Altcoin

Will Cardano Price Hit $3 or Drop to New Lows?

Following the recent market crash, the crypto industry is showing signs of recovery, with the global market cap reaching $3.2 trillion, marking a 1.21% increase. In line with the overall crypto market, the Cardano price is exhibiting a rebound, signaling a potential rally to a new all-time high.

Driven by speculations of an imminent ADA ETF launch, analysts foresee Cardano’s bullish ascendance. However, with market participants also bracing for possible declines in ADA’s value, they are closely monitoring the token’s price fluctuations.

Cardano Price Eyes $3: A New ATH on the Horizon?

Notably, the Cardano price has been hovering below the $2 level for more than three years. Currently, the altcoin is trading below the significant range of $1. However, analysts remain bullish about ADA’s potential rebound, especially driven by Grayscale’s ADA ETF filing.

Nala, a prominent crypto voice on X, shared an X post today, drawing the community’s attention to the Cardano price’s possible uptrend. According to Nala, Cardano is about to make history. After nearly touching $3 in 2021, the analyst expects Cardano’s ADA to make a comeback to this price point and potentially break through it soon.

Echoing Nala’s view, Max Brown also predicted Cardano’s possible bull run, potentially reaching a new all-time high of around $3.

April Target: Is $1.5 Within Reach?

Significantly, the recent recovery and potential rally in Cardano’s price are triggered by Grayscale’s ADA ETF initiative. In a recent development, Grayscale Investments filed a registration statement with the NYSE to launch its Cardano ETF.

Reflecting on Cardano’s recent trends, trader Niels posited that the Cardano price has already experienced a notable dip, marking a bottom. While ADA’s capitulation candle has already occurred, similar to 90% of other utility altcoins, the worst might be over for Cardano. Reiterating the bullish outlook, the trader suggested that ADA will reach $1.5 by April 2025.

Cardano’s Potential Bull Run: Key Levels to Watch

Interestingly, Cardano’s ADA price is driven in part by founder Charles Hoskinson’s hint at a potential partnership with Microsoft. Triggered by Hoskinson’s announcement and Grayscale’s ETF filing, ADA is set for an upward momentum.

As highlighted by analyst Trader Courage, Cardano has surged past a significant resistance zone of $0.7012. ADA has further pierced the critical level of $0.7577, continuing its upward trajectory. The next target for the token is $0.8082, which will push the Cardano price to $0.8715 and higher.

Meanwhile, there are also concerns that Cardano’s price could drop to unprecedented lows.

Cardano Price Gains 7.5%: What To Expect?

As of press time, the Cardano price is at $0.7845, with a daily gain of 3.5%. Despite a monthly dip of 13%, the altcoin has marked a notable growth of 7.5% over the last seven days.

Boasting a market cap of $27.61 billion, Cardano is ranked 9th on CoinMarketCap. The 24-hour trading volume, marked at $1.3 billion, has declined by 16.8%, showing investors’ changing sentiment.

Analysts’ predictions, coupled with Cardano’s current performance, signal the altcoin’s further growth to new highs. However, as with any cryptocurrency, traders and investors should exercise caution and conduct thorough research before making investment decisions.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Shiba Inu Burn Rate Blows Up 2000%; Is SHIB Price Gearing Up For A Pump?

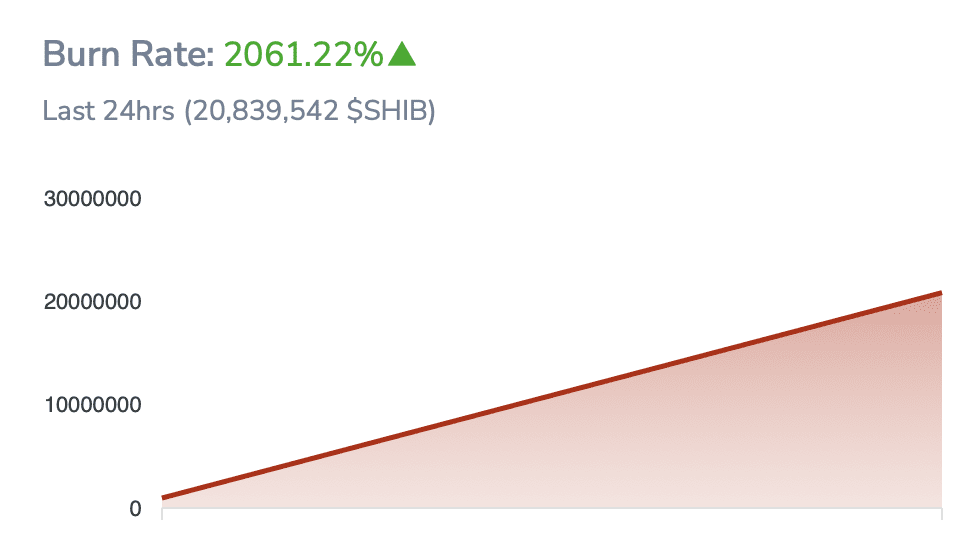

The Shiba Inu burn rate once again shot up by a staggering 2000% on Tuesday, reverberating market optimism surrounding its future price movements. Recent burn metrics revealed that over 20 million SHIB tokens were removed from the asset’s circulating supply in just a day. Now, crypto market traders and investors speculate if price gains loom, whilst a renowned SHIB community member further revealed that a “new pump wave is loading.”

Shiba Inu Burn Rate Soars 2000% As 20M Tokens Burnt

According to Shibburn’s data on April 15, the Shiba Inu burn rate exploded by 2061.22% at the time of reporting. This surge in the meme token’s burn rate is in sync with 20.83 million coins removed from the asset’s supply intraday.

For context, the SHIB burn mechanism transfers tokens to a null address and makes their recovery impossible. This saga drastically reduces the dog-themed meme coin‘s circulating supply, a reason that many believe is driving SHIB’s relatively sluggish performance over the years.

Besides, a renowned Wall Street expert going by the name “wallstreetbets” on X has stated that “Despite burns, SHIB supply remains unchanged.” This statement has ushered an apprehensive sentiment among market participants who are anticipating price gains ahead in light of the constant burns. Intriguingly, CoinGape found that the total circulating supply rested at 584.37 trillion tokens at the time of reporting.

Can SHIB Price Pump Ahead?

CoinMarketCap’s data showed that SHIB token’s price rested at $0.00001193, down nearly 3% over the day despite the Shiba Inu burn rate surge. The meme coin fell from an intraday high of $0.00001239, even hitting a bottom of $0.00001182. Crypto market participants are currently uncertain about the coin’s future price movements, given broader market trends and a volatile price trajectory.

Nevertheless, renowned Shiba Inu community member SHIB Knight posted on X that a “new pump wave is loading.” Notably, a sustained break above $0.00001238 paves the way for a bull run, per the community member. Traders and investors continue to monitor the coin for further price action shifts ahead.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Expert Urges Pi Network To Learn From The OM Crash Ahead Of Open Mainnet Transition

In the wake of the jarring incident around Mantra, community members are calling for Pi Network to glean valuable lessons from the black swan event. Pseudonymous cryptocurrency analyst Dr Altcoin wants the PiCoreTeam (PCT) to establish key guardrails to prevent a repeat of the OM incident for the Pi Network.

The OM Incident Is A Huge Lesson For Pi Network

Cryptocurrency expert Dr Altcoin has urged the Pi Network to learn valuable lessons from the grim Mantra (OM) incident. According to a post on X, Dr Altcoin called on the PiCoreTeam to lay a proper foundation to prevent steep price drops for token prices.

The price of Mantra (OM) fell from $6.32 to $0.57 in one steep drop that left investors scratching their heads. OM, once ranked among the top 50 cryptocurrencies by market capitalization, tumbled by over 90% in a day, stoking speculations of a rug pull.

While the official explanation puts the blame on liquidations, a consensus is forming that the steep drop is a “carefully orchestrated dump.” Market losses totaled $6 billion as a cohort of crypto traders lost $400 million after buying OM three days before the incident.

However, Dr Altcoin wants the PCT to speed up the development of ecosystem guardrails to prevent a repeat of the incident for Pi Network. Dr Altcoin has his eyes on the clock, urging the PCT to set up robust infrastructure before the transition to open mainnet.

“The OM incident is a wake-up call for the entire crypto industry – proof that stricter regulations are urgently needed,” said Dr Altcoin. “It also serves as a HUGE lesson for the PCT as we transition from the Open Network to the Open Mainnet.

Belief In the PiCoreTeam Is Waning

While a cross-section of community members will argue that the PCT is not scheming a rug pull, there is rising dissent in the ecosystem. Dr Altcoin remarks that faith in the PCT is waning given a trail of transparency issues facing the Pi Network in recent weeks.

“One thing is clear about the PCT,” wrote Dr Altcoin on X. “They are not transparent.”

Questions about the PCT’s transparency first reared its head over the murkiness of the locking and burning mechanism for Pi Coins. Furthermore, delays in issuing KYB approvals for projects leading to PiDaoSwap launching NFTs on the Binance Chain inflamed soured optimism for the PCT.

Dr Altcoin notes that if the PCT fast-tracks the KYB process for centralized exchanges, it will unlock the floodgates of demand for Pi ahead of the transition

At the moment, Pi miners are capitulating casting a shadow of doubt over the direction of Pi Coin price. Pi Coin is on the rise, climbing by nearly 30% over the last seven days to trade at $0.7404 but the specter of a drop to 0.3 hangs like a Sword of Damocles.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Canada Approves Multiple Spot Solana ETFs To Launch This Week

Canada is set to launch the world’s first spot Solana ETFs after receiving regulatory approval from the Ontario Securities Commission (OSC). The green light allows several issuers, including Purpose, Evolve, CI, and 3iQ, to list their Solana ETFs.

The new financial products will be available to investors starting April 16, 2025, marking an important development in the cryptocurrency investment space.

Canada Approves Multiple Spot Solana ETFs

According to Bloomberg analyst Eric Balchunas, the OSC approved multiple SOL ETFs today. These ETFs will hold actual Solana tokens rather than relying on futures contracts, offering investors direct exposure to the cryptocurrency.

Purpose, Evolve, CI, and 3iQ are among the firms that have secured approval to launch these innovative products.

The launch of these ETFs coincides with an upward surge in the price of Solana. Over the past week, the price of Solana has seen a notable increase of 25%. Experts suggest that the growing institutional interest in Solana, further bolstered by these ETF products, could soon lead to even greater price appreciation. As the world’s first spot Solana ETFs hit the market, the launch is a critical step forward for altcoin-based investment products.

Staking Features and Yield Benefits

The newly approved SOL ETFs will engage in staking, which offers potential benefits for ETF investors, including enhanced returns compared to traditional investments.

Staking can improve yields and offset holding costs, making these ETFs more attractive. However, according to Balchunas, TD Bank will assist in processing staking information but will not directly facilitate it.

Staking could provide an edge for SOL ETFs over other cryptocurrency ETFs, such as Ethereum-based ETFs, especially with US SEC delaying Grayscale’s ETH Spot ETF staking proposal. The yield from staking and the token’s performance could offer additional incentives for investors looking to diversify their portfolios.

Solana Whale Moves and Growing ETF Expectations in the US

The approval of spot SOL ETFs in Canada comes during heightened activity in the Solana market. Amid the market activity, a whale moved 762,416 SOL, worth approximately $101 million, according to Whale Alert.

In another instance, 790,427 SOL, valued at over $105 million, was moved between unknown wallets. These large-scale transactions suggest that whales, or large holders of Solana, are preparing for future moves, possibly in anticipation of the market momentum the new ETFs could trigger. The approval of the first spot Solana ETFs in Canada follows the recent launch of the first-ever XRP ETF, Teucrium 2x Long Daily, in the U.S.

Concurrently, several major firms have already filed for approval to offer SOL ETFs in the United States. These firms include Grayscale, 21Shares, Bitwise, VanEck, and Franklin Templeton. In addition to the Canadian approval, market expectations for the approval of SOL ETFs in the United States are rising. Polymarket traders now assign an 81% probability to approving a Solana ETF by the end of 2025, up from just 65% in early 2025.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market21 hours ago

Market21 hours agoXRP Outflows Cross $300 Million In April, Why The Price Could Crash Further

-

Altcoin19 hours ago

Altcoin19 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?

-

Altcoin22 hours ago

Altcoin22 hours agoBinance Breaks Silence Amid Mantra (OM) 90% Price Crash

-

Market20 hours ago

Market20 hours agoFLR Token Hits Weekly High, Outperforms Major Coins

-

Market19 hours ago

Market19 hours agoAuto.fun Launchpad Set to Debut Amid Fierce Market Rivalry

-

Altcoin18 hours ago

Altcoin18 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds

-

Bitcoin20 hours ago

Bitcoin20 hours agoCrypto Outflows Hit $795 Million On Trump’s Tariffs & Market Fear

-

Market23 hours ago

Market23 hours agoBitcoin Price Rises Steadily—But Can the Rally Hold This Time??

✓ Share: