Bitcoin

Bitcoin-Backed Loans Will Crush the $1.5 Trillion Credit Market

Bitcoin-backed lending has experienced steady growth over the past few years, but new deals and increasing market interest signal that this could be the start of a massive surge.

With institutional backing and rising adoption rates, this market may soon undergo exponential growth, fundamentally transforming credit markets on a global scale.

Bitcoin-Backed Lending: A Growing Market Opportunity

The Bitcoin-backed lending and credit market has quietly gained momentum within the crypto industry. Although several firms have explored this concept for a few years, it is only now receiving wider recognition.

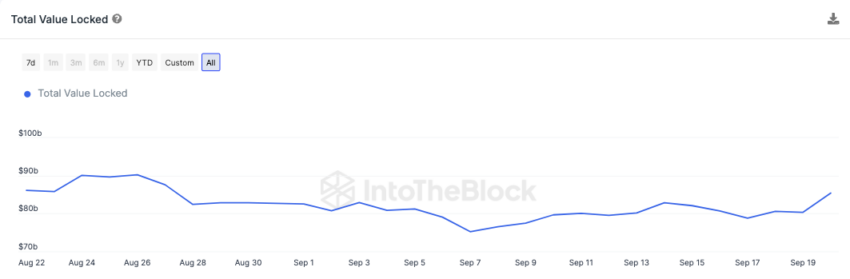

Crypto lending is one of the most widely-used services in decentralized finance (DeFi), with the potential for significant growth. The broader DeFi ecosystem, for instance, grew from $21 billion in total value locked (TVL) in early 2021 to over $85 billion today, showing the massive appetite for blockchain-based financial services.

This type of lending opens new doors for borrowers who wish to access liquidity without selling their Bitcoin. More importantly, it gives lenders new avenues to tap into crypto markets while securing loans with a highly fungible and decentralized asset.

For example, in August 2023, Sygnum, a Swiss digital asset bank, issued a $50 million syndicated loan to crypto lender Ledn. This deal was significant not only because it was one of the first major Bitcoin-backed loans in fiat currency, but also because the loan’s collateral was Bitcoin.

Institutional players from Sygnum’s client base were involved, marking a shift in how traditional finance engages with digital assets .

Market research firms like Messari predict that the overall DeFi lending market will grow exponentially, with Chainalysis estimating that crypto-backed loans could represent a significant portion of the total crypto market by 2026. Moreover, a report from Fidelity Digital Assets indicated growing institutional participation in crypto lending, highlighting how traditional lenders are increasingly interested in offering crypto-backed loans.

In line with this optimism, Kevin Charles, co-founder and CEO of Open Bitcoin Credit Protocol, foresees explosive growth in the Bitcoin-backed credit market.

“In five years, the Bitcoin-backed credit market could grow into a multi-billion-dollar industry, with estimates reaching $100-200 billion in outstanding loans as Bitcoin adoption expands. With broader acceptance and improved infrastructure, we could see Bitcoin-backed loans becoming a standard offering at major banks and fintechs, serving millions globally,” Charles told BeInCrypto.

Read More: How to Take Out a Decentralized Loan with Crypto

According to Chain, regions where traditional banking services are limited—particularly in Latin America and Africa—are seeing the fastest Bitcoin adoption rates. These underserved markets represent untapped opportunities for Bitcoin-backed lending to provide liquidity to individuals and businesses that would otherwise be excluded from traditional credit markets.

Yield Comparison and DeFi Synergies

Yield generation in DeFi platforms such as Aave and BlockFi further illustrates the appeal of Bitcoin-backed loans. Current yield offerings on DeFi platforms can range from 4% to 10%, depending on market conditions and asset types.

In comparison, traditional financial institutions typically offer much lower yields on secured loans, making DeFi a more attractive alternative for crypto holders looking to leverage their assets.

However, these lucrative yields often come with risks, particularly when interest rates fluctuate or when markets experience significant volatility. A Bernstein report indicated that while high interest rates can stifle DeFi lending growth, impending rate cuts could serve as a catalyst, reinvigorating demand for Bitcoin-backed loans.

“With a rate cut likely around the corner, DeFi yields look attractive again. This could be the catalyst to reboot crypto credit markets and revive interest in DeFi and Ethereum,” Gautam Chhugani, Mahika Sapra and Sanskar Chindalia wrote.

As with any new financial product, risks remain. Bitcoin’s notorious price volatility poses challenges for both borrowers and lenders. For borrowers, sudden price drops could trigger margin calls, forcing the liquidation of their Bitcoin holdings. According to VanEck, Bitcoin has experienced price swings as large as 30% within a single week, underscoring the difficulty in managing collateral.

Lenders face their own challenges as well. Managing the value of Bitcoin collateral is an ongoing process, and market illiquidity during downturns could leave lenders with devalued collateral. BeInCrypto reported that liquidations across DeFi platforms reached $5.55 billion in April, illustrating the potential risks when markets turn sour.

However, blockchain security firms like Fireblocks have developed advanced collateral management systems to mitigate these risks, offering real-time data monitoring and multi-layer security protocols to ensure the integrity of loans.

The participation of institutional investors, fintech companies, and even traditional banks in the Bitcoin-backed lending market is likely to provide much-needed liquidity and stability. CoinShares reports that institutional inflows into crypto-related assets reached over $436 million last week, highlighting how institutions are increasingly viewing Bitcoin-backed loans as viable investment options.

“Traditional banks will play an essential role in Bitcoin-backed lending by providing credibility, capital, and innovation. They will push the industry forward by integrating decentralized models that lower costs and increase efficiency in lending,” Charles emphasized.

Read more: Crypto-Secured Loans: An Explainer on How They Work

Moreover, Bitcoin adoption continues to grow, especially in regions underserved by traditional banks. According to Chainalysis, Bitcoin adoption in Africa increased by over 1,200% between 2020 and 2022, signaling that Bitcoin-backed lending could become a primary financial tool in these regions as the infrastructure improves.

Future Success and Roadblocks

While Bitcoin-backed lending presents numerous opportunities, the industry still faces challenges. Unclear regulatory frameworks, lacking infrastructure, and security concerns remain significant obstacles.

Fireblocks and other security platforms are working to address these challenges by implementing stronger custody and collateral management protocols. Additionally, Charles believes that future regulatory efforts will enhance consumer protection, improve legitimacy, and increase adoption.

Ultimately, Bitcoin-backed lending has the potential to revolutionize traditional credit markets by offering a more flexible, secure, and decentralized form of collateralized lending. This could drive innovation and push traditional banks to adopt decentralized models that lower costs and speed up loan processes.

Despite the hurdles, the adoption of Bitcoin-backed credit could significantly “expand access to credit, diversify financial products, and create a more efficient global lending system,” Charles concluded.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Could Serve as Inflation Hedge or Tech Stock, Say Experts

Bitcoin may be a useful hedge against inflation in the near future as market uncertainty is growing. In the long run, it may also be useful to envision Bitcoin differently, treating it as a barometer for the tech industry.

Standard Chartered’s Head of Digital Assets Research and WeFi’s Head of Growth both shared exclusive comments with BeInCrypto regarding this topic.

Bitcoin: Inflation Hedge or Magnificent 7 Candidate?

Since the early days of the crypto space, investors have been using it as a hedge against inflation. However, it’s only recently that institutional investors are beginning to treat it the same way. According to Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, the trend of Bitcoin as an inflation hedge is increasing.

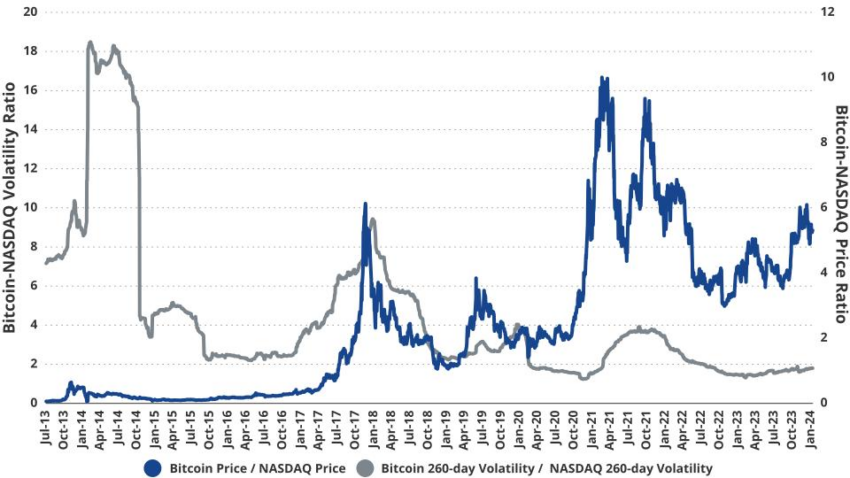

Still, this view may be too narrow in a few ways. Since the Bitcoin ETFs were first approved, BTC has been increasingly well-integrated with traditional finance. Kendrick noted this, saying that it is highly correlated with the NASDAQ in the short term. He claimed that Bitcoin might represent more than an inflation hedge, instead serving as an ersatz tech stock:

“BTC may be better viewed as a tech stock than as a hedge against TradFi issues. If we create a hypothetical index where we add BTC to the ‘Magnificent 7’ tech stocks, and remove Tesla, We find that our index, ‘Mag 7B’, has both higher returns and lower volatility than Mag 7,” Kendrick said in an exclusive interview with BeInCrypto.

This comparison is particularly apt for a few reasons. Tesla’s stock price is heavily entangled with Bitcoin, but it’s also been dropping due to political controversies. If Bitcoin were to replace Tesla’s position in the Magnificent 7, it may be a welcome addition. Of course, there is currently no mechanism to cleanly treat Bitcoin as a similar type of product. That could change.

However, Bitcoin’s role as an inflation hedge might be more immediately relevant. As Trump’s Liberation Day approaches, the crypto markets are becoming increasingly nervous about new US tariffs. As Agne Linge, Head of Growth at WeFi, said in an exclusive interview, these fears are impacting all risk-on assets, Bitcoin included.

“Crypto markets are closely tracking investor sentiment ahead of Trump’s…tariff announcement, with growing concerns over the potential economic impact. Bitcoin’s increasing correlation with traditional markets has amplified its exposure to broader macroeconomic trends, making it more sensitive to the risk-off sentiment that has affected equity markets,” Linge claimed.

She went on to state that US economic uncertainty was at record levels, surpassing both the 2008 financial crisis and the pandemic in April 2020. In these circumstances, recent inflation indicators are showing expected rates above expectations.

In such an environment, the crypto market is sure to take a hit, but traditional finance and the dollar is also in great jeopardy. All that is to say, Bitcoin is likely to be a solid inflation hedge in the near future. Even if it falls dramatically, it has worldwide appeal and the ability to rebound.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

Michael Saylor, one of the most outspoken supporters of Bitcoin, is back and bolder than ever. In a recent statement, the former MicroStrategy CEO predicted that the alpha coin will potentially hit a $500 trillion market cap. Saylor’s bold prediction for the world’s top digital asset comes during the intensified push for a Strategic Bitcoin Reserve (SBR).

In his latest pro-crypto statement, Saylor argued that the digital asset will “demonetize gold”, then it will demonetize real estate, which he calculated as 10x more than gold. To summarize his argument, Saylor further states that Bitcoin will demonetize “all long-term store of value”.

Push For SBR Gains Ground

Saylor’s latest statement comes as Congress intensifies its efforts to build the country’s BTC holdings. United States President Donald Trump formalized the plans to build crypto holdings through an executive order to establish a strategic crypto reserve that will initially include $17 billion worth of BTC that the country currently controls.

Michael Saylor: Bitcoin Headed to $500 Trillion 🚀₿

– At Digital Asset Summit, MicroStrategy’s Saylor predicted:

• BTC will reach $500T market cap

• It will “demonetize gold, real estate & all long-term stores of value”

– Capital shift: “From physical to digital, from…— AFV GLOBAL (@afvglobal) March 28, 2025

According to the president, additional acquisitions of cryptocurrency are allowed, provided these are done through “budget-neutral” approaches. Senator Cynthia Lummis initially proposed in the Senate, through the Bitcoin Act, the plan to create a Bitcoin reserve. Under the proposal, the administration can purchase 1 million Bitcoin to complement the reserve.

Saylor Explains Crypto’s Role During Blockchain Summit

Saylor’s latest prediction on Bitcoin was made during his appearance at the DC Blockchain Summit. He was joined on stage by Jason Les, the CEO of Rito Platforms, and Lummis, the principal author of the Bitcoin Act.

During the program, Saylor was asked about America’s need for Bitcoin. Saylor answered with conviction, saying the rising importance of BTC is inevitable and will happen with the US’ participation. During his talk, he shared that Bitcoin, created by the enigmatic Satoshi Nakamoto, is unstoppable.

Image: Gemini Imagen

Saylor added that the premier digital asset is the next stage in money’s evolution, and it’s currently absorbing value from traditional assets like currency reserves and real estate.

Saylor Predicts Top Coin Will Reach $500 Trillion In Market Cap

During his talk, Saylor predicted that BTC will eventually grow from $2 billion to $20 billion, which can hit $200 billion and beyond. Finally, he thinks the asset can achieve a $500 trillion market capitalization, reflecting more than 29,000% increase from its current market capitalization of $1.67 trillion.

Saylor’s recent bold prediction aligns with his firm conviction and support for the asset. He argues that Bitcoin’s unique features, its decentralized nature and fixed supply, make it a perfect hedge against economic uncertainties like inflation.

Featured image from Gemini Imagen, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Big Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

A top executive of Strategy, formerly MicroStrategy, posted a cryptic post on X, fueling speculation that the company might be positioning itself to make another Bitcoin acquisition soon.

Strategy Executive Chairman Michael Saylor suggested in an X post that the company would purchase additional Bitcoins to boost its current BTC holding of $42 billion.

Saylor To Buy More Bitcoin

In a typical Saylor fashion, the Strategy top honcho disclosed the company’s BTC investment portfolio tracker, an indicator that the company is planning an upcoming Bitcoin acquisition.

Needs even more Orange. pic.twitter.com/lV5qgUP6oY

— Michael Saylor⚡️ (@saylor) March 30, 2025

“Needs even more Orange,” Saylor said in the post, referring to the orange circles in the graph (below), which represents the company’s Bitcoin purchases since September 2020.

Once again, Saylor’s post intrigued the crypto community because many believe the graph conveys a message that Strategy will buy more BTC soon.

Strategy Stockpile: Over $40B BTC

According to Saylor, Strategy’s Bitcoin holding now stands at more than $42 billion. Despite the company’s already huge investment in BTC, it seems the company will continue to increase its holdings, believing in the value of crypto.

Strategy has made great strides in building its BTC reserve from its initial Bitcoin purchase of 21,454 coins worth $250 million in August 2020.

On March 17, the company announced its latest acquisition of 130 Bitcoins for about $10.7 million in cash, with an average price of around $82,981 per coin.

Meanwhile, Onchain Lens reported on Sunday that Strategy moved a considerable number of its coins to new addresses.

“Strategy (formerly MicroStrategy) transferred 7,383.25 $BTC worth $612.92M to three new addresses on March 30,” Onchain Lens said in a post.

Analysts believe the company is influencing the crypto market to strengthen its position, as its chairman has consistently urged others never to sell their Bitcoin.

Strategy (formerly #MicroStrategy) has transferred 7,383.25 $BTC worth $612.92M into 3 new addresses.https://t.co/8KVn8hYNDL pic.twitter.com/g92HZCvoLp

— Onchain Lens (@OnchainLens) March 30, 2025

Fueling BTC Adoption

Many market observers argued that Saylor’s BTC investment strategy might have driven crypto adoption. Ironically, Saylor was pessimistic about Bitcoin’s future in 2013, predicting that the flagship crypto would fail.

However, in 2020, Saylor became one of Bitcoin’s staunch advocates and has now been preaching the merits of the firstborn crypto, urging companies to acquire Bitcoin.

For example, Visa planned to let its customers spend digital assets directly at 70 million merchants. At the same time, financial institutions such as JPMorgan and Morgan Stanley have begun offering crypto investments to wealthy clients and institutional investors.

Featured image from Times Now, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market18 hours ago

Market18 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

-

Altcoin21 hours ago

Altcoin21 hours agoA Make or Break Situation As Ripple Crypto Flirts Around $2

-

Market20 hours ago

Market20 hours agoXRP Bulls Fight Back—Is a Major Move Coming?

-

Market19 hours ago

Market19 hours agoIs CZ’s April Fool’s Joke a Crypto Reality or Just Fun?

-

Bitcoin16 hours ago

Bitcoin16 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Market23 hours ago

Market23 hours agoEthereum Price Faces a Tough Test—Can It Clear the Hurdle?

-

Bitcoin15 hours ago

Bitcoin15 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Market22 hours ago

Market22 hours agoSolana (SOL) Holds Steady After Decline—Breakout or More Downside?