Bitcoin

Bitcoin In Texas’ Future? Gov. Dan Patrick Unveils Reserve Plan

Texas is poised to be at the forefront of cryptocurrency adoptions through its ambitious legislative proposal. Lieutenant Governor Dan Patrick has an ambitious plan to set up a Bitcoin reserve for the state as part of his legislative priorities in 2025. This is a new shift at the state level in terms of cryptocurrency policy and adoption, which can transform the financial landscape of Texas.

States Race To Embrace Bitcoin Reserves

Momentum for state-level Bitcoin reserves is growing across America. A recent committee approval of a Strategic Bitcoin Reserve bill has energized the movement in Utah, following in the footsteps of Arizona, which helped to pioneer this approach. Now several other states follow close behind with similar proposals.

An AI image rendition of a bitcoin reserve vault in Texas. Image created by: Gemini Imagen 3.

Texas Builds On Crypto-Friendly Foundation

With Texas’s latest Bitcoin project, the state advances even more as a cryptocurrency hub. The state had rules in place earlier that support blockchain technology development and Bitcoin mining activities. This new reserve will be strictly guided by the state. This way, it can ensure compliance with regulations while extracting maximum benefits.

🇺🇸 TEXAS LT GOVERNOR DAN PATRICK SAYS ESTABLISHING TEXAS #BITCOIN RESERVE IS A TOP PRIORITY‼️ pic.twitter.com/G4y1ZzagI2

— The Bitcoin Conference (@TheBitcoinConf) January 29, 2025

Senate Bill 21, the BTC reserve proposal, is one of Dan Patrick’s top 40 legislative priorities. Its presence on such a renowned list indicates how digital assets are becoming essential to state financial strategy. The project may influence how other states integrate cryptocurrency.

Federal Discussions Signal Broader Changes

States are continuing their efforts, and the federal government is contemplating cryptocurrency reserves. Senator Cynthia Lummis is an important figure on the national reserve. Her plan has sparked lively arguments in Washington. The debate focuses on how cryptocurrencies are becoming more commonly accepted as a viable asset class.

Total crypto market cap at $3.5 trillion on the daily chart: TradingView.com

State-Level Innovation Drives National Policy

Joining the states seeking to draft legislation for a crypto reserve are Oklahoma and Massachusetts, with both bringing their distinct approach to the incorporation of digital assets. Divergent views at the state level could assist in establishing standards and best practices when implemented later on.

Evolution in state-level policies on cryptocurrency signifies a major shift in American mindset about finance. Traditional reserve approaches are being reappraised through digital alternatives. The Texas model, with Lieutenant Governor Dan Patrick at the helm, could be adopted by other states. Its roll-out would make it a highly watched policy within the United States.

Setting up state Bitcoin reserves is an important step in the growth of the alpha crypto as a valuable asset. States are shifting from basic rules to actively getting involved in digital assets. This change shows that people are becoming more confident in the future of cryptocurrency.

Featured image from Gemini Imagen 3, chart from TradingView

Bitcoin

BlackRock Approved by FCA to Operate as UK Crypto Asset Firm

BlackRock, the world’s largest asset manager, received approval from the UK’s Financial Conduct Authority (FCA) to operate as a crypto asset firm.

This marks a significant milestone for the investment giant, allowing it to extend its influence in the growing digital asset market.

BlackRock Joins Crypto Elite with FCA Approval in the UK

With this approval, BlackRock can operate its newly launched European Bitcoin exchange-traded product (ETP) as a UK entity.

According to the FCA’s website, BlackRock officially became the 51st company registered as a crypto asset firm on April 1, 2025. The firm joins a select group of financial entities, including Coinbase, PayPal, and Revolut, which have met the FCA’s stringent regulatory requirements.

BlackRock’s iShares Bitcoin ETP recently launched on the Euronext stock exchanges in Paris and Amsterdam. As BeInCrypto reported, this marked an expansion of the firm’s footprint in the European crypto investment market.

To attract investors, the product was introduced with a temporary fee waiver. It reduced its expense ratio to 0.15% until the end of the year. Once the waiver expires, the fee will revert to 0.25%, aligning with competing products like CoinShares’ Bitcoin ETP.

The iShares Bitcoin ETP is designed for institutional and informed retail investors. It offers a regulated and cost-effective way to gain exposure to Bitcoin. This move also positions BlackRock as a leader in the European digital asset space, catering to the growing demand for crypto-based financial products.

Meanwhile, the FCA has faced criticism for its cautious approach to crypto regulation. It has only approved around 9% of all applicants seeking registration as crypto asset firms.

“This low level of application approval signifies potential concern for the UK’s ambition to become a crypto hub,” Alan Vey, founder of web3 firm Aventus and a former Brevan Howard developer, said recently.

The regulator has defended its strict policies. A statement on its website articulated that many submissions lack essential information or fail to meet compliance standards.

“We have rejected submissions that didn’t include key components necessary for us to carry out an assessment, or the poor quality of key components meant the submission was invalid,” the FCA wrote.

Therefore, BlackRock’s FCA approval is not a mean feat. It marks another step in the mainstream adoption of crypto. With the UK now part of BlackRock’s growing crypto asset operations, the firm continues to push forward in integrating Bitcoin into traditional finance (TradFi).

BlackRock also manages approximately $12 trillion in assets (AUM) and continues actively expanding its crypto market presence. It launched its iShares Bitcoin Trust (IBIT) in the US in January 2024. The financial instrument has since grown into the largest US spot Bitcoin ETF, managing nearly $49 billion in assets.

Moreover, the surge in institutional interest in Bitcoin ETFs has been remarkable. In just one year, US spot Bitcoin ETFs have attracted over $95 billion in investments, SoSoValue data shows. This highlights the increasing demand for regulated Bitcoin investment vehicles.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

What It Means for Bitcoin

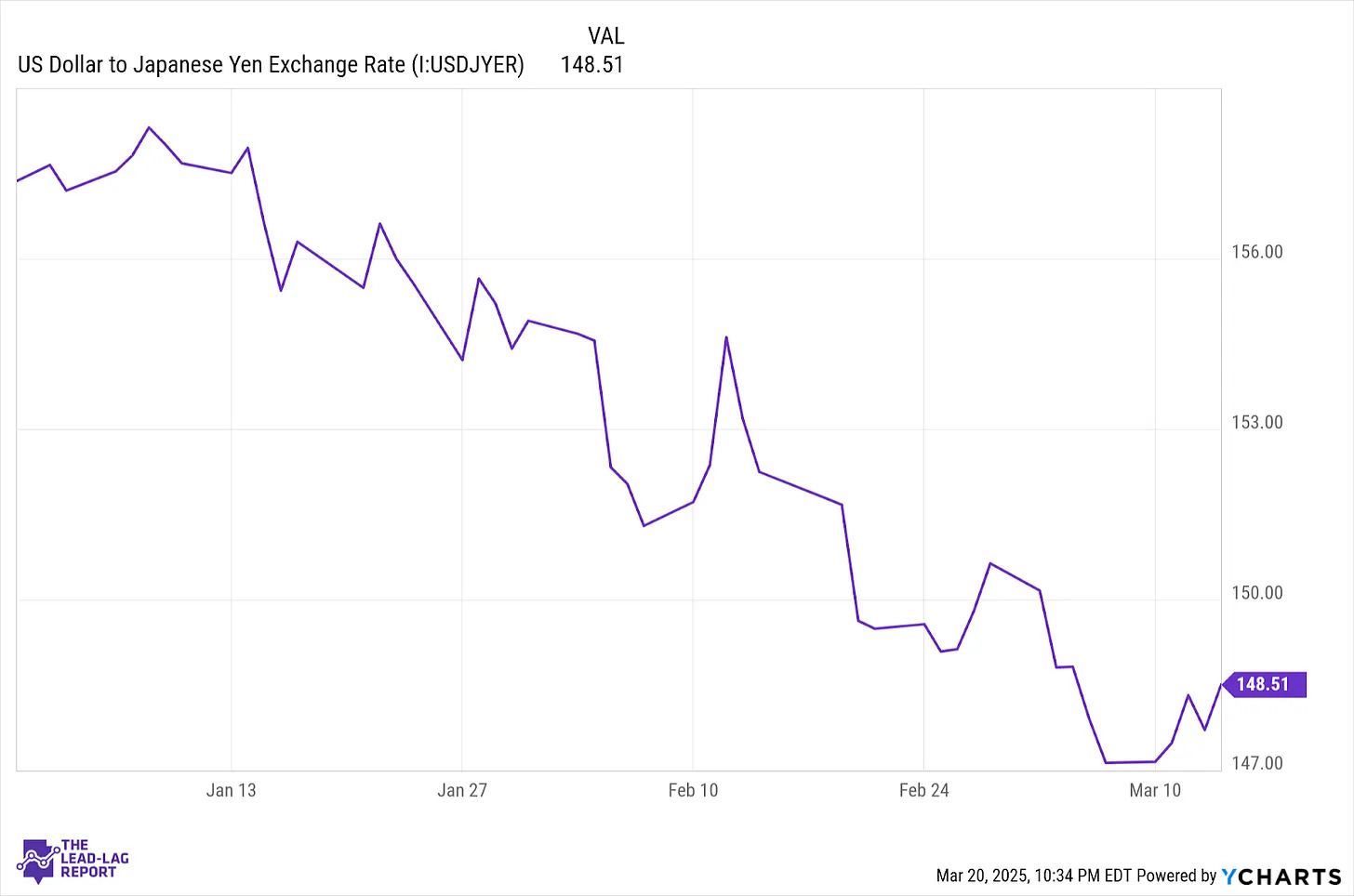

An expert has cautioned that the reverse yen carry trade is currently unfolding, albeit at a slower and more controlled pace.

This could have significant implications not only for traditional financial markets but also for cryptocurrencies like Bitcoin (BTC).

Why Investors Should Pay Attention to the Yen Carry Trade?

For context, the yen carry trade is a strategy in which investors borrow yen at low interest rates and invest the funds in higher-yielding assets, such as the US dollar or technology stocks. The goal is to profit from the difference in interest rates.

Nonetheless, this strategy’s risk arises from currency fluctuations. If the yen appreciates, investors converting the investment back to yen to repay the loan may see reduced or eliminated profits.

According to Michael A. Gayed, this scenario appears to be materializing now.

“The problem today is that those borrowing costs are starting to get more expensive. Traders who were able to access virtually free capital for years are now finding themselves sitting on costly margin positions that they’re potentially being forced to unwind,” he said.

In his recent report, Gayed explained that rising borrowing costs compel traders to offload dollar-denominated assets. This, in turn, heightens market volatility and depresses the prices of risk assets.

Notably, this happened last year as well. Gayed pointed out that in August 2024, the Bank of Japan’s decision to raise interest rates twice sparked a significant rally in the yen. Yet, at the same time, the S&P 500 saw an approximate 10% correction.

He added that the subsequent rebound alleviated investor concerns. Nevertheless, he believes the real issue is that the situation was never fully resolved.

“Big carry trade unwinds don’t just last a couple of weeks, and conditions are suddenly normalized,” Gayed stressed.

He added that the current market conditions resemble a similar situation. Notably, the Japanese 10-year yield has surged to 1.56%, the highest since 2008. As these yields climb, the yen strengthens, and the carry trade dynamics begin to shift.

“The 10-year yield continues to climb higher and close the interest rate differential on comparable 10-year US Treasury yields. That’s going to continue fueling strength in the yen that may continue into the later stages of 2025. And as long as the yen continues to strengthen, whether it’s quickly and slowly, that’s going to keep unwinding any outstanding carry trade that’s still out there. And it’s probably a lot,” he stated.

Moreover, Gayed suggested that the Bank of Japan will likely continue raising rates. Meanwhile, the Fed might possibly lower them in the coming months, further solidifying his outlook.

He also focused on the correlation between the S&P 500 and the yen. Gayed noted that the yen’s rise preceded the recent S&P 500 pullback by several weeks.

The correction could also be linked to an anticipated US growth slowdown and potential tariffs. Yet, he emphasized that the reverse carry trade is particularly risky due to its potential to escalate quickly, especially in the current macroeconomic climate.

“The market is plenty capable of correcting on its own, given the fears associated with tariffs and slowing economic growth. If you add people being forced to sell their US equity holdings in order to close out their short yen positions on top of that, it’s easy to see how a bad situation quickly becomes worse. And it’s already happening. Japan is still the real risk,” he claimed.

Now, the question is, why will this impact Bitcoin? Given its close correlation with the S&P 500, a correction in the latter could spell trouble for BTC. Analyst Lark Davis pointed out that Bitcoin and the S&P 500 have been closely linked since 2023.

“So as we’re trying to determine where Bitcoin goes from here, the unfortunate truth is that it all probably depends on what happens to the major stock indices,” he noted

Davis also advised crypto investors to monitor the broader economy, the stock market, and the M2 money supply, both in the US and globally.

For now, the largest cryptocurrency continues to navigate volatility ahead of President Trump’s tariff announcement. In fact, BeInCrypto reported that spot Bitcoin ETFs have recorded outflows for three consecutive days.

On the price front, Bitcoin has dipped 3.1% over the past week. At press time, the coin was trading at $85,042, representing small gains of 0.8% over the past day.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin to $250K? Hayes Links Price Surge to Fed’s QE Move

Arthur Hayes, former CEO of BitMEX, has predicted that Bitcoin (BTC) could soar to $250,000 by the end of the year.

However, this prediction is contingent on the US Federal Reserve (Fed) shifting its monetary policy toward Quantitative Easing (QE).

Bitcoin to $250,000, Hayes Predicts

Hayes argues that a halt in Quantitative Tightening (QT) and a return to liquidity injections would trigger a substantial Bitcoin rally.

“If my analysis regarding the interplay of the Fed, Treasury, and banking system is correct, then Bitcoin hit a local low of $76,500 last month, and now we begin the ascent to $250,000 by year-end,” read an excerpt in his latest blog.

This prediction hinges on his belief that central banks, particularly the Fed, will be forced to intervene to support financial markets, ultimately driving Bitcoin higher.

Further, the BitMEX co-founder directly ties Bitcoin’s potential price movement to the Fed’s approach to monetary policy. He argues that the central bank’s response to mounting fiscal pressures will lead to an end of QT and a de facto return to QE.

“Powell proved last week that fiscal dominance is alive and well and that he will do whatever it takes to ensure the Treasury can fund itself at reasonable rates. Therefore, I am confident QT, at least regarding treasuries, will stop in the short to medium term,” Hayes added.

Based on these, Arthur Hayes sees this as a pivotal moment for Bitcoin, emphasizing that the pioneer crypto would “scream higher once this is formally announced.”

Hayes also reinforced his confidence in the prediction, stating that his Bitcoin target is attainable as the bond market, banks, and Congress (which he terms BBC) will pressure the Fed into action.

British financial expert Raoul Pal supports the thesis of a bullish outlook for Bitcoin price. The former Goldman Sachs executive pointed to macroeconomic indicators that suggest a Bitcoin rally is imminent.

Raoul Pal shared a chart correlating the global M2 money supply and Bitcoin’s price. Based on history, Bitcoin tends to rise around 10 weeks after M2 increases, with Pal’s analysis suggesting that Bitcoin may soon enter a bullish phase.

“The waiting game is almost over…the 10-week lead is my preferred… but,” Pal remarked.

QCP Capital’s Stagflation Warning

Adding another layer to the macroeconomic picture, analysts at QCP Capital warn that if stagflation takes hold, the Fed could lean toward hiking rates instead of cutting them. Such an action would complicate the bullish outlook for Bitcoin.

“Markets continue to price 2.5 cuts in 2025. The Fed finds itself in a tight corner with consumer confidence and soft data coming in weak which may portend weaker GDP in Q2. At the same time, tariff-induced inflationary pressures could start building after April 2,” the analyst wrote.

The optimism comes despite Bitcoin logging its worst first quarter (Q1) performance in seven years. This notwithstanding, analysts point to a bullish momentum, suggesting that a price recovery is on the horizon.

“Sellers have dried up, and buyers seem comfortable with current price levels – setting the stage for a structural supply shortage. April-May could turn into a consolidation zone – a calm before the next impulse,” stated market analyst Axel Adler Jr.

Veteran investors are also increasing their Bitcoin holdings, signaling a phase of accumulation that often precedes strong price rallies. Market data also indicates that declining selling pressure from Bitcoin holders is paving the way for a potential push toward $90,000.

Meanwhile, Standard Chartered has noted Bitcoin’s growing role as an inflation hedge. This further solidifies the pioneer crypto’s place as a macroeconomic asset in uncertain financial times.

Nevertheless, as macroeconomic concerns continue challenging Bitcoin’s attractiveness, Gold is progressively presenting as an alternative store of value. BeInCrypto also reported that gold is outshining Bitcoin as a haven amid Trump’s 2025 tariff chaos.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation24 hours ago

Regulation24 hours agoKraken Obtains Restricted Dealer Registration in Canada

-

Altcoin20 hours ago

Altcoin20 hours agoHere’s Why This Analyst Believes XRP Price Could Surge 44x

-

Ethereum17 hours ago

Ethereum17 hours agoWhy A Massive Drop To $1,400 Could Rock The Underperformer

-

Altcoin19 hours ago

Altcoin19 hours agoHow Will Elon Musk Leaving DOGE Impact Dogecoin Price?

-

Altcoin16 hours ago

Altcoin16 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Ethereum19 hours ago

Ethereum19 hours agoWhales Dump 760,000 Ethereum in Two Weeks — Is More Selling Ahead?

-

Altcoin17 hours ago

Altcoin17 hours agoWill Cardano Price Bounce Back to $0.70 or Crash to $0.60?

-

Altcoin9 hours ago

Altcoin9 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds