Altcoin

Will Ethereum Price Hit $5,000 If Pectra Goes Live on Mainnet?

The price of Ethereum (ETH) has fluctuated in 2025, causing some traders and investors to worry about its future. The price has fallen by almost half after hitting a Year-to-Date (YTD) $3,635 in January.

Many people wonder if Ethereum price will ever breach the $4,000 resistance and a new high of around $5,000. Notably, a big focus is on the upcoming Pectra upgrade and whether it can trigger an increase in the price of Ethereum.

Ethereum Price and Rocky Start to 2025

So far, 2025 has been rough for Ethereum. At the end of January, Ethereum was trading at $3,267.90 per an earlier ETH price analysis as the forecast for January’s push to $4,000 failed. Unfortunately, it dropped to around $1,910.67 by mid-March. This big drop in just a few weeks has left several large investors selling off, as seen in Ethereum ETF outflows.

While Ethereum still has high growth potential for the future, the short-term price movement has been unpredictable. The delay in key upgrades, like the Pectra update, has made things harder for Ethereum.

As of press time, CoinMarketCap data shows that Ethereum’s price was trading at $1,931.64 and has seen an over 1% decline in the last 24 hours. Still, ETH remains the second largest cryptocurrency globally, with a Market capitalization of $233.12 billion.

With the price drawdowns conditional, the question hinges on what its prospects for growth are in the short term.

Impact of Pectra Upgrade on Ethereum

As Vitalik Buterin announced, the Pectra upgrade is meant to make Ethereum faster and more efficient. It combines two key updates, Prague and Electra, designed to improve Ethereum’s performance, especially regarding scalability and staking.

The mainnet launch for Pectra was expected to happen in early April, but the circumstances surrounding its testing are uncertain. This is because the Sepolia and Holesky testnets encountered configuration issues.

This testnet hiccup fueled the latest Ethereum price drawdown as community sentiments dropped. However, ETH developers have stepped up to create a fix. They are set to launch the “Hoodi” testnet by Monday, March 17, which will help redirect the testing of key Pectra upgrade features.

If all goes well, the mainnet launch could take place between April and May 2025. Many Ethereum proponents believe the success of Pectra might serve as a primary catalyst for the Ethereum price boom to $5,000.

Ethereum ETF and Potential Impact on Price

Ethereum ETFs could also boost the ETH price outlook. While Bitcoin ETFs have gained popularity, Ethereum ETFs are lagging behind in terms of sustained capital flow.

Data from SoSoValue shows that Ethereum ETFs lost over $143 million in assets this week. This is a large outflow compared to last week when they recorded $119 million in outflows.

Although the broader market sentiment is impacting this shift, when the stock market gains revival, the ETF market and by extension Ethereum price may gain momentum.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Mantra (OM) Price Pumps As Founder Reveals Massive Token Burn Plan

The Mantra (OM) token price has surged after founder JP Mullin announced plans for a massive token burn. Mullin clarified that he intends to burn his personal team token allocation and implement a “comprehensive burn program for other parts of the OM supply.”

OM Pumps After Founder’s Burn Announcement

The OM token, which had experienced a major price drop over recent weeks, jumped from a low of $0.5115 to as high as $0.8706 following Mullin’s statement on X.

This announcement comes as OM has seen price drops of 87.0% over the past week. CoinGape has released a Mantra OM price prediction for April 2025, which could give you an idea of how the token can perform this month.

Mantra has initially shelved 300 million OM tokens for its team and core contributors. This accounts for 16.88% of the token’s nearly 1.78 billion total supply. These tokens are currently locked and were scheduled for a phased release between April 2027 and October 2029.

To be 100% clear, I am stating that I am burning MY team tokens, and we will create a comprehensive burn program for other parts of the OM supply. https://t.co/Yy6GzRBbM8

— JP Mullin (🕉, 🏘️) (@jp_mullin888) April 16, 2025

The planned burn could possibly take out a huge quantity of these tokens from the market for good. A decentralized vote could decide if all 300 million team token issuance needs to be burnt, as proposed by Mullin.

The announcement has been followed by various reactions from the Mantra community. Some members of the community believed that Mullin’s commitment was a positive development for token valuation, while others were concerned about having long-term issues.

Crypto Banter founder Ran Neuner warned against the move: “Burning the incentive may seem like a good gesture but it will hurt the team motivation long term.”

Mantra Refutes Allegations Following Price Collapse

Mullin’s token burn announcement comes at a difficult time for the project. The company has vehemently denied reports that it holds 90% of OM token supply. It has also rejected allegations of market manipulation and insider trading submitted by some community members.

Mantra explained that the latest price drop of OM occurred due to “reckless liquidations” and not due to anything the team had done. The recent history of the token indicates the size of this drop, with the charts reflecting a nearly 90% decline in value over the past month.

Major cryptocurrency exchanges OKX and Binance both experienced major OM trading activity immediately before the token’s collapse. However, both platforms have denied any wrongdoing in relation to the price crash. Binance mentioned that the crash was mainly due to cross-exchange liquidations.

They attributed the collapse to tokenomics adjustments that were made during October 2024 and abnormal market volatility that ultimately led to high-volume cross-exchange liquidations on April 13.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Bitcoin & Others Slip As Trump Imposes Up To 245% Tariff On China

Crypto Market Update: The digital assets continue to bleed as the US President Donald Trump slapped up to 245% tariff on Chinese goods. The intensifying trade war and macroeconomic concerns have continued to weigh on the investors’ sentiment, wiping off the previous gains from the digital assets space. Bitcoin price today slipped more than 2% while ETH, XRP, SOL, DOGE, and Cardano prices fell between 4% and 7%.

Crypto Market Update: Trump’s 245% Tariff On China Sparks Concerns

The crypto market slipped today after US President Donald Trump escalated the long-standing trade war with China by imposing a fresh 245% tariff on a wide range of imports. According to a White House document released in the late US hours on Tuesday, the move targets critical minerals and related products, citing national security and economic resilience as key reasons.

Meanwhile, the fact sheet stated that China now faces tariffs of up to 245% following its “retaliatory actions” and lack of cooperation. However, this is not the first volley in the tariff saga, as it continued to dampen the crypto market sentiment over the past few weeks.

Trump’s Tariff On China

For context, it began with a 20% levy, followed by a 34% hike on April 2nd. As tensions grew, Trump raised the rate again, reaching 104%. In response, China imposed an 84% tariff on the US goods.

Trump responded by increasing the US tariff to 125%. However, it has excluded certain tech products from China, which has boosted market sentiment. However, just last week, China matched that level, lifting its tariffs to 125%. The situation escalated dramatically this week with the 245% blanket tariff.

The White House cited the need to protect America’s defense sector, tech advancement, and infrastructure. As per Reuters, China exports over $400 billion worth of goods to the U.S. annually — far more than any other country. The impact of this aggressive move is now spilling over into the financial sector, including the crypto market.

How Crypto Prices Are Performing?

The global crypto market cap lost more than 2.3% from yesterday to $2.63 trillion while its one-day volume fell 6% to $73.89 billion. Besides, the fear and greed index showed a reading of 29, indicating a “Fear” momentum hovering in the market.

Notably, BTC price today fell nearly more than 2.5% to $83,368.76, while ETH price fell about 5% to $1,566. On the other hand, XRP price today was down nearly 4% to $2.04 and SOL price slipped more than 3% to $124.89.

Simultaneously, Cardano price today slipped nearly 7% to $0.6032. In the meme coins segment, DOGE price was down around 5% to $0.1528 and SHIB’s value lost around 3% to $0.00001160.

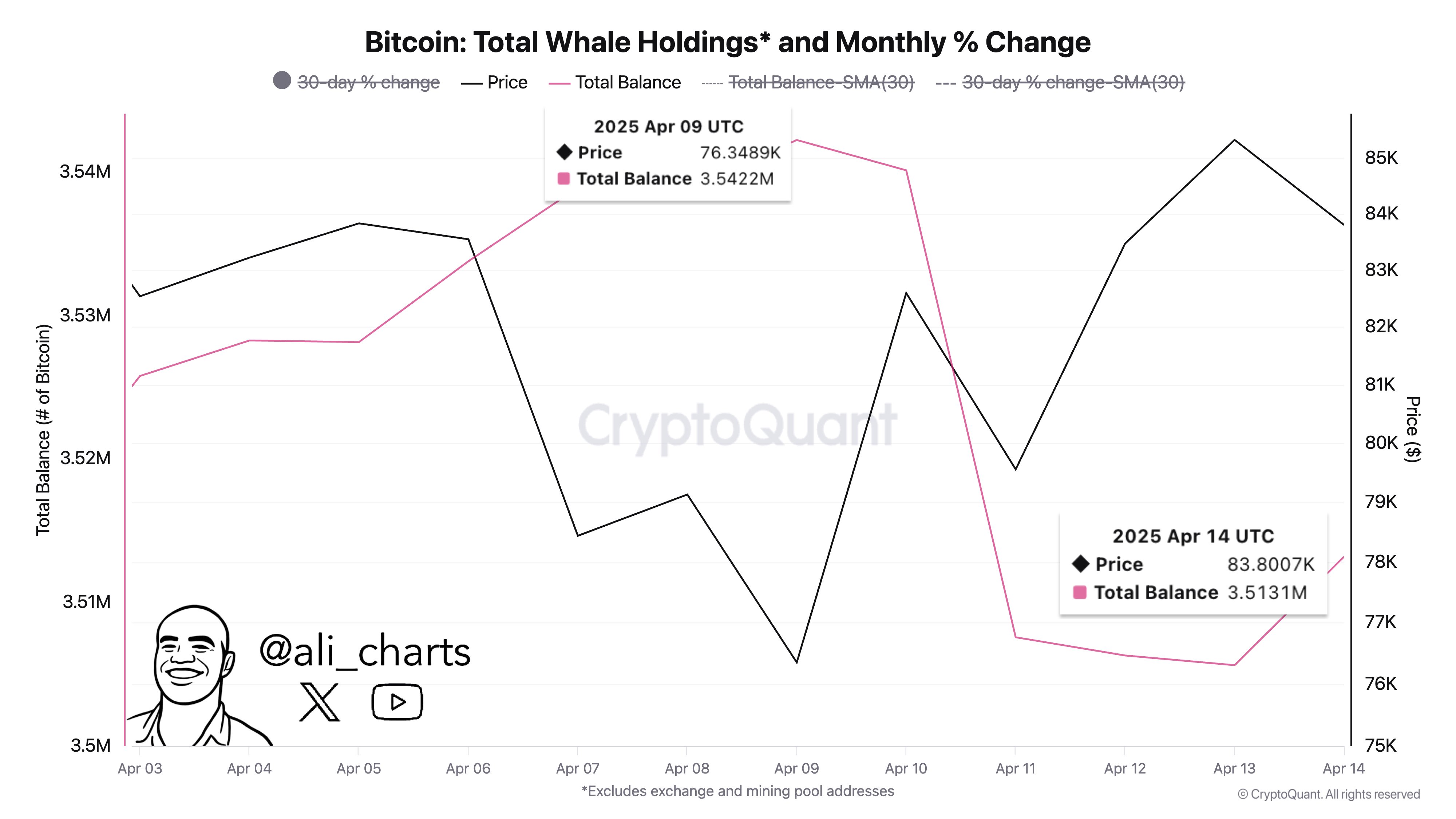

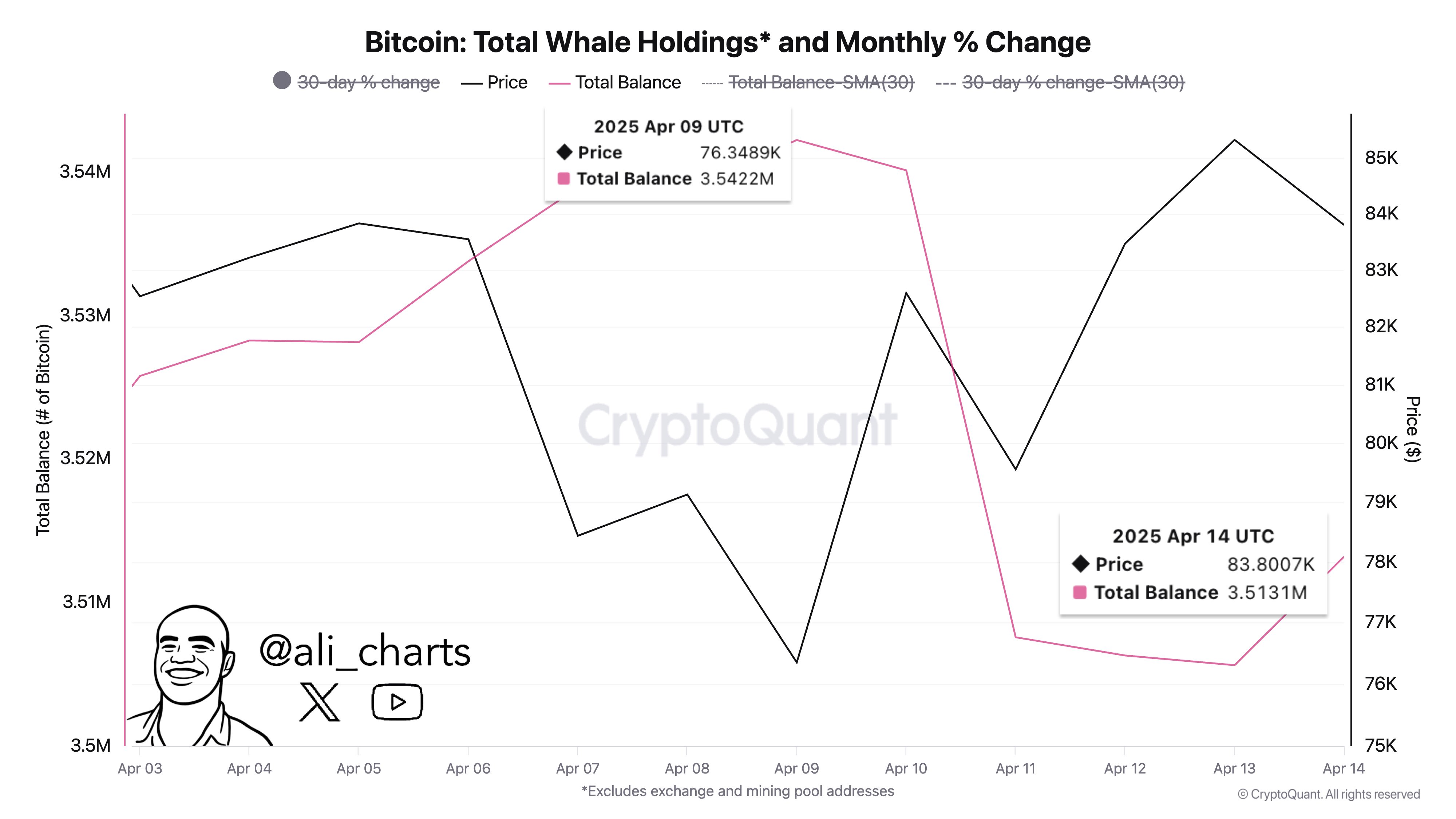

Bitcoin Whale Continues To Dump Amid Crypto Market Woes

The recent slump in BTC price also comes as Bitcoin whales appear to be losing confidence in the asset’s potential amid an intensifying trade war. Besides, speculations are also high that the whales are booking profit, reflecting a waning risk bet appetite of the investors. The US vs China tensions amid Trump’s tariff policies have weighed on the investors’ sentiment, causing a massive selloff in the market.

For context, renowned analyst Ali Martinez recently highlighted the selling trend. In a recent X post, Martinez said “Whales have been taking profits during the recent rally.” According to him, the whales have offloaded more than 29,000 BTC from April 9.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Expert Reveals Current Status Of 9 Ripple ETFs

As the Ripple vs SEC lawsuit nears its conclusion, the anticipation surrounding XRP ETFs has reached a fever pitch. With multiple asset managers receiving green light from the US Securities and Exchange Commission (SEC), the community is eagerly awaiting the regulator’s approval.

Offering a closer examination of the XRP ETFs’ current status and their possible approval dates, expert All Things XRP shared a series of X posts. Let’s examine the expert’s views and the spot Ripple ETFs’ possible launch.

Expert Reveals Possible Dates for Spot XRP ETFs Approval

In a recent X post, All Things XRP, a Ripple expert, shared insights into the current status of all nine spot XRP ETFs. Top asset managers Bitwise, Canary Capital, and 21Shares have officially tossed their hats into the XRP ETF arena, with the US SEC acknowledging their applications.

While the XRP community is eagerly awaiting the SEC’s regulatory approval of the Ripple ETFs and their potential launch, All Things XRP revealed crucial dates. All nine XRP ETF applications have cleared the initial hurdle, receiving formal acknowledgment from the US SEC, and are now awaiting further review.

Bitwise, 21Shares, Grayscale & Canary To Receive Approval in May

According to All Things XRP, the ETF applications submitted by prominent asset managers like Bitwise, 21Shares, Grayscale, and Canary Capital are poised to receive approval in May 2025.

Bitwise

Reportedly, investment giant Bitwise applied for its spot XRP ETF on October 2, 2024 and received the SEC’s recognition on February 18, 2025. As cited by the expert, Bitwise is expected to gain regulatory approval for its ETF by May 18, 2025.

Canary Capital

Canary Capital’s XRP ETF application, filed on October 8, 2024, and acknowledged by the SEC on February 18, 2025, is pending approval, with an expected decision date of May 22, 2025.

21Shares

21Shares filed for a Ripple ETF on November 1, 2025. The firm received green light from the US SEC on February 14, 2025. As highlighted by the expert, 21Shares also expects a regulatory approval for its ETF by May 22, 2025.

Grayscale

Investment behemoth Grayscale, which filed to convert its XRP Trust into an exchange-traded fund on January 30, 2025, secured the SEC’s acknowledgement on February 14, 2025. The expert predicted that the SEC will legally approve the platform’s Ripple ETF by May 21, 2025.

Asset Managers Pushing for XRP ETF Approval in July-August

Furthermore, All Things XRP pointed out that asset managers like WisdomTree and CoinShares are expected to gain approval for Ripple ETF launch by August.

WisdomTree

Filed on December 2, 2024, WidsomTree’s XRP ETF received the SEC’s recognition on February 19, 2025. Reportedly, the asset manager will gain regulatory approval for its exchange-traded fund by July 2025.

CoinShares

CoinShares submitted its XRP ETF application on January 24, 2025. The SEC acknowledged the application on February 19, 2025. And now, the platform expects its ETF to be approved by the Commission by August 2025.

All 9 Will Be Approved By December, Says Expert

Moreover, the expert predicts that all nine ETFs will be approved in 2025. This development comes on the heels of increasing whale activity within the XRP community.

ProShares

ProShares filed and received recognition for its ETF on January 17 and March 3, respectively. Further, the ETF is expected to gain SEC’s approval by November 2025.

Volatility Shares

Volatility Shares applied to launch its XRP ETF on March 7, 2025. The SEC recognized it on March 24. The estimated approval date for the ETF falls by December 2025.

Franklin Templeton

Franklin Templeton filed to launch its Ripple ETF on March 11 and gained recognition on March 27. As per the expert insights, the platform is expected to gain regulatory approval for its ETF by December. Recently, NYSE Arca approved the listing and registration of Teucrium’s 2X Long Daily XRP ETF.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market24 hours ago

Market24 hours agoTrump Family Plans Crypto Game Inspired by Monopoly

-

Market21 hours ago

Market21 hours agoBitcoin Eyes $90,000, But Key Resistance Levels Loom

-

Market16 hours ago

Market16 hours agoSolana (SOL) Jumps 20% as DEX Volume and Fees Soar

-

Market15 hours ago

Market15 hours agoHedera Under Pressure as Volume Drops, Death Cross Nears

-

Market23 hours ago

Market23 hours agoETH Retail Traders Boost Demand Despite Institutional Outflows

-

Altcoin23 hours ago

Altcoin23 hours agoCould Tomorrow’s Canada Solana ETF Launch Push SOL Price to $200?

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Metrics Reveal Critical Support Level – Can Buyers Step In?

-

Market14 hours ago

Market14 hours agoEthena Labs Leaves EU Market Over MiCA Compliance

✓ Share: