Bitcoin

Bitcoin ETFs Rebound With a $744 Million Weekly Inflow

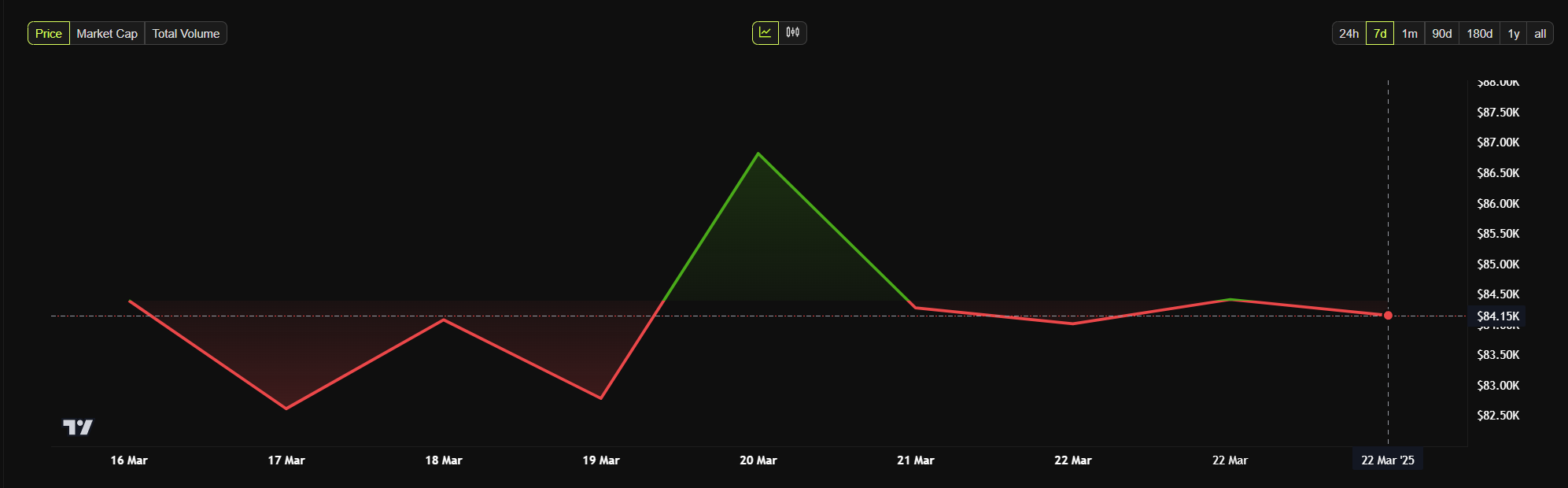

After five weeks of consecutive outflows, US spot Bitcoin ETFs have rebounded with $744 million in net inflows this week. On Monday, March 17, ETFs saw a $274 million inflow, which was the highest daily figure in over a month.

This rebound suggests that institutional investors are coming back to the Bitcoin market as macroeconomic factors have priced in. However, BTC still remains below the $90,000 threshold.

Bitcoin ETFs Start Recovering from a $5 Billion Loss

US Bitcoin ETFs lost over $5.3 billion since the second week of February. The month was particularly brutal for ETFs, with a record-breaking $3.5 billion in outflows.

The sharp sell-off was attributed to institutional investors liquidating their holdings amid market volatility and shifting macroeconomic conditions. However, March has signaled a turnaround, with inflows steadily increasing over the past week.

With macroeconomic concerns easing, institutional investors appear to be regaining confidence in the market. The week began on a strong note, with Bitcoin ETFs recording $274 million in inflows on Monday.

The positive momentum persisted, culminating in six straight days of net inflows. On March 21 alone, the ETFs saw a total net inflow of $83.09 million.

BlackRock’s IBIT led the way, recording up to $150 million in positive flows on Friday. Meanwhile, all other issuers remained stagnant. The only outlier was Grayscale’s GBTC, which continued its trend of outflows, losing $21.9 million that day.

This shift suggests that institutional players may be positioning themselves for a potential market recovery. Crypto influencer and Open4Profit founder Zia ul Haque pointed to this resurgence, questioning whether institutional investors are acting on inside knowledge.

“Institutes started Accumulating Again: Do they know something?! Bitcoin ETF saw a positive inflow for the last consecutive 5 days! This is the major consecutive inflow this month. From the beginning of March, giants sold BTC heavily which created a massive panic and price dump in the market. But in the last few days, they are accumulating again. This could be a good sign for the market,” ul Haque wrote.

His observation aligns with the steady recovery in ETF inflows and Bitcoin’s price action, which continues to defend against further downside.

However, despite the positive ETF flows, not everyone shares the bullish outlook and optimism for Bitcoin’s price recovery. Some analysts think that Bitcoin ETF inflows do not clearly reflect resuming buyer interest.

Institutional trading strategies are potentially experiencing structural shifts. Hedge funds often leverage a low-risk arbitrage strategy involving Bitcoin spot ETFs and CME futures.

“The ETF ‘demand’ was real, but some of it was purely for arbitrage. There was a genuine demand for owning BTC, just not as much as we were led to believe. Until real buyers step in, this chop & volatility will continue,” popular analyst Kyle Chasse explained.

If this structural shift continues, it could influence market stability despite the recent return of ETF inflows.

As of this writing, Bitcoin is trading at around $84,148. It is down by a modest 0.46% in the last 24 hours, failing to reflect optimism amid the recent uptick in Bitcoin ETF investments.

Meanwhile, Ethereum ETFs continue to post negative flows, with net inflows in 12 consecutive trading days (over two weeks).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bolivia Reverses Crypto-for-Fuel Plan Amid Energy Crisis

Bolivia’s Ministry of Trade and Imports has rejected a state-backed plan to use cryptocurrency for fuel imports.

This move, which marks a stunning policy reversal, signals a retreat from the government’s recent push to adopt digital assets as a workaround for dollar shortages.

Bolivia Rejects Crypto-for-Fuel Scheme Amid Energy Sector Turmoil

The initial plan, announced in March by Bolivia’s state-owned energy giant YPFB, aimed to use crypto to secure fuel imports. This was in response to acute shortages of both US dollars and refined fuel.

As reported by Reuters on March 13, the proposal had received government backing at the time.

But in a statement released Tuesday, Director of Trade and Imports Marcos Duran clarified that YPFB will not be permitted to use crypto for international transactions.

“YPFB must use Bolivia’s own resources and dollar-based financial transfers,” Duran said.

Head of digital assets at VanEck, Mathew Sigel, labels this a clear U-turn on crypto policy.

“U-Turn: Bolivia appears to back away from its crypto-for-fuel scheme,” Sigel quipped.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Poised for Summer Rally as Gold Leads and Liquidity Peaks

The crypto market and broader economy are moving fast as global liquidity reached an all-time high in April 2025. Gold has already broken past $3,200, setting a new record. Meanwhile, Bitcoin is still 30% below its previous peak.

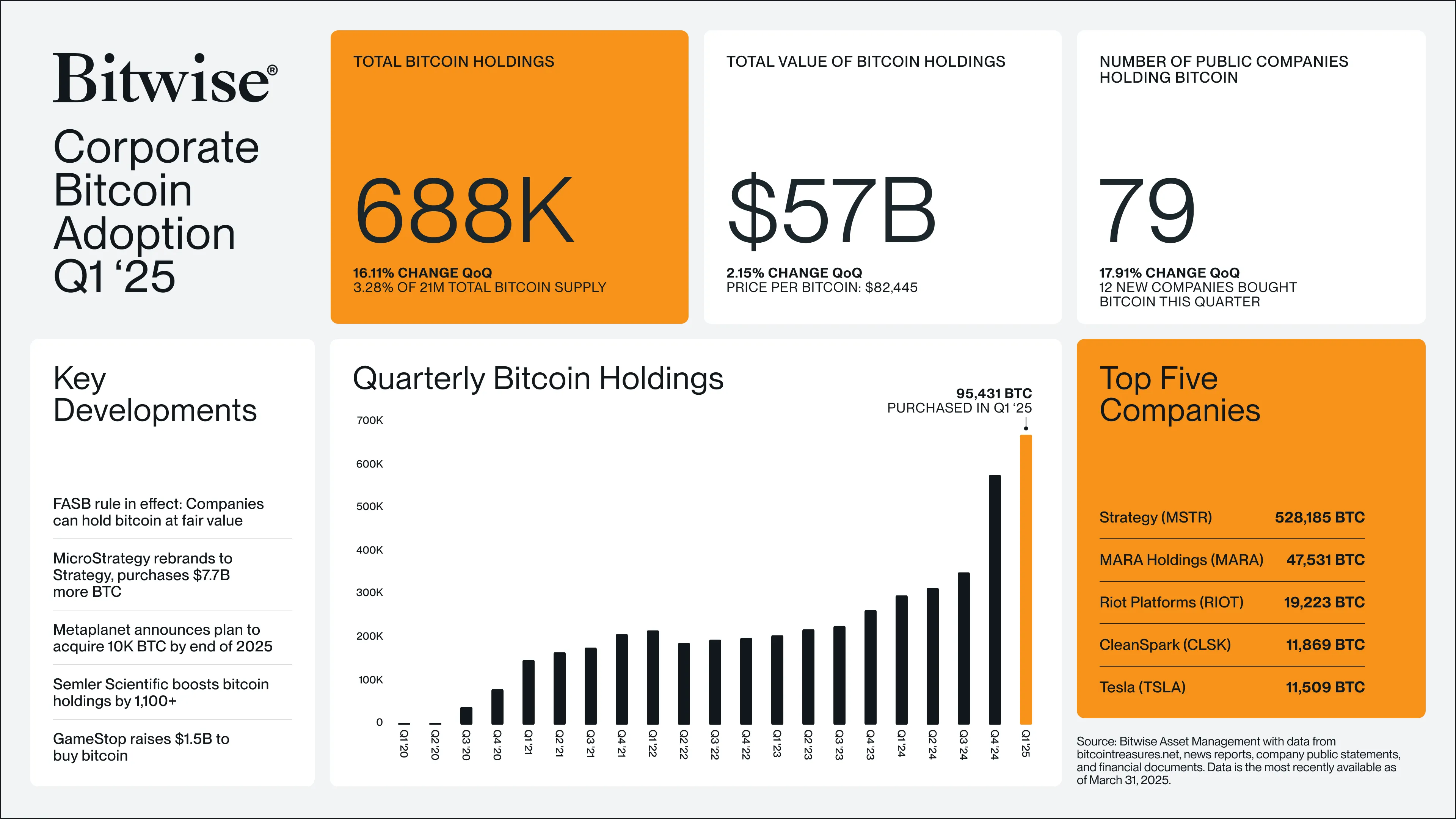

Amid this backdrop, analysts are taking a closer look at the link between Bitcoin and gold. Fresh data also shows strong corporate demand for Bitcoin, with record levels of buying in Q1 2025.

What Bitcoin’s Ties to Gold and Liquidity Signal for Its Price

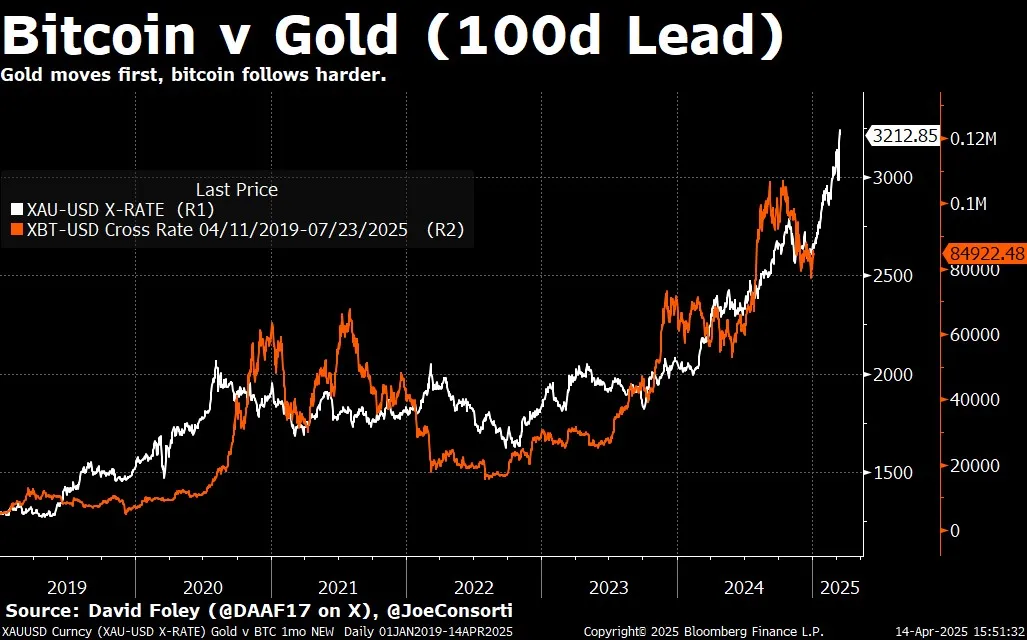

According to Joe Consorti, Head of Growth at Theya, Bitcoin tends to follow gold’s lead with a lag of about 100 to 150 days. A chart shared by Consorti on X, based on Bloomberg data, illustrates this trend from 2019 to April 14, 2025.

The chart shows gold (XAU/USD) in white and Bitcoin (XBT/USD) in orange. The data reveals that gold usually moves first during upswings, but Bitcoin often rallies harder afterward—especially when global liquidity is rising.

“When the printer roars to life, gold sniffs it out first, then Bitcoin follows harder,” Consorti said.

That 100-to-150-day lag is notable. It suggests Bitcoin could be set for a sharp move higher within the next 3 to 4 months. The recent surge in global liquidity also supports this view.

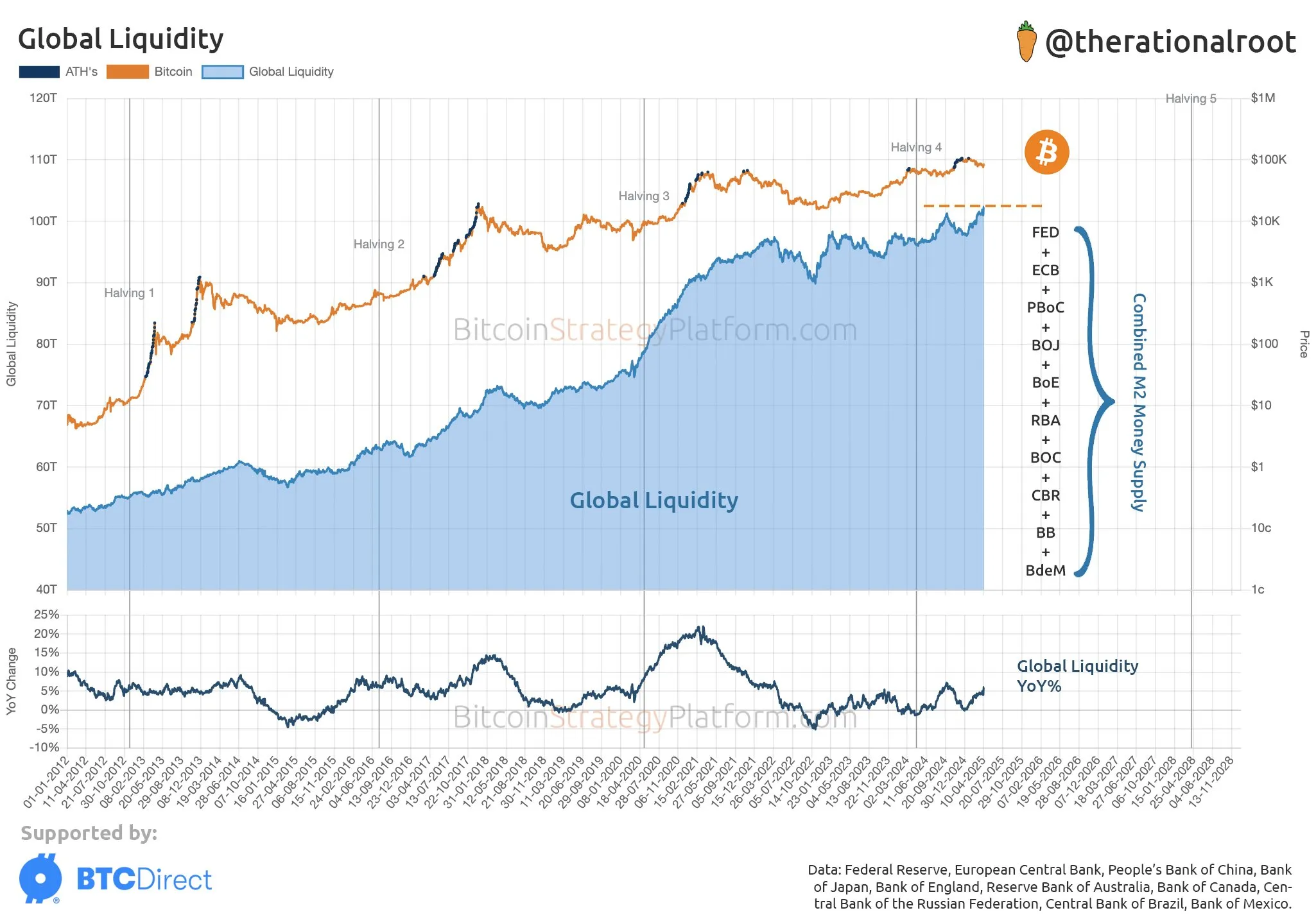

According to analyst Root, M2 money supply from major central banks—including the US Federal Reserve, European Central Bank (ECB), People’s Bank of China (PBoC), Bank of Japan (BoJ), Bank of England (BoE), Reserve Bank of Australia (RBA), Bank of Canada (BoC), and others—has hit a record high as of April 2025.

The sharp rise points to more cash flowing through the global economy.

Historically, Bitcoin bull markets have often lined up with major increases in global liquidity, as more money in the system tends to push investors toward riskier assets like Bitcoin.

Why Bitcoin Might Outperform Gold and Stocks

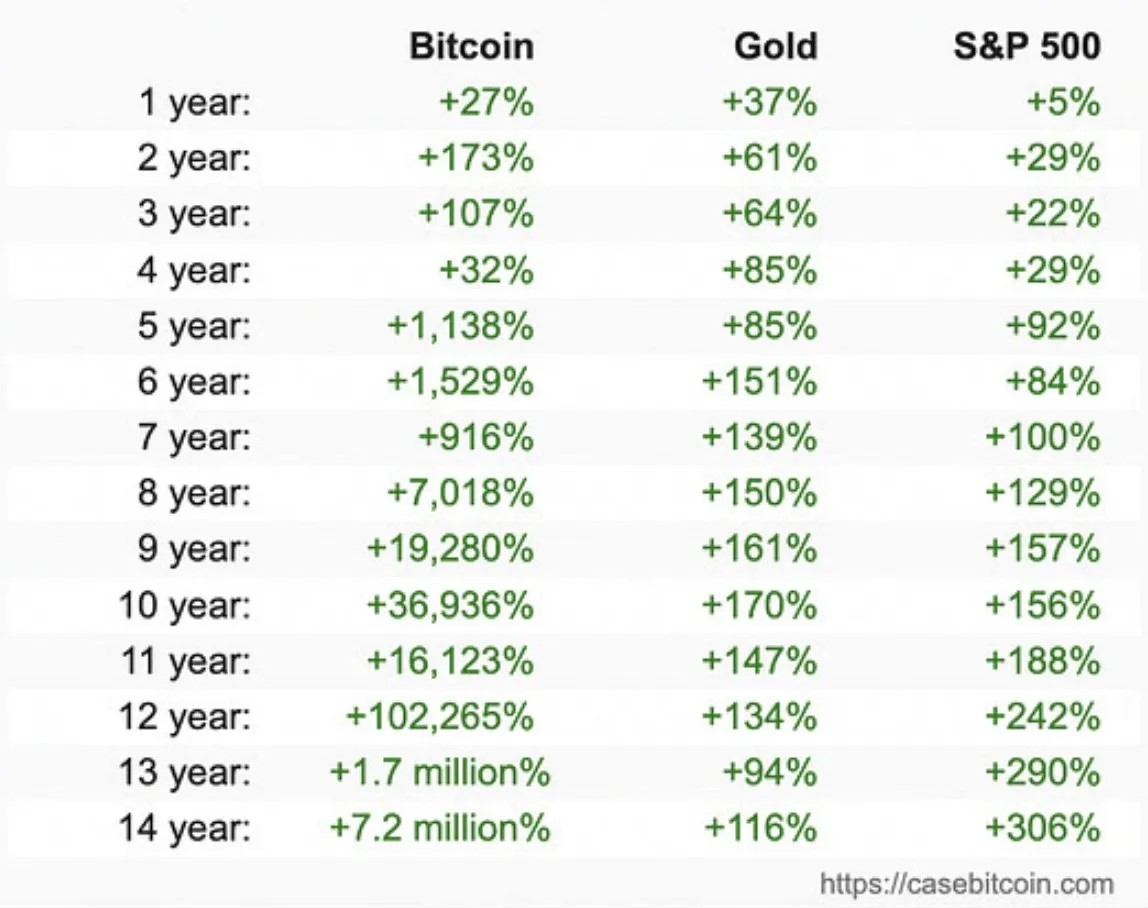

Matt Hougan, Chief Investment Officer at Bitwise Invest, states that Bitcoin is not just outperforming gold but is also surpassing the S&P 500 in the long run. This indicates that Bitcoin is becoming a stronger investment option despite its price volatility.

Data also supports this. A recent Bitwise report shows corporations bought over 95,400 BTC in Q1—about 0.5% of all Bitcoin in circulation. That makes it the largest quarter for corporate accumulation on record.

“People want to own Bitcoin. Corporations do too. 95,000 BTC purchased in Q1,” Bitwise CEO Hunter Horsley said.

With rising corporate demand and Bitcoin’s strong performance against traditional assets, the stage may be set for a major rally in summer 2025—driven by peak global liquidity and Bitcoin’s historic tendency to follow gold’s lead.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Crypto Outflows Hit $795 Million On Trump’s Tariffs & Market Fear

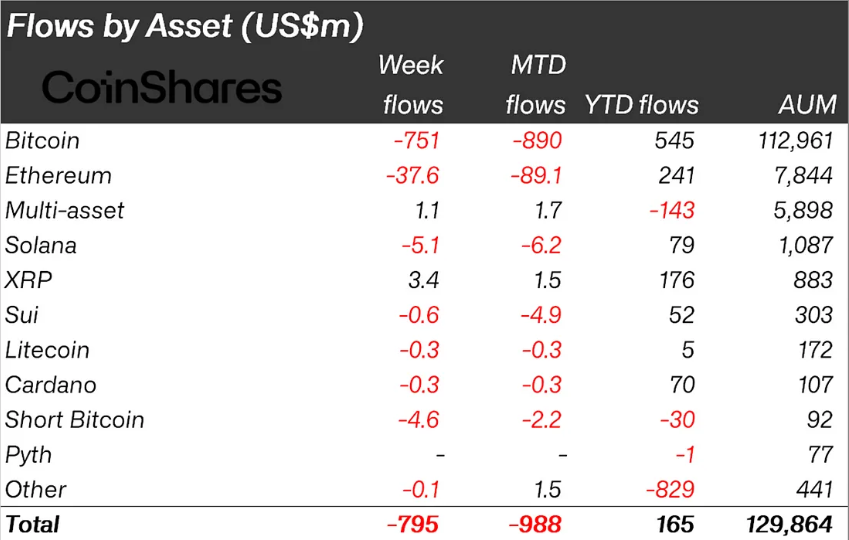

According to the latest CoinShares research, crypto outflows hit $795 million last week. This marks the third consecutive week of negative flows, as financial uncertainty continues to weigh heavy on investor sentiment.

This report aligns with the outlook for Bitcoin spot ETFs (exchange-traded funds), which saw $713 million in outflows last week, a 314% surge from the prior week’s $172.69 million.

Crypto Outflows Reached $795 Million Last Week

CoinShares’ researcher James Butterfill reveals that while Bitcoin led the outflows at $751 million, some altcoins, including XRP, Ondo Finance (ONDO), Algorand (ALGO, and Avalanche (AVAX), managed positive flows.

It suggests investors adjust their investment strategies, pivoting to altcoins as broader economic chaos bombards the Bitcoin (BTC) market.

“…recent tariff activity continues to weigh on sentiment towards the asset class,” wrote Butterfill.

This trend is not new, as altcoins have outperformed Bitcoin on flow metrics in the past. Two weeks ago, altcoins broke a five-week streak of negative flows, catapulting crypto inflows to $226 million.

Meanwhile, the influence of Trump’s tariffs on digital asset investment products has been consistent. In the week ending April 7, crypto outflows hit $240 million in the backdrop of Trump’s trade chaos.

Investor sentiment took a particularly sharp turn after President Donald Trump’s tariff pause announcement sidelined China, reigniting fears of a US-China trade war. This spooked markets across traditional and digital assets, along with China’s retaliatory move, exacerbates the sentiment.

Nevertheless, despite sidelining China, Trump’s temporary rollback of tariffs helped lift assets under management (AuM) by 8% to $130 billion, up from the lowest point seen since November 2024.

“… a late-week price rebound helped lift total AuM from their lowest point on April 8 (the lowest since early November 2024) to $130 billion, marking an 8% increase following President Trump’s temporary reversal of the economic calamitous tariffs,” Butterfill added.

Bitcoin Bleeds, ETF Flows Confirm Sentiment

As indicated, Bitcoin bore the brunt of last week’s bearish turn. Outflows surged in line with a 314% week-over-week increase in Bitcoin ETF outflows. The consistent bleed highlights that institutional interest is cooling, particularly among US-based ETF providers.

Short-Bitcoin products also suffered, with $4.6 million in outflows. This suggests traders may retreat to the sidelines entirely rather than taking leveraged bets on downside movement.

CoinShares emphasized that last week’s outflows spanned multiple regions and product providers. This signals that the bearish tone is not isolated to any one market. It aligns with broader risk-off behavior across equities and commodities in response to the volatile US trade stance.

Trump’s unpredictable tariff moves have reintroduced uncertainty into a fragile macro environment. Crypto markets, particularly institutional products, are responding with a broad withdrawal of capital.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds

-

Market19 hours ago

Market19 hours agoMENAKI Leads Cat Themed Tokens

-

Market17 hours ago

Market17 hours ago3 Altcoins to Watch in the Third Week of April 2025

-

Market14 hours ago

Market14 hours agoBinance Futures Causes a Brief Crash For Story (IP) and ACT

-

Market22 hours ago

Market22 hours agoSolana Futures Traders Eye $147 as SOL Recovers

-

Market18 hours ago

Market18 hours agoTether Deploys Hashrate in OCEAN Bitcoin Mining Pool

-

Market16 hours ago

Market16 hours agoCardano (ADA) Eyes Rally as Golden Cross Signals Momentum