Bitcoin

Bitcoin ETFs Spark Frenzy, But Can It Ignite 8 Year Bull Market?

Since the US Securities and Exchange Commission (SEC) approved spot Bitcoin exchange-traded funds (ETFs) on January 11, 2024, the crypto market has experienced a significant recovery. This culminated on March 14, 2024, when Bitcoin (BTC) reached a new all-time high (ATH) of $73,737.

This uptrend isn’t confined to the US alone. Hong Kong just launched its spot Bitcoin and Ethereum ETFs, while Australia is preparing to launch its own versions of spot Bitcoin ETFs.

The global enthusiasm mirrors the community’s optimistic view of Bitcoin as not just a currency but a potential digital counterpart to gold.

Can Bitcoin ETFs Help Sustain 8-Year Bull Rally?

The narrative of Bitcoin as a store of value and an inflation hedge brings it close to gold’s market stance, with comparisons now extending to their respective ETFs. Historical precedents offer a compelling storyline.

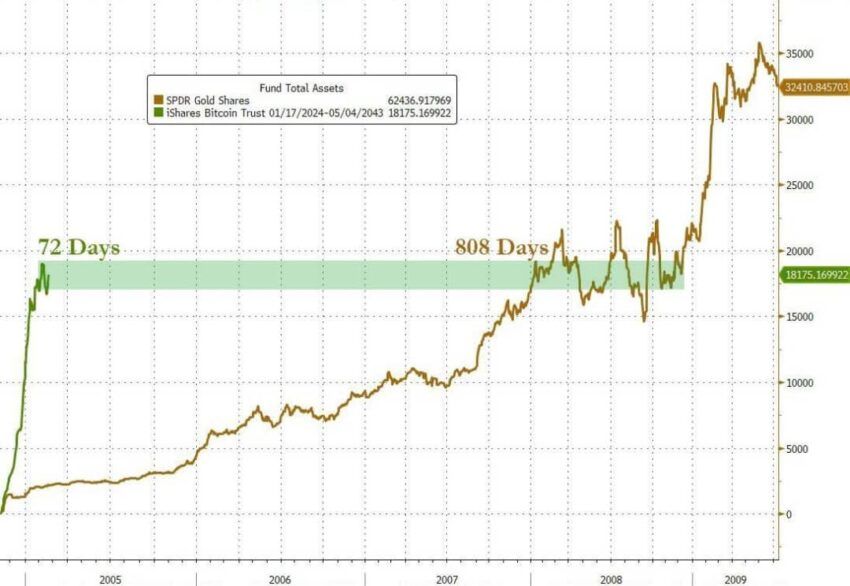

The gold ETF launch in 2004 triggered a nearly 8-year bull market. The first gold ETF, SDPR Gold Shares, was listed on the New York Stock Exchange (NYSE) on November 1, 2004, when gold was priced at $450.80 per ounce. It then consistently grew, reaching $1,825 on August 1, 2011. In 2024, gold has successfully achieved a price of $2,392 on April 19.

However, according to a post by crypto YouTuber Altcoin Daily on X (formerly Twitter), the BlackRock Bitcoin ETF achieved in 70 days what took the gold ETF over 800 days in assets under management (AUM). He highlighted the unprecedented demand for Bitcoin compared to gold’s initial days in the ETF sphere.

“This is just the beginning…” Altcoin Daily noted.

Read more: Crypto ETN vs. Crypto ETF: What Is the Difference?

Supporting this perspective, Bitcoin analyst Willy Woo pointed out the current fiscal dynamics.

“Now that the monetary inflation rate of Bitcoin has dropped below Gold, it will be interesting to see if its market cap will exceed gold according to the stock to flow [S2F] thesis,” Woo commented.

He anticipates that Bitcoin will align with its S2F valuation but with a lag of 5-10 years. Woo cites the slower pace of global financial systems in adopting such innovations.

Bitcoin’s technological architecture might give it another edge over gold. Events like the quadrennial halving are designed to reduce the number of new Bitcoins entering the market, theoretically increasing its value over time.

Indeed, historically speaking, post-halving periods have led to substantial price increases. The 2012 halving preceded a jump from $12 to over $1,000 by late 2013. Similarly, the 2016 halving saw prices soar from around $650 to nearly $20,000 by December 2017. Finally, the 2020 halving pushed prices from around $8,000 to $69,000 by November 2021.

These patterns suggest a bullish outlook, albeit with the caveat that price surges are typically long-term rather than immediate. Renowned analyst PlanB reaffirmed this. They predicted significant future growth despite short-term fluctuations.

PlanB noted a bullish outlook that aligns with historical data and market analysis despite current market variances.

“BTC > $100,000 in 2024. BTC top > $300,000 in 2025,” PlanB stated.

Price Retreats Despite ETF Success

Yet, regardless of speculative optimism and historical trends, today’s market movement paints a different picture. At the time of writing, Bitcoin trades at $62,035, a slight decrease of 0.47% over the last 24 hours.

Similarly, spot gold is also experiencing modest movement, trading at $2,311. This number represents a decrease of approximately 1.02% from yesterday’s price.

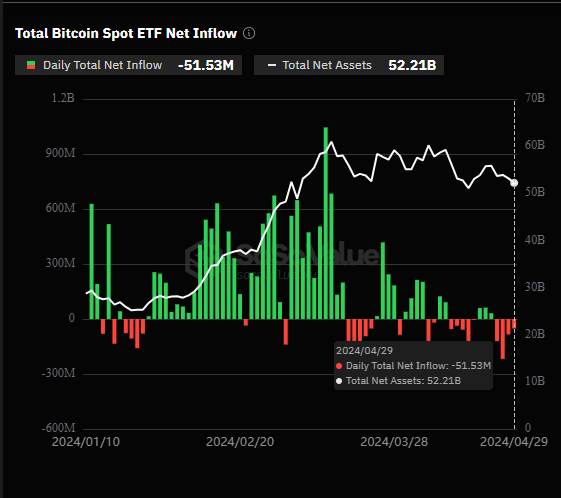

Furthermore, data from SoSo Value indicates that US spot Bitcoin ETFs have recorded daily outflows of $51.53 million as of April 29, 2024. This marks the fourth consecutive day of negative flows. Even BlackRock’s iShares Bitcoin Trust (IBIT), previously a top performer, recorded no new inflows during the period.

Read more: Bitcoin Price Prediction 2024/2025/2030

These indicators suggest a cautious approach. While the enthusiasm around Bitcoin ETFs is palpable, and comparisons to gold’s ETF-driven rally are tempting, the reality on the trading floors tells a story of volatility and speculative uncertainty.

With its complex interplay of technology, economics, and global regulations, Bitcoin presents a unique investment perspective that may or may not parallel the historical ascent of gold. Investors and spectators alike would do well to observe these developments closely, considering both the potential and the pitfalls of this digital asset class.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

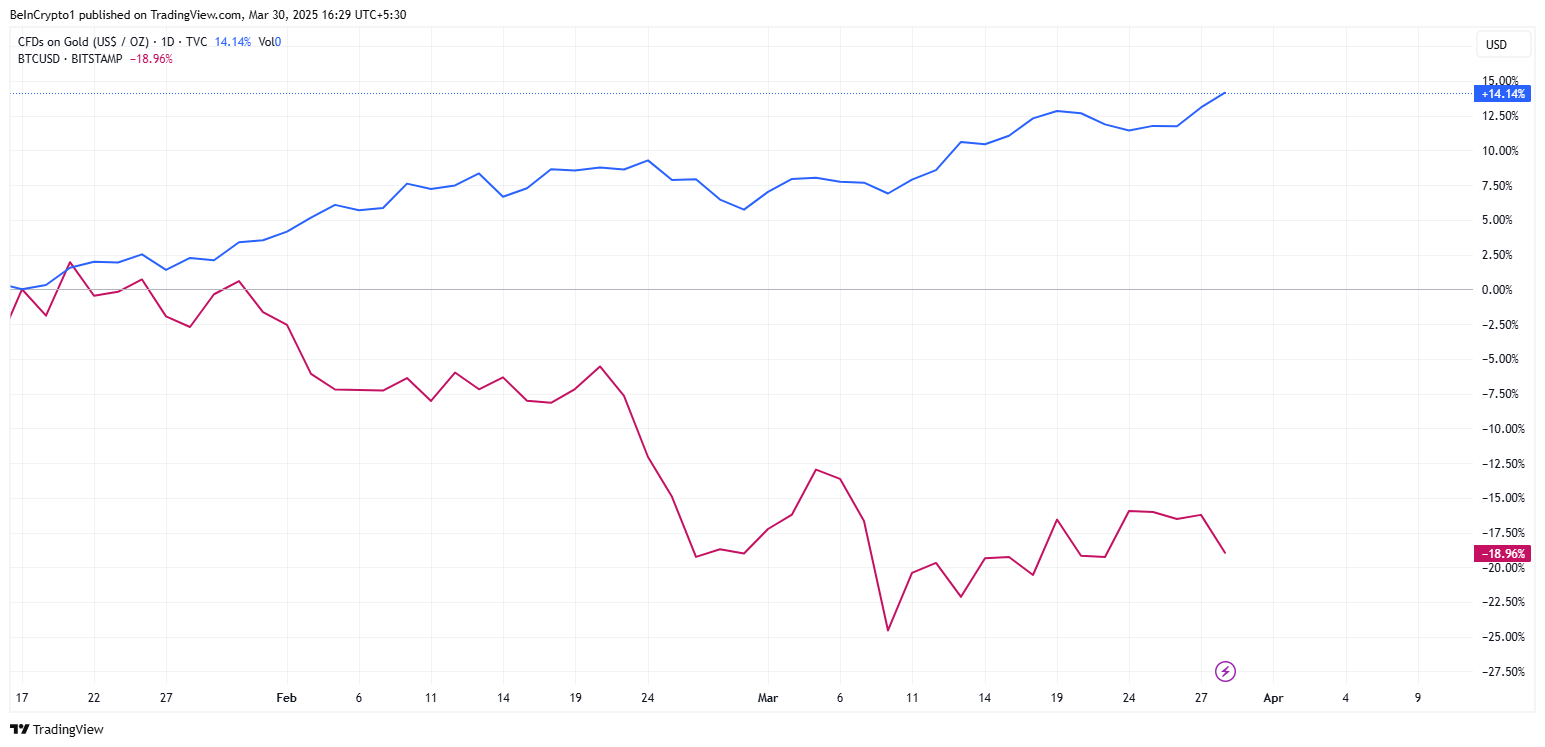

Gold Keeps Outperforming Bitcoin Amid Trump’s Trade War Chaos

Bitcoin (BTC) has long been touted as “digital gold.” However, as the global economy reels from escalating trade war tensions under Trump’s second term, institutional investors are fleeing to the real thing.

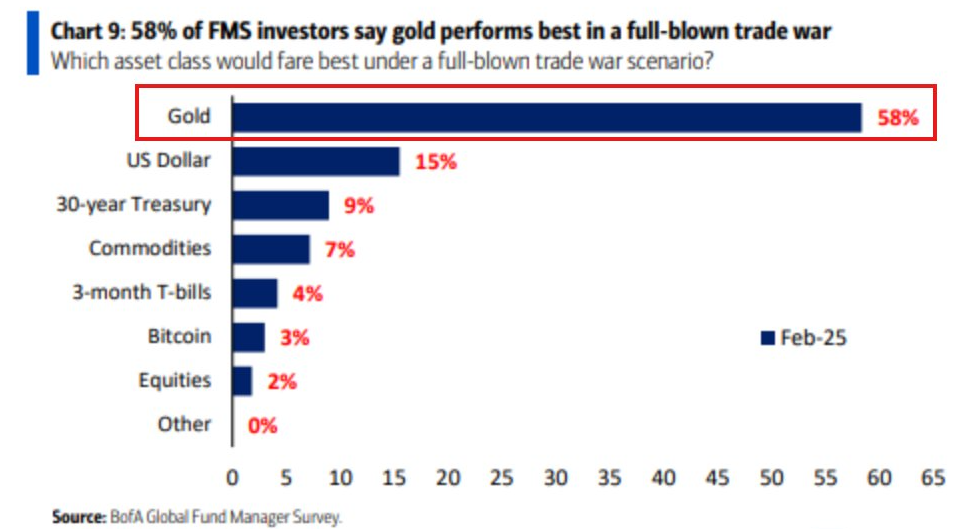

A recent Bank of America (BofA) survey found that 58% of fund managers view gold as the best-performing haven in a trade war—leaving Bitcoin with only a 3% preference.

Bitcoin’s Haven Status Faces a Reality Check

Gold is proving its dominance as the crisis asset of choice while Bitcoin struggles to hold its ground. This comes amid rising geopolitical risks, the ballooning US deficit, and uncertainty driving capital flight.

“In a recent Bank of America survey, 58% of fund managers said gold performs best in a trade war. This compares to just 9% for 30-year Treasury Bonds and 3% for Bitcoin,” The Kobeissi Letter noted.

For years, Bitcoin advocates have championed it as a hedge against economic instability. Yet, in 2025’s volatile macro environment, Bitcoin struggles to earn institutional investors’ full trust.

The Bank of America survey reflects this status, with long-term US Treasury bonds and even the US dollar losing appeal as trade wars and fiscal dysfunction shake market confidence.

The US deficit crisis—now projected to exceed $1.8 trillion—has further eroded confidence in traditional safe havens like US Treasuries.

“This is what happens when the global reserve currency no longer behaves as the global reserve currency,” a trader quipped in a post.

However, instead of looking to Bitcoin as an alternative, institutions are overwhelmingly choosing gold, doubling physical gold purchases to record levels.

Barriers To Bitcoin Institutional Adoption

Despite its fixed supply and decentralization, Bitcoin’s short-term volatility remains a key barrier to institutional adoption as a true safe-haven asset.

While some traders still view Bitcoin as a long-term store of value, it lacks the immediate liquidity and risk-averse appeal that gold provides during crises.

Further, President Trump is expected to announce sweeping new tariffs on “Liberation Day.” Experts flag the event as a potential trigger for extreme market volatility.

“April 2nd is similar to election night. It is the biggest event of the year by an order of magnitude. 10x more important than any FOMC, which is a lot. And anything can happen, “Alex Krüger predicted.

Trade tensions have historically driven capital into safe-haven assets. With this announcement looming, investors preemptively position themselves again, favoring gold over Bitcoin.

“Gold’s no longer just a hedge against inflation; it’s being treated as the hedge against everything: geopolitical risk, de-globalization, fiscal dysfunction, and now, weaponized trade. When 58% of fund managers say gold is the top performer in a trade war, that’s not just sentiment that’s allocation flow. When even long bonds and the dollar take a back seat, it’s a signal: the old playbook is being rewritten. In a world of rising tariffs, FX tension, and twin deficits, gold might be the only politically neutral store of value left,” trader Billy AU observed.

Despite Bitcoin’s struggle to capture institutional safe-haven flows in 2025, its long-term narrative remains intact.

Specifically, the global reserve currency system is changing, US debt concerns are mounting, and monetary policies continue to shift. Despite all these, Bitcoin’s value proposition as a censorship-resistant, borderless asset is still relevant.

However, in the short term, its volatility and lack of widespread institutional adoption as a crisis hedge mean gold is taking the lead.

For Bitcoin believers, the key question is not whether Bitcoin will one day challenge gold but how long institutions will adopt it as a flight-to-safety asset.

Until then, gold remains the undisputed king in times of economic turmoil. Meanwhile, Bitcoin (BTC exchange-traded funds notwithstanding) fights to prove its place in the next financial paradigm shift.

“The ETF demand was real, but some of it was purely for arbitrage…There was a genuine demand for owning BTC, just not as much as we were led to believe,” analyst Kyle Chassé said recently.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Why Bitcoin Seasoned Investors Are Accumulating — Analyst Evaluates BTC’s Current Phase

The cryptocurrency market has not had a clear direction in 2025, reflecting the uncertain condition of the digital asset industry. Bitcoin, the world’s largest cryptocurrency by market capitalization, is currently 24% away from its record-high price of $108,786 reached in January 2025.

With the premier cryptocurrency steadily drifting away from its all-time high, there have been questions about what phase of the cycle the market is currently in. Interestingly, recent on-chain data offers some insight into the current state of the Bitcoin market and the reaction of the participants.

Are Seasoned BTC Investors Anticipating A Price Surge?

In a Quicktake post on the CryptoQuant platform, analyst Axel Adler Jr. shared an analysis of the current Bitcoin cycle, offering insight into the behavior of an important group of investors. According to the online pundit, seasoned BTC players are back to accumulating the flagship cryptocurrency.

Adler Jr. revealed that the experienced BTC investors have been involved in four phases of accumulation (January 2023, October 2023, October 2024, March 2025) in the current cycle. On the flip side, the selling activity of these market participants has reached four distinct peaks, including January 2024, April 2024, July 2024, and January 2025.

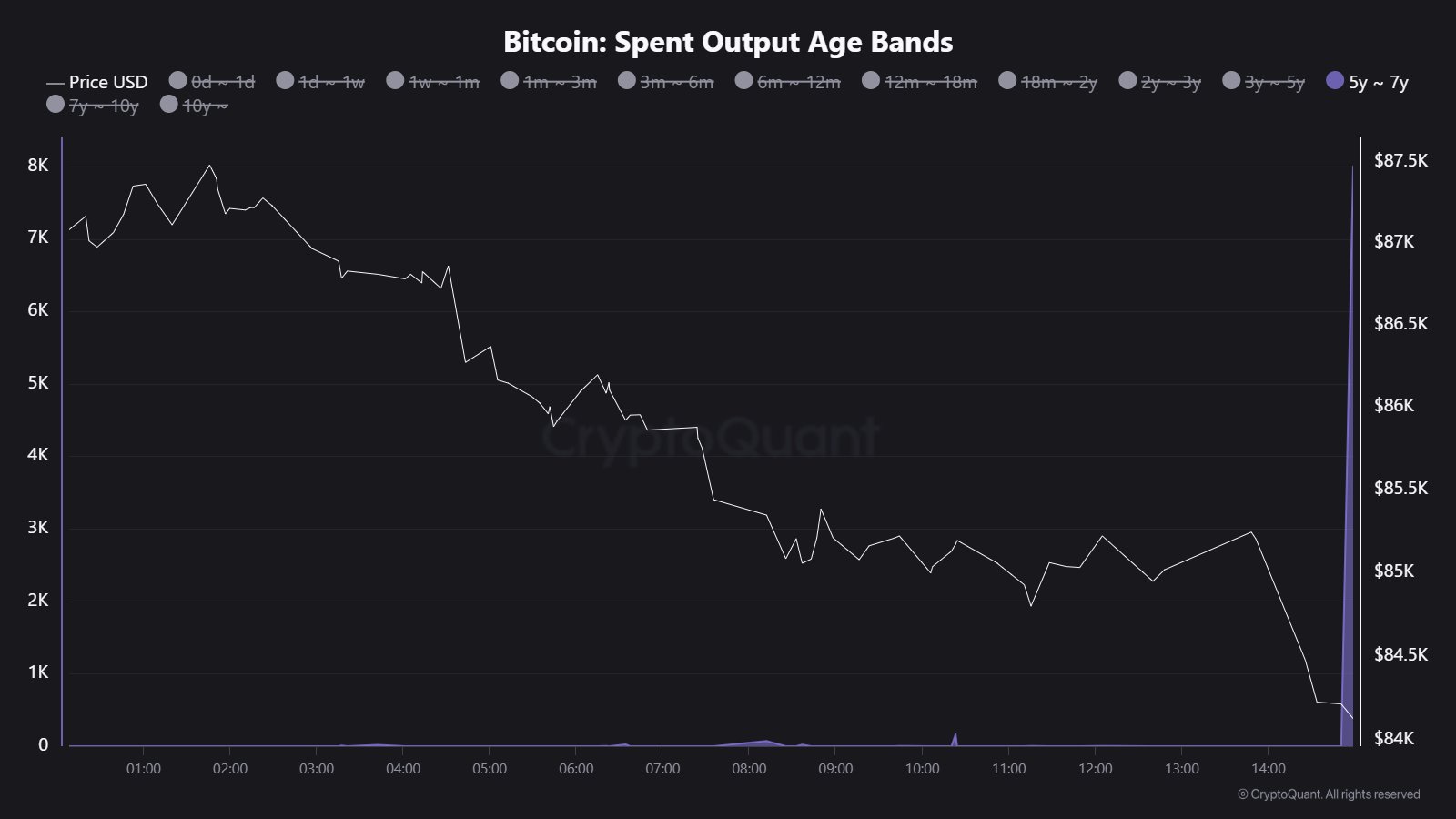

The relevant on-chain indicator here is the Value Days Destroyed (VDD) metric, which tracks the spending behaviour of long-term investors. The chart below shows that the VDD metric has been steadily declining since the start of 2025.

Source: CryptoQuant

Using the chart as a basis, Adler Jr. mentioned that three major features define the current phase of the Bitcoin cycle. Firstly, the seasoned investors, who were actively distributing their BTC at local peaks, have now shifted their strategy toward holding and accumulating their coins.

Additionally, the Value Days Destroyed metric suggests an absence of significant selling pressure, which means that the experienced traders are skeptical about profit at the current Bitcoin price. Moreover, periods of low VDD values have historically preceded significant upward price movements, as investors accumulate in anticipation of a price surge.

Ultimately, this positive shift in the behavior of seasoned Bitcoin holders suggests that there might be room for further price growth for Bitcoin in the medium term.

Bitcoin Price At A Glance

As of this writing, the price of BTC sits at around $83,200, with an over 2% decline in the past 24 hours. According to data from CoinGecko, the flagship cryptocurrency is also down by about 2% on the weekly timeframe.

BTC price reclaims $83,000 level on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image created by DALL-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

8,000 Dormant Bitcoin Suddenly Move: What’s Next For The Market?

Popular CryptoQuant analyst Maartunn reports that 8,000 Bitcoin (BTC) which have been dormant for five to seven years have been moved suddenly, adding to current bearish concerns in the crypto. This development comes after a rather adventurous week as BTC prices struggled to break above $89,000, following an initial steady bullish climb, before succumbing to heavy selling pressures driven by US President Donald Trump’s hawkish tariff policy.

$674 Million In Old BTC Transfers In Single Block – Cause For Alarm?

The Spent Output Age Bands is a crucial metric to measure how long Bitcoin tokens remain inactive before moving. According to Maartuun in an X post, this metric has recently revealed that 8,000 BTC worth $674 million that was last transferred between 2018 and 2020 have been moved recently in a single block drawing significant market attention.

This transfer follows a string of recent activations of dormant Bitcoin stashes. On March 24, a 14-year inactive Bitcoin wallet suddenly moved 100 Bitcoin valued at $8.5 million. Meanwhile, in early March, six ancient Bitcoin wallets also transferred nearly 250 BTC worth $22 million.

Notably, the most recent transaction reported by Maartuun is of far larger size with potentially strong implications for an uncertain Bitcoin market. Generally, a movement of such a large amount of BTC from long-term dormancy is usually interpreted as a signal for incoming selling pressure leading to major price corrections.

However, there are other potential non-bearish motives behind such transactions such as internal wallet shuffling by institutional investors or large holders as well as a cold storage reorganization. Currently, the owners of the new wallets receiving the 8000 is unknown thus reducing the potential of a bearish reaction from BTC holders.

Bitcoin Price Overview

In the last day, Bitcoin prices declined by 4.00% after the US Government announced intentions to impose a 25% tariff on auto imports and goods from China, Mexico, and Canada starting from April 3. This marks the latest negative reaction of the crypto market to President Trump’s international trade policies following similar incidents in early February and mid-March.

These measures by the Donald Trump administration are flaming fears of a potential economic slowdown which could further push high-risk assets such as BTC out of investors’ portfolios leading to a further downside.

At press time, Bitcoin currently trades at $83,693 reflecting a decline of 0.72% and 2.53% in the last seven and 30 days respectively. Meanwhile, the asset’s daily trading volume is up by 19.38% and is valued at $31.58 billion. The BTC market cap now stands at $1.66 trillion and still represents a dominant 61.1% of the total crypto market.

BTC trading at $83,727 on the daily chart | Source: BTCUSDT chart on Tradingview.com

-

Market22 hours ago

Market22 hours agoONDO Whales Retreat as Price Risks Dropping Below $0.70

-

Altcoin22 hours ago

Altcoin22 hours agoPepe Coin Whale Sells 150 Billion Tokens, Price Fall Ahead?

-

Market21 hours ago

Market21 hours agoXRP Falls 12% in a Week as Network Activity Declines

-

Altcoin21 hours ago

Altcoin21 hours agoIs Burger King Teasing Crypto Launch? Decoding Their X Post

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Bulls Disappointed As Recovery Attempt Fails At $2,160 Resistance

-

Altcoin24 hours ago

Altcoin24 hours agoExpert Predicts Listing Date For WLFI’s USD1 Stablecoin, Here’s When

-

Market23 hours ago

Market23 hours agoGRASS Jumps 30% in a Week, More Gains Ahead?

-

Bitcoin22 hours ago

Bitcoin22 hours ago8,000 Dormant Bitcoin Suddenly Move: What’s Next For The Market?