Bitcoin

Bitcoin Next’s Move Hinges On $98,000 Price Level, Analyst Says Why

The price of Bitcoin (BTC) suffered a significant loss on Friday as prices dipped below $102,000 marking the end of a rather turbulent trading week. As the global financial markets weathered major losses, Bitcoin made no new price discovery, casting more speculations over the bull market.

Critical Price Level Emerges At $98,000 For Bitcoin

Despite an overall positive performance in January, Bitcoin has struggled to confirm the bull run continuation with its all-time high price increasing by merely 0.6%.

As market investors remain confident of more price gains, blockchain analytics firm Glassnode has highlighted a price level that might prove pivotal to Bitcoin’s current bullish setup. In a new post on X, Glassnode shares that market participants have traded a substantial volume of BTC between the price range of $94,000 – $101,000 over the last 45 days.

As a result of this development, there is currently a dense supply cluster forming around the $98,000 price zone indicating a significant amount of investors are acquiring BTC near this price zone. Historically, price areas of high accumulation activity are considered important as they tend to serve as strong support in market downturns and act as resistance during price rallies.

Therefore, if Bitcoin consolidates above $98,000 for an extended period, this price zone could form a sturdy floor, offering support for further rallies in the current bullish structure. However, a fall below this price level could convert it into a strong resistance zone as investors may aim to sell to recoup losses.

In terms of immediate price movement, if Bitcoin bulls can hold above $98,000 with sufficient buying pressure, the asset could make a return to the $106,000 price region which currently represents a strong psychological resistance zone. On the other hand, if sellers overpower demand at the $98,000 price level, Bitcoin is subject to further decline with a possible retest at $92,000 on the table.

BTC Records Nearly $450 Million In Exchange Outflows

In other developments, the Bitcoin market registered $442 million in exchange outflows over the past week. According to more data from IntoTheBlock, a net outflow of $70 million was reached as exchange inflows stood at $372 million.

Generally, higher exchange outflows than inflows is a bullish development indicating investors are less interested in selling and are moving their assets to private wallets in expectation of a price gain. At press time, BTC trades at $102,269 after a 1.94% decline in the past day. Meanwhile, the asset’s daily trading volume is down by 12.58% and valued at $44.44 billion.

Featured image from Depositphotos, chart from Tradingview

Bitcoin

Bitcoin STH MVRV Climbs To 0.90, Is A Price Rebound On?

Bitcoin (BTC) has moved to reclaim the $86,000 price level following a 2.65% gain in the last 24 hours. Notably, the premier cryptocurrency has maintained a bullish form over the past few rising by over 15% since retesting the $74,000 rice zone. Amid a potential resumption of the broader bull rally, prominent crypto analyst Burak Kesmeci has highlighted notable developments in Bitcoin short-term holders MVRV (Market Value to Realized Value) ratio.

Bitcoin Market Recovery Awaits Final Signal: Analyst

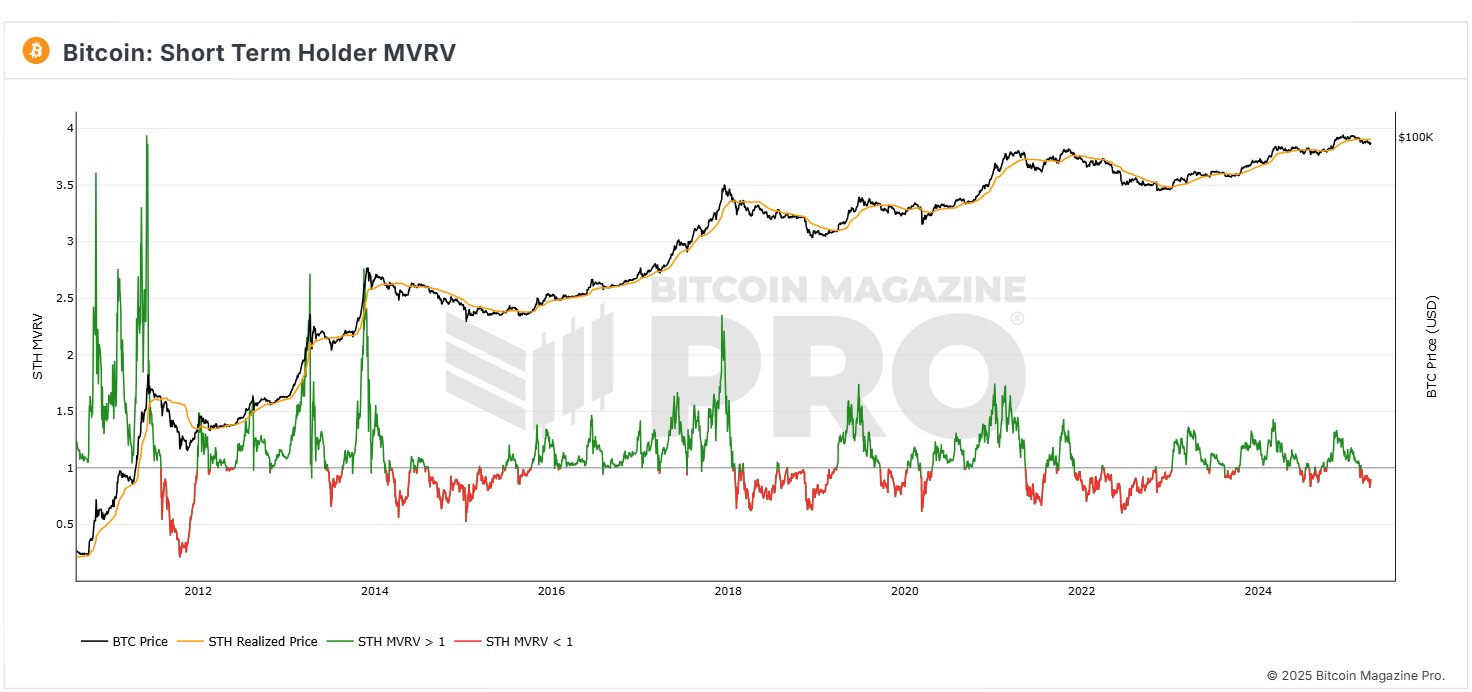

In a new post on X, Kesmeci explains that Bitcoin is showing early signs of a market recovery following recent developments in the Bitcoin MVRV for short-term investors. For context, the MVRV measures investors’ profitability by comparing the market value of an asset to the price at which it was acquired. An MVRV score below 1.00 indicates that the average holder is at a loss, while a score above 1.00 suggests profit.

The MVRV for Bitcoin short-term holders i.e. addresses that have held Bitcoin for less than 155 days, is particularly important as this cohort of investors is usually the most reactive to price changes. Notably, the STH MVRV provides insight into market sentiment and potential price direction.

According to Kesmeci, the Bitcoin STH MVRV is now at 0.90, close to a profit level above 1.00. The STH MVRV had hit 0.82 amidst the recent “tax tariff poker” crisis, ignited by international tariff changes by the US government. Notably, this decline falls lower than levels seen during the Japan-based carry trade crisis on August 5, 2024, when STH MVRV dipped to 0.83.

Over the last few days, the STH MVRV has climbed to 0.90 in line with the resurgence of BTC prices However, Kesmeci warns that Bitcoin must still cross 1.00 to confirm the potential for any significant price gains for short-term investors. Albeit, the rise from 0.82 to 0.90 remains a positive development that indicates an ongoing shift in market sentiment.

BTC Price Outlook

At press time, Bitcoin is trading at $85,390 following a slight price retracement in the past few hours. Amidst recent daily gains, the premier cryptocurrency is up by 2.11% on its weekly chart and 4.33% on the monthly chart as bullish momentum continues to build among investors. However, market bulls must offset the 38.98% decline in daily trading volume if the present uptrend must persist.

Notably, BTC investors should expect to face ample resistance at the $88,000 price zone which has acted as a strong price barrier in previous times. Meanwhile, in the advent of any price fall, the immediate price support lies around $79,000.

Featured image from iStock, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

New Bill Pushes Bitcoin Miners to Invest in Clean Energy

US Senators Sheldon Whitehouse and John Fetterman have introduced the Clean Cloud Act of 2025. The bill aims to reduce carbon emissions from energy-intensive crypto-mining operations and artificial intelligence data centers.

This comes at a time when Bitcoin miners are increasingly moving towards renewable energy sources to power their operations.

Clean Cloud Act Links Rising Energy Demand to Bitcoin Mining

According to the bill, the Environmental Protection Agency (EPA) would have the authority to set annual carbon performance standards for facilities with over 100 kilowatts of installed IT power.

These standards would tighten each year, with emissions limits declining by 11% annually.

Companies that exceed the cap will pay a starting fee of $20 per ton of carbon dioxide equivalent. This fee will rise yearly, adjusting for inflation and an additional $10 per ton. The bill also enforces strict accounting methods to include indirect emissions from the grid.

The lawmakers argue that crypto miners and AI centers are driving up power demand at an unsustainable pace. According to them, the current clean energy sources cannot keep up with the rapid growth of the demand for Bitcoin mining.

They noted that data centers alone use 4% of all electricity in the US and could hit 12% by 2028. They also pointed out that utilities have even restarted old coal plants to meet rising demand, worsening the country’s carbon footprint.

Considering this, Senator Whitehouse noted that this pressure is driving up electricity costs for consumers. He said the bill would push tech firms toward clean energy investments and help ensure the US power grid can reach net-zero emissions within the next decade.

“The good news is that we don’t have to choose between leading the world on AI and leading the world on climate safety: big technology and AI companies have all the money in the world to pay for developing new sources of clean energy, rather than overloading local grids and firing up fossil fuel pollution. The Clean Cloud Act will drive utilities and the burgeoning crypto and AI industries to invest in new sources of clean energy,” the lawmaker stated.

To protect low-income households, 25% of the revenue generated from emissions penalties will offset energy costs. The rest will fund grants supporting long-duration storage and clean power generation projects.

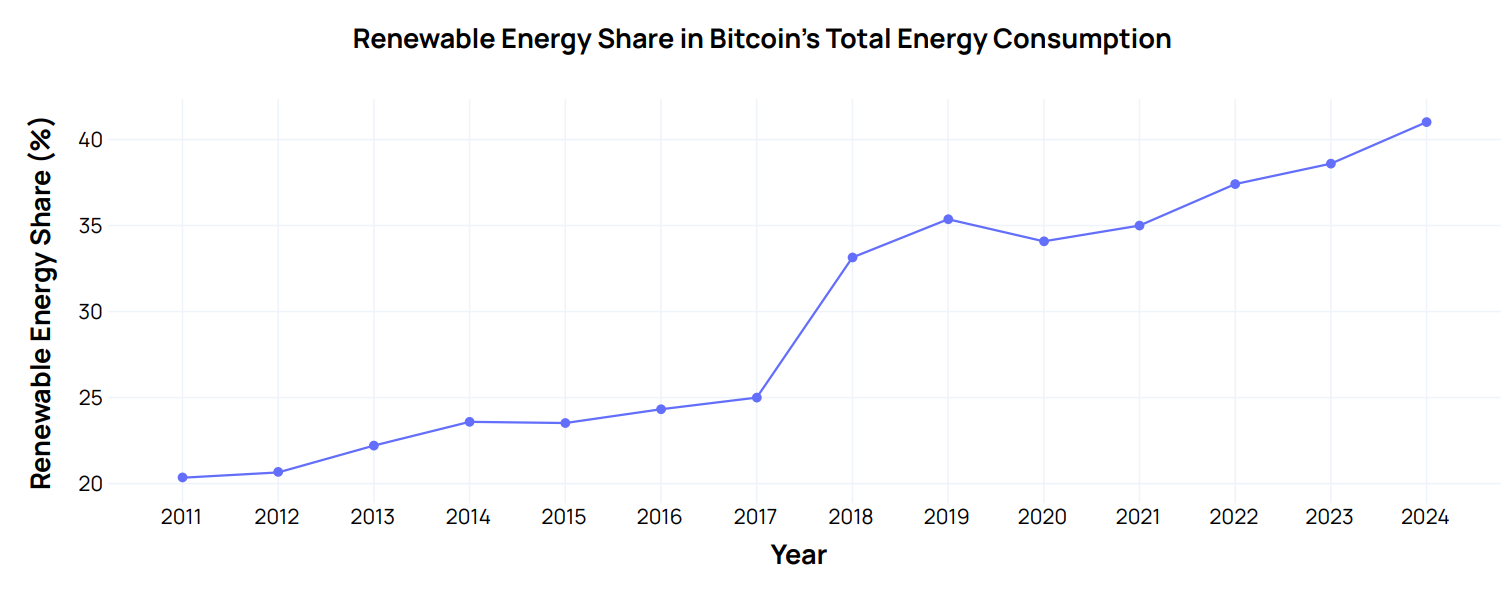

Meanwhile, this move is coming as the crypto industry steadily transitions to greener energy.

A recent MiCA Crypto Alliance report shows that renewable energy powered 41% of Bitcoin mining by the end of 2024, up from 20% in 2011.

Following this rapid adoption rate, the report forecast that renewables could support over 70% of mining activities by 2030, driven by cost efficiency, evolving policies, and a broader shift toward sustainable practices

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

CryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why

Ki Young Ju, the CEO of blockchain analytics platform CryptoQuant, has declared that the Bitcoin bull cycle is over. Notably, the premier cryptocurrency has struggled to establish a sustained uptrend since hitting a new all-time high of around $109,000 in January, causing doubts about the viability of the current bull run.

Bitcoin’s Unresponsive Price Points To Bear Market Onset

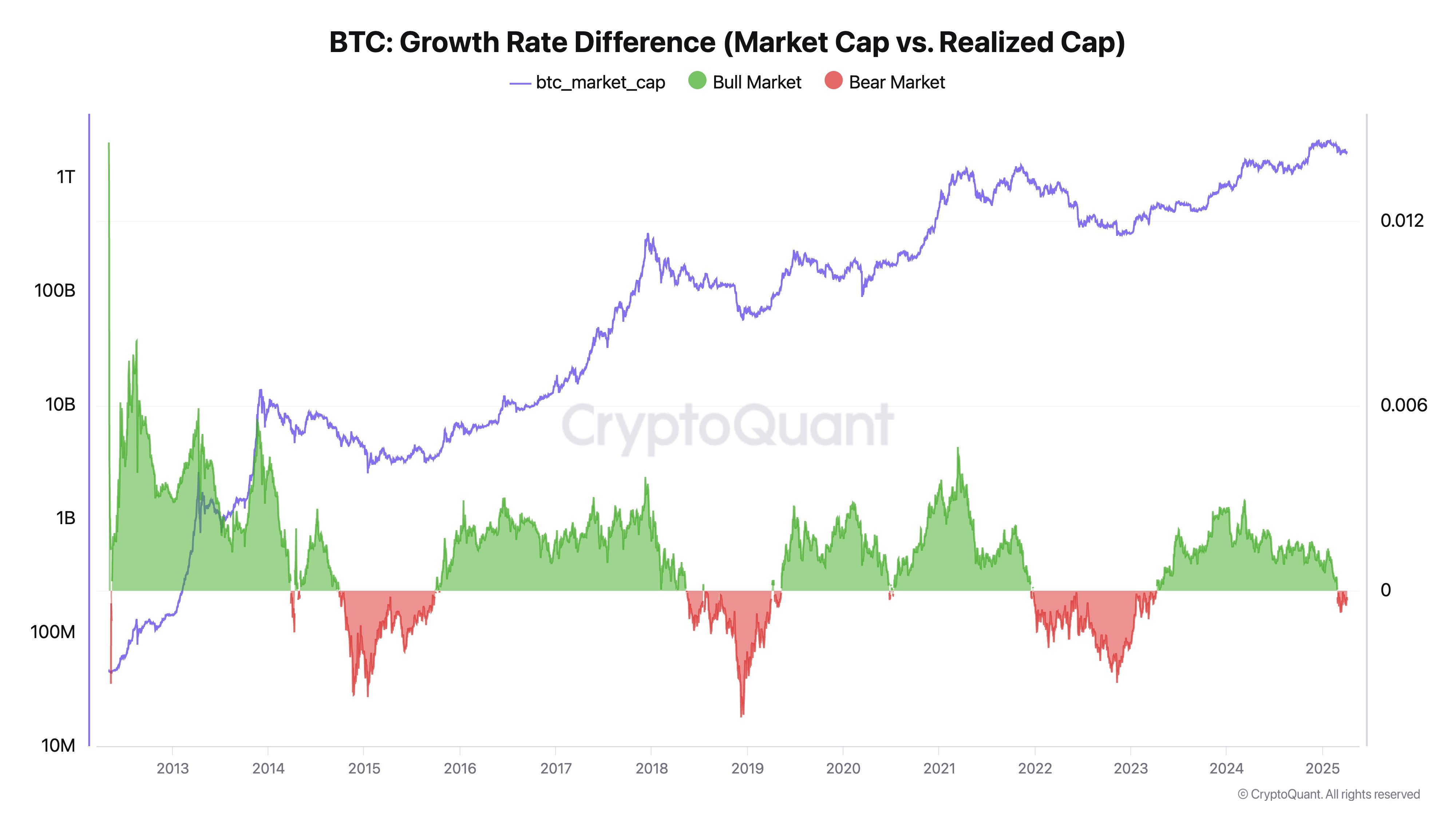

In an X post on April 5, Ki Young Ju shared an interesting theory on why Bitcoin may have concluded its current bull run. The prominent crypto figure has based this postulation on on-chain data concepts around the Realized Cap and the Market Cap.

Young Ju describes the Realized Cap as the total capital that flows into the BTC market as revealed by actual on-chain activity. The Realized cap reveals a more accurate measurement of the BTC network by summing the price at which each coin last moved.

On the other hand, the Market Cap provides a BTC network valuation based on the latest exchange trading prices. The CryptoQuant CEO explains that market cap/prices do not increase or decrease in proportion to transaction sizes based on common misconceptions but in response to the balance between buying and selling pressure.

Young Ju states that amidst low sell pressure, a small buy can cause a rise in price and market cap. On the other hand, large Bitcoin purchases during high sell pressure can fail to effect a positive price reaction as the market consists of a high number of sellers.

Looking at both concepts, it is understood that Realized Cap measures the capital inflows into the BTC market while Market Cap indicates price reaction to these inflows. Therefore, the CryptoQuant boss explains that a rise in Realized Cap, while Market Cap declines or remains unchanged, presents a classic bearish signal as prices are failing to respond positively despite new investments.

Alternatively, a stagnant Realized Cap accompanied by an increased Market Cap is a bullish signal that reflects the low level of sellers; thus any small amount of new capital can induce substantial price gains.

Ki Young Ju states the former situation is currently playing out in the Bitcoin market with prices failing to rise inflow as indicated by on-chain data in exchange transactions, ETF markets, and custodial wallets activity. This development suggests the presence of a bear market. While Young Ju states that the current sell pressure could wane at any time, historical data supports a reversal period of at least six months.

Bitcoin Price Overview

At press time, Bitcoin was trading at $83,700 reflecting a decline of 0.94% in the past day.

Featured image from TheStreet, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin6 hours ago

Altcoin6 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Market11 hours ago

Market11 hours agoHackers are Targeting Atomic and Exodus Wallets

-

Market18 hours ago

Market18 hours agoXRP Golden Cross Creates Bullish Momentum: Is $2.50 Next?

-

Market10 hours ago

Market10 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Bitcoin17 hours ago

Bitcoin17 hours agoCryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why

-

Market17 hours ago

Market17 hours agoPI Coin Recovers 80% From All-time Low — Will It Retake $1?

-

Market16 hours ago

Market16 hours agoDOGE Spot Outflows Exceed $120 Million in April

-

Market15 hours ago

Market15 hours agoBinance Users Targeted by New Phishing SMS Scam