Bitcoin

AI Company Invests $10 Million In BTC Treasury

As MicroStrategy continues to reap success with its aggressive Bitcoin play, it’s only a matter of time before other companies tread in the same path.

Genius Group, an AI-focused and Bitcoin education firm, is the latest one to the bandwagon. According to a press release, Genius Group said that it had bought 110 Bitcoins for a sum of $10 million at an average price of $90,932.

This purchase sets up the company’s first “Bitcoin treasury,” an essential step towards its plans to implement a “Bitcoin-first policy,” which it initially outlined in 2023. Under its Bitcoin-first policy implemented last year, the company commits to investing at least 90% of its current and future reserves in digital assets, initially targeting $120 million.

The 110 BTC is the company’s first tranche, and it expects to make more purchases to achieve its strategic plan.

JUST IN: AI firm Genius Group kicks off its #Bitcoin treasury with a $10M purchase of 110 BTC! 🚀 pic.twitter.com/Ts5KQqi4I6

— Simply Bitcoin (@SimplyBitcoinTV) November 18, 2024

A Bitcoin-First Policy For Genius Group

Genius Group announced on November 12th to go full-steam ahead on Bitcoin. According to the company’s corporate strategy presented at the end of the 2023 quarter, it would commit 90% of its reserve to BTC, a long-term plan of holding Bitcoins worth as much as $120 million.

According to CEO Roger James Hamilton, his company is in a position to integrate traditional learning with modern financial literacy backed by the blockchain. He added that when Genius Group adopted MicroStrategy’s Michael Saylor’s Bitcoin plan, there were no rules or plans to follow.

BTC market cap currently at $1.8 trillion. Chart: TradingView.com

Genius Group Continues Its Blockchain, Bitcoin Education Series

The Genius Group is primarily an AI-focused and Bitcoin-first education group. The group aims to promote Bitcoin as a payment system through its educational platform as part of its operations.

The company recently launched its Web3 Wealth Renaissance, an initiative that seeks to encourage the use of AI and spread awareness of the benefits and functions of cryptocurrencies and the blockchain.

Genius Group’s education campaign also includes a Bitcoin and Blockchain podcast series. On Tuesday at 9:00 a.m. Eastern Time, the podcast will cover a forecast on Bitcoin and fiat money’s future. The podcast will also explore the MicroStrategy story and how Saylor pioneered the Bitcoin Treasury concept.

This morning:

– MicroStrategy buys another 51,780 BTC for $4.6B

– MARA announces $700 million convert to acquire more BTC

– Semler Scientific raises $21mm ATM and acquires 215 BTC

– Metaplanet issues ¥1.75B debt offering to buy more BTCThe corporate Bitcoin race is heating up.

— Sam Callahan (@samcallah) November 18, 2024

More Corporations Adopt A Bitcoin-Focused Investing Policy

With MicroStrategy as a clear leader, many companies are also starting to add Bitcoin to their holdings. On November 18th, MicroStrategy announced its purchase of 51,780 Bitcoin for $4.6 billion.

Other companies followed suit, with MARA allocating $700 million to buy more Bitcoin, Semler Scientific raising $21 billion to buy 215 BTC, and Metaplanet issuing a $1.75 billion yen debt to finance its Bitcoin dream.

Other industries are joining the trend, including tech and crypto companies. For example, Cosmos Health Inc. has integrated a crypto strategy. The government’s interest in Bitcoin and crypto is also increasing. Sławomir Mentzen, a Polish presidential candidate, has announced his plans to create a BTC reserve.

Featured image from DALL-E, chart from TradingView

Bitcoin

Here Are The Bitcoin Levels To Watch For The Short Term

Bitcoin has produced a range-bound movement recently, with prices oscillating between $83,000 and 86,000. Interestingly, popular crypto analyst Burak Kesmeci has identified the important price levels for any short-term action.

Support At 82,800, Resistance At 92,000 – But Where Is Bitcoin Headed?

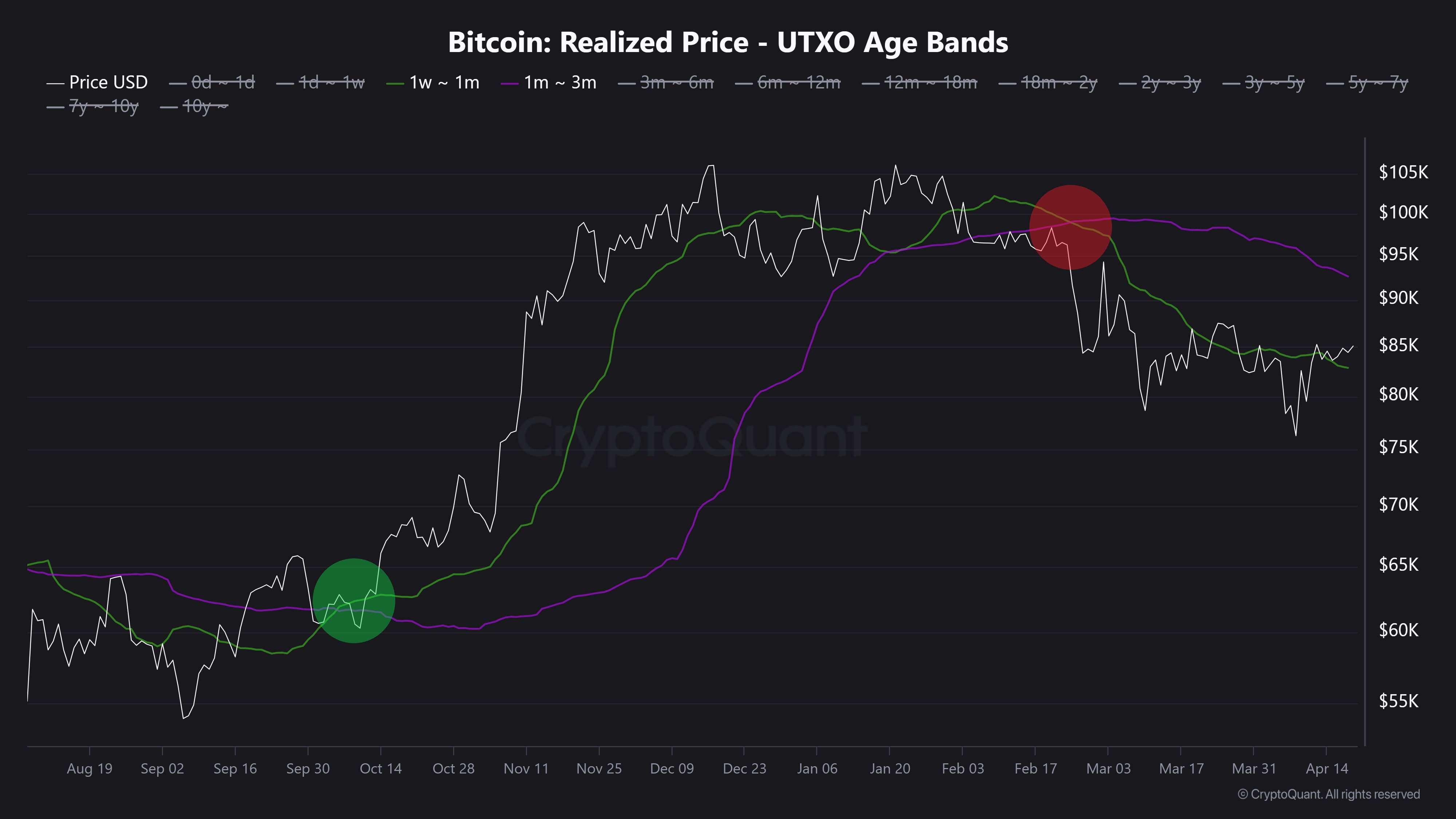

In a new post on X, Kesmeci shared an interesting on-chain analysis of the Bitcoin market. Using the short-term investor cost basis, the analyst identified two key price levels that could prove critical to Bitcoin’s next major move.

Firstly, Burak Kesmeci focuses on the average cost prices of new traders over the past 1-4 weeks, which are likely the most reactive to price changes. The realized price for these traders currently stands at $82,800, forming a near-term support that indicates many recent buyers are still in profit and may defend this level as a psychological floor.

Meanwhile, Kesmeci also highlights the $92,000 price level, which marks the average cost basis for BTC holders for 1-3 months. This price point has emerged as an important resistance zone, as investors are likely to exit the market once they break even. Furthermore, the $92,000 price level is also marked by a confluence with various technical indicators.

The interplay between these two levels is significant. Historically, short-term bullish trends in BTC tend to begin when the cost basis of more recent investors, 1–4 weeks, crosses above that of the 1–3 BTC holders. This shift signals increased confidence and willingness to buy at higher levels, which often fuels broader rallies.

However, that dynamic remains to play out in the current market. As of now, Bitcoin is trading around 85,000, positioning it above its support at the 1–4 week average of $82,800 but still below the 1–3 month resistance of $92,000. Furthermore, both cost basis levels have been declining over the past two months, reflecting hesitation or a lack of aggressive buying from new entrants.

Notably, Kesmeci states that BTC must surge above $92,000 to confirm a strong bullish momentum for a price reversal.

Bitcoin ETFs Offload 1,725 BTC

In other news, Ali Martinez reports that the Bitcoin ETFs have suffered withdrawals of 1,725 Bitcoin, valued at $146.92 million, over the past week. This development illustrates a high level of negative sentiment among institutional investors, adding to market uncertainty around the BTC market.

Meanwhile, Bitcoin trades at $85,249 following a price change of 0.89% in the past day. The premier cryptocurrency also reflects a 0.58% loss on the weekly chart and a 1.06% gain on a monthly chart.

Feature image from Adobe Stock, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin LTH Selling Pressure Hits Yearly Low — Bull Market Ready For Take Off?

Following an extensive price correction in the past three months, the Bitcoin bull market continues to hang in the balance. Despite a modest price rebound in April, the premier cryptocurrency is yet to display a strong intent to resume its bull rally amidst a lack of positive market factors. However, crypto analyst Axel Adler Jr. has highlighted a promising development that could signal major upside potential for Bitcoin.

Bitcoin Long-Term Holders Looking To Halt Selling Pressure

In a recent post on X, Adler Jr. shared an important update in Bitcoin long-term holders (LTH) activity, which could prove significantly positive for the broader BTC market.

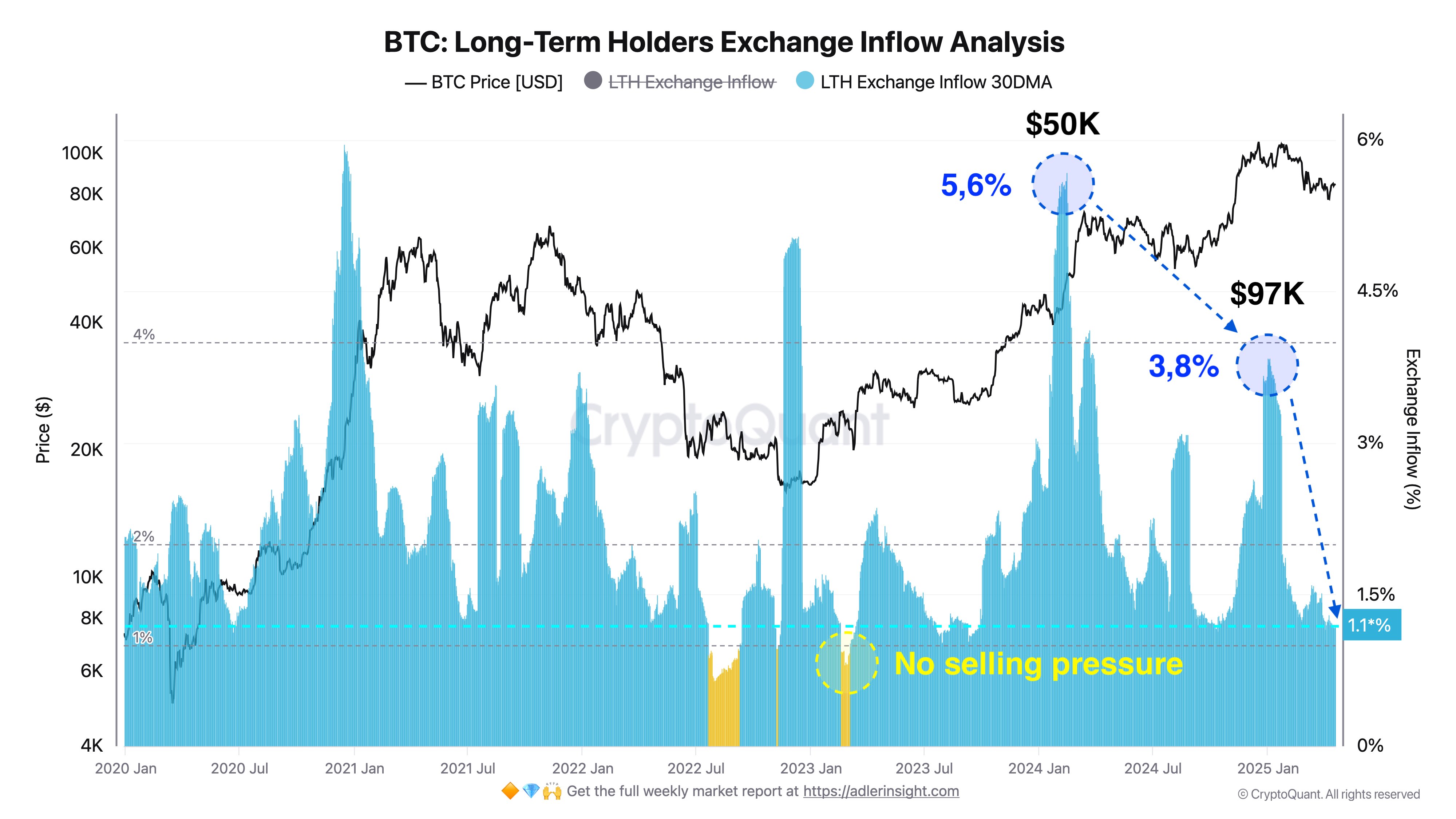

Using on-chain data from CryptoQuant, the renowned analyst reports that selling pressure by long-term holders, i.e. amount of LTH holdings on exchanges, has now hit its lowest point at 1.1% over the past year. This development indicates that Bitcoin LTH are now opting to hold on to their assets rather than take profits.

Adler explains that a further decline in these LTH exchange holdings to 1.0% would signal the total absence of selling pressure. Notably, this development could encourage new market entry and sustained accumulation, creating a strong bullish momentum in the BTC market.

Importantly, Alder highlights that the majority of the Bitcoin LTH entered the market at an average price of $25,000, Since then, CryptoQuant has recorded the highest LTH selling pressure of 5.6% at $50,000 in early 2024 and 3.8% at $97,000 in early 2025.

According to Adler, these two instances likely represent the primary profit-taking phases for long-term holders who intended to exit the market. Therefore, a resurgence in selling pressure from this cohort of BTC investors is unlikely in the short-term, which supports a building bullish case as long-term holders currently control 77.5% of Bitcoin in circulation.

BTC Price Overview

At the time of writing, Bitcoin was trading at $85,226 following a 0.36% gain in the past day and a 0.02% loss in the past week. Both metrics only reflect the ongoing market consolidation as BTC continues to struggle to achieve a convincing price breakout beyond $86,000.

Meanwhile, the asset’s performance on the monthly chat now reflects a 1.97% gain, indicating a potential trend reversal as the market correction ceases. Nevertheless, BTC remains in need of a strong market catalyst to ignite any sustainable price rally. With a market cap of $1.67 trillion, Bitcoin is ranked as the largest digital asset, controlling 62.9% of the crypto market.

Featured image from Adobe Stock, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Analyst Says Bitcoin Price Might Be Gearing Up For Next Big Move — What To Know

The Bitcoin price seems stuck in a consolidation range, ricocheting off the $83,000 and $86,000 levels over the past week. With no clear direction for the premier cryptocurrency, investors are left wondering what phase the market cycle is in—bullish or bearish.

According to a popular crypto analyst on the social media platform X, the Bitcoin price could be preparing for its next big move in either direction over the next few weeks. In any case, here are the important levels to watch out for in the next few days.

Crucial Levels To Watch For BTC’s Next Move

In an April 19 post on the X platform, crypto analyst Ali Martinez shared an interesting analysis of the Bitcoin price while highlighting the current layout of the world’s largest cryptocurrency by market cap. The online pundit noted that BTC bears and bulls are locked in a battle, leading to a choppy market condition.

Notably, the premier cryptocurrency appears to have entered the $83,000 – $86,000 range on Saturday, April 12. Hence, Martinez’s analysis basically revolves around the price of BTC bouncing off the support and resistance levels on its one-hour timeframe.

Source: @ali_charts on X

As shown in the chart above, the Bitcoin price attempted multiple times to breach the resistance zone around the $86,000 region over the past week. However, the bulls’ optimism was met with the staunch resilience of the Bitcoin bears, as the price of BTC almost always found its way back toward the $83,000 mark.

Most recently, the flagship cryptocurrency made its way toward the $86,000 level on Wednesday, April 16, but failed to break the significant resistance zone after the US Federal Reserve (Fed) chair Jerome Powell suggested that interest rate cuts might not be coming as early as anticipated by crypto traders.

Martinez noted in his post that the next significant move for the Bitcoin price depends primarily on the $83,000 and $86,000 levels. According to the crypto pundit, a breakout above the $86,000 mark could spell the start of a bullish run for Bitcoin, while a break below $83,000 could mean further correction for the market leader.

Bitcoin Price Overview

After reaching its all-time high of $108,786 in January 2025, the price of BTC has been on a steady decline in the past few months. According to data from CoinGecko, the flagship cryptocurrency has losst more than 22% of its value since hitting its record-high price.

As of this writing, the price of Bitcoin stands at around $84,530, reflecting a 0.3% decline in the past 24 hours. Meanwhile, the Bitcoin price is up by more than 1% on the weekly timeframe.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin22 hours ago

Altcoin22 hours agoUniswap Founder Urges Ethereum To Pursue Layer 2 Scaling To Compete With Solana

-

Market18 hours ago

Market18 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Altcoin21 hours ago

Altcoin21 hours agoWhat’s Up With BTC, XRP, ETH?

-

Market12 hours ago

Market12 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Market13 hours ago

Market13 hours agoVOXEL Climbs 200% After Suspected Bitget Bot Glitch

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Accumulators At A Crucial Moment: ETH Realized Price Tests Make-Or-Break Point

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Enters Historic Buy Zone As Price Dips Below Key Level – Insights