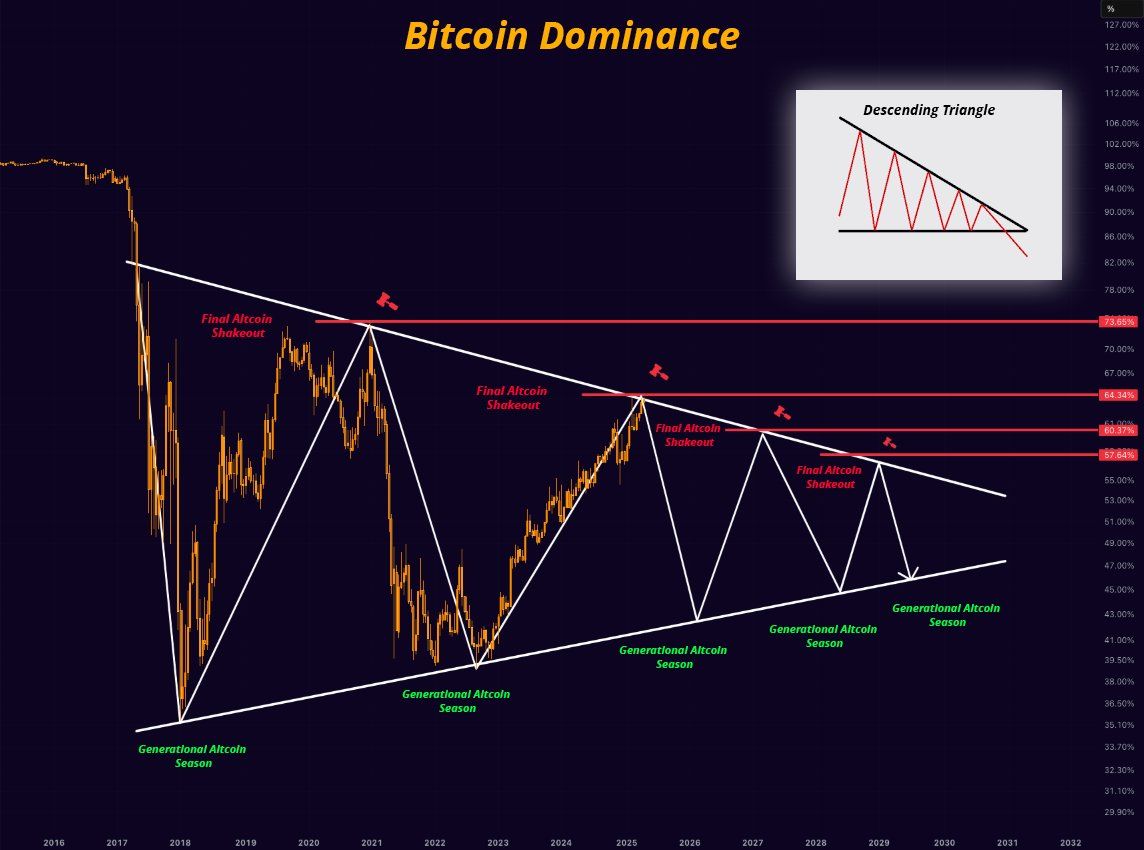

Bitcoin’s (BTC) market dominance has surged to 64%, reaching its highest level in over four years.

However, experts remain divided on what this means for the future. Some predict an impending altcoin season, and others caution that Bitcoin’s dominance could continue to suppress altcoins.

What Does Bitcoin’s Rising Dominance Mean?

For context, Bitcoin dominance (BTC.D) refers to the percentage of the total cryptocurrency market capitalization that BTC holds. It is a key indicator of Bitcoin’s market strength relative to other cryptocurrencies. A rising dominance suggests that Bitcoin is outperforming altcoins, while a decrease may signal growing interest or investment in other digital assets.

The metric has been steadily increasing since late 2022. As of the latest data, it surged to 64%, marking highs last seen in early 2021.

Notably, Benjamin Cowen, founder of Into The Cryptoverse, highlighted that the number is much higher when excluding stablecoins.

“Excluding stable coins, Bitcoin dominance is now at 69%,” Cowen revealed.

The rise in Bitcoin dominance has sparked debate among analysts about its implications for altcoins. Cowen believes there will be a correction or downward movement in altcoins before any substantial gains can be expected in the market. This implies that the altcoin season may not be imminent yet.

“I think ALT/ BTC pairs need to go down before they can go up,” he stated.

Nordin, founder of Nour Group, also expressed caution. He stressed that Bitcoin dominance is nearing the levels seen during the peak of the 2020 bear market.

“This isn’t just a BTC move. Its capital rotating out of alts,” he noted.

Moreover, Nordin warned that a break above 66% could intensify selling pressure on altcoins. This, in turn, could delay the altcoin season.

“Bitcoin dominance back to 64%. No Alt seasons in 2024 or 2025,” analyst, Alessandro Ottaviani, predicted.

On the other hand, analyst Mister Crypto predicts that Bitcoin’s dominance may follow a long-term descending triangle pattern. A descending triangle typically suggests bearish momentum, where the price or dominance gradually decreases as lower highs are formed.

However, this could prolong its market control before a broader correction allows altcoins to gain traction.

Another analyst mentioned that Bitcoin dominance is currently testing the resistance zone between 64% and 64.3%. Therefore, a possible retracement may be on the horizon. Should this retracement occur, altcoins could begin to gain traction, with some potentially emerging as top performers in the market as capital shifts away from Bitcoin.

“However, a breakout from this zone could mean further declines for alts,” the analyst remarked.

Finally, Junaid Dar, CEO of Bitwardinvest, offered a more optimistic view. According to Dar’s analysis, if Bitcoin’s dominance drops below 63.45%, it could trigger a strong upward movement in altcoins. This, he believes, would create an ideal opportunity to profit from altcoin positions.

“For now, alts are stuck. Just a matter of time,” Dar added.

Tether Dominance Signals Potential Altcoin Season

Meanwhile, many analysts believe that the trends in Tether dominance (USDT.D) signal a potential altcoin season. From a technical analysis standpoint, USDT.D has reached a resistance zone and may be due for a correction, suggesting the possibility of capital flowing from USDT into altcoins.

“The USDTD is in a rejection zone, as long as it does not close above 6.75% it will be favorable for the market,” a technical analyst wrote.

Another analyst also stressed that the USDT.D and USD Coin dominance (USDC.D) have reached resistance, forecasting an incoming altcoin season. Doğu Tekinoğlu drew similar conclusions by observing the combined chart of BTC.D, USDT.D, and USDC.D.

As Bitcoin’s dominance climbs, investors are closely monitoring these technical and on-chain signals. The interplay between Bitcoin’s strength and stablecoin dynamics could dictate whether altcoins stage a comeback this summer or face further consolidation. For now, Bitcoin’s grip on the market remains firm.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Babylon’s TVL Drops 32% After Massive Bitcoin Unstaking

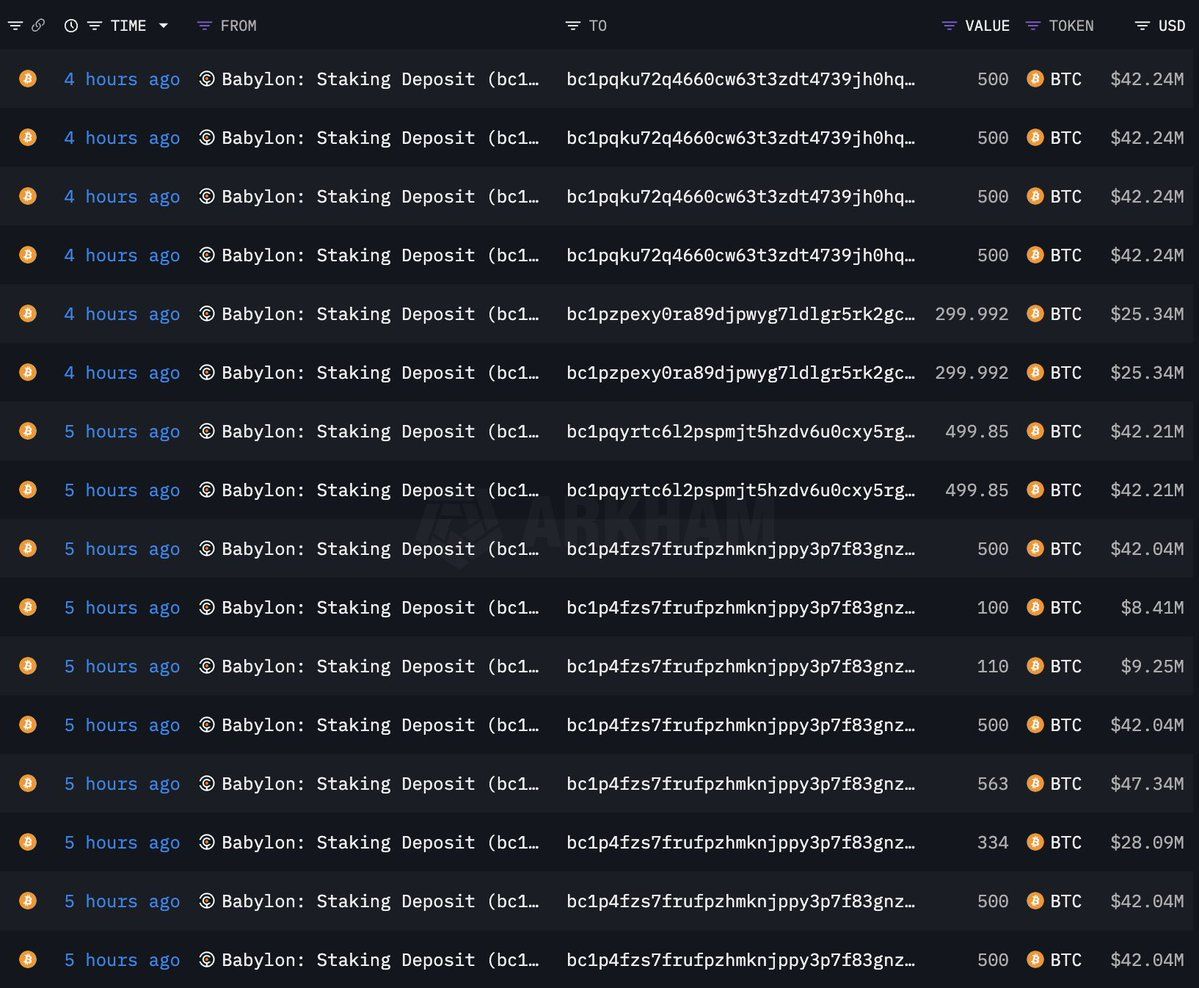

Babylon, a platform enabling native Bitcoin (BTC) staking, recorded a notable unstaking event on April 17. Approximately $1.26 billion worth of BTC was withdrawn from the protocol.

The move resulted in a significant decline in Babylon’s total value locked (TVL). Moreover, the price of its native token, BABY, also dipped.

Babylon’s TVL Drops 32% After Massive BTC Unstaking

Blockchain analytics firm Lookonchain alerted users about the unstaking on X (formerly Twitter).

“About 5 hours ago, 14,929 BTC($1.26 billion) was unstaked from Babylon,” the post read.

This move triggered a sharp drop in the platform’s TVL. According to data from DefiLama, Babylon’s TVL dropped from $3.9 billion to $2.6 billion in just a day, representing a decline of 32.7%. Moreover, only 31,502 BTC remain staked in the protocol at press time.

That’s not all. The BABY token was also not immune to market pressures. According to BeInCrypto data, the token depreciated by 9.8% over the past day alone. At the time of writing, the altcoin was trading at $0.8.

The unstaking led to widespread speculation about the platform’s stability and the broader implications for Bitcoin-based decentralized finance (DeFi) protocols.

“What’s going on. I don’t waste my time partaking in staking BTC, but this can be concerning. You don’t just see so much unstaking in such a short window,” a user said.

Nonetheless, Lombard Finance quickly moved to calm investor concerns. The Bitcoin restaking protocol, built on Babylon, clarified that the withdrawal was part of a planned transition to a new set of finality providers.

“To carry out the transition to our new set of Finality Providers, the Lombard Protocol has begun the process of unstaking BTC from the Lombard Finality Provider,” Lombard Finance stated.

The post emphasized that this process was a necessary step in the evolution of the platform. In addition, the company reassured investors that the withdrawn funds are expected to be restaked once the unbonding process concludes.

The unstaking event follows closely on the heels of Babylon’s airdrop earlier this month. 600 million BABY tokens—representing 6% of the token’s total supply—were distributed to early adopters, including Phase 1 stakers, Pioneer Pass NFT holders, and contributing developers.

Shortly after the airdrop, $21 million worth of Bitcoin was unstaked within 24 hours. This suggests a pattern of capital withdrawal that has intensified with the latest event.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

What Good Friday Options Expiry Means for Bitcoin & Ethereum

On Good Friday, over $2.2 billion worth of Bitcoin and Ethereum options contracts expire today.

It comes as crypto markets continue to reel from macroeconomic uncertainty. President Donald Trump is pressuring the Federal Reserve (Fed) to cut interest rates, but the chair, Jerome Powell, will not budge.

Over $2.2 Billion Options Expire Today

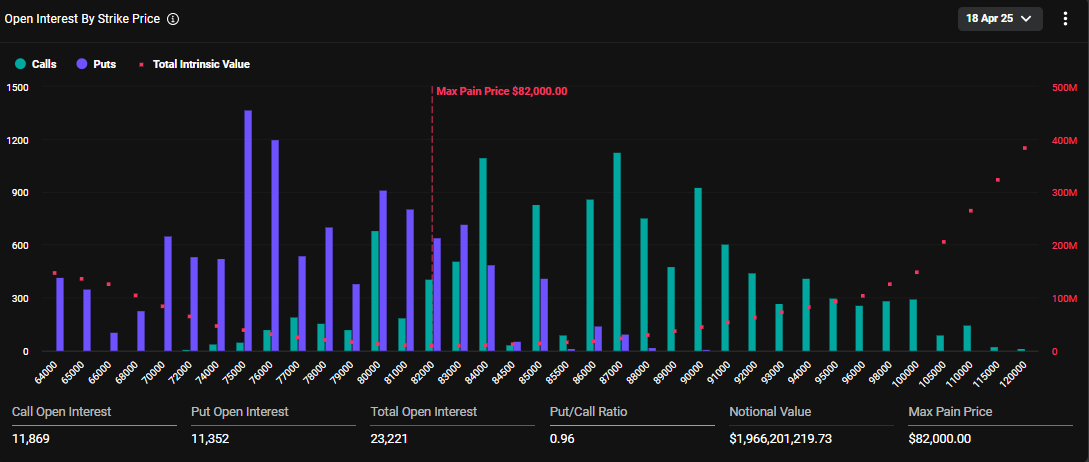

Today, April 18, amid Good Friday celebrations, 23,221 Bitcoin (BTC) options contracts will expire. The notional value for this Friday’s tranche of expiring Bitcoin options contracts is $1.966 billion, according to data on Deribit.

The put/call ratio is 0.96, suggesting a prevalence of purchase options (calls) over sales options (puts).

As the Bitcoin options expire, they have a maximum pain or strike price of $82,000; at this point, the asset will cause the greatest number of holders’ financial losses.

Similarly, crypto markets will witness the expiry of 177,130 Ethereum contracts, with a notional value of $279.789 million. The put-to-call ratio for these expiring Ethereum options is 0.84, with a maximum pain of $1,600.

This week’s options expiry event is slightly smaller than what crypto markets witnessed last week on Friday. As BeInCrypto reported, approximately $2.5 billion worth of BTC and ETH options expired then, with short-term dips bringing put demand.

Traders and investors must closely monitor today’s developments as options expiry could lead to price volatility. Nevertheless, put-to-call ratios below 1 for Bitcoin and Ethereum in options trading indicate optimism in the market. It suggests that more traders are betting on price increases.

Meanwhile, analysts at Deribit highlight low volatility and flat skew. While this suggests a calm market, historical data from CoinGlass suggests post-expiry price swings are common, potentially signaling an upcoming move.

“With volatility crushed and skew flat, is the market setting up for a post-expiry move?” they posed.

Blackswan Event Likely, Greeks.live Analysts Say

Analysts at Greeks.live shed light on current market sentiment, echoing the calm outlook. However, they note that the market is predominantly bearish to neutral. Traders expect continued choppy action before potentially revisiting $80,000 to $82,000.

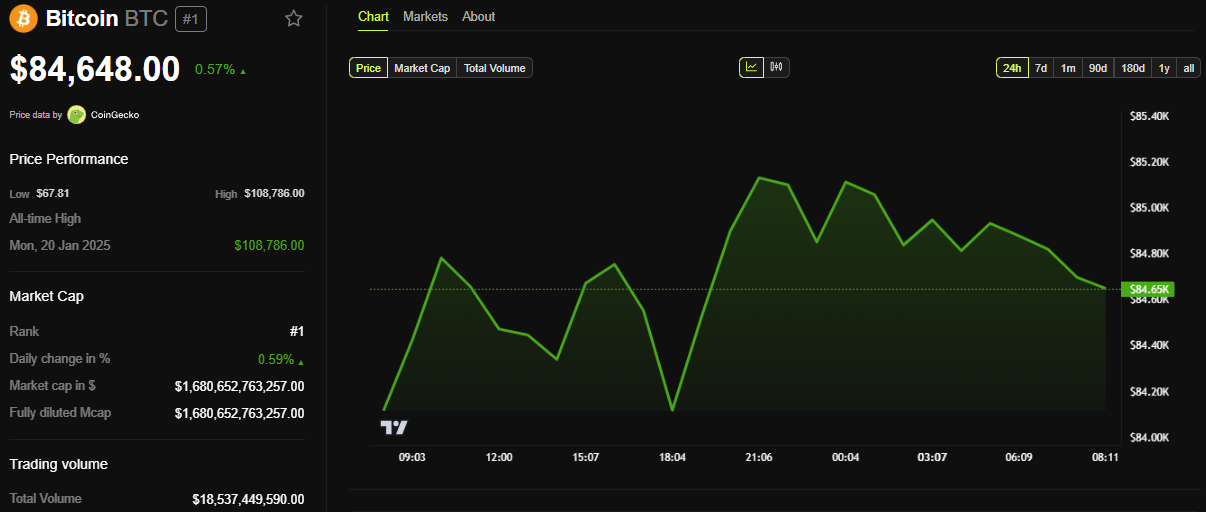

As of this writing, Bitcoin was trading for $84,648, slightly above its strike price of $82,000. Based on the Max Pain theory, prices will likely move toward this strike price as options near expiry.

Citing a mild sentiment, Greek.live analysts ascribe the calm to Trump not putting out a lot of news this week. Nevertheless, they anticipate more trade wars, heightened uncertainty, and volatility.

“We expect the trade and tariff wars to be far from over, and the uncertainty in the market will continue for a long time, as will the volatility in the market,” Greeks.live wrote.

They also ascribe the outlook to Powell’s comments, which created downward pressure as 100 bps rate cut expectations for the year were reduced. This led to crypto correlation with traditional markets.

Against this backdrop, Greeks.live says the probability of a black swan event is higher, where a rare, unexpected event that has a significant and often disruptive impact on the market occurs.

“…it is now a period of pain when the bulls have completely turned to bears, and investor sentiment is relatively low. In this worse market of bulls turning to bears, the probability of a black swan will be significantly higher,” they explained.

They urge traders to buy out-of-the-money (OTM) put options. An option is classified as out-of-the-money when its strike price is less favorable than the current market price of the underlying asset. This means it has no intrinsic value, only time value (the potential for it to become valuable before expiration).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin21 hours ago

Altcoin21 hours agoEthereum ETFs Record $32M Weekly Outflow; ETH Price Crash To $1.1K Imminent?

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Price Stalls In Tight Range – Big Price Move Incoming?

-

Market13 hours ago

Market13 hours agoPi Network Roadmap Frustrates Users Over Missing Timeline

-

Market12 hours ago

Market12 hours agoSolana (SOL) Price Rises 13% But Fails to Break $136 Resistance

-

Market14 hours ago

Market14 hours agoMEME Rallies 73%, BONE Follows

-

Market20 hours ago

Market20 hours agoAre Ethereum Whales Threatening ETH Price Stability?

-

Market19 hours ago

Market19 hours agoHow $31 Trillion in US Bonds Could Impact Crypto Markets in 2025

-

Bitcoin18 hours ago

Bitcoin18 hours agoWhat Does This Mean for Altcoins?