Bitcoin

Bitcoin Demand Growing At Fastest Pace Since April — Is BTC Price Next?

According to the latest on-chain data, demand for Bitcoin, the world’s largest cryptocurrency, has been picking up pace over the last few days. The question here is — can this growing pressure jumpstart the Bitcoin bull run?

Can The Latest Demand Spike Restart The Bull Run?

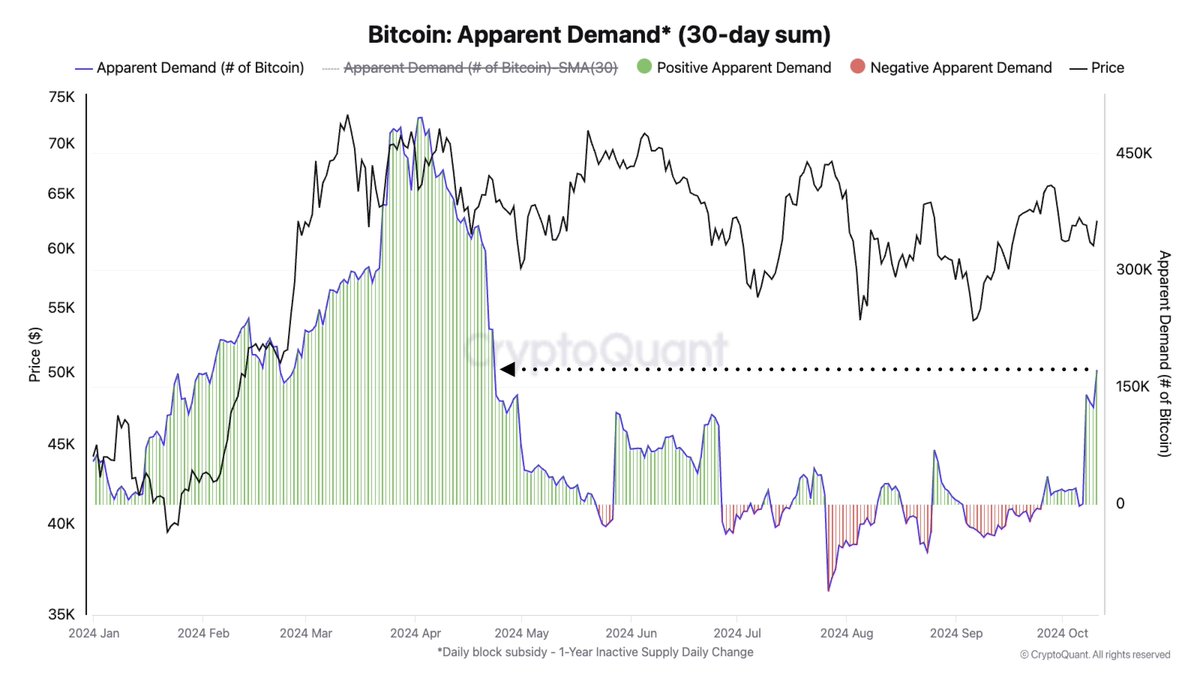

CryptoQuant’s head of research Julio Moreno took to the X platform to share an interesting on-chain observation about Bitcoin and investors’ appetite over the last few weeks. According to the on-chain expert, apparent demand for BTC is growing at its fastest monthly pace since April 22.

This on-chain revelation is based on the apparent demand metric, which measures the difference between the daily total Bitcoin block subsidy and the daily change in the amount of Bitcoin held for one year or longer. This metric reflects how much BTC is in active circulation and is being demanded by the market.

As earlier reported, the Bitcoin apparent demand has been in a steady decline since April when the price of Bitcoin hovered around the $70,000 mark. The Bitcoin demand has sometimes trended towards the negative over the past six months, precipitating a relatively quiet market climate.

In an October 2 report, CryptoQuant revealed that the flagship cryptocurrency might be entering a period of positive seasonal performance, especially as the Q4 of all halving years is historically bullish. However, the on-chain analytics firm highlighted that increasing demand is one of the critical factors that must align for the BTC price to resume its bull run.

With the pace of demand growth now back in the April levels, it appears that Bitcoin price might be gearing for a run to the upside. Hence, there is a higher likelihood of the premier cryptocurrency returning to its all-time high price and potentially printing a new one in Q4 2024.

A chart showing BTC's apparent demand and price in 2024 | Source: jjcmoreno/X

However, Moreno noted in his post that the demand momentum remains in the negative at the moment. The CryptoQuant head of research said that although “there is still more selling than buying, the scale of this imbalance has eased.”

Bitcoin Price At A Glance

As of this writing, the price of BTC sits just above the $63,000 mark, reflecting a mere 1.1% rise in the last 24 hours. According to data from CoinGecko, the premier cryptocurrency is up by more than 2% in the past week.

The price of BTC holds above $63,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Bitcoin

El Salvador’s Nayib Bukele Open to White House Visit

El Salvador’s President Nayib Bukele has hinted at an upcoming visit to US President Donald Trump at the White House. The move has fueled speculation about closer cooperation between the two pro-Bitcoin leaders.

Although no official agenda has been released, if confirmed, the meeting would mark Bukele as the first Western Hemisphere leader to visit Trump at the White House during his current term.

Can Bitcoin Improve Diplomatic Relationship Between US and El Salvador?

On March 28, Bukele reacted to a report claiming that Trump plans to invite him to Washington.

Responding on social media, Bukele confirmed his willingness to visit and jokingly noted that he would bring “several cans of Diet Coke” — a nod to Trump’s well-known beverage of choice.

The two leaders have enjoyed a friendly relationship since Trump’s return to office. They reportedly spoke after the inauguration, and Trump later thanked Bukele publicly, commending his “understanding of this horrible situation” regarding US border issues.

Meanwhile, the possible visit follows El Salvador’s acceptance of deported Venezuelan gang members from the US.

These individuals were held at the country’s high-security Terrorism Confinement Center. The facility was recently visited by US Homeland Secretary Kristi Noem.

President Bukele’s administration has earned international praise — and criticism — for its tough stance on crime. His crackdown on gangs has transformed El Salvador from one of the most violent nations in the world to one of the safest in Latin America.

Meanwhile, speculation is growing within the crypto community that Bitcoin may emerge as a significant topic during the leaders’ discussions. Both Bukele and Trump have openly supported Bitcoin, though their approaches differ slightly.

Bukele’s stance on Bitcoin is notably proactive. In 2021, he spearheaded the creation of the world’s first national Bitcoin reserve, which has since grown to 6,130.18 BTC—worth over $512 million.

Moreover, his pro-Bitcoin initiatives have attracted substantial foreign investments, including partnerships with prominent crypto companies like Tether.

President Trump also recently became more supportive of the top crypto asset, reversing previous skepticism.

Earlier this month, Trump authorized the establishment of a US National Bitcoin Reserve, with the federal government holding initial holdings of around 200,000 BTC.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Is Bitcoin About To Skyrocket Or Crash? What Truflation Says

In the March 27, 2025 analysis, titled “Where is Bitcoin headed next? A Signal hidden in Real-Time Data,” Truflation highlights a recurring phenomenon: each time its inflation index experiences a pronounced downtrend that later pauses or reverses, Bitcoin has tended to surge soon afterward.

Where Is Bitcoin Headed Next?

Truflation’s research points to a backdrop shaped by the aftermath of COVID-19, when central banks worldwide slashed interest rates to almost zero and funneled liquidity into the economy. That period of easy money overlapped with Bitcoin’s run to all-time highs in 2021. By 2022 and 2023, however, persistent inflation took hold, prompting the US Federal Reserve to reverse course. Interest rate hikes and quantitative tightening became the primary tools for fighting price pressures, with the Federal Reserve explicitly aiming to bring consumer price inflation down to 2%.

According to the Truflation report, real-time inflation readings reached as low as 2% in June 2023. The official Consumer Price Index (CPI), published by the Bureau of Labor Statistics, mirrored that pattern about a month and a half later, bottoming out at 3% in July 2023. Yet from mid-2023 onward, Truflation’s index did not simply keep dropping in a straight line. Instead, it oscillated between higher and lower bounds, demonstrating a cyclical pattern of disinflation that would then stabilize or reverse course. Truflation now believes that each of these cyclical “inflection points” closely correlates with subsequent upswings in Bitcoin’s price.

The report references four distinct periods from September 2023 to September 2024 when Truflation’s index trended downward and then either flattened or rebounded. In each of those cases, Bitcoin’s price rose soon after. Truflation suggests that a fifth such event may now be unfolding: the inflation index dropped steeply in early 2025, hitting around 1.30%—a level not seen in several months—before rebounding to 1.80%. This situation is reminiscent of previous disinflation troughs that, based on Truflation’s data, presaged a new wave of Bitcoin buying.

“When Truflation’s disinflation trend pauses or reverses, Bitcoin tends to rally shortly after. This pattern has repeated a few times already — and if history rhymes, it may be unfolding once again soon,’” the analysis states.

The underlying reason, Truflation explains, revolves around Bitcoin’s forward-looking nature and its sensitivity to changes in liquidity conditions. Strong disinflation usually prompts speculation that the Federal Reserve may be done raising rates and could soon turn dovish. While steep and unrelenting disinflation can trigger fears of recession, a slowdown or pause in that disinflation trend often reassures markets that the economy is not sliding into an economic downturn.

This “soft landing” scenario emboldens risk-on sentiment. Traders and investors who believe that inflation has been subdued enough to delay additional tightening—or to accelerate rate cuts—frequently channel their optimism into assets like Bitcoin.

The report acknowledges that no single piece of data, including Truflation’s own, holds absolute sway over an asset as complex and widely traded as Bitcoin. However, it emphasizes that real-time inflation expectations reverberate throughout global markets, influencing equities, commodities, and foreign exchange trading, in addition to crypto. By anticipating shifts in those expectations, some investors may find themselves ahead of the curve when official CPI reports and central bank pronouncements finally confirm or contradict the evolving trend.

“Truflation doesn’t influence Bitcoin in a vacuum. No single data source ever does. But inflation expectations ripple across a wide range of markets — from equities to commodities — and especially into bond yields and forex markets,” the analysis concludes.

At press time, BTC traded at $84,461.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Strategic Bitcoin Reserve Proposed by Brazil’s VP Advisor

Brazil’s Vice President Geraldo Alckmin’s (PSB) chief of staff, Pedro Giocondo Guerra, underscored on Wednesday the importance of establishing a national strategic Bitcoin reserve. Guerra was speaking at the swearing-in ceremony of the new president of the FPBC (Parliamentary Front for Competitive Brazil), Deputy Júlio Lopes (PP-RJ), while representing the government of President Luiz Inácio Lula da Silva (PT).

“Rigorously debating the constitution of a sovereign reserve of bitcoin value is in the public interest and will be decisive for our prosperity. After all, Bitcoin is digital gold, the gold of the internet. It’s a technology that allows us to transmit wealth from one end of the planet to the other quickly and store the fruits of our labor efficiently and securely,” Guerra stated.

Will Brazil Get A Strategic Bitcoin Reserve?

His remarks highlighted Bitcoin’s intrinsic appeal—particularly its digital scarcity and deflationary design, in contrast to fiat currencies that can be printed at will. Guerra noted that an official BTC reserve might bolster the country’s resilience and adaptability, especially amid global economic and geopolitical fluctuations.

Notably, Congressman Eros Biondini (PL-MG) has introduced PL 4501/2024, which would permit the creation of a Sovereign Strategic Reserve of Bitcoins—referred to in the bill as RESBit. According to Biondini, the primary goal is to guard Brazil against currency fluctuations and geopolitical uncertainties by diversifying the government’s international reserves.

The text proposes a limit of 5% of the country’s international reserves—which totaled $366 billion in December—for Bitcoin acquisitions. Should it pass, Brazil would be authorized to invest as much as $18.3 billion in Bitcoin, based on the reserve’s valuation at the time the bill was drafted.

Currently under review by Rapporteur Luiz Gastão (PSD-CE) in the Lower House’s Economic Development Committee, the bill sets forth guidelines for gradual acquisition and emphasizes robust security measures, using cold wallets and advanced AI- and blockchain-based monitoring.

The legislation details how the Central Bank and the Ministry of Finance would jointly manage RESBit, ensuring transparency through regular biannual reports to both the public and Congress. In addition, the text addresses the need for educational and innovation programs, including specialized courses on blockchain, crypto-economics, and cybersecurity, as well as incentives like tax benefits for crypto-related startups.

Related Reading: Trump Endorses Pro-Bitcoin Senator Lummis: ‘Make US The Crypto Capital’

A technical advisory committee composed of experts in blockchain, digital economy, and cybersecurity would also be established to ensure rigorous oversight and to foster collaboration with international regulators and research institutions. The proposal cites global precedents, such as El Salvador’s adoption of Bitcoin as legal tender, the United States’ approval of BTC ETFs, China’s investment in blockchain and digital currency efforts, Dubai’s success in developing a blockchain-friendly business environment, and the EU’s regulatory framework for digital assets.

In its justification section, the bill argues that Brazil is already one of the countries with the highest rate of cryptocurrency adoption, yet government policy has not kept pace with the rapid evolution of this market.

According to the text, “The creation of RESBit will allow Brazil to diversify its international reserves, reducing exposure to foreign exchange fluctuations and geopolitical risks while increasing economic resilience. This measure will also position Brazil as a regional leader in financial and technological innovation, attracting external investment and strengthening our presence in the digital economy.”

At press time, BTC traded at $86,205.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Price Set To Reach $1 As Once In A Year Buy Opportunity Returns

-

Market21 hours ago

Market21 hours agoAnalysts Reveal Q2 Crypto Market Outlook: BTC at $200,000?

-

Market16 hours ago

Market16 hours agoCoinbase Users Lost $46 Million to Crypto Scams in March

-

Altcoin16 hours ago

Altcoin16 hours agoPiDaoSwap, Trump Media, & Grayscale

-

Regulation16 hours ago

Regulation16 hours agoUS SEC Drops Charges Against Hawk Tuah Girl Hailey Welch

-

Market23 hours ago

Market23 hours agoSatLayer CEO Luke Xie Talks Bitcoin Restaking and DeFi’s Future

-

Altcoin23 hours ago

Altcoin23 hours agoBlessing or Curse for the Crypto Market?

-

Market22 hours ago

Market22 hours agoHedera Falls 4% as Bears Dominate: What’s Next for HBAR?