Bitcoin

Bitcoin Holders are More Profitable Than Ethereum Since 2023

New data from Glassnode suggests that Bitcoin’s MVRV (Market Value to Realized Value) has been higher than Ethereum’s for 812 consecutive days. This means that the average BTC investor has accumulated much larger profits than their ETH counterpart since 2023.

Due to recent losses, Ethereum’s MVRV actually fell below 1.0, suggesting that the average investor has lost money. It may be undervalued and well-posed for a resurgence, but this will take time.

Bitcoin vs Ethereum: Which is More Profitable?

Despite a few recent market turmoils, the price of Bitcoin is doing reasonably well right now. Although much of its gains since Trump’s election have been wiped out, its pre-election value spent most of 2024 at a shelf near its previous all-time high.

According to new data from Glassnode, Bitcoin’s investor profitability is far above Ethereum’s.

“Since November 2022 (FTX collapse), Bitcoin’s realized cap has grown by $468 billion (+117%), while Ethereum’s increased by just $61 billion (+32%). Bitcoin investors have held consistently larger unrealized profits than #Ethereum holders since January 2023. BTC investor profitability has exceeded ETH for 812 consecutive days – an all-time record,” Glassnode said.

Glassnode came to these conclusions by analyzing both tokens’ MVRV and their ratio of market value to realized value. This metric compares the listed price of Bitcoin and Ethereum to the actual price at which these tokens were most recently traded.

Despite maintaining similar MVRVs for a prolonged period, Bitcoin is plowing well ahead today:

While Bitcoin has been more volatile than Ethereum, the altcoin has seen a much smaller uptick during bullish cycles. For instance, in the latest bull run between October and December 2024, Bitcoin surged by nearly 70%.

In the same period, Ethereum’s price increase was less than 50%. Yet, if we look at the drop during the current market downturn, BTC lost 3% in the first week of April, while ETH lost over 15%.

Meanwhile, the altcoin’s investor sentiment is also dropping. Major whales who HODL’ed the token for many years are now selling their ETH holdings.

Also, the average Bitcoin holder enjoys an MVRV of around 2.0, meaning that they have huge unrealized gains. Most of their counterparts have an MVRV below 1.0, signifying that they have lost money. These data points are concerning, especially for the median ETH holder.

However, there’s a silver lining. Ethereum recently fell to a yearly low, but there’s also a strong uptick of new investors. New developments, like the SEC approving ETH ETF options trading, could spur a recovery.

In other words, Ethereum may be highly undervalued and, therefore, an attractive investment.

Still, for the time being, Bitcoin holders are in a much better position than ETH holders. Ethereum is still the second-largest cryptoasset by market cap, and it can always make a comeback. This will almost certainly pose a significant challenge.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Scottish School Lomond Pioneers Bitcoin Tuition Payment In The UK

The Lomond School in Scotland has become the first academic institution in the United Kingdom to accept tuition payments in Bitcoin (BTC) representing a major step in crypto mainstream adoption.

Bitcoin Represents Independence And Innovation, Lomond Says

In a recent blog post, Lomond School announced the inclusion of BTC as a payment option for tuition fees. The management of the British school explains that this decision was driven by multiple factors including Bitcoin’s alignment with independent thinking and innovation which are part of the school’s core ethos.

Lomond describes Bitcoin as a decentralized asset with no central authority and is easily accessible and transferable, thus reflecting important principles such as democracy and inclusion.

A statement by the school reads:

… Bitcoin is available to anyone willing to learn—making it more democratic and inclusive, particularly for people in developing nations who lack access to traditional banking. Lomond sees Bitcoin as a perfect real-world case study in economics, computing, ethics, and innovation.

The Scottish school further states that the adoption of BTC as a payment alternative is also driven by significant demand from local parents and international agents, showcasing the rising global acceptance of cryptocurrencies as viable financial assets.

However, Lomond has stated the school will only deal with Bitcoin at the moment which has distinguished itself from other cryptocurrencies in terms of “security, scarcity, transparency and resilience.”

Lomond: Bitcoin Treasury Is Feasible

To assuage customer fears about blockchain security, Lomond has stated that these BTC payments will be received by regulated and KYC-compliant partners — Musket and CoinCorner, on behalf of the school. However, despite this crypto-friendly approach, Lomond has stated that all Bitcoin received will be immediately converted to the Great Britain Pounds (GBP) to avoid dealing with the crypto market volatility.

Nevertheless, there is the possibility of establishing a BTC Treasury in the advent of significant support from the school community.

Lomond says:

The (Bitcoin) treasury is a phased goal, not an immediate change, and it depends entirely on community support and the school’s ability to responsibly “stack sats” over time.

While Lomond may be the first British school to dabble into Bitcoin payments, academic institutions in other countries have long explored the use of the premier cryptocurrency. Some of these schools include Wharton College in the University of Pennsylvania, King’s College in New York, and major universities in El Salvador among others. Meanwhile, other academic institutions such as the University of Wyoming have developed ample resources to conduct peer-reviewed research on the “digital gold.”

At the time of writing, BTC continues to trade at $83,230 after a 3.65% price gain in the last 24 hours.

Featured image from Pexels, chart from tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin Set For Challenge With Two Major Resistance Zones

The Bitcoin (BTC) market proved rather turbulent in the past week after a price decline below $75,000 was followed by a rebound to above $83,000. With the premier cryptocurrency showing indications of a sustained uptrend, blockchain analytics firm CryptoQuant has identified two potential key resistance zones lying in wait.

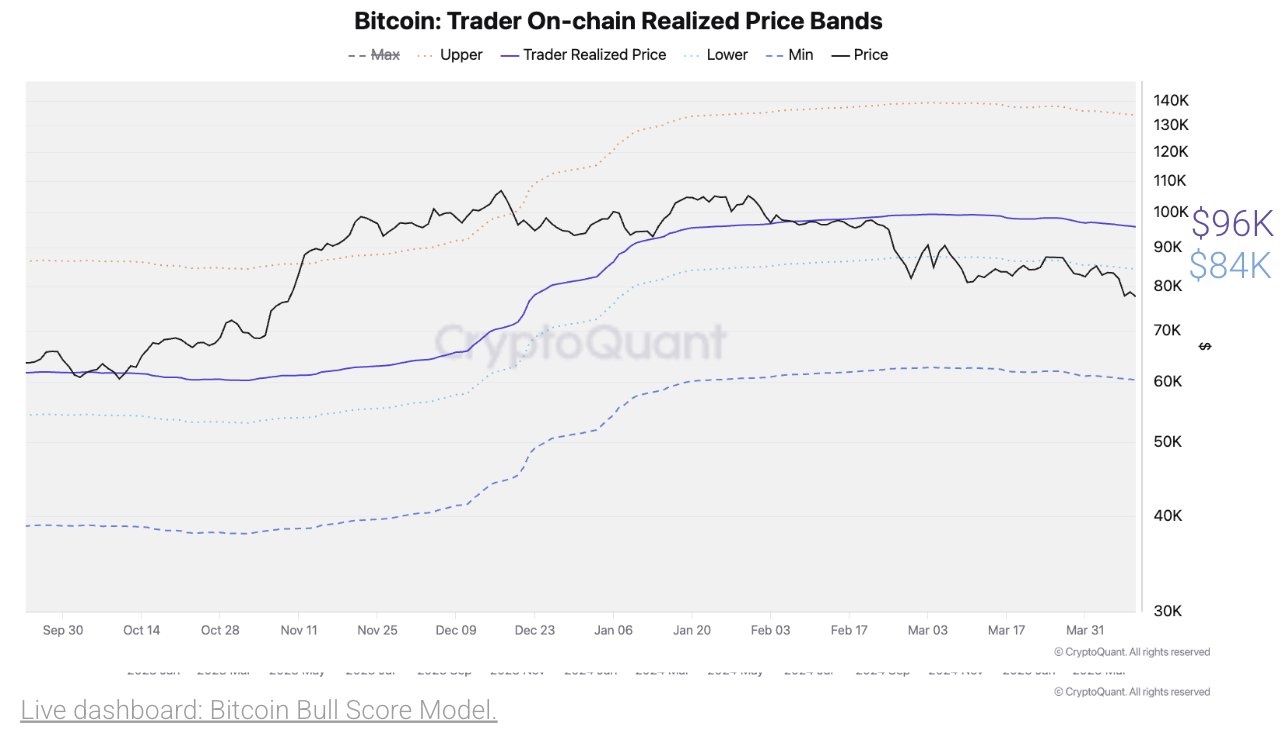

Bitcoin Realized Price Reveals Potential Strong Barriers At $84,000 And $96,000

In an X post on April 11, CryptoQuant shared an on-chain report on the BTC market indicating a potential encounter with two major resistances at $84,000 and $96,000 if Bitcoin maintains its current upward trajectory. These price barriers are revealed by the Realized Price metric which reflects the average price at which the current supply of BTC last moved on-chain thereby determining the market-wide cost basis.

When Bitcoin trades above this level, it indicates a healthy bullish momentum with the majority of holders in profit. Conversely, when BTC is below the threshold, it suggests underwater sentiment as most investors are holding a loss. Therefore, the Realized price often functions as a crucial market pivot acting as strong support during bull markets and stiff resistance in bear phases. According to Julio Moreno, Head of Research at CryptoQuant, BTC’s current on-chain realized price is $96,000 with an immediate lower price band of $84,000.

Interestingly, these two price levels have served as key support zones in the earlier bullish phase of the current market cycle. However, there is potential for both zones to act as resistance amidst the ongoing market correction. However, if Bitcoin is able to move past $84,000 and $96,000, it could signify the resumption of the bull market with the potential for the premier cryptocurrency to trade as high as $130,000. This projected gain would represent a 55% increase in current market prices.

BTC Price Overview

At press time, Bitcoin continues to trade at $83,180 reflecting a 3.65% gain in the past day. Meanwhile, daily trading volume is down by 11.99% and valued at $39.19 billion.

Amidst continuous macroeconomic developments driven by the US Government tariff changes, the crypto market continues to exhibit a strong level of uncertainty and assets fail to establish a clear momentum. However, blockchain analytics Glassnode reports that Bitcoin investors have formed a strong support zone at $79,000 and $82,080 at which over 40,000 BTC and 51,000 BTC have been accumulated respectively.

In the advent of any downtrend, both price levels are to offer short-term support and prevent a further price fall. With a market cap of $1.66 trillion, Bitcoin remains the largest digital asset accounting for over 60% of the crypto market cap.

Featured image from CNN, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin Price Volatility Far Lower Than During COVID-19 Crash — What This Means

Over the past few weeks, the cryptocurrency market has been overwhelmed by a high degree of uncertainty and volatility triggered by the constantly shifting global macroeconomics. This unsettled market condition saw the Bitcoin price dance between $74,000 and $83,000 in the space of a few days.

The price of BTC sank toward $74,000 at the start of the past week as crypto investors panicked after United States President Donald Trump announced new trade tariffs. On Thursday, April 10, the premier cryptocurrency reclaimed the $83,000 level after President Trump paused trade tariffs on all countries except China.

Is Bitcoin Now A ‘Mature Asset’?

The Bitcoin price has been quite reactive to virtually every piece of news in the global trade, demonstrating the highly volatile state of the cryptocurrency market. However, an on-chain analytics expert has explained that the volatility of the current Bitcoin market pales in comparison to past episodes.

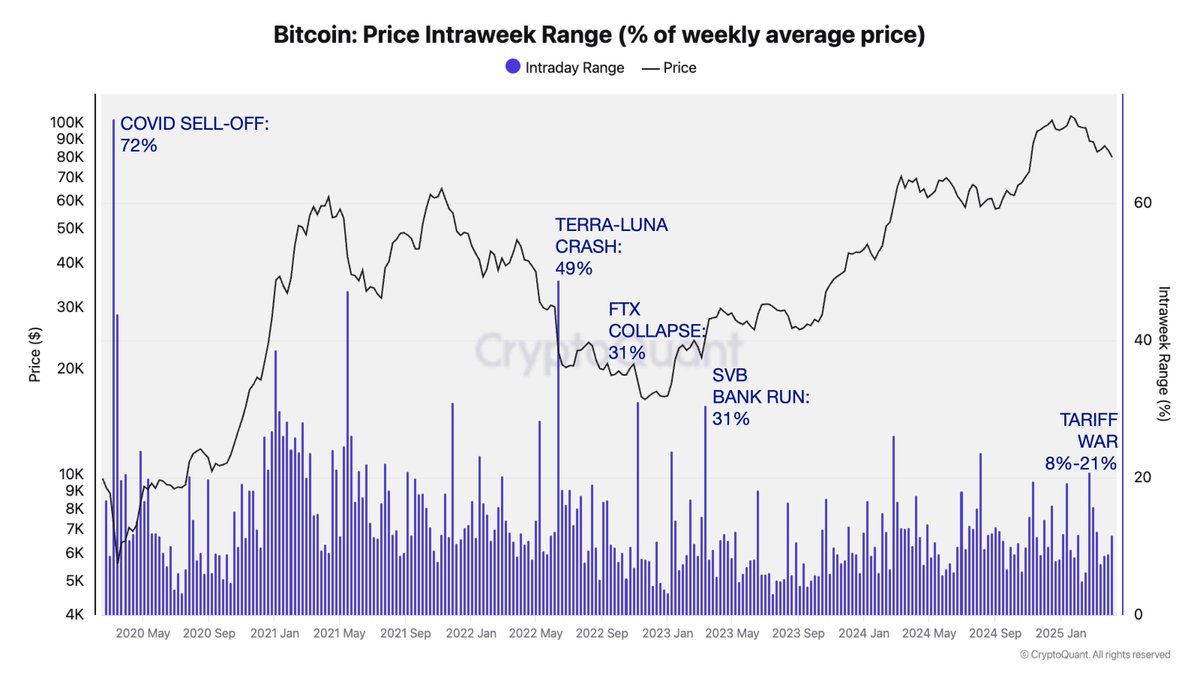

In a new post on the social media platform X, CryptoQuant’s head of research, Julio Moreno, revealed that the Bitcoin price volatility in the ongoing global trade drama has been “so far lower” than that from other past events, such as the COVID-19 crash, Terra-Luna collapse, FTX downfall, and the Silicon Valley Bank (SVB) bank run.

The relevant indicator here is the Price Intraweek Range metric, which estimates the percentage change in the average weekly price of Bitcoin. According to data from CryptoQuant, the Bitcoin Price Intraweek Range climbed to an all-time high of 72% during the COVID-19 market downturn in April 2020.

Source: @jjcmoreno on X

The chart above shows that the BTC Intraweek Range metric surged to 49% after the crash of the Terra Luna ecosystem in May 2022. Meanwhile, the indicator reached 31% following the collapse of the Sam-Bankman-Fried-led FTX exchange in late 2022 and the SVB bank run in early 2023.

With the escalating trade tensions between the United States and China, the Bitcoin Price Intraweek Range metric stands between 8% – 21%. This reduced volatility suggests that the premier cryptocurrency has matured as an asset, with deeper liquidity and a better market structure.

The relatively stable price action can be connected to the growing base of long-term holders and steady corporate adoption, as institutional players are beginning to view the world’s largest cryptocurrency less as a high-risk asset and more as a hedge against macroeconomic uncertainties.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $83,700, reflecting a 5% increase in the past 24 hours.

The price of BTC returns to above $83,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin22 hours ago

Altcoin22 hours agoSolana Meme Coin Fartcoin Price Could Hit $1.29 If It Holds This Key Level

-

Market21 hours ago

Market21 hours agoCrypto Whales Position for Gains with DOGE, WLD and ONDO

-

Altcoin23 hours ago

Altcoin23 hours agoBinance Issues Important Update On 10 Crypto, Here’s All

-

Market20 hours ago

Market20 hours agoSEC Signals Readiness to Rethink Crypto Trading Oversight

-

Market19 hours ago

Market19 hours agoEthereum ETFs See Seventh Consecutive Week of Net Outflows

-

Bitcoin19 hours ago

Bitcoin19 hours agoBitcoin’s Impact Alarming, Says NY Atty. General—Congress Needs To Act

-

Market22 hours ago

Market22 hours agoBinance Reportedly Seeks Reentry Into American Market

-

Market22 hours ago

Market22 hours agoBinance Reportedly Seeks Reentry Into American Market